Abstract

A growing complexity in the financial world has attracted the interest of academicians and policymakers to examine the financial planning and well-being of individuals. This study attempts to explore the individual level determinants for improving financial well-being. Based upon the literature review, key enablers of individual financial well-being were identified which were then finalized by incorporating expert suggestions. Pursuant to this, six levels hierarchical structure was developed with the application of interpretive structural modeling (ISM) technique. Next, Matriced'ImpactsCroises Multiplication Appliques a un Classement (MICMAC) analysis was applied to determine the dependence and driving power of the identified variables. Our findings demonstrate that socio-economic factors and financial socialization are placed at the bottom level in the ISM hierarchy and all of them are also found to have the highest driving power under the MICMAC classification. On the other hand, healthy financial behaviors emerge on the top level and have the highest dependence power. The results of the study can provide valuable insights to financial educators and policymakers in terms of a better understanding of individual level enablers and their interrelationships. The knowledge of the importance of each enabler can enhance their capability to formulate improved strategies focused on securing the financial future of individuals. The concern of living a financially secured life is growing in a world full of economic uncertainties. Individual differences play a vital role in achieving a higher level of financial well-being. This study is one of the preliminary attempts to identify the individual level factors and rank them according to importance.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

Researchers across multiple disciplines have long been exploring the sources of individual well-being. Financial well-being (FWB) is one such influential domain that has a significant effect on the overall well-being of individuals (Netemeyer et al. 2018). FWB demonstrates one’s financial circumstances, the effect of which extends far beyond financial context. The magnitude of its influence is comparable with combined effect of all other life domains (Netemeyer et al. 2018). Thus, it has gained immense popularity from academicians and policy makers, specifically after the 2008 financial crisis (Sorgente and Lanz 2017). The challenges put forward by the turbulent economic and financial environment escalate the financial problems and question the financial capability of individuals. At the macro level, extensive work exists on economic growth and development using aggregate measures such as GDP per capita, but the financial concerns raised across the globe pinpoint the need to go beyond such broader measures to better explore the living standards of people and their well-being (Oquaye et al. 2020). In one American survey, it is found that a large number of people are struggling financially than indicated by traditional poverty measures (CFPB 2019) such as income. This provides valuable ground to explore drivers of FWB other than income. A study by Aegon’s (2021) UK business also publishes data wherein 1 out of 3 top earners are financially worried which brings to light the role of factors other than money in assessing FWB. Several international bodies reveal the distressed financial health of their respective citizens. For instance, the Banking giant ANZ statistics show that 36% of Australians are just getting by financially and almost 22% have no savings (ANZ 2018). Sizeable literature confirms its significant impact on other important life domains such as relationships, jobs, physical and mental health (Shim et al. 2009; Wilmarth et al. 2014; Espinosa and Rudenstine 2020) which makes it a fundamental research area.

Although a growing interest of researchers on FWB is well-documented in the form of its determinants and consequences, the subject is still in its development stage and lacks consensus over its measurement and definition. Literature highlights the two criterion measurement- the objective aspect which gauges indicators such as the absolute income, debt level, and net worth, and the subjective aspect, also referred to as ‘financial satisfaction’ which measures perceived satisfaction with one’s financial situation (Shim et al. 2009). Though, both the measures reflect the financial health of an individual but some recent studies have laid greater emphasis on the subjective aspect reasoning that two individuals might perceive their FWB differently even when they have the same financial assets (Brüggen et al. 2017; CFPB 2018). Brüggen et al. (2017) conceptualize it as a state where an individual is able to maintain their current and future desired living standards and can exercise their life choices without financial constraints. The terms “current” and “future” emphasise the dynamic nature of FWB i.e. it may undergo changes over time due to several life events. A similar perspective is held in another study by Netemeyer et al. (2018) which bifurcates FWB into two significant but discrete constructs- current money management stress and future financial security. The authors argue that the two constructs are independent meaning that the present financial burden doesn’t automatically translate to an unsecured financial future. Thus, FWB is a multifaceted construct that includes both, objective and subjective characteristics, is linked with living standards and financial freedom, has a time element, and is relative in nature.

It should be noted that FWB is a complex issue, in which various factors such as socio-demographics (Sahi 2013), knowledge, attitudes, and behavior (Parrotta and Johnson 1998), socialization agents (Lanz et al. 2019; Shim et al. 2009), financial inclusion (Fu 2020), financial capability (Xiao and Porto 2017) play critical roles. Based upon the previous studies, the impact factors of FWB can be classified at three levels, namely individual or self related, family or household related, and society or community related (Salignac et al. 2019). A large number of previous studies have laid emphasis on identifying individual level impact factors. However, very few have analysed the interrelationships among these factors. These factors are not independent and have complex interrelationships. Therefore, it is imperative to identify and analyse these factors and their interactive relationships so that more innovative financial solutions customized according to individual preferences can be designed. This study can also prove beneficial for financial educators to devise financial interventions striving to improve individual FWB. A report by the consumer financial protection bureau points out that FWB should be the ultimate aim of financial literacy and also emphasise that studying behavioral perspectives other than financial knowledge is highly important (CFPB 2015). Brüggen et al. (2017) also lay down in their research agenda the need to investigate personal factors. In this context, the present study aims to propose a comprehensive model representing key individual level factors and their interrelationship causing significant influence on individual FWB using interpretive structural modeling (ISM). The focus of this study is on individual level factors as these differences bring desirable or undesirable financial actions and also lead people to follow different coping strategies in case of any major economic event, such as an outbreak of a covid-19 pandemic, resulting in differential FWB scores. Hence, this study attempts to resolve the three research objectives formulated below:

-

RO1. Identify the key enablers of individual FWB;

-

RO2. Determine their interrelationships and propose a multi-hierarchical model of factors;

-

RO3. Ascertain the dependence and driving power of every factor.

The remainder of the paper is structured as follows. Following this introductory section is the detailed discussion of various factors selected for this study which contribute to individual FWB (Sect. 2). Section 3 provides in detail the research methodology adopted to carry out the study. Section 4 highlights the data analysis and results. Discussion of key findings and conclusion comprising limitations of the study and future research scope is provided in Sects. 5 and 6 respectively.

2 Literature review of key enablers selected for the study

2.1 Article selection scheme

The articles selection was conducted using scopus database in order to find studies of highest relevance in the field of FWB. Though the scopus database search was conducted for a broader FWB related research, it also helped in identifying relevant articles for present research. A list of keywords included “Financial well-being” and also related terms such as “Financial wellness” OR “Financial health” OR “Financial satisfaction” combined with the words such as “Individual” OR “Personal” OR “Consumer”. This searching resulted into identification of 591 publications. After carrying out the initial screening through title and abstract, a total of 391 articles were left. A detailed screening of these articles left us with 90 articles belonging to the renowned peer-reviewed international journals.

2.2 Factor selection scheme

The final set of articles were examined to figure out the factors. This resulted into a list of important factors which were appearing in most research articles and had significant on Individual FWB. However, these factors were finalized after making the suggested changes based upon expert opinion (details about experts are presented in next section). In this context, a questionnaire was initially developed using the identified factors from the literature review and was to be completed in two rounds. The first round involved discussion of the research agenda and its importance followed by the second round of discussion, wherein, a list of most relevant factors was finalized after removing factors with similar meanings and merging the appropriate factors. For instance, experts advised to include future time orientation and discard other identical meaning factors such as saving orientation, planning for money long term. On the other side, specific financial behaviors such as compulsive buying and credit card behavior were clubbed under single variable i.e. healthy financial behavior.

