Abstract

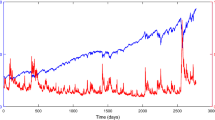

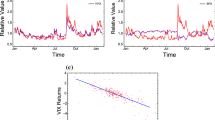

Following a trend of sustained and accelerated growth, the VIX futures and options market has become a closely followed, active and liquid market. The standard stochastic volatility models—which focus on the modeling of instantaneous variance—are unable to fit the entire term structure of VIX futures as well as the entire VIX options surface. In contrast, we propose to model directly the VIX index, in a mean-reverting local volatility-of-volatility model, which will provide a global fit to the VIX market. We then show how to construct the local volatility-of-volatility surface by adapting the ideas in Carr (Local variance gamma. Bloomberg Quant Research, New York, 2008) and Andreasen and Huge (Risk Mag 76–79, 2011) to a mean-reverting process.

Similar content being viewed by others

Notes

Note: VIX futures contracts have a multiplier of 1000 while VIX options contracts have a multiplier of 100. Therefore, futures contracts volumes are multiplied by a factor \(10\!\times \), to make them comparable to options contracts volume.

We note that the function \(\lambda (\cdot , \cdot )\) is the same function as in Eq. (1) of the previous section, only the notation of the arguments may differ depending on the context.

Note that the shrinkage problem is not alleviated by working in log-strikes:

$$\begin{aligned} \lim _{\Delta K \rightarrow 0} \log \left( \frac{\theta + (K_2 - \theta ) e^{-k(T_N-T_1)}}{\theta + (K_1 - \theta ) e^{-k(T_N-T_1)}} \right) \Big / \log \left( \frac{K_2}{K_1} \right) = e^{-k(T_N-T_1)} \cdot \frac{K_1}{\theta + (K_1 - \theta ) e^{-k(T_N-T_1)}}. \end{aligned}$$

References

Andersen, L., & Brotherton-Ratcliffe, R. (1998). The equity option volatility smile: An implicit finite-difference approach. Journal of Computational, Finance, 1(2), 5–37.

Andersen, L., & Andreasen, J. (2000). Jump diffusion processes: Volatility smile fitting and numerical methods for options pricing. Review of Derivatives Research, 4(3), 231–262.

Andreasen, J., & Huge, B. (2011). Volatility interpolation. Risk Magazine, pp. 76–79.

Bergomi, L. (2005). Smile dynamics 2. Risk Magazine, pp. 67–73.

Bergomi, L. (2008). Smile dynamics 3. Risk Magazine, pp. 90–96.

Black, F., & Scholes, M. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81, 637–654.

Carr, P., & Madan, D. (1998). Towards a theory of volatility trading. In R. Jarrow (Ed.), Volatility: New estimation techniques for pricing derivatives (pp. 417–427). London: Risk Books.

Carr, P., & Sun, J. (2007). A new approach for option pricing under stochastic volatility. Review of Derivatives Research, 10, 87–150.

Carr, P. (2008). Local Variance gamma, working paper. New York: Bloomberg Quant Research.

Cont, R., & Kokholm, T. (forthcoming, 2011). A consistent pricing model for index options and volatility derivatives. Mathematical Finance.

Derman, E., & Kani, I. (1994). Riding on a smile. Risk Magazine, 7(2), 32–39.

Dupire, B. (1993). Model art. Risk Magazine, 6(9), 118–124.

Dupire, B. (1994). Pricing with a smile. Risk Magazine, 7(1), 18–20.

Eberlein, E., & Madan, D. (2009). Sato processes and the valuation of structured products. Quantitative Finance, 9(1), 27–42.

Fengler, M. (2009). Arbitrage-free smoothing of the implied volatility surface. Quantitative Finance, 9(4), 417–428.

Heston, S. (1993). A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies, 6, 327–343.

Jeanblanc, M., Yor, M., & Chesney, M. (2009). Mathematical methods for financial markets. London: Springer Finance.

Lewis, A. (2000). Option valuation under stochastic volatility. Newport Beach, CA: Finance Press.

Neuberger, A. (1994). The log contract. Journal of Portfolio Management, 20, 2.

Scott, L. (1987). Option pricing when the variance changes randomly: Theory, estimation and an application. Journal of Financial and Quantitative Analysis, 22, 419–438.

