Abstract

In order to investigate the interaction between tax policy, welfare benefits, the government technology for monitoring and sanctioning inadequate search, workfare, and externalities from work, we incorporate endogenous job search and involuntary unemployment into a model of optimal nonlinear income taxation. In this setting, the government faces a trade-off between boosting employment of low-skilled agents and raising work effort of high-skilled workers. If sanctions for inadequate search effort can be targeted at high productivity types for whom it is socially optimal to search, the government can afford to levy higher labor taxes on marginal workers without discouraging these agents from seeking work. This allows for lower marginal taxes on work effort of agents with a job. In contrast to workfare, job externalities in the private sector raise marginal tax rates, as the government attaches more importance to boosting employment of low-skilled workers.

Similar content being viewed by others

1 Introduction

Policy makers are increasingly concerned about the adverse incentive effects of generous income support on job search. Indeed, unemployment imposes substantial social costs in terms of obsolescence of human capital and social skills. In response to these concerns, many countries have cut taxes on unskilled work, while tightening sanctions on inadequate efforts to find work. Moreover, as part of active labor-market policies and ‘welfare-to-work’ programs, several governments have also introduced workfare.

This paper investigates the interaction between tax policy, welfare benefits, sanctions on inadequate search, workfare, and externalities from work. To that end, we incorporate labor-market imperfections that induce governments to provide income support to those without work (namely, search costs and involuntary unemployment) into a model of optimal nonlinear income taxation. In the standard optimal tax model, workers can adjust their labor supply only on the so-called intensive margin by altering hours of work. Empirical work, however, reveals that tax and benefit programs cause low-skilled workers to adjust their labor supply not only on the intensive margin (i.e., marginally reducing or raising the hours they work in their jobs), but also on the extensive margin (i.e., entering or leaving the labor force). By incorporating search costs, we allow agents to adjust their labor supply on both these margins.

Within this setting, optimal unemployment is determined by the requirement that distortions on the extensive margin balance those on the intensive margin. On the one hand, generous in-work benefits help to alleviate distortions on the participation margin by encouraging more low-skilled workers to actively look for work. On the other hand, such benefits make it more attractive for high-ability agents to mimic lower ability agents, thereby distorting work effort. Given an exogenous income level provided to the poor without work, the government thus faces a trade-off between boosting employment of low-skilled agents and raising work effort of higher skilled workers. A positive implicit tax rate on the extensive margin distorting job search is therefore the price for combatting poverty while protecting labor supply of higher skilled workers.

This paper extends the analysis of Boone and Bovenberg (2004) in two directions. First, it incorporates job externalities, workfare and a public monitoring technology for the search effort and skill levels of the unemployed and explores how exogenous changes in these new elements impact optimal policy and employment. As a second extension, we allow the government to optimize over not only the tax system but also welfare benefits.

Job externalities in the private sector cause the government to attach more importance to reducing the tax wedge on the extensive margin. This results in more progressive labor taxes as marginal taxes on the intensive margin are raised. At the same time, welfare benefits paid to those out of work decline as in-work benefits assume a larger role in alleviating poverty. Hence the recent popularity of Earned Income Tax Credits (EITC), which reduce average tax rates for low-skilled workers but raise marginal tax rates in their phase-out range, can be explained by governments putting more emphasis on the positive externalities for society of people working in a job instead of receiving welfare benefits.

If it can target sanctions for inadequate search effort at high productivity types for whom it is socially optimal to search for work, the government can afford to levy higher labor taxes on marginal workers without discouraging these agents from seeking work and without hurting lower skilled agents. In this case, the government in fact uses information about the skill levels of the unemployed to redistribute consumption towards low-skilled agents with fewer distortions on the search margin. The lower overall tax wedge on the search margin allows for a larger explicit tax wedge on search and a smaller tax wedge on the intensive margin of labor supply. Accordingly, active labor market policies designed to monitor unemployed workers’ search behavior act as a substitute for an EITC as they allow the government to levy a higher average tax on low skilled workers and reduce marginal taxes for the higher skills.

Similarly, if the sanctions for inadequate job search are accompanied by workfare, the benefits of workfare (in terms of additional production and possibly job externalities) cause the government to attach less importance to stimulating employment in the private sector and thus reduce the need to make the tax system more progressive. Hence, in the same manner as sanctions aimed at high-skilled workers for whom it is socially optimal to search, workfare is a substitute for the EITC. In particular, it raises average tax rates on low-skilled workers while reducing marginal tax rates facing higher skilled agents.

Also Saez (2002) incorporates the two labor-supply margins of not only hours worked but also labor-force participation in an optimal income tax model. Our approach differs from that of Saez in two important respects. First of all, whereas Saez assumes that all unemployed have voluntarily left the labor force, we account also for involuntary unemployment. Agents thus face two risks: being born with low ability and being involuntarily unemployed. More generally, we are more explicit than Saez (2002) about the labor-market imperfections affecting the costs and effectiveness of labor-market search, including the welfare implications of these imperfections. We incorporate not only more labor-market imperfections (such as search costs and positive externalities of employment), but also additional government instruments, including workfare and sanctions on inadequate search based on monitoring both search effort and skill levels of the unemployed.

The second main difference is that Saez (2002) allows for more general preferences that are not necessarily quasi-linear in leisure. Whereas his results are thus more general than ours, Saez assumes heterogeneous preferences and leaves implicit the underlying social welfare function in the presence of these heterogeneous preferences. Our specific assumptions on preferences enable us to derive more analytical results on comparative statics with respect to labor-market imperfections (such as the costs and effectiveness of search) and institutional features of the welfare and monitoring system (such as workfare and the level and nature of sanctions on inadequate search). This sheds additional light on the determinants of the optimal tax schedule. Indeed, a substantial literature (see, e.g., Boadway et al. 2000; Ebert 1992; Weymark 1986, 1987, and Lollivier and Rochet 1983) has turned to quasi-linear preferences in leisure in order to obtain more intuition for the determinants of the optimal nonlinear income tax, as these preferences allow for closed-form solutions of the standard optimal nonlinear income tax problem. Our quasi-linear preferences also imply that a utilitarian government cares about the distribution of consumption rather than the distribution of work effort. Indeed, policy debates typically focus on raising consumption rather than reducing work effort of the poor.

The rest of this paper is structured as follows. After Sect. 2 sets up the model, Sect. 3 characterizes the solution and focuses on how the government trades off distortions on the intensive and extensive margins. Section 4 shows that an EITC becomes more attractive if the government attaches a higher social value to people working in the private sector. The opposite happens if a government prefers workfare. Section 5 concludes. All proofs of the results are in the Appendix.

