Abstract

European Monetary Union member countries’ forecasts are often combined to obtain the forecasts of the Euro area macroeconomic aggregate variables. The aggregation weights which are used to produce the aggregates are often considered as combination weights. This paper investigates whether using different combination weights instead of the usual aggregation weights can help to provide more accurate forecasts. In this context, we examine the performance of equal weights, the least squares estimators of the weights, the combination method recently proposed by Hyndman et al. (Comput Stat Data Anal 55(9):2579–2589, 2011) and the weights suggested by shrinkage methods. We find that some variables like real GDP and the GDP deflator can be forecasted more precisely by using flexible combination weights. Furthermore, combining only forecasts of the three largest European countries helps to improve the forecasting performance. The persistence of the individual series seems to play an important role for the relative performance of the combination.

Similar content being viewed by others

Notes

It is also possible to forecast the Euro area aggregate variables just by using data from one EMU member country as predictors. For example, Brüggemann et al. (2008) forecast the Euro area variables with German pre-EMU data. Thus, by combining forecasts which use data from different member countries as predictors, estimated combination weights considering the forecast accuracy of each single forecast can be used. This is also examined in our work. However, the results show that this way of forecast combination cannot reduce the mean squared forecast errors. Thus, the results are not reported in this work.

Marcellino (2004) compares a large number of linear and nonlinear models for forecasting aggregate EMU macroeconomic variables and the main result is that for a number of variables the simple autoregressive models perform quite well.

Athanasopoulos et al. (2009) discuss two versions of the top-down approach. One approach disaggregates the top level forecasts to produce the lower level forecasts based on the historical proportions of the lower level series relative to the top aggregate. The other one is based on the forecasted proportions.

The AWM database may be obtained from http://www.eabcn.org.

12 European countries considered in this work are Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, Netherlands, Portugal and Spain.

A robustness check for different lag length choice is also undertaken. Using the Akaike information criteria (AIC) for selecting the lag length does not change the main findings of this paper.

Detailed results for this are not reported in this paper, but are available on request.

The Quandt–Andrews Breakpoint testa are carried out by Eviews 8 for all aggregate and country-specific data. The results are not reported here, but available on request.

A simulation study has also been conducted. The aim has been to investigate whether the persistence of the data can effect the performance of forecast combination. However, the simulation results cannot support our empirical findings from Sect. 4.5.

References

Altissimo F, Bilke L, Levin A, Mathä T, Mojon B (2006) Sectoral and aggregate inflation dynamics in the Euro area. J Eur Econ Assoc 4(2–3):585–593

Anderson HM, Dungey M, Osborn DR, Vahid F (2011) Financial integration and the construction of historical financial data for the Euro Area. Econ Model 28(4):1498–1509

Andrawis RR, Atiya AF, El-Shishiny H (2011) Combination of long term and short term forecasts, with application to tourism demand forecasting. Int J Forecast 27(3):870–886

Athanasopoulos G, Ahmed RA, Hyndman RJ (2009) Hierarchical forecasts for Australian domestic tourism. Int J Forecast 25(1):146–166

Banerjee A, Marcellino M, Masten I (2005) Leading indicators for Euro-area inflation and GDP growth. Oxford Bull Econ Stat 67(Supplement):785–813

Bates JM, Granger CWJ (1969) The combination of forecasts. Oper Res Q 20(4):451–468

Beck GW, Hubrich K, Marcellino M (2009) Regional inflation dynamics within and across euro area countries and a comparison with the United States. Econ Policy 24(57):142–184

Benati L (2008) Investigating inflation persistence across monetary regimes. Q J Econ 123(3):1005–1060

Beyer A, Doornik JA, Hendry DF (2001) Constructing historical Euro-zone data. Econ J 111:F102–F121

Brüggemann R, Lütkepohl H (2013) Forecasting contemporaneous aggregates with stochastic aggregation weights. Int J Forecast 29(1):60–68

Brüggemann R, Lütkepohl H, Marcellino M (2008) Forecasting Euro-area variables with German pre-EMU data. J Forecast 27:465–481

Capistran C, Constandse C, Ramos-Francia M (2010) Multi-horizon inflation forecasts using disaggregated data. Econ Model 27(3):666–677

Clemen RT (1989) Combining forecasts: a review and annotated bibliography. Int J Forecast 5:559–583

Diebold FX, Pauly P (1990) The use of prior information in forecast combination. Int J Forecast 6:503–508

Fagan G, Henry J, Mestre R (2001) An area-wide model for the Euro area. In: Working Papers 42, European Central Bank

Fagan G, Henry J, Mestre R (2005) An area-wide model for the Euro area. Econ Model 22:39–59

Fliedner G (1999) An investigation of aggregate variable time series forecast strategies with specific subaggregate time series statistical correlation. Comput Oper Res 26(10–11):1133–1149

Genre V, Kenny G, Meyler A, Timmermann A (2013) Combining expert forecasts: Can anything beat the simple average? Int J Forecast 29:108–121

Granger CWJ (1989) Combining forecasts—twenty years later. J Forecast 8(3):167–173

