Abstract

Based on panel data from the German Socio-Economic Panel (SOEP) for the years 1998 to 2018, we investigate the association between paternal childcare and parental economic well-being after separation in Germany. Referring to the post-separation year, we explore a sample of 176 separated couples with resident mothers and nonresident fathers, where fathers differ in their childcare involvement during weekdays. We propose equivalized annual net household income after exchange of alimony and child maintenance payments among the ex-partners as a novel indicator of parental economic well-being. Our study reveals the importance of considering both paid and received alimony, and child maintenance payments in analyzing post-separation economic well-being. Fathers’ childcare engagement during weekdays is not significantly associated with maternal post-separation income. Resident mothers take up the major or even full childcare burden. On the other hand, fathers with non-zero childcare hours manage to combine some paternal engagement with intensified employment. Mothers, however, fail to gain substantial ground on the labor market, which is unlikely to be due to differences in human capital, but rather due to persistently high maternal childcare involvement. We conclude that neither high levels of own resources, nor receiving help with childcare during the week shield resident mothers from economic deterioration after separation.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

Introduction

A rich body of literature addresses the question of how separation affects parents’ economic well-being (e.g., Bianchi et al., 1999; Smock, 1994). Different measures have been employed, for example individual and family income (Poortman, 2000), housing costs (Bröckel & Andreß, 2015), and wealth (Boertien & Lersch, 2021; Kapelle & Baxter, 2021). Regarding social inequality of economic well-being after separation, a variety of studies point to the relevance of socio-demographics, such as couple and child characteristics before and after separation, and the parent’s gender (Hao, 1996; Poortman, 2000; Ross, 1995; Smock, 1993). Post-separation parental behavior has attracted less attention in this regard. As time spent with children cannot be spent doing paid work, parental employment opportunities and earnings post-separation notably hinge on the ex-partner’s childcare involvement. This is particularly true for mothers. The interplay of labor market dynamics and family demographics produces parenthood wage gaps (van Winkle & Fasang, 2020) that can be more detrimental for women in the case of ‘absent fathers’ after separation. Germany is an interesting case to study in this context, as almost every third marriage dissolves (Federal Statistical Office, 2021), but shared parenting is still rather scarce (Walper et al., 2016, 2020) despite the introduction of major family policy reforms geared towards boosting work-family balance and paternal family involvement over the last two decades. Instead, the predominant post-separation model is characterized by resident mothers and non-resident fathers (Köppen, 2018). Thus, care-active fathers should make a difference for mothers’ post-separation economic well-being.

This article aims to investigate the association between the economic well-being of mothers and fathers and post-separation paternal childcare involvement in Germany. This explorative analysis necessarily remains purely descriptive in absence of an adequate (quasi-) experimental setting, which would allow for a causal analysis. In particular we are unable to explore potential endogeneities of union dissolution, of the pre-separation division of labor within the couple, or even of union formation, which might be driven by the same factors that shape parents’ economic well-being thereafter. However, our study provides interesting insights into the potential mechanisms behind income evolution post-separation and their associations with paternal childcare engagement. Moreover, we uncover the importance of specification issues.

Based on German panel data for separated parents (both formerly cohabiting and formerly married) and referring to the post-separation year with respect to the pre-separation year, the study explores the short-term gender and group associations with parental economic well-being. Focusing on the predominant post-separation model of resident mothers and nonresident fathers, we add to the previous literature by observing both ex-partners. This allows us to explore paternal childcare on weekdays reported by fathers themselves, and to employ a measure of household income after exchange of alimony/child maintenance payments among ex-partners (which, in the SOEP data is only possible when both ex-partners are observed). There is only one previous study employing a similar sample for the U.S. context: Bianchi et al. (1999) are limited to a similarly small sample size due to the requirement of following both ex-partners after separation. We update their analysis in the German context, add a focus on post-separation paternal childcare involvement, and additionally consider non-married separated couples.

Background and Hypotheses

Social scientists have employed a variety of theories to explain how union dissolution affects adults and children (cf. Amato, 2000, 2010). From the economic standpoint conveyed in the resource model (Johnson & Wu, 2002; McLanahan & Sandefur, 1994; Soons et al., 2009), separation is related to economic costs such as the loss of a second income, lost economies of scale and foregone earnings due to increased childcare obligations. Depending on their individual endowments with human capital, social networks and physical attractiveness, parents are differently protected against these risks. Individual resources act as moderators, determining the speed with which parents manage to adjust (Amato, 2000).Footnote 1 Parents (mostly mothers) who have been specializing in unpaid work during marriage suffer from decreased employment and earning capacities since their human capital depreciates during that time (Duncan & Hoffman, 1985; Sørensen, 1994). This decline in individual resources is partly compensated by public and private transfer receipts which rely on social policies and spousal alimony obligations, respectively. However, alimony payments often do not suffice to fully cover child maintenance, inducing a further decline in resources (Leopold & Kalmijn, 2016). Instead, repartnering proves to be an effective strategy combatting material hardship after separation, especially for women (Duncan & Hoffman, 1985).

Studies based on German data come to different conclusions on the permanence of income losses after separation, depending on the data and sample. Augustijn (2022) investigates the association between separated mothers’ subjective evaluations of economic well-being and the physical custody arrangement, based on a sample drawn from the 2019 Family Models in Germany (FAMOD) study. The researcher concludes that mothers in joint custody settings fare better than their peers with sole custody. This still holds when pre-separation couple constellations and individual characteristics are taken into account. Radenacker (2020) finds that the employment and earnings of West German mothers who divorced between 2008 and 2015 increased considerably within a four-year window around separation, albeit remaining far below the levels necessary for financial independence. Brüggmann (2020) explores the employment and income effects of divorce for West German women between 2000 and 2005 and finds that marginal employment is reduced and regular employment is increased after divorce, but there is no impact on daily earnings. Leopold and Kalmijn (2016) focus on a period spanning one year before separation to five years thereafter, and find that declines in economic well-being for mothers with preschool age children were sharper than for fathers. However, according to their findings, most declines were only temporary, with divorced parents approaching childless divorcees over time. Bröckel and Andreß (2015) refer to a time span that covers the year before divorce up to two years thereafter. They find that even after the turn of the millennium, in spite of increasing female labor participation and the expansion of public childcare economic consequences of divorce in terms of equivalized disposable income were still more negative for women than for men.

Overall, the literature points to the importance of two main factors for economic conditions after separation: first, post-separation behavior, and second, pre-separation conditions. Specifically, mothers can reap the returns from pre-separation human capital investment only if they spend sufficient time on the labor market post-separation. Here, paternal childcare time comes into play, yet this important driver of parental well-being post-separation has seldomly been analyzed so far. There are good reasons to expect that non-resident fathers spend less time with their children compared to before separation, since not residing with the child means less contact opportunities and practical barriers hindering access to the child.Footnote 2 This includes the time that is spent on planning and organizing daily family life, which is referred to as ‘mental labor’ in the literature (Hochschild, 2012). Koster et al. (2021) argue that the residence-gradient in childcare should be higher for fathers since in the context of traditional gender roles, fathers are less expected to act as the primary caretakers than mothers. However, if even non-resident fathers, representing the major subgroup of separated fathers in Germany, provide sufficient (measurable) variation in their weekly childcare time, the association with maternal economic well-being poses an interesting empirical question. This is even more the case if labor market activity is a feasible option for mothers. Despite a still dominant resident-mother normFootnote 3 in today’s Germany, a change towards more egalitarian attitudes has become evident in recent years (Blohm & Walter, 2018; Danzer et al., 2021), triggered by major policy reforms such as the parental leave reform in 2007 (Unterhofer & Wrohlich, 2017; Zoch & Schober, 2018). Hence, separated mothers with care-active ex-partners are “allowed” to use released time budgets for gainful work. This further strengthens our expectation that care-active fathers should make a difference for separated mothers’ economic well-being.

However, increased childcare engagement on the part of fathers, freeing up maternal time for gainful employment, and new social norms encouraging mothers to take up this option do not suffice: women must also have access to attractive wages. Poor human capital endowment pre-separation, be it due to low formal qualifications and/or high levels of depreciation of human capital in the course of family breaks, limits potential returns to maternal employment post-separation. Generally speaking, economic activity post-separation might be endogenous, reflecting selection processes prior to separation. There is myriad empirical evidence hinting at potential selectivity of union formation (e.g., Greenwood et al., 2014; Guner et al., 2018; Lichter et al., 2022), of intra-couple labor division during marriage (e.g., Boll et al., 2014; Bredemeier & Juessen, 2013; Fleche et al. 2020; Goussé et al., 2017) and of separation (e.g., Amato, 2000; Bredemeier et al., 2021; Lise & Yamada, 2019; Voena, 2015)Footnote 4 along specific individual characteristics. Moreover, the endogeneity of separation is theoretically motivated by rational choice models, comparing anticipated individual utility and costs of staying vs. leaving the union (Becker et al., 1977; Thibaut & Kelley, 1959). In light of this literature, it seems that paternal childcare behavior post-separation and resulting economic outcomes are also at least partly endogenous, shaped by the same factors underlying pre-separation conditions, i.e. individual and couple traits and constellations, as well as opportunity structures. We argue that at least part of this endogeneity should be filtered out by our restricting our sample to separated parental couples only, and our employing an individual fixed effects approach. Moreover, our descriptive evidence on pre-separation human capital endowments at least partly advocates against endogeneity/reverse causality. Nevertheless, our analysis makes no claim to causality in the absence of exogenous variation in post-separation paternal childcare involvement.

Added Value and Hypotheses of this Study

In contrast to previous studies, this study presents a more comprehensive and economically integrated approach covering both mothers and fathers. We explore the short-term group and gender differentials in economic well-being for the time around separation. Using German panel data, we measure economic well-being by equivalized net household income (ENHI). This allows us to infer parents’ monetary risks around separation, which cannot be inferred from subjective indicators such as satisfaction with household income (which we also examine). Further, ENHI allows us to monitor underlying mechanisms such as changes in household composition, earnings, and public and private transfers. We extend the study of Bröckel and Andreß (2015) by using a more recent panel, and by extending the focus to also include non-married separated couples. We further contribute to the literature by investigating economic well-being after exchange of alimony and child maintenance payments among the ex-partners, which is a new and unique feature of our study.

Second, we take a closer look at real (ex-)couples’ economic well-being around separation, linking post-separation economic outcomes to post-separation childcare arrangements and to pre-separation conditions. Comparing (ex-) partners of real couples instead of unrelated mothers and fathers allows us to establish a common point of reference, i.e. the joint household of the couple before separation. That is, gender gaps in economic outcomes after separation are more “pure” in our analysis since cross-couple heterogeneity in within-couple gender differences are filtered out. Different from Bianchi et al. (1999), who also investigate real (ex-)couples, we additionally consider non-married separated couples.

Third, by focusing on non-zero paternal childcare time on a typical weekday, we acknowledge that daily parenting practices should have direct implications for parents’ post-separation employment and partner market opportunities, both shaping parental economic well-being after separation. At the same time, as the literature has shown, parenting decisions after separation are arguably influenced by individual traits and the former couple constellation. Observing relevant pre-separation conditions, we are able to reveal path dependencies in childcare behavior. This approach allows us to explore potential human capital differences pre-separation that could motivate post-separation time use. Thus, we can at least qualitatively assess potential endogeneity of time use for childcare and employment post-separation, driven by income-relevant selection processes pre-separation. At the same time, we are aware that we are able to grasp only part of the selection processes, since neither marriage formation nor separation are random, but are instead likely to be driven by unobserved traits which at the same time shape post-separation behavior and economic welfare.Footnote 5

The following hypotheses guide our study:

Based on an evidently stronger labor market attachment for fathers, we expect them to achieve higher incomes post-separation (t+1) in both groups compared to their female ex-partners (role of gender with respect to income—H1).

Second, we postulate that mothers with ex-partners who are involved in childcare in the year after separation should experience a more favorable income evolution, compared to mothers practicing sole maternal care (role of paternal childcare with respect to maternal income—H2).

Third, we hypothesize that mothers with ex-partners who are involved in childcare in the post-separation year should experience a stronger increase in paid hours and earnings, compared to mothers practicing sole maternal care (role of paternal childcare with respect to maternal paid hours and earnings—H3).

Data and Method

We use the unique survey data from the German Socio-Economic Panel (SOEP), which is a representative longitudinal survey of over 25,000 individuals from about 16,000 households (Goebel et al., 2019; SOEP, 2020).

Sample

The sample consists of separated couples (1) with children under 16,Footnote 6 who cohabitated in the year preceding the separation, (2) in which mother and fatherFootnote 7 did not continue cohabitation after separation, (3) in which all minor children live with the mother in the post-separation year, and (4) for whom interviews were successfully conducted in the mother’s and father’s households annually from the pre-separation year (t−1) at least up until the calendar year post-separation (t+1). The year of separation (t0) refers to the information provided by the respondents in the annual survey’s individual questionnaire asking for information regarding changes in one’s family situation.Footnote 8 In the case of several observed consecutive separations, we refer to the first separation that occurred after the birth of a mother’s firstborn child. The sample reduces substantially during sample selection: among 1656 separated mothers with a child under 16 at the time of her first separation occurring after the birth of their firstborn, for only 645 can we both identify the partner from whom these women are separating as the parent of at least one biological child from this relationship and also observe this partner in the survey data. Only 347 remain once we restrict our sample to separating couples that were observed and were not cohabiting in the post-separation year. Finally, for 176 separating couples (176 fathers and 176 mothers), we observe in the survey data that all minor children live with the mother post-separation, and additionally observe information on our key variables concerning childcare and household income both pre- and post-separation for both ex-partners. Note that of previous studies, that with the closest approach to ours, Bianchi et al. (1999), yields a similarly small sample size of 199 separated couples due to the prerequisite of observing both partners around separation.

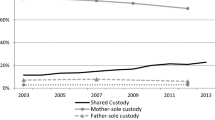

Our final main analysis sample hence consists of 176 separating couples for which we observe the immediate pre- and post-separation period over the years 1998 to 2018. We restrict our sample to this particular period, since a distinct measure of alimony and child maintenance payments received is not available prior to this date in the SOEP data. This measure is needed to construct equivalized net household income after exchange of alimony and child maintenance payments among the ex-partners (see Sect. 3.2 for more details). Figure 1 displays the distribution of separation years for the separating couples in our analysis sample.

Variables

Dependent Variables

Regarding economic outcomes, individual gross annual labor earnings capture regular income from paid work.Footnote 9 According to neoclassical models, gross earnings are closely related to market productivity. In economic theory, gross earnings reflect a partner’s market productivity, and thus together with household productivity, her comparative advantage for market work (Becker, 1965), and her economic autonomy after union dissolution, impacting bargaining power during marriage (Manser & Brown, 1980; McElroy & Horney, 1981). However, individual earnings are not appropriate for measuring individual economic well-being. If, as is standard in economic theory, one assumes that economic well-being arises from consumption opportunities and leisure, net household income is more adequate. Further, household size must be taken into account.

