Abstract

This paper examines the impact of climate risk on macroeconomic activity for thirty countries using over a century of panel time series data. The key innovation of our paper is to use a factor stochastic volatility approach to decompose climate change into global and country-specific climate risk and to consider their distinct impact upon macroeconomic activity. To allow for country heterogeneity, we also differentiate the impact of climate risk upon advanced and emerging economies. While the existing literature has focused on country based climate risk shocks, our results suggest idiosyncratic or country-specific climate risk shocks are relatively unimportant. Global climate risk, on the other hand, has a negative and relatively more important impact on macroeconomic activity. In particular, we find that both advanced and emerging countries are adversely impacted by global climate risk shocks.

Similar content being viewed by others

1 Introduction

Climate change is widely expected to have a significant impact on economic activity for a whole host of countries around the world.Footnote 1 In his Nobel Prize Lecture, Nordhaus (2019) summed up the consensus on climate change: global warming is a threat to humankind and the natural world. The economic implications of climate change are potentially huge for firms, households and government policy. In addition to degradation of both the environment and ecosystem itself, climate change shall damage the economy by impacting primary resources, physical and human capital, R &D and productivity. In response, countries have implemented policies to tackle climate change in an effort to reduce greenhouse gas emissions and abate the adverse economic impact. While a policy consensus has emerged on climate change, some research questions remain, see Weitzman (2007), Stern (2008) and Pindyck (2021). Stern (2008) summarises effectively the challenges for researchers in this context: climate risk is global in its nature and impact; the effects may only reveal themselves over the long-term; and economic analysis of climate change should have a central role for risk and uncertainty. This paper seeks to add to the literature on the macroeconomic impact of climate change, focusing upon the nature and impact of global and country specific climate risk over an extended time period.

As the United Nation’s Intergovernmental Panel on Climate Change (IPCC) noted in its Sixth Assessment Report, climate change has one particular critical facet: our climate has become more volatile through time, with extreme temperature changes impacting an increasing variety of geographic regions (Arias et al. 2021). We observed from an illustrative sample of thirty countries that there has been an increase in both average annual temperature growth and variability. For our sample of thirty countries for over a century of annual data, average annual temperature growth was 0.012 °C, with a standard deviation of 0.279 °C between 1901 and 1950. From 1950 to 2020 average annual temperature growth rose to 0.015 °C, with the standard deviation increasing to 0.292 °C. This increase in climate variability is important, not least since Alessandri and Mumtaz (2021), Kotz et al. (2021) and Donadelli et al. (2022) present evidence that climate risk in the form of temperature variability can have a detrimental impact upon macroeconomic outcomes. This is based upon both empirical and theoretical research, using either realized temperature volatility or ex ante stochastic volatility measures of climate risk.Footnote 2

There are several channels by which climate risk may impact the economy. Investments which are irreversible, and have an option value of waiting, may be delayed by firms due to uncertainty (Bloom 2009). This may result in decreased expenditures on new business capital and R &D. Berestycki et al. (2022) document that climate policy uncertainty is linked with substantial declines in investment in capital-intensive industries, notably in pollution-intensive sectors subject to climate policy changes. Extensive research have emphasised the urgency of incorporating the physical aspect of climate threats into economic impact studies (Donadelli et al. 2017, 2021; Kotz et al. 2021; Pindyck 2021; Donadelli et al. 2022; Kotz et al. 2022; Sheng et al. 2022). These studies demonstrate that climate risks have a negative impact, not only upon labour productivity and capital quality, but also upon R &D expenditures, thereby lowering economic growth. In other words, climate risks can directly influence both economic production and consumption.

Our paper makes four contributions to the literature on the economic impact of global warming. Firstly, we illustrate climate interconnectedness from one country to the next for our large sample of countries using generalised temperature spillover indices from Diebold and Yilmaz (2012), which is also order invariant. Our evidence suggests that temperature changes have experienced spillovers from one country to the next, indicating the interconnectedness of these countries. In essence, connectedness motivates the notion that there are common factors in temperature changes. Given this global interconnectedness, it is critical to model common factors of climate when assessing its impact on macroeconomic activity.

Our second contribution is to consider the impact of climate variability upon real GDP growth by differentiating between the impact of global climate risk and country specific climate risk using a factor model. Global climate risk may matter more than idiosyncratic climate risk for economic activity, since climate change is a global phenomenon, as suggested by Stern (2008). Factor models are widely used in empirical macro research: see Kose et al. (2003), Foerster et al. (2011) and Fernández et al. (2018).Footnote 3 Related to, but different from our factor approach, Alessandri and Mumtaz (2021) use univariate stochastic volatility associated with temperature to examine the long-term impact of climate change uncertainty on economic growth.Footnote 4 However, the potentially distinct impact of global and country specific climate uncertainties upon GDP growth have not been considered by the literature as far as we are aware. In light of this, the purpose of this present work is to extend Alessandri and Mumtaz (2021) by employing factor stochastic volatility, which is multivariate, as opposed to stochastic volatility which is univariate, to decompose climate uncertainties. Our factor stochastic volatility approach to modeling climate change more fully accounts for the global nature of climate risk.

The third contribution of our paper is to consider the impact of climate change over the very long term. This also chimes with Stern (2008) who emphasizes that climate change can be long term in its nature or impact. We therefore consider around 120 years of data when examining the impact of global and country specific climate risk on GDP. This contrasts with existing studies which typically consider a more recent sample period. And while climate change has become more acute in recent years, climate risk has potentially impacted outcomes for an extended period. We also assess whether our results are sensitive to the sample period chosen and whether the effects of climate change have become more acute in recent years. Fourthly, our work distinguishes the effects of climate risk upon advanced and emerging economies because the effects of climate change may depend upon country characteristics. Despite the possibility of cummulative temperature increases above pre-industrial levels ranging from 1.5 to 4.5 °C, certain regions may be heterogeneously impacted by global warming (see Houghton 1996; O’Brien and Leichenko 2000). We consider whether the climate risk experienced by emerging economies is country-specific or mainly the result of global spillovers. Both advanced and emerging economies are major contributors of greenhouse gas emissions which could substantially affect their economies due to climate risk. Both groups of countries may be heterogeneously impacted by climate risk and be more or less able to abate the impact of climate variability.

To preview our result, we established that overall climate risk is substantial and relevant for macroeconomic activity, consistent with the earlier literature such as: Dell et al. (2012), Donadelli et al. (2017), Alessandri and Mumtaz (2021), Donadelli et al. (2021), Kotz et al. (2021), Donadelli et al. (2022), Kotz et al. (2022), Sheng et al. (2022), among others. Separating climate risk into global and country-specific elements we make our key contributions. Country specific climate risk shocks have a relatively less important impact on GDP fluctuations. By comparison, global climate risk has a negative and relatively more important impact on GDP, and induces more volatility of macroeconomic activity. Our results indicate that both advanced and emerging economies are impacted to a greater extent by common, rather than the idiosyncratic climate risk, which emphasizes the global dimension of climate change. In addition, we find evidence of stronger interconnectedness of temperature changes among the countries’ in our sample. Most importantly, both temperature changes and GDP growth depict positive spillover effects from one country to another. Our econometric method’s ability to capture cross-sectional heterogeneity and spillovers renders our findings robust and substantial.

The rest of the study is divided as follows: the second section briefly discuss existing literature, the third describes the empirical model and method used in the empirical analysis; the four section reports the our empirical results; and the fifth section concludes the study.

2 Brief Literature Review

Uncertainty is increasingly important for empirical research in several economic applications, see Cascaldi-Garcia et al. (2023). In an early study, Bernanke (1983) argues that an increase in uncertainty damages the economy’s total demand through a conventional channel tied to real option theory. Bloom (2009) suggests that uncertainty influences decision-making because it increases the option value of waiting. In other words, corporations and, in the case of durable products, consumers are more cautious when confronted with uncertainty due to the significant costs associated with making poor investment decisions. Consequently, investments, hirings, and expenditures are postponed until periods of lesser uncertainty. Due to the misallocation of resources across businesses, uncertainty is also anticipated to have a negative influence on the supply-side productivity of the economy (Bloom et al. 2018). According to Bloom et al. (2018), it is argued that in periods of normal economic conditions, less efficient companies tend to experience a decrease in size, while more productive firms tend to grow, thereby contributing to the overall maintenance of high aggregate productivity. In situations characterised by elevated levels of uncertainty, businesses tend to impose restrictions on their expansion and contraction activities. This, in turn, hampers a substantial portion of the productivity-enhancing reallocation process, ultimately resulting in a decline in the evaluated aggregate total factor productivity. The main question of this study pertains to whether there exists a correlation between a heightened likelihood of encountering greater temperature variations in the future, specifically an increase in the conditional volatility of yearly temperatures, and its potential impact on economic growth.