Szado, E. (2009). VIX futures and options: A case study of portfolio diversification during the 2008 financial crisis. Journal of Alternative Investments, 12(2), 68–85.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix I

Proof of Proposition 2.1

Denote \(\rho (V, T)\) the density of \(V_T\). We have

from where, differentiating with respect to strike \(K\) twice

Recall Kolmogorov’s forward equation for \(\rho (V,T)\), see e.g. Jeanblanc et al. (2009):

Differentiating both sides of (29) with respect to maturity \(T\) and using (30)

Denoting the two terms in the parenthesis by \(A\), respectively \(B\), we proceed to compute each in turn, using integration by parts. The first term becomes

where we have assumed that the boundary term, on the first line, vanishes at \(K=+\infty \). The second term becomes

where we have assumed that the boundary terms vanish at \(K=+\infty \). Using the expressions for \(A\) and \(B\) in (31), we obtain

which, upon rearrangement, leads to the statement in Proposition 2.1.

Proof of Proposition 2.2

We will find it convenient to work with the undiscounted Black function. Also, noting that, for \( T \in [T_{i-1}, T_i]\), the futures price \(F_0^T\) can be written as

the definition of the Black implied volatility surface becomes

For easier reference, we recall below the Black greeks which will be needed in our subsequent calculations:

From (32)

Using the expressions in (33), (34) and (35), we obtain for the numerator of Eq. (5)

and for the denominator of Eq. (5)

Finally, combining (36) and (37), we arrive at the statement in Proposition 2.2. \(\square \)

Proof of Lemma 3.1

The butterfly spread condition (11) is immediate, as the payoff of a butterfly is strictly positive. For the calendar spread condition (10), we consider the VIX futures of maturity \(T_2\), given by \(F_t^{T_2} = E \left( V_{T_2} | \mathcal F _t \right)\), which is a martingale on \([0, T_2]\). By the conditional form of Jensen’s inequality

which in turn implies

Using that

where the first relation follows by applying Itô to the process \(e^{kt} V_t\) on \([T_1, T_2]\), we obtain

Equivalently, this can be written as

which leads to the statement in Lemma 3.1.\(\square \)

Appendix II: VIX futures and options quotes

We include below CBOE’s VIX futures and options quotes as of the close of trading on Jul-05-2011, when 6 maturities were listed: Jul-20-2011, Aug-17-2011, Sep-21-2011, Oct-19-2011, Nov-16-2011 and Dec-21-2011. The VIX spot closed at 16.06 and the term structure of VIX futures as well as the VIX Put / Call quotes are given in the following tables.

VIX futures term structure | ||||||

|---|---|---|---|---|---|---|

Maturity | 07/20/2011 | 08/17/2011 | 09/21/2011 | 10/19/2011 | 11/16/2011 | 12/21/2011 |

VIX futures | 16.95 | 18.10 | 20.00 | 21.00 | 21.60 | 21.85 |

Maturity Jul-20-2011 | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

Strike | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 29 |

Bid | 0.05 | 0.4 | 1 | 0.7 | 0.5 | 0.4 | 0.35 | 0.15 | 0.15 | 0.05 |

Offer | 0.1 | 0.45 | 1.05 | 0.75 | 0.55 | 0.5 | 0.4 | 0.25 | 0.2 | 0.1 |

Type | P | P | P | C | C | C | C | C | C | C |

Maturity Aug-17-2011 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 30 | 35 | 40 | 50 |

Bid | 0.05 | 0.25 | 0.6 | 1.15 | 1.8 | 1.6 | 1.4 | 1.2 | 0.8 | 0.75 | 0.45 | 0.25 | 0.15 | 0.05 |

Offer | 0.1 | 0.3 | 0.65 | 1.25 | 1.9 | 1.7 | 1.45 | 1.3 | 0.9 | 0.8 | 0.5 | 0.35 | 0.2 | 0.1 |

Type | P | P | P | P | P | C | C | C | C | C | C | C | C | C |

Maturity Sep-21-2011 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 30 | 35 | 40 | 45 | 50 |

Bid | 0.15 | 0.45 | 0.8 | 1.35 | 1.9 | 2.55 | 2.2 | 1.6 | 1.45 | 0.85 | 0.55 | 0.3 | 0.2 | 0.1 |

Offer | 0.25 | 0.5 | 0.9 | 1.4 | 2 | 2.65 | 2.4 | 1.75 | 1.55 | 1 | 0.65 | 0.4 | 0.25 | 0.2 |

Type | P | P | P | P | P | P | C | C | C | C | C | C | C | C |

Maturity Oct-19-2011 | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 30 | 35 | 40 | 50 |

Bid | 0.35 | 0.7 | 1.1 | 1.6 | 2.15 | 2.8 | 2 | 1.85 | 1.15 | 0.75 | 0.45 | 0.15 |

Offer | 0.45 | 0.75 | 1.2 | 1.7 | 2.3 | 2.9 | 2.15 | 1.95 | 1.25 | 0.8 | 0.55 | 0.25 |

