Abstract

We study the effects of minimum capital requirements, capital buffers, liquidity regulation and loan loss provisions on the incentives of bankers to exert effort and take excessive risk. These regulations impact differently the behavior of bankers. Capital regulation, liquidity requirements and traditional loan loss provisions for expected losses provide adequate incentives to bankers. Capital requirements are the most powerful instrument. Counter-cyclical (so-called dynamic) loan loss provisions may provide bankers with incentives to gamble. The results help informing the ongoing debate about the harmonization of banking regulation and the implementation of Basel III.

Similar content being viewed by others

1 Introduction

In recent years the trend towards the harmonization of financial regulation has gained momentum. New regulation is being introduced with the aim of avoiding regulatory arbitrage and making financial institutions safer and more resilient to shocks. The Basel Committee on Banking Supervision, for instance, promulgated a new version of its Accord (called Basel III) determining higher minimum capital requirements for banks and the conditions under which they should build extra capital buffers, such as the conservation and the counter-cyclical ones, as well as enhanced liquidity requirements. In the same spirit, accounting bodies (e.g. the International Financial Reporting Standards) have been revising the rules for the recognition of loan losses with the objective of achieving a timelier and more adequate loan loss provision system.

The primary objective of Basel III is to build buffers in order to achieve the broader macroprudential goal of protecting the banking sector from expansionary periods that have often been associated with the build-up of system-wide risk. While the introduction of this regulation may have positive outcomes, it might also have unintended consequences. A key criterion to identify the case for policy intervention is the presence of systemic negative externalities. In general, such externalities arise whenever the costs of failed endeavors are not only borne by those who stood to benefit from the initial risk-taking activity, but also spill over to the wider financial sector and economy. Though they have macroeconomic consequences, these externalities typically originate from misaligned incentives at a microeconomic level, e.g. pervasive moral hazard that induces agents into excessive risk-taking in their contractual relations. Not all such market failures are relevant for financial stability, but insofar as they aggregate up to a systemic level they may become relevant. Hence, it is important to understand the impact of regulation on banker’s incentives because it will determine whether regulation would help to lean against the build-up of risk (a secondary objective of Basel III) or have the opposite unintended effect.

The implementation of Basel III is also matter of debate in several jurisdictions. Banking systems around the world show key differences, which in turn have justified the enactment of different banking regulations.Footnote 1 For example, several countries (e.g. Spain, Peru and Uruguay) introduced counter-cyclical loan loss provision regulation (also called dynamic or statistical provisions) long before the Basel’s III counter-cyclical capital buffer proposal. Recently, Spain stops using dynamic provisions in order to implement a counter-cyclical capital buffer. Should regulators prefer the use of one instrument over the other?

This paper aims to inform the ongoing debate by analyzing how different bank regulations affect bankers’ incentives to exert effort in monitoring loans and to take excessive risk by shifting to risky projects. More precisely, we propose a formal model, based on Holmstrom and Tirole (1997) and inspired by Biais and Casamatta (1999), to investigate the effects of four different banking regulations: (i) minimum capital requirements, (ii) capital buffers, (iii) liquidity requirements, (iv) loan loss provisions for expected losses and counter-cyclical provisions.

We find that regulations impact differently the behavior of bankers. We characterize conditions under which they make it easier to implement the first-best solution. The requirement of a capital buffer facilitates the provision of the correct incentives to bankers. Capital buffers are the most powerful among the policy options that are analyzed: requiring extra capital is a direct mechanism to increase the participation of the banker on the bank so as to mitigate the moral hazard problems. When the capital buffer is financed by external investors, it also makes it easier to provide the correct incentives to bankers because the capital buffer relaxes the participation constraint of depositors. Moreover, the equity contract with external investors improves efficiency in financing making it easier to provide the right incentives to bankers. Liquidity requirements also make it easier to provide the correct incentives to bankers, but they are a less powerful instrument than capital regulation. The reason for this is that capital requirements affect the funding structure of the bank (the liability side of the balance sheet) but liquidity requirements affect the structure of the investment (the asset side) restricting the possibility of investing the requirement in more productive opportunities. This result is also valid for the case of traditional provision systems for expected loan losses. The accumulation of a counter-cyclical loan loss provision fund, however, makes it more difficult to provide the correct incentives to bankers. Since part of the loan portfolio’s returns needs to be put on reserve, the fraction left available to compensate the banker is reduced in such a way that she may get incentives to gamble by taking more risks and shirking.

Our results shed light on the complementarity of implementing a counter-cyclical capital buffer for banks in countries already running counter-cyclical loan loss provision systems. Capital buffers and traditional provisions for expected loan losses (which works as a reserve requirement) provide adequate incentives to bankers, the former being a more powerful instrument than the latter. However, counter-cyclical loan loss provision regulation may provide bankers with incentives to gamble in periods when the fund is accumulating (i.e. in good times). Hence, in good times bank supervisors should either prefer the use of capital buffers like the proposed in Basel III, or complement counter-cyclical loan loss provisions with higher minimum capital requirements and stronger supervision of risk-taking activities.

In the next section, we revise related literature. In Section 3, we introduce the basic model and derive the benchmark case. In Section 4, we analyze the impact of introducing different kind of regulatory tools on banker’s incentives, compare the results, and link them to empirical evidence. In Section 5, we make final comments. Proof of the main propositions and other technicalities are in the Appendix.

2 Related literature

This paper contributes to the ever-growing literature on banking regulation by considering the effects of different tools currently used for prudential regulation on the incentives of bankers. Managers’ incentives are particularly relevant in banking because asymmetric information determines that, in addition to the traditional effort problem, another moral hazard problem is likely to exist under the form of risk shifting. Hence, the outcome of the same prudential regulation may be very different when one considers these moral hazard problems as, for example, Arango and Valencia (2015) have highlighted.