The subsequent paragraphs discuss these factors in detail:

2.3 Demographic characteristics

Different demographic factors exert a significant influence on FWB. For instance, women have been consistently found to be less financially knowledgeable (Lusardi and Mitchell 2014), more risk averse (Barber and Odean 2001; Fellner and Maciejovsky 2007), less confident in their capacity to make financial decisions, and less financially satisfied (Hira and Mugenda 2000; kirbiš et al. 2017). Gender role theories and family financial socialization models support these findings (Fan and Babiarz 2019; Hira and Mugenda 2000). Studies indicate that parents socialize boys and girls differently which causes a difference in financial knowledge, attitude, behavior and ultimately their financial well-being (Falahati and Paim 2011, 2012). A considerable effect of age has also been noticed. Young people lack the required financial knowledge to take desirable financial decisions (Lusardi et al. 2010), whereas, old people are equipped with more financial knowledge, a greater amount of assets, and lower liabilities (Hansen et al. 2008; Plagnol 2011; Hseih 2003). The level of education is also positively associated with financial satisfaction (Joo and Grable 2004; Hira and Mugenda 1998). Being married provides a sense of financial security and is linked with higher financial satisfaction (Zurlo 2009; Fan and Babiarz 2019).

2.4 Financial characteristics

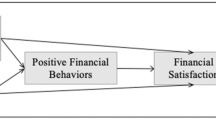

Income as a predictor of FWB attracts research efforts given the amount of emphasis laid by economists on income as a measure of welfare and well-being. A consistent positive relationship exists between income and FWB (Newman et al. 2008; Riitsalu and Murakas 2019; Subramanium et al. 2014; Chatterjee et al. 2019). In a quest to study FWB across three different level income groups of Malaysia, Shahnaz et al. (2019) find that low income group experiences more financial stress and lowest financial satisfaction. Tapping in to the subjective function of income, Grable et al. (2013) argue that it’s not only income but also the perception of income adequacy that decides financial satisfaction or dissatisfaction. On the other side, borrowings such as student loans, mortgages, and credit card debt show a significant negative correlation with FWB (Norvilitis et al. 2006, Henager and Wilmarth 2018; Grable and Joo 2006). However, Xiao et al. (2009) find that the negative effect of debt on FWB can be mitigated if positive financial behaviors are performed.

2.5 Financial knowledge

A plethora of research has identified financial knowledge (objective and subjective) as a significant contributor to individual FWB through its ability to influence financial attitudes and financial decisions. Objective indicators capture the subject’s knowledge about various financial notions such as the relationship of interest rates and inflation whereas subjective indicators capture their self-assessed financial knowledge such as “how good one is in managing their own finance”? Though both the indicators play a respective part some studies show greater effect size of subjective financial knowledge in influencing FWB (Xiao and Porto 2017; Riitsalu and Murakas 2019). Literature provides a trail where people scoring high on financial knowledge are found effective in credit, saving, and investment behavior (Parrotta and Johnson 1998; Hilgert et al. 2003), are more likely to invest in an emergency fund (Edmiston and Fisher 2006), plan for post retirement years (Van Rooji et al. 2011b) and perceive high financial satisfaction or FWB (Lee et al. 2020; Ali et al. 2015; Philippas and Avdoulas 2020). Research provides evidence that financial knowledge helps people prepare for economic distress (Klapper et al. 2011). More recent research into financial literacy indicates its strong effect on long term financial behaviors than short term (Wagner and Walstad 2019). However, some authors also cast doubt on the effect of financial knowledge on financial behaviors (Fernandes et al. 2014). In this context, a study by Mandell and Klein (2009) shows that high school graduates who undertook financial management course did not show any better financial behaviors than those who did not.

2.6 Attitude towards money

Numerous studies find money attitude instrumental in the choice of financial products, responsible financial behavior, and perception of financial status (Aydin and Selcuk 2019; Abdullah et al. 2019; Hayhoe et al. 2012). Literature on money attitudes unfolds two different dimensions: one related to symbolic meaning people attach with money and the other reflecting one’s attitude towards money management (Gasiorowska 2015). Money attitudes are helpful in understanding consumption, saving, and debt behaviors (Hayhoe et al. 2012) which ultimately affect FWB level. Money attitudes predict the likelihood of making risky or responsible financial decisions depending upon their type such as people with more liberal attitudes engage in compulsive buying and credit card use (Ahamed and Limbu 2018) whereas people holding more proactive attitude tend to make responsible decisions such as tracking expenses, emphasizing saving over spending, and reluctance to borrow money which is related to more financial satisfaction (Parrotta and Johnson 1998; Shim et al. 2009).

2.7 Healthy financial behaviors

Financial behaviors indicate the range of financial domains in which a person can take action which include past financial decisions (Joo and Grable 2004), financial behavioral intentions and coping strategies in case of poor financial circumstances (Shim et al. 2009), and wealth-building activities (Davis and Runyan 2016). A consistent positive influence of financial behaviors has been confirmed in the past studies with FWB (Shim et al. 2009; Oquaye et al. 2020). Financial behaviors include responsible financial behaviors, preserving behaviors during serious life circumstances, and also include destructive financial decisions (Brüggen et al. 2017). Decisions relating to general cash flow management, saving, budgeting, investment, risk management, compulsive buying, retirement planning are all examples of financial behaviors. Such behaviors can be desirable or positive such as keeping a monthly budget or saving for a rainy day and it also includes risky or destructive behaviors such as maxing out credit limits or buying things one cannot afford. Research highlights that performing risky financial behaviors (such as max out on credit limit) costs twice than benefits accumulated by exhibiting desirable financial behaviors such as active saving (Xiao et al. 2009; Jian et al. 2014).

2.8 Materialism

Extensive research evidences the effect of materialism on well-being. Richin and Dawson (1992) define materialism as a “set of centrally held beliefs about the importance of (material) possessions in one’s life” (p.308). One of the earliest researches on materialism and FWB found that materialists are likely to experience more dissatisfaction with living standards than non-materialists (Sirgy 1998). A comprehensive literature review on materialism and personal well-being show a consistent negative relationship between the two (Vargas and Yoon 2006; Dittmar et al. 2014). People who endorse materialistic values are more engaged in excessive debt levels (Watson 2003), financial worries (Gardarsdóttir and Dittmar 2012), and current money management stress (Ponchio et al. 2019).

2.9 Risk orientation

An individual’s capacity to contain risk results in different financial decisions and thus affects financial satisfaction (Gutter and Copur 2011; Joo and Grable 2004). Portfolio allocation which resonates with an individual’s risk tolerance level is important to achieve financial satisfaction (Asebedo and Payne 2019). Risk tolerance is influenced by several demographic and socio-economic factors. For instance, men, highly educated, and higher income groups are found more risk tolerant than women, less educated, and lower income groups. Previous studies provide divergent results as to the relationship between risk tolerance and financial satisfaction. For instance, Joo and Grable (2004) find a negative relationship arguing that those with high risk tolerance tend to build financial expectations which are incompatible with their current standard of living and thus, lead to lower financial satisfaction. Contrary to this, few others support a positive relationship between risk tolerance and financial satisfaction contending that more risk tolerant individuals perform positive financial behaviors and in turn, are highly satisfied (Castro et al. 2020). Credit card users with a high tolerance for risk are also found to be more financially satisfied than low risk tolerant users (Payne et al. 2019).