Climate change is a key policy concern. It has the potential to damage household welfare and economic activity (Giglio et al. 2021).Footnote 5 Two lines of research underpin our study. The first line examines the economic implications of climate change. They substantially argued on the negative relationship between income and global warming. To assess the relationship between climate and economic activity researchers use variety of methods, including the general equilibrium model, the integrated assessment model in its reduced form.Footnote 6 The second line of research examines the macroeconomic implications of increases in risk and uncertainty associated with climate change. The literature establishes the critical role of macroeconomic volatility on investment, consumption, and output.Footnote 7 By examining the relationship between climate risk, notably climate change uncertainty, and macroeconomic activity, this study aims to bring new and diverse information to inform policy direction and academic discussion.

Several papers examine the empirical relationship between economic development and weather conditions. For instance, Dell et al. (2012) seek to determine the economic effects of climate change for the first time. They accomplish this by tracing the temporal evolution of countries’ average temperatures and output growth. According to Dell et al. (2012), rising temperatures have a greater negative impact on economic growth in developing nations than in industrialised nations. Similar to Dell et al. (2012), a study used a panel of nations to determine if changes in temperature and precipitation levels are associated with slowed economic growth.Footnote 8 They demonstrate that rising temperatures have a detrimental effect on economic growth in warm, developed nations, whereas increased precipitation has a beneficial effect on growth, particularly in developed nations with low average precipitation. Meanwhile, Zhao et al. (2018) contend that the impacts of annual temperature on productivity can also vary widely among countries. Using global sub-national short panel data, they review the link between temperature and economic growth and demonstrate that climate-related negative consequences can differ at the regional level. Donadelli et al. (2017) demonstrate empirically that a temperature shock has a substantial, negative, and statistically significant effect on total factor productivity, production, and labour productivity. In contrast, they demonstrate that quicker adaptation to climate shocks is associated with lower welfare costs. In line with that, welfare benefits increase dramatically when the rate of adaptation improves over time. According to Kotz et al. (2022), a rise in the number of rainy days and excessive daily rainfall, as well as a nonlinear reaction to the total annual and averaged monthly variations in rainfall, slows economic growth rates. In addition, both daily rainfall and total annual rainfall are most detrimental to high-income countries and industries, such as services and manufacturing, supporting previous research that emphasised the benefits of greater annual rainfall for low-income, agriculturally-based economies.

Apparently, numerous studies have identified connections between overall changes in temperature and economic growth either in short or long-term, but data on the relationship between within-year temperature variability and macroeconomic variables is scant (Donadelli et al. 2022); few studies have suggested that the relationship between climate uncertainty and economic outcomes is significant and very important (Burke et al. 2015; Pindyck 2021). Other studies are of the view that climate change risks as a result of uncertainty leads to output losses and surges in prices. Essentially, the negative effect of climate risks or uncertainties emanate from demand-side and supply-side shocks (Batten 2018; Batten et al. 2020; Ciccarelli and Marotta 2021; Kiley 2021). Further, Kotz et al. (2022) postulate that climate change exacerbate growth such that variability of rainfall respond to economic growth non-linearly. It is demonstrated by Sheng et al. (2022) that climate risks have a detrimental impact on economic activity to a similar extent regardless of whether the risks are caused by changes in temperature growth or volatility. However, when temperature growth increases by a similar magnitude in the higher uncertainty-based regime in a nonlinear context, the volatility of temperature growth contracts economic activity roughly five times more than when temperature growth decreases by a similar amount. Donadelli et al. (2021) explore labour productivity, patent obsolescence, and capital quality in their analysis of the negative R &D expenditure effect of rising temperatures. According to them, temperature shocks are damaging to economic growth due to a decline in investment on research and development. It has been found by Donadelli et al. (2022) that richer economies are more susceptible to the negative economic consequences of temperature fluctuation shocks. Kotz et al. (2021) argue that day-to-day temperature variability is influenced by seasonal differences and income, resulting in the greatest risks in low-income regions and low-latitudes.

On the contrary, Pretis et al. (2018) studied uncertain impacts on economic growth when stabilizing global temperatures at 1.5 °C or 2 °C warming, and they claim that, aside from global nonlinear temperature effects, within-year variability of monthly temperatures and precipitation has no impact on economic growth. They also document that temperature variations have almost no effect on growth in economies with a yearly average temperature, but temperature variations appear to have significant consequences in countries with extremely high or low average yearly.

The topic of climate spillovers has received limited attention in the existing body of research. The existence of this gap becomes apparent when examining multiple facets of climate interactions. Prominent instances encompass investigations that delve into the direct impacts of climate change, as exemplified in the scholarly contribution of Schleypen et al. (2022). Moreover, the examination of spillover effects of regional temperatures, as illustrated by Cashin et al. (2017), underscores the insufficient consideration given to this complex phenomenon.

Furthermore, scholarly research has increasingly focused on investigating intricate aspects of climate spillovers. For instance, Zhao et al. (2023) have delved into the systemic risk that emerges from the interconnection between coal-supported electricity generation and weather patterns. The research conducted by Khalfaoui et al. (2022) and Su et al. (2022) demonstrates the growing acknowledgement of the interdependencies between climate policy spillovers and their impacts on energy systems. These studies shed light on the interconnected nature of climate-related dynamics, both within and between sectors and regions.

Significantly, there has been increased attention on indirect climate spillovers, as evidenced by research conducted by Zhang et al. (2023). This study has provided valuable insights into the complex mechanisms through which climate change can spread across interconnected systems, thereby emphasising the necessity for a more holistic comprehension of the extensive consequences associated with climate spillovers.

Given ongoing investigations, it is apparent that climate spillovers are a multifaceted and interconnected phenomenon that warrants increased scholarly focus. The scholarly literature emphasises the significance of not only mitigating the immediate impacts of climate change but also recognising the complex web of repercussions that can span across geographical, sectoral, and policy domains, ultimately influencing the global socioeconomic framework. The available data on climate change and macroeconomic activity indicate that an increase in annual average temperature has an effect on macroeconomic growth. However, a number of fundamental elements of the economy are affected by deviations in daily temperature from seasonal expectations that are not adequately reflected in annual averages.

3 Empirical Methods

3.1 Data

Key time series used in this study are measures of climate risk, macroeconomic activity and carbon emissions. We use temperature changes as the basis of measuring country-specific and global climate risk. To model macroeconomic activity, we use the growth rate of real GDP. The steady increase in global temperature caused by accumulated carbon dioxide in the atmosphere, which raises atmospheric carbon concentration and eventually changes temperature, is measured using carbon emissions per capita. Moreover, we use carbon emission per capita since this is also important for the relationship between climate risk and macroeconomic activity. The data spans from 1901 to 2020 for thirty countries.Footnote 9

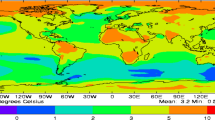

3.1.1 Climate Data

To construct a measure of climate risk, we source temperature data from World Bank Climate Knowledge Portal and we focus upon temperature changes. Temperature is derived from the Climate Research Unit (CRU) observed dataset. The CRU gridded time series is a widely used climate dataset that covers all land domains of the world except Antarctica on a 0.5° latitude by 0.5° longitude grid. It is calculated by obtaining climate anomalies from large networks of weather stations’ observations within a country. However, a key innovation in this paper is that climate risk is measured by a factor stochastic volatility model of average temperature changes. The primary practical and computational benefit of the factor stochastic volatility (FSV) model lies in its parsimony. This model effectively represents the variances and covariances of a vector of time-series by employing a low-dimensional stochastic volatility (SV) structure that is determined by common factors. It is a frequently observed phenomenon that the quantity of common factors among extensive sets of time-series vectors tends to be significantly smaller, typically by one or two orders of magnitude. This occurrence has a notable impact on the accuracy of estimation and computational processes.Footnote 10 Unlike the FSV which uses a multivariate process, previous studies modelled climate risk by a standard normal factor model in which both the idiosyncratic time series variances and common factors variances are combined as a univariate stochastic volatility process.Footnote 11

3.1.2 Macroeconomic Activity

Macroeconomic activity in our study is measured by the real GDP growth rate. The real GDP growth rate is calculated by authors using real GDP per capita and population data from the Maddison Project and the World Development Indicators. Dell et al. (2012) document two possible outcome of temperature impact on economic activity; that is, level of output through agricultural yields and productivity growth through investment and institutional effectiveness. In addition, the authors suggest that warmer temperatures may slow growth in developing and underdeveloped countries rather than temporarily lowering output. These growth effects would imply huge repercussions of global warming because even minor growth effects have large consequences over time. According to Burke et al. (2015), the global climate and economic activity are intertwined. It is essential to note that hotter climates reduce output by reducing investment, lowering worker productivity, worsening health outcomes, and lowering agricultural and industrial output—thereby, thwarting overall macroeconomic activity (Moore and Diaz 2015; Carleton and Hsiang 2016). Some recent studies have emphasised the importance of understanding the impact of climate uncertainty on macroeconomic growth (Kiley 2021; Kotz et al. 2021; Donadelli et al. 2022; Kotz et al. 2022). According to Dell et al. (2012), transient weather shocks that capture levels and growth effects have an impact on the growth rate during the shock’s initial phase. This effect eventually goes the other way when weather returns to normalcy. As an illustration, a temperature shock may result in lower agricultural output, but after the temperature returns to normal, agricultural production recovers. Contrarily, the growth effect manifests during the weather shock and cannot be reversed: a country’s failure to innovate during one era pushes it further behind the curve over the long term.