One strand of the banking regulation literature has focused on microeconomic aspects by analyzing the optimal bank’s funding structure. In general, it looks for optimal financial contracts in presence of the two moral hazard problems described previously, i.e. effort and risk-shifting. When dealing exclusively with the effort problem, debt contracts arise as the optimal ones (see, for example, Calomiris and Kahn 1991; Diamond and Rajan 2001; and Diamond and Rajan 2012). The reason is that short-term debt acts as a threat to bankers: if they do not diligently manage the loan portfolio, then debt holders would not roll over their financing. Hence, debt contracts are needed in order to impose some market discipline to bankers.

In dealing exclusively with the risk-shifting problem, Bolton et al. (2015) develop a model that includes shareholders, debtholders, depositors and bankers in order to capture the risk-taking incentives of each of these players. Equity contracts arise as the optimal ones (see also Admati et al. 2013 and the references therein). The reason for this is that once debt is in place, bankers (and also shareholders) have incentives to take excessive risk at the expense of creditors: creditors do not benefit from the high returns in the event of success but they are burdened with the increased cost in the event of default. Feess and Hege (2012) find that capital requirements differentiated according to the bank size are good instruments to deal with the risk-shifting problem.

Acharya et al. (2012, 2014) and Hellwig (2009) consider both moral hazard problems simultaneously. In all these papers debt and equity pose a trade-off for regulators: debt is good for monitoring incentives while equity is good for prudent investment. Hence, the prescription of these models is to require banks hybrid funding contracts. Our work also consider both moral hazard problems simultaneously and assume that banker’s incentives are linked to shareholders’ value as in Holmstrom and Tirole (1993). We contribute to the previously mentioned strand of the literature by analyzing the impact that different banking regulations have on the implementation of the first best optimal solution via the incentives that they provide to bankers.

Another strand of the literature focuses on the design of macro-prudential policies and looks for mechanisms that minimize the frequency and cost of systemic failures (see, for example, Galati and Moessner 2011, for a review). This strand of the literature has pointed out that capital requirements may add procyclicality (Benigno 2013; Brunnermeier et al. 2009; Hanson et al. 2011; Repullo and Suarez 2013), and several policy options have been proposed to tackle this problem. For example, Repullo et al. (2010) propose cyclically adjusted capital requirements; Allen and Carletti (2013) suggest the use of counter-cyclical capital ratios and loan loss provisions; the Committee of European Banking Supervisors (2009) and the Basel Committee on Banking Supervision (2010) recommend the construction of capital buffers during economic booms; Burroni et al. (2009) suggest the use of counter-cyclical loan loss provisions. Although these policies may be useful to generate buffers during booms that could help to absorb losses during down-turns, the aforementioned papers do not explicitly consider the effects of regulatory policies on bankers’ risk-taking and monitoring incentives. We focus on the study of these effects, which may be relevant for financial stability as they may channel misaligned incentives into externalities up to a systemic level.

3 The basic model

3.1 Set up

We consider the following extension of Holmstrom and Tirole (1997) inspired by Biais and Casamatta (1999). There are two types of risk neutral investors: bankers and external investors.

- Bankers. :

-

There is a continuum of bankers. Each banker is endowed with initial equity E and the ability to manage a bank. A bank may be visualized as a portfolio of loans L > E. The bankers’ equity may serve as inside financing to the bank. In order to complete the financing of the loan portfolio, bankers need to raise funds from external investors. The loan portfolio yields a return R𝜃, which is contingent on the state of the world 𝜃 and perfectly verifiable ex post. For simplicity, we assume that there are three states of the world, 𝜃 ∈{u,m,d}, with corresponding returns: Ru > Rm > L > Rd.Footnote 2 In order to keep things in the simplest way and without loss of generality we normalize Rd to zero. The probability distribution of portfolio returns is affected by bankers’ decisions, which are not observable by third parties.

- External investors. :

-

There is a continuum of external investors with excess of funds but without the ability to directly invest in a portfolio of loans. They could provide outside financing to the bank or invest in an alternative project with a rate of return r. In the basic model, we consider exclusively depositors as external investors. A particular feature of depositors is that they are small and non-sophisticated agents without the incentive or the capacity to monitor bankers. This feature has some implications that help to simplify our analysis. First, we assume that depositors use only deposit contracts with a face value, D ≤ Rm. Second, following Dewatripont and Tirole (1994) we consider that depositors are represented by some banking authority. In the next section, we also consider cases in which sophisticated investors may provide funding to the bank through equity contracts that promise a participation in bank’s revenue.

- Moral hazard. :

-

In the same spirit of Jensen and Meckling (1976), we consider that there are two sources of moral hazard. First, each banker chooses the level of effort to exert in detecting good investment opportunities. Exerting effort is privately costly for the banker but it improves the distribution of portfolio returns in the sense of first-order stochastic dominance. We denote by B the banker’s cost of exerting effort (or equivalently the utility from shirking). Second, each banker chooses the riskiness of the portfolio. Taking more risk leads to a deterioration of the distribution of portfolio returns in the sense of second-order stochastic dominance.