Granger CWJ (1990) Aggregation of time-series variables: a survey. In: Barker T, Pesaran MH (eds) Disaggregation in econometric modelling. Routledge Revivals, London, pp 17–34

Granger CWJ, Ramanathan R (1984) Improved methods of combining forecasts. J Forecast 3(2):197–204

Greene WH, Seaks TG (1991) The restricted least squares estimator: a pedagogical note. Rev Econ Stat 73(3):563–567

Grunfeld Y, Griliches Z (1960) Is aggregation necessarily bad? Rev Econ Stat 42(1):1–13

Hendry DF, Clements MP (2004) Pooling of forecasts. Econ J 7(1):1–31

Hendry DF, Hubrich K (2006) Forecasting economic aggregates by disaggregates. In: Working Papers 589, European Central Bank

Hendry DF, Hubrich K (2011) Combining disaggregate forecasts or combining disaggregate information to forecast an aggregate. J Bus Econ Stat 29(2):216–227

Hsiao C, Wan SK (2014) Is there an optimal forecast combination? J Econom 178(2):294–309

Hubrich K (2005) Forecasting euro area inflation: Does aggregating forecasts by HICP component improve forecast accuracy? Int J Forecast 21(1):119–136

Hyndman RJ, Ahmed RA, Athanasopoulos G, Shang HL (2011) Optimal combination forecasts for hierarchical time series. Comput Stat Data Anal 55(9):2579–2589

Hyndman RJ, Lee AJ, Wang E (2014) Fast computation of reconciled forecasts for hierarchhier and grouped time series. In: Working paper 17/14, Department of Econometrics and Business Statistics, Monash University

Küster K, Wieland V (2010) Insurance policies for monetary policy in the Euro area. J Eur Econ Assoc 8(4):872–912

Lütkepohl H (1984a) Forecasting contemporaneously aggregated vector ARMA processes. J Bus Econ Stat 2(3):201–214

Lütkepohl H (1984b) Linear transformations of vector ARMA processes. J Econom 26(3):283–293

Lütkepohl H (2010) Forecasting aggregated time series variables: a survey. OECD J J Bus Cycle Meas Anal 2010(2):37–62

Marcellino M (2004) Forecasting EMU macroeconomic variables. Int J Forecast 20:359–372

Marcellino M, Stock JH, Watson MW (2003) Macroeconomic forecasting in the Euro area: country specific versus area-wide information. Eur Econ Rev 47(1):1–18

Schwarzkopf AB, Tersine RJ, Morris MJ (1988) Top-down versus bottom-up forecasting strategies. Int J Prod Res 26(11):1833–1843

Shlifer E, Wolff RW (1979) Aggregation and proration in forecasting. Manag Sci 25(6):594–603

Smith J, Wallis KF (2009) A simple explanation of the forecast combination puzzle. Oxford Bull Econ Stat 71(3):331–355

Stock JH, Watson MW (2002) Macroeconomic forecasting using diffusion indexes. J Bus Econ Stat 20:147–162

Stock JH, Watson MW (2004) Combination forecasts of output growth in a seven-country data set. J Forecast 23:405–430

Swanson NR, Zeng T (2001) Choosing among competing econometric forecasts: regression-based forecast combination using model selection. J Forecast 20:425–440

Tiao GC, Guttman I (1980) Forecasting contemporal aggregates of multiple time series. J Econom 12(2):219–230

Timmermann A (2006) Forecast combinations. In: Elliott G, Granger CWJ, Timmermann A (eds) Handbook of economic forecasting, chapter 4, vol 1. North Holland, Amsterdam, pp 135–196

Wallis KF (2011) Combining forecasts—forty years later. Appl Financ Econ 21(1–2):33–41

Wei WWS, Abraham B (1981) Forecasting contemporal time series aggregates. Commun Stat Theory Methods 10(13):1335–1344

Wright JH (2008) Bayesian model averaging and exchange rate forecasts. J Econ 146:329–341

Zellner A (1986) On assessing prior distributions and bayesian regression analysis with g-prior distributions. In: Goel PK, Zellner A (eds) Bayesian inference and decision techniques: essays in honour of Bruno de Finetti. North Holland, Amsterdam

Zellner A, Tobias J (2000) A note on aggregation, disaggregation and forecasting performance. J Forecast 19(5):457–465

Acknowledgments

I thank the participants of the Doctoral Seminar on Econometrics at the University of Konstanz, the Konstanz–Lancaster Workshop on Finance and Econometrics, the Annual Meeting of the Austrian Economic Association 2015 and the Jahrestagung der Statistischen Woche 2015 for helpful comments and suggestions. Financial support by the Deutsche Forschungsgemeinschaft, Project Number BR 2941/1-2, is gratefully acknowledged.

Author information

Authors and Affiliations

Corresponding author

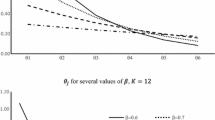

Appendix: Plots of the persistence of the data

Appendix: Plots of the persistence of the data

Rights and permissions

About this article

Cite this article

Zeng, J. Combining country-specific forecasts when forecasting Euro area macroeconomic aggregates. Empirica 43, 415–444 (2016). https://doi.org/10.1007/s10663-016-9330-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10663-016-9330-x