Climate change distresses the demand and supply side of an economy: from the supply side, it disrupts output by adversely affecting prices and hampering future growth through extreme weather conditions and natural disasters-and perhaps affect physical capital as a demand side effects (Ciccarelli and Marotta 2021). Arguably, the aforementioned effects from both demand and supply sides relative to climate change have been identified as simple, taking into account the short-term and long-term effects. Therefore, demand side adjustments stemming from consumption patterns, disruption to income, exports, changes in consumers’ behaviour, investment and infrastructure are possibly and explicitly related to climate awareness and migration (Batten et al. 2020).

3.1.3 Carbon Emissions

Carbon dioxide emissions are caused by the combustion of fossil fuels, deforestation, agriculture, and industrial activities such as the production of cement. They include carbon dioxide emitted during the combustion of solid, liquid, and gas fuels, as well as gas flaring. Productivity and economic growth have a direct influence on individual well-being. Since at least the industrial revolution, global economic growth has been driven by energy from fossil fuel, which contributes to greenhouse gas emissions. Carbon emissions cause global warming on the long run affecting atmospheric carbon concentration, which alters temperatures and induces climate change (Pindyck 2021).

3.2 Modelling Climate Risk

Common variation in the unpredictable component of a large variety of economic variables, is frequently referred to as time-varying macroeconomic uncertainty (Jurado et al. 2015; Mumtaz and Theodoridis 2017; Beckmann et al. 2019). Commonly used uncertainty measures do not capture the long-lasting bursts of activity that seems to correlate with real economic activity (Jurado et al. 2015). Nonetheless, Jurado et al. (2015) state that there is no objective measure of uncertainty when it comes to assessing macroeconomic activity and uncertainty. To this end, the authors develop novel metrics of uncertainty and connect them to macroeconomic activity. The objective is to generate reasonable econometric estimates of uncertainty that are decoupled from the structure of specific theoretical models, as well as from reliance on any single or limited number of measurable economic indicators. Other measures of climate change policy uncertainty and overall economic policy uncertainty have emerged, with these indexes being built against the backdrop of newspapers using specific keywords, see Baker et al. (2016), among other.Footnote 12

In the factor Stochastic Volatility model, Bayesian estimation improves on the univariate Stochastic Volatility implementations and offers multiple options to enhance efficiency (Andersen et al. 1999; Hosszejni and Kastner 2021). To circumvent the issue of sluggish convergence in high dimensions, our model is estimated with a sampler that uses multiple interweaving strategies (Hosszejni and Kastner 2021).Footnote 13 Several factors are influenced by a small number of random sources, which explain how the observations interact with one another. In addition, latent factor models provide an effective method for estimating the dynamic covariance matrix. They decrease the number of unknowns. In a typical latent factor model with r factors, the decomposition is the diagonal matrix, which contains the variances of the idiosyncratic errors (Hosszejni and Kastner 2021).

A significant issue with dynamic covariance estimate is the large number of unknowns relative to the number of observations. To be precise, a quadratic expression in N have N(N+1)/2 degrees of freedom which has a corresponding covariance matrix \(\Sigma _t\) when the cross-sectional dimension is N. Using latent factors, one can make \(\Sigma _t\) appear sparser in order to overcome the dimensionality curse. When creating latent factor models, it is essential to keep in mind that even multidimensional systems can be governed by a limited number of random sources.

Against this backdrop, this research employed a factor stochastic volatility method to measure climate risks in order to assess its impact on macroeconomic activity. In the factor stochastic model, the covariance matrix of \({\overline{\Sigma }}_t\) and \({\tilde{\Sigma }}_t\) is representing independent univariate stochastic volatility processes which are both diagonal. Identification issues relative to factor stochastic volatility are relevant. Some of the identification assumptions are the sign, the order, and the scale of the factors is unidentified. In the factor Stochastic Volatility model, Bayesian estimation improves on the univariate SV implementations and offers multiple options to enhance efficiency. To circumvent the issue of sluggish convergence in high dimensions, it is performed with a sampler that employs several ancillarity-sufficiency interweaving strategy (ASIS) types.Footnote 14

In this paper we model global climate risk using a Factor Stochastic Volatility model. Temperature changes \({\mathbb {T}}_{it}\) for country i at time t are used to construct a measure of country specific and global climate risk. The factor stochastic volatility model for \({\mathbb {T}}_{it}\) is as follows:

where \({\mathcal {N}}(\varvec{\beta } + \varvec{\Lambda } {\varvec{f}}_t, \varvec{{\overline{\Sigma }}}_t)\) denotes the normal distribution for the matrix \({\mathbb {T}}_{it}\) with mean temperature changes represented by \(\varvec{\beta }\) = (\(\beta _1\),...,\(\beta _N\))\(^\top\) with temperature change factors \({{\varvec{f}}}_t\) = (\(f_{1t},....,f_{rt})^\top\). The factor loadings are \(\varvec{\Lambda }\) \(\in\) \({\mathbb {R}}^{N\times r}\) in Eq. (1). The covariance matrices \(\varvec{{\overline{\Sigma }}}_t\) and \(\varvec{{\tilde{\Sigma }}}_t\) are both diagonal and can be written as:

The total variance (\(\varvec{\Sigma }_t\)) of temperature changes can be decomposed into factor and idiosyncratic variance.

where \(\varvec{{\overline{\Sigma }}}_t\) consists of variances of the idiosyncratic errors while \(\varvec{{\tilde{\Sigma }}}_t\) = r < N. Equation (3) can be modified utilising Eq. (1) to become:

In essence, identification issues relative to factor stochastic volatility are relevant at this stage. For any generalised permutation matrix P of size \(r \times r\), there is some other viable decomposition \(\varvec{\Sigma }_t\) = \(\varvec{\Lambda ^{\prime }}\) \(\varvec{{\tilde{\Sigma }}_t^{\prime }}\) \((\varvec{\Lambda ^{\prime })^\top }\) + \(\varvec{{\overline{\Sigma }}}_t\), where \(\varvec{\Lambda ^{\prime }}\) = \(\varvec{\Lambda } {{{\varvec{P}}}}^{-1}\) and \(\varvec{{\tilde{\Sigma }}}_t^{\prime }\) = P \(\varvec{{\tilde{\Sigma }}_t} {{{\varvec{P}}}}^{\top }\). However, the uncertainty in the scale of the factors is resolved by setting their log-variance level to zero. In the second stage of our empirical analysis examining the relationship between macroeconomic activity and climate risk, we denote country-specific climate risk (\(\varvec{{\overline{\Sigma }}}_t\)) as \(\sigma _{it}^{\mathbb {T}}\) and global climate risk (\(\varvec{\Lambda {\tilde{\Sigma }}}_t \varvec{\Lambda ^\top }\)) as \(\sigma _{Ft}^{\mathbb {T}}\).