We therefore generate the measure equivalized net household income (ENHI), using the weights from the OECD’s modified scale (OECD, 1982). Net household income, from which ENHI is derived, is measured for the previous year and relies on the variable “household post-government income” (i11102) provided by the SOEP team in the $PEQUIV dataset (Grabka, 2020). We modify the original variable in several ways. First, we recode the variable to represent the net household income of each respective survey year (instead of the calendar year preceding the interview). Second, we aim at measuring household income after exchange of alimony and child maintenance payments among the ex-partners. Hence, received child support and alimony payments reported by the recipient partner are included in the recipients’ household income and are subtracted from the ex-partners’ household income post-separation. We term this the ‘symmetric approach’. Note that it is our unique sample of parental separations for which we observe both ex-partners pre- and post-separation that allows us to subtract monthly spouse and child maintenance payments received by one ex-partner from the paying ex-partner’s net household income.Footnote 10 We build the ENHI variable for mothers’ and fathers’ incomes around separation (from t−1 to t+1) employing the time-varyingFootnote 11 Modified OECD Equivalence Weights (Hagenaars et al., 1994).

To illustrate the distinctive features of our proposed “symmetric approach” to account for post-separation exchange of alimony and child maintenance payments among the ex-partners, we additionally measure ENHI using what we call the ‘asymmetric approach’, which is simply what is provided as the original variable of net household income in the SOEP $PEQUIV dataset. It includes received spouse and child maintenance payments, but it does not subtract paid spouse and child maintenance payments (Grabka, 2020, p. 42).Footnote 12 Table 2 in the Appendix, which reports the mean values of our key variables, depicts NHI and ENHI for mothers and fathers in our sample both according to the asymmetric and the symmetric approach. Using the asymmetric approach leads to a higher paternal income (both NHI and ENHI) in year t+1. Specifically, fathers experience an ENHI increase in this setting. The reason why is that in the asymmetric approach, alimony and maintenance payments are not deducted from the payer’s income. Since there are male payers only, maternal income is unaffected. Henceforth, we stick to the ‘symmetric approach’. We argue that accounting for these payments both on the recipient’s and the payer’s side renders income measures more informative with respect to disposable income. Concentrating on the symmetric approach, it turns out that both fathers and mothers experience a decrease in mean income around separation. Obviously, the deduction of alimony payments on the side of fathers more than outweighs the household composition effect. Additionally, since fathers regularly earn higher incomes, the lost second labor income should harm maternal income more strongly than paternal income. This negative effect adds to unchanged household composition for mothers, which is why income decrease is more pronounced for mothers.

Core Explanatory Variables

Concerning parents’ time investments into children after separation, which potentially affect parents’ economic well-being after separation, we focus on fathers’ childcare time on weekdays, since in only 9.09% of separations in our sample do mothers spend zero hours on childcare in the year after separation on a typical weekday, but this holds true for 71.02% of fathers (see Table 2 in the Appendix).Footnote 13 Childcare time is reported as average hours on a usual weekday, which we employ as a dichotomous indicator of “zero hours” vs. “more than zero hours” spent on childcare by fathers. Childcare time during the weekend is not included in this measure since it is not available continuously throughout our observation period. Thus, when we term fathers “care-inactive” in this study, we refer to whether they report spending any time on childcare during weekdays in the year after separation.

Irrespective of fathers’ daily childcare involvement, our sample consists of resident mothers, i.e. all minor children reside with the mother after separation. Therefore, it is the father’s post-separation equivalized income only that can be affected by a decreasing number of minor biological children in the household after separation. In contrast, both parents’ equivalized incomes are subject to repartnering processes, and repartnering might go hand in hand with stepchildren moving in (although this is seldom the case—only 4.5% of mothers and 12.5% of fathers have repartnered in t+1).

To further explore the interrelations between parental childcare arrangements and economic well-being, the sample is stratified into two groups (Table 1), with one group comprising separations where the father’s childcare time on weekdays is zero (125 separations) and a second group consisting of separations where the father spends at least some regular time with the child(ren) during weekdays (51 separations). The former is the group which most strongly adheres to traditional gender roles, shifting the full burden of childcare onto the mother.Footnote 14 We hence call couples in the former group “Traditionalist”, and couples in the latter group “Care-Sharer”.

Methods

Given the limited sample size, and in absence of an adequate (quasi-)experimental setting (that would allow for a causal analysis), we perform a purely descriptive exploratory analysis. For the two groups of separated couples (with and without paternal childcare involvement on weekdays), we calculate and plot predicted group means of the outcome variables with their 95% confidence intervals for two points in time relative to the year of separation (t)—t−1 and t+1. We do the same for a selected number of additional key variables. We adjust for calendar year fixed effects in all analyses. This way, inflation is filtered out, which is necessary to compare monetary terms across time, and any other time-specific effects are also filtered out. Note that although a differentiation by divorce cohorts would be desirable to trace e.g. policy reforms, this is not possible in our case due to small observation numbers.

Regarding outcome variables, we refer to ENHI and NHI to test our hypotheses H1 and H2. Regarding additional key variables, we calculate and plot their mean predicted values to be able to detect underlying changes in components of net household income. These are mothers’ and fathers’ gross annual labor earnings, public and private transfers, received alimony and child maintenance payments (as a component of private transfers), contractually agreed weekly working hours, and childcare hours. Maternal earnings and paid hours are used to test hypothesis H3.

We run regressions with individual fixed effects for mothers and fathers separately. With the pre-separation income level as our reference, we explore the statistical significance of group differences in income changes over time. In particular, we estimate the following equation

where \({y}_{itc}\) is the outcome of interest (ENHI of mothers or fathers, respectively) observed for parent i in period t (with t = [pre-separation year t−1; post-separation year t+1]) in calendar year c. The indicator of the post-separation year (\({\alpha }_{t}\)) is interacted with\({Group}_{i}\), which is an indicator variable for paternal care-involvement groups, as specified earlier in Sect. 3.2: The “Traditionalist” group comprises separations with care-inactive fathers, the “Care-Sharer” group consists of separations with care-active fathers who provide at least some regular childcare during weekdays in the year after separation. The equation includes a Constant (\(\theta\)), calendar year fixed effects (\({\delta }_{\mathrm{c}}\)), individual fixed effects (\({u}_{i}\)), and a time-varying random error term (\(\varepsilon_{itc}\)).This specification corresponds to the standard difference-in-differences setup with two-way fixed effects. However, in the absence of exogenous variation in post-separation paternal childcare involvement, it has no causal interpretation, since the assumption of parallel trends cannot be made. Additionally, setups with two-way fixed effects rely on a constant-effect assumption (see de Chaisemartin & D'Haultfoeuille, 2022 for a survey of the recent literature), e.g. over time (in our case: calendar year of separation), which equally cannot be made.

Results

Figure 2 illustrates the difference in household income post-separation between the asymmetric (Panel 2a) and the symmetric approach (Panel 2b) and depending on whether equivalence weights are used (ENHI) or not (NHI).Footnote 15

Predicted group means of equivalized annual net household income (ENHI) of mothers and fathers (to the left) and of annual net household income (NHI) of mothers and fathers (to the right), both in Euros. Asymmetric approach: (equivalized) annual net household income includes received alimony and child maintenance payments among the ex-partners, while paid alimony and child maintenance payments are not subtracted. Symmetric approach: (equivalized) annual net household income calculated after exchange of alimony and child maintenance payments among ex-partners, i.e., received child support and alimony payments reported by the recipient partner are included in the recipients’ household income and are subtracted from the ex-partners’ household income post-separation. Adjusted for survey year fixed effects. “Traditionalist”: all children reside with mother, no paternal childcare on weekdays. “Care-Sharer”: all children reside with mother, some paternal childcare on weekdays.