In order to keep the model as simple as possible, we assume that a banker can choose between two levels of risk and two levels of effort. Consider the case in which the banker does not take excessive risk. If she does not exert effort, then we assume that the three states of nature are equally probable. If she exerts effort, however, the distribution of portfolio returns improves in the sense of first order stochastic dominance. More precisely, the probability of the good state (𝜃 = u) increases by 𝜖 and the probability of the bad state (𝜃 = d) decreases by 𝜖. Denote by \(\overline {V}\) the expected outcome under effort and by \(\underline {V}\) the expected outcome when shirking. To further simplify the analysis, we assume that the project has positive net present value (NPV) only if the banker exerts effort and that effort is socially optimal: \(\overline {V}>\underline {V}+B. \label {Assumption 1}\) If a banker switches to riskier projects, the probability of the medium state (𝜃 = m) is reduced by α + β, the probability of the good state (𝜃 = u) is increased by α and that of the bad state (𝜃 = d) by β. We assume that this riskier distribution is dominated in the sense of second order stochastic dominance, which is equivalent to: α (Ru − Rm) < βRm. Under this assumption the NPV of the bank’s loan portfolio is reduced by risk-taking.

- First best. :

-

Since the NPV of the bank is positive only if the banker exerts effort, which is socially optimal, and excessive risk taking reduces the NPV, then the first best solution is clearly characterized by effort and no risk-taking.

- Regulation. :

-

In order to allow banks to operate, a banking authority may request that they fulfill some regulations. We will consider the cases of minimum capital requirements, extra capital requirements (e.g. buffers like in Basel III), liquidity requirements and loan loss provisions.

- Timing. :

-

The sequence of events is as follows. Bankers raise funds from external investors and invest these funds together with their own internal equity in a portfolio of loans. At this point, they decide whether to take excessive risk or not and the effort they exert in looking for investment opportunities. At the end of the period, loan portfolio returns are realized and the outcome distributed between the banker and depositors.

3.2 Benchmark case: minimum capital requirement

We first analyze the benchmark case in which the banking authority requires a minimum level of capital to bankers in order to raise deposits and operate the bank. More precisely, we derive the minimum capital requirement that makes the first best solution attainable. Since in the first best solution the banker should choose to exert effort and to abstain from taking excessive risk, then the two following incentive compatibility conditions must hold. First, when the banker does not take excessive risk she should also exert effort:

The left-hand side of Eq. 1 is the expected return of the banker, after paying depositors the face value of their deposits, D, when she refrains from taking risk and exerts effort. The right-hand side is the sum of her expected return when she shirks and the benefit she gets from shirking.

Second, when the banker exerts effort, she should also refrain from taking excessive risk:

The left-hand side of Eq. 2 is the expected return of the banker when she exerts effort and abstains from excessive risk taking, while the right-hand side is the sum of her expected return when she exerts effort but takes excessive risk.

A third constraint would be considered to ensure that the banker prefers to exert effort and to abstain from risk taking rather than shirking and taking excessive risk. It is straightforward to show that such a constraint is redundant given Eqs. 1 and 2.

The participation constraint of depositors is:

It is not hard to show that the participation constraint of the banker is always satisfied under the assumption that the portfolio of loans has positive NPV (see Appendix A).

Notice that Eqs. 1 and 2 provide two upper bounds for the amount of money depositors can get in exchange of investing L − E:

There is another bound for D resulting from our assumption on deposit contracts, i.e. D ≤ Rm. This bound, however, is redundant given Eq. 5. Without loss of generality we can assume that Eq. 3 is binding, from where we get that \(D=\frac {(L-E)(1+r)}{2/3+\epsilon }\). Combining this expression with the two bounds in Eqs. 4 and 5, and after some algebraic manipulation the following inequality arises:

When Eq. 6 holds the bank can be financed with deposits and the first best solution attained. The following Proposition summarizes:

Proposition 1

A positive NPV bankcan be financed exclusively with deposits and the first best solution is attained ifthe initial equity of bankers ( E) is larger than the minimum capital requirementE0defined in Eq. 6.

Proposition 1 states that the initial equity of the banker (E) must be larger than a minimum level (E0) for the loan portfolio to be financed by depositors; i.e. the banker needs to fulfill a minimum capital requirement. In other words, given the moral hazard problems, depositors require some skin of the banker on the portfolio of loans. When E is large enough, the return required by depositors to participate leaves enough return to compensate the banker in such a way that she gets the incentive to exert effort and to abstain from excessive risk taking.

4 Regulation and bankers’ incentives

In this section, we analyze how the introduction of different regulatory tools currently used by banking authorities impact banker’s incentives. In particular, we focus on three different policies: extra capital requirements (so-called capital reserves or capital buffers), liquidity requirements and loan loss provisions.

4.1 Extra capital requirements

Under Basel III regulation, banks are required to build extra capital buffers, such as the conservation and the counter-cyclical buffers. These buffers are designed to ensure that banks build up an additional loss-absorbing capital cushion outside periods of stress, which can be drawn down as losses are incurred. A secondary objective of the buffer regime is that they help to lean against the build-up of excessive risk-taking in the first place. In this regard, the impact of regulation on the incentives of bankers to excert effort and take excessive risk become relevant. We study this issue here.

Consider the case in which regulation takes the form of an additional capital buffer P on top the minimum capital requirement. More precisely, we analyze the situation in which banking authorities decide to increase the level of equity capital in order to build a buffer against future losses. This additional capital requirement affects the bank’s funding structure.Footnote 3 The extra capital buffer needs to be financed either by the banker or by external investors other than depositors.

Financed by the banker

We analyze first the case in which the extra capital buffer is funded by the banker. In such a case, the new requirement affects incentives in the following way. First, the participation constraint of depositors becomes softer because their participation in the funding of the bank is smaller than in the benchmark case:

Second, it is not difficult to see that the incentive compatibility constraints of the banker remain unchanged with the introduction of the additional capital requirements, i.e. Eqs. 1 and 2 hold. Third, since the additional capital requirement is funded by the banker, her participation constraint becomes tighter than in the benchmark case. However, it is not difficult to show that the banker will be willing to participate as long as the net present value of the bank is positive.

