Abstract

In recent years, climate policy has experienced several episodes of crest and trough in the US, which has induced profound uncertainty. This climate policy uncertainty (CPU) may exert economic, social, and environmental impacts. Therefore, using the environmental Kuznets curve (EKC) framework, this study targets to probe whether CPU affects sectoral carbon dioxide emissions (COE) in the US. We make use of advanced econometric procedures such as the novel SOR unit root test (to probe the order of integration of the entire dataset) and the novel Fourier ARDL approach (to retrieve the long- and short-run estimates). The findings delineate that the EKC holds for the industrial, electric power, commercial, and residential sectors. In addition, CPU escalates COE in the residential, commercial, and electric power sectors in both the long- and short-run. Parallel to this, CPU affects industrial COE neither in the short-run nor in the long-run. Keeping in view the key findings, we propose a set of sector-specific policy implications to curb COE.

Similar content being viewed by others

Avoid common mistakes on your manuscript.

1 Introduction

The volume of carbon emission (henceforth COE) has witnessed an unprecedented upsurge during the last several years (Li et al., 2022; Liu et al., 2022a). According to recent statistics,Footnote 1 the volume of COE was 3.51 billion metric tons in 1920, while it was about 34.81 billion metric tons in 2020. This delineates that COE has witnessed about a 900% upsurge during the last century. The enormous rise in the levels of COE has been causing several issues related to environmental quality (e.g., climate change, environmental degradation, extreme weather events, etc.). Next, COE also triggers several human diseases. Wherefore, curbing the levels of COE is an imperative agenda of the world. Hence, Kyoto Protocol, Paris Climate Accords, and the recent Glasgow Climate Pact (COP26) are the key collective efforts of the entire world, targeting to reduce COE. Even though intergovernmental organizations, world leaders, and policymakers have been striving to achieve net-zero emissions, the levels of COE are still remarkably high. This calls for further efforts, in terms of research-based policies, to probe the drivers of COE so that effective policies could be introduced in the future.

It is a well-cited point that economic growth (EG) is mainly accountable for the high COE (Abbasi et al., 2022; Acheampong, 2018; Bandyopadhyay et al., 2022; Esmaeili et al., 2023; Liu et al., 2022b). In environmental economics, the Environmental Kuznets Curve (EKC) hypothesis remains the center of the debate, claiming that income is responsible for environmental deterioration at the early stage of development, but it plunges environmental degradation once a country crosses a certain level of income. Although the authenticity of the EKC hypothesis has enormously been scrutinized, the contrasting findings create interest to further investigate it to avoid any ambiguity. It is worth noting that the EKC possesses several shapes, thereby each shape proposes a separate policy implication. For instance, the U-shaped EKC describes that a higher income level escalates environmental degradation, therefore, the environment can be protected at the cost of income, and vice versa. Thus, probing the validity of EKC to devise environmental protection policies is imperative. There might be several reasons for inconclusive findings on the validity of the EKC hypothesis such as the choice of methodology, choice of independent variables, choice of economic sectors, and choice of economic/empirical modeling for the EKC (Shahbaz and Sinha, 2019).

In the prior literature, several socioeconomic indicators (e.g., unemployment, population, energy, etc.) have been embodied in the EKC framework to discern both the existence of the EKC hypothesis and the influence of socioeconomic indicators on COE (Syed and Bouri, 2021; Bhowmik et al., 2021; Syed et al., 2022; Anwar et al., 2023; Cai et al., 2022; Habiba et al., 2022; Sun et al., 2022; Bhowmik et al., 2022). However, the literature disregards whether climate policy uncertainty (CPU) impacts COE, especially in the EKC framework. It is worth describing that CPU can affect COE through several channels. For instance, the CPU can compel individuals to use traditional energy sources, which, in turn, upsurges COE. Next, higher CPU implies that policymakers are more focused on economic stability and hence not taking environmental policies as their core agenda. This transmits a signal to the economy that there is still room to keep using cheap energy sources (i.e., fossil fuels), generating higher COE. On the contrary, Fried et al. (2021) propose two channels that connect the CPU with emissions. First, the CPU acts as a carbon tax and plunges the envisaged value of returns on the fossil fuel capital compared to the green energy capital, switching the economy to green energy which leads to lower levels of COE. Second, CPU impedes the marginal product of fossil fuel-based capital, resulting in low output and COE. Hence, CPU may increase/decrease emissions based on the dominancy of opposing theoretical channels/effects. Recently, Gavriilidis (2021) presented the climate policy uncertainty (CPU) index and links it with total and sectoral COE using the vector autoregressive model (VAR) model. The author notes that CPU has a significant impact on COE at both the aggregate and sectoral levels. However, the aforementioned study has some limitations. For instance, the author ignored the structural breaks in the dataset, while ignoring breaks might cause wrong inferences. Second, the aforementioned study does not adopt any economic theory/model (e.g., the EKC hypothesis, STIRPAT model, etc.) and hence disregard economic basis. Third, the existing literature may suffer from omitted variable bias since no control variable has been used by Gavriilidis (2021). Finally, the separate short-run (henceforth SR) and long-run (henceforth LR) impacts of CPU on COE have been disregarded in the existing literature, which could be used to devise separate policies across different time horizons. Thus, reinvestigating the CPU-COE nexus is imperative while addressing all the aforementioned limitations.

Another reason behind contrasting findings on the EKC is the choice of economic sectors (e.g., the industrial sector, the residential sector, the commercial sector, etc.). Every sector has its particular dynamics in terms of the quantity of energy used, the nature of the energy source, the level of economy of scale, and the nature of economic and environmental policies (Htike et al., 2021). For instance, the industrial sector is considered a relatively dirtier sector compared to the residential sector because households switch to renewables as income escalated. Thus, it might be possible that each sector has a different situation in the income-emission nexus. Thus, it is indispensable to test the authenticity of the EKC at the sectoral level.

Keeping in view the above-mentioned arguments, this study has the objective to discern the impact of CPU on sectoral COE in the US while using the EKC framework. We choose the US because it is the largest economy and the second-largest carbon emitter in the world. Regarding the climate/environmental policies of the US, National Environmental Policy Act (1969–70) was the first attempt by the US to replenish the quality of the environment. Thereafter, several environmental policies were introduced in the US, and these policies are still active. Also, the element of uncertainty is associated with them, creating ambiguity in the decision-making of individuals and hence affecting environmental quality. For instance, as highlighted by Fried et al. (2021), there does not exist any federal carbon tax in the US. However, growing environmental concerns posit threats to adopting carbon taxation soon, generating risks related to climate policy. Moreover, the heterogeneous policies related to renewables’ imports and investment incentives on renewables in consort with shocks in non-renewable energy prices also generate uncertainty in climate policy. Therefore, it is inevitable to quantify its environmental impacts.

We attempt to contribute from three angles. Firstly, this is the earliest attempt to test the existence of the EKC amidst CPU on sectoral COE. Second, we adopt the SOR unit root test, renowned for handling smooth and sharp structural breaks in the dataset and hence outperforms traditional unit root tests (e.g., ADF test, LM unit root test, etc.). Third, we employ the novel Fourier ARDL methodology (henceforth FARDL) to probe the SR and LR impact of CPU on sectoral COE. The advantage of FARDL lies in its ability to cover smooth and sharp structural breaks, which motivates us to adopt it for this study.

