Abstract

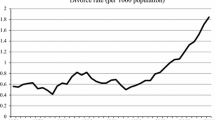

The increasing divorce rate has become a major social concern for policy makers in the Islamic government of Iran. The price of gold coin is an important factor in cost-benefit analysis for individuals in their marriage and divorce decisions in Iran. Dowries (Mehrieh) are usually in the form of gold coin and a wife has a legal right to request them from her husband upon both parties signing the marriage contract. Increasing the price of gold coin may intensify the internal stress and struggles within families, leading to a higher probability of divorce. We investigated the long-run relationship between real price of gold coin and divorce rate for the case of Iran over the period 1980–2014. Controlling for other factors such as women’s education, social globalization, economic growth rate, and the war period with Iraq, our regression results showed that there is a positive and significant long-run relationship between real price of gold coin (as well as unanticipated changes in real price of gold coin) and marital instability.

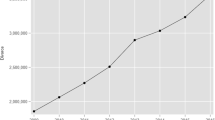

Reproduced with permission from National Organization for Civil Registration of Iran (2018)

Similar content being viewed by others

Notes

The other main part of Mehrieh is real estate properties (Farzanegan and Gholipour 2016).

Results are available upon request.

The results of impulse response analysis for case of Egypt are available upon request.

References

Aghajanian, A., & Moghadas, A. A. (1998). Correlates and consequences of divorce in an Iranian city. Journal of Divorce & Remarriage, 28(3–4), 53–71. https://doi.org/10.1300/J087v28n03_03.

Aghajanian, A., & Thompson, V. (2013). Recent divorce trend in Iran. Journal of Divorce & Remarriage, 54(2), 112–125. https://doi.org/10.1080/10502556.2012.752687.

Amato, P. R., & Beattie, B. (2011). Does the unemployment rate affect the divorce rate? An analysis of state data 1960–2005. Social Science Research, 40(3), 705–715. https://doi.org/10.1016/j.ssresearch.2010.12.012.

Arellano, M., & Bond, S. (1991). Some tests of specification for panel data: Monte Carlo evidence and an application to employment equations. Review of Economic Studies, 58(2), 277–297. https://doi.org/10.2307/2297968.

Central Bank of Iran. (2018). Economic time series database. Retrieved from https://www.cbi.ir/page/8020.aspx.

Civil Code of the Islamic Republic of Iran. (1928). Retrieved from WIPO - World Intellectual Property Organization website http://www.wipo.int/wipolex/en/details.jsp?id=7731.

Conger, R. D., Elder, G. H., Lorenz, F. O., Conger, K. J., Simons, R. L., Whitbeck, L. B., Huck, S., & Melby, J. N. (1990). Linking economic hardship to marital quality and instability. Journal of Marriage and the Family, 52(3), 643–656. https://doi.org/10.2307/352931.

Dadgaran Hami Law Firm. (2018). Divorce costs. Retrieved from https://goo.gl/waJnjY.

Dehghanpisheh, B. (2014). Rise in divorce in Iran linked to shift in status of women. Retrieved from http://www.reuters.com/article/2014/10/22/us-iran-divorce-idUSKCN0IB0GQ20141022.

Dickey, D., & Fuller, W. A. (1981). Likelihood ratio statistics for autoregressive time series with a unit root. Econometrica, 49(4), 1057–1072. https://doi.org/10.2307/1912517.

Donya-e-Eqtesad. (2012). Divorce would increase if prices of gold coin does not drop. Retrieved from https://www.donya-e-eqtesad.com/fa/tiny/news-397978.

Dreher, A. (2006). Does globalization affect growth? Evidence from a new Index of Globalization. Applied Economics, 38(10), 1091–1110. https://doi.org/10.1080/00036840500392078.

Euromonitor International. (2018). Economies and consumers annual data. Retrieved from http://www.euromonitor.com/.

Farzanegan, M. R. (2013). Effects of international financial and energy sanctions on Iran’s informal economy. The SAIS Review of International Affair, 33(1), 13–36. https://doi.org/10.1353/sais.2013.0008.

