Abstract

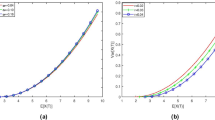

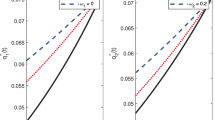

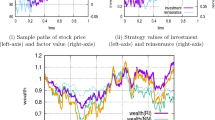

Optimal investment and risk control problem for an insurer subject to a stochastic economic factor in a Lévy market is considered in this paper. In our mathematical model, a riskless bond and a risky asset are assumed to rely on a stochastic economic factor which is described by a Lévy stochastic differential equation (SDE). The risk process is described by a new “jump-diffusion” SDE depending on the stochastic economic factor and is negatively correlated with capital gains in the financial market. Using expected utility maximization, we characterize the optimal strategies of investment and risk control under the logarithmic utility function and the power utility function, respectively. With the logarithmic utility assumption, we use the classical optimization method to obtain the optimal strategy. However, for the power utility function, we apply dynamic programming principle to derive the Hamilton–Jacobi–Bellman (HJB) equation, and analyze its solution in order to obtain the optimal strategy. We also show the verification theorem. Finally, to study the impact of the market parameters on the optimal strategies, we conduct a numerical analysis.

Similar content being viewed by others

Availability of Data and Material

Not applicable.

References

Barles G, Buckdahn R, Pardoux E (1997) Backward stochastic differential equations and integral-partial differential equations. Stochastics 60(1–2):57–83

Bo L, Liao H, Wang Y (2019) Optimal credit investment and risk control for an insurer with regime-switching. Math Financ Econ 13(1):147–172

Bo L, Wang S (2017) Optimal investment and risk control for an insurer with stochastic factor. Oper Res Lett 45(3):259–265

Bo L, Wang Y, Yang X (2010) An optimal portfolio problem in a defaultable market. Adv in Appl Probab 42(3):689–705

Bo L, Wang Y, Yang X (2013) Stochastic portfolio optimization with default risk. J Math Anal Appl 397(2):467–480

Delong Ł, Klüppelberg C (2008) Optimal investment and consumption in a Black-Scholes market with Lévy-driven stochastic coefficients. Ann Appl Probab 18(3):879–908

Duffie D, Fleming W, Soner HM, Zariphopoulou T (1997) Hedging in incomplete markets with HARA utility. J Econ Dyn Control 21(4–5):753–782

Fleming W, Soner HM (1993) Controlled Markov processes and viscosity solutions. Springer, New York

Guambe C, Kufakunesu R (1997) A note on optimal investment-consumption-insurance in a Lévy market. Insurance Math Econom 65:30–36

Li J, Liu H (2015) Optimal investment for the insurers in markov-modulated jump-diffusion models. Comput Econ 46:143–156

Liu B, Meng H, Zhou M (2021) Optimal investment and reinsurance policies for an insurer with ambiguity aversion. N Am J Econ Financ 55:101303

Merton R (1971) Optimum consumption and portfolio rules in a continuous-time model. J Econom Theory 3:373–413

Nutz M (2012) Power utility maximization in constrained exponential Lévy models. Math Finance 22(4):690–709

Øksendal B (2003) Stochastic differential equations: an introduction with applications. Springer, Berlin

Øksendal B, Sulem A (2005) Applied stochastic control of dump diffusions. Springer, Berlin

Pang T (2006) Stochastic portfolio optimization with log utility. Int J Theor Appl Finance 9(06):869–887

Perera RS (2010) Optimal consumption, investment and insurance with insurable risk for an investor in a Lévy market. Insurance Math Econom 46(3):479–484

Pham H (2002) Smooth solutions to optimal investment models with stochastic volatilities and portfolio constraints. Appl Math Optim 46(1):55–78

Shreve SE, Soner HM (1994) Optimal investment and consumption with transaction costs. Ann Appl Probab 4:609–692

Stein JL (2012) Stochastic optimal control and the U.S. financial debt crisis. Springer, New York

Wang Y, Gao H, Xing W (2018) Optimal replenishment and stocking strategies for inventory mechanism with a dynamically stochastic short-term price discount. J Global Optim 70(1):27–53

Xu L, Yao D, Cheng G (2020) Optimal investment and dividend for an insurer under a Markov regime switching market with high gain tax. J Ind Manag Optim 16(1):325–356

Zariphopoulou T (2009) Optimal asset allocation in a stochastic factor model-an overview and open problems. Adv Financ Model 8:427–453

Zou B, Cadenillas A (2014) Optimal investment and risk control policies for an insurer: expected utility maximization. Insurance Math Econom 58:57–67

Funding

This work was supported in part by the National Natural Science Foundation of China (Grant No. 61973096), GDUPS (2019) and the postgraduate innovative ability training program of Guangzhou University (2021GDJC-D03).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Competing Interests

The authors declare that they have no competing interests.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Shen, W., Yin, J. Optimal Investment and Risk Control Strategies for an Insurer Subject to a Stochastic Economic Factor in a Lévy Market. Methodol Comput Appl Probab 24, 2913–2931 (2022). https://doi.org/10.1007/s11009-022-09964-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11009-022-09964-z