2 The model

Agents exhibit homogenous preferences but heterogeneous skills. A worker featuring ability n who provides y units of work effort supplies ny efficiency units of homogeneous labor. In the face of a fixed, unitary labor productivity, these efficiency units are transformed in the same number of units of output. With output as the numeraire and a competitive labor market, the before-tax wage per hour collected by a worker is given by the exogenous skill level of that worker n. Hence, gross (i.e., before-tax) labor income earned by a worker of skill n, z(n), amounts to z(n)=ny(n). The function f(n) denotes the density of agents of ability n, and F(n) represents the corresponding cumulative distribution function. The support of the distribution of abilities is given by [n 0,n 1], while f(⋅) is differentiable and satisfies 1−n 0 f(n 0)>0. We discuss the last condition below.

As in Lollivier and Rochet (1983), Weymark (1987), Ebert (1992), and Boadway et al. (2000), workers share the following quasi-linear utility function over consumption x≥0 and work effort y≥0

where v(x) is increasing and strictly concave: v′(x)>0,v′′(x)<0 for all x≥0. Furthermore, v(0)=0, lim x↓0 v′(x)=∞ and lim x→+∞ v′(x)=0. Since utility is linear in work effort, consumption x is not affected by income effects, while a utilitarian government cares only about aggregate work effort in the economy. The concavity of v(⋅) implies that a utilitarian government wants to insure agents against the risk of a low consumption level. Such a government thus aims at an equal distribution of consumption rather than an equal distribution of work effort over the various agents. Indeed, public policy typically focuses on raising consumption rather than reducing work effort of the poor.

Agents can adjust their labor supply on not only the intensive margin (i.e., by varying work effort y) but also the extensive margin (i.e., by deciding whether or not to look for a job). In particular, by searching with intensity s∈[0,1], agents find a job with probability s. Search costs γ(s) are given by

where (with a slight abuse of notation) γ≥0 is a parameter representing the magnitude of the search costs. \(\bar{s}<1\) implies that agents can fail to find a job, even though they search at maximum capacity \(\bar{s}\). By modeling the costs and (in)effectiveness of search, the parameters γ and \((1-\bar{s})\) capture labor-market imperfections that give rise to unemployment.Footnote 1 As shown in (1) below, this search cost function implies a simple discrete decision: either search (at full capacity) or do not search.

If an agent does not succeed in finding a job, (s)he receives a public welfare (or social assistance) benefit b≥0.Footnote 2 The government imposes a sanction with exogenous probability 0<p c <1 if an agent does not search at the maximum level \(\bar{s}\) while (s)he is supposed to do so. The sanction reduces the agent’s utility by π>0 in terms of foregone leisure.Footnote 3 The government cannot perfectly observe search effort. Accordingly, agents who looked for a job at the maximum intensity \(\bar{s}\) but did not find one and thus are involuntarily unemployed also face an exogenous probability p s (where 0≤p s ≤p c <1) of being incorrectly sanctioned. We interpret p s >0 as an exogenous tagging error where the government misclassifies an involuntarily unemployed agent as being voluntary unemployed.

An agent of ability n selects search intensity s to maximize expected utility

where p(s) denotes the probability of suffering a sanction and u(n) stands for ex-post utility (net of search costs) of a type n agent who has found a job. With the search cost function γ(s) and the sanction system (i.e., p(s)=p c if \(s<\bar{s}\), and p(s)=p s if \(s=\bar{s}\)) introduced above, the optimal choice of s for type n amounts to

where

A worker thus either does not search at all (and is thus voluntarily unemployed) or searches at the maximum intensity \(\bar{s}\). Just as p s >0, we can interpret 1−p c >0 as an exogenous tagging error where the government misclassifies a voluntarily unemployed agent as being involuntarily unemployed.

We refer to the constraint \(u ( n ) \geq\bar{\gamma} +v ( b ) \) as the participation or individual rationality constraint. We impose \(\gamma \bar{s}-(p_{c}\pi-p_{s}\pi(1-\bar{s}))>0\) so that \(\bar{\gamma}>0\). Hence, although the government can observe search intensity to some extent, the sanction system does not completely eliminate the incentive problems associated with positive welfare benefits. In particular, workers must enjoy higher consumption levels than the unemployed do (i.e., \(v(x(n))\geq u(n)>v(b)+\bar{\gamma}>v(b)\)) in order to induce agents to look for a job. In particular, additional consumption must compensate a worker for the costs of work effort and job search.

After a worker has found a job, (s)he has to determine work effort. The ex-post utility of a type n agent who finds a job is determined by type n’s choice of gross income z:

where \(\tilde{T} ( z ) \) denotes the tax schedule as a function of gross income z. We can write \(T ( n ) =\tilde{T} ( z ( n ) ) \), since type n chooses gross income z(n) in equilibrium. The envelope theorem yields the first-order incentive compatibility constraint

Here we have used the first-order condition for individual optimization

where \(\tau ( n ) = \frac{d\tilde{T}(z)}{dz} |_{z=z(n)} \) denotes the marginal tax rate faced by agent n.

Since z(n)≥0, incentive compatibility (3) implies that utilities do not decline with skill (i.e., u′(n)≥0). Accordingly, if the participation constraint

is satisfied for skill \(\bar{n}\), it is met also for all higher skills \(n>\bar{n}\). Defining n w as the lowest skill level for which the participation constraint is met, we thus have s(n)=0 for n<n w and \(s ( n ) =\bar{s}\) for n≥n w . The agents with skill n<n w can be viewed as being voluntarily unemployed. The higher skills n>n w , in contrast, look for work but may be involuntarily unemployed (if \(\bar{s}<1\)).

The government does not observe workers’ skills n but knows the distribution function f(n) and observes before-tax income of each individual z(n). Although the government is not able to observe the skills of workers, it may be able to distinguish between the unemployed with lower skills n<n w and those unemployed with higher skills n>n w . In particular, whereas the high-skilled agents n>n w who do not engage in the maximum search activity \(\bar{s}\) are sanctioned with probability p c , non-searching low-skilled agents n<n w receive a sanction with exogenous probability p 0, which may be lower than p c . The difference between these two probabilities, μ n ≡p c −p 0, thus captures the extent to which the government can observe the skills of the unemployed and can therefore target sanctions at the more productive agents. We assume \(p_{0} \geq(1-\bar{s})p_{s} \), so that agents who do not search at all do not face a lower (ex ante or unconditional) probability of being sanctioned than agents who do search at maximum intensity.

