Abstract

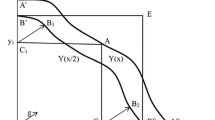

This paper develops a theoretical framework for modeling farm households’ joint production and consumption decisions in the presence of technical inefficiency. Following Lopez (1984), a household model where farmers display different preferences between on-farm and off-farm labor is adopted while their production activity can be subject to technical inefficiency. The presence of technical inefficiency does not only lead to the inability of farmers to achieve maximal output but it will also affect the consumption allocation and the household’s labor supply decisions through its effect on both income and on the shadow price of on-farm labor, leading to overall household inefficiency. An application to a panel dataset of 296 farms in the UK illustrates the basic concepts introduced in the theoretical model. The results show that households in our sample are technically inefficient but their efficiency scores are very close. However there is a big dispersion in the household efficiency scores and some households can adapt better their consumption and labor supply decisions when production is technically inefficient.

Similar content being viewed by others

Notes

Solis et al., (2007), in their meta-regression analysis, provide an excellent review of 167 relevant studies in developed and developing countries.

According to Sadoulet and de Janvry (1995) the key element in defining the household is identifying the decision making unit which sets the strategy concerning the generation of income and the use of this income for consumption and reproduction.

Taylor and Adelman (2003) provide an excellent synthesis of agricultural household modeling, its evolution and empirical uses in both developed and developing countries.

The certainty of off-farm employment income vis-a-vis the uncertainty inherent to crop production, may also enforce household members to allocate higher skilled family labor to off-farm activities leaving the farm with less-endowed managerial ability enhancing further technical inefficiency problems in farm production. This of course depends on the skills demanded by the local rural markets and individual preferences. We would like to thank the Associate Editor for pointing out this issue.

We assume throughout the paper and in model development, that off-farm labor market is efficient and robust enough to absorb changes in supply. However, if this assumption is not valid, the inefficiency problem is more intense at a household level as the oversupply of off-farm labour is affecting wage rates and therefore household inefficiency in rural areas.

We assume that households are not making allocative errors concerning crop and variable inputs prices in farm production. Our analysis can be extended in that direction making though the econometric estimation of the empirical model unnecessarily complicated.

Leisure is assumed to be a normal good for household members.

From a different perspective there are differences in the commuting cost between farm operation and wage employment.

In our graphical exposition rural households are assumed to be net sellers of labor. The analysis can be carried out when households are net buyers of labor input.

One ESU = 1,200€SGM, where SGM is the standard gross margin. For crop farms SGM is estimated based on the area for each crop and a standardized SGM coefficient for each type of crop.

Hired labor for these farms is included in the intermediate inputs. The respective price of this aggregate input category was computed using Tornqvist procedures with cost shares as weights.

The survey provided information on the level of educational attainment which was transformed into years of schooling.

We have statistically examined the Cobb-Doulgas form for both the profit and the indirecet utility functions but the Wald test rejected that hypothesis (The associated value of the chi-square is \({\chi }^{2}\left(5\right)=74.23\) well above the corresponding critical value at the 1% significance level). We further tried to fit the quadratic and the normalized quadratic functional specifications but the empirical model didn’t converge.

The null hypothesis of variable returns-to-scale has been rejected in our FBS dataset using the conventional LR-test. The value of the chi-squared is 79.40 well above the corresponding critical value at the 5% significance level. It should be noted though that the hypothesis of constant returns-to-scale has not been rejected also by Hadley (2006) using the same dataset in a different empirical context.

All formulas for the elasticities computation in production and consumption are presented in Appendix A.

We would like to thank an anonymous reviewer for pointing out this direction of analysis.

We run the simulation under 10 more different parameter values and the results are robust.

References

Aigner DJ, Lovell CAK, Schmidt P (1977) Formulation and estimation of stochastic frontier production function models. J Econ 6:21–37

Battese GE, Coelli TJ (1995) A Model for Technical Inefficieny Effects in a Stochastic Frontier Production Function for Panel Data. Empir Econ 20:325–332

Benjamin D (1992) Household composition, labor markets, and labor demand: testing for separation in agricultural household models. Econometrica 60:287–322

Chambers RG, Karagiannis G, Tzouvelekas V (2010) Another look on pesticide productivity and pest damage. Am J Agric Econ 92:1401–11

Chang H, Wen F (2011) Off-farm work, technical efficiency, and rice production risk in Taiwan. Agric Econ 42:269–278

Chavas JP, Petrie R, Roth M (2005) Farm household production efficiency: evidence from Gambia. Am J Agric Econ 87:160–179