2 Relevant existing literature

2.1 The EKC at the sectoral level

While testing the EKC hypothesis at the sectoral level, Congregado et al. (2016) note that the EKC holds for all selected sectors excluding the industrial sector. In the case of China, Wang et al. (2017) validate the existence of the EKC just for the electric power sector. Zhang et al. (2019) use a global sample to test the sectoral EKC hypothesis. The authors report that the EKC holds for the industrial and manufacturing sectors. While Raza et al. (2020) noted the validity of the EKC for the residential sector. Contrary to this, Fujii and Managi (2013) notice the N-shaped EKC for several sectors in the OECD countries. In selected OPEC countries, Moutinho et al. (2020) report the U-shaped EKC for various sectors. Likewise, Erdoğan et al. (2020) conclude the absence of the EKC hypothesis in selected G20 countries.

Using a panel dataset for 86 developing countries, Htike et al. (2021) investigate the EKC at the sectoral level. The authors report heterogeneous findings across the sectors. That is, the EKC is validated for the energy sector, electricity and heat production sector, and commercial and public services sectors. On the contrary, the EKC is invalid in the agriculture and transport sectors. Congegado et al. (2016) examine whether the EKC exists across sectors in the US using quarterly data. The findings claim that the EKC holds for the transport, commercial, residential, and electric power sectors. Interestingly, the EKC is invalid for the industrial sector. Aslan et al. (2018) test the validity of the EKC at the sectoral level in the US. The findings from the rolling windows procedure report that the EKC is valid for the electric power, industrial, and residential sectors. Using a panel dataset for several sectors of Spain and Portugal, Moutinho et al. (2017) examine the existence of the EKC-type relationship. The study notes heterogeneous findings, i.e., the EKC is valid for some sectors and remains invalid for other sectors.

For 27 European countries, Pablo-Romero et al. (2017) probe the EKC hypothesis in the transport sector. The study notes that there is an inverted U-shaped relationship between income and emissions. Using the ARDL approach, Hashmi et al. (2020) attempt to probe the relationship between the services sector’s income and emissions in Pakistan. The authors conclude that there is a presence of the EKC hypothesis in the services sector of Pakistan. For ten selected countries, Erdogan et al. (2020) probe the EKC hypothesis, and report that there is an inverted U-shaped relationship been EG and COE in the transport sector. Moutinho et al. (2020) examine the validity of the EKC hypothesis at the sectoral level for 12 OPEC countries using panel data. The authors reveal that for all sectors, EG and COE have a U-shaped relationship. From this discussion, it is manifested that the validity of EKC at the sectoral level is not well-established; therefore, the following hypothesis could be developed.

H0 1

There exists an inverted U-shaped relationship between EG and COE (the EKC hypothesis) at the sectoral level.

It is worth noting that testing the aforementioned hypothesis is indispensable for many reasons. For instance, it will help to explain whether the validity of the EKC hypothesis varies across sectors. Also, EG is a solution to curb COE at the sectoral level. Moreover, is there a need to devise heterogeneous sector-specific policies to achieve carbon neutrality targets? Finally, it will complement existing literature, on the sectoral EKC, to reach a particular conclusion.

2.2 Key drivers of COE

Like EG, energy consumption (ECN) is one of the vital influencing factors of COE. In particular, fossil fuel-based energy sources are among the top culprits for high levels of COE. There exists a bagful of literature with the conclusion that ECN (i.e., non-renewable) leads to higher COE (Dogan and Aslan, 2017; Dogan et al., 2017). Prior literature segregates the energy-emissions nexus into several dimensions. For instance, some researchers examine the energy-emissions relationship at the sectoral level. In this dimension, Nain et al. (2017) probe whether ECN causes COE at the sectoral level using the causality test. The findings report that ECN impacts COE across the sectors. Similarly, Yin et al. (2015) probe whether ECN impacts COE at the global level. The findings document that ECN upsurges COE. Zhou et al. (2018) also reach a similar conclusion for the industrial sector. Moreover, several studies segregate ECN into renewable and non-renewable components, and they report that renewables reduce COE, while non-renewables increase it (Dogan and Seker, 2016). Maji and Adamu (2021) explore whether renewable energy mitigates COE in Nigeria. The findings from OLS estimators report a heterogeneous outcome, i.e., renewable energy does not wane COE in the construction sector, agriculture, and manufacturing sector. On the contrary, renewable energy mitigates COE in the transport sector, residential, and commercial sectors (Liu et al., 2022a; Anwar et al., 2021a, 2021b).

Similarly, a rise in population growth exerts pressure on the demand for goods/services. As a result, ECN and COE witness an enormous upsurge (Anser et al., 2021a; Anwar et al., 2021a; Wen et al., 2021). Urbanization also raises the ECN and eventually, COE delineate an upsurge (Sadorsky, 2014; Zhang et al., 2018). Apart from the aforementioned factors, several other drivers of COE are reported in the literature such as trade (Halicioglu, 2009), financial development (Lv and Li, 2021; Anwar et al., 2022; Chien et al., 2021; Farooq et al., 2021), institutional quality (Sarkodie and Adams, 2018), economic policy uncertainty (Syed et al., 2022), unemployment (Anser et al., 2021b), and geopolitical risk (Zhao et al., 2021; Anser et al., 2021c).

Using data from the European and Central Asian regions, Salahodjaev et al. (2022) discern whether tourism and renewable energy contribute to emissions. The authors conclude that tourism is an imperative trigger of COE in European and Central Asian regions. While applying FMOLS and DOLS, Anwar and Malik (2022) and Salem et al. (2021) confirm that renewable energy reduces COE. Using the wavelet coherence approaches, Habib et al. (2021) investigate the role of COVID-19 and oil prices in global COE. The authors confirm that both the COVID-19 pandemic and oil prices plunge COE worldwide. Oad et al. (2022) investigate the effect of tourism on COE in Pakistan. The outcomes from the error correction model delineate that tourism does not impact COE in the LR. For South Asian economies, Mehmood (2022) probes the impact of EG, ECN, and trade on COE. The results retrieved from the CS-ARDL approach conclude that EG and ECN escalate COE, whereas trade impedes COE.

The author claims that EG, coal, and natural gas consumption enhance COE in the LR. Recently, Zeng and Wang (2023) investigate the role of EG, trade, and technology in curbing COE in China. The study notes that these aforementioned elements impact COE in the LR. In a recent study, Kaya Kanlı and Küçükefe (2023) conduct a global analysis to test the EKC hypothesis. The study reveals that the EKC is valid for high-income countries whereas low-income countries do not follow the EKC path. Lv et al. (2023) not only validate the EKC hypothesis for China, but also confirm that technology, population, and urbanization enhance COE. Using the data for 36 Asian economies, Bilgili et al. (2023) explore whether gender plays any significant role in predicting COE. The study discusses that males and females have heterogeneous environmental impacts. Similarly, Cheng and Hu (2023) discern whether urbanization explains COE using the STIRPAT framework for China. The authors point out that urbanization upsurges industrial, residential, and construction-related COE in China. Husnain et al. (2022) conclude that geopolitical tensions impact emissions. Awan et al. (2022) confirm that internet usage is a key driver of emissions. Zhang et al. (2023) conclude that policy uncertainty impacts emissions in the US.