Farzanegan, M. R., & Gholipour, H. F. (2016). Divorce and the cost of housing: Evidence from Iran. Review of Economics of the Household, 14(4), 1029–1054. https://doi.org/10.1007/s11150-014-9279-0.

Farzanegan, M. R., & Krieger, T. (2017). The response of income inequality to positive oil rents shocks in Iran: Implications for the post-sanction period (MAGKS Papers on Economics No. 33-2017). Retrieved from https://ideas.repec.org/p/mar/magkse/201733.html.

Fischer, T., & Liefbroer, A. C. (2006). For richer, for poorer: The impact of macroeconomic conditions on union dissolution rates in the Netherlands 1972–1996. European Sociological Review, 22(5), 519–532. https://doi.org/10.1093/esr/jcl013.

Friedberg, L., & Stern, S. (2014). Marriage, divorce, and asymmetric information. International Economic Review, 55(4), 1155–1199. https://doi.org/10.1111/iere.12086.

Gholipour, H. F., & Farzanegan, M. R. (2015). Marriage crisis and housing costs: Empirical evidence from provinces of Iran. Journal of Policy Modeling, 37(1), 107–123. https://doi.org/10.1016/j.jpolmod.2015.01.009.

Golchin, M., Sakhaei, A., & Afshani, A. (2012). The effect of level of usage and type of Persian satellite channels on family structure among the citizens of Tehran. Women Strategic Studies (Motaleate Rahbordi Zanana), 14, 83–118. Retrieved from http://jwss.ir/article_12267.html.

Haaretz (2002). Iran parliament passes bill allowing women equal divorce right. Retrieved from https://www.haaretz.com/1.5005466.

Harknett, K., & Schneider, D. (2012). Is a bad economy good for marriage? The relationship between macroeconomic conditions and marital stability from 1998 to 2009. (National Poverty Center Working Paper SeriesNo. 12 – 06). Retrieved from http://www.npc.umich.edu/publications/u/2012-06%20NPC%20Working%20Paper.pdf.

Hellerstein, J. K., & Morrill, M. S. (2011). Booms, busts, and divorce. The B.E. Journal of Economic Analysis & Policy. https://doi.org/10.2202/1935-1682.2914.

Hofstede, G., Hofstede, G. J., & Minkov, M. (2010). Cultures and organizations: Software of the mind. Revised and Expanded. New York: McGraw Hill.

Islamic Parliament Research Center. (2013). 40% increases in divorce/Western culture has promoted divorce. No. 862049, Tehran, Iran: Islamic Parliament Research Center. Retrieved from http://rc.majlis.ir/fa/news/print_version/862049.

ISNA. (2013). The existence of 1,500 prisoners with the belief that “who has given Mehrieh and who has got it”. Iranian Students’ News Agency. Retrieved from http://www.isna.ir/news/92030603263.

ISNA. (2015). Women tricks to get dowry. Iranian Students’ News Agency. Retrieved from https://www.isna.ir/news/94061509186.

Jensen, P., & Smith, N. (1990). Unemployment and marital dissolution. Journal of Population Economics, 3(3), 215–229. https://doi.org/10.1007/BF00163076.

Johansen, S. (1995). Likelihood-based inference in cointegrated vector autoregressive models. Oxford: Oxford University Press.

Kazemipour, S. (2010). 450 gold coins; the average of Mehrieh/Educated people have higher Mehrieh. Retrieved from https://www.mehrnews.com/news/1145830/.

Kazemzadeh, F. (2012). Weight in gold for a divorce in Iran. BBC report. Retrieved from http://www.bbc.com/news/av/world-middle-east-17147842/the-cost-of-a-divorce-in-iran-your-weight-in-gold.

Klein, J. (2017). House price shocks and individual divorce risk in the United States. Journal of Family and Economic Issues, 38(4), 628–649. https://doi.org/10.1007/s10834-017-9532-9.