The inequality p c >p 0 implies that the government is able to acquire some (albeit imperfect) information about an agent’s type n. In particular, the government can distinguish types n>n w from n<n w . This limits the extent to which the former types can mimic the latter. This can lead to situations where types below n w are better off in terms of overall utility than types slightly above n w without violating the incentive compatibility constraint for type n w .

The government faces the following budget constraint:

where E represents exogenously given exhaustive government expenditure and T(n)≡z(n)−x(n) denotes the tax paid by type n. Expression (6) allows us to interpret the sanction system as productive workfare if z π >0. In particular, with probability p 0, a voluntarily unemployed person with skill n<n w (who thus does not search) is forced to engage in workfare and produce z π for the public sectorFootnote 4 by giving up leisure π. An involuntarily unemployed person (who does engage in search \(s=\bar{s}\)) is put on workfare with probability p s . In order to focus our analysis on optimal tax-transfer policies, we take the monitoring and sanction system to be exogenous and do not model the costs of monitoring.Footnote 5

The utilitarian government maximizes ex-ante expected utility (i.e., expected utility before the skill level and labor market status have been revealed) subject to the incentive compatibility constraint (3), the participation constraint (1), and the government budget constraint (6). In addition, labor supply and therefore before-tax income should be non-negative (i.e., z(n)≥0), while the second-order conditions for the agents’ optimal choice of consumption and gross income imply that consumption and gross income are non-decreasing in type n (i.e., z′(n)≥0 and x′(n)≥0; see, for instance, Fudenberg and Tirole 1991). As in Boone and Bovenberg (2004), we assume that these constraints are not binding (except for the unemployed who feature zero gross income).

By employing u(n) as state variable (instead of x(n)) to facilitate the inclusion of incentive compatibility (3) into the optimization problem, we can formulate the social planner’s problem as follows:

where \(T ( n ) \equiv z ( n ) -x ( n ) =z ( n ) -v^{-1} ( u ( n ) +\frac{z ( n ) }{n} ) \). λ u (n) represents the Lagrange multiplier of the incentive compatibility constraint, λ E stands for the multiplier of the government budget constraint, and η w denotes the Lagrange multiplier on the participation constraint for type n w .

The job externality ε≥0 represents the value of working in the private sector beyond the production value of the job. ε f denotes the external effect associated with workfare jobs, which may differ from the external effect of a regular job in the private sector. We included these external benefits of work because they play an important role in the public policy debates on stimulating low-skilled workers to seek employment. These external effects can be justified on several grounds. First of all, social problems (such as crime) are often associated with unemployment. Second, social norms such as the work ethic are eroded if more people collect unemployment benefits (see Lindbeck et al. 1999). Third, unemployment may not only hurt social capital but also lead to the obsolescence of human capital. Depreciation of human and social capital may harm public finances in the future by reducing tax revenues and raising public spending on welfare. It also damages private welfare directly if decision makers are myopic, for example, on account of hyperbolic discounting. This holds true even if current inactivity does not impact social norms but affects only preferences of the individual concerned.

In our setting, the government faces two reasons why it would like to sanction the voluntary unemployed. The first reason is a standard fiscal externality: a worker generates tax revenue while an unemployed person collects a public welfare benefit b. The second reason is the work externality. The government, however, does not like everyone to work (n w =n 0) even if monitoring of search activity would be perfect or if the government could perfectly observe skills n. Only those types should search for work who through their productivity and external benefits recoup the search cost γ>0. With imperfectly observable skills, it may be optimal to put people out of work also to reduce the informational rent for higher skills types n>n w .

3 Optimal taxes and welfare benefits

This section characterizes the optimal tax and benefit system. In particular, the following lemma characterizes the solution for the optimal policy problem.

Lemma 1

If \(n_{0} f(n_{0})<1-\bar{s}\), the optimal values for the consumption level of the marginal worker, x w =x(n w ), the skill of the marginal worker, n w , the welfare benefit, b, and the shadow value of the government budget constraint, λ E , are determined by

where \(\boldsymbol{\upsilon} \equiv[1-\bar{s}(1-F(n_{w}))]\) denotes the unemployment rate, \(G ( n ) \equiv\int_{n_{0}}^{n}\frac {f ( t ) }{t}\,dt\) and

with consumption x(n) by type n≥n w determined by

This solution features η w >0, n w >n 0, v′(b)>λ E , and τ(n)>0 for n≥n w .

We focus on the case in which \(n_{0}f(n_{0})<1-\bar{s}\). The right-hand side of the inequality \(n_{0}f(n_{0})<1-\bar{s}\) stands for involuntary unemployment among the skills that are actively searching for a job. Hence, if these labor-market imperfections as measured by this involuntary unemployment \(1-\bar{s}\) are substantial, voluntary unemployment (i.e., n w >n 0 so that the least skilled do not look for a job) becomes optimal. Intuitively, to avoid poverty among the substantial numbers of involuntarily unemployed, the government sets the welfare level b at such a high level that the participation constraint becomes binding and the least skilled workers no longer search for work, especially if these workers feature only low labor productivity (i.e., n 0 is small) and account for a relatively small share of the labor force (i.e., f(n 0) is small). The desire to combat poverty among the low skilled and the involuntarily unemployed agents thus optimally creates additional, voluntary unemployment.Footnote 6

Expression (8) (together with (13)) determining the marginal type searching for a job, n w , can be written in terms of the tax distortion on the intensive margin τ(n w ) and the tax and benefit distortion on the extensive margin, T(n w )+b (using \(v(x_{w})-v(b)-\bar{\gamma}=z(n_{w})/n_{w}\), \(v'(x_{w})=\frac{1}{n_{w}(1-\tau(n_{w}))}\), and x(n w )=z(n w )−T(n w )):

This expression balancing distortions on the extensive and intensive margins of labor supply is similar to the corresponding expression in Boone and Bovenberg (2004) except for the additional term ρ involving job externalities and the monitoring and sanction technology. We thus discuss the impact of this latter term, starting with positive externalities on account of work in the private sector (but with ε f =z π =0, and p c =p 0) so that \(\rho=\frac{\varepsilon}{\lambda_{E}}>0\). In that case, ceteris paribus the gross replacement rate \(\frac{b}{z(n_{w})}\), the gap between the marginal and average tax rates widens at the minimum productivity level, thereby making the tax system more progressive at this skill level. Intuitively, with positive employment externalities, the government wants to subsidize the job search of unskilled workers (i.e., labor supply on the extensive margin) in order to reap more of these externalities by encouraging more workers to pursue paid employment in the private sector. These subsidies are financed by higher skilled agents so that the tax system becomes more progressive. An alternative way to understand why employment externalities make the tax system more progressive is that positive employment externalities can be viewed as implicit taxes on search. With a larger overall tax wedge on search T(n w )+b+ρ, the optimal trade-off between distortions on the intensive and extensive margins demands that the explicit tax on search (i.e., the extensive margin) is reduced and that the tax on effort (i.e., the intensive margin) is raised.