Regarding the existing literature on CPU, Fuss et al. (2008) propose two channels that connect the CPU with COE. First, the CPU is responsible for the “wait and see” policy which encourages producers not to invest in green energy and keep using non-renewable sources of energy. On the contrary, CPU may create fear in individuals related to high environmental taxes, and, hence, investment in green energy escalates. As a result, COE mitigates over time. Golub et al. (2018) highlighted that the CPU mitigates the investment in low-carbon technology, and hence, the CPU is responsible for the high levels of emissions. Using the DSGE framework, Fried et al. (2021) note that CPU impedes COE. We can conclude that innovations, technological advancement, and investment in research and development discourage renewable energy consumption which in turn enhances emissions. It could be concluded from the aforementioned study that CPU will upsurge fossil fuel energy through the energy price effect, thereby COE is expected to increase. Recently, using the vector autoregressive (VAR) model, Gavriilidis (2021) noted that CPU mitigates total and sectoral COE. Keeping in view the aforementioned discussion, the second hypothesis could be developed as follows.

H0 2

There is an impact of CPU on sectoral COE.

It is inevitable to test this hypothesis for several reasons. For instance, it will guide whether CPU has any significant impact on sectoral emissions. Second, whether CPU has a heterogeneous environmental impact on sectoral emissions. Should CPU be considered to model COE? Finally, this will help to complement the spare literature on the CPU-COE nexus, and researchers will further dig deep into this issue.

It is worth mentioning that prior literature on the income-emissions nexus does not test the validity of the EKC hypothesis amid CPU at the sectoral level. On top of this, the existing studies do not cover the dynamic (SR and LR) impact of CPU on COE. Therefore, this study explores the impact of CPU on sectoral COE using the FARDL approach.

3 Model and data

3.1 Economic/empirical model

The literature on environmental economics describes several frameworks/models to test the drivers of COE; nonetheless, the EKC framework has been extensively used (Shahbaz and Sinha, 2019). The EKC delineates that EG and COE depict an inverted U-shaped association. However, the conventional EKC framework suffers from the problem of model misspecification (Stern, 2004). Moreover, the econometric modeling behind the EKC hypothesis is found to be weak (Stern and Common, 2001). According to the study of Narayan and Narayan (2010), the conventional EKC may also contain the issue of multicollinearity due to square and/or cubic terms of income (i.e., GDP). Hence, the aforementioned study modified the conventional EKC framework by excluding the quadratic and/or cubic terms from the model and comparing the magnitude of the SR and LR elasticities of income. If the SR income elasticity is higher than the LR income elasticity, the EKC will hold. Recently, several researchers employ the EKC hypothesis modified by Narayan and Narayan (2010) to test the influencing factors of COE (see, inter alia, Danish et al., 2020). Based on the merits of the aforementioned EKC framework compared to the conventional EKC model, we also utilize the same framework while discerning whether CPU affects sectoral COE. Other than EG, ECN is another crucial driver of COE. Energy sources mainly consist of fossil fuels that contain high-carbon components, resulting in high levels of COE. Many studies recently use ECN (see, for example, Mesagan and Olunkwa, 2022; Bhowmik et al., 2023). Hence, we follow the empirical model of Hashmi et al. (2022), who include ECN in the EKC framework to discern the impact of geopolitical risk on global COE. The EKC framework with the inclusion of ECN and CPU is expressed as follows:

In Eq. (1), COE denotes the vector of sectoral carbon emissions, while IPI is industrial production (a proxy for EG).Footnote 2 Next, ECN represents the vector of sectoral energy consumption, and CPU denotes climate policy uncertainty. The expected sign of ECN and IPI is positive, showing that ECN and IPI contribute to COE (Bhowmik et al., 2021). Since CPU affects COE through different channels, we are unable to envisage the sign of CPU.

3.2 Data

To accomplish its objective (i.e., investigating the impact of CPU on COE at the sectoral level), this study makes use of monthly time series data from 2000M1 to 2020M12 for the US. We analyze five sectors, namely the transport sector, the industrial sector, the electric power sector, the residential sector, and the commercial sector. Hence, the dependent variables include COE from the transport sector, the industrial sector, the electric power sector, the residential sector, and the commercial sector. Further, all dependent variables (sectoral COE) are measured in metric tons, and their data are gathered from Energy Information Administration (EIA).

Next, we adopt sectoral energy consumption and industrial production index as control variables. The energy consumption for all sectors is measured in British Thermal Units, while the industrial production index is measured as the level of production against 2010 as the base year. The data on the industrial production index (IPI) is downloaded from Federal Reserve Economic Data (FRED), while we obtain data on sectoral energy from EIA.

With regard to the key independent variable (i.e., CPU) of this empirical study, we adopt the climate policy uncertainty index recently proposed by Gavriilidis (2021). Following the methodology of Baker et al., (2016), who develop the economic policy uncertainty index, Gavriilidis (2021) measured the CPU index based on the frequency of newspaper articles on climate policies. In particular, the above-mentioned study computes the proportion of newspaper articles, which contain words related to climate policy uncertainty (e.g., ‘climate uncertainty,’ ‘climate change,’ ‘environmental legislation,’ among others), in the total number of newspaper articles. To compute the CPU index, data from eight leading daily newspapers in the US have been used. For the details regarding the methodology of the CPU index, readers are advised to follow Gavriilidis (2021). A large number of studies have been using policy uncertainty indices since the seminal work by Baker et al. (2016) (see, e.g., Syed and Bouri, 2022). It is worth mentioning that we transform the entire dataset into the natural logarithmic format to avoid heteroscedasticity. Figure 1 summarizes the data used in this analysis.

Next, Table 1 describes the descriptive statistics of the selected dataset. As depicted in Table 1, IPI contains the highest mean, whereas standard deviation is the highest for CPU. Next, the entire dataset is negatively skewed, while a few variables (e.g., CPU) contain a heavy tail. Moreover, all selected variables follow non-normal distribution excluding ECNIndustry and ECNelectricpower.

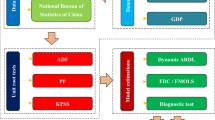

4 Methodology

The study follows a three-step methodological procedure to evaluate the impact of CPU on sectoral COE emissions. The first step revolves around testing the unit root using the novel SOR test. In the second step, the FARDL bounds test is applied to investigate whether CPU and COE have any long-run association across the selected sectors. Finally, LR and SR estimates are retrieved from FARDL model.

