Abstract

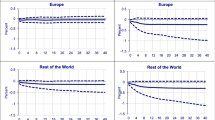

This paper studies the trade balance dynamics in the G-7 countries plus Spain. We estimate a SVAR model to identify three different shocks: real supply shocks, real demand disturbances and nominal shocks. A microfounded stochastic open-economy model is built to derive the long-term identification restrictions. Estimates show that real demand shocks explain most of the variability of trade imbalances, whereas, contrary to previous findings, nominal shocks play a very limited role. These results are consistent with the predictions of a widely set of open-economy models and illustrate that demand policies are the main responsible of trade imbalances.

Similar content being viewed by others

Notes

This weight is related negatively to the aversion to inflation variability.

Some recent papers adopt an alternative assumption, considering that the number of firms changing prices in any given period is determined endogenously (state dependent pricing models). See, for instance, Burstein (2003) and Goloslov and Lucas (2003). As emphasized by Eichenbaum and Fisher (2004), empirically plausible versions of state dependent pricing models produce similar results to those in the line of Calvo (1983) for many experiments that are relevant in countries with moderate rates of inflation.

When the probability of adjusting prices is one, which means that all firms change their prices at each moment (the case of full price flexibility), the aggregate supply is a line completely vertical (see, for instance, Woodford 2003, chapter 2).

See, for instance, Fraga et al. (2003).

These results are available from the authors upon request.

The fact that the trade balance does not improve in the short run, despite the depreciation in the real exchange rate could also be rationalised with J −curve effects in each country. Many empirical studies show, in fact, that real exchange rate depreciations worsen the trade balance during several quarters.

References

Álvarez F, Atkenson A, Kehoe P (2002) Money, interest rates and exchange rates in endogenously segmented markets. J Polit Econ 110:73–112

Bartolini L, Lahiri A (2006) Twin deficits twenty years later. Curr Issues Econ Financ 12(7):1–7

Betts C, Devereux M (2000) Exchange rate dynamics in a model of pricing-to-market. J Int Econ 50:215–244

Burstein A (2003) Inflation and output dynamics with state dependent pricing decisions, manuscript. University of Michigan

Bussière M, Fratzscher M, Muller G (2005) Productivity shocks, budget deficits and the current account. European central bank workshop paper no 509

Calvo G (1983) Staggered prices in a utility-maximizing framework. J Monet Econ 12(3):383–398

Chadha B, Prasad E (1997) Real exchange rate fluctuations and the business cycle. IMF Staff Pap 44:328–355

Chinn MD (2005) Getting serious about the twin deficits. Council on foreign relations special report

Chinn MD, Ito H (2005) Current account balances, financial development, and institutions: assaying the world ’saving glut’. La follette school working paper, no 2005-023

Chinn MD, Prasad ES (2003) Medium-term determinants of current accounts in industrial and developing countries: an empirical exploration. J Int Econ 59:47–76

Clarida R, Galí J (1994) Sources of real exchange-rate fluctuations: how important are nominal shocks? Carnegie-Rochester Conf Ser Public Policy 41:1–56

Detken C, Gaspar V (2003) Maintaining price stability under free-floating: a fearless way out of the corner? European central bank working paper series, no 241

Durand M, Madaschi C, Terribile F (1998) Trends in OECD countries’ international competitiveness: The influence of emerging market economies. Economics department working papers, no 195

Erceg C, Guerrieri L, Gust C (2005) Expansionary fiscal shocks and the trade deficit. International finance discussion paper 2005-825, Washington, Board of Governors of the Federal Reserve System

Erceg C, Guerrieri L, Gust C (2006) SIGMA: a new open economy model for policy analysis. Int J Central Banking 2:1–50

Eichenbaum M, Fisher J (2004) Evaluating the Calvo model of sticky prices. Working paper 10617, National Bureau of Economic Research

Elliot G, Fatás A (1996) International business cycles and the dynamics of the current account. Eur Econ Rev 40:361–387

Fraga A, Goldfajn I, Minella A (2003) Inflation targeting in emerging market economies. Bank of Brazil (unpublished paper)

Glick R, Rogoff K (1995) Global versus country-specific productivity shocks and the current account. J Monet Econ 35:159–192

Giuliodori M (2004) Nominal shocks and the current account: a structural VAR analysis of 14 OECD countries. Rev World Econ 140:569–591

Goloslov M, Lucas R Jr (2003) Menu costs and Phillips curves, manuscript. University of Chicago

Gruber J, Kamin S (2005) Explaining the global pattern of current account imbalances. Board of Governors of the Federal Reserve System. International finance discussion papers, no 846

Hoffmann M (2003) International macroeconomic fluctuations and the current account. Can J Econ 36:2, 401–420

Johansen, S. (1988): Statistical analysis of cointegration vectors. J Econ Dyn Control 12:231–254

Kano T (2003) A structural VAR approach to the intertemporal model of the current account. Bank of Canada, Working paper 2003-42

Kim S, Roubini N (2004) Twin deficit or twin divergence? Fiscal policy, current account, and real exchange rate in the US. Econometric Society 2004 North American Winter Meetings, no 271

Koray F, McMillin W (2006) Fiscal shocks, the trade balance, and the exchange rate. LSU department of economic working paper 2006-02

Kwiatkowski D, Phillips P, Schmidt P, Shin Y (1992) Testing the null hypothesis of stationary against the alternative of a unit root. J Econom 54:159–178

Lee J, Chinn MD (2006) Current account and the real exchange rate in the G7 countries. J Int Money Financ 25:257–274

MacKinnon JG (1996) Numerical distribution functions for unit root and cointegration tests. J Appl Econ 11(6):601–618

Prasad ES (1999) International trade and the business cycle. Econ J 109:588–606

Prasad ES, Gable J (1998) International evidence on the determinants of trade dynamics. IMF Staff Pap 45:401–439

Woodford M (2003) Interest and prices: foundations of a theory of monetary policy. Princeton University Press, Princeton, NJ

Author information

Authors and Affiliations

Corresponding author

Additional information

We thank J. L. Carrión-i-Silvestre and participants in the Workshop on Dynamic Macroeconomics, Seville, October 2006, III Jornadas de Integración Económica, Valencia, November 2006, and X Jornadas de Economía Internacional, Madrid, June 2007, for their helpful comments and suggestions. We would also like to thank two anonymous referees for hepful comments on a previous version of the paper. J. Rodríguez and José L. Torres acknowledge financial support from Fundación Centro de Estudios Andaluces (projects ECOD1.05/025 and ECOD 1.07/085) and Proyecto de Excelencia, Junta de Andalucía P07-SEJ-02479. José García-Solanes acknowledges financial support from the Spanish Ministry of Education and Science through Project SEJ 2006-15172.

Rights and permissions

About this article

Cite this article

García-Solanes, J., Rodríguez-López, J. & Torres, J.L. Demand Shocks and Trade Balance Dynamics. Open Econ Rev 22, 739–766 (2011). https://doi.org/10.1007/s11079-010-9171-3

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11079-010-9171-3