Working out the previous constraints, the following Proposition summarizes the conditions under which a bank can be financed by depositors when an additional capital requirement is required to bankers.

Proposition 2

Assume that capital regulation takes the form of a capital buffer P which isfinanced by bankers. Then the first best solution can be attained and a positiveNPV bank can be funded with deposit with a minimum capital requirementE1:

The introduction of a capital buffer enlarges the set of bankers for which the first best solution can be attained with respect to the benchmark case, i.e. E1 < E0. Requiring extra capital is a direct mechanism to increase the stake of the banker on the bank and then it mitigates the moral hazard problems. In this sense, capital buffer regulation makes it easier to provide the correct incentives to bankers. Moreover, capital buffers are as powerful as minimum capital requirements for motivating the banker to exert effort and refrain from excessive risk taking.

Financed by sophisticated, external investors

We analyze next the case in which the additional capital requirement is funded by sophisticated, external investors operating through financial markets. Assume that external investors provide the extra funds P in exchange of a participation in banks’ revenues. Let δu and δm be the share of revenue earned by external investors in states u and m, respectively. This new funding structure changes the banker’s incentive compatibility conditions (Eqs. 1 and 2) in the following way. First, the banker prefers to exert effort and to abstain from taking excessive risk, instead of not exerting effort and abstain from taking excessive risk if:

Second, the banker prefers to exert effort and to abstain from taking excessive risk, instead of exerting effort and taking excessive risk, if the following condition holds:

Additional capital requirements makes depositors’ participation constraint softer (Eq. 7 holds) and introduces the participation constraint of external investors. External investors will be willing to invest in the bank if and only if the following condition holds:

As it is shown in the Appendix, the system made up of Eqs. 9 to 11 put thresholds in the amount of deposits the bank can raise. Combining these thresholds with the participation constraint given by Eq. 7 we get that a bank can be funded by depositors and external investors if the level of internal equity is high enough. We summarize the result in the following Proposition.

Proposition 3

Assume that capital regulation takes the form of a capital buffer P which is financed by external investors. Then the first best solution canbe attained and a positive NPV bank can be funded with deposits if theinitial equity of bankers ( E) is larger than the minimum capital requirementE2:

Proof

See Appendix B. □

The comparison between the level of equity required to implement the first best solution when additional capital is funded by external investors and the benchmark case depends on the prevailing moral hazard problem. For the sake of exposition, we focus on the two cases separately.

When the risk-taking is the dominant moral hazard problem, the first best solution can be attained if Eqs. 7, 10 and 11 hold, which imply that \(\mathbb {U}<\mathbb {V}\) in Eq. 12. Hence, the first-best can be implemented when the level of internal equity is higher than the threshold \(E_{2}^{risk}\):

When risk-taking is the dominant moral hazard problem, the benchmark minimum capital requirement derived in Eq. 6 becomes:

The comparison between the minimum capital requirements \(E_{2}^{risk}\) and \(E_{0}^{risk}\) is established by the following Proposition.

Proposition 4

Assume that capital regulation takes the form of a capital buffer P which isfinanced by external investors and that risk-taking is the dominant moral hazardproblem. Then the minimum level of banker’s equity that implements the firstbest solution is:

Proof

See Appendix B. □

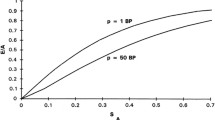

Figure 1 presents the relationship between \(E_{2}^{risk}\) and \(E_{0}^{risk}\), as well as the comparison with the case in which the capital buffer is financed by bankers, E1. Both minimum capital requirements increase in the magnitude of the risk-taking problem, which is measured by α. However, they increase less than proportionally than the risk-taking problem, i.e. \(E_{0}^{risk}\) and \(E_{2}^{risk}\) are concave in α (see Appendix B). To see the intuition for this result consider the case of \(E_{0}^{risk}\). If risk-shifting is a more important problem, i.e. when α increases, then the implementation of the first-best requires that bankers put more equity into the bank, i.e. \(\partial E_{0}^{risk} / \partial \alpha \) is positive and linear in α. But, if α increases, then β must also increase so that the resulting distribution of probabilities is second-order stochastically dominated by the previous one. The increase in the probability of the failure state by β, with the symmetric reduction in the probability of the medium state, moderates the banker’s willingness for taking excessive risk. In turn, this reduces the need for bankers’ equity in order to restore incentives, partially compensating the former effect.

Minimum capital requirement when risk-taking is the dominant moral hazard problem: \(E_{0}^{risk}\) for the benchmark case, \(E_{2}^{risk}\) for the case with a capital buffer financed by external investors, and E1 for the case with a capital buffer financed by bankers. Note: these draws assume that β increases less than proportionally to an increase in α

The introduction of a capital buffer that is financed by external investors enlarges the set of bankers for which the first-best solution can be attained. There are two reasons behind this result. First, as in the case in which the buffer is financed by bankers, the financing by external investors softens the participation constraint of depositors, so that they are willing to participate even if the banker’s equity is lower. This determines a linear reduction on the minimum capital requierement, which is comparable to E1 in Fig. 1. Second, the issuance of a financial contract different from bank deposits, i.e. a contract that allows for state-contingent payoffs to investors, introduces flexibility so that the banker’s payoff can be optimally set in such a way that it is easier to provide the correct incentives towards risk-taking. More precisely, the optimal financial contract with external investors would reduce the banker’s residual payoff in the upper state of the world more than proportionally than in the medium state, i.e. δu > δm. Hence, it would be as if the bank had issued warrants or convertible debt, e.g. CoCos, among sophisticated investors. As a result, the minimum capital required to implement the first-best (\(E_{2}^{risk}\)) increases less than the benchmark (\(E_{0}^{risk}\)) as the risk-shifting problem becomes more important, i.e. \(E_{2}^{risk}\) is more concave in α than \(E_{0}^{risk}\).

