Abstract

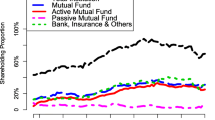

Collectively, institutional investors hold large ownership stakes in REITs. The traditional view is that institutions are both long-term and passive investors. The financial crisis beginning in 2007 provides an opportunity to analyze the investment choices of institutional investors before, during, and after the crisis. Our results indicate that institutional ownership increased prior to the financial crisis, declined significantly during the period of market stress, but rebounded after. These results hold for four institutional investor subtypes: mutual funds/investment advisors, bank trusts, insurance companies, and other institutions, with mutual funds/investment advisors and bank trusts most clearly exhibiting this pattern. We also find evidence that institutions actively manage their REIT portfolios, displaying a “flight to quality” after the market downturn by reducing beta and individual risk exposure, and by increasing ownership in larger REITs.

Similar content being viewed by others

Notes

For instance, from 2007 to the end of 2008, the total composite REIT market capitalization decreased from $438 billion to 191 billion. The FTSE NAREIT All-REIT index declined (from 189.73 to 97.69, a 49% decrease) more than the S&P 500 index (from 134.69 to 89.52, a 34% decrease) over the 2-year time period of 2007–2008 (source: NAREIT).

The casual relationship between institutional ownership and firm performance is likely to be endogenous. While poor firm performance may deter investments from institutional investors, institutional ownership also serves as an effective corporate governance mechanism (see, for example, Davis and Steil 2001 for a discussion on the governance roles of institutional investors). Thus, it is possible that when the level of institutional ownership falls, the firm is subject to less effective monitoring and governance from its institutional investors, thereby depressing firm value.

For example, Gordon and Pound (1993) document the systematic influence in proxy voting across institutional investor types clearly signifying their different preferences.

However, this positive relation between performance and institutional investment is not found in other studies (e.g., Faccio and Lasfer 2000, among others).

For example, some (e.g., Coffee 1991; Parrino et al. 2003) suggest that institutions prefer to sell shares instead of monitoring. In contrast, Grinstein and Michaely (2005) suggest that a number of coordination mechanisms make institutional investors effective monitors. However, Chen et al. (2007) suggest that only a few types of institutions (i.e., those with a long-term orientation) are active monitors.

Our study differs from Chung et al. (2010) and complements their findings in two important ways: First, their study examines a sample period from 1997 to 2005. In contrast, we examine a sample period over 2004 to 2010, which enables us to provide insights on the impact of the financial crisis on institutional ownership dynamics. Second, their study classifies institutional ownership into binary categories (long-term versus short-term investors, active versus passive investors, all versus top-5 investors). In contrast, we divide the institutions into their specific types and analyze ownership dynamics of each institutional type prior to, during and after the financial crisis.

We check the Case-Shiller Index and Moodys/REAL CCPI Index and find similar breakpoints. Nonetheless, we also replicate our analysis using the second quarter of 2007 and the last quarter of 2009 as our breakpoints to define the crisis and post-crisis periods. Our results are robust to this alternative definition of the sub-periods. Interestingly, Eichholtz et al. (2010) formally test for structural breaks in the NAREIT index during this period and report that the crisis started in February of 2010 and ended in May of 2009.

For a complete description of this methodology, see Bennett et al. (2003).

Note that none of our variables that are based on CRSP data are annualized.

This is also likely due to the lag observed in the changes of institutional ownership.

As a robustness check, we also perform a similar analysis, using OLS regressions, while controlling for clustering and including additional time dummies. We find that in most cases OLS analysis suggests that the same variables are related to our dependent variables. However, in some instances, OLS regression suggests that there are additional variables that may matter. We opt to use our methodology because it allows for comparisons across time and ownership type. The results of OLS regressions are available upon request.

These results are available upon request.

References

Badrinath, S. G., Kale, J. R., & Ryan, H. E. (1996). Characteristics of common stock holdings of insurance companies. The Journal of Risk and Insurance, 63(1), 49–76.

Below, S. D., Stansell, S. R., & Coffin, M. (2000). The determinants of REIT institutional ownership: tests of the CAPM. Journal of Real Estate Finance and Economics, 21(3), 263–278.

Bennett, J. A., Sias, R. W., & Starks, L. T. (2003). Greener pastures and the impact of dynamic institutional preferences. Review of Financial Studies, 16(4), 1203–1238.

Bushee, B. J. (2001). Do institutional investors prefer near-term earnings over long-run value? Contemporary Accounting Research, 18(2), 207–246.

Chan, S. H., Leung, W. K., & Wang, K. (1998). Institutional investment in REITs: evidence and implications. Journal of Real Estate Research, 16(3), 357–374.

Chan, S. H., Erickson, J., & Wang, K. (2003). Real estate investment trusts: Structure, performance, and investment opportunities. USA: Oxford University Press.

Chen, X., Harford, J., & Li, K. (2007). Monitoring: which institutions matter? Journal of Financial Economics, 86(2), 279–305.

Chung, R., Fung, S., Shilling, J. D., & Simmons-Mosley, T. X. (2007). Are hedge fund managers better able to forecast real estate security returns than others? Journal of Portfolio Management, 33(5), 165–174.

Chung, R., Fung, S., & Hung, S.-Y. K. (2010). Institutional investors and firm efficiency of real estate investment trusts. Journal of Real Estate Finance and Economics. doi:10.1007/s11146-010-9253-4.