Annual net household income (NHI) decreases for both sexes and groups in both specification settings. However, equivalized income (ENHI) clearly increases for both father groups in the specification referring to the asymmetric approach (Panel 2a), while it decreases and stagnates for Traditionalist and Care-Sharer-fathers, respectively, based on the symmetric approach (Panel 2b). Thus, fathers’ financial situations are much less advantageous once the payment of alimony and child maintenance is taken into account (symmetric approach). In the remainder of the paper, we hence employ the symmetric approach.

Under the symmetric approach, it becomes evident that predicted group means accounting for year fixed effects support the descriptive findings stating that all four groups experience an NHI decrease, which translates into an ENHI decrease for all groups except Care-Sharer-fathers: their equivalized income stagnates. Thus, focusing on total annual income only would miss an important part of the story.

It turns out that particularly for care-active fathers (Care-Sharer), the financial situation is less negative when referring to equivalized instead of total annual income, due to a favorable change in household composition. Since all minor children in our sample reside with the mother post-separation, and only 12.5% of fathers (and 4.5% of mothers) have a new partner residing with them in the year succeeding separation, father-headed households are likely to decrease in size.

We argue that equivalized net household income (after exchange of alimony and child maintenance payments) is the relevant measure for economic well-being, since it accounts for the (cost-relevant) household composition. For this reason, at-risk-of-poverty rates refer to equivalized household income (Eurostat, 2021; OECD, 2022). Our findings indicate that economic risks increase for both groups of resident mothers and for nonresident care-inactive fathers. Referring to the gender income gap in year t+1, Care-Sharer fathers are clearly ahead of Care-Sharer-mothers (the average gap amounts to 3.318€), but the income difference is marginal between Traditionalist-parents (the average gap amounts to 780€). Thus, hypothesis H1 is only partially confirmed by our data. Care-Sharer-fathers faring better than Traditionalist-fathers is a somewhat puzzling result at first sight, which we further investigate later on. When it comes to hypothesis H2, our findings do not find any support, since mothers whose ex-partners engage in some childcare during the week do not fare better than mothers who bear the full childcare burden.

Before we delve into a more detailed descriptive analysis of the underlying mechanisms behind the results presented so far, we aim to isolate the association of parental childcare behavior with economic success post-separation in a multivariate analysis. To this end, we employ Eq. (1) and regress the (log of) our main outcome variable, equivalized annual net household income (ENHI), on a group dummy additional to individual and year fixed effects. The coefficients on time-group interactions indicate that the group differences in household income change around separation net of any time-invariant individual and calendar year effects. As Table 4 in the Appendix shows, the multivariate results confirm the predicted values shown in Fig. 2 for both parents. For fathers, estimated group differences in post-separation ENHI changes amount to about 19%. While this difference is not statistically significant in the OLS model with year fixed effects only (Column 3), statistical significance emerges in panel regressions once individual fixed effects are included (Column 4). While Traditionalist-fathers experience on average a 19% decline in ENHI, this is not the case for Care-Sharer-fathers, whose ENHI remains on average rather stable. Among mothers, the average decline in ENHI is estimated to be about 30%, with no significant group differences. In sum, Care-Sharer-fathers’ ENHI lead over Traditionalist-fathers is confirmed when observed or unobserved time invariant characteristics, potentially reflecting selection into groups, are accounted for in the within-person perspective. On the other hand, no significant group differences can be ascertained for mothers.

To better understand the mechanisms behind the divergent income patterns, we conduct two exercises. First, we look at the components of income—mainly labor income and received transfers—to identify the relevant drivers. Additionally, we explore pre-separation conditions to qualitatively assess potential selection into groups, potentially reflecting childcare preferences and shaping labor market options after separation.

Panel 3a and 3b of Fig. 3 illustrate the evolution of parents’ employment probabilities and annual labor earnings around separation. The well-known gender gaps in employment and earnings become apparent: both paternal employment and paternal earnings lie well above maternal ones, for both groups and at both points in time.Footnote 16 Interestingly, Traditionalist-mothers show the most favorable earnings trend, while the earnings of the other groups either stagnate and show only a minor increase. The earnings lead of fathers becomes plausible when considering human capital endowments (see Table 3 in Appendix). Whereas genders are almost equally equipped with educational credentials (on average 12 years of education), fathers have a lead over mothers in terms of full-time work experience (on average more than twice the years); this holds for both groups. According to human capital theory (Becker, 1964; Mincer, 1974), the higher on-the-job-training translates into higher earnings. As Panel 3c of Fig. 3 shows, the well-known gender difference in working hours contributes to the gender gap in earnings. Although both groups of mothers increase their agreed hoursFootnote 17 after separation, they do not manage to catch up with fathers. Further, the increase in hours for Care-Sharer-mothers does not translate into increased earnings.Footnote 18 However, neither on the side of mothers, nor of fathers do considerable group differences in pre-separation human capital emerge. The same results apply for differences in age or self-assessed health. Thus, inter-group pre-separation human capital differences can hardly be blamed for diverging post-separation economic conditions.

Predicted group means of parents’ employment (1 = employed, 0 otherwise), parents’ annual earnings (in Euros), contractually agreed weekly working hours and childcare time on weekdays (in hours) around separation. Adjusted for survey year fixed effects. “Traditionalist”: all children reside with mother, no paternal childcare on weekdays. “Care-Sharer”: all children reside with mother, some paternal childcare on weekdays.

In sum, the results for earnings and hours do not support our hypothesis H3. Presumably, strategic behavior in terms of increased hours of work before separation is partly inhibited here, since mothers anticipate their consistently high childcare obligations in the post-separation period, which discourages them from increasing their labor market involvement pre-separation. Brüggmann (2020) confirms this strategic behavior for German women divorcees. What cannot be examined here is whether mothers trade earnings for higher flexibility (Gangl & Ziefle, 2009).

Fathers show different trends in working hours, which only partly manifest in earnings evolution. Care-Sharer-fathers might combine a modest increase in hours with switching to a job with more flexible schedules, which comes with lower hourly earnings. Traditionalist-fathers’ decrease in hours is striking, especially in the context of this group’s zero childcare hours in year t+1 (Panel 3d of Fig. 3). Potential endogeneity due to selection processes occurring many years before separation cannot be ruled out here, and they can only partly be addressed by our fixed effects-approach. At least, a lower income capacity of Traditionalist-fathers compared to Care-Sharer-fathers seems unlikely, since they had higher earnings pre-separation; moreover, they manage to keep their earnings stable over time. Another explanation would be that Traditionalist-fathers tend to shift their attention to something else, which could be a new partnership and stepchildren. Koster et al. (2021) refer to traditional gender roles when expecting a more pronounced resident gradient in childcare hours for fathers. Further, there seems to be evidence for the notion that fathers tend to shift their attention to children with whom they live (Fuerstenberg & Cherlin, 1991). Note that we refer to gross earnings here to circumvent any biases from changes in marital status.

Additionally, we compare weekly work hours with parents’ childcare time on weekdays. Panel 3d of Fig. 3 reveals the well-known gender gap in unpaid work, which still holds after separation and irrespective of partners’ childcare arrangements. While fathers reduce their engagement even further, mothers stick to their primary carer role, and this holds particularly true for Care-Sharer-mothers. Care-Sharer-mothers seem to strive for intense parenthood before and after separation (see Table 3 in Appendix). They spent on average 7.84 h per day on childcare the year prior to separation (Traditionalist-mothers: 7.10 h), and they barely reduce their childcare after separation with 7.24 h in year t+1 (Traditionalist-mothers: 6.04 h). Apart from differences in preferences, the higher engagement of Care-Sharer-mothers could also relate to the younger age of their children (94% of group 2-mothers, but only 83% of Traditionalist-mothers have a child under 14 in the household). As a result, and despite paternal engagement during weekdays, Care-Sharer-mothers remain involved after separation with higher hours compared to Traditionalist-mothers, which might explain the more favorable earnings trend of Traditionalist-mothers.

As we have seen, Care-Sharer-mothers increase their paid hours, but see their earnings stagnate, pointing to adjusted working conditions offering a better fit with high family demands. Earlier on, we opted for a similar interpretation of Care-Sharer-fathers’ behavior, and indeed, Care-Sharer-fathers were more involved in childcare before separation compared to Traditionalist-fathers (3.41 h vs. 1.80 h, see Table 3 in Appendix), and remain so afterwards (2.65 h vs. 0.00 h). Thus, the group differentiation reveals that Care-Sharer-parents can be characterized as more childcare-oriented throughout separation, notwithstanding the severe gender gaps which also emerge here. Additionally, Care-Sharer-couples divorce later on average, with potentially stronger family ties for Care-Sharer-fathers as a cause or consequence, but in any case, associated with stronger paternal childcare investment.Footnote 19

Next, we explore the role of public and private transfers for parents’ economic well-being after separation. As Panel 4a of Fig. 4 illustrates, Traditionalist-mothers experience a marginal increase and Care-Sharer-mothers a slight decrease in public transfer receipts around separation, while fathers receive much less than before separation. Additional analyses show that the notion of a less advantageous evolution of public transfers for fathers remains valid if child-related components of public transfers (child allowance, additional child benefit, childcare subsidy) are excluded.Footnote 20 It appears that either mothers or children are in most cases the primary recipients of public transfers. Moreover, mothers experience a notable increase in private transfers around separation, which is starkest for Traditionalist-mothers, who bear the full childcare burden (see Panel 4b of Fig. 4). This seems plausible since Care-Sharer-fathers should be compensated for their non-zero childcare hours by somewhat lower payments. Note that our sample of real (ex-)couples allows us to approximately equate average payments received with average payments made within the same group. In contrast, private transfer receipts are irrelevant to fathers. A decomposition analysis of private transfers confirms this view. In particular, these findings are still valid if one focuses on alimony and child maintenance receipt only, which represent two out of five components of aggregate private transfers (see Panel 4c of Fig. 4). Summarizing the results for fathers so far, we find that while fathers’ equivalized income benefits from a decreasing household size in both groups, Traditionalist-fathers do not manage to translate their higher time budget for gainful work into sufficiently high earnings to outweigh the relative higher alimony and child maintenance payments with respect to Care-Sharer-fathers.

Predicted group means of parents’ public and private transfers (alimony and child maintenance payments) received (in Euros) around separation. Adjusted for survey year fixed effects. Traditionalist: all children reside with mother, no paternal childcare on weekdays. Care-Sharer: all children reside with mother, some paternal childcare on weekdays.

Finally, we test whether actual income evolution corresponds to subjective evaluations of economic well-being. Figure 5 in the Appendix depicts the results. It becomes evident that mothers’ evaluations closely fit the actual financial situation, while Traditionalist-(Care-Sharer-) fathers perceive their situation as better (worse) than it is according to the ENHI measure proposed in this study. This does not necessarily mean distorted paternal receptions, since measurement errors in our data may occur in different areas, e.g. understated true childcare obligations, psycho-emotional burden, or understated financial burden (we do not measure discretionary cash transfers) of fathers who are emotionally bonded to their children but live separately from them. In the end, the perceived situation may come closer to the truth than what quantitative measures suggest. It therefore does not come as a surprise that life satisfaction decrease is less pronounced for mothers compared to fathers (see Panel A1c of Figure A1), which confirms previous findings (Leopold & Kalmijn, 2016).

Conclusion

In an economically integrated approach covering real (ex-)couples, we explore the short-term group and gender differentials in economic well-being for the time around separation. We refer to the standard in contemporary Germany, a female resident-parent setting. Our main focus is on the associations with paternal childcare post-separation. Our data confirm the well-known gender gap in income, which persists throughout separation, albeit being more pronounced among those ex-couples where fathers spend some hours caring for their children on weekdays. Those fathers experience stable equivalized income around separation, while mothers and care-inactive fathers suffer a decline, which clearly contradicts our expectations. However, after considering this more carefully, this seems somewhat plausible since fathers with zero childcare hours on weekdays are confronted with higher alimony payments and at the same time fail to increase their earnings accordingly, resulting in an income disadvantage compared to fathers with non-zero childcare hours. However, the childcare support in the “non-zero childcare hours” father group (Care Sharer) is presumably too low to make a difference for maternal careers, earnings and equivalized income: mothers formerly coupled with those fathers do not fare better economically than their female counterparts who take on the full childcare burden. An explanation for this unexpected result is that despite the help from their ex-spouses, those mothers still spend more time on childcare on weekdays, presumably due to younger children and/or preferences for higher childcare standards. Pre-separation group differences in mother’s human capital are unlikely to play a role in explaining our main result since there are hardly any group differences. However, we do find notable pre-separation group and gender differences with respect to childcare behavior, as well as group differences in gender norms and children’s age. Path dependencies in these factors could reflect some selection into groups according to fertility timing, intra-couple childcare division and related norms and preferences, which can only partly be addressed with our fixed effects approach. While the provided associations are therefore not to be interpreted as causal, we still consider our finding that in maternal sole residency settings, fathers’ childcare engagement during weekdays is not significantly associated with maternal equivalized post-separation income quite important. As argued, the help of fathers could be cancelled out by maternal own preferences for ‘intensive care’ but this is less likely to happen in shared parenting settings where there is more substantial support from fathers. Further, we show that subjective evaluations of economic well-being correspond with actual income for mothers, but less so for fathers.

Our study offers two novel insights into the importance of specification issues when interpreting economic well-being. First, for non-resident fathers, focusing only on annual income would draw a too pessimistic picture of paternal income dynamics. Accounting for the change in household composition by using equivalized income results in a more advantageous income evolution. Second, however, when deducting paid alimony and maintenance from the payer’s income, which is mostly the father, the paternal upward income trend turns into a downward trend for the group of care-inactive fathers, and to a somewhat stagnating pattern for the group of care-active fathers. We term this the ‘symmetric approach’ since those payments are symmetrically accounted for on the side of both the payer and the recipient, drawing—in our view—a more adequate picture of disposable household income.

We conclude that, when they are in the role of residence providers, even high resources do not shield mothers against increased economic risks and persistent economic dependence post-separation. Our findings seem rather unaffected by Germany’s recent family policy reforms geared to higher gender equality, which confirms previous studies (Bröckel & Andreß, 2015). Further, our results qualitatively support the findings from Augustijn (2022) who reports that any form of joint physical custody is better in terms of maternal post-separation economic well-being than sole (maternal) custody.

The limitations of this study are evident. Some exogenous variation in paternal childcare involvement would be necessary to estimate causal effects. Driven by low observation numbers, our broad childcare measure and our failure to map variety in child residence mask the true granularity of actually practiced care arrangements between ex-partners. For the same reason, differentiations by cohorts, age groups, or family constellations were not possible. Tracking population subgroups over their further life course requires data that combines high observation numbers with rich household context and valid income information. Hopefully, data of this kind will be available in the near future.

Data Availability

The SOEP data used in this study are available via DIW Berlin (https://doi.org/10.5684/soep-core.v35).

Code Availability

Codes are available from the authors upon request.