The results that a capital buffer enlarges the set of bankers for which the first-best solution can be attained and that the resulting minimum capital requirements are concave in α are robust. However, the minimum capital requirements will be decreasing in α if the increase in the probability of the failure state is large enough, i.e. when β increases more than proportionally to α. The intuition for this result follows the same lines that we have highlighted. From a banker’s point of view, the attractiveness for risk-shifting increases in α (the increase in the probability of the upper state) and decreases in β (the corresponding increase in the probability of the failure state at expense of the probability of the medium state). If the latter effect is too harsh, then it would be easier to give bankers the correct incentives towards excessive risk taking.

We turn now to the analysis of the case where effort is the dominant moral hazard problem and extra capital requirements are financed by external investors. In this case, the first best solution can be attained if Eqs. 7, 9 and 11 hold, i.e. \(\mathbb {U}>\mathbb {V}\) in Eq. 12. As in the previous cases, these equations imply bounds on the amount of deposits that can be raised by banks. In turn, this implies a minimum capital requirement \(E_{2}^{effort}\):

Considering that effort is the dominant problem, the benchmark minimum capital requirement derived in Eq. 6 becomes:

The comparison between the minimum capital requirements \( E_{2}^{effort}\) and \(E_{0}^{effort}\) is established by the following Proposition.

Proposition 5

Assume that capital regulation takes the form of a capital buffer P whichis financed by external investors and that effort is the dominant moral hazardproblem. Then the minimum level of equity that implements the first best solutionis:

Proof

See Appendix B.□

As it is shown in Fig. 2, both minimum capital requirements are non-decreasing in the magnitude of the effort problem, which is measured by \(\frac {B}{\epsilon }\). When effort is the only moral hazard problem, then the level of internal equity required to the banker in order to implement the first best solution is lower if the bank receives financing which is provided by external investors. The intuition for this result is the same than in the risk-taking case. The financing by external investors softens the participation constraint of depositors and allows flexibility to the financial contract with the banker such that it becomes easier to provide the correct incentives. In this case, an optimal financing arrangement may involve making the banker’s payoff even more convex than what equity implies, which would be achieved by setting δu < δm, as if the banker owned stock options on the bank.

4.2 Liquidity requirement

The financial crisis 2007–2009 had a harmful effect through global liquidity shortages. The introduction of the Basel’s III liquidity coverage ratio aims to promote the resilience of the liquidity risk profile of banks. It does this by ensuring that banks have an adequate stock of unencumbered high-quality liquid assets that can be converted easily and immediately in private markets into cash to meet their liquidity needs.

In this subsection, we model this feature by considering the case in which regulation imposes a liquidity requirement P. Liquidity requirements must be kept aside in order for the bank to be authorized to operate. In this case, the total investment on the bank is L + P, i.e. the portfolio of loans plus the liquidity requirement. We assume that the liquidity requirement is financed by the banker. The liquidity requirement affects the optimal contract because of their effects on the distribution of portfolio returns between bankers and depositors: the latter will now receive a payment coming from the reserve fund even in the case that the state of nature is bad (𝜃 = d). Hence, the participation constraint of depositors is:

The left-hand side of Eq. 19 is the expected return accruing to depositors when the banker exerts effort and abstains from excessive risk taking, while the right-hand side is the amount of funds raised from depositors plus its opportunity cost. The following Proposition summarizes the effect of liquidity requirements on banker’s incentives.

Proposition 6

Assume that regulation takes the form of a liquidity requirement P. Then the first best solution can be attained and a positiveNPV bank can be financed with deposits if the initial equityof bankers ( E) is larger than the minimum capital requirementE3:

As in the case of capital buffer regulation, liquidity requirement regulation relaxes the participation constraint of depositors so that they require a lower proportion of the return from the portfolio of loans. In turn, a higher proportion of the return is accruing to the banker who now receives stronger incentives to exert effort and to refrain from taking excessive risk. In this sense, liquidity requirements make it easier to provide the correct incentives to the banker: E3 < E0. However, since the liquidity requirement needs to be put aside and cannot be invested in loans, it introduces inefficiencies. As a result, this instrument is less powerful than a capital buffer, i.e. E1 < E3.Footnote 4

4.3 Loan loss provision

The traditional loan loss provision system consists in anticipating the expected losses due to non-repayment of loans and accounting them as a reduction to the loan’s face value. At maturity, if the loan is repaid the provision is released but if it is not the provision covers (part of) the losses. Other things equal, a loan loss provision for expected losses affects the capital of the bank at the moment the loan is granted because the loss is anticipated and counted.

We use the following modeling shortcut to introduce loan loss provisions: when a loan L is granted, then the banker needs equity capital E in order to provide internal financing to the loan and also an amount P to cover the provision for loan losses, i.e. in order not to fall short the minimum capital requirement. Assuming that P is kept in riskless assets, then a loan loss provision for expected losses has the same effects than the reserve requirement analyzed in the previous section. Hence, Proposition 6 holds for the case of loan loss provisions for expected loses.