2.10 Future time orientation

In well-being literature, it is widely acknowledged that individuals’ high orientation towards the future may augment their social and economic well-being (Shobe and Page-Adams 2001). Individuals with more inclination towards the future tend to delay immediate gratifications for future financial security (Sehrawat et al. 2021; Kooij et al. 2018). Howlett et al. (2008) opine that future oriented consumers are engaged more in retirement investments and avoid risky investments. On contrary, a greater focus on present needs at the cost of the future can augment financial problems and jeopardize the sound attitude required for responsible management of finance (Vyvyan et al. 2014). In another study, it is found that people with a more present mindset have higher levels of non mortgage debt, credit card debt, and lesser levels of savings (Rutledge and Deshpandey 2015). Hence, an individual’s attitude towards the future is a vital personality element that may enhance or hinder their FWB.

2.11 Self-efficacy

Self-efficacy is a vital determinant in making responsible financial decisions which is an essential force driving individual FWB (Gutter and Copur 2011). Lown et al. (2014) find a positive impact of financial self-efficacy on the saving behavior of low and middle income individuals. Financial self-efficacy is suggested to be a missing link between knowledge and effective behavior (Lapp 2010). Corroborating to this, Limbo and Sato (2019) confirm the mediating role of financial self efficacy between credit card literacy and FWB. The findings point out that adequate credit card literacy fosters confidence and skills to use credit cards effectively which further delivers increased financial security. Mindra et al. (2017) find financial self-efficacy as an important determinant of financial inclusion (demand side) because it provides the confidence required to avail financial services and thus make lives better. Moreover, people high on self-efficacy are more resilient in hard circumstances and can better control stress and worries have initiated by these events (Asebedo and Payne 2019).

2.12 Financial socialization

Among the different socialization agents, parents have been found to be the most influential oneswho discuss financial issues at home (Drever et al. 2015; Lanz et al. 2019). Factors such as parent’s objective and subjective financial status, parental financial behavior, parent–child financial relationship have been modeled as factors influencing young adult’s FWB. Shim et al. (2009) empirically test the role of parents as financial socialization agents towards the development of positive financial attitudes among young adults. Serido et al. (2010) highlight that parents who displaysound financial behaviors also have young children who takehealthy financial decisions. Though large empirical research has focused on young adults and adolescents, a critical review on family financial socialization by Gudmunson and Danes (2011) further suggests recognizing the role of family socialization over the life course of an individual. In this view, Ammerman and Stueve (2019) conduct, an empirical study on young, middle and older adults and findings reveal a significant positive effect of childhood financial lessons on financial well-being in later stages of life. Therefore, the study indicates that pathways to the FWB begin from experiential learning and socialization during childhood and have a significant influence on an individual’s financial decisions and well-being through out.

2.13 Social/income comparisons

The relative concept of FWB has garnered huge research attention. Relative financial wealth is considered a vital determinant of individual FWB (Brown and Gray 2016). It points towards the innate habit of human beings to compare themselves with others in their reference group which might result in either favorable or unfavorable financial perceptions. For instance, studies show that people who make frequent social comparisons experience lower well-being due to the presence of destructive emotions such as guilt, envy, and unmet cravings (White et al. 2006) and might engage in financially destructive behaviors such as credit card debt (Braun santos et al. 2016), compulsive buying and lesser savings (Zhang et al. 2016). On the other hand, research on social comparisons also gives evidence of positive outcomes in the form of increased income aspirations (Stutzer 2004), motivation to save more for retirement (Koposko et al. 2015; Raue et al. 2019), and feeling of better financial future among young adults (Brown and Gray 2016). Therefore, the relative financial position can trigger either self enhancing values and positive financial behaviors or lead to a path of stress and destructive financial behaviors.

3 Research methodology

The study follows four step methodology: (1) Identifying factors influencing individual FWB; (2) Collecting expert opinion to finalise the factors list and develop interrelationships among factors; (3) Developing the ISM model; (4) Evaluating the driving and dependence power of each factor using MICMAC analysis.

The current study commenced with the identification of factors influencing individual financial well-being based on literature review which were finalized after incorporating expert opinions. On completion of the key enablers list, the expert opinion was collected to depict interactive relationships among variables using pair wise comparisons. The experts included 14 academic and financial experts dealing in personal financial management. To minimize the biasness and generalize the results, heterogeneous experts were chosen for which the details are given in Table 1. Thereafter, all expert opinions were aggregated to the structural self-interaction matrix (SSIM). The subsequent part discusses ISM methodology and MICMAC analysis in detail.

3.1 Interpretive structural modeling (ISM)

Interpretive Structural Modeling (ISM) is one of the multi criteria decision making tools to understand complex issues (Attri et al. 2020). Warfield (1974) gave the concept of ISM for building the hierarchy of the variables. ISM technique proves to be useful for developing and understanding interactions between significant factors which describe the research problem. The technique is of interpretative nature as it involves expert decision regarding the direction of relationship among factors based on their own knowledge and experience (Sienkiewicz-Małyjurek 2021). ISM results into development of a structural model depicting complex relationships among different factors, leading towards main study construct (for e.g. FWB in the present study). These relationships are used to develop Structured Self-InteractionMatrix (SSIM) which further becomes a basis to prepare Reachability Matrix (RM) and then conduct level partitionining. After this, a diagraph model and structural model are prepare to represent the identified relationships. Further, MICMAC analysis is used to validate these findings based upon the dependence and driving power of factors obtained from reachability matrix. The outputs of this analysis serve as the basis for making decisions to curb the particular problems or issues. ISM has been applied in the latest studies to evaluate the interrelationship between the factors (Gan et al. 2018). ISM technique has been applied in various research fields such as CSR in the supply chain (Faisal 2010), in a smart organization (Khan and Haleem 2012), software quality (Anand and Bansal 2017), implementation in mass communication (Ullah and Narain 2018), and e-commerce (Valmohammadi and Dashti 2016). These research studies have applied the ISM technique to examine the relationship between the variables and building the ISM model for decision making. Following steps have been applied for implementing ISM technology.

3.2 Micmac analysis

Duperrin and Godet (1973) have given the concept of MICMAC, which is popularly known as cross impact matrix multiplication applied to classification. According to Ojha et al. (2014), the main purpose of this technique is to find out the dependence and driving power of the factors and recognize the factors with the highest driving power. Driving power is the sum of all the values in the rows of each factor and dependence power is the sum of all the values in the column of each factor. Driving and dependence power has been divided into four parts. The classification of these four possible outcomes is: (1) independent factors which represent high driving power and low dependence power, (2) Autonomous factors which represent low driving and dependence power, (3) Dependent factors that represent high dependence power and low driving power, and (4) Linkage factors which represent high dependence and driving power. Therefore, the four quadrants represent the influence of driving and dependence aspects of different variables in relation to one another.

4 Results and data analysis

4.1 Development of SSIM matrix

Based upon the identified factors in the previous step, a contextual relationship is established for each pair of factors. Using pair wise contextual relationships, an SSIM matrix is constructed showing interrelationships between all enablers of financial well-being using symbols: V, A, X, and O. These four symbols depict the pair-wise relationship between factors i and j depending upon the direction of relationship:

-

1.

V-if ‘i' leads to ‘j’ but not vice-versa;

-

2.

A-if ‘i'doesn’t lead to ‘j’ but ‘j’ leads to ‘i';

-

3.

X-if both ‘i’ and ‘j’ are responsible for each other;

-

4.

O-if no relation exists between ‘i' and ‘j’

The SSIM matrix developed using the above symbols is given in Table 2.

4.2 Development of reachability matrix

Table 3 displays an initial reachability matrix derived from the SSIM matrix by converting V, A, X and O into 1 s and 0 s using the following rules:

-

1.

For symbol V, (i,j) and (j,i) entry becomes 1 and 0 respectively;

-

2.

For symbol A, (i,j) and (j,i) entry becomes 0 and 1 respectively;

-

3.

For symbol X, both (i,j) and (j,i) entry in the reachability matrix become 1 and

-

4.

For symbol O, both (i,j) and (j,i) entry becomes 0.

The final reachability matrix is developed from the initial reachability matrix using the transitivity rule (Kannan et al. 2008). The transitivity rule states that if variable A leads to variable B and variable B leads to variable C, then A must be related to C (Tables 3 and 4).

4.3 Level partitions

From the final reachability matrix, the reachability set and antecedent set are derived in order to conduct level partitioning. The reachability set for a variable comprises all the variables that it may influence and the antecedent set for a variable consists of all the variables that may influence it (Ghatak 2020). The intersection set contains an intersection of both reachability set and antecedent set. The variables with the same reachability set and intersection set are considered as level I in ISM hierarchy i.e., such variables are driven by all other variables. Subsequently, variables pertaining to level I are discarded for the next iteration, and the process is repeated until all levels are determined to establish a multi-level hierarchical structure (Tables 5, 6, 7, 8, 9 and 10).

4.4 Construction of digraph and ISM hierarchical model

According to Ullah and Narain(2021), an initial digraph, containing transitive links, was constructed using the information from the final reachability matrix and level partitioning (Fig. 1). The digraph has been prepared by way of nodes, vertices, and edge lines. In a digraph, an arrow from ‘i' to ‘j’ denotes a relationship between the variables ‘i' and ‘j’. The initial digraph has been finally turned into an ISM hierarchical model, as shown in Fig. 2, after deleting the indirect links as indicated by the ISM technique.

4.5 MICMAC analysis

The overall details of four clusters and their driving, dependence power are presented in Fig. 3 and Table 11. For example, A- (Age) with a driving power of 11 and a dependence power of 1 is located at a position of 1 on the x-axis and 11 on the y-axis, and it is defined as independent variable.

-

1.

Cluster I- Autonomous Variables: Nil

-

2.

Cluster II- Dependent Variables: HFB

-

3.

Cluster III- Linkage Variables: M, FTO, FK, ATM, SE, and SC

-

4.

Cluster IV- Independent Variables: A, G, E, MS, IL, and FS.

4.6 Results of ISM analysis

In the present study, the use of ISM facilitated the development of the hierarchical structure of multiple individual level factors which play a considerable part in achieving FWB. After the partition of the level, the digraph (Fig. 1) has been prepared to show the relationship among various factors. This model can provide significant insights for drawing out ideal measures to achieve financial success. The ISM based hierarchical structure presents six levels. The model (Fig. 2) corroborates with the conceptual framework provided by the consumer financial protection bureau (CFPB 2015) which states that an individual’s set of social and economic environment is fundamental in providing a set of opportunities to individuals and influencing the hierarchy of antecedents of financial satisfaction. In the present financial well-being framework, it can be seen that age (A), education (E), gender (G), and financial socialization (FS) are positioned at the bottom level. Concerning the middle level, a person’s income level (IL), marital status (MS), materialistic (M) and future oriented behavior (FTO) play a key role as antecedents of FWB. As regards the top level in the ISM hierarchy, healthy financial behavior (HFB) acts as the most important enabler of FWB which can further be influenced by second level enablers such as financial knowledge (FK), attitude towards money (ATM), self-efficacy (SE), risk orientation (RO), and social/income comparisons (SC).

4.7 Results of MICMAC analysis

Based upon the MICMAC analysis, we can find the driving and dependence power of different factors within ISM. This will help in identifying the most crucial factors which influence individual FWB and also in designing the most suitable financial interventions. Findings of the MICMAC analysis are highlighted below (Fig. 3):

Through this study, it can be noticed that none of the enablers is found in the autonomous zone. Usually, factors falling into this category hold very little relevance and are disconnected from other factors in the system.

In the dependent zone, enablers have high dependence power and low driving power. Enabler healthy financial behavior (HFB) falls into this category with the highest dependence power. It can be seen as the immediate and direct cause of FWB and cannot affect other factors in the system. This finding is in corroboration with previous studies which state that responsible management of finance is of prime importance in achieving higher FWB (Joo and Grable 2004; Riitsalu and Murakas 2019) and also is in line with domain specific behavior and satisfaction relationship (Xiao et al. 2009).

Enablers in the Linkage zone are of prime importance as they have both strong driving and strong dependence power. The presence of these enablers shows the level of interdependency among enablers in the system. Enablers such as materialism (M), future time orientation (FTO), financial knowledge (FK), financial attitude (FA), self-efficacy (SE), social/income comparisons (SC) fall into this zone.

In the independent zone, we can find enablers such as age (A), education (E), marital status (MS), income (IL), gender (G), and financial socialization (FS). These factors have high driving power and are also highly important factors. These results are in tune with findings from previous research studies which confirm that individual FWB is highly influenced by factors such as family financial socialization and formal financial education (Shim et al. 2009), level of income (Hsieh 2003), age of an individual (Hansen et al. 2008; Plagnol 2011) gender and marital status (Fan and Babiarz 2019). The family resource management model also presents demographic and financial characteristics as important input variables in the FWB model (Parrotta and Johnson 1998; Gutter and Copur 2011). These factors have the ability to directly influence FWB and also the other higher level factors in the ISM hierarchy.

5 Discussion and implications

The issue to improve FWB of an individual is still an aim and a challenge for both academicians and financial practitioners. The risk of failure to achieve the desired objective lies in the manifold factors and their root causes responbile for enhancing or reducing individual FWB. Therefore, it is imperative to know what factors put individuals’ financial position at risk and what are the root causes of decreased FWB. Such knowledge would provide information to timely diagnose the risk factors and take appropriate measures to prevent negative effects from evolving further.

While analyzing the driving and dependence power, the analysis highlights that age, gender, education, marital status, and financial socialization are the basic level enablers of FWB with the highest driving power. This finding is significant in the backdrop of research evidence on socio-demographics influence on FWB (Sahi 2013). As one of strongest driving enabler, age signifies the financial challenges specific to a particular life stage that can threaten FWB. Thus, it is of utmost importance to consider age specific factors while developing FWB strategies. For instance, the lower FWB of young adults cannot solely be justified through less income and net wealth but efforts should be focused to explore other age specific factors such as young adults increasing financial burden due to low financial knowledge and experience, impulsive buying due to hoard in consumerism, improper use of credit cards and high education costs. Likewise, marital status represents a major life event influencing FWB, as it leads to change in financial needs and challenges the financial capability of individuals. Gender as another primary enabler of FWB reflects the need to take gender issues in financial decision making seriously. The issue of women being at disadvantaged position compared to men when it comes to financial matters points toward the need to develop gender specific financial interventions. The results add value to research by Fan and Babiarz (2019) according to which gender and marital status have significant influence on individual financial satisfaction. These results encourage investigation of the root causes of gender based financial differences such as to examine the role of societal norms grounded in theories like social role theory, according to which financial behaviors of men and women are influenced by stereotypical beliefs of society regarding participation of both genders in economic decisions (Cupák et al. 2018; Driva et al. 2016). Therefore, the findings pinpoint the very important role of these socio-economic factors themselves and encourage practitioners to examine forces working behind these factors, visualise the financial problems of clients considering their demographic characteristics, and also provide customized suggestions to improve their present and future FWB.