Type | P | P | P | P | P | C | C | C | C | C | C | C |

Maturity Nov-16-2011 | ||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 30 | 35 | 40 | 45 | 50 | 70 |

Bid | 0.35 | 0.6 | 1 | 1.45 | 2 | 2.65 | 2.25 | 2.05 | 1.25 | 0.75 | 0.5 | 0.3 | 0.2 | 0.05 |

Offer | 0.45 | 0.75 | 1.1 | 1.6 | 2.15 | 2.75 | 2.45 | 2.2 | 1.4 | 0.9 | 0.6 | 0.4 | 0.3 | 0.1 |

Type | P | P | P | P | P | P | C | C | C | C | C | C | C | C |

Maturity Dec-21-2011 | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 16 | 17 | 18 | 19 | 20 | 21 | 24 | 25 | 26 | 29 | 30 | 40 | 70 |

Bid | 0.35 | 0.7 | 1.1 | 1.5 | 2.05 | 2.6 | 2.5 | 2.25 | 2.05 | 1.5 | 1.35 | 0.55 | 0.05 |

Offer | 0.55 | 0.9 | 1.25 | 1.7 | 2.25 | 2.85 | 2.7 | 2.45 | 2.25 | 1.7 | 1.55 | 0.7 | 0.15 |

Type | P | P | P | P | P | P | C | C | C | C | C | C | C |

We include below CBOE’s VIX futures and options quotes as of the close of trading on Sep-06-2012, when 6 maturities were listed: Sep-19-2012, Oct-17-2012, Nov-21-2012, Dec-19-2012, Jan-16-2013 and Feb-13-2013. The VIX spot closed at 15.60 and the term structure of VIX futures as well as the VIX Put / Call quotes are given in the following tables.

VIX futures term structure | ||||||

|---|---|---|---|---|---|---|

Maturity | 09/19/2012 | 10/17/2012 | 11/21/2012 | 12/19/2012 | 01/16/2013 | 02/13/2012 |

VIX futures | 16.10 | 18.55 | 20.60 | 21.00 | 24.05 | 25.35 |

Maturity Sep-19-2012 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 |

Bid | 0.05 | 0.3 | 0.75 | 0.6 | 0.4 | 0.3 | 0.25 | 0.2 | 0.15 | 0.15 | 0.1 | 0.1 | 0.1 | 0.1 | 0.05 | 0.05 | 0.05 |

Offer | 0.1 | 0.35 | 0.9 | 0.7 | 0.5 | 0.4 | 0.35 | 0.25 | 0.25 | 0.2 | 0.2 | 0.15 | 0.15 | 0.15 | 0.1 | 0.1 | 0.1 |

Type | P | P | P | C | C | C | C | C | C | C | C | C | C | C | C | C | C |

Maturity Oct-17-2012 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 |

Bid | 0.05 | 0.1 | 0.25 | 0.6 | 1.05 | 1.6 | 1.75 | 1.5 | 1.25 | 1.1 | 0.9 | 0.8 | 0.65 | 0.6 | 0.5 | 0.45 | 0.4 |

Offer | 0.1 | 0.15 | 0.35 | 0.7 | 1.15 | 1.7 | 1.9 | 1.55 | 1.35 | 1.2 | 1 | 0.9 | 0.8 | 0.7 | 0.6 | 0.55 | 0.5 |

Type | P | P | P | P | P | P | C | C | C | C | C | C | C | C | C | C | |

Strike | 30 | 32.5 | 35 | 37.5 | 40 | 42.5 | 45 | ||||||||||

Bid | 0.35 | 0.25 | 0.15 | 0.1 | 0.1 | 0.05 | 0.05 | ||||||||||

Offer | 0.4 | 0.35 | 0.3 | 0.25 | 0.2 | 0.15 | 0.15 | ||||||||||

Type | C | C | C | C | C | C | C | ||||||||||

Maturity Nov-21-2012 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 13 | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 |

Bid | 0.05 | 0.1 | 0.3 | 0.6 | 0.95 | 1.45 | 1.95 | 2.5 | 2.75 | 2.4 | 2.15 | 1.9 | 1.7 | 1.5 | 1.35 | 1.2 | 1.05 |

Offer | 0.1 | 0.2 | 0.4 | 0.7 | 1.1 | 1.55 | 2.1 | 2.7 | 2.9 | 2.55 | 2.3 | 2.05 | 1.85 | 1.65 | 1.45 | 1.3 | 1.15 |

Type | P | P | P | P | P | P | P | P | C | C | C | C | C | C | C | C | C |

Strike | 30 | 32.5 | 35 | 37.5 | 40 | 42.5 | 45 | 47.5 | 50 | 55 | 60 | ||||||

Bid | 0.95 | 0.7 | 0.55 | 0.4 | 0.3 | 0.2 | 0.15 | 0.1 | 0.05 | 0.05 | 0.05 | ||||||

