Abstract

We present evidence that managers consider employee turnover likelihood in their accounting choices. Our tests exploit U.S. state courts’ staggered recognition of the inevitable disclosure doctrine (IDD), which reduces employees’ ability to switch employers. We find a significant decrease in upward earnings management for firms headquartered in states that recognize the IDD, relative to firms headquartered elsewhere. The effect of the IDD is stronger for firms relying more on human capital and for firms whose employees have higher ex-ante turnover likelihood, confirming the employee retention channel. Overall, our results support the view that retaining employees is an important motive for corporate earnings management.

Similar content being viewed by others

Notes

For example, firms may increase their investment in laboratory equipment.

An extensive literature shows that firms usually locate their core business activities and R&D facilities close to their headquarters (e.g., Howells 1990; Pirinsky and Wang 2006; Breschi 2008). Therefore it is reasonable to assume that a significant part of the firm’s key employees, who know its trade secrets, work in the firm’s headquarters state.

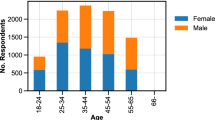

IPUMS database categorizes occupations into seven groups: 1) management, professional, and related occupations; 2) service occupations; 3) sales and office occupations; 4) farming, fishing, and forestry occupations; 5) construction, extraction, and maintenance occupations; 6) production, transportation, and material mobbing occupations; and 7) military-specific occupations.

References

Aboody, D., & Lev, B. (2000). Information asymmetry, R&D, and insider gains. Journal of Finance, 55(6), 2747–2766.

Ali, A., & Zhang, W. (2015). CEO tenure and earnings management. Journal of Accounting and Economics, 59(1), 60–79.

Ali, A., Li, N., & Zhang, W. (2015). Restrictions on managers’ outside employment opportunities and asymmetric disclosure of bad versus good news. https://doi.org/10.2139/ssrn.2674412.

Ashbaugh-Skaife, H., Collins, D. W., Kinney Jr., W. R., & LaFond, R. (2008). The effect of SOX internal control deficiencies and their remediation on accrual quality. The Accounting Review, 83(1), 217–250.

Badertscher, B. A., Collins, D. W., & Lys, T. Z. (2012). Discretionary accounting choices and the predictive ability of accruals with respect to future cash flows. Journal of Accounting and Economics, 53(1–2), 330–352.

Balsam, S., & Miharjo, S. (2007). The effect of equity compensation on voluntary executive turnover. Journal of Accounting and Economics, 43(1), 95–119.

Barton, J., & Simko, P. J. (2002). The balance sheet as an earnings management constraint. The Accounting Review, 77(Supplement), 1–27.

Beck, P. J., & Narayanamoorthy, G. S. (2013). Did the SEC impact banks’ loan loss reserve policies and their informativeness? Journal of Accounting and Economics, 56(2–3), 42–65.

Bertrand, M., & Mullainathan, S. (2003). Enjoying the quiet life? Corporate governance and managerial preferences. Journal of Political Economy, 111(5), 1043–1075.

Bird, R. C., & Jain, S. C. (2008). The global challenge of intellectual property rights. Northampton, MA: Edward Elgar Publishing.

Bowen, R. M., DuCharme, L., & Shores, D. (1995). Stakeholders’ implicit claims and accounting method choice. Journal of Accounting and Economics, 20(3), 255–295.

Breschi, S. (2008). Innovation-specific agglomeration economies and the spatial clustering of innovative firms. In C. Karlsson (Ed.), Handbook of research on innovation and clusters (pp. 167–192). Cheltenham: Edward Elgar Publishing.

Burgstahler, D., & Dichev, I. (1997). Earnings management to avoid earnings decreases and losses. Journal of Accounting and Economics, 24(1), 99–126.

Carter, M. E., Lynch, L. J., & Tuna, I. (2007). The role of accounting in the design of CEO equity compensation. The Accounting Review, 82(2), 327–357.

Chang, X., Fu, K., Low, A., & Zhang, W. (2015). Non-executive employee stock options and corporate innovation. Journal of Financial Economics, 115(1), 168–188.

Chava, S., & Roberts, M. R. (2008). How does financing impact investment? The role of debt covenants. Journal of Finance, 63(5), 2085–2121.

Chen, X., Cheng, Q., & Wang, X. (2015). Does increased board independence reduce earnings management? Evidence from recent regulatory reforms. Review of Accounting Studies, 20(2), 899–933.

Chen, D., Gao, H., & Ma, Y. (2018). Human capital driven acquisition: Evidence from the Inevitable Disclosure Doctrine. Working paper, Fudan University, and University of International Business and Economics. https://doi.org/10.2139/ssrn.2713600.

Cheng, Q., & Warfield, T. D. (2005). Equity incentives and earnings management. The Accounting Review, 80(2), 441–476.

Choudhary, P., Rajgopal, S., & Venkatachalam, M. (2009). Accelerated vesting of employee stock options in anticipation of FAS 123-R. Journal of Accounting Research, 47(1), 105–146.