3.3 Panel VAR

To examine the relationship between macroeconomic activity, idiosyncratic and global climate risk, this study uses a Bayesian Panel VAR with a hierarchical prior. This Bayesian Panel VAR method was created by Jarociński (2010). It provides a richer approach because it treats all parameters as random variables and incorporates them into the estimation process. The hierarchical structure of our panel VAR model, which allows for the possibility of heterogeneous responses to climate risk shocks across the selected countries, is one of the model’s key components. To capture the endogenous relationship between climate risk and macroeconomic activity, we define \({{\varvec{X}}}_{it}\) = [\(\sigma _{it}^{\mathbb {T}}\), \(\sigma _{Ft}^{\mathbb {T}}\), \(y_{it}]'\) with country-specific climate risk (\(\sigma _{it}^{\mathbb {T}}\)), global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) and \(y_{it}\) denotes the growth rate of real GDP. Both climate risk measures are obtained from the factor stochastic volatility model in Eq. (1) using annual temperature changes. In accordance with Jarociński (2010), we assume a panel model as follows:

where \({{\varvec{w}}}_t\) is a vector of common exogenous variable and \({{\varvec{X}}}_{it}\) is a n vector of endogenous variables. The subscrpits \(i = 1,...,N\) represents countries, \(t = 1,...,T\) represents time periods, and \(l = 1,...,L\) represents the lags. In terms of the \({{\varvec{X}}}_{it-1}\) and \({\varvec{w}}_t\) coefficients, we define an exchangeable prior. The prior is non-informative for the \({\varvec{z}}_{it}\) coefficients, which may contain country-specific constant terms. The vector \({\varvec{u}}_{it}\) contains \({\mathcal {N}} (0, \varvec{\Sigma }_i)\) VAR innovations which are iid. The variables to which the exchangeable prior applies are collected in a vector called \({{\varvec{x}}}_{it} = [{{\varvec{X}}}'_{it-1}... {{\varvec{X}}}'_{it-l}, {\varvec{w}}'_t]'\). In terms of data matrices, the model for country i can be obtained by vertically stacking \({{\varvec{X}}}'_{it}, {\varvec{x}}'_{it}\) and \({\varvec{w}}'_{t}\) for all t:

\({{\varvec{X}}}_{i}\) and \({\varvec{U}}_{i}\) are \(T \times n\). Where \(\varvec{{\mathbb {X}}}_{i}\) is \(T \times K\), \({\varvec{Z}}_{i}\) are \(T \times M\), \({\varvec{B}}_{i}\) are \(K \times n\) and \(\varvec{\Gamma }_{i}\) are \(M \times n\). \({\varvec{B}}_{i}\) = [\({\varvec{B}}'_{i1},..., {\varvec{B}}'_{iL}\), \({\varvec{b}}'_i]'\) relates the coefficients matrix of \({\varvec{B}}_{i}\) to the coefficients of Eq. (5). Therefore, we can formulate \({{\varvec{x}}}_{i}\) = vec\({{\varvec{X}}}_i\), \(\varvec{\beta }_i\) = vec\({\varvec{B}}_{i}\), \(\varvec{\gamma }_i\) = vec\(\varvec{\Gamma }_i\).

The data-generating statistical model is assumed to be as follows, in which the probability for country i has the form

Country coefficients on the variables in \({\mathbb {X}}_{i}\) are assumed to be normally distributed with a mean of \({\varvec{{\overline{\beta }}}}\) and a variance of \(\varvec{\Lambda }_i\) which may vary by country:

The prior for \(\varvec{\Lambda }_i\) and \(\overline{\varvec{\beta }}\) is uniform on the real line and non-informative:

Subsequently, the standard diffuse prior is also applied to the error’s variances:

The Eqs. (7) to (10) define the dynamic models of variables in \({{\varvec{X}}}_i\) and exogenous controls in \({\varvec{W}}\) as particular instances of the unknown underlying model defined by \(\overline{\varvec{\beta }}\).

Mumtaz and Sunder-Plassmann (2021) implemented the hierarchical VAR prior to threshold and regime switching, demonstrating its robustness given that it permits cross-sectional heterogeneity. In such circumstance, regularisation is required because the majority of macroeconomic data contain time series with fewer observations. The Bayesian literature provides several methods for achieving parsimony within the PVAR framework to address this issue. One body of research applies shrinkage priors to various regions of the parameter space, see Koop and Korobilis (2016, 2019). This method theoretically treats the PVAR as a large VAR with asymmetric shrinkage with respect to the coefficients in \(\varvec{\Lambda }_{i}\), \({\varvec{B}}_{i}\), and the free elements of \(\varvec{\Sigma }_{i}\). Canova and Ciccarelli (2004), Canova and Ciccarelli (2009) and Jarociński (2010) make use of the observation that domestic macroeconomic dynamics are relatively similar across countries, implying that the matrices \(\varvec{\Lambda }_{i}\) are comparable. However, interdependencies, whether dynamic or static, are typically disregarded when data from multiple countries are combined by averaging \(\varvec{\Lambda }_{i}\).

The functional form of the prior, which is standard and motivated by computational ease, consists of a normal, uniform, inverted gamma density combined with a degenerated inverted Wishart density for \(\varvec{\Sigma }_i\), making the prior conditionally conjugate. The Bayes theorem is used to calculate the posterior density of the model’s parameters, which is a normalised product of the likelihood and the prior (Jarociński 2010). Due to the prior’s conditional conjugacy, all conditional posterior densities can be conveniently and numerically analysed using the Gibbs sampler because they are all normal, inverted gamma, or inverted Wishart (Gelman et al. 1995).

The estimation procedure employs Gelman et al. (1995)’s hierarchical linear model modified by Jarociński (2010). The concept of similarity is formalised as a Gaussian prior for each country’s coefficients that is centred on the countries’ common mean—an exchangeable prior. This method offers two distinct benefits: (i) we can estimate the cross-country average impulse response to climate risk shocks by averaging the coefficients. In light of this, there is a greater likelihood of estimation precision when information from a panel is utilised as opposed to business cycle dynamics from a single time series. (ii) Since our model allows for heterogeneous effects of climate risk shocks across the panel, the exchangeable prior, or hierarchical prior, implies that the posterior estimates of country-specific impulse responses incorporate panel data. It is essential to note that the precision of estimates for individual countries could potentially be enhanced (Mumtaz and Sunder-Plassmann 2021). Above all, it treats all parameters as random variables and incorporates them into the estimation process, this method is more flexible [also see Jarociński (2010) for details].

3.3.1 Identification Strategy

In this section we set out the identification scheme we use to operationalise our empirical model. We utilise impulse response functions based upon the estimated parameters of our PVAR model to consider the impact of climate risk shocks on economic activity. We are therefore focused upon the effect of a climate risk shock upon GDP. Climate risk can have a contemporaneous impact upon economic activity in our model and this is consistent with weather shocks impacting the economy within year. Our model also allows there to be a more nuanced and data driven interaction and feedback between climate and GDP in the medium to long run. Our panel VAR model therefore allows for a two-way interaction between climate and macroeconomic activity: in theory, temperature can influence GDP growth and respond endogenously to GDP growth. Against this backdrop, we use a recursive identification strategy. Our Choleski factorization of shocks implies macroeconomic activity has no immediate impact on climate change. In computing the orthogonalized impulse response shocks, we typically order climate variables first in bivariate VARs, whether they be temperature growth or uncertainty. We order economic activity last, except when we also include CO2 in our model.

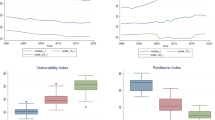

Climate risk, temperature and GDP. Notes: This figure presents average time of series of country temperature levels, temperature growth and GDP growth rates for the period 1901 to 2020. Unweighted averages of all 30 sampled countries. Temperature levels and temperature growth are measured in Degree Celsius and GDP growth are in percentages

Generalized spillover index: temperature changes. Notes: The Generalized Directional Spillover heatmap represents the estimated contribution to the forecast error variance of country i from innovations to country j for temperature using Diebold and Yilmaz (2012). The off-diagonal column sums represent contributions to Others, while the row sums represent contributions from Others; when these are totaled across countries, we get the Spillover Index numerator. The figure indicates that there are considerable temperature linkages from one country to another in our sample, and that therefore climate is international or global in nature. C denotes contribution either from others, to others or to others including own

3.4 Descriptive Statistics

Graphical evidence of the key variables of interest is provided in Fig. 1: which depicts climate risk, temperature changes, temperature levels, and GDP growth rate from 1901 to 2020. It is clear that temperature levels have risen dramatically on average for the countries we sample since the beginning of the last century, and especially over the last sixty year. For our sample of countries, average temperatures have risen by nearly 2 °C over the full sample period. The increase in temperatures is for both advanced and emerging economies. Advanced economies have increased by around 2 °C, while emerging economies have increased 1 °C. Temperature growth has been highly variable over the entire sample period, although with more pronounced and frequent spikes later in the second half of the sample period. Despite some recessions, GDP growth in both advanced and emerging economies has been consistent. The results from Diebold and Yilmaz (2012) applied to our temperature data are provided in Fig. 2. The key message from this figure is that temperatures in one country are linked to temperatures in other countries. This can be gleaned from the sizable spillover percentages in Fig. 2, which are at least 29% and frequently considerably more. We use this preliminary evidence to justify our focus in this paper on the macroeconomic impact of global temperature.