4.1 SOR unit root test

It is inevitable to probe the order of integration (i.e., unit root) to avoid spurious findings (Zhang et al., 2022; Zheng et al., 2022; Zhou et al., 2022; Durani et al., 2023). The existing literature provides several unit root tests, such as ADF unit root test and Fourier-based test, among others. However, these tests suffer from certain drawbacks, generating a strong likelihood of wrong inferences (Enders and Lee, 2012). For instance, the ADF unit root test does not cover the presence of structural breaks. Moreover, the ADF test has low explanatory power, which makes it unsuitable in the case of small datasets (Ng and Perron, 2001). Likewise, Fourier-based unit root tests (e.g., Enders and Lee (2012), etc.) also contain a few drawbacks. Although the Fourier approximation captures the presence of sharp breaks, it over-fits the data and hence causes problems of over-filtering, especially in the stochastic part of the data series (Omay et al., 2020). By contrast, Shahbaz et al. (2018) propose a two-step procedure in SOR unit root tests, having the ability to capture state-dependent nonlinearity and sharp and smooth breaks, without creating over-fitting problems (Shahbaz et al., 2022). Therefore, the analysis uses the SOR test put forward by Shahbaz et al. (2018). The SOR test outperforms other conventional tests since it accounts for the sharp and smooth structural breaks in the data, providing reliable estimates. The test follows a two-step procedure delineated below:

In step-1, an algorithm on constraint nonlinear optimization is applied. Then, the deterministic component of the suitable model is estimated. Next, the residuals are calculated using models A, B, and C, reported as follows:

In step-2, we compute Enders and Lee (2012) (henceforth, Enders & Lee, (2012)) test statistic, which is the t ratio affiliated with \(\widehat{\varphi }\) in the following OLS regression:

In Eq. (5), d(t) represents a deterministic function of t, while \({\varepsilon }_{t}\) is a stationary error term that contains a variance σ2. Next, it is worth reporting that \({\varepsilon }_{t}\) is weakly dependent. Furthermore, its initial value is supposed to be fixed. We can directly estimate Eq. (5) and test the null hypothesis of a unit root (i.e., \({\varphi }_{1}\) =1), if the functional form of d(t) is known. However, the actual form of d(t) is unknown, hence, testing can be incorrect for \({\varphi }_{1}\) =1, if d(t) is misspecified. Therefore, the procedure adopted here is established on the theory that it is conventionality possible to approximate d(t) by employing the following Fourier expansion:

In Eq. (6), T is the number of observations, k denotes the frequency, n depicts the number of cumulative frequencies achieved in the Fourier function’s approximation. It is worth mentioning that if there does not exist a nonlinear trend all values of \({\alpha }_{k}={\beta }_{k}=0,\) indicating a special case. It is also documented that the value of n should not be large since it may lead to an over-fitting problem. Next, it is empirically evident that the functional form of smooth breaks can be constructed through Fourier approximation (Bierens, 1997; Gallant and Souza, 1991). Furthermore, to allow the evolution of nonlinear trends to be imperceptible, n needs to be small. Hence, the final equation contains the following form:

while testing the equation, to account for any stationary dynamics in \({\widehat{\in }}_{t}\), it is common to augment the dependent variables’ lag value. Next, to construct \({\widehat{\in }}_{t},\) the value of EL test statistic is delineated as \(\delta {\tau }_{\alpha }\) in Model A, \(\delta {\tau }_{\alpha (\beta )}\) in Model B, and \(\delta {\tau }_{\alpha ,\beta }\) in Model C. In the case of the SOR test, an inevitable issue is to check whether the small number of frequency components can replicate the types of breaks, observed in the time series dataset. Using a single-frequency component denoted as k, Fourier approximation is considered to cover the aforementioned issue. Next, \({\mathrm{\alpha }}_{\mathrm{k}}\) and \({\upbeta }_{\mathrm{k}}\) show the amplitude and displacement of the sinusoidal component of the deterministic term. In the case of a single frequency (i.e., k = 1), this setting covers several smooth breaks. Finally, the Ho and H1 hypotheses can be stated as follows:

H0: Linear non-stationary

H1: Nonlinear Stationary

It is worth noting that to test the hypothesis, we use critical values of Model A* provided by Shahbaz et al. (2018). Several researchers recently used SOR test (see, for example, Hashmi et al., 2022; Syed et al., 2023).

4.2 The novel FARDL approach

To probe the cointegration betwixt variables, Pesaran et al. (2001) developed the ARDL bounds test. It is reported that the ARDL bounds test outshines other methods as it is applicable even if the variables do not follow the same order of integration (Narayan, 2004). In the ARDL specification, we use the following model/equation in this study:

In Eq. (8), \(\alpha\) shows the intercept, whereas \({\varphi }_{i}\), \({\beta }_{i}\), \({\gamma }_{i}\), and \({\omega }_{i}\) are SR coefficients. Furthermore, \({\pi }_{i}\) (i=1, 2, 3, 4) depicts the LR estimates. In addition, y, p, q, and m denote the lag order. Next, while \(v\) t is the disturbance term. The ARDL model is incapable of covering the structural breaks, while ignoring them may lead to weak inferences (Enders and Lee, 2012). Thus, the analysis uses the Fourier approximation in the ARDL framework, because it can handle the presence of sharp and smooth breaks (Gallant, 1981; Gallant and Souza, 1991). It is worth noting that the Fourier approximation does not entail any prior information about the nature, frequency, and date/time of structural breaks. Not only this, unlike structural break dummies, the Fourier approximation does not require several parameters and hence provides good size and power properties (Enders & Lee, 2012). Based on the above arguments, we adopt the ARDL model with the Fourier approximation (i.e., the Fourier ARDL approach) to explore the impact of CPU on COE. The final expression of the Fourier ARDL model yields:

where \(\mu 1\) and \(\mu 2,\) respectively, represent the amplitude and displacement of the frequency component. Next, \(\pi\) = 3.14, k denotes the frequency of Fourier, t denotes the trend, and T represents the sample size. For further details related to the Fourier approximation in ARDL modeling, the reader is advised to see the studies of Solarin (2019), Pata and Aydin (2020), and Yilanci et al. (2020).

5 Findings

5.1 Findings from SOR unit root

We start this section by reporting the findings from the SOR unit root test. As shown in Table 2, at I (0), the calculated t-statistics are lower than their respective critical values in the case of all considered variables. Hence, we could not reject the null hypothesis at I (0), implying that the dataset is not integrated at I (0). However, the calculated t-statistics are greater than the critical values at I (1), inferring that all variables follow I (1).

5.2 Cointegration from FARDL bounds test

In this section, we present the results of cointegration retrieved from the FARDL approach. As delineated in Table 3, the calculated value from the bounds test is greater than the upper bound values in the case of CO2Commercial, CO2Industrial, CO2Electric Power, and CO2Residential. However, the calculated value is less than its upper bound value in the case of CO2Transport. Hence, we can reject the null hypothesis of no cointegration for all models excluding CO2Transport. This implies that there exists LR association between CPU and sectoral carbon emissions except for the transport sector. This indicates that in LR, CPU and COE have comovement, while these aforementioned variables may deviate/diverge in SR. Therefore, any change in the CPU may alter the LR trend of emissions. Since we validate the cointegration in our study, it would be plausible to separately estimate the SR and LR impacts of CPU on sectoral COE. To that end, we make use of FARDL approach presented in the next subsection.

5.3 Estimates from the novel FARDL model

We report the LR and SR estimates in this section. Since we are unable to find cointegration in the case of CO2Transport, we do not report the LR and SR estimates for CO2Transport.

In Table 4, section-S1 reports the SR estimates, section-S2 delineates the LR estimates, and section-S3 notes the diagnostics in consort with the Fourier terms. We set 4 maximum lags to choose the optimum lags for the FARDL model. Moreover, AIC is used to select the best-fitted FARDL model.