Notes

Resources are also a relevant predictor of separation. As Hogendoorn et al. (2020) find for Dutch mothers, divorce was associated with higher risk of poverty, particularly for those with lower education levels, due to both higher risks of divorce and greater vulnerability to divorce, whereas among fathers, divorce was unrelated to poverty. Further, in the context of social norms, earnings-relevant resources are heavily gendered, and resulting sex differences in primary incomes are differently buffered by social policies (DiPrete & McManus, 2000). Thus, sex differences in secondary incomes are more pronounced in countries with rather low income redistribution rates such as the US (Duncan & Hoffman, 1985; Smock, 1993) compared to countries with higher redistributive effects such as the Netherlands (Poortman, 2000).

The literature points to several relevant predictors of father-child-contact after separation, such as spatial distance (Hubert & Schier 2018; Stephen et al., 1994), time since separation (Köppen et al., 2018; Stephens, 1996), child custody (Köppen et al., 2018; Smock, 1994), the child’s age (Leopold & Kalmijn, 2016), the families’ and particularly fathers’ socioeconomic status (Kalmijn, 2015; Köppen et al., 2018, p. 5; Hubert & Schier, 2018), paternal childcare involvement pre-separation (Haux et al., 2015), and the child’s biological sex.

Nine out of ten separated fathers have a first child who mainly lives with the biological mother, and only a very small portion of the fathers practice shared parenting with the child’s mother (Köppen et al., 2018, p. 8; cf. Walper, 2018 for similar conclusions based on the German Family Panel 2014/15).

Applied methods to extract causality of separation on post-separation economic well-being span from fixed effects estimations (e.g. Boertien & Lersch, 2021; Kapelle & Baxter, 2021), to instrumental variables (Ananat & Michaels, 2008), matching procedures (e.g. Brüggmann, 2020; Hübgen, 2020) and endogenous switching regression models (Birkeneder & Boll, 2021).

We do not investigate selection into separation. Our sample is comprised of separated couples only.

i.e. at least one child is a minor in the post-separation year.

The sample is restricted to mixed-sex couples. We require that the father in the separating couple is the father of at least one of the biological children of the mother in the separating couple, and that this child was under 16 and present in the household in the year prior to separation. We either identify fatherhood via the SOEP BIOBIRTH data (8%), the KIDLONG data (1%) or define the mother’s partner in the year of a child’s birth as a father (16%).

In more detail, the question reads “Has your family situation changed since December 31, xxxx? Please indicate if any of the following apply to you and if so, when this change occurred.?” and the following answer has been marked: “I separated from spouse / partner”.

Grabka (2020, p. 50): “Labor earnings include wages and salary from all employment including training, primary and secondary jobs, and self-employment, plus income from bonuses, overtime, and profit-sharing. Specifically labor earnings are the sum of income from primary job, secondary job, self-employment, 13th month pay, 14th month pay, Christmas bonus pay, holiday bonus pay, miscellaneous bonus pay, and profit-sharing income.”

In fact, the values of maintenance payments paid to ex-partners and children outside the household is not easily identifiable in the data. The SOEP surveys payments to ex-partners and children outside the own household as annual rather than monthly amounts (while components of household net income are surveyed as monthly amounts and subsequently aggregated to the annual level), which might bias reporting towards one-time payments, gifts and donations rather than regular monthly payments.

Equivalence weights may vary over time due to changes in household composition and children growing older.

Specifically, to calculate annual spouse and child maintenance payments, we use the IALIM$$-variable from SOEP waves 2001 to 2014. As of 2015, we use the aggregate of ISPOU$$ and ICHSU$$. There is no respective information available in the raw data before 2001, i.e. before the calendar year 2000, which is why we restrict our sample to separations in the years 1999 onwards, i.e. separations for which we can calculate net household income after exchange of spouse and child maintenance payments among ex-partners for the year after separation (see Fig. 1). We refrain from subtracting received advance child payments as reported by the receiving partner from the other partner’s income since advance child payments are paid directly by the state and we do not observe in our data whether the state was successful in collecting the debt from the defaulter.

The share of fathers with non-zero hours on a weekday is plausible: As Keil and Langmeyer (2020) review of the empirical literature for Germany reveals, 16–32% of fathers break contact with their children, and 43–70% of those who stay in contact see their children less than once a week.

This situation is often termed Sole Physical Custody (SPC; Steinbach & Augustijn, 2021). Unfortunately, we cannot identify children with multiple residencies (Wechselmodell), since according to the German Framework Registration Act (§12 Melderechtsrahmengesetz), each citizen can have only one main domicile and accordingly, the SOEP requires unambiguous assignment of each individual to one (and only one) household. Cases of couples where both partners are observed around separation and at least some children reside with the father after separation were rather low, which is why we focus exclusively on resident-mother couples. For explorative results on this group, cf. Boll and Schüller (2021).

Note that the y-axis intercept denotes pre-separation selection into couple traits. The group-specific y-axis intercept should be identical between fathers and mothers, since the values in t-1 refer to the pre-separation year in which the parental couples shared a household. The minimal differences in our data stem from cases for which the exact separation year is unknown; that is, respondents state that they have separated from their partner since the last survey interview, but there is missing information on whether the separation happened in the current or the previous calendar year. In these cases, we assume that the separation happened in the current calendar year. This is to avoid the year we declare t+1 including months in which the couple still shared a household.

Regarding employment probability, and for both mothers and fathers, neither significant group differences nor significant intertemporal changes can be ascertained.

Results for actual hours are available upon request.

Brüggmann (2020) reports a similar pattern, denoting increased work volumes, but no increase in daily earnings for female divorcees between 2000 and 2005.

Importantly, we cannot distinguish between paternal childcare time devoted to children with the ex-partner and time devoted to stepchildren in the same household, which could explain why their female ex-partners benefit to such a limited extent. However, the likelihood of having repartnered in the year after separation is only 12.8% (11.8%) for Traditionalist (Care-Sharer)-fathers, and the likelihood of living with at least one child below the age of 14 in the household in the year after separation is 9.8% for Care-Sharer-fathers, but only 3.2% for Traditjonalist-fathers (see Table 3 in Appendix). Since fathers in our sample do not reside with their biological children after separation, Care-Sharer-fathers are thus more likely to be in the stepfather role in t+1.

Results available from the authors upon request.

References

Amato, P. R. (2000). The consequences of divorce for adults and children. Journal of Marriage and Family, 62(4), 1269–1287. https://doi.org/10.1111/j.1741-3737.2000.01269.x

Amato, P. R. (2010). Research on divorce: Continuing trends and new developments. Journal of Marriage and Family, 72(3), 650–666. https://doi.org/10.1111/j.1741-3737.2010.00723.x

Ananat, E. O., & Michaels, G. (2008). The effect of marital breakup on the income distribution of women with children. Journal of Human Resources, 43(3), 611–629. https://doi.org/10.3368/jhr.43.3.611

Augustijn, L. (2022). Mothers’ economic well-being in sole and joint physical custody families. Journal of Family and Economic Issues. https://doi.org/10.1007/s10834-022-09818-3

Becker, G. S. (1964). Human capital: A theoretical and empirical analysis with special reference to education. University of Chicago Press.

Becker, G. S. (1965). A theory of the allocation of time. The Economic Journal, 75(299), 493–517. https://doi.org/10.2307/2228949

Becker, G. S., Landes, E. M., & Michael, R. T. (1977). An economic analysis of marital instability. Journal of Political Economy, 85(6), 1141–1187. https://doi.org/10.1086/260631

Bianchi, S. M., Subaiya, L., & Kahn, J. R. (1999). The gender gap in the economic wellbeing of nonresident fathers and custodial mothers. Demography, 36(2), 195–203. https://doi.org/10.2307/2648108

Birkeneder, A. & Boll, C. (2021). How causal is separation? Lessons learnt from endogenous switching regression models for single mothers' economic strain in Germany. SOEPpapers on Multidisciplinary Panel Data Research No. 1147.