Descriptive statistics are presented in Table 1. In addition to mean, standard deviation, maximum and minimum statistics, we include Pearson correlations. Economic growth has generally be positive over the entire sample period. It is important to note that the correlation between country-specific climate risk (\(\sigma _{it}^{\mathbb {T}}\)) and GDP growth (\(y_{it}\)) is negative and significant, for the entire sample, 1901 to 2020. We find that temperature growth (\({\mathbb {T}}_{it}\)) is positively correlated with GDP growth (\(y_{it}\)) but crucially this is not a statistically significant relationship. In contrast, there is also a positive correlation between the country-specific climate risk (\(\sigma _{it}^{\mathbb {T}}\)) and GDP growth (\(y_{it}\)). However, a negative correlation is observed between univariate climate risk (\(\text {H}^{\mathbb {T}}_{it}\)) and GDP growth (\(y_{it}\)) as well as global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) and GDP growth (\(y_{it}\)). The correlation between global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) and GDP growth (\(y_{it}\)), as well as univariate climate risk (\(\text {H}^{\mathbb {T}}_{it}\)) and GDP growth (\(y_{it}\)), are statistically significant at the 5% level. In terms of carbon emissions (\(\text {CO2}_{it}\)), it is clear that there has been an increase of 0.85 metric tonnes per capita on average per year between 1901 and 2020, with a standard deviation of 1.46 metric tonnes per capita.

The study revealed that there was a discernible pattern of temperature fluctuations, indicating a mean rise of 0.5 °C over the period spanning from 1901 to 2020. Similarly, Alessandri and Mumtaz (2021) find that the volatility in temperature for different economic regions ranges from 0.1 to 0.5 °C. What seems to be surprising is the trend in country-specific and global temperature volatility for our sample. Our evidence suggests that the idiosyncratic (country-specific) and global (common) factor have time variation in volatility. This substantiates the benefit of our approach. There could be heterogeneity. However we have sought to accommodate that by splitting our sample of countries into advanced economies and emerging countries, based upon a demarcation from the World Bank.Footnote 15 We also argue that the Alessandri and Mumtaz (2021)’s approach used in estimating temperature volatility differ from ours. Since we decomposed the univariate climate risk into country-specific and global climate risks, our approach uses latent factors that make \(\Sigma _t\) appear sparser in order to overcome the dimensionality curse.

We have temperature change as our underlying measure of climate. Temperature changes are more likely to have a constant mean. Formally we test for whether the panel time series is non-stationary using panel unit root tests. In particular we use Levin et al. (2002) (LLC) and Im et al. (2003) (IPS) Panel Unit Root tests. These methods applied to temperature changes confirm they are I(0) stationary. Both LLC and IPS have a null hypothesis of panel unit root. The results in Table A2 reject the null hypothesis for the panel time series temperature change (\({\mathbb {T}}_{it}\)) that the data is unit root, since the test statistic is much less than the critical value at the 1% statistical level. Panel unit root tests are employed to test whether the underlying temperature change data has panels containing a unit root. However, our finding suggests that there is no evidence of unit root.

4 Empirical Results

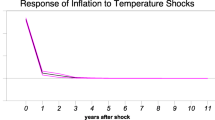

4.1 Climate Risk as Univariate Stochastic Volatility

In this section, we present baseline empirical results of the relationship between climate risk and macroeconomic activity.Footnote 16 To set the scene, we begin by considering the impact of univariate country climate risk upon GDP using standard impulse response analysis. Climate risk based upon univariate stochastic volatility of temperature changes conflates both idiosyncratic and global climate risk. The impact upon GDP of a univariate climate variability shock are presented in Fig. 3. We present three panels of impulse response functions based upon the estimated Panel VAR with univariate climate variability (H\(_{it}^{\mathbb {T}}\)) and GDP growth (\(y_{it}\)).Footnote 17 We plot 10 year response horizons to these climate variability shocks for all 30 countries in our sample. This shall allow us to benchmark the effect of climate variability on macroeconomic activity in general. We see from Fig. 3 that climate risk has an important and negative effect upon GDP. This is because the median posterior response in the top panel of Fig. 3 of economic activity to a univariate climate risk shock for all countries is below zero and the response critical interval does not contain the zero axis. We also present evidence that for both advanced and emerging economies, in the lower panels, climate variability also has a negative effect upon economic activity. After year six, there is a relatively small yet positive effect of univariate climate risk upon growth for all nations. Consistent with our findings, Donadelli et al. (2017) present evidence that univariate temperature variability has a negative relationship with real economic activities. That is, an increase in temperature variability is more likely to reduce overall economic activity through for example, lower labour productivity. Meanwhile, Kotz et al. (2021) document that due to seasonal differences and income levels, low-income countries are more susceptible to greater climate risks. In a separate study, Kotz et al. (2022) confirmed that advanced countries are also not spared the economic impact of climate risk. Burke et al. (2015) confirmed in their study that temperature uncertainty has a negative impact on overall output and increases prices as a result of both supply-side and demand-side shocks. Donadelli et al. (2022) and Sheng et al. (2022) acknowledge that the impact of climate risks on macroeconomic activity is significant and negative. However, the effect is identical to both temperature growth and uncertainty.

Impact of univariate climate variability on GDP. Notes: This figure presents evidence of the impact of univariate climate variability on macroeconomic activity. A measure of risk based upon univariate stochastic volatility comprises idiosyncratic and global climate risk. Specifically the top panel is the impulse response function from a shock to temperature change (univariate stochastic) volatility (H\(_{it}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)) for all countries. Our sample of 30 advanced and emerging economies is between 1901 and 2020. We use a bivariate Panel VAR, PVAR(H\(_{it}^{\mathbb {T}}\), \(y_{it}\)) to produce the impulse responses in this figure. The evidence suggests there is a negative impact from 2 to 4 years. The shock is a one standard deviation increase in risk. These can be convert to one unit shocks by dividing by the standard deviation of the original series. We include the posterior median of the shock (red) and 68% critical band or posterior coverage band (grey)

Global and country specific climate risk impact upon GDP. Notes: This figure presents evidence of the impact of global and country specific climate risk on macroeconomic activity. Specifically the left column is the impulse response function from a shock to idiosyncratic country climate risk (\(\sigma _{it}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)). The right column of panels are global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)). Our sample of 30 advanced and emerging economies between 1901 and 2020. We use a trivariate Panel VAR, PVAR(\(\sigma _{it}^{\mathbb {T}}\), \(\sigma _{Ft}^{\mathbb {T}}\), \(y_{it}\)). The evidence suggests the impact on macroeconomic activity of a country specific climate risk shock is more rapid, negative and short-lived. The shock is a one standard deviation increase in risk. Global climate risk, on the other hand, is an important determinant of macroeconomic activity. A global climate risk shock could either impede or promote macroeconomic activity. We include the posterior median of the shock (red) and 68% critical band or posterior coverage band (grey)

4.2 Climate Risk and Factor Stochastic Volatility

4.2.1 Full Sample

Having considered the impact of univariate climate risk on GDP, we now look to our main results, which differentiate global and idiosyncratic climate risk. Figure 4 presents the core results of the impact of global and idiosyncratic climate risk on macroeconomic activity. We initially focus in Fig. 4 on the impact of country specific risk (\(\sigma _{it}^{\mathbb {T}}\)) in panel (i) and global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) in panel (ii), delineated by the factor stochastic volatility model for the full sample period. Evidence from the core results suggests that shocks to country-specific climate risk are relatively less important for macroeconomic activity. While the effect of idiosyncratic risk is generally negative, critical intervals are close to zero indicating less evidence of a substantial impact. Global climate risk is a relatively more important determinant of macroeconomic activity. This is indicated by the larger negative GDP response to a global risk shock after year three. It takes several years for the full effect of a global climate risk shock to feed the way through GDP.