Several jurisdictions manage counter-cyclical loan loss provision systems (also called dynamic provisions). Under counter-cyclical provisioning a fund is accumulated in periods where the expected losses are lower than the long-run, or through-the-cycle, level of losses. The fund is constituted and counter-cyclical provisions are not released in periods with low default rates. In practice, it is common that bankers use current profits to build the counter-cyclical provision fund. Hence, part of the return from the bank loans is kept aside to build the fund, affecting the distribution of returns between bankers and depositors with implications for the bankers’ incentives. Once the fund is accumulated, it is used to cover losses for loan non-repayment as in the traditional loan loss provision system.

In order to keep the framework as simple as possible, we abstract from modeling the use of the fund and focus on the accumulation phase. More precisely, we assume that in periods where the bank loan repays, an amount P of the cash flow is accumulated to the counter-cyclical loan loss provision fund. In this context, the optimal contract will have to satisfy the following two incentive compatibility constraints:Footnote 5

and

The participation constraint of depositors is the same as in the benchmark case (see Eq. 3). Given this new set of constraints we are able to state the following proposition.

Proposition 7

Assume that regulation takes the form of a counter-cyclical loan lossprovision and that a fund P is accumulating. Then the first best solutioncan be attained and a positive NPV bank can be financed with deposits if theinitial equity of bankers ( E) is larger than the minimum capital requirementE4:

The impact of the accumulation of a counter-cyclical loan loss provision fund is twofold. On the one hand, it reduces the banker expected return. This implies that bankers need to put more skin in the business to get the right incentives to exert effort and to abstain from excessive risk taking. On the other hand, depositors require lower returns compared to the benchmark case because they will receive something in the bad state. As a net result of these two effects, it is necessary to increase the contribution of the banker to the financing of the bank portfolio in order to satisfy the incentive compatibility constraints. Otherwise stated, a proportion of bankers with initial equity between E0 and E4 fails to be financed by depositors. Hence, when the fund is accumulating, counter-cyclical loan loss provision regulation makes it more difficult to provide the correct incentive to bankers determining that a larger proportion of positive NPV commercial banks fail to get financing from depositors. Hence, the accumulation of loan loss provisions needed to be complemented with higher minimum capital requirements so that the combination of regulatory tools reestablish the incentives of bankers.

4.4 Comparisons

To sum up, capital buffers, liquidity requirements and traditional loan loss provisions make it easier to provide the correct incentives to the banker. However, the consequences of implementing one or the others are not exactly the same because of their different power to provide incentives to bankers. Thereby, capital buffers are the most powerful among these instruments. Recall than in the benchmark case, bankers are required to put a minimum capital of E0 because if putting less than this figure, then they will get wrong incentives to exert effort in monitoring loans and take excessive risk. The first-best allocation of effort and risk may be implemented with a minimum capital requirement, E3, that is lower than the benchmark, i.e. E3 < E0, when liquidity requirements and the traditional loan loss provision system are introduced. These policy tools help to provide the correct incentives to bankers. In turn, capital buffers outperform the latter tools. Indeed, when a capital buffer that is financed by bankers is introduced, then the minimum capital requirement falls further to E1 < E3 < E0. Moreover, capital buffers are stronger instruments to disciplining bankers when they are financed by sophisticated external investors: \(E_{2}^{risk}<E_{1}\).

These results seem to be empirically relevant. Barth et al. (2013) examine the implications of an extensive and changing set of regulations on bank efficiency using data for more than 4050 banks in 72 countries over the period 1999–2007. Their bank efficiency measures are constructed to gauge the extent to which the performance of individual banks deviates from that predicted for the “best practice”, which may be associated to our theoretical first-best allocation. They find that greater capital regulation stringency is marginally and positively associated with bank efficiency, which is in line with our prediction that E1 < E0. Moreover, increased market-based monitoring of banks in terms of more financial transparency and better external audits is positively associated with bank efficiency, which is comparable to \(E_{2}^{risk}<E_{1}\) in our model. Regarding provisions, they consider this variable together with others to explain the power of official supervision, which turns out to be positively associated with bank efficiency only in countries with independent supervisory authorities.

Although a traditional loan loss provision for expected losses makes it easier to provide the correct incentives to bankers, in our theoretical model counter-cyclical loan loss provision regulation makes this more difficult in times where the fund is accumulating, i.e. E0 < E4. In this case, bankers get incentives to gamble, so that the accumulation of loan loss provisions needed to be complemented with higher minimum capital requirements in order to restore bankers’ incentives.

Carbo-Valverde and Rodriguez-Fernandez (2015) find empirical evidence supporting our gambling prediction in a sample of 55 Spanish banks from 1995 to 2013. Their results suggest that the counter-cyclical loan loss provision system has not prevented Spanish banks from employing various mechanisms for earnings management, and that there are ex-ante incentives for banks to take more risk when the provisions are implemented. In turn, they negatively affect loan quality and loan performance during the crisis. Moreover, these provisions do not appear, by themselves, to have effectively control excessive loan growth and, to some extent, can also be exacerbated if they are not accompanied by other risk prevention measures such as countercyclical capital. This evidence is consistent with our predictions and with other assessments of the effectiveness of Spanish dynamic provisions, suggesting that while dynamic provisions may effectively reduce procyclicality and act as a buffer for loan losses over the business cycle, they cannot prevent credit booms (e.g. Brunnermeier et al. 2009; Balla and McKenna2009).

5 Concluding remarks

In this paper, we propose a formal model to investigate the effects of minimum capital requirements, capital buffers, liquidity requirements and loan loss provisions on the bankers’ incentives to exert effort and take excessive risk. We characterize the conditions under which these regulations make it easier to implement the first-best solution.

We find that capital buffers, liquidity requirements and traditional loan loss provision regulation make it easier to provide the correct incentives to bankers. Capital buffers are the most powerful of these instruments. By contrast, counter-cyclical loan loss provision regulation makes it more difficult to provide the correct incentives to the banker in times where the fund is accumulating.