De Janvry A, Fafchamps M, Sadoulet E (1991) Peasant household behavior with missing markets: some paradoxes explained. Econ J 101:1400–17

Debreu G (1951) The coefficient of resource utilization. Econometrica 3:273–292

Defra. Agricultural Classification in the United Kingdom. https://webarchive.nationalarchives.gov.uk/20030731054514/http://statistics.defra.gov.uk:80/esg/pdf/farmclassification5.pdf (2003)

Defra. Farm business survey: technical notes and guidance. https://www.gov.uk/guidance/farm-business-survey-technical-notes-and-guidance (2010)

Department of the Environment, Food and Rural Affairs, Agriculture in the United Kingdom (2002) London, The Stationery Office, 2002

Farrell MJ (1957) The measurement of productive efficiency. J R Stat Soc Ser A 120:253–290

Fletschner D (2008) Women’s access to credit: does it matter for household efficiency? Am J Agric Econ 90:669–683

Hadley D (2006) Patterns in Technical Efficiency and Technical Change at the Farm-level in England and Wales, 1982–2002. J Agric Econ 57:81–100

Hennessy TC, Rehman T (2008) Assessing the Impact of the ’Decoupling’ Reform of the Common Agricultural Policy on Irish Farmers’ Off-farm Labour Market Participation Decisions. J Agric Econ 59:41–56

Jacoby H (1993) Shadow wages and peasant family labor supply: an econometric application to the Peruvian Sierra. Rev Econ Stud 60:903–921

Jorgenson DW, Lau LJ (1975) The structure of consumer preferences. Ann Econ Soc Measure 4:49–101

Key N, Sadoulet E, de Janvry A (2000) Transaction costs and agricultural household supply response. Am J Agric Econ 82:245–259

Kumbhakar SC (2001) Estimation of profit functions when profit is not maximum. Am J Agric Econ 83:1–19

Kumbhakar SC, Ghosh S, McGuckin JT (1991) A generalized production frontier approach for estimating determinants of inefficiency in U.S. dairy farms February. J Bus Econ Stat 9:279–86

Le KT (2010) Separation hypothesis tests in the agricultural household model. Am J Agric Econ 92:1420–31

Lien G, Kumbhakar SC, Hardaker JB (2010) Determinants of off-farm work and its effects on farm performance: the case of Norwegian Grain Farmers. Agric Econ 41:577–586

Lopez R (1984) Estimating labour supply and production decisions of self-employed farm producers. Eur Econ Rev 24:61–82

Lovo S (2011) Pension transfers and farm household technical efficiency: evidence from South Africa. Am J Agric Econ 93:1391–05

Pfeiffer L, Lopez,-Feldman, A, Talyor JE (2009) Is off-farm income reforming the farm? evidence from Mexico. Agricultura Econ 40:125–138

Phimister E, Roberts D (2006) The effect of off-farm work on the intensity of agricultural production. Environ Res Econ 34:493–515

Politis D, Romano J (1994) Large sample confidence regions based on subsamples under minimal assumptions. Ann Stat 22:2031–2050

Sadoulet E, de Janvry, A (1995) Quantitative Development Policy Analysis. John Hopkins Univ. Press, Baltimore

Seyoum ET, Battese GE, Fleming EM (1998) Technical Efficieny and productivity of maize producers in eastern Ethiopia: A Study of Farmers within and Outside the Sasakawa-Global 2000 Project. Agric Econ 19:341–348

Singh I, Squire L, Strauss J (1986) Agricultural Household Models: Extension, Applications and Policy. John Hopkins Univ. Press, Baltimore

Solis D, Bravo-Ureta B, Moreira VH, Maripani JF (2007) Technical efficiency in farming: a meta-regression analysis. J Prod Anal 27:57–72

Sonoda T (2008) A system comparison approach to distinguish two nonseparable and nonnested agricultural household models. Am J Agric Econ 90:509–523

Tauer LW (1995) Age and farmer productivity. Rev Agric Econ 17:63–69

Taylor JE, Adelman I (2003) Agricultural household models: genesis, evolution and extensions. Rev Econ Househ 1:33–58

Wang HJ (2002) Heteroscedasticity and Non-monotonic Efficiency Effects of a Stochastic Frontier Model. J Product Anal 18:241–253

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Additional information

Publisher’s note Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Elasticity calculation