In the past few years, the cross-sectional and distributional ramifications of climate change have been debated. It has been argued that rising temperatures may only or largely affect impoverished countries that are heavily dependent on agriculture and have low capacity for response to climate change (Burke et al. 2015; Feng and Kao 2021; Kiley 2021; Kotz et al. 2022). In line with this argument, we split our sample into advanced and emerging countries to investigate the impact of climate risk on these distinct country groupings. The outcome for advanced and emerging economies depicted in Fig. 4 as Panel (iii), (iv), (v) and (vi). The Fig. 4 emphasizes that both advanced and emerging economies are more susceptible to global risk shocks, than to idiosyncratic climate shocks. This is a surprising result, since typically poorer countries are considered to be more likely to be effected by climate change. But our results would indicate that this distinction within our modeling context may have been over emphasized.

4.2.2 Later Sample

It may be the case that climate change is a more recent phenomenon and its impact is different in more recent decades. We examined the exogenous impact therefore of country-specific and the global climate risks on GDP growth from 1950 to 2020 in a separate empirical model. To comprehend how climate risk has contributed to the overall macroeconomic activities of selected countries, we tend to focus on the post-war period. This sample is comparable to those from Alessandri and Mumtaz (2021) and Donadelli et al. (2022). Figure 5 illustrates the outcome for the post 1950 sample. We find stronger evidence that shocks to country-specific climate risk have no effect on GDP growth. We identify an initially negative and important impact of the global risk shock on GDP, with a maximum at year four. This is irrespective of whether we consider advanced or emerging countries. There does seem to be overshooting of GDP after the initial negative shock as additional volatility is induced into GDP by the global climate risk shock, which eventually abates as the response returns to zero.

Impact of climate risk on GDP: post 1950 period. Notes: This figure presents evidence of the impact of climate risk on macroeconomic activity. Specifically the left panel is the impulse response function from a shock to country climate risk (\(\sigma _{it}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)). The right column of panels are global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)). Our sample of 30 advanced and emerging economies between 1950 and 2020. We use a trivariate Panel VAR, PVAR(\(\sigma _{it}^{\mathbb {T}}\), \(\sigma _{Ft}^{\mathbb {T}}\), \(y_{it}\)). The evidence suggests the impact on macroeconomic activity of a climate risk shock is more rapid, negative and pronounced. The shock is a one standard deviation increase in risk. Global climate risk, on the other hand, is an important determinant of macroeconomic activity. A global climate risk shock could either impede or promote macroeconomic activity. We include the posterior median of the shock (red) and 68% critical band or posterior coverage band (grey)

4.3 Robustness/Extension

4.3.1 Climate Risk Impact on GDP Per Capita

From a development standpoint, GDP per capita growth may be more interesting to capture macroeconomic activity, since it also has implications for average living standards. To understand the dynamics of shocks to country-specific climate risk, and the global climate risk from a development perspective, in the spirit of Dell et al. (2012) and Donadelli et al. (2017), we substitute GDP growth with GDP per capita growth in our baseline model. According to the findings in Fig. 4, global climate risk is important for macroeconomic activity. The short run impact is rapid, sizable and negative. This findings is an indication of the robustness of our baseline model with GDP growth (as shown in Fig. 6).

Robustness/extension. Notes: This figure presents evidence of the impact of climate risk on macroeconomic activity, comparing the impact on GDP per capita and GDP. Specifically the left column of panels are the impulse response function from a shock to country climate risk (\(\sigma _{it}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)) and GDP per capita (\(ypc_{it}\)). The right column of panels are global climate risk (\(\sigma _{Ft}^{\mathbb {T}}\)) upon GDP growth (\(y_{it}\)) and GDP per capita (\(ypc_{it}\)). Our sample of 30 advanced and emerging economies between 1901 and 2020. We use a trivariate Panel VAR, PVAR(\(\sigma _{it}^{\mathbb {T}}\), \(\sigma _{Ft}^{\mathbb {T}}\), \(ypc_{it}\)) for panel (i) and (ii). Panel (iii) and (iv) use a four-variable Panel VAR, PVAR(\(\sigma _{it}^{\mathbb {T}}\), \(\sigma _{Ft}^{\mathbb {T}}\), \(ypc_{it}\), \(\text {CO2}_{it}\)). The evidence suggests the impact on GDP per capita of a climate risk shock is more rapid, negative and pronounced. Meanwhile, country specific shocks impact on GDP growth is not important. The shock is a one standard deviation increase in risk. Global climate risk, on the other hand, is an important determinant of macroeconomic activity. A global climate risk shock could impede and later promote macroeconomic activity. We include the posterior median of the shock (red) and 68% critical band or posterior coverage band (grey)

4.3.2 Climate Risk Impact on GDP Volatility

Higher temperature risks increase growth risks; perhaps a GDP contraction arises from the combined impact of higher climatic and economic uncertainty. As a result, the transmission mechanism is based on risk rather than actual temperature changes.Footnote 18 In contrast to this argument, we show that the impact of shocks on country-specific climate risk is not important for GDP growth volatility. It is worth noting that even with our later sample, the impact of both country-specific and global climate risk are not important for GDP growth volatility. Overall, we find that climate risk impact on GDP growth is homogeneous.

4.3.3 Climate Risk, Carbon Emissions and GDP Growth

Pindyck (2021) emphasises the importance of carbon emissions as the largest contributor to greenhouse gas emissions, which cause global warming in the long run by affecting atmospheric carbon concentration and influencing temperature through climate change. We examined aggregate outcomes directly in our baseline model, ignoring a priori assumptions about which mechanisms to include and how they might interact, operate, and combine. Furthermore, we used temperature fluctuations with the intention of isolating their effects from time-invariant country characteristics.

We expand our baseline model to include carbon emissions in order to better understand the mechanism or transmission channel between climate risk and macroeconomic activity, i.e., country-specific climate risk, global climate risk, and GDP growth. We discovered that the results of our baseline model do not differ from the results of the extended model with carbon emissions. Our findings suggest that country-specific climate risk are unimportant for macroeconomic activity, despite a negative impact in the 2 years following the shock. Global climate risk, on the other hand, is an important determinant of macroeconomic activity. In the initial phase of a global climate risk shock, macroeconomic activity may be hindered; however, macroeconomic activity is subsequently boosted as shown in Fig. 6. Notably, the timing of the impacts is similar for our full and post-1950 samples in the baseline models. Consistently, we have demonstrated that global climate risk is important and could adversely (positively) impact macroeconomic activity, as suggested by our post 1950-sample. More robustness and extension analyses are presented in online Appendix B.

4.3.4 Further Robustness

In this subsection we consider further robustness and extensions of our approach. These include using dynamic panel methods robust to endogeneity, controlling for temperature levels, and alternative identification of shocks. To account for endogeneity and whether our evidence is contingent upon specific empirical methods we can generalise our results by using Generalised Methods of Moments (GMM) estimation from Blundell and Bond (1998), Blundell et al. (2001), Blundell and Bond (2000) and Windmeijer (2005). Also whilst Bai and Ng (2006, 2008b) and Bai and Ng (2008a) show in linear models that the factor estimates can be treated as known if \(\sqrt{T}/N \rightarrow 0\), as in our case, there may be a question whether generated regressors drive our results. We go with the grain of Pagan (1984) and use GMM to circumnavigate this potential issue to obtain consistent estimates of the relationship between climate risk and macroeconomic activity. We find evidence of a stronger and more deleterious impact upon macroeconomic activity from the global climate risk factor, relative to idiosyncratic results, using dynamic panel systems GMM, including with robust standard errors. These results are provided in Online Appendix C. Finally, we re-ordered the variables in a benchmark VAR with GDP, idiosyncratic and global climate risk to examine whether benchmark results from impulse responses were order invariant. We found evidence that our impulse responses were not sensitive to the ordering of the variables in the VAR.

5 Conclusion

Temperature increases have been shown to have an adverse effect on economic growth, especially in developing countries (see Dell et al. 2012; Burke et al. 2015; Feng and Kao 2021; Kotz et al. 2021, among others). This study demonstrates how climate change affects macroeconomic activity via a volatility channel. We used the Bayesian Panel VAR with hierarchical prior to estimate the VAR coefficients of macroeconomic activity and climate risk for 17 advanced and 13 emerging economies for the period 1901 to 2020. No other papers as far as we are aware have applied factor stochastic volatility to model global risk, consistent with the notion from Stern (2008) that climate change is global in character. Our results highlight that there is a powerful negative impact from global climate risk on macroeconomic activity.