Blohm, M., & Walter, J. (2018). Einstellungen zur Rolle der Frau und der des Mannes. In Statistisches Bundesamt & Wissenschaftszentrum Berlin für Sozialforschung (Eds.): Datenreport 2018: Ein Sozialbericht für die Bundesrepublik Deutschland (pp. 397–402).

Boertien, D., & Lersch, P. M. (2021). Gender and changes in household wealth after the dissolution of marriage and cohabitation in Germany. Journal of Marriage and Family, 83(1), 228–242. https://doi.org/10.1111/jomf.12705

Boll, C., Leppin, J., & Reich, N. (2014). Paternal childcare and parental leave policies: Evidence from industrialized countries. Review of Economics of the Household, 12(1), 129–158. https://doi.org/10.1007/s11150-013-9211-z

Boll, C., & Schüller, S. (2021). Shared parenting and parents’ income evolution after separation—New explorative insights from Germany, SOEPpapers on Multidisciplinary Panel Data Research No. 1131, Berlin.

Bredemeier, C., Gravert, J., & Juessen, F. (2021). Accounting for limited commitment between spouses when estimating labor-supply elasticities. IZA Discussion Paper No. 14226.

Bredemeier, C., & Juessen, F. (2013). Assortative mating and female labor supply. Journal of Labor Economics, 31(3), 603–631. https://doi.org/10.1086/669820

Bröckel, M., & Andreß, H. J. (2015). The economic consequences of divorce in Germany: What has changed since the turn of the millennium? Comparative Population Studies, 40(3), 277–312. https://doi.org/10.12765/CPoS-2015-04en

Brüggmann, D. (2020). Women’s employment, income and divorce in West Germany: A causal approach. Journal for Labour Market Research, 54(1), 1–22. https://doi.org/10.1186/s12651-020-00270-0

Danzer, N., Huebener, M., Pape, A., Spieß, C. K., Siegel, N. A. & Wagner, G. G. (2021). Cracking under pressure? Gender role attitudes toward maternal employment in times of a pandemic. CESifo Working Papers No. 9144.

de Chaisemartin, C., & D’Haultfoeuille, X. (2022). Two-way fixed effects and differences-in-differences with heterogeneous treatment effects: A survey. The Econometrics Journal. https://doi.org/10.1093/ectj/utac017

DiPrete, T. A., & McManus, P. A. (2000). Family change, employment transitions, and the welfare state: Household income dynamics in the United States and Germany. American Sociological Review, 65(3), 343–370. https://doi.org/10.2307/2657461

Duncan, G. J., & Hoffman, S. D. (1985). A reconsideration of the economic consequences of marital dissolution. Demography, 22(4), 485–497. https://doi.org/10.2307/2061584

Eurostat. (2021). Glossary: At-risk-of-poverty rate. Statistics Explained. Retrieved February 22, 2022, from https://ec.europa.eu/eurostat/statistics-explained/index.php?title=Glossary:At-risk-of-poverty_rate

Federal Statistical Office. (2021). Maßzahlen zu Ehescheidungen 2000–2020. Retrieved February 27, 2022, from https://www.destatis.de/DE/Themen/Gesellschaft-Umwelt/Bevoelkerung/Eheschliessungen-Ehescheidungen-Lebenspartnerschaften/Tabellen/masszahlen-ehescheidungen.html

Flèche, S. N., Lepinteur, A., & Powdthavee, N. (2020). Gender norms, fairness and relative working hours within households. Labour Economics, 65, 101866. https://doi.org/10.1016/j.labeco2020.101866

Furstenberg, F. F., Jr., & Cherlin, A. J. (1991). Divided families: What happens to children when parents part. Harvard University Press.

Gangl, M., & Ziefle, A. (2009). Motherhood, labor force behavior, and women’s careers: An empirical assessment of the wage penalty for motherhood in Britain, Germany, and the United States. Demography, 46(2), 341–369. https://doi.org/10.1353/dem.0.0056

Goebel, J., Grabka, M. M., Liebig, S., Kroh, M., Richter, D., Schröder, C., & Schupp, J. (2019). The German Socio-Economic Panel Study (SOEP). Jahrbücher Für Nationalökonomie Und Statistik / Journal of Economics and Statistics, 239(2), 345–360. https://doi.org/10.1515/jbnst-2018-0022

Goussé, M., Jacquemet, N., & Robin, J.-M. (2017). Marriage, labor supply, and home production. Econometrica, 85(6), 1873–1919. https://doi.org/10.3982/ECTA11221

Grabka, M. M. (2020). SOEP-core v35-codebook for the $ pequiv file 1984–2018: CNEF variables with extended income information for the SOEP. SOEP Survey Paper No. 772.

Greenwood, J., Guner, N., Kocharkov, G., & Santos, C. (2014). Marry your like: Assortative mating and income inequality. American Economic Review, 104(5), 348–353. https://doi.org/10.1257/aer.104.5.348

Guner, N., Kulikova, Y., & Llull, J. (2018). Marriage and health: Selection, protection, and assortative mating. European Economic Review, 104(1), 138–166. https://doi.org/10.1016/j.euroecorev2018.06.002

Hagenaars A. J. M., de Vos, K., & Zaidi, M. A. (1994). Poverty statistics in the late 1980's: Research based on micro-data. Study carried out for Eurostat. Luxemborg, Office for Official Publications of the European Communities. Population and Social Conditions Series 3C (p. 18).

Hao, L. (1996). Family structure, private transfers, and the economic well-being of families with children. Social Forces, 75(1), 269–292. https://doi.org/10.1093/sf/75.1.269

Haux, T., Platt, L., & Rosenberg, R. (2015). Parenting and post-separation contact: What are the links? Centre for Analysis of Social Exclusion, London School of Economics.

Hochschild, A. R. (2012). The managed heart: Commercialization of human feeling. University of California Press.

Hogendoorn, B., Leopold, T., & Bol, Th. (2020). Divorce and diverging poverty rates: A risk-and-vulnerability approach. Journal of Marriage and Family, 82(3), 1089–1109. https://doi.org/10.1111/jomf.12629

Hubert, S., & Schier, M. (2018). Wohnentfernung und Vater-Kind-Kontakte nach Trennung und Scheidung. In E. Geisler, K. Köppen, M. Kreyenfeld, H. Trappe, & M. Pollmann-Schult (Eds.), Familien nach Trennung und Scheidung in Deutschland (pp. 20–21). Hertie School.

Hübgen, S. (2020). Understanding lone mothers’ high poverty in Germany: Disentangling composition effects and effects of lone motherhood. Advances in Life Course Research, 44, 100327. https://doi.org/10.1016/j.alcr.2020.100327

Johnson, D. R., & Wu, J. (2002). An empirical test of crisis, social selection, and role explanations of the relationship between marital disruption and psychological distress: A pooled time-series analysis of four wave panel data. Journal of Marriage and Family, 64(1), 211–224. https://doi.org/10.1111/j.1741-3737.2002.00211.x

Kalmijn, M. (2015). Father-child relations after divorce in four european countries: patterns and determinants. Comparative Population Studies, 40(3), 251–276. https://doi.org/10.12765/CPoS-2015-10en

Kapelle, N., & Baxter, J. (2021). Marital dissolution and personal wealth: Examining gendered trends across the dissolution process. Journal of Marriage and Family, 83(1), 243–259. https://doi.org/10.1111/jomf.12707

Keil, J., & Langmeyer, A. N. (2020). Father-child contact after separation and divorce: The importance of structural and intrafamilial factors. Zeitschrift Für Soziologie Der Erziehung Und Sozialisation, 40(1), 39–61.

Köppen, K., Kreyenfeld, M., & Trappe, H. (2018). Loose ties? Determinants of father–child contact after separation in Germany. Journal of Marriage and Family, 80(5), 1163–1175. https://doi.org/10.1111/jomf.12504

Koster, T., Poortman, A. R., van der Lippe, T., & Kleingeld, P. (2021). Parenting in postdivorce families: The influence of residence, repartnering, and gender. Journal of Marriage and Family, 83(2), 498–515. https://doi.org/10.1111/jomf.12740

Leopold, T., & Kalmijn, M. (2016). Is divorce more painful when couples have children? Evidence from long-term panel data on multiple domains of well-being. Demography, 53(6), 1717–1742. https://doi.org/10.1007/s13524-016-0518-2

Lichter, D. T., Qian, Z., & Song, H. (2022). Gender, union formation, and assortative mating among older women. Social Science Research, 103, 102656. https://doi.org/10.1016/j.ssresearch2021.102656

Lise, J., & Yamada, K. (2019). Household sharing and commitment: Evidence from panel data on individual expenditures and time use. The Review of Economic Studies, 86(5), 2184–2219. https://doi.org/10.1093/restud/rdy066

Manser, M., & Brown, M. (1980). Marriage and household decision-making: A bargaining analysis. International Economic Review, 21(1), 31–44. https://doi.org/10.2307/2526238

McElroy, M. B., & Horney, M. J. (1981). Nash-bargained household decisions: Toward a generalization of the theory of demand. International Economic Review, 22(2), 333–349. https://doi.org/10.2307/2526280

McLanahan, S., & Sandefur, G. (1994). Growing up with a single parent: What hurts, what helps. Harvard University Press.

Mincer, J. (1974). Schooling, experience, and earnings. Bureau of Economic Research und Columbia University Press.

OECD. (1982). The OECD list of social indicators. Organization for Economic Cooperation and Development.

OECD. (2022). “Poverty rate” (indicator). Retrieved February 08, 2022, from https://doi.org/10.1787/0fe1315d-en

Poortman, A. R. (2000). Sex differences in the economic consequences of separation: A panel study of the Netherlands. European Sociological Review, 16(4), 367–383. https://doi.org/10.1093/esr/16.4.367

Radenacker, A. (2020). Changes in Mothers’ earnings around the time of divorce. In M. Kreyenfeld & H. Trappe (Eds.), Parental life courses after separation and divorce in Europe (pp. 65–81). Springer.

Ross, C. E. (1995). Reconceptualizing marital status as a continuum of social attachment. Journal of Marriage and the Family, 57(1), 129–140. https://doi.org/10.2307/353822

Smock, P. J. (1993). The econcomic cost of marital disruption for young women over the past two decades. Demography, 30, 353–371. https://doi.org/10.2307/2061645

Smock, P. J. (1994). Gender and the short-run economic consequences of marital disruption. Social Forces, 73, 243–262. https://doi.org/10.1093/sf/73.1.243

SOEP (2020). Socio-Economic Panel (SOEP), data for years 1984–2018, version 35. https://doi.org/10.5684/soep.v35.

Soons, J. P. M., Liefbroer, A. C., & Kalmijn, M. (2009). The long-term consequences of relationship formation for subjective well-being. Journal of Marriage and Family, 71, 1254–1270. https://doi.org/10.1111/j.1741-3737.2009.00667.x

Sørensen, A. (1994). Women’s economic risk and the economic position of single mothers. European Sociological Review, 10(2), 173–188. https://doi.org/10.1093/oxfordjournals.esr.a036328

Steinbach, A., & Augustijn, L. (2021). Post-separation parenting time schedules in joint physical custody arrangements. Journal of Marriage and Family, 83(2), 595–607. https://doi.org/10.1111/jomf.12746

Stephen, E. H., Freedman, V. A., & Hess, J. (1994). Near and far: Contact of children with their non-residential fathers. Journal of Divorce and Remarriage, 20(3–4), 171–191. https://doi.org/10.1300/J087v20n03_11

Stephens, L. S. (1996). Will Johnny see daddy this week? An empirical test of three theoretical perspectives of postdivorce contact. Journal of Family Issues, 17(4), 466–494. https://doi.org/10.1177/019251396017004003

Thibaut, J. W., & Kelley, H. H. (1959). The social psychology of groups. Wiley.

Unterhofer, U., & Wrohlich, K. (2017). Fathers, parental leave and gender norms. DIW Discussion Paper No. 1657.

Van Winkle, Z., & Fasang, A. E. (2020). Parenthood wage gaps across the life course: A comparison by gender and race. Journal of Marriage and Family, 82(5), 1515–1533. https://doi.org/10.1111/jomf.12713

Voena, A. (2015). Yours, mine, and ours: Do divorce laws affect the intertemporal behavior of married couples? American Economic Review, 105(8), 2295–2332. https://doi.org/10.1257/aer.20120234

Walper, S. (2018). Elterliche Sorge und Wohn-bzw. Betreuungsarrangements. In K. Geisler, K. Köppen, M. Kreyenfeld, H. Trappe, & M. Pollmann-Schult (Eds.), Familien nach Trennung und Scheidung in Deutschland (pp. 16–17). Hertie School.

Walper, S., Amberg, S., & Langmeyer, A. N. (2020). Familien mitgetrennten Eltern. In J. Ecarius, & A. Schierbaum (Eds.), Handbuch Familie. Gesellschaft, Familienbeziehungen und differentielle Felder. Springer VS (pp. 1–19).

Walper, S., Entleitner-Phleps, C., & Wendt, E. V. (2016). Brauchen Kinder immer (nur) zwei Eltern? Recht Der Jugend Und Des Bildungswesens, 64(2), 210–226. https://doi.org/10.5771/0034-1312-2016-2-210

Zoch, G., & Schober, P. S. (2018). Public child-care expansion and changing gender ideologies of parents in Germany. Journal of Marriage and Family, 80(4), 1020–1039. https://doi.org/10.1111/jomf.12486

Acknowledgements

We thank participants of the 2021 SLLS International Conference and the DJI “Familie am Mittag” seminar series for helpful comments. Anil Eldiven and Quirin Sepp for editorial assistance; Kirsty Weiler and Paul David Boll for language editing.

Funding

Open Access funding enabled and organized by Projekt DEAL. This research did not receive any specific grant from funding agencies in the public, commercial, or not-for-profit sectors.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Ethical Approval

Since our study has involved only secondary analysis of anonymized data, ethics approval was not required.

Participant Consent

Since our study involves only secondary analysis of anonymized data, participant consent was not required.

Consent for Publication

Not applicable since our study involves only secondary analysis of anonymized data.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

See Tables 2, 3, 4 and Fig. 5.

Predicted group means of parents’ satisfaction with household income, ‘big’ financial worries, and life satisfaction around separation. Satisfaction with household income and satisfaction with life is measured on a 11-point scale (0-low to 10-high). ‘Big’ financial worries consists of a binary indicator variable equal to 1 if respondent indicates big financial worries and 0 otherwise. Adjusted for survey year fixed effects. Traditionalists: all children reside with mother, no paternal childcare on weekdays. Care-Sharer: all children reside with mother, some paternal childcare on weekdays.

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Boll, C., Schüller, S. The Economic Well-Being of Nonresident Fathers and Custodial Mothers Revisited: The Role of Paternal Childcare. J Fam Econ Iss 44, 836–853 (2023). https://doi.org/10.1007/s10834-022-09876-7

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-022-09876-7