Another notable basic level enabler with highest driving power is financial socialization, which plays a crucial role in building individual’s financial attitudes, behaviors, and well-being. The results substantiate findings of previous studies which highlight the importance of parental financial socialization through implicit and explicit socialization as a key determinant for a successful financial life (Lanz et al. 2020; Grusec and Davidov 2007). Hence, it is to be noted that financial socialization drives FWB and also other higher level enabelers such as financial attitude and behavior. The study recommends that to understand the importance and influence of financial socialization, researchers should follow a dual approach integrating the views of both parents and children to better explore the financial dynamics in households.

The next in the hierarchical structure are linkage factors consisting of financial knowledge and various dispositional factors such as materialism, time orientation, financial attitudes, risk orientation, and self-efficacy. These enablers transform the influence of lower level enablers to the top level in the FWB model. For example, financial characteristics (income level) effect one’s level of materialism which can interact with indivduals’ time orientation to influence their attiude towards money, which can further encourage healthy (or irresponsible) financial behaviors leading towards increase (or decrease) in FWB. This is consistent with the Gasiorowska (2015) in which one’s attitude toward money mediates and moderates the relationship between income and financial satisfaction. Moreover, the presence of all dispositional factors along with financial knowledge in same quadrant signifies that these factors are equally important as financial knowledge in predicting FWB. Thus, the results substantiate findings of Ponchio et al. (2019) that indicates that role of financial knowledge as a predictor of FWB is weakened in the presence of other psychological variables. Hence, the findings highlight the need for financial educators to go beyond traditional remedial actions i.e. sole focus on improving content financial knowledge but should also inculcate in their programmes the role of other personal or dispositional factors and develop strategies to show consumers the positive and negative consequences of adopting such dispositions so as to help them overcome undesirable traits.

Healthy financial behavior comes out as a first level enabler with the highest dependence power. A number of studies suggest financial management practices to be an immediate predictor of FWB (Parrotta and Johnson 1998; Joo and Grable 2004; Shim et al. 2009; Saurabh and Nandan 2018). This highlights the need for financial educators and counselors to direct their efforts towards improving the money management practices of individuals. The results also indicate that facilitating positive changes in lower level enablers such as materialism and future orientation can automatically help in the achievement of desirable money management practices. For example, a person who is less materialistic, less impulsive, and more future oriented will spending less than they earn and will maintain control of their budget. This would ultimately lead to higher indivdual FWB.

The study has got both theoretical and practical implications. This articles fills the identified research gap on development of comprehensive individual FWB framework which addresses factors that act enablers as obstacles in the way of FWB. The proposed framework lays foundation for analyzing individual FWB by idenitifying various factors and analyzing their interrelationships. The results also contribute to FWB research agenda developed by Brüggen et al. (2017) through identification of several individual related FWB factors, how they are related and evaluating which among them have the highest driving or dependce power. The use of ISM and MICMAC also highlights methodological contribution in FWB literature.

The findings also provide practical implications. They highlight different potential factors at four different levels in ISM hierarchy which were also validated through MICMAC analysis in four different quadrants. Financial counselors and educators should keep track of these factors while addressing concerns of clients at financially high risk position. The findings of the study can act as a road map for financial educators and practitioners to understand the holistic FWB framework and thus, enable them to develop strategies to eliminate the undesirable and promote the practice of adopting desirable attitudinal and behavioral factors rather than strictly focusing only on improvement of financial knowledge as only means to greater FWB. Moreover, the knowledge of these factors can also boost digital technology and marketing approaches of online financial service providers who can undertake profiling of customers according to these factors and design more customer specific financial solutions.

6 Conclusion, limitations, and future research scope

The current research contributes to the identification of various FWB enablers. The application of ISM provides a hierarchical structure and establishes the relationship among 14 enablers identified with the help of the literature and expert opinion. Further, the use of MICMAC analysis helped in categorizing the enablers according to their driving and dependence power. The results from MICMAC analysis confirm the significance of all the enablers towards achieving FWB.

Despite these merits, the present research has some limitations. Firstly, cause-effect relationships used to develop the ISM model were based on the experience and knowledge of experts. Therefore, the potential of response bias affecting the results of the study cannot be ruled out. Secondly, the study is of generic nature and identifies a common set of enablers affecting FWB. Future studies can endeavor to identify context specific enablers such as enablers concerned to FWB of some vulnerable groups like women, young adults, disabled, retirees, minorities and immigrants. This may lead to the addition or deletion of some variables specific to the context and open up new routes to understand and improve the FWB of such groups. Morevoer, the articles focuses only on individual related factors. Thus, it calls for similar study but with a broader perspective on FWB i.e. inclusion of contextual variables. Third, the ISM and MICMAC analysis only consider the hierarchical relationship and do not disclose the strength of the relationship. Further research can aim at empirically testing and validating the impact intensity among enablers. Last, the research has limitation resulting out from limited number of experts. However, the knowledge and experience of experts provide us a basis for understanding different interrelationships and unlocking opportunities for continued research.

Data availability

The datasets generated during and/or analysed during the current study are available from the corresponding author on reasonable request.

References

Abdullah, N., Fazli, S.M., Muhammad Arif, A.M.: The relationship between attitude towards money, financial literacy and debt management with young worker's financial well-being. Pertanika J. Soc. Sci. Humanit. 27(1), (2019)

Aegon: Financial wellbeing is more about mindset than money, (2021), https://www.aegon.com/newsroom/news/2021/aegon-financial-wellbeing-index-2021/

Ahamed, A.J., Limbu, Y.B.: Dimensions of materialism and credit card usage: an application and extension of the theory of planned behavior in Bangladesh. J. Financ. Serv. Mark. 23(3–4), 200–209 (2018). https://doi.org/10.1057/s41264-018-0058-5

Ali, A., Rahman, M.S.A., Bakar, A.: Financial satisfaction and the influence of financial literacy in Malaysia. Soc. Indic. Res. 120(1), 137–156 (2015). https://doi.org/10.1007/s11205-014-0583-0

Ammerman, D.A., Stueve, C.: Childhood financial socialization and debt-related FWB indicators in adulthood. J. Financ. Couns. Plan. 30(2), 213–230 (2019). https://doi.org/10.1891/1052-3073.30.2.213

ANZ: Financial well-being: a survey of adults in Australia (2018). https://www.anz.com.au/content/dam/anzcomau/documents/pdf/aboutus/wcmmigration/financial-wellbeing-aus18.pdf

Anand, A., Bansal, G.: Interpretive structural modelling for attributes of software quality. J. Adv. Manag. Res. 14(3), 256–269 (2017)

Asebedo, S., Payne, P.: Market volatility and financial satisfaction: the role of financial self-efficacy. J. Behav. Financ. 20(1), 42–52 (2019). https://doi.org/10.1080/15427560.2018.1434655

Attri, R., Ashishpal, N.A., Khan, N.Z., Siddiquee, A.N., Khan, Z.A.: ISM-MICMAC approach for evaluating the critical success factors of 5S implementation in manufacturing organisations. Int. J. Bus. Excell. 20(4), 521 (2020). https://doi.org/10.1504/IJBEX.2020.106437

Aydin, A.E., Akben Selcuk, E.: An investigation of financial literacy, money ethics and time preferences among college students: a structural equation model. Int. J. Bank Mark. 37(3), 880–900 (2019). https://doi.org/10.1108/IJBM-05-2018-0120