In case of workfare for agents who have not found a job in the private sector, not only searching for a job in the private sector but also refraining from search and relying on workfare gives rise to positive externalities (if \(z_{\pi}+\frac{\varepsilon_{f}}{\lambda_{E}}>0\)).Footnote 7 The net externalities of search are then given by \(\frac{\varepsilon}{\lambda_{E}}-(\frac{p_{0}-(1-\bar{s})p_{s}}{\bar {s}})(z_{\pi}+\frac{\varepsilon_{f}}{\lambda_{E}}) \).Footnote 8 By decreasing these net externalities, workfare thus reduces the need to decrease the explicit tax wedge on search T(n w )+b compared to the taxes on the intensive margin τ(n w ).

If the government imposes more substantial sanctions on the higher skilled individuals who are supposed to search for a job (but do not) than on other non-searching skills (i.e., π(p c −p 0)>0 with z π =ε f =0), it can rely less on the tax system to redistribute consumption across skills. Hence, ceteris paribus the gross replacement rate \(\frac{b}{z(n_{w})}\), taxes on labor income become less progressive as the gap between marginal and average tax rates narrows at the minimum productivity level. Intuitively, the government can afford to levy a higher tax wedge T(n w ) on marginal workers without discouraging these agents from seeking work and without hurting lower skilled agents. By observing the skills of the unemployed, the government thus can redistribute consumption across skills while imposing fewer distortions on the search margin. Whereas positive employment externalities can be viewed as an implicit tax on search, the penalty system works as an implicit subsidy on search. The lower overall tax wedge on the search margin as a result of sanctions allows for a larger explicit tax wedge on search T(n w )+b and a smaller wedge on the intensive margin of labor supply τ(n w ). Compared to positive employment externalities (which increase the overall distortionary tax wedge on the extensive margin), targeted sanctions thus exert exactly the opposite effect by decreasing the overall tax wedge T(n w )+b+ρ and making the tax system less progressive.

The monitoring system allows the government to alleviate the distortions on the search margin imposed by a welfare system that protects the consumption level of the least productive agents (n<n w ).Footnote 9 In particular, by targeting sanctions at non-searching high productivity types, the government can provide a lower effective income to these types compared to the effective welfare incomes enjoyed by non-searching low-skilled types. By differentiating its instruments in this way, the government can redistribute from the high skilled to the low skilled with smaller distortions on the search margin. The intuition for the term \(b - \frac{\pi(p_{c} - p_{0})}{\lambda_{E} \bar{s}}\) (where we focus on the part of the ρ term that involves the monitoring and sanction system) at the right-hand side of (14) is as follows. If the government reduces n w , it would save \(b - (1-\bar{s})b=\bar{s}b\) in terms of expenditure which is valued at λ E . But the type that would be drawn into work by the reduction in n w actually loses utility, as

where we have used the participation constraint \(u(n_{w}) = v(b) + \bar{\gamma}\). As long as \(b\lambda_{E}\bar{s}>\pi(p_{c}-p_{0})\),Footnote 10 the welfare system distorts search and the tax system is progressive at the minimum productivity level (i.e., the marginal tax rate exceeds the average tax rate at this skill, so that \(\tau( n_{w} )> \frac{T ( n_{w} )}{z ( n_{w} )}\) in order to protect search incentives. Intuitively, sanctions are not strong enough to completely offset the distortions imposed by the benefit system on the search margin. Accordingly, the tax system is used to limit these search distortions through a relatively low average tax rate on marginal workers (i.e., \(\frac{T ( n_{w} ) }{z ( n_{w} ) }< \tau( n_{w} )\)).

To conclude our discussion of (14), we note that the term ρ captures the additional welfare effects of raising employment (by reducing n w so that more skills search for private employment) beyond the direct budgetary implications of not having to pay a welfare benefit b and collecting additional tax revenue T(n w ).Footnote 11 In particular, raising private employment generates additional externalities (if ε>0), reduces the externalities and public revenues associated with workfare (if \(z_{\pi}+\frac{\varepsilon_{f}}{\lambda_{E}}>0\) and \(p_{0}-(1-\bar{s})p_{s}>0\)), and depresses private welfare of the additional searching agents who are more heavily penalized if they do not search (if π(p c −p 0)>0 so that more people face the threat of more serious penalties if they refrain from search).Footnote 12

Equation (10) is the first order condition for optimal b. The left-hand side of this expression represents the direct marginal benefits of more generous unemployment compensation in terms of a higher utility level of the unemployed (υ). The right-hand side stands for the marginal social costs, which consist of the direct marginal resource costs of public spending λ E (the first term) and the adverse impact on search incentives of the marginal worker n w (the second term featuring the shadow value of the participation constraint of the marginal worker η w ).

Equation (11) shows that with optimally set welfare benefits, the government can raise revenues by adjusting taxes and benefits in such a way that marginal incentives on neither the intensive nor the extensive margin are affected. In particular, raising one additional euro from each worker induces all workers to work harder so as to raise their gross incomes by one euro and thereby maintain their net incomes (and thus their consumption levels). By at the same time reducing b so that utility of the unemployed falls by the same amount as that of marginal workers n w , the government prevents behavioral responses on the extensive margin.Footnote 13 By adjusting taxes and the welfare benefit in this fashion, the government eliminates behavioral effects on the government budget constraint. The left-hand side of (11) represents the direct positive impact on the government budget constraint: the first term stands for the impact of lower welfare benefits for the unemployed (who represent a share υ of the population), while the second term represents the revenues from the uniform tax on workers (who account for a share (1−υ) of the population). The right-hand side of (11) denotes the cost of the additional revenues in terms of the private utilities of both the unemployed (the first term) and the workers (the second term).Footnote 14

We can alternatively write the expression (11) for λ E as follows:

The terms between square brackets can be interpreted as distributional wedges. The weighted sum of these distributional wedges (with as weights the number of agents) should be zero.

As explained above with \(n_{0}f(n_{0}) < 1-\bar{s}\), it is optimal to have voluntary unemployment (n w >n 0). Although v′(b)>λ E , it is not optimal for the government to increase b because of the detrimental effect of higher welfare benefits on the participation constraint η w >0. Finally, all workers face positive marginal tax rates in order to redistribute resources to agents with lower skills.