Regarding the residential sector, all SR and LR estimates are statistically significant. This indicates that CPU, IPI, and ENC affect the residential sector emissions. The coefficient of CPU is 0.008 and 0.033 in the SR and LR, respectively. This implies that a 1% increase in CPU escalates the residential sector's COE by 0.008% and 0.033% in the SR and LR, respectively. Also, the magnitude of CPU is relatively high in the LR. This infers that there exists a relatively profound impact of CPU on emissions in the LR. Likewise, ECN and IPI are also positive in both the LR and SR, indicating that residential sector energy consumption and industrial output contribute to carbon emissions.

Next, for the commercial sector, all coefficients are statistically significant in the LR and SR. The coefficient of CPU is 0.008 and 0.012 in the SR and LR, respectively. This expounds that a 1% upsurge in CPU increases the commercial sector COE by 0.008% and 0.012% in the SR and LR, respectively. Thus, we note that CPU leads to higher emissions in the commercial sector. As can be noticed, the magnitude of the CPU is relatively small in the SR. In addition, the coefficient of ECN and IPI is positive, indicating that energy consumption and industrial output are the drivers of COE. Finally, we report the existence of the EKC hypothesis as the value of IPI is relatively high in the SR.

Similarly, in the electric power sector, the coefficients are statistically significant either in the SR or LR. The coefficient of CPU is 0.008 and 0.020 in the SR and LR, respectively. This explains that a 1% rise in CPU contributes to levels of emissions by 0.008% and 0.020% in the SR and LR, respectively. The value of CPU in LR is higher than its value in SR, concluding the meager impact of CPU in the SR. The findings of control variables highlight that industrial production and energy consumption leads to higher emissions, while we report the validity of the KEC hypothesis based on the magnitude of IPI in the LR and SR.

Regarding the findings for the industrial sector, the coefficient of CPU is statistically insignificant in both the LR and SR. This infers that the CPU does not explain the industrial COE. Next, the coefficient of IPI and ECN is positive and statistically significant, noting that industrial COE depends on the levels of energy consumption and industrial production, while a relatively high magnitude of CPU in the SR compared to its LR counterpart validates the presence of the EKC hypothesis.

Regarding the economic rationale behind key findings, prior literature assists us. For instance, Fuss et al. (2008) conclude that CPU profoundly impedes investment in green energy, research and development, and innovation. As a result, renewable energy witnessed a decline, and, hence, COE is expected to upsurge. In addition to this, the CPU plunges fossil fuel energy (oil and gas) prices, which, in turn, escalates non-renewable energy consumption. This increase in non-renewables ultimately upsurges COE. Also, the uncertainty may show that policymakers have not been considering environmental degradation as an inevitable issue, and there still exist odds to use non-renewables in order to minimize cost (Jiang et al., 2019). As a result, COE will be increased. Interestingly, our findings contradict the conclusion of Gavriilidis (2021), who noted that CPU plunges emissions. The reasons behind the opposite results might be the difference in model and methodologies.

Related to the outcomes on ECN and IPI, it is evident that energy consumption in the US is dominated by non-renewable energy sources, which are responsible for tons of COE. These results are similar to the findings by Hashmi et al. (2022), who noted that global energy consumption triggers global emissions. The coefficient of IPI is positive across the SR and LR, implying that industrial production enhances the emissions in the residential sector. Nonetheless, the magnitude of the coefficient on IPI is relatively smaller in the LR, validating the existence of the EKC hypothesis. This argues that IPI enhances emissions at the initial stage of economic prosperity. However, an increase in IPI beyond a specific threshold will wane emissions. Our result related to IPI supports the key findings of Bhowmik et al. (2022), who revealed that IPI has a U-shaped relationship with emissions in the US.

Next, section-S3 of Table 4 presents the Fourier terms in consort with the adjusted-R2 and ECT (error correction term). The ECT reports that deviation from the equilibrium will be converged since the ECT is statistically significant with a negative sign. Moreover, the adjusted R2 expounds on the explanatory power of the independent variables. In addition, μ1 and μ2 refer to the displacement and amplitude, covering the smooth and sharp structural breaks. It is worth reporting that we perform all conventional diagnostics (e.g., ARCH test, serial correlation test, CUSUM test, and CUSUM-square test), reporting that all models do not contain any problem.

6 Conclusion

The unprecedented upsurge in the levels of COE has been causing a momentous threat to the entire world. Therefore, it is inevitable to examine the drivers of COE to develop policies that help to achieve Sustainable Development Goals. The relevant literature disregards the impact of CPU on COE; therefore, we discern whether CPU determines the levels of carbon emissions in the US. Particularly, we use sectoral carbon emissions to probe the impact of CPU across different sectors. To this end, we employ the novel SOR unit root test put forward by Shahbaz et al. (2018) in consort with the novel FARDL model. We reveal that there does not exist any cointegration between CPU and transport sector COE. The findings also document that CPU upsurges the emissions in the residential sector, the commercial sector, and the electric power sector during the SR and LR. Next, we report that the CPU does not exert any impact on industrial COE across the LR and SR.

We propose a few policy recommendations in light of our findings:

-

(1)

The existence of the EKC hypothesis in all sectors proposes that higher EG is a key to achieve improved environmental quality. Therefore, policymakers need to take measures to escalate EG such as human capital, improved institutional quality, stable economic policies, etc.;

-

(2)

Since we do not find any LR association between CPU and COE in the transport and industrial sector, any uncertainty related to environmental policy does not affect emissions in these sectors. Therefore, in the transport and industrial sector, policymakers can introduce reversible environmental policies;

-

(3)

Policymakers should introduce clear and well-defined environmental policies in the commercial, residential, and electric power sectors to avoid any uncertainty, which, in turn, generates strong emissions;

-

(4)

Next, policymakers need to avoid policy reversals related to environmental policies in the commercial, residential, and electric power sectors. Since CPU has a relatively profound impact in the LR, policymakers need to put efforts to shrink CPU in the LR to curb emissions;

-

(5)

Since CPU enhances the COE in the commercial, residential, and electric power sectors, policymakers should devise policies to encourage renewable energy consumption during times of high CPU. For instance, policymakers can plunge sales tax and tariffs on renewables to escalate their usage during the high CPU regimes.

On the limitations of this study, we use monthly data due to the availability of CPU at a monthly frequency. Due to this reason, we do not include other control variables such as technological innovations, institutional quality, globalization, urbanization, etc. On top of this, the CPU index is developed for the US, and hence, we do not incorporate other countries in this analysis.

Regarding future research directions, researchers can explore the impact of CPU on different sources of COE. Also, the Fourier NARDL approach could be employed to see the impact of positive and negative shocks on carbon emissions. In addition, the CPU might be used as a mediator/moderator while exploring the energy-emissions nexus. Also, the CPU-emissions nexus can be explored across different quantiles of (in)dependent variables. Finally, researchers can also probe different channels through which the CPU affects COE.

Data availability and materials

Available upon request.

Notes

The data on GDP at monthly frequency is unavailable, therefore, researchers widely use IPI as a proxy for GDP. See, e.g., Bhowmik et al. (2021) and Syed and Bouri (2022a).

References

Abbasi, K. R., Hussain, K., Haddad, A. M., Salman, A., & Ozturk, I. (2022). The role of financial development and technological innovation towards sustainable development in Pakistan: Fresh insights from consumption and territory-based emissions. Technological Forecasting and Social Change, 176, 121444.