The theoretical results in this paper may help informing ongoing regulatory debates. More precisely, our results shed light on the complementary effects of implementing a counter-cyclical capital buffer like the proposed in Basel III in countries already running counter-cyclical loan loss provision systems (e.g. Spain, Peru and Uruguay among others).Footnote 6 We find that a capital buffer is the most powerful instrument to provide adequate incentives to bankers. Counter-cyclical loan loss provision regulation may provide bankers with incentives to gamble in periods during which the fund is accumulating (i.e. in good times). Hence, in good times bank supervisors should either prefer the use of counter-cyclical capital buffers, or complement counter-cyclical loan loss provisions with higher minimum capital requirements and stronger supervision of risk-taking activities.

Notes

According to Ayadi et al. (2015), there is no evidence that any common set of best practices is universally appropriate for promoting well-functioning banks. Regulatory structures that will succeed in some countries may not constitute best practice in other countries that have different institutional settings.

This is the simplest setting in which one could capture the bankers’ two dimensional moral hazard problem and extract general results about the impact of regulation on bankers’ incentives.

It is important to notice that capital regulation does not affect what assets banks invest in or hold, neither it requires setting aside funds and not investing them productively. See Admati et al. (2013) for a detailed discussion about bank equity and capital regulation.

Notice that the introduction of reserve requirements should not help finance the bank because the total wealth that the banker would need for the arrangement to be feasible would be E3 + P > E0.

For simplicity we are working under the assumption that P < Rm. Otherwise, it may be the case that the cash flow from the return of the portfolio of loans is not enough to fulfill the provision requirement. Relaxing this assumption does not change the qualitative results of the model but makes the algebra more complicated.

Our analysis does not focus on particular cases of capital regulation (e.g. counter-cyclical buffers) but on the general instruments (e.g. capital buffers). Hence, our results hold for particular cases. For example, the consideration of a counter-cyclical component affects the calibration of P and once this parameter is determined the results of our model apply.

References

Acharya VV, Mehran H, Schuermann T, Thakor A (2012) Robut capital regulation. CEPR Discussion Paper No. 8792

Acharya VV, Mehran H, Thakor A (2014) Caught between scylla and charybdis? Regulating bank leverage when there is rent seeking and risk shifting. Working paper

Admati A, DeMarzo P, Hellwig M, Pfleiderer P (2013) Fallacies, irrelevant facts, and myths in the discussion of capital regulation: why bank equity is not socially expensive. MPI Collective Goods Preprint

Allen F, Carletti E (2013) Systemic risk from real estate and macro-prudential regulation. Int J Bank Account Financ 5:28–48

Arango C, Valencia O (2015) Macro-prudential policy under moral hazard and financial fragility. Working Paper 878, Banco de la República de Colombia

Ayadi R, Naceur S, Casu B, Quinn B (2015) Does Basel compliance matter for bank performance? IMF Working Paper 15/100

Balla E, McKenna A (2009) Dynamic provisioning: a countercyclical tool for loan loss reserves. FRB Richmond Econ Q 95(4):383–418

Barth JR, Lin C, Ma Y, Seade J, Song FM (2013) Do bank regulation, supervision and monitoring enhance or impede bank efficiency? J Bank Financ 37 (8):2879–2892

Basel Committee on Banking Supervision (2010) Basel III: a global framework for more resilient banks and banking systems. Bank for International Settlements, Basel

Benigno G (2013) Comment on macropudential policies. Int J Central Bank 9 (1):287–297

Biais B, Casamatta C (1999) Optimal leverage and aggregate investment. J Financ 54(4):1291–1323

Bolton P, Mehran H, Shapiro J (2015) Executive compensation and risk taking. Rev Financ 19(6):2139–2181

Brunnermeier M, Crockett C, Goodhart C, Persaud A, Shin H (2009) The fundamental principles of financial regulation. Geneva reports on the world economy 11

Burroni M, Quagliariello M, Sabatini E, Tola V (2009) Dynamic provision: rationale, functioning, and prudential treatment. Ocasional Papers, Banca D’ Italia 57

Calomiris CW, Kahn CM (1991) The role of demandable debt in structuring optimal banking arrangements. Am Econ Rev 81(1):497–513

Carbo-Valverde S, Rodriguez-Fernandez F (2015) Do bank game on dynamic proprovision? Working Paper of the Federal Reserve Bank of San Francisco

Committee of European Banking Supervisors (2009) Position paper on a countercyclical capital buffer. Official Document, available at www.eba.europa.eu

Dewatripont M, Tirole J (1994) The prudential regulation of banks. MIT Press, Cambridge

Diamond DW, Rajan RG (2001) Liquidity risk, liquidity creation and financial fragility. J Polit Econ 109:287–327

Diamond DW, Rajan RG (2012) Illiquid banks, financial stability and interst rate policy. J Polit Econ 120:552–591

Feess E, Hege U (2012) The Basel Accord and the value of bank differentiation. Rev Financ 16(4):1043–1092

Galati G, Moessner R (2011) Macroprudential regulation: a literature revi. BIS Working Paper No 337

Hanson S, Kashyap AK, Stein JC (2011) A macroprudential approach to financial regulation. J Econ Perspect 25:3–28

Hellwig MF (2009) A reconsideration of the Jensen-Meckling model of outside finance. J Financ Intermed 18:495–525

Holmstrom B, Tirole J (1993) Market liquidity and performance monitoring. J Polit Econ 101:678–709

Holmstrom B, Tirole J (1997) Financial intermediation, loanable funds, and the real sector. Q J Econ 112:663–691