If we make an additional assumption, we can also show that the overall tax wedge (including implicit taxes) on the extensive margin is strictly positive.

Lemma 2

Let \(\underline{x}\) denote the minimal consumption level necessary to ensure an agent’s participation: \(v(\underline{x})=\bar{\gamma}\).Footnote 15 If in addition to \(n_{0}f(n_{0}) < 1-\bar{s}\) parameter values are such that \(\underline{x} \geq \rho\), we have b+T(n w )+ρ>0, and z(n)>0 for all n≥n w .

Intuitively, if search costs are large (so that \(\underline{x}\) is large) compared to the non-revenue external effects of employment ρ, low-skilled workers should not search for non-productive jobs (i.e., jobs with z(n)=0). With marginal workers n w in productive work, a positive marginal tax rate τ(n w )>0 distorts the intensive margin of these workers. In order to contain these distortions on the intensive margin, the government optimally taxes on the extensive margin (i.e., b+T(n w )+ρ>0 and τ(n)>0 for n≥n w ). Indeed, b+T(n w )+ρ can be viewed as the marginal first-order welfare gain from putting the marginal skill to work. It is in fact the implicit tax wedge on the participation margin. Non-revenue externalities from work ρ≠0 may cause this implicit tax wedge to differ from the explicit tax wedge resulting from the tax and benefit system b+T(n w ).

Another way to understand why the government imposes a positive implicit tax on search (i.e., b+T(n w )+ρ>0) is that welfare benefits rather than in-work benefits are the most effective way to reach the poor (i.e., those suffering from a low consumption level) for two reasons. First, with involuntary unemployment, in contrast to in-work benefits, welfare benefits reach the involuntarily unemployed who are worse off than workers. Second, with positive search costs, welfare benefits help low-skilled agents without these agents having to engage in costly search. In-work benefits are thus relatively costly ways to address poverty if search is ineffective (so that \(\bar{s}\) is small and therefore \(n_{0} f(n_{0}) <1 -\bar{s}\)) and costly (compared to positive job externalities, so that \(\underline{x} \geq\rho\)).

4 Job externalities

This section considers the effects of a government changing its valuation of the external effects of employment. We explore external effects ε of jobs in the private sector and of workfare ε f .Footnote 16 We find that higher ε (or a better appreciation by governments of external effects like ε) can explain why many countries have introduced EITC type of tax measures.

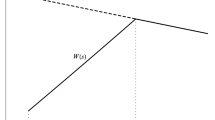

Conducting comparative statics on the solution characterized in Lemma 1 is not trivial. The key to make this tractable is shown in Fig. 1. We first explain this figure for the case in which b is exogenously fixed. Subsequently, we show that we can generalize the results to the case in which b is endogenously determined by (11).

Figure 1 shows two relationships in (n w ,λ E ) space. The Labor Supply curve (LS) depicts the combinations of n w and λ E that satisfy (8) and (13) for n=n w . As in Boone and Bovenberg (2004), the LS curve is upward sloping. Intuitively, by indicating that government revenue has become scarcer, a large value for λ E raises the overall tax burden on workers, thereby harming the incentives to look for work and thus increasing n w .

Equation (12) represents the Government Budget Constraint, GBC. We assume that apart from revenue considerations the government features a preference for a higher level of private employment (this corresponds to the assumption ρ ∗≥0 in the proposition below). Hence, employment is subsidized at the margin so that a higher level of employment makes public revenues scarcer. A higher level of employment (i.e., lower n w ) thus goes together with a higher value for the shadow price of public money λ E . The downward sloping GBC formalizes this trade off between raising employment (lower n w ) and raising public revenues (lower λ E ).

Figure 1 shows two comparative static exercises, namely higher government spending E and a higher external effect ε of work in the private sector. An increase in government expenditure E does not affect the LS curve. The GBC curve shifts up (for given n w ) because a higher value for λ E is needed to balance the budget if government spending increases. Scarcer public money raises unemployment (higher n w ) because at the margin the government subsidizes employment. An increase in the external effect ε of work in the private sector leaves the GBC curve unaffected but shifts the LS curve to the left; for given value of λ E , the government now prefers a higher level of private employment (lower n w ). In equilibrium, an increase in ε thus reduces unemployment and raises λ E .

To endogenize b in this analysis, we add a linearized version of (10):

where \(\alpha_{n_{w}}\equiv\frac{\bar{s}f(n_{w}) ( \frac {1}{v^{\prime }(x_{w})}-\frac{1}{v^{\prime}(b)} ) }{\boldsymbol{\upsilon} \frac{-v''(b)}{[v^{\prime }(b)]^{2}}}>0\) and \(\alpha_{\lambda_{E}}\equiv\frac{n_{w}\bar{s}(1-F(n_{w}))+\frac{\boldsymbol{\upsilon}}{v^{\prime }(b)}}{\boldsymbol{\upsilon} \lambda_{E}\frac{-v''(b)}{[v^{\prime }(b)]^{2}}}>0\). Larger unemployment (i.e., an increase in n w ) raises the optimal welfare benefit. The reason is that more people rely on the welfare benefit for their livelihood if unemployment is substantial, so that the distributional benefits of more generous welfare benefits are larger. A larger value for λ E raises the budgetary costs of public spending on welfare benefits and thus reduces the optimal welfare benefit.

To derive the LS and GBC curves with endogenous b we rely on three regularity conditions, namely assumptions 2–4 in the proposition below (the proof of Proposition 1 provides the corresponding formal conditions). We discuss these conditions in turn.

With exogenous b, an increase in n w raises x w (through (13) with v′(x w )=v′(x(n w ))) so that the right-hand side of (8) increases relative to the left-hand side. With endogenous b, (16) shows that an increase in n w raises b which works in the opposite direction. The first regularity condition implies that the former effect dominates the latter.

Turning to the second regularity condition, we note that an increase in λ E raises the left-hand side of (8) relative to the right-hand side if b is exogenous. With endogenous b, however, an increase in λ E reduces b (see (16)) which works in the opposite direction. The former effect dominates the latter if the second regularity condition is met. These first two assumptions ensure that the LS curve is upward sloping if b is endogenous.

As regards the last regularity condition, we observe that an increase in n w raises government revenues if b is exogenous because employment is subsidized at the margin. However, as n w increases, unemployment rises which induces the government to raise b (see (16)), thereby reducing net government revenues. The final regularity condition implies that the latter effect is not strong enough to dominate the former effect. With an increase in λ E raising government revenues (this effect is strengthened with endogenous b), the GBC curve is therefore unambiguously downward sloping.