Offer | 1.05 | 0.85 | 0.65 | 0.5 | 0.4 | 0.35 | 0.3 | 0.25 | 0.2 | 0.15 | 0.1 | ||||||

Type | C | C | C | C | C | C | C | C | C | C | C | ||||||

Maturity Dec-19-2012 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 |

Bid | 0.1 | 0.3 | 0.55 | 0.9 | 1.25 | 1.7 | 2.25 | 2.85 | 3.3 | 3 | 2.75 | 2.5 | 2.25 | 2.05 | 1.85 | 1.7 | 1.55 |

Offer | 0.2 | 0.4 | 0.65 | 1 | 1.4 | 1.85 | 2.4 | 3 | 3.6 | 3.2 | 2.9 | 2.65 | 2.4 | 2.2 | 2 | 1.8 | 1.65 |

Type | P | P | P | P | P | P | P | P | C | C | C | C | C | C | C | C | C |

Strike | 32.5 | 35 | 37.5 | 40 | 42.5 | 45 | 47.5 | 50 | 55 | 60 | |||||||

Bid | 1.2 | 0.95 | 0.75 | 0.65 | 0.5 | 0.4 | 0.3 | 0.25 | 0.15 | 0.1 | |||||||

Offer | 1.35 | 1.1 | 0.9 | 0.75 | 0.6 | 0.45 | 0.4 | 0.35 | 0.25 | 0.2 | |||||||

Type | C | C | C | C | C | C | C | C | C | C | |||||||

Maturity Jan-16-2013 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 |

Bid | 0.05 | 0.2 | 0.35 | 0.55 | 0.9 | 1.25 | 1.65 | 2.15 | 2.7 | 3.3 | 3.9 | 3.6 | 3.2 | 2.95 | 2.7 | 2.45 | 2.25 |

Offer | 0.15 | 0.25 | 0.5 | 0.7 | 1.05 | 1.4 | 1.8 | 2.3 | 2.85 | 3.4 | 4.1 | 3.8 | 3.5 | 3.2 | 2.9 | 2.65 | 2.45 |

Type | P | P | P | P | P | P | P | P | P | P | P | C | C | C | C | C | C |

Strike | 32.5 | 35 | 37.5 | 40 | 42.5 | 45 | 47.5 | 50 | 55 | 60 | |||||||

Bid | 1.8 | 1.45 | 1.15 | 0.95 | 0.75 | 0.6 | 0.5 | 0.4 | 0.25 | 0.15 | |||||||

Offer | 2 | 1.6 | 1.35 | 1.1 | 0.85 | 0.75 | 0.6 | 0.5 | 0.4 | 0.3 | |||||||

Type | C | C | C | C | C | C | C | C | C | C | |||||||

Maturity Feb-13-2013 | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Strike | 14 | 15 | 16 | 17 | 18 | 19 | 20 | 21 | 22 | 23 | 24 | 25 | 26 | 27 | 28 | 29 | 30 |

Bid | 0.05 | 0.15 | 0.3 | 0.5 | 0.75 | 1.05 | 1.45 | 1.85 | 2.35 | 2.9 | 3.4 | 4 | 4 | 3.6 | 3.3 | 3.1 | 2.85 |

Offer | 0.2 | 0.3 | 0.35 | 0.6 | 0.9 | 1.2 | 1.6 | 2.05 | 2.55 | 3.1 | 3.7 | 4.3 | 4.2 | 3.9 | 3.6 | 3.4 | 3.1 |

Type | P | P | P | P | P | P | P | P | P | P | P | P | C | C | C | C | C |

Strike | 32.5 | 35 | 37.5 | 40 | 42.5 | 45 | 47.5 | 50 | 55 | 60 | 65 | 70 | |||||

Bid | 2.35 | 1.9 | 1.55 | 1.25 | 1.05 | 0.85 | 0.7 | 0.6 | 0.4 | 0.25 | 0.15 | 0.15 | |||||

Offer | 2.55 | 2.1 | 1.75 | 1.45 | 1.2 | 1 | 0.85 | 0.75 | 0.55 | 0.4 | 0.3 | 0.2 | |||||

Type | C | C | C | C | C | C | C | C | C | C | C | C | |||||

Rights and permissions

About this article

Cite this article

Drimus, G., Farkas, W. Local volatility of volatility for the VIX market. Rev Deriv Res 16, 267–293 (2013). https://doi.org/10.1007/s11147-012-9086-9

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11147-012-9086-9