Lütkepohl, H. (1991). Introduction to multiple time series analysis. New York: Springer.

MacKinnon, J. G. (1996). Numerical distribution functions for unit root and cointegration tests. Journal of Applied Econometrics, 11(6), 601–618.

Naeimi, M. (2011). The impact of family interaction and satellite phenomena in divorce (Case study of Gorgan city). Sociology Youth Studies (Jameh Shenasi Motaleate Javanan), 1, 191–211. Retrieved from http://fa.journals.sid.ir/ViewPaper.aspx?ID=145959.

National Organization for Civil Registration of Iran. (2018). Vital events, divorce. Ministry of Interior (Iran). Retrieved from https://www.sabteahval.ir/en/tab-789.aspx.

Pesaran, M. H., & Shin, Y. (1998). Generalised impulse response analysis in linear multivariate models. Economics Letters, 58(1), 17–29. https://doi.org/10.1016/S0165-1765(97)00214-0.

Phililips, P. C. B. (1995). Fully modified least squares and vector autoregression. Econometrica, 63(5), 1023–1078. https://doi.org/10.2307/2171721.

Phillips, P. C. B., & Hansen, B. E. (1990). Statistical inference in instrumental variable regression with I(1) processes. Review of Economic Studies, 57(1), 99–125. https://doi.org/10.2307/2297545.

Research Directorate. (1998). Iran: Grounds for a woman to get a divorce at the Special Civil Court of Iran if she is being abused by her husband and he will not agree to a divorce; documents a woman might obtain to prove that she has taken steps to seek a divorce. Immigration and Refugee Board of Canada, Iran. Retrieved from http://www.refworld.org/docid/3ae6aae318.html.

Roodman, D. (2009). A short note on the theme of too many instruments. Oxford Bulletin of Economics and Statistics, 71(1), 0305–9049. https://doi.org/10.1111/j.1468-0084.2008.00542.x.

Saadat, M., Ansari-Lari, M., & Farhud, D. D. (2004). Consanguineous marriage in Iran. Annals of Human Biology, 31(2), 263–269. https://doi.org/10.1080/03014460310001652211.

Saikkonen, P. (1992). Estimation and testing of cointegrated systems by an autoregressive approximation. Econometric Theory, 8(1), 1–27. https://doi.org/10.1017/S0266466600010720.

Schwartz, C. R., & Han, H. (2014). The reversal of the gender gap in education and trends in marital dissolution. American Sociological Review, 79(4), 605–629. https://doi.org/10.1177/0003122414539682.

Stiglitz, J. E., Walsh, C. E., Gow, J., & Richmond, B. (2015). Introductory microeconomics, 1st Australian Edition. Milton: Wiley.

Stock, J. H., & Watson, M. (1993). A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica, 61(4), 783–820. https://doi.org/10.2307/2951763.

Tabnak (2014). Dowries are not waived. Retrieved from http://www.tabnak.ir/fa/print/413408.

The Guardian. (2014). The rising price of love in Iran. Iran, Tehran Bureau. Retrieved from https://www.theguardian.com/world/iran-blog/2014/apr/07/the-rising-price-of-love-in-iran.

Walther, S. (2017). Moral hazard in marriage: The use of domestic labor as an incentive device. Review of Economics of the Household, 15(2), 357–382. https://doi.org/10.1007/s11150-016-9347-8.

WDI. (2017). World development indicators. Data Catalog, World Bank. Retrieved from https://datacatalog.worldbank.org/dataset/world-development-indicators.

Wooldridge, J. M. (2009). Introductory econometrics: A modern approach. Mason: South-Western.

World Bank. (2017). Population estimates and projections database. Retrieved from https://datacatalog.worldbank.org/dataset/population-estimates-and-projections.

Acknowledgements

We would like to thank the Editor (Elizabeth M. Dolan) and two anonymous referees for their useful comments. We also thank our Egyptian colleagues—Ahmed Badreldin and Dalia Fadly (CNMS, University of Marburg) for information on Mehrieh in Egypt.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

Authors declare that they have no conflict of interest.