Proposition 1

Consider the case in which b is endogenously determined by (10). We make the following four assumptions:

-

1.

\(\rho^{*}\equiv\varepsilon- \varepsilon_{f} (p_{0} -(1-\bar {s})p_{s})/\bar{s}-\pi(p_{c} -p_{0})/\bar{s}\geq0\);

-

2.

An (exogenous) increase in n w raises the right-hand side of (8) relative to its left-hand side;

-

3.

An (exogenous) increase in λ E raises the left-hand side of (8) relative to its right-hand side;

-

4.

An (exogenous) increase in n w increases the government’s budget surplus (or equivalently, reduces the deficit).

Then the effect of λ E on n w along the LS curve is given by

and the effect of λ E on n w along the GBC curve is given by

The government attributing a larger external effect to people working in the private sector yields the following effects:

The government attributing a larger external effect to workfare yields the following effects:

Assumption 1 that ρ ∗≥0 formalizes the idea that apart from revenue considerations the government exhibits a preference for higher private employment. As discussed above, this is a sufficient condition for the GBC curve to be downward sloping with exogenous b.

External effects from work

We first consider the impact of a larger external effect ε of work in the private sector. In Fig. 1, this leaves the GBC unaffected, but shifts the LS curve to the left. Hence, n w declines. Moreover, as λ E goes up, the marginal tax rates on all working types n∈〈n w ,n 1〉 increase. The economic intuition behind these impacts is that a larger external effect of private employment induces the government to encourage more agents to search (so that n w declines). Improved search incentives for marginal workers require a tax cut for the marginal skills around n w . The associated loss in tax revenue implies that skilled agents have to bear a higher tax burden. The shift of the burden of the labor tax away from low-skilled workers towards skilled workers raises marginal tax rates for all workers. A better appreciation of these external effects ε by governments can thus explain the introduction of EITC type of tax measures in many countries.

Equation (16) implies that the decline in n w and the increase in λ E reduce b. Hence, higher externalities ε lead to lower benefits b as the government relies more on in-work benefits than on welfare benefits to alleviate poverty.

External effects from workfare

Additional external effects from workfare ε f yield the opposite effects of additional external effects from work in the private sector. With more external effects of workfare, the government perceives less need to induce agents to look for work in the private sector through low labor taxes on marginal skills. Hence, the government raises the tax burden on marginal skills, thereby depressing private-sector employment. Moreover, marginal tax rates on workers decline as the tax burden is shifted away from high-skilled to low-skilled workers. Finally, it follows from (16) that this leads to higher benefits b.

5 Conclusions

This paper explored how tax policy, welfare benefits, job externalities and the technology for monitoring and sanctioning inadequate search interact in a model of optimal nonlinear income taxation with search costs and involuntary unemployment. Within this setting, optimal unemployment is determined by the requirement that distortions on the extensive margin balance those on the intensive margin. We show how sanctions on inadequate search, workfare, and externalities from work affect this requirement. Among other things, we find that job externalities reduce the optimal welfare benefit and raise marginal tax rates on work effort. These marginal tax rates are reduced, however, by workfare. Whereas workfare can be seen as a substitute for an EITC, job externalities make an EITC more attractive.

Notes

A special case of our model is a regular labor-supply model with fixed costs of work (such as child care costs). In particular, in the absence of involuntary unemployment (i.e., \(\bar{s}=1\)), the parameter γ can be interpreted as these fixed costs of entering the labor market.

We interpret b as a social assistance payment rather than an unemployment insurance benefit because b does not depend on ability n.

We are interested here in workfare and therefore consider a sanction in terms of foregone leisure. Alternatively, one could consider a sanction in terms of a cut in welfare benefits. This would lead to similar results, although the analysis would be more complicated because the sanction would impact private utility in a nonlinear fashion. Hence, another reason for focussing on sanctions in terms of foregone leisure is that it keeps our analysis transparent.

However, the government may have to provide people on workfare with certain tools, while only little or no monetary revenue is generated. If forcing people to give up leisure in this way is costly, then z π <0.

In order to come up with results on the optimal monitoring technology, we would have to estimate the costs of monitoring, which is beyond the scope of the present paper. See Boone et al. (2007) for a calibration of the costs and benefits of introducing monitoring and sanctions in a setting without distortionary redistributive taxation.

Indeed, the left-hand side of the inequality \(n_{0}f(n_{0})<1-\bar{s}\) captures the efficiency costs of generous welfare benefits putting the lowest skill out of work, while the right-hand side represents the distributional benefits in terms of more consumption for the involuntarily unemployed.

Since \(p_{0}-(1-\bar{s})p_{s}>0\), the voluntarily unemployed (who do not search) face a higher probability of being put on workfare than those agents who actively search for a job in the private sector but may not find one.

The externalities ε and ε f are divided by λ E to transform utilities in commodities (or government revenue).

Whereas we model the benefits of monitoring, we do not specify the costs of monitoring. We thus cannot compute optimal monitoring levels.

This implies that b+ρ>0, assuming that \(\frac{\varepsilon}{\lambda_{E}}-(\frac{p_{0}-(1-\bar{s})p_{s}}{\bar {s}})(z_{\pi}+\frac{\varepsilon_{f}}{\lambda_{E}})\geq 0\).

ρ includes the budgetary effect of the revenues from workfare z π .

As mentioned, this condition π(p c −p 0)>0 implies that non-searching skills just below n w enjoy higher ex-ante levels of welfare than the marginal searching skill n w . However, \(\bar{\gamma}>0\) implies that workers enjoy higher consumption levels than the unemployed do (i.e., \(v(x(n))\geq u(n)>v(b)+\bar{\gamma}>v(b)\)).

In particular, all working agents raise production by the same amount dz>0. In order to leave unaffected the participation margin \(v(b) + \bar{\gamma}= v(x_{w}) - z_{w}/n_{w}\), the government reduces the welfare benefit b so that \(v'(b) \,db = -{\frac{1}{n_{w}}} dz\), or equivalently, db/dz=−1/(n w v′(b)).

The utility cost is lowest for the highest skills because these skills need to exert the least effort to generate an additional euro of gross income.

At this consumption level \(\underline{x}\), a marginal type n w participates only if z(n w )=0 and b=0.

The working paper version of this paper considers also the comparative statics with respect to the monitoring technology p c ,p 0, and π.

The optimality (or transversality) condition for the bound n w can be found in texts like Kamien and Schwartz (1981).

References

Boadway, R., Cuff, K., & Marchand, M. (2000). Optimal income taxation with quasi-linear preferences revisited. Journal of Public Economic Theory, 2, 435–460.