To allow for country heterogeneity, we also differentiate the impact of climate risk upon advanced and emerging economies. Intriguingly, we discover that both advanced and emerging countries are negatively affected by climate risk shocks. Existing literature has focused on country-based risk shocks, but our findings indicate that idiosyncratic or country-specific climate risk shocks are relatively unimportant. On the other hand, global climate risk has a negative and relatively more important impact on macroeconomic activity. Our research illustrates that both advanced and emerging countries are vulnerable to global climate risk shocks, which extends the important work of Alessandri and Mumtaz (2021) on univariate climate risk to examine the global dimension of climate change. Notably, it seems that the common volatility in temperature changes is quantitatively more important for GDP than the idiosyncratic volatility in temperature changes. In accordance with Stern (2008), we also find that the impact of climate risk on macroeconomic activity is far-reaching and potentially long-lasting. It is essential to recognise that countries’ temperature changes are interconnected, as evidenced by substantial spillovers. This discovery supports and justifies the significance of our findings. In addition, the capability of our econometric method to capture cross-sectional heterogeneity and spillovers makes our findings robust and noteworthy.

One potential limitation to our research that we do not differentiate various forms of shocks. We leave to future research discussion of modelling underpinning shocks to climate variability and how they can impact GDP depending upon the source of shock. Additionally, our study fails to consider additional external factors, such as policy responses, adaptive strategies, or technological advancements, which have the potential to either mitigate or exacerbate the effects of climate risks. Hence, it is plausible that dynamic models that effectively capture the dynamic nature of the relationship between climate risk and macroeconomic activity, taking into consideration the temporal changes in climate patterns, economic conditions, and policies, may provide valuable insights into this phenomenon. This could also encompass the examination of policy measures, international cooperation, and their resultant effects.

Notes

Nordhaus and Moffat (2017) considered several existing analyses on the macroeconomic implications of climate change using a systematic research synthesis. They found that the damage to income ranged from over 2% to over 8%, depending upon whether there was 3 °C or 6 °C warming. See also Weitzman (2007), Tol (2009), Burke et al. (2015), Donadelli et al. (2017), Alessandri and Mumtaz (2021), Kotz et al. (2021), Kahn et al. (2021), Pindyck (2021), Donadelli et al. (2022), and Kotz et al. (2022).

See Cascaldi-Garcia et al. (2023) for an extensive discussion of empirical measures of uncertainty and risk.

Sheng et al. (2022) demonstrate that volatility in temperature growth decelerates economic activity roughly five times more than when temperature growth increases by the same amount in the higher uncertainty-based domain of a nonlinear model.

These studies investigated the link between climate change as in temperature, rainfall and precipitation growth on aggregate production and consumption and in general economic productivity or economic growth (Hassler et al. 2016; Stern 2016; Nordhaus and Moffat 2017; Alessandri and Mumtaz 2021; Kotz et al. 2021, 2022).

Brenner and Lee (2014) anticipate a substantial increase in the global average temperature in the coming decades. They analyse historical temperature and precipitation variations to determine whether changes in temperature and precipitation are connected with economic growth declines.

Countries include both advanced and emerging economies. These are Australia, Belgium, Canada, Switzerland, Germany, Denmark, Spain, Finland, France, United Kingdom, Italy, Japan, Netherlands, Portugal, Sweden, United States, Norway, Argentina, Bolivia, Brazil, Chile, Colombia, Cuba, Indonesia, India, Sri Lanka, Mexico, Peru, Uruguay, and Venezuela. Further details on our data set can be found in Table A3 in the appendix.

Gavriilidis (2021) develops an index for climate policy uncertainty to measure the volatility of climate change policy and its related implications for the US. Our work is focused upon developing a more broad based multi-country measure of climate uncertainty.

The efficiency of sampling in Bayesian inference for stochastic volatility models using Markov Chain Monte Carlo (MCMC) methods is heavily contingent upon the specific values of the parameters being estimated. The standard centre parameterization of posterior draws is inadequate in cases where the volatility of the volatility parameter in the latent state equation is low. Conversely, non-centered versions of the model exhibit shortcomings when applied to highly persistent latent variable series. The efficacy of the ancillarity-sufficiency interweaving technique in addressing these challenges across various multilevel models has been substantiated (Yu and Meng 2011; Kastner and Frühwirth-Schnatter 2014).

The efficiency of sampling in Bayesian inference for stochastic volatility models using Markov Chain Monte Carlo (MCMC) methods is heavily contingent upon the specific values of the parameters being estimated. The standard centre parameterization of posterior draws is inadequate in cases where the volatility of the volatility parameter in the latent state equation is low. Conversely, non-centered versions of the model exhibit shortcomings when applied to highly persistent latent variable series. The efficacy of the ancillarity-sufficiency interweaving technique in addressing these challenges across various multilevel models has been substantiated (Yu and Meng 2011; Kastner and Frühwirth-Schnatter 2014).

Further information on the parameters associated with model estimation are reported in Table A5 in the online appendix.

See Online Appendix A for the methodology underpinning H\(_{it}^{\mathbb {T}}\).

Alessandri and Mumtaz (2021) argue that shocks to temperature volatility trigger a positive impact on GDP growth volatility.

References

Alessandri P, Mumtaz H (2021) The macroeconomic cost of climate volatility. Queen Mary University of London working paper, 928

Andersen TG, Chung H-J, Sørensen BE (1999) Efficient method of moments estimation of a stochastic volatility model: a Monte Carlo study. J Econom 91(1):61–87

Ang A, Hodrick RJ, Xing Y, Zhang X (2009) High idiosyncratic volatility and low returns: international and further US evidence. J Financ Econ 91(1):1–23

Arias P, Bellouin N, Coppola E, Jones R, Krinner G, Marotzke J, Naik V, Palmer M, Plattner G-K, Rogelj J et al (2021) Climate change 2021: the physical science basis. In: Contribution of working group 14 i to the sixth assessment report of the intergovernmental panel on climate change; technical summary. Intergovernmental Panel on Climate Change Report

Bai J, Ng S (2006) Confidence intervals for diffusion index forecasts and inference for factor-augmented regressions. Econometrica 74(4):1133–1150

Bai J, Ng S (2008a) Extremum estimation when the predictors are estimated from large panels. Ann Econ Finance 9(2):201–222

Bai J, Ng S (2008b) Large dimensional factor analysis. Foundations and Trends in®. Econometrics 3(2):89–163

Baker SR, Bloom N, Davis SJ (2016) Measuring economic policy uncertainty. Q J Econ 131(4):1593–1636

Batten S (2018) Climate change and the macro-economy: a critical review. Bank of England working papers, 706

Batten S, Sowerbutts R, Tanaka M (2020) Climate change: macroeconomic impact and implications for monetary policy. In: Walker T, Gramlich D, Bitar M, Fardnia P (eds) Ecological, societal, and technological risks and the financial sector. Palgrave studies in sustainable business in association with future earth. Palgrave Macmillan, Cham, p 13

Beckmann J, Berger T, Czudaj R (2019) Gold price dynamics and the role of uncertainty. Quant Finance 19(4):663–681

Berestycki C, Carattini S, Dechezleprêtre A, Kruse T (2022) Measuring and assessing the effects of climate policy uncertainty. OECD Economics Department working papers, 1724

Bernanke BS (1983) Irreversibility, uncertainty, and cyclical investment. Q J Econ 98(1):85–106

Bloom N (2009) The impact of uncertainty shocks. Econometrica 77(3):623–685

Bloom N, Floetotto M, Jaimovich N, Saporta-Eksten I, Terry SJ (2018) Really uncertain business cycles. Econometrica 86(3):1031–1065

Blundell R, Bond S (1998) Initial conditions and moment restrictions in dynamic panel data models. J Econom 87(1):115–143

Blundell R, Bond S (2000) GMM estimation with persistent panel data: an application to production functions. Econom Rev 19(3):321–340

Blundell R, Bond S, Windmeijer F (2001) Estimation in dynamic panel data models: improving on the performance of the standard GMM estimator. In: Baltagi BH, Fomby TB, Carter Hill R. (eds.) Nonstationary panels, Panel cointegration, and Dynamic panels, pp 53–91

Brenner T, Lee D (2014) Weather conditions and economic growth-is productivity hampered by climate change? Technical Report 06.14, working papers on innovation and space

Burke M, Hsiang SM, Miguel E (2015) Global non-linear effect of temperature on economic production. Nature 527:235–239

Canova F, Ciccarelli M (2004) Forecasting and turning point predictions in a Bayesian panel VAR model. J Econom 120(2):327–359

Canova F, Ciccarelli M (2009) Estimating multicountry VAR models. Int Econ Rev 50(3):929–959

Carleton TA, Hsiang SM (2016) Social and economic impacts of climate. Science 353(6304):aad9837

Carriero A, Clark TE, Marcellino M (2018) Measuring uncertainty and its impact on the economy. Rev Econ Stat 100(5):799–815