Barber, B.M., Odean, T.: Boys will be boys: gender, overconfidence, and common stock investment. Q. J. Econ. 116(1), 261–292 (2001). https://doi.org/10.1162/003355301556400

Braun Santos, D., Mendes-Da-Silva, W., Flores, E., Norvilitis, J.M.: Predictors of credit card use and perceived FWB in female college students: a Brazil-United States comparative study. Int. J. Consum. Stud. 40(2), 133–142 (2016). https://doi.org/10.1111/ijcs.12234

Brown, S., Gray, D.: Household finances and well-being in Australia: an empirical analysis of comparison effects. J. Econ. Psychol. 53, 17–36 (2016). https://doi.org/10.1016/j.joep.2015.12.006

Brüggen, E.C., Hogreve, J., Holmlund, M., Kabadayi, S., Löfgren, M.: FWB: a conceptualization and research agenda. J. Bus. Res. 79, 228–237 (2017). https://doi.org/10.1016/j.jbusres.2017.03.013

Castro-González, S., Fernández-López, S., Rey-Ares, L., Rodeiro-Pazos, D.: The influence of attitude to money on individuals’ financial well-being. Soc. Indic. Res. 148(3), 747–764 (2020). https://doi.org/10.1007/s11205-019-02219-4

CFPB: Financial well-being: the goal of financial education, (2015). https://files.consumerfinance.gov/f/201501_cfpb_report_financial-well-being.pdf. Accessed 11 Dec 2015

CFPB: Pathways to financial well-being: the role of financial capability, (2018). https://www.consumerfinance.gov/data-research/research-reports/pathways-financial-well-being/

CFPB: Financial well-being by state: using data from the Financial Industry Regulatory Authority Foundation 2018 National Financial Capability Study (2019). https://files.consumerfinance.gov/f/documents/201911_cfpb_fwb-state-report.pdf

Chatterjee, D., Kumar, M., Dayma, K.K.: Income security, social comparisons and materialism: determinants of subjective FWB among Indian adults. Int. J. Bank Mark. 37(4), 1041–1061 (2019). https://doi.org/10.1108/IJBM-04-2018-0096

Cupák, A., Fessler, P., Schneebaum, A., Silgoner, M.: Decomposing gender gaps in financial literacy: new international evidence. Econ. Lett. 168, 102–106 (2018). https://doi.org/10.1016/j.econlet.2018.04.004

Davis, K., Runyan, R.C.: Personality traits and financial satisfaction: investigation of a hierarchical approach. J. Financ. Couns. Plan. 27(1), 47–60 (2016). https://doi.org/10.1891/1052-3073.27.1.47

Dittmar, H., Bond, R., Hurst, M., Kasser, T.: The relationship between materialism and personal well-being: a meta-analysis. J. Pers. Soc. Psychol. 107(5), 879–924 (2014)

Drever, A.I., Odders-White, E., Kalish, C.W., Else-Quest, N.M., Hoagland, E.M., Nelms, E.N.: Foundations of financial well-being: insights into the role of executive function, financial socialization, and experience-based learning in childhood and youth. J. Consum. Aff. 49(1), 13–38 (2015). https://doi.org/10.1111/joca.12068

Driva, A., Lührmann, M., Winter, J.: Gender differences and stereotypes in financial literacy: off to an early start. Econ. Lett. 146, 143–146 (2016). https://doi.org/10.1016/j.econlet.2016.07.029

Duperrin, J.C., Godet, M.: Methode de hierarhisation des elements d’un systemeeconomique du [Methods for the Hierarchization of the Elements of a System, EconomicReport of the CEA], pp. 45–51. CEA, Paris (1973)

Edmiston, K., Fisher, M.G.: Financial education at the workplace: evidence from a survey of federal reserve bank employees (No. 2006–02). Federal Reserve Bank of Kansas City (2006)

Espinosa, A., Rudenstine, S.: The contribution of financial well-being, social support, and trait emotional intelligence on psychological distress. Br. J. Clin. Psychol. 59(2), 224–240 (2020). https://doi.org/10.1111/bjc.12242

Faisal, M.N.: Analysing the barriers to corporate social responsibility in supply chains: aninterpretive structural modelling approach. Int. J. Logist. Res. Appl. 13(3), 179–195 (2010)

Falahati, L., Paim, L.: The emergence of gender differences in consumer socialization among college students. Life Sci. J. 8(3), 187–191 (2011)

Falahati, L., Paim, LHj.: Experiencing financial problems among university students: an empirical study on the moderating effect of gender. Gend. Manag. 27(5), 315–330 (2012). https://doi.org/10.1108/17542411211252633

Fan, L., Babiarz, P.: The determinants of subjective financial satisfaction and the moderating roles of gender and marital status. Fam. Consum. Sci. Res. J. 47(3), 237–259 (2019). https://doi.org/10.1111/fcsr.12297

Fellner, G., Maciejovsky, B.: Risk attitude and market behavior: evidence from experimental asset markets. J. Econ. Psychol. 28(3), 338–350 (2007). https://doi.org/10.1016/j.joep.2007.01.006

Fernandes, D., Lynch, J.G., Jr., Netemeyer, R.G.: Financial literacy, financial education, and downstream financial behaviors. Manag. Sci. 60(8), 1861–1883 (2014). https://doi.org/10.1287/mnsc.2013.1849

Fu, J.: Ability or opportunity to act: What shapes FWB? World Dev. (2020). https://doi.org/10.1016/j.worlddev.2019.104843

Gan, X., Chang, R., Zuo, J., Wen, T., Zillante, G.: Barriers to the transition towards off-site construction in China: an Interpretive structural modeling approach. J. Clean. Prod. 197, 8–18 (2018). https://doi.org/10.1016/j.jclepro.2018.06.184

Gardarsdóttir, R.B., Dittmar, H.: The relationship of materialism to debt and FWB: the case of Iceland’s perceived prosperity. J. Econ. Psychol. 33(3), 471–481 (2012). https://doi.org/10.1016/j.joep.2011.12.008

Gasiorowska, A.: The impact of money attitudes on the relationship between income and financial satisfaction. Pol. Psychol. Bull. 46(2), 197–208 (2015). https://doi.org/10.1515/ppb-2015-0026

Grable, J.E., Joo, S.: Student racial differences in credit card debt and financial behaviors and stress. Coll. Stud. J. 40, 400–408 (2006)

Grable, J.E., Cupples, S., Fernatt, F., Anderson, N.R.: Evaluating the link between perceived income adequacy and financial satisfaction: a resource deficit hypothesis approach. Soc. Indic. Res. 114(3), 1109–1124 (2013). https://doi.org/10.1007/s11205-012-0192-8

Grusec, J.E., Davidov, M.: Socialization in the family: the roles of parents. In Grusec, J.E., Hastings, P.D. (Eds.) Handbook of socialization: theory and research, pp. 284–308. Guilford Press, New York, NY (2007)

Gudmunson, C.G., Danes, S.M.: Family financial socialization: theory and critical review. J. Fam. Econ. Issues 32(4), 644–667 (2011). https://doi.org/10.1007/s10834-011-9275-y

Gutter, M., Copur, Z.: Financial behaviors and FWB of college students: evidence from a national survey. J. Fam. Econ. Issues 32(4), 699–714 (2011). https://doi.org/10.1007/s10834-011-9255-2

Hansen, T., Slagsvold, B., Moum, T.: Financial satisfaction in old age: A satisfaction paradox or a result of accumulated wealth? Soc. Indic. Res. 89(2), 323–347 (2008). https://doi.org/10.1007/s11205-007-9234-z