Boone, J., & Bovenberg, A. L. (2004). The optimal taxation of unskilled labor with job search and social assistance. Journal of Public Economics, 88, 2227–2258.

Boone, J., Fredriksson, P., Holmlund, B., & Van Ours, J. (2007). Optimal unemployment insurance with monitoring and sanctions. Economic Journal, 117, 399–421.

Ebert, U. (1992). A reexamination of the optimal nonlinear income tax. Journal of Public Economics, 49, 47–73.

Fudenberg, D., & Tirole, J. (1991). Game theory. Cambridge: MIT Press.

Lindbeck, A., Nymberg, S., & Weibull, J. (1999). Social norms and economic incentives in the welfare state. Quarterly Journal of Economics, 114, 1–35.

Lollivier, S., & Rochet, J. (1983). Bunching and second-order conditions: a note on optimal tax theory. Journal of Economic Theory, 31, 392–400.

Kamien, M. I., & Schwartz, N. L. (1981). Dynamic optimization: the calculus of variations and optimal control in economics and management. Amsterdam: North-Holland.

Saez, E. (2002). Optimal income transfer programs: intensive versus extensive labor supply responses. Quarterly Journal of Economics, 117, 1039–1073.

Weymark, J. A. (1986). A reduced-form optimal nonlinear income tax problem. Journal of Public Economics, 30, 199–217.

Weymark, J. A. (1987). Comparative static properties of optimal nonlinear taxes. Econometrica, 55, 1165–1185.

Acknowledgements

Jan Boone gratefully acknowledges financial support from NWO (grant number 453.07.003).

Open Access

This article is distributed under the terms of the Creative Commons Attribution License which permits any use, distribution, and reproduction in any medium, provided the original author(s) and the source are credited.

Author information

Authors and Affiliations

Corresponding author

Appendix: Proofs of the results

Appendix: Proofs of the results

Proof of Lemma 1

Equation (7) is an optimal control problem where z(n) is the control, u(n) is the state variable, and n w is a lower bound that is chosen optimally. The first-order conditions for this problem can be written as follows:Footnote 17

The first order condition for b is given by (10).

Individual optimization in (2) implies

Substitution of (22) into (18) yields

Together with (19) this implies

Substituting (18) into (17) to eliminate v′(x(n)), we arrive at a linear differential equation in λ u (n) which is given by \(( \frac{\lambda_{u}(n)}{n} )' = (\lambda_{E} - \frac{1}{n} ) \bar{s} f(n) \). This can be solved (using transversality condition (20)) to yield

Substitution of (25) into (18) to eliminate λ u (n) yields (13). Substituting (19) into (25) to eliminate λ u (n), we arrive at

Combining (26) with (10) yields (11).

An alternative expression for λ E can be derived by evaluating (13) at n=n w :

Substitution of the participation constraint \(u ( n_{w} ) =\gamma +v ( b ) -\frac{p_{c}- ( 1-\bar{s} ) p_{s}}{\bar{s}}\pi\) into (21) yields

Using (24) to eliminate η w and (3) to eliminate u′(n w ), we can rewrite the left-hand side of this equation to obtain (using the definition of ρ from (9))

Substitution of (4) and T(n)=z(n)−x(n) for n=n w to eliminate τ(n w ) and T(n w ) and \(z(n_{w}) = n_{w} (v(x_{w})-u(n_{w})) = n_{w}(v(x_{w})-v(b) -\bar{\gamma}) \) to eliminate z(n w ) yields (8) in the lemma.

Substituting z(n)=n(v(x(n))−u(n)) in (3) to eliminate z(n), we arrive at the differential equation (nu(n))′=v(x(n)). With the participation constraint \(u(n_{w}) =v(b) + \bar{\gamma} \), we can solve the differential equation for u(⋅) as

Substitution of T(n)=z(n)−x(n)=nv(x(n))−nu(n)−x(n) to eliminate T(n) from the government budget constraint (6) yields:

Rearranging and changing the order of integration results in (12).

Equation (10) can be rewritten as:

First, we prove that η w >0. Suppose by contradiction that η w ≤0. Then (31) implies that λ E ≥v′(b). The participation constraint \(v ( x ( n ) ) -\frac{z ( n ) }{n} \geq v ( b ) +\bar{\gamma}\) where z(n)≥0 and \(\bar{\gamma} >0\) implies that x(n)>b for all n≥n w . Concavity of v(x) then implies that λ E ≥v′(b)>v′(x(n)) for all n so that (from (17)) \(\lambda^{\prime}_{u}(n) > 0\) for all n≥n w . Since λ u (n w )=−η w ≥0, this contradicts λ u (n 1)=0. Hence, we have shown that η w >0 and (from (31)) v′(b)>λ E .

Equation (26) and η w >0 imply that

for all n>n w . Equation (25) then implies that λ u (n)<0 so that (see (23)) τ(n)>0 for all n≥n w .

Next, we show that \(\bar{s}<1-n_{0}f(n_{0})\) implies that n w >n 0. Suppose by contradiction that n w =n 0. In that case, using (26) and (31), we find that

which can be rewritten as

Substitution of n w =n 0 into (13) yields

To prove the result, we will show that \(\bar{s}<1-n_{0}f ( n_{0} ) \) implies v′(b)<v′(x(n 0)) and thus (with concavity of v(x)) x(n 0)<b, which contradicts the participation constraint \(v ( x ( n_{0} ) ) -\frac{z ( n_{0} ) }{n_{0}}\geq v ( b ) +\bar{\gamma}\) where z(n 0)≥0 and \(\bar{\gamma}>0\). Since (32) implies λ E >G(n 1) (recall that n w =n 0), we must prove that

for all λ E >G(n 1). This inequality can be rewritten as

For λ E =G(n 1), the right-hand side of this equation is 0, while the left-hand side is strictly positive at λ E =G(n 1) because \(G ( n_{1} ) <\frac {1}{n_{0}}\). Accordingly, a necessary and sufficient condition for the inequality to hold for all λ E >G(n 1) is that the right-hand side is more strongly downward sloping in λ E than the left-hand side so that

or equivalently,

which holds by assumption. □

Proof of Lemma 2

We show that \(\underline{x}\geq\rho\) implies z(n w )>0. The second-order condition of the agent’s optimization problem z′(n)≥0 then implies that z(n)>0 for all n≥n w . Suppose by contradiction that z(n w )=0. The participation constraint and (28) (with T(n w )=−x(n w )) since z(n w )=0) imply that

Both curves can be drawn in the (b,x w ) space. By our assumption \(\underline{x}>\rho\), curve (34) lies above (35) at b=0. \(\frac{v^{\prime}(b)}{v^{\prime}(x_{w})}>1\) (since x w >b by the participation constraint) implies that the curve (34) is steeper than (35). The two curves thus do not intersect, and (34) and (35) cannot hold simultaneously. This rules out z(n w )=0.