Acheampong, A. O. (2018). Economic growth, COE and energy consumption: What causes what and where? Energy Economics, 74, 677–692.

Anser, M. K., Apergis, N., & Syed, Q. R. (2021a). Impact of economic policy uncertainty on CO2 emissions: Evidence from top ten carbon emitter countries. Environmental Science and Pollution Research, 1–10.

Anser, M. K., Apergis, N., Syed, Q. R., & Alola, A. A. (2021b). Exploring a new perspective of sustainable development drive through environmental Phillips curve in the case of the BRICST countries.Environmental Science and Pollution Research, 1–11.

Anser, M. K., Syed, Q. R., & Apergis, N. (2021c). Does geopolitical risk escalate CO2 emissions? Evidence from the BRICS countries. Environmental Science and Pollution Research, 28(35), 48011–48021.

Anwar, A., Chaudhary, A. R., & Malik, S. (2023). Modeling the macroeconomic determinants of environmental degradation in E-7 countries: The role of technological innovation and institutional quality. Journal of Public Affairs, 23(1), e2834.

Anwar, A., Sharif, A., Fatima, S., Ahmad, P., Sinha, A., Khan, S. A. R., & Jermsittiparsert, K. (2021a). The asymmetric effect of public private partnership investment on transport CO2 emission in China: Evidence from quantile ARDL approach. Journal of Cleaner Production, 288, 125282.

Anwar, A., Siddique, M., Dogan, E., & Sharif, A. (2021b). The moderating role of renewable and non-renewable energy in environment-income nexus for ASEAN countries: Evidence from Method of Moments Quantile Regression. Renewable Energy, 164, 956–967.

Anwar, A., Sinha, A., Sharif, A., Siddique, M., Irshad, S., Anwar, W., & Malik, S. (2022). The nexus between urbanization, renewable energy consumption, financial development, and CO2 emissions: Evidence from selected Asian countries. Environment, Development and Sustainability, 24, 6556–6576.

Aslan, A., Destek, M. A., & Okumus, I. (2018). Sectoral carbon emissions and economic growth in the US: Further evidence from rolling window estimation method. Journal of Cleaner Production, 200, 402–411.

Awan, A., Abbasi, K. R., Rej, S., Bandyopadhyay, A., & Lv, K. (2022). The impact of renewable energy, internet use and foreign direct investment on carbon dioxide emissions: A method of moments quantile analysis. Renewable Energy, 189, 454–466.

Baker, S. R., Bloom, N., & Davis, S. J. (2016). Measuring economic policy uncertainty. The Quarterly Journal of Economics, 131(4), 1593–1636.

Bandyopadhyay, A., Rej, S., Abbasi, K. R., & Awan, A. (2022). Nexus between tourism, hydropower, and CO2 emissions in India: Fresh insights from ARDL and cumulative fourier frequency domain causality. Environment, Development and Sustainability, 1–25.

Bhowmik, R., Durani, F., Sarfraz, M., Syed, Q. R., & Nasseif, G. (2023). Does sectoral energy consumption depend on trade, monetary, and fiscal policy uncertainty? Policy recommendations using novel bootstrap ARDL approach. Environmental Science and Pollution Research, 30(5), 12916–12928.

Bhowmik, R., Rahut, D. B., & Syed, Q. R. (2022). Investigating the impact of climate change mitigation technology on the transport sector CO2 emissions: Evidence from panel quantile regression. Frontiers in Environmental Science, 709.

Bhowmik, R., Syed, Q. R., Apergis, N., Alola, A. A., & Gai, Z. (2021). Applying a dynamic ARDL approach to the Environmental Phillips Curve (EPC) hypothesis amid monetary, fiscal, and trade policy uncertainty in the USA. Environmental Science and Pollution Research, 1–15.

Bierens, H. J. (1997). Testing the unit root with drift hypothesis against nonlinear trend stationarity, with an application to the US price level and interest rate. Journal of Econometrics, 81(1), 29–64.

Bilgili, F., Khan, M., & Awan, A. (2023). Is there a gender dimension of the environmental Kuznets curve? Evidence from Asian countries. Environment, Development and Sustainability, 25(3), 2387–2418.

Cai, Y., Xu, J., Ahmad, P., & Anwar, A. (2022). What drives carbon emissions in the long-run? The role of renewable energy and agriculture in achieving the sustainable development goals. Economic Research-Ekonomska Istraživanja, 35(1), 4603–4624.

Cheng, Z., & Hu, X. (2023). The effects of urbanization and urban sprawl on CO2 emissions in China. Environment, Development and Sustainability, 25(2), 1792–1808.

Chien, F., Anwar, A., Hsu, C. C., Sharif, A., Razzaq, A., & Sinha, A. (2021). The role of information and communication technology in encountering environmental degradation: Proposing an SDG framework for the BRICS countries. Technology in Society, 65, 101587.

Congregado, E., Feria-Gallardo, J., Golpe, A. A., & Iglesias, J. (2016). The environmental Kuznets curve and COE in the USA: Is the relationship between GDP and COE time varying? Evidence across economic sectors. Environmental Science and Pollution Research, 23(18), 18407–18420.

Dogan, E., & Aslan, A. (2017). Exploring the relationship among COE, real GDP, energy consumption and tourism in the EU and candidate countries: Evidence from panel models robust to heterogeneity and cross-sectional dependence. Renewable and Sustainable Energy Reviews, 77, 239–245.

Dogan, E., & Seker, F. (2016). The influence of real output, renewable and non-renewable energy, trade and financial development on carbon emissions in the top renewable energy countries. Renewable and Sustainable Energy Reviews, 60, 1074–1085.

Dogan, E., Seker, F., & Bulbul, S. (2017). Investigating the impacts of energy consumption, real GDP, tourism and trade on COE by accounting for cross-sectional dependence: A panel study of OECD countries. Current Issues in Tourism, 20(16), 1701–1719.

Durani, F., Cong, P. T., Syed, Q. R., & Apergis, N. (2023). Does environmental policy stringency discourage inbound tourism in the G7 countries? Evidence from panel quantile regression. Environment, Development and Sustainability, 1–15.

Enders, W., & Lee, J. (2012). A unit root test using a Fourier series to approximate smooth breaks. Oxford bulletin of Economics and Statistics, 74(4), 574–599.

Erdogan, S., Adedoyin, F. F., Bekun, F. V., & Sarkodie, S. A. (2020). Testing the transport-induced environmental Kuznets curve hypothesis: The role of air and railway transport. Journal of Air Transport Management, 89, 101935.

Erdoğan, S., Yıldırım, S., Yıldırım, D. Ç., & Gedikli, A. (2020). The efects of innovation on sectoral carbon emissions: Evidence from G20 countries. Journal of Environmental Management, 267, 110637.

Esmaeili, P., Lorente, D. B., & Anwar, A. (2023). Revisiting the environmental Kuznetz curve and pollution haven hypothesis in N-11 economies: Fresh evidence from panel quantile regression. Environmental Research, 228, 115844.

Farooq, A., Anwar, A., Ahad, M., Shabbir, G., & Imran, Z. A. (2021). A validity of environmental Kuznets curve under the role of urbanization, financial development index and foreign direct investment in Pakistan. Journal of Economic and Administrative Sciences. https://doi.org/10.1108/JEAS-10-2021-0219

Fried, S., Novan, K. M., & Peterman, W. (2021). The macro effects of climate policy uncertainty.

