Abstract

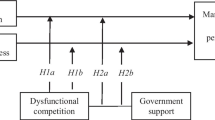

Viability is the key to driving enterprises towards high-quality development. This paper takes listed companies in China’s manufacturing industry as the object of study during 2007–2021, empirically analyses the impact of enterprise innovation on viability and the moderating impacts of strategic differentiation on the relationship between enterprise innovation and viability from the point of view of innovation inputs and innovation outputs, and extends the analysis of the threshold effect of strategic differentiation on the impact of enterprise innovation and viability. The findings show that the level of viability varies across firms, that firm innovation is conducive to enhancing the level of viability, and that there is a moderating effect of strategic differentiation and vital innovation on viability. The result still holds in the robustness tests with replacing core variables, changing samples, and instrumental variables, while it has heterogeneous effects across different equity properties, spatial geographic locations, and high technology dependence. Further analysis reveals a threshold effect of strategic differentiation on the relationship between enterprise innovation and viability. The outcome demonstrates that choosing a strategy aligned with industry conventions and strengthening enterprise innovation is conducive to enhancing enterprises’ viability to foster the manufacturing industry’s high-quality growth.

Similar content being viewed by others

Data availability

Data are available from the authors upon request.

References

Aghion, P., Cai, J., Dewatripont, M., Du, L., Harrison, A., & Legros, P. (2015). Industrial policy and competition. American Economic Journal: Macroeconomics, 7(4), 1–32.

Anagnostopoulou, S. C., & Levis, M. (2008). R&D and performance persistence: Evidence from the United Kingdom. The International Journal of Accounting, 43(3), 293–320.

Atanassov, J., Julio, B., & Leng, T. (2015). The bright side of political uncertainty: The case of R&D. Available at SSRN 2693605.

Bentley, K. A., Omer, T. C., & Sharp, N. Y. (2013). Business strategy, financial reporting irregularities, and audit effort. Contemporary Accounting Research, 30(2), 780–817.

Bloom, N. (2007). Uncertainty and the dynamics of R&D. American Economic Review, 97(2), 250–255.

Botosan, C. A., & Plumlee, M. A. (2002). A re-examination of disclosure level and the expected cost of equity capital. Journal of Accounting Research, 40(1), 21–40.

Bradley, D., Pantzalis, C., & Yuan, X. (2016). Policy risk, corporate political strategies, and the cost of debt. Journal of Corporate Finance, 40(40), 254–275.

Brown, J. R., Martinsson, G., & Petersen, B. C. (2012). Do financing constraints matter for R&D? European Economic Review, 56(8), 1512–1529.

Cao, J., Chen, X., Zhang, X., Gao, Y., Zhang, X., Zhao, Y., & Schnoor, J. L. (2018). Public awareness of remanufactured products in Yangtze river delta of China: Present status, problems and recommendations. International Journal of Environmental Research and Public Health, 15(6), 1199.

Cao, J., Chen, X., Wu, S., & Kumar, S. (2021). Evolving remanufacturing strategies in China: An evolutionary game theory perspective. Environment, Development and Sustainability, 23, 14827–14853.

Carpenter, M. A. (2000). The price of change: The role of CEO compensation in strategic variation and deviation from industry strategy norms. Journal of Management, 26(6), 1179–1198.

Chamanski, A., & Waagø, S. J. (2001). Organizational performance of technology-based firms–the role of technology and business strategies. Enterprise and Innovation Management Studies, 2(3), 205–223.

Coad, A., Segarra, A., & Teruel, M. (2016). Innovation and firm growth: Does firm age play a role? Research Policy, 45(2), 387–400.

Diamond, D. W., & Verrecchia, R. E. (1991). Disclosure, liquidity, and the cost of capital. The Journal of Finance, 46(4), 1325–1359.

Duan, J. S., & Zhuang, X. D. (2021). Financial investment behavior and corporate technological innovation—motivational analysis and empirical evidence. China Industrial Economy, 1, 155–173.

Eisdorfer, A., Giaccotto, C., & White, R. (2013). Capital structure, executive compensation, and investment efficiency. Journal of Banking & Finance, 37(2), 549–562.

Francis, B. B., Hasan, I., & Zhu, Y. (2014). Political uncertainty and bank loan contracting. Journal of Empirical Finance, 29, 281–286.

