Abstract

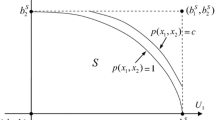

Increasingly, arbitration is becoming used to resolve bargaining disputes in a variety of settings. Reducing dispute rates is often listed as a main goal in designing arbitration mechanisms. Conventional arbitration and final-offer arbitration are two commonly used procedures, but theoretical examinations of these arbitration procedures show that disputants’ final bargaining positions do not converge and disagreement is likely. This article contains results from a set of experiments designed to compare bargaining outcomes under the two commonly used arbitration procedures with outcomes under an innovative procedure called “double-offer” arbitration (Zeng et al., 1996). This procedure requires that disputants make two final offers at impasse: a primary and a secondary offer. The arbitrator evaluates the pairs of offers using a linear criterion function, and theory suggests the secondary offers converge to the median of the arbitrator’s preferred settlement distribution. Because the procedure’s rules are that convergence of offers generates a settlement at those offers, this theoretical convergence result implies that arbitration is not needed in the end. Experimental results indicate that dispute rates in double-offer arbitration are, on average, about the same as dispute rates in conventional arbitration. However, other results show reason to favor double-offer arbitration. Specifically, in repeated bargaining, there is concern over whether use of an arbitration procedure becomes addictive and makes bargainers more likely to use the procedure in the future-a “narcotic effect.” The data show that double-offer arbitration is non-addictive, whereas both conventional and final-offer arbitration are.

Similar content being viewed by others

References

Ashenfelter, O., Currie, J., Farber, H.S., and Spiegel, M. (1992). “An Experimental Comparison of Dispute Rates in Alternative Arbitration Systems.” Econometrica 60, 1407–1433.

Babcock, L., Farber, H. Fobian, C., and Shafir, E. (1993). “Forming Beliefs about Adjudicated Outcomes: Perceptions of Risk and Reservation Values.” International Review of Law and Economics. 15, 289–303.

Babcock, L. and Loewenstein, G. (1997). “Explaining Bargaining Impasse: The Role of Self-Serving Biases.” Journal of Economic Perspectives. 11, 109–126.

Babcock, L., Loewenstein G., and Issacharof, S. (1997). “Creating Convergence: Debiasing Biased Litigants.” Law and Social Inquiry. 22, 401–413.

Babcock, L., Wang, X., and Loewenstein. G. (1996). “Choosing the Wrong Pond: Social Comparisons that Reflect a Self-Serving Bias.” Quarterly Journal of Economics. 111, 1–19.

Bolton, G.E. and Katok, E. (1998). “Reinterpreting Arbitration’s Narcotic Effect: An Experimental Study of Learning in Repeated Bargaining.” Games and Economic Behavior. 25, 1–33.

Brams, S. and Merrill, III. S. (1986). “Binding Versus Final-Offer Arbitration: A Combination Is Best.” Management Science 32, 1346–1355.

Brams, S.J. and Merrill, III. S. (1983). “Equilibrium Strategies for Final-Offer Arbitration: There Is No Median Convergence.” Management Science 29, 927–941.

Butler, R.J. and Ehrenberg, R.G. (1981). “Estimating the Narcotic Effect of Public Sector Impasse Procedures.” Industrial and Labor Relations Review 35, 3–20.

Crawford, V.P. (1979). “On Compulsory Arbitration Schemes.” Journal of Political Economy 87, 131–159.

Deck, C. and Farmer, A. “Bargaining Over an Uncertain Value: Arbitration Mechanisms Compared.” Working paper University of Arkansas.

Dickinson, D.L. (2004). “A Comparison of Conventional, Final-Offer, and ‘Combined’ Arbitration for Dispute Resolution.” Industrial and Labor Relations Review. 57(2), 288–301.

Dickinson, D.L. (2003). “Expectations and Comparative Arbitration Institutions.” Utah State University ERI working paper #03–02.

Farber, H.S. (1980). “An Analysis of Final-Offer Arbitration.” The Journal of Conflict Resolution 24, 683–705.

Farber, H.S. and Katz, H.C. (1979). “Interest Arbitration, Outcomes, and the Incentive to Bargain.” Industrial and Labor Relations Review 33, 55–63.

Farber, H.S. and Bazerman, M.H. (1989). “Divergent Expectations as a Cause of Disagreement in Bargaining: Evidence from a Comparison of Arbitration Schemes.” Quarterly Journal of Economics 104, 99–120.

Pecorino, P. and Boening, M.V. (2001). “Bargaining and Information: An Empirical Analysis of a Multistage Arbitration Game.” Journal of Labor Economics 19, 922–948.

Stevens, C.M. (1966). “Is Compulsory Arbitration Compatible with Bargaining?” Industrial Relations 19, 38–52.

Zeng, D., Nakamura, S., and Ibaraki, T. (1996). “Double-Offer Arbitration.” Mathematical Social Sciences 31, 147–170.

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Dickinson, D.L. Bargaining Outcomes with Double-Offer Arbitration. Exp Econ 8, 145–166 (2005). https://doi.org/10.1007/s10683-005-1469-4

Received:

Revised:

Accepted:

Issue Date:

DOI: https://doi.org/10.1007/s10683-005-1469-4