Hayhoe, C.R., Cho, S.H., DeVaney, S.A., Worthy, S.L., Kim, J., Gorham, E.: How do distrust and anxiety affect saving behavior? Fam. Consum. Sci. Res. J. 41(1), 69–85 (2012). https://doi.org/10.1111/j.1552-3934.2012.02129.x

Henager, R., Wilmarth, M.J.: The relationship between student loan debt and financial wellness. Fam. Consum. Sci. Res. J. 46(4), 381–395 (2018). https://doi.org/10.1111/fcsr.12263

Hilgert, M.A., Hogarth, J.M., Beverly, S.G.: Household financial management: the connection between knowledge and behavior, pp. 309–322. Federal Reserve Bulletin (2003)

Hira, T.K., Mugenda, O.M.: Predictors of financial satisfaction: differences between retirees and non-retirees. J. Financ. Couns. Plan. 9(2), 75–84 (1998)

Hira, T.K., Mugenda, O.: Gender differences in financial perceptions, behaviors and satisfaction. J. Financ. Plan. Denver 13(2), 86–93 (2000)

Howlett, E., Kees, J., Kemp, E.: The role of self-regulation, future orientation, and financial knowledge in long-term financial decisions. J. Consum. Aff. 42(2), 223–242 (2008). https://doi.org/10.1111/j.1745-6606.2008.00106.x

Hsieh, C.-M.: Income, age and financial satisfaction. Int. J. Aging Hum. Dev. 56(2), 89–112 (2003). https://doi.org/10.2190/KFYF-PMEH-KLQF-EL6K

Jian, J., Chen, C., Chen, F.: Consumer financial capability and financial satisfaction. Soc. Indic. Res. 118(1), 415–432 (2014). https://doi.org/10.1007/s11205-013-0414-8

Joo, S.-H., Grable, J.E.: An exploratory framework of the determinants of financial satisfaction. J. Fam. Econ. Issues 25(1), 25–50 (2004). https://doi.org/10.1023/B:JEEI.0000016722.37994.9f

Kannan, G., Haq, A.N., Sasikumar, P., Arunachalam, S.: Analysis and selection of green suppliers using interpretative structural modelling and analytic hierarchy process. Int. J. Manag. Decis. Mak. 9(2), 163–182 (2008)

Khan, U., Haleem, A.: Smart organisations: modelling of enablers using an integrated ISMand fuzzy-MICMAC approach. Int J Intell Enterp 1(3–4), 248–269 (2012)

Kirbiš, I.Š, Vehovec, M., Galić, Z.: Relationship between financial satisfaction and financial literacy: exploring gender differences. Društvenaistraživanja 26(2), 165–185 (2017)

Klapper, L., Panos, G.A.: Financial literacy and retirement planning: the Russian case. J. Pension Econ. Financ. 10(4), 599–618 (2011). https://doi.org/10.1017/S1474747211000503

Kooij, D.T.A.M., Kanfer, R., Betts, M., Rudolph, C.W.: Future time perspective: a systematic review and meta-analysis. J. Appl. Psychol. 103, 867–893 (2018). https://doi.org/10.1037/apl0000306

Koposko, J.L., Kiso, H., Hershey, D.A., Gerrans, P.: Perceptions of retirement savings relative to peers. Work Aging Retire. 2(1), 65–72 (2015)

Lanz, M., Sorgente, A., Danes, S.: Implicit family fnancial socialization and emerging adults’ fnancial well-being: a multi-informant approach. Emerg. Adulthood 10(1177/21676), 96819876752 (2019)

Lapp, W.M., Ph, D., Lapp, W.M., Ph, D.: The missing link : financial self-efficacy’s critical role in financial capability. EARN White paper. EARN Research Institute, San Francisco (2010)

Lee, J.M., Lee, J., Kim, K.T.: Consumer financial well-being: knowledge is not enough. J. Fam. Econ. Issues 41(2), 218–228 (2020)

Limbu, Y.B., Sato, S.: Credit card literacy and FWB of college students: a moderated mediation model of self-efficacy and credit card number. Int. J. Bank Mark. 37(4), 991–1003 (2019). https://doi.org/10.1108/IJBM-04-2018-0082

Lown, J.M., Kim, J., Gutter, M.S., Hunt, A.: Self-efficacy and savings among middle and low income households. J. Fam. Econ. Issues 36(4), 491–502 (2014). https://doi.org/10.1007/s10834-014-9419-y

Lusardi, A., Mitchell, O.S.: The economic importance of financial literacy: theory and evidence. J. Econ. Lit. 52(1), 5–44 (2014). https://doi.org/10.1257/jel.52.1.5

Lusardi, A., Mitchell, O.S., Curto, V.: Financial literacy among the young. J. Consum. Aff. 44(2), 358–380 (2010). https://doi.org/10.1111/j.1745-6606.2010.01173.x

Mandell, L., Klein, L.S.: The impact of financial literacy education on subsequent financial behavior. J. Financ. Couns. Plan. 20(1), (2009)

Mindra, R., Moya, M., Zuze, L.T., Kodongo, O.: Financial self-efficacy: a determinant of financial inclusion. Int. J. Bank Mark. 35(3), 338–353 (2017). https://doi.org/10.1108/IJBM-05-2016-0065

Netemeyer, R.G., Warmath, D., Fernandes, D., Lynch, J.G.: How am I doing? Perceived FWB, its potential antecedents, and its relation to overall well-being. J. Consum. Res. 45(1), 68–89 (2018). https://doi.org/10.1093/jcr/ucx109

Newman, C., Delaney, L., Nolan, B.: A dynamic model of the relationship between income and financial satisfaction: evidence from Ireland. Econ. Soc. Rev. 39(2), 105–130 (2008)

Norvilitis, J.M., Merwin, M.M., Osberg, T.M., Roehling, P.V., Young, P., Kamas, M.M.: Personality factors, money attitudes, financial knowledge, and credit-card debt in college students. J. Appl. Soc. Psychol. 36(6), 1395–1413 (2006). https://doi.org/10.1111/j.0021-9029.2006.00065.x

Ojha, R., Vij, A.K., Vrat, P.: Manufacturing excellence and its critical factors. J. Adv. Manag. Res. 11(3), 312–332 (2014)

Oquaye, M., Owusu, G.M.Y., Bokpin, G.A.: The antecedents and consequence of financial well-being: a survey of parliamentarians in Ghana. Rev. Behav. Financ. (2020). https://doi.org/10.1108/RBF-12-2019-0169

Parrotta, J.L., Johnson, P.J.: The impact of financial attitudes and knowledge on financial management and satisfaction of recently married individuals. J. Financ. Couns. Plan. 9(2), 59–75 (1998)

Payne, P., Kalenkoski, C.M., Browning, C.: Risk tolerance and the financial satisfaction of credit card users. J. Financ. Couns. Plan. 30(1), 110–120 (2019). https://doi.org/10.1891/1052-3073.30.1.110

Philippas, N.D., Avdoulas, C.: Financial literacy and financial well-being among generation-Z university students: evidence from Greece. Eur. J. Financ. 26(4–5), 360–381 (2020). https://doi.org/10.1080/1351847X.2019.1701512

Plagnol, A.C.: Financial satisfaction over the life course: the influence of assets and liabilities. J. Econ. Psychol. 32(1), 45–64 (2011). https://doi.org/10.1016/j.joep.2010.10.006