Ganapati, S. (2021). Growing oligopolies, prices, output, and productivity. American Economic Journal: Microeconomics, 13(3), 309–327.

Gao, X., Qi, R. L., & Jian, Z. H. (2018). Factor market distortions and the domestic value added rate of Chinese firms’ exports: Facts and mechanisms. World Economy, 10, 26–50.

Gomariz, M. F. C., & Ballesta, J. P. S. (2014). Financial reporting quality, debt maturity and investment efficiency. Journal of Banking & Finance, 40, 494–506.

Görg, H., & Strobl, E. (2007). The effect of R&D subsidies on private R&D. Economica, 74(294), 215–234.

Gu, X. M., Chen, Y. M., & Pan, S. Y. (2018). Economic policy uncertainty and innovation-an empirical analysis based on listed companies in China. Economic Research, 2, 109–123.

Habib, A., & Hasan, M. M. (2017). Business strategy, overvalued equities, and stock price crash risk. Research in International Business and Finance, 39, 389–405.

Hansen, B. E. (1999). Threshold effects in non-dynamic panels: Estimation, testing, and inference. Journal of Econometrics, 93(2), 345–368.

Holmström, B. (1999). Managerial incentive problems: A dynamic perspective. The Review of Economic Studies, 66(1), 169–182.

Huang, J. W., & Li, Y. H. (2018). How resource alignment moderates the relationship between environmental innovation strategy and green innovation performance. Journal of Business & Industrial Marketing, 33(3), 316–324.

Kumbhakar, S. C., Ortega-Argilés, R., Potters, L., Vivarelli, M., & Voigt, P. (2012). Corporate R&D and firm efficiency: Evidence from Europe’s top R&D investors. Journal of Productivity Analysis, 37, 125–140.

Liu, X. M., Song, H. R., & Fan, L. (2020). Signaling effects of government subsidies and enterprise innovation on investors’ investment decisions. Science and Technology Progress and Countermeasures, 37(2), 26–33.

Mancusi, M. L., & Vezzulli, A. (2010). R&D, innovation and liquidity constraints. In: CONCORD 2010 conference, Sevilla (pp. 3–4).

Nemlioglu, I., & Mallick, S. K. (2017). Do managerial practices matter in innovation and firm performance relations? New evidence from the UK. European Financial Management, 23(5), 1016–1061.

Onufrey, K., & Bergek, A. (2021). Transformation in a mature industry: The role of business and innovation strategies. Technovation, 105, 102190.

Shi, J. J., & Li, X. Y. (2021). Government subsidies and enterprise innovation capability: A new empirical findings. Economic Management, 3, 113–128.

Skaife, H., Collins, D., & Lafond, R. (2004). Corporate governance and cost of equity capital. SSRN Electronic Journal. https://doi.org/10.2139/ssrn.639681

Tang, J., Crossan, M., & Rowe, W. G. (2011). Dominant CEO, deviant strategy, and extreme performance: The moderating role of a powerful board. Journal of Management Studies, 48(7), 1479–1503.

Wigger, B. U. (1996). Convergence and divergence of economic growth in a two-country model without externalities. Journal of Economic Integration, 11, 160–178.

Xiong, D. B., & Lou, H. (2022). Research on production efficiency, transaction efficiency and self-generating capacity of enterprises: An analysis based on data of listed manufacturing companies. Industrial Economics Review, 1, 86–104.

Yang, G. C., Liu, J., Lian, P., & Rui, M. (2017). Tax reduction incentives, R&D manipulation and R&D performance. Economic Research, 8, 110–124.

Yao, L. J., & Zhou, Y. (2018). Management Competence, innovation level and innovation efficiency. Accounting Research, 6, 70–77.

Ye, K. T., Zhang, S. S., & Zhang, Y. X. (2014). Corporate strategy differences and the value relevance of accounting information. Accounting Research, 5, 44–51.

Yi, Z., Z, F., & Xi, Z. (2016). Geographical location, environmental regulation and enterprise innovation transformation. Journal of Finance and Economics, 42(09), 87–98.

Funding

This work was supported by the National Natural Science Foundation of China (Grant Nos. 72063018 and 72163015).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflicts of interest.

Human and animal rights

This article does not contain any experiments with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Chi, Z., Jiang, F., Yan, L. et al. Nexus between enterprise innovation and viability: strategic differentiation of China manufacturing sector unveils the truth. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-04220-x

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-04220-x