(28) and z(n w )>0 and τ(n w )>0 (see (24) with η w >0) imply that T(n w )+b+ρ>0. □

Proof of Proposition 1

We derive the proof of this result in two steps. First, we show that the result holds for exogenous b. Then we derive that the result generalizes to the case with endogenous b.

Exogenous b: Linearizing (8) and (27), we derive the slope of the LS curve:

where

because the second-order conditions for individual optimization imply that x′(n)≥0, and

Inverting the matrix on the left-hand side, we write

where

Using the fact that \(\frac{d\rho}{d\lambda_{E}}=\frac{1}{\lambda _{E}^{2}}(-\varepsilon+\varepsilon_{f}(p_{0}+(1-\bar{s})p_{s})/\bar{s}+(\pi (p_{c}-p_{0}))/\bar{s})\) (from the definition of ρ in expression (9)), we find that \(\frac{dn_{w}}{d\lambda_{E}}\) is given by

where \(\zeta_{\lambda_{E}} >0\) and \(\zeta_{n_{w}} \leq0 \) are given by (38) and (37) and ρ ∗≥0 by assumption 1.

Linearizing the government budget constraint (12), we establish

where (the third equality below follows from (8) and (27))

Hence, \(\frac{\rho^{*}}{\lambda_{E}}=\frac{\varepsilon}{\lambda_{E}}-\frac{p_{0}-(1-\bar{s})p_{s}}{\bar{s}}\frac{\varepsilon _{f}}{\lambda_{E}}-\frac{\pi(p_{c}-p_{0})}{\lambda_{E}\bar{s}} \geq0\) is a sufficient condition for \(\phi_{n_{w}}>0\). We also have

so that \(dn_{w}/d\lambda_{E}=-\phi_{\lambda_{E}}/\phi_{n_{w}}<0\). □

E has no effect on the LS curve. For given λ E , the GBC curve (41) implies

so that the GBC curve shifts to the right. Hence, an increase in E raises both n w and λ E .

(39) implies that (for given λ E ), the LS curve shifts to the left with ε:

With a fixed GBC curve, an increase in ε raises λ E and reduces n w . Equation (39) then implies that dx w /dε<0. Equations (13) and (4) (with \(\frac{\partial\lambda _{E}}{\partial \varepsilon}>0\)) then imply that marginal tax rates go up for all n>n w . Writing T(n) as follows (where the second equality follows from z(n)=n(v(x(n))−u(n)) and (29))

we find

At n=n w , only the negative effects remain:

where n w v′(x(n w ))−1>0 and \(v(x_{w})-v(b)-\bar {\gamma}>0\), so that \(\frac{dT(n)}{d\varepsilon}<0\) for n close to n w . Close to n=n 1, we have n 1 v′(x(n 1))=1 and thus

At the margin, a decline in n w drains the government budget. This effect working in the direction of \(\frac{dT(n)}{d\varepsilon }>0\) is strongest for high values of n because the integral at the right-hand side of the equation above increases with n (in absolute value).

A rise in ε f exerts the same qualitative effects as a decline in ε.

We now show that these results can be generalized to the case with endogenous b.

Endogenous b: With endogenous b, (8) and (27) are linearized as follows:

where \(\zeta_{n_{w}} \leq0\) and \(\zeta_{\lambda_{E}}>0\) are defined in (37) and (38).

Together with the linearized (16), we can write the linearized system as

where the matrix A is defined as follows:

so that

where x w −b−ρ>0,v″(x w )<0. To find the sign of det(A), we use assumption 2 in the proposition. Fix λ E , then the first equation of the linearized system can be written as

where the inequality follows from assumption 2. Using the second and third equation from this linearized system (47)—with given λ E —we find \(\frac{\partial x_{w}}{\partial n_{w}} = \frac{\zeta_{n_{w}}}{v(x_{w})}\) and \(\frac{\partial b}{\partial n_{w}} = \alpha_{n_{w}}\). Substituting this into the inequality above shows that

and therefore det(A)<0 in (48).

Using Cramer’s rule, we derive the slope of the LS curve as follows (using \(\frac{d\rho}{d\lambda_{E}}=-\frac{\rho^{*}}{\lambda_{E}^{2}}\)):

which yields

where \(\zeta_{b}\equiv\frac{v^{\prime}(b)-v^{\prime}(x_{w})}{x_{w}-b-\rho}>0\). The denominator is positive due to (49). With a similar argument as above, one can show that assumption 3 in the proposition implies that \(\zeta_{\lambda _{E}}-\alpha_{\lambda_{E}}\zeta_{b}>0\). Together with assumption 1 (ρ ∗≥0) this implies that the LS curve is upward sloping:

Combining the linearized government budget constraint (12) with (16), we obtain:

where \(\phi_{n_{w}}>0\) and \(\phi_{\lambda_{E}}>0\) are defined in (42) and (43) and

Inverting the matrix on the left-hand side of (50), we find the slope of the GBC curve:

where \(\alpha_{\lambda_{E}},\phi_{\lambda_{E}},\phi_{b}>0\) (given by expressions (42), (43), and (51)) imply that the numerator of the fraction on the right-hand side is positive. With similar arguments as above (using assumptions 2 and 3), one can show that assumption 4 in the proposition implies that \(\phi_{n_{w}} -\phi_{b} \alpha_{n_{w}} >0\). Hence the GBC curve is downward sloping:

Hence, with endogenous b, we also have an upward sloping LS curve and downward sloping GBC curve. To finish the proof, we show that ρ (and hence ε and ε f ) shifts LS in the same direction under endogenous and exogenous b.

The expression for \(| \frac{\partial n_{w}}{\partial\rho} |_{\mathtt{endogenous}\ b} \) in case of the LS curve can be written as

Since \(\frac{\zeta_{n_{w}}}{\zeta_{n_{w}} + \alpha_{n_{w}} \zeta_{b}} >0\), the derivative \(\frac{\partial n_{w}}{\partial\rho}\) has the same sign under endogenous and exogenous b.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 2.0 International License (https://creativecommons.org/licenses/by/2.0), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

About this article

Cite this article

Boone, J., Bovenberg, L. Optimal taxation and welfare benefits with monitoring of job search. Int Tax Public Finance 20, 268–292 (2013). https://doi.org/10.1007/s10797-012-9227-y

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10797-012-9227-y