1.1 Profit function

-

Uncompensated Variable-Input Demand Elasticities

$$\begin{array}{lll}\,{\text{Own}} {\hbox {-}} {\text{Price}}\!:\quad {\varepsilon }_{jj}^{v}={S}_{j}^{v}-1+\frac{{\beta }_{jj}^{vv}}{{S}_{j}^{v}}\\ \,{\text{Cross}} \hbox{-} {\text{Price}}\!:\quad {\varepsilon }_{jk}^{v}={S}_{k}^{v}+\frac{{\beta }_{jk}^{vv}}{{S}_{j}^{v}}\\ \,{\text{Crop}}\, {\text{Price}}\!:\quad {\varepsilon }_{jp}^{v}={S}^{y}+\frac{\sum _{k}{\beta }_{jk}^{vv}}{{S}_{j}^{v}}\end{array}$$where j, k = S, F, I are the three variable inputs used (i.e., seeds, fertilizers and intermediate inputs) and p is the crop price.

-

Crop Supply Elasticities

$$\begin{array}{ll}\,{\text{Crop}} \hbox{-} {\text{Price}}\!:\quad {\varepsilon }_{p}^{y}=-{\sum \limits _{j}}{S}_{j}^{v}+\frac{\sum _{j}\sum _{k}{\beta }_{jk}^{vv}}{{S}^{y}}\\ \,{\text{Variable}}\hbox{-}{\text{Input}}\, {\text{Price}}\!: \quad {\varepsilon}_{j}^{y}={S}_{j}^{v} + \frac{\sum _{k}{\beta }_{jk}^{vv}}{{S}^{y}}\end{array}$$ -

The matrix of Compensated Variable-Input Demand Elasticities is obtained from:

$$\left[\begin{array}{lll}{\epsilon }_{SS}^{v}&{\epsilon }_{SF}^{v}&{\epsilon }_{SI}^{v}\\ {\epsilon }_{FS}^{v}&{\epsilon }_{FF}^{v}&{\epsilon }_{FI}^{v}\\ {\epsilon }_{IS}^{v}&{\epsilon }_{IF}^{v}&{\epsilon }_{II}^{v}\end{array}\right]=\left[\begin{array}{lll}{\varepsilon }_{SS}^{v}&{\varepsilon }_{SF}^{v}&{\varepsilon }_{SI}^{v}\\ {\varepsilon }_{FS}^{v}&{\varepsilon }_{FF}^{v}&{\varepsilon }_{FI}^{v}\\ {\varepsilon }_{IS}^{v}&{\varepsilon }_{IF}^{v}&{\varepsilon }_{II}^{v}\end{array}\right]-\left[\begin{array}{l}{\varepsilon }_{Sp}^{v}\\ {\varepsilon }_{Fp}^{v}\\ {\varepsilon }_{Ip}^{v}\end{array}\right]{\left[{\varepsilon }_{p}^{y}\right]}^{-1}\left[{\varepsilon }_{S}^{y}\ {\varepsilon }_{F}^{y}\ {\varepsilon }_{I}^{y}\right]$$

1.2 Indirect utility function

-

Uncompensated Leisure and Aggregate Marketed Good Demand Elasticities

$$\begin{array}{lll}\,{\text{Own}} \hbox{-} {\text{Price}}\!:\quad {\varepsilon }_{jj}^{d} = \frac{{\alpha }_{jj}}{{Z}_{j}}-\frac{{\alpha }_{mj}}{Q}-1\\ \,{\text{Cross}} \hbox{-} {\text{Price}}\!:\quad {\varepsilon }_{jk}^{d} = \frac{0.5{\alpha }_{jk}}{{Z}_{j}}-\frac{{\alpha }_{mk}}{Q}\\ \,{\text{Income}}\!:\quad {\varepsilon }_{jm}^{d} = -\sum _{k}{\varepsilon }_{jk}^{d}\end{array}$$where j, k = ℓf, ℓo, c are the two leisures and aggregate marketed good and Zj and Q are the numerator and the denominator, respectively, of the corresponding budget shares.

-

Uncompensated Leisure and Aggregate Marketed Good Demand Elasticities w.r.t. to variable-input and crop prices

$$\begin{array}{l}\,{\text{Crop}} \, {\text{Price}}\!:\quad {e}_{jp}^{d} = \left({\varepsilon }_{\pi j}^{d}+{\varepsilon }_{\pi m}^{d}\frac{\bar{T}{\tilde{\pi }}^{f}}{M}\right){S}^{y}\\ \,{\text{Variable}} \hbox{-} {\text{Input}}\, {\text{Price}}\!:\quad {e}_{jq}^{d} =\left({\varepsilon }_{\pi j}^{d}+{\varepsilon }_{\pi m}^{d}\frac{\bar{T}{\tilde{\pi }}^{f}}{M}\right){S}_{\mathrm{q}}^{\mathrm{v}}\end{array}$$with q being the variable-inputs used (i.e., seeds, fertilizers and intermediate inputs).