Ciochetti, B. A., Craft, T. M., & Shilling, J. D. (2002). Institutional investors' preferences for REIT stocks. Real Estate Economics, 30(4), 567–594.

Coffee, J. C., Jr. (1991). Liquidity versus control: the institutional investor as corporate monitor. Columbia Law Review, 91, 1277–1386.

Cornett, M. M., Marcus, A. J., Saunders, A., & Tehranian, H. (2007). The impact of institutional ownership on corporate operating performance. Journal of Banking and Finance, 31(6), 1771–1794.

Crain, J. L., Cudd, M., & Brown, C. L. (2000). The impact of the Revenue Reconciliation Act of 1993 on the pricing structure of equity REITs. Journal of Real Estate Research, 19(3), 275–285.

Davis, E. P., & Steil, B. (2001). Institutional investors. Cambridge: MIT Press.

Del Guercio, D. (1996). The distorting effect of the prudent-man laws on institutional equity investments. Journal of Financial Economics, 40(1), 31–62.

Del Guercio, D., & Hawkins, J. (1999). The motivation and impact of pension fund activism. Journal of Financial Economics, 52(3), 293–340.

Downs, D. H. (1998). The value in targeting institutional investors: evidence from the five-or-fewer rule change. Real Estate Economics, 26(4), 613–616.

Eichholtz, P., Kok, N., & Yonder, E. (2010). Real estate, governance, and the global economic crisis. University of Pennsylvania Press, forthcoming

Faccio, M., & Lasfer, M. A. (2000). Do occupational pension funds monitor companies in which they hold large stakes? Journal of Corporate Finance, 6(1), 71–110.

Feng, Z., Ghosh, C., He, F., & Sirmans, C. F. (2010). Institutional monitoring and REIT CEO compensation. Journal of Real Estate Finance and Economics, 40(4), 446–479.

Ferson, W., & Harvey, C. (1991). The variation of economic risk premiums. Journal of Political Economy, 99(2), 385–415.

Friday, H. S., Sirmans, G. S., & Conover, C. M. (1999). Ownership structure and the value of the firm: the case of REITs. Journal of Real Estate Research, 17(1), 71–90.

Ghosh, C., & Sirmans, C. F. (2003). Board independence, ownership structure and performance: evidence from real estate investment trusts. Journal of Real Estate Finance and Economics, 26(2), 287–318.

Ghosh, C., Nag, R., & Sirmans, C. F. (1997). Financing choice by equity REITs in the nineties. Real Estate Finance, 14(3), 41–50.

Glascock, J. L., Lu, C., & So, R. W. (2000). Further evidence on the integration of REIT, bond, and stock returns. Journal of Real Estate Finance and Economics, 20(2), 177–194.

Gompers, P. A., & Metrick, A. (2001). Institutional investors and equity prices. Quarterly Journal of Economics, 116(1), 229–259.

Gordon, L. A., & Pound, J. (1993). Information, ownership structure, and shareholder voting: evidence from shareholder-sponsored corporate governance Proposals. Journal of Finance, 48(2), 697–718.

Graff, R. A., & Young, M. S. (1997). Institutional investor impact on equity REIT performance. Real Estate, Finance, 14(3), 31–39.

Grinstein, Y., & Michaely, R. (2005). Institutional holdings and payout policy. Journal of Finance, 60(3), 1389–1426.

Hartzell, J. C., Sun, L., & Titman, S. (2006). The effect of corporate governance on investment: evidence from real estate investment trusts (REITs). Real Estate Economics, 34(3), 343–376.

Jensen, M. (1986). Agency costs of free cash flow, corporate finance, and takeovers. American Economic Review, 76(2), 323–329.

Ling, D., & Ryngaert, M. (1997). Valuation uncertainty, institutional involvement, and the underpricing of IPOs: the case of REITs. Journal of Financial Economics, 43(3), 433–456.

Newell, G. (2010). The effectiveness of A-REIT futures as a risk management strategy in the global financial crisis. Pacific Rim Property Research Journal, 16(3), 339–357.

Nofsinger, J. R., & Sias, R. W. (1999). Herding and feedback trading by institutional and individual investors. Journal of Finance, 54(6), 2263–2295.

O’Brien, P. C., & Bhushan, R. (1990). Analyst following and institutional ownership. Journal of Accounting Research, 28, 55–76.

Parrino, R., Sias, R. W., & Starks, L. T. (2003). Voting with their feet: institutional ownership changes around forced CEO turnover. Journal of Financial Economics, 68(1), 3–46.

Shleifer, A., & Vishny, R. W. (1986). Large shareholders and corporate control. Journal of Political Economy, 94(3), 461–488.

Acknowledgement

We thank the editor and an anonymous reviewer for their comments. We also like to thank Qing Bai, Eva Steiner and seminar participants at the Real Estate Markets in Transition Conference at Hofstra University (2010), the Financial Management Association Meetings (2011), and the American Real Estate & Urban Economic Association Meetings (2012). Spieler and Tsang acknowledge financial support from Hofstra University and McGill University, respectively.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Devos, E., Ong, SE., Spieler, A.C. et al. REIT Institutional Ownership Dynamics and the Financial Crisis. J Real Estate Finan Econ 47, 266–288 (2013). https://doi.org/10.1007/s11146-012-9363-2

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11146-012-9363-2