Clogg, C. C., Petkova, E., & Haritou, A. (1995). Statistical methods for comparing regression coefficients between models. American Journal of Sociology, 100(5), 1261–1293.

Cohen, D. A., Dey, A., & Lys, T. Z. (2008). Real and accrual-based earnings management in the pre-and post-Sarbanes-Oxley periods. The Accounting Review, 83(3), 757–787.

Cornell, B., & Shapiro, A. C. (1987). Corporate stakeholders and corporate finance. Financial Management, 16(1), 5–14.

Dechow, P. M., & Dichev, I. D. (2002). The quality of accruals and earnings: the role of accrual estimation errors. The Accounting Review, 77(Supplement), 35–59.

Dechow, P. M., Sloan, R. G., & Sweeney, A. P. (1995). Detecting earnings management. The Accounting Review, 70(2), 193–225.

DeFond, M. L., & Jiambalvo, J. (1994). Debt covenant violation and manipulation of accruals. Journal of Accounting and Economics, 17(1–2), 145–176.

Demerjian, P. R., & Owens, E. L. (2016). Measuring the probability of financial covenant violation in private debt contracts. Journal of Accounting and Economics, 61(2–3), 433–447.

Deng, X., & Gao, H. (2013). Nonmonetary benefits, quality of life, and executive compensation. Journal of Financial and Quantitative Analysis, 48(1), 197–218.

Dichev, I. D., & Skinner, D. J. (2002). Large-sample evidence on the debt covenant hypothesis. Journal of Accounting Research, 40(4), 1091–1123.

Dorsey, S. (1995). Pension portability and labor market efficiency: a survey of the literature. Industrial & Labor Relations Review, 48(2), 276–292.

Dou, Y., Khan, M., & Zou, Y. (2016). Labor unemployment insurance and earnings management. Journal of Accounting and Economics, 61(1), 166–184.

DuCharme, L. L., Malatesta, P. H., & Sefcik, S. E. (2004). Earnings management, stock issues, and shareholder lawsuits. Journal of Financial Economics, 71(1), 27–49.

Fang, V. W., Tian, X., & Tice, S. (2014). Does stock liquidity enhance or impede firm innovation? Journal of Finance, 69(5), 2085–2125.

Flood, S., King, M., Ruggles, S., & Warren, J. R. (2015). Integrated Public Use Microdata Series, Current Population Survey: Version 4.0 [dataset]. https://doi.org/10.18128/D030.V4.0.

Francis, J. R. (2001). Discussion of empirical research on accounting choice. Journal of Accounting and Economics, 31(1–3), 309–319.

Francis, J. R., & Krishnan, J. (1999). Accounting accruals and auditor reporting conservatism. Contemporary Accounting Research, 16(1), 135–165.

Gao, H., & Zhang, W. (2017). Employment nondiscrimination acts and corporate innovation. Management Science, 63(9), 2982–2999.

Gao, H., Luo, J., & Tang, T. (2015). Effects of managerial labor market on executive compensation: evidence from job-hopping. Journal of Accounting and Economics, 59(2–3), 203–220.

Garmaise, M. J. (2011). Ties that truly bind: noncompetition agreements, executive compensation, and firm investment. Journal of Law, Economics, and Organization, 27(2), 376–425.

Godfrey, E. R. (2004). Inevitable disclosure of trade secrets: employee mobility v. employer’s rights. Journal of High Technology Law, 3(1), 161–179.

Godfrey, J. M., & Hamilton, J. (2005). The impact of R&D intensity on demand for specialist auditor services. Contemporary Accounting Research, 22(1), 55–93.

Graham, J. R., Harvey, C. R., & Rajgopal, S. (2005). The economic implications of corporate financial reporting. Journal of Accounting and Economics, 40(1–3), 3–73.

Hall, B. H., Jaffe, A. B., & Trajtenberg, M. (2005). The NBER patent citation data file: Lessons, insights and methodological tools. In A. B. Jaffe & M. Trajtenberg (Eds.), Patents, citations and innovations: A window on the knowledge economy (pp. 403–470). Cambridge: MIT Press.

Harris, J. O. (2000). Doctrine of inevitable disclosure: a proposal to balance employer and employee interests. Washington University Law Review, 78(1), 325–345.

Healy, P. M. (1985). The effect of bonus schemes on accounting decisions. Journal of Accounting and Economics, 7(1–3), 85–107.

Healy, P. M., & Palepu, K. G. (1993). The effect of firms' financial disclosure strategies on stock prices. Accounting Horizons, 7(1), 1–11.

Howells, J. (1990). The location and organization of research and development: new horizons. Research Policy, 19(2), 133–146.

Hribar, P., & Collins, D. W. (2002). Errors in estimating accruals: implications for empirical research. Journal of Accounting Research, 40(1), 105–134.

Imbens, G. W., & Wooldridge, J. M. (2009). Recent developments in the econometrics of program evaluation. Journal of Economic Literature, 47(1), 5–86.

Ippolito, R. A. (1985). The labor contract and true economic pension liabilities. The American Economic Review, 75(5), 1031–1043.