Fujii, H., & Managi, S. (2013). Which industry is greener? An empirical study of nine industries in OECD countries. Energy Policy, 57, 381–388.

Fuss, S., Szolgayova, J., Obersteiner, M., & Gusti, M. (2008). Investment under market and climate policy uncertainty. Applied Energy, 85(8), 708–721.

Gallant, A. R. (1981). On the bias in flexible functional forms and an essentially unbiased form: The Fourier flexible form. Journal of Econometrics, 15(2), 211–245.

Gallant, A. R., & Souza, G. (1991). On the asymptotic normality of Fourier flexible form estimates. Journal of Econometrics, 50(3), 329–353.

Gavriilidis, K. (2021). Measuring climate policy uncertainty. Available at SSRN 3847388.

Golub, A. A., Fuss, S., Lubowski, R., Hiller, J., Khabarov, N., Koch, N., Krasovskii, A., Kraxner, F., Laing, T., Obersteiner, M., & Palmer, C. (2018). Escaping the climate policy uncertainty trap: Options contracts for REDD+. Climate Policy, 18(10), 1227–1234.

Habib, Y., Xia, E., Fareed, Z., & Hashmi, S. H. (2021). Time–frequency co-movement between COVID-19, crude oil prices, and atmospheric CO2 emissions: Fresh global insights from partial and multiple coherence approach. Environment, Development and Sustainability, 23, 9397–9417.

Habiba, U. M. M. E., Xinbang, C., & Anwar, A. (2022). Do green technology innovations, financial development, and renewable energy use help to curb carbon emissions? Renewable Energy, 193, 1082–1093.

Halicioglu, F. (2009). An econometric study of COE, energy consumption, income and foreign trade in Turkey. Energy policy, 37(3), 1156–1164.

Hashmi, S. H., Hongzhong, F., Fareed, Z., & Bannya, R. (2020). Testing non-linear nexus between service sector and CO2 emissions in Pakistan. Energies, 13(3), 526.

Hashmi, S. M., Syed, Q. R., & Inglesi-Lotz, R. (2022). Monetary and energy policy interlinkages: The case of renewable energy in the US. Renewable Energy, 201, 141–147.

Htike, M. M., Shrestha, A., & Kakinaka, M. (2021). Investigating whether the environmental Kuznets curve hypothesis holds for sectoral COE: Evidence from developed and developing countries. Environment, Development and Sustainability, 1–28.

Husnain, M. I. U., Syed, Q. R., Bashir, A., & Khan, M. A. (2022). Do geopolitical risk and energy consumption contribute to environmental degradation? Evidence from E7 countries. Environmental Science and Pollution Research, 29(27), 41640–41652.

Jiang, Y., Zhou, Z., & Liu, C. (2019). Does economic policy uncertainty matter for carbon emission? Evidence from US sector level data. Environmental Science and Pollution Research, 26, 24380–24394.

Kaya Kanlı, N., & Küçükefe, B. (2023). Is the environmental Kuznets curve hypothesis valid? A global analysis for carbon dioxide emissions. Environment, Development and Sustainability, 25(3), 2339–2367.

Li, X., Ozturk, I., Syed, Q. R., Hafeez, M., & Sohail, S. (2022). Does green environmental policy promote renewable energy consumption in BRICST? Fresh insights from panel quantile regression. Economic Research-Ekonomska Istraživanja, 35(1), 5807–5823.

Liu, H., Anwar, A., Razzaq, A., & Yang, L. (2022a). The key role of renewable energy consumption, technological innovation and institutional quality in formulating the SDG policies for emerging economies: Evidence from quantile regression. Energy Reports, 8, 11810–11824.

Liu, L., Anwar, A., Irmak, E., & Pelit, I. (2022b). Asymmetric linkages between public-private partnership, environmental innovation, and transport emissions. Economic Research-Ekonomska Istraživanja, 35(1), 6519–6540.

Lv, T., Hu, H., Xie, H., Zhang, X., Wang, L., & Shen, X. (2023). An empirical relationship between urbanization and carbon emissions in an ecological civilization demonstration area of China based on the STIRPAT model. Environment, Development and Sustainability, 25(3), 2465–2486.

Lv, Z., & Li, S. (2021). How financial development affects COE: A spatial econometric analysis. Journal of Environmental Management, 277, 111397.

Maji, I. K., & Adamu, S. (2021). The impact of renewable energy consumption on sectoral environmental quality in Nigeria. Cleaner Environmental Systems, 2, 100009.

Mehmood, U. (2022). The role of economic globalization in reducing CO2 emissions: Implications for sustainable development in South Asian nations. Environment, Development and Sustainability, 1–13.

Mesagan, E. P., & Olunkwa, C. N. (2022). Heterogeneous analysis of energy consumption, financial development, and pollution in Africa: The relevance of regulatory quality. Utilities Policy, 74, 101328.

Moutinho, V., Madaleno, M., & Elheddad, M. (2020). Determinants of the Environmental Kuznets Curve considering economic activity sector diversifcation in the OPEC countries. Journal of Cleaner Production, 271, 122642.

Moutinho, V., Varum, C., & Madaleno, M. (2017). How economic growth affects emissions? An investigation of the environmental Kuznets curve in Portuguese and Spanish economic activity sectors. Energy Policy, 106, 326–344.

Nain, M. Z., Ahmad, W., & Kamaiah, B. (2017). Economic growth, energy consumption and CO2 emissions in India: A disaggregated causal analysis. International Journal of Sustainable Energy, 36(8), 807–824.

Narayan, P. (2004). Reformulating critical values for the bounds F-statistics approach to cointegration: An application to the tourism demand model for Fiji (Vol. 2, No. 04). Australia: Monash University.

Narayan, P. K., & Narayan, S. (2010). Carbon dioxide emissions and economic growth: Panel data evidence from developing countries. Energy policy, 38(1), 661–666.

Ng, S., & Perron, P. (2001). Lag length selection and the construction of unit root tests with good size and power. Econometrica, 69(6), 1519–1554.

Oad, S., Jinliang, Q., Shah, S. B. H., & Memon, S. U. R. (2022). Tourism: Economic development without increasing CO2 emissions in Pakistan. Environment, Development and Sustainability, 24(3), 4000–4023.

Omay, T., Shahbaz, M., & Hasanov, M. (2020). Testing PPP hypothesis under temporary structural breaks and asymmetric dynamic adjustments. Applied Economics, 52(32), 3479–3497.

Pablo-Romero, M. D. P., Cruz, L., & Barata, E. (2017). Testing the transport energy-environmental Kuznets curve hypothesis in the EU27 countries. Energy Economics, 62, 257–269.

Pata, U. K., & Aydin, M. (2020). Testing the EKC hypothesis for the top six hydropower energy-consuming countries: Evidence from Fourier Bootstrap ARDL procedure. Journal of Cleaner Production, 264, 121699.

Pesaran, M. H., Shin, Y., & Smith, R. J. (2001). Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics, 16(3), 289–326.