Cascaldi-Garcia D, Sarisoy C, Londono JM, Sun B, Datta DD, Ferreira T, Grishchenko O, Jahan-Parvar MR, Loria F, Ma S, Rodriguez M, Zer I, Rogers J (2023) What is certain about uncertainty? J Econ Lit 61(2):624–54

Cashin P, Mohaddes K, Raissi M (2017) Fair weather or foul? The macroeconomic effects of El Niño. J Int Econ 106:37–54

Ciccarelli M, Marotta F (2021) Demand or supply? An empirical exploration of the effects of climate change on the macroeconomy. Technical report, ECB working paper

Creal DD, Wu JC (2017) Monetary policy uncertainty and economic fluctuations. Int Econ Rev 58(4):1317–1354

Dell M, Jones BF, Olken BA (2012) Temperature shocks and economic growth: evidence from the last half century. Am Econ J Macroecon 4(3):66–95

Diebold FX, Yilmaz K (2012) Better to give than to receive: predictive directional measurement of volatility spillovers. Int J Forecast 28(1):57–66

Donadelli M, Grüning P, Jüppner M, Kizys R (2021) Global temperature, R &D expenditure, and growth. Energy Econ 104:105608

Donadelli M, Jüppner M, Riedel M, Schlag C (2017) Temperature shocks and welfare costs. J Econ Dyn Control 82:331–355

Donadelli M, Jüppner M, Vergalli S (2022) Temperature variability and the macroeconomy: a world tour. Environ Resour Econ 83(1):221–259

Feng Q, Kao C (2021) Large-dimensional panel data econometrics: testing, estimation and structural changes. World Scientific, Singapore

Fernández A, González A, Rodriguez D (2018) Sharing a ride on the commodities roller coaster: common factors in business cycles of emerging economies. J Int Econ 111:99–121

Foerster AT, Sarte P-DG, Watson MW (2011) Sectoral versus aggregate shocks: a structural factor analysis of industrial production. J Polit Econ 119(1):1–38

Gavriilidis K (2021) Measuring climate policy uncertainty. Available at SSRN 3847388

Gelman A, Carlin JB, Stern HS, Rubin DB (1995) Bayesian data analysis. Chapman and Hall/CRC, London

Giglio S, Kelly B, Stroebel J (2021) Climate finance. Annu Rev Financ Econ 13(1):15–36

Hassler J, Krusell P, Smith Jr, AA (2016) Environmental macroeconomics. In: Taylor JB, Uhlig H (eds.) Handbook of macroeconomics, vol 2. Elsevier, New York, pp 1893–2008

Herskovic B, Kelly B, Lustig H, Van Nieuwerburgh S (2016) The common factor in idiosyncratic volatility: quantitative asset pricing implications. J Financ Econ 119(2):249–283

Hosszejni D, Kastner G (2021) Modeling univariate and multivariate stochastic volatility in R with stochvol and factorstochvol. J Stat Softw 100(12):1–34

Houghton E (1996) Climate change 1995: the science of climate change: contribution of working group I to the second assessment report of the intergovernmental panel on climate change, vol 2. Cambridge University Press, Cambridge

Huber F, Krisztin T, Pfarrhofer M (2018) A Bayesian Panel VAR model to analyze the impact of climate change on high-income economies. Ann Appl Stat arXiv. Preprint arXiv:1804.01554

Im KS, Pesaran MH, Shin Y (2003) Testing for unit roots in heterogeneous panels. J Econom 115(1):53–74

Jarociński M (2010) Responses to monetary policy shocks in the East and the West of Europe: a comparison. J Appl Economet 25(5):833–868

Jurado K, Ludvigson SC, Ng S (2015) Measuring uncertainty. Am Econ Rev 105(3):1177–1216

Kahn ME, Mohaddes K, Ng RN, Pesaran MH, Raissi M, Yang J-C (2021) Long-term macroeconomic effects of climate change: a cross-country analysis. Energy Econ 104:105624

Kastner G, Frühwirth-Schnatter S (2014) Ancillarity-sufficiency interweaving strategy (ASIS) for boosting MCMC estimation of stochastic volatility models. Comput Stat Data Anal 76:408–423

Kastner G, Frühwirth-Schnatter S, Lopes HF (2014) Analysis of exchange rates via multivariate Bayesian factor stochastic volatility models. In: The contribution of young researchers to Bayesian statistics. Springer, New York, pp 181–185

Khalfaoui R, Mefteh-Wali S, Viviani J-L, Jabeur SB, Abedin MZ, Lucey BM (2022) How do climate risk and clean energy spillovers, and uncertainty affect US stock markets? Technol Forecast Soc Chang 185:122083

Kiley MT (2021) Growth at risk from climate change. FEDS working paper, finance and economics discussion series, 2021-054

Kim HS, Matthes C, Phan T (2021) Extreme weather and the macroeconomy. Available at SSRN 3918533

Koop G, Korobilis D (2016) Model uncertainty in panel vector autoregressive models. Eur Econ Rev 81:115–131

Koop G, Korobilis D (2019) Forecasting with high-dimensional panel VARs. Oxford Bull Econ Stat 81(5):937–959

Kose MA, Otrok C, Whiteman CH (2003) International business cycles: world, region, and country-specific factors. Am Econ Rev 93(4):1216–1239

Kotz M, Levermann A, Wenz L (2022) The effect of rainfall changes on economic production. Nature 601(7892):223–227

Kotz M, Wenz L, Stechemesser A, Kalkuhl M, Levermann A (2021) Day-to-day temperature variability reduces economic growth. Nat Clim Change 11(4):319–325

Levin A, Lin C-F, Chu C-SJ (2002) Unit root tests in panel data: asymptotic and finite-sample properties. J Econ 108(1):1–24

Moore FC, Diaz DB (2015) Temperature impacts on economic growth warrant stringent mitigation policy. Nat Clim Change 5(2):127–131

Mumtaz H, Sunder-Plassmann L (2021) Nonlinear effects of government spending shocks in the USA: evidence from state-level data. J Appl Economet 36(1):86–97

Mumtaz H, Theodoridis K (2017) Common and country specific economic uncertainty. J Int Econ 105:205–216

Nordhaus W (2019) Climate change: the ultimate challenge for economics. Am Econ Rev 109(6):1991–2014

Nordhaus WD, Moffat A (2017) A survey of global impacts of climate change: replication, survey methods, and a statistical analysis. NBER working paper, 23646:1–39

O’Brien KL, Leichenko RM (2000) Double exposure: assessing the impacts of climate change within the context of economic globalization. Glob Environ Change 10(3):221–232

Pagan A (1984) Econometric issues in the analysis of regressions with generated regressors. Int Econ Rev 25(1):221–247

Pindyck RS (2021) What we know and don’t know about climate change, and implications for policy. Environ Energy Policy Econ 2(1):4–43

Pitt MK, Shephard N (1999) Time varying covariances: a factor stochastic volatility approach. Bayesian Stat 6:547–570

Pretis F, Schwarz M, Tang K, Haustein K, Allen MR (2018) Uncertain impacts on economic growth when stabilizing global temperatures at 1.5 Degree Celsius or 2 Degree Celsius warming. Philos Trans R Soc A Math Phys Eng Sci 376(2119):20160460

Schleypen JR, Mistry MN, Saeed F, Dasgupta S (2022) Sharing the burden: quantifying climate change spillovers in the European Union under the Paris Agreement. Spat Econ Anal 17(1):67–82

Sheng X, Gupta R, Çepni O (2022) The effects of climate risks on economic activity in a panel of US States: the role of uncertainty. Econ Lett 213:110374

Stern N (2008) The economics of climate change. Am Econ Rev 98(2):1–37

Stern N (2016) Economics: current climate models are grossly misleading. Nature 530(7591):407–409

Su C-W, Yuan X, Tao R, Shao X (2022) Time and frequency domain connectedness analysis of the energy transformation under climate policy. Technol Forecast Soc Chang 184:121978

Tol RS (2009) The economic effects of climate change. J Econ Perspect 23(2):29–51

Weitzman ML (2007) A review of the stern review on the economics of climate change. J Econ Lit 45(3):703–724

Windmeijer F (2005) A finite sample correction for the variance of linear efficient two-step GMM estimators. J Econom 126(1):25–51

Yu Y, Meng X-L (2011) To center or not to center: that is not the question-an ancillarity-sufficiency interweaving strategy (ASIS) for boosting MCMC efficiency. J Comput Graph Stat 20(3):531–570