Jones, J. J. (1991). Earnings management during import relief investigations. Journal of Accounting Research, 29(2), 193–228.

Jorda, K. F. (2007). Trade secrets and trade-secret licensing. In A. Krattiger, R. T. Mahoney, L. Nelsen, J. A. Thomson, A. B. Bennett, K. Satyanarayana, et al. (Eds.), Intellectual property management in health and agricultural innovation: A handbook of best practices (pp. 1043–1057). Oxford: Centre for the Management of Intellectual Property in Health Research and Development and Davis: Public Intellectual Property Resource for Agriculture.

Khan, M., & Watts, R. L. (2009). Estimation and empirical properties of a firm-year measure of accounting conservatism. Journal of Accounting and Economics, 48(2–3), 132–150.

Klasa, S., Ortiz-Molina, H., Serfling, M., & Srinivasan, S. (2018). Protection of trade secrets and capital structure decisions. Journal of Financial Economics, 128(2), 266–286.

Kogan, L., Papanikolaou, D., Seru, A., & Stoffman, N. (2017). Technological innovation, resource allocation, and growth. The Quarterly Journal of Economics, 132(2), 665–712.

Kothari, S. P., Leone, A. J., & Wasley, C. E. (2005). Performance matched discretionary accrual measures. Journal of Accounting and Economics, 39(1), 163–197.

Ljungqvist, A., & Wilhelm Jr., W. J. (2003). IPO pricing in the dot-com bubble. Journal of Finance, 58(2), 723–752.

Malsberger, B. M. (2004). Covenants not to compete: A state-by-state survey. Washington, DC: BNA Books.

Matsumoto, D. A. (2002). Management’s incentives to avoid negative earnings surprises. The Accounting Review, 77(3), 483–514.

Palomeras, N., & Melero, E. (2010). Markets for inventors: learning-by-hiring as a driver of mobility. Management Science, 56(5), 881–895.

Petersen, M. A. (2009). Estimating standard errors in finance panel data sets: comparing approaches. Review of Financial Studies, 22(1), 435–480.

Pirinsky, C., & Wang, Q. (2006). Does corporate headquarters location matter for stock returns? Journal of Finance, 61(4), 1991–2015.

Png, I., & Samila, S. (2015). Trade secrets law and mobility: Evidence from inevitable disclosure. Working paper, National University of Singapore, and University of Navarra. https://doi.org/10.2139/ssrn.1986775.

Poterba, J., Rauh, J., Venti, S., & Wise, D. (2007). Defined contribution plans, defined benefit plans, and the accumulation of retirement wealth. Journal of Public Economics, 91(10), 2062–2086.

Roberts, M. R., & Whited, T. M. (2013). Endogeneity in empirical corporate finance. Handbook of the Economics of Finance, 2(A), 493–572.

Seaman, C. B. (2015). The case against federalizing trade secrecy. Virginia Law Review, 101, 317–394.

Skinner, D. J., & Sloan, R. G. (2002). Earnings surprises, growth expectations, and stock returns or don't let an earnings torpedo sink your portfolio. Review of Accounting Studies, 7(2–3), 289–312.

Sweeney, A. P. (1994). Debt-covenant violations and managers’ accounting responses. Journal of Accounting and Economics, 17(3), 281–308.

Teoh, S. H., Welch, I., & Wong, T. J. (1998). Earnings management and the underperformance of seasoned equity offerings. Journal of Financial Economics, 50(1), 63–99.

U.S. Chamber of Commerce. (2014). The case for enhanced protection of trade secrets in the trans-pacific partnership agreement. https://www.uschamber.com/sites/default/files/legacy/international/files/Final%20TPP%20Trade%20Secrets%208_0.pdf. Assessed 15 Sept 2018.

Watts, R. L., & Zimmerman, J. L. (1986). Positive accounting theory. Englewood Cliffs, NJ: Prentice-Hall.

Yu, F. (2008). Analyst coverage and earnings management. Journal of Financial Economics, 88(2), 245–271.

Zechman, S. L. C. (2010). The relation between voluntary disclosure and financial reporting: Evidence from synthetic leases. Journal of Accounting Research, 48(3), 725–765.

Acknowledgements

We are grateful for the helpful comments from Scott Richardson (editor), an anonymous referee, Agnes Cheng, Zhonglan Dai, Yiwei Dou (the discussant at the 2017 China International Conference in Finance), Andrew Winton, the seminar participants at Nanyang Technological University, and the conference participants at 2017 China International Conference in Finance. Huai Zhang acknowledges the financial support from Singapore Ministry of Education for providing research funding (RG76/13). Huasheng Gao acknowledges the financial support from Shanghai Pujiang Program. All errors are our own.

Author information

Authors and Affiliations

Corresponding author

Appendix 1

Appendix 1

Rights and permissions

About this article

Cite this article

Gao, H., Zhang, H. & Zhang, J. Employee turnover likelihood and earnings management: evidence from the inevitable disclosure doctrine. Rev Account Stud 23, 1424–1470 (2018). https://doi.org/10.1007/s11142-018-9475-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-018-9475-x