Raza, S. A., Shah, N., & Khan, K. A. (2020). Residential energy environmental Kuznets curve in emerging economies: The role of economic growth, renewable energy consumption, and financial development. Environmental Science and Pollution Research, 27(5), 5620–5629.

Sadorsky, P. (2014). The effect of urbanization on COE in emerging economies. Energy Economics, 41, 147–153.

Salahodjaev, R., Sharipov, K., Rakhmanov, N., & Khabirov, D. (2022). Tourism, renewable energy and CO2 emissions: Evidence from Europe and Central Asia. Environment, Development and Sustainability, 24(11), 13282–13293.

Salem, S., Arshed, N., Anwar, A., Iqbal, M., & Sattar, N. (2021). Renewable energy consumption and carbon emissions—Testing nonlinearity for highly carbon emitting countries. Sustainability, 13(21), 11930.

Sarkodie, S. A., & Adams, S. (2018). Renewable energy, nuclear energy, and environmental pollution: Accounting for political institutional quality in South Africa. Science of the Total Environment, 643, 1590–1601.

Shahbaz, M., & Sinha, A. (2019). Environmental Kuznets curve for COE: A literature survey. Journal of Economic Studies.

Shahbaz, M., Omay, T., & Roubaud, D. (2018). Sharp and smooth breaks in unit root testing of renewable energy consumption. The Journal of Energy and Development, 44(1/2), 5–40.

Shahbaz, M., Song, M., Ahmad, S., & Vo, X. V. (2022). Does economic growth stimulate energy consumption? The role of human capital and R&D expenditures in China. Energy Economics, 105, 105662.

Solarin, S. A. (2019). Modelling the relationship between financing by Islamic banking system and environmental quality: Evidence from bootstrap autoregressive distributive lag with Fourier terms. Quality and quantity, 53(6), 2867–2884.

Stern, D. I. (2004). The rise and fall of the environmental Kuznets curve. World development, 32(8), 1419–1439.

Stern, D. I., & Common, M. S. (2001). Is there an environmental Kuznets curve for sulfur? Journal of Environmental Economics and Management, 41(2), 162–178.

Sun, Y., Anwar, A., Razzaq, A., Liang, X., & Siddique, M. (2022). Asymmetric role of renewable energy, green innovation, and globalization in deriving environmental sustainability: Evidence from top-10 polluted countries. Renewable Energy, 185, 280–290.

Syed, Q. R., & Bouri, E. (2021). Impact of economic policy uncertainty on COE in the US: Evidence from bootstrap ARDL approach. Journal of Public Affairs, e2595.

Syed, Q. R., & Bouri, E. (2022). Spillovers from global economic policy uncertainty and oil price volatility to the volatility of stock markets of oil importers and exporters. Environmental Science and Pollution Research, 1–11.

Syed, Q. R., Apergis, N., & Goh, S. K. (2023). The dynamic relationship between climate policy uncertainty and renewable energy in the US: Applying the novel Fourier augmented autoregressive distributed lags approach. Energy, 127383.

Syed, Q. R., Bhowmik, R., Adedoyin, F. F., Alola, A. A., & Khalid, N. (2022). Do economic policy uncertainty and geopolitical risk surge COE? New insights from panel quantile regression approach. Environmental Science and Pollution Research, 1–17.

Ulucak, R., & Khan, S. U. D. (2020). Relationship between energy intensity and CO2 emissions: Does economic policy matter? Sustainable Development, 28(5), 1457–1464.

Wang, Y., Zhang, C., Lu, A., Li, L., He, Y., ToJo, J., & Zhu, X. (2017). A disaggregated analysis of the environmental Kuznets curve for industrial COE in China. Applied Energy, 190, 172–180.

Wen, J., Mughal, N., Zhao, J., Shabbir, M. S., Niedbała, G., Jain, V., & Anwar, A. (2021). Does globalization matter for environmental degradation? Nexus among energy consumption, economic growth, and carbon dioxide emission. Energy policy, 153, 112230.

Yilanci, V., Bozoklu, S., & Gorus, M. S. (2020). Are BRICS countries pollution havens? Evidence from a bootstrap ARDL bounds testing approach with a Fourier function. Sustainable Cities and Society, 55, 102035.

Yin, X., Chen, W., Eom, J., Clarke, L. E., Kim, S. H., Patel, P. L., Yu, S., & Kyle, G. P. (2015). China’s transportation energy consumption and CO2 emissions from a global perspective. Energy Policy, 82, 233–248.

Zeng, S., & Wang, M. (2023). Theoretical and empirical analyses on the factors affecting carbon emissions: Case of Zhejiang Province, China. Environment, Development and Sustainability, 25(3), 2522–2549.

Zhang, G., Zhang, N., & Liao, W. (2018). How do population and land urbanization affect COE under gravity center change? A spatial econometric analysis. Journal of Cleaner Production, 202, 510–523.

Zhang, J., Abbasi, K. R., Hussain, K., Akram, S., Alvarado, R., & Almulhim, A. I. (2022). Another perspective towards energy consumption factors in Pakistan: Fresh policy insights from novel methodological framework. Energy, 249, 123758.

Zhang, M., Abbasi, K. R., Inuwa, N., Sinisi, C. I., Alvarado, R., & Ozturk, I. (2023). Does economic policy uncertainty, energy transition and ecological innovation affect environmental degradation in the United States? Economic Research-Ekonomska Istraživanja, 36(1), 1–28.

Zhang, Y., Chen, X., Wu, Y., Shuai, C., & Shen, L. (2019). The environmental Kuznets curve of COE in the manufacturing and construction industries: A global empirical analysis. Environmental Impact Assessment Review, 79, 106303.

Zhao, W., Zhong, R., Sohail, S., Majeed, M. T., & Ullah, S. (2021). Geopolitical risks, energy consumption, and CO2 emissions in BRICS: an asymmetric analysis. Environmental Science and Pollution Research, 1-12.

Zheng, L., Abbasi, K. R., Salem, S., Irfan, M., Alvarado, R., & Lv, K. (2022). How technological innovation and institutional quality affect sectoral energy consumption in Pakistan? Fresh policy insights from novel econometric approach. Technological Forecasting and Social Change, 183, 121900.

Zhou, R., Abbasi, K. R., Salem, S., Almulhim, A. I., & Alvarado, R. (2022). Do natural resources, economic growth, human capital, and urbanization affect the ecological footprint? A modified dynamic ARDL and KRLS approach. Resources Policy, 78, 102782.

Zhou, S., Wang, Y., Yuan, Z., & Ou, X. (2018). Peak energy consumption and CO2 emissions in China’s industrial sector. Energy strategy reviews, 20, 113–123.

Acknowledgements

Not applicable.

Funding

Not applicable.

Author information

Authors and Affiliations

Contributions

Not applicable

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no competing interests.

Consent for publication

Not applicable.

Consent to participate

Not applicable.

Ethics approval and consent to participate

This article does not contain any studies with human participants or animals performed by any of the authors.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Hashmi, S.M., Yu, X., Syed, Q.R. et al. Testing the environmental Kuznets curve (EKC) hypothesis amidst climate policy uncertainty: sectoral analysis using the novel Fourier ARDL approach. Environ Dev Sustain (2023). https://doi.org/10.1007/s10668-023-03296-9

Received:

Accepted:

Published:

DOI: https://doi.org/10.1007/s10668-023-03296-9