Human and Animal Participants

This article does not contain any studies with human participants or animals performed by any of the authors.

Appendix

Appendix

The VAR Model: Dynamic Response of Divorce to Gold Coin Price Shocks

The VAR provides a multivariate framework relating changes in a particular variable (e.g., divorce rates) to changes in its own lags and to changes in (the lags of) other variables (e.g., gold coin prices). The reduced form VAR model is presented as follows:

where \({y_t}~\) is a vector of k endogenous variables; \({x_t}\) is a vector of d exogenous variables; \({A_1}\),…, Ap and B are matrices of coefficients to be estimated; and \({\varepsilon _t}\) is a vector of innovations. The variables are affecting each other with some optimum lags and therefore they are all treated as endogenous variables. While changes in macroeconomic conditions, such as the gold market, can influence family stability, the changes in divorce rate can also influence the former. Our endogenous variables in the VAR were logarithm of divorce rate, logarithm of gold coin prices, and logarithm of women’s education, social globalization index and GDP per capita growth. Descriptions of used variables are mentioned in the main body of the analysis. We also controlled for the war period with Iraq with a dummy variable.

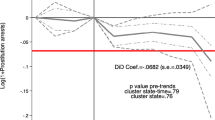

Our aim was to apply impulse response function in order to simulate the response of divorce rate to a positive shock in gold coin prices in Iran. Farzanegan and Gholipour (2016) also used this method to study the response of divorce rate to positive shocks in housing prices of Iran. To estimate response of divorce rate in Iran to positive shocks to gold coin prices, we employed the generalized impulse-response function (IRF) on the basis of our estimated unrestricted VAR model. The IRF shows the direction, size, and statistical significance of responses following an initial shock to gold coin prices. It is important to check for stability and residual autocorrelation of the estimated VAR model before using IRF tool. We used 2 years as the optimum lag in estimation of the VAR model on the basis of different lag order selection indicators as are shown in Table 5.

The next step was to check the stability of the estimated VAR model. In the case of instability of the estimated VAR, we could not rely on the confidence intervals of simulated responses in IRF analysis (Farzanegan and Krieger 2017; Lütkepohl 1991). Table 6 shows that our estimated VAR was stable. In other words, the influence of a shock on all variables was decreasing over time.

In addition, we needed to check the residual autocorrelation of the estimated VAR model. The null hypothesis implied “no serial correlation at a specific order of lag.” In case of rejection of null hypothesis, we had to revise our VAR specification or had to use a higher lag lengths. Table 7 shows the residual serial correlation test results which does not show a concern in our case.

The ordering of variables in the estimated VAR model can be also important for subsequent IRF analysis. We followed Pesaran and Shin (1998) and used the Generalized IRF, which was not sensible to specific ordering of variables in the VAR. Figure 3 shows the IRF results. We can see that an unexpected positive change in gold coin prices led to an increasing response of divorce rate following initial shocks. The positive response of divorce reached its peak point within 3 years after shock. The response was statistically significant for the first 3 years following shock. A one standard deviation increase in log (gold coin prices) led to 0.06 unit increase in log (divorce rate) within the 3 years. This was equivalent to 6% increase in divorce rate as a response to positive shock in gold coin prices, controlling for other channels such as women’s education, social globalization and economic growth.

Response of logarithm of (divorce rate) to logarithm of (gold coin price) positive shock. The dotted lines represent ± 2 standard deviation (at 95% confidence intervals). The deviation from the baseline scenario of no shocks is on the vertical axis; the periods (years) after the shock are on the horizontal axis. The vertical axis shows the magnitude of the responses

Rights and permissions

About this article

Cite this article

Farzanegan, M.R., Gholipour, H.F. Does Gold Price Matter for Divorce Rate in Iran?. J Fam Econ Iss 39, 588–599 (2018). https://doi.org/10.1007/s10834-018-9581-8

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10834-018-9581-8