Jensen M, Meckling W (1976) Theory of the firm: managerial behavior, agency costs, and ownership structure. J Financ Econ 3:305–360

Repullo R, Suarez J (2013) The procyclical effec ts of bank capital regulation. Rev Financ Stud 26(2):452–490

Repullo R, Saurina J, Trucharte C (2010) An assessment of Basel II procyclicality in mortgage portfolios. J Financ Serv Res 32:81–101

Acknowledgments

The views expressed herein are those of the authors and do not necessarily represent the views of the institutions to which they are affiliated. The authors would like to thank Marc Rennert, participants to the 30 Jornadas Anuales de Economía at Banco Central del Uruguay and the 10 Seminar on Risk, Financial Stability and Banking at the Banco Central do Brasil for their comments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Bankers’ participation

In this appendix we derive a sufficient condition that assures the participation of the banker. More precisely, we show that the banker is willing to participate as long as the net present value of the bank is positive. We focus on the benchmark case. However, by following the same steps we follow below it can also be shown that the same condition guarantees the participation of the banker on the other cases we have considered through the paper.

The banker participation constraint is:

Considering that the participation constraint of depositors holds with equality (see Eq. 3) we get:

Substituting Eq. 25 into Eq. 24 and making computations we get that Eq. 24 holds if and only if:

Appendix B: Derivations and proofs

1.1 Proof of Proposition 3

The strategy of the proof is to determine the conditions under which there exists a pair (δu, δm) ∈ [0, 1]2 such that Eqs. 7, 9, 10 and 11 hold. Note that there is no loss of generality in considering the case where Eq. 11 holds with equality:

Since δm ∈ [0, 1] we get two bounds for δu:

Substituting the value of δm obtained in Eq. 27 into Eqs. 9 and 10 gives:

Therefore, there exists an admissible contract if and only if \(\delta ^{u} \in \left [max(\mathbb {B},\mathbb {D}),\right .\)\(\left .min(\mathbb {A},\mathbb {C})\right ]\). It is easy to show that when Eq. 11 holds, \(\mathbb {B}\leq \mathbb {D}\), which implies that Eq. 29 is redundant and only Eq. 31 is the operative constraint. We need therefore that \(\mathbb {D} \leq \mathbb {A}\) and \(\mathbb {D} \leq \mathbb {C}\), which gives raise to the following two inequalities:

Considering that Eq. 7 is binding, we get the following inequality:

which can be rewritten as:

1.2 Proof of Proposition 4

We need to determine the conditions under which there exists a pair (δu, δm) ∈ [0, 1]2 such that Eqs. 7, 10 and 11 hold. As above, there is no loss of generality in considering the case where Eq. 11 holds with equality, which implies that Eqs. 27, 28, 29 and 30 hold.

Therefore, there exists an admissible contract if and only if \(\delta ^{u} \in \left [\mathbb {D},\mathbb {A}\right ]\). We need therefore that \(\mathbb {D} \leq \mathbb {A}\), which gives raise to a bound in the amount the bank must pay to depositors, \(D\leq \mathbb {U} \), where \(\mathbb {U}\) is defined in Eq. 32. Considering that Eq. 7 binds, we get the following inequality that completes the proof:

1.3 Derivations for Fig. 1 and robustness

The slope of \(E_{0}^{risk}\) is equal to

Making computations one can get

where \(\eta \equiv \frac {\alpha }{\beta }\frac {\partial \beta }{\partial \alpha }\) is the proportional change on β to α, i.e. its elasticity. \(E_{0}^{risk}\) increases in α (as shown in Fig. 1) when η < 1, and decreases otherwise. Since β always increases with α, then \(\frac {d E_{0}^{risk}}{d \alpha }\) is decreasing in α, i.e. \(E_{0}^{risk}\) is always concave.

The slope of \(E_{2}^{risk}\) is equal to

which can be written as

The slope of \(E_{2}^{risk}\) is smaller than the slope of \(E_{0}^{risk}\) when η < 1, and larger otherwise. \(E_{2}^{risk}\) is always concave.

1.4 Proof of Proposition 5

Again, we need to determine the conditions under which there exists a pair (δu, δm) ∈ [0, 1]2 such that Eqs. 7, 9 and 11 hold. As above, there is no loss of generality in considering the case where Eq. 11 holds as an equality, which implies that Eqs. 27, 28, 29 and 31 hold.

Therefore, there exists an admissible contract if and only if \(\delta ^{u} \in \left [\mathbb {B},\min (\mathbb {A},\mathbb {C})\right ]\). We need therefore that \(\mathbb {B} \leq \mathbb {A}\) and \(\mathbb {B} \leq \mathbb {C}\), which implies two bounds to deposits:

Considering that Eq. 7 binds, we get the following inequality

Noticing that if effort is the dominant moral hazard problem the benchmark minimum capital requirement is \( E_{0}^{effort }\equiv L-\frac {2/3+\epsilon }{1+r}\min [R^{u}-\frac {B}{\epsilon };R^{m}]\), the proof is completed.

Rights and permissions

Open Access This article is distributed under the terms of the Creative Commons Attribution 4.0 International License (http://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons license, and indicate if changes were made.

About this article

Cite this article

Gómez, F., Ponce, J. Regulation and Bankers’ Incentives. J Financ Serv Res 56, 209–227 (2019). https://doi.org/10.1007/s10693-018-0303-z

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10693-018-0303-z

Keywords

- Banking regulation

- Minimum capital requirement

- Capital buffer

- Liquidity requirement

- (Counter-cyclical) loan loss provision

- Bankers’ incentives

- Effort

- Risk