Ponchio, M.C., Cordeiro, R.A., Gonçalves, V.N.: Personal factors as antecedents of perceived FWB: evidence from Brazil. Int. J. Bank Mark. 37(4), 1004–1024 (2019). https://doi.org/10.1108/IJBM-03-2018-0077

Raue, M., D’Ambrosio, L.A., Coughlin, J.F.: The power of peers: prompting savings behavior through social comparison. J. Behav. Financ. (2019). https://doi.org/10.1080/15427560.2019.1587762

Richins, M.L., Dawson, S.: A consumer values orientation for materialism and its measurement: scale development and validation. J. Consum. Res. 19(3), 303–316 (1992)

Riitsalu, L., Murakas, R.: Subjective financial knowledge, prudent behaviour and income: the predictors of FWB in Estonia. Int. J. Bank Mark. 37(4), 934–950 (2019). https://doi.org/10.1108/IJBM-03-2018-0071

Roy Ghatak, R.: Barriers analysis for customer resource contribution in value co-creation for service industry using interpretive structural modeling. J. Model. Manag. 15(3), 1137–1166 (2020). https://doi.org/10.1108/JM2-07-2019-0168

Rutledge, D., Deshpande, S.: The influence of time orientation on personal finance behaviours. In: ideas in marketing: finding the new and polishing the old, pp. 67–76. Springer, Cham (2015)

Sahi, S.K.: Demographic and socio-economic determinants of financial satisfaction: a study of SEC-A segment of individual investors in India. Int. J. Soc. Econ. 40(2), 127–150 (2013). https://doi.org/10.1108/03068291311283607

Salignac, F., Hamilton, M., Noone, J., Marjolin, A., Muir, K.: Conceptualizing financial wellbeing: an ecological life - course approach. J. Happiness Stud. (2019). https://doi.org/10.1007/s10902-019-00145-3

Saurabh, K., Nandan, T.: Role of financial risk attitude and financial behavior as mediators in financial satisfaction: empirical evidence from India. South Asian J Bus Stud 7(2), 207–224 (2018). https://doi.org/10.1108/SAJBS-07-2017-0088

Sehrawat, K., Vij, M., Talan, G.: Understanding the path toward financial well-being: evidence from India. Front. Psychol. 12, 638408 (2021). https://doi.org/10.3389/fpsyg.2021.638408

Serido, J., Shim, S., Mishra, A., Tang, C.: Financial parenting, financial coping behaviors, and well‐being of emerging adults. Fam. Relat. 59(4), 453–464 (2010)

Shim, S., Xiao, J.J., Barber, B.L., Lyons, A.C.: Pathways to life success: a conceptual model of FWB for young adults. J. Appl. Dev. Psychol. 30(6), 708–723 (2009). https://doi.org/10.1016/j.appdev.2009.02.003

Shobe, M., Page-Adams, D.: Assets, future orientation, and well-being: exploring and extending Sherraden’s framework. J. Sociol. Soc. Welf. 18, 109–127 (2001)

Sienkiewicz-Małyjurek, K.: Interpretive structural modelling of inter-agency collaboration risk in public safety networks. Qual. Quant. (2021). https://doi.org/10.1007/s11135-021-01172-0

Sirgy, M.J.: Materialism and quality of life. Soc. Indic. Res. 43(3), 227–260 (1998). https://doi.org/10.1023/A:1006820429653

SorgenteLanz, A.M.: Emerging adults’ FWB: a scoping review. Adolesc Res. Rev. 2(4), 255–292 (2017). https://doi.org/10.1007/s40894-016-0052-x

Stutzer, A.: The role of income aspirations in individual happiness. J. Econ. Behav. Organ. 54(1), 89–109 (2004)

Subramaniam, G., Ali, E., Maniam, B.: Subjective financial well-being and incidence of indebtedness among young workers in Malaysia. Bus. Stud. J. 6, 57–65 (2014)

Ullah, I., Narain, R.: Analysis of interactions among the enablers of mass customization: aninterpretive structural modelling approach. J. Model. Manag. 13(3), 626–645 (2018)

Ullah, I., Narain, R.: Analyzing the barriers to implementation of mass customization in Indian SMEs using integrated ISM-MICMAC and SEM. J. Adv. Manag. Res. 18(2), 323–349 (2021). https://doi.org/10.1108/JAMR-04-2020-0048

Valmohammadi, C., Dashti, S.: Using interpretive structural modeling and fuzzy analyticalprocess to identify and prioritize the interactive barriers of e-commerce implementation. Inf. Manag. 53(2), 157–168 (2016)

Van Rooij, M.C.J., Lusardi, A., Alessie, R.J.M.: Financial literacy and retirement planning in the Netherlands. J. Econ. Psychol. 32(4), 593–608 (2011). https://doi.org/10.1016/j.joep.2011.02.004

Vargas, P.T., Yoon, S.: On the psychology of materialism: wanting things, having things, and being happy. Advert. Soc. Rev. 7(1), 1–15 (2006)

Vyvyan, V., Blue, L., Brimble, M.: Factors that influence financial capability and effectiveness: exploring financial counsellors’ perspectives. Aust. Account. Bus. Financ. J. 8(4), 3–22 (2014)

Wagner, J., Walstad, W.B.: The Effects of financial education on short-term and long-term financial behaviors. J. Consum. Aff. 53(1), 234–259 (2019)

Warfield, J.N.: Developing interconnection matrices in structural modelling. IEEE Trans. Syst. Man. Cybern. 4(1), 81–87 (1974)

Watson, J.J.: The relationship of materialism to spending tendencies, saving, and debt. J Econ Psychol 24(6), 723–739 (2003). https://doi.org/10.1016/j.joep.2003.06.001

White, J.B., Langer, E.J., Yariv, L., Welch, J.C.: Frequent social comparisons and destructive emotions and behaviors: the dark side of social comparisons. J. Adult Dev. 13(1), 36–44 (2006)

Wilmarth, M.J., Nielsen, R.B., Futris, T.G.: Financial Wellness and relationship satisfaction: Does communication mediate? Fam. Consum. Sci. Res. J. 43(2), 131–144 (2014). https://doi.org/10.1111/fcsr.12092

Xiao, J.J., Porto, N.: Financial education and financial satisfaction: financial literacy, behavior, and capability as mediators. Int. J. Bank Mark. 35(5), 805–817 (2017). https://doi.org/10.1108/IJBM-01-2016-0009

Xiao, J.J., Tang, C., Shim, S.: Acting for happiness: financial behavior and life satisfaction of college students. Soc. Indic. Res. 92(1), 53–68 (2009). https://doi.org/10.1007/s11205-008-9288-6

Zhang, J.W., Howell, R.T., Howell, C.J.: Living in wealthy neighborhoods increases material desires and maladaptive consumption. J. Consum. Cult. 16(1), 297–316 (2016)

Zurlo, K.A.: Personal attributes and the financial well-being of older adults: the effects of control beliefs. PARC Working Paper Series, WPS 09-03 (2009)

Acknowledgements

Not applicable.

Funding

No Funding.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical approval

The manuscript should not be submitted to more than one journal for simultaneous consideration.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Kaur, G., Singh, M. & Gupta, S. Analysis of key factors influencing individual financial well-being using ISM and MICMAC approach. Qual Quant 57, 1533–1559 (2023). https://doi.org/10.1007/s11135-022-01422-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11135-022-01422-9

Keywords

- Financial well-being

- Financial satisfaction

- Responsible finance

- Financial behavior

- Enabler

- Interpretive structural model