-

Compensated Leisure and Aggregate Marketed Good Demand Elasticities

$$\begin{array}{l}\,{\text{Own}}\hbox{-}{\text{Price}}\!:\quad {\epsilon }_{jj}^{d}={\varepsilon }_{jj}^{d}+{\mathrm{S}}_{j}^{h}{\varepsilon }_{jm}^{d}\\ \,{\text{Cross}} \hbox{-} {\text{Price}}\!:\quad {\epsilon }_{jk}^{d}={\varepsilon }_{jk}^{d}+{\mathrm{S}}_{k}^{h}{\varepsilon }_{jm}^{d}\end{array}$$

Appendix B: Monte-Carlo simulation

In order to examine the possible bias in price elasticities obtained from the separable vis-a-vis the non-separable agricultural household model, we formulate a Monte-Carlo simulation where we generate a translog short-run profit function with one crop output, three variable inputs and one quasi-fixed input. For the indirect utility function we assume only off-farm labor together with aggregate marketed good. Profits obtained from farming were added to autonomous income. To keep the analysis simple we assume that rural households are fully efficient and thus no inefficiency terms exist in both the profit and indirect utility functions.

Linear homogeneity in crop and variable input prices was imposed in the profit function, while we ensure that all parameter restrictions and monotonicity conditions are satisfied in the simulated model. The same was done for the indirect utility function (homogeneous of degree zero, non-increasing in prices and non-decreasing in autonomous income). We draw variables from a normal distribution with \(N\left(10,2\right)\) for all explanatory variables and \(N\left(0,0.01\right)\) for all random terms.

We use the following parameter values for both functions during the Monte-Carlo simulation:Footnote 20β0 = 0.070, βy = 1.500, βyy = − 0.166, \({\beta }_{S}^{yv}=0.070\), \({\beta }_{F}^{yv}=0.090\), \({\beta }_{L}^{yf}=0.087\), \({\beta }_{S}^{v}=-01.160\), \({\beta }_{F}^{v}=-0.199\), \({\beta }_{SS}^{v}=-0.010\), \({\beta }_{SF}^{v}=-0.030\), \({\beta }_{FF}^{v}=-0.100\), \({\beta }_{SL}^{vf}=-0.025\), \({\beta }_{FL}^{vf}=0.046\), \({\beta }_{L}^{f}=0.070\) and \({\beta }_{LL}^{f}=-0.025\) for the profit function and αw = −0.220, αww = −0.700, αc = −0.370, αcc = −0.200 and αwc = −0.110 for the indirect utility function. We run the simulation using 10 different sets of parameter values but the results were robust.

Off-farm | Price of | Autonomous | |

|---|---|---|---|

Wage Rate | Marketed Good | Income | |

Uncompensated Demand Elasticities | |||

Off-Farm Leisure | 0.752 | 0.227 | 0.525 |

Marketed Good | 0.048 | 0.491 | 0.443 |

Compensated Demand Elasticities | |||

Off-Farm Leisure | 0.504 | 0.126 | – |

Marketed Good | 0.063 | 0.191 | – |

We set the number of farms to be 300 and the time periods equal to 5. The number of replications was set to 1,000. For all iterations, we calculate the mean absolute bias of the estimated point elasticities in both the profit and the indirect utility function. Since in the short-run profit the structure remains the same in both models (separable vs non-separable) crop supply and variable input demand elasticity estimates do not deviate significantly. The maximum absolute mean bias obtained from the simulation is 0.003. Hence, we can assume that the separability hypothesis does not affect point elasticities obtained from the short-run profit function. The following Table present average values of the mean absolute bias over all iterations for the off-farm labor supply and aggregate marketed good elasticities. The highest bias is between off-farm leisure and autonomous income whereas the lowest for the demand elasticity of marketed good with respect to the off-farm wage rate. Generally, biases are significant implying that model formulation is important in determining household responses to changes in market conditions and autonomous income.

Rights and permissions

About this article

Cite this article

Christopoulos, D., Genius, M. & Tzouvelekas, V. Farm and non-farm labor decisions and household efficiency. J Prod Anal 56, 15–31 (2021). https://doi.org/10.1007/s11123-021-00602-3

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11123-021-00602-3