Abstract

In this paper, a comparative analysis of traditional and hybrid root finding algorithms is performed in estimating implied volatility for Ethereum Options using the Black–Scholes model. Results indicate the efficiency of Newton–Raphson method in terms of algorithmic convergence as well as computational time. Since Newton–Raphson method may not always lead to convergence, the best approximation technique is chosen from the convergent bracketed methods. The hybrid Bisection–Regula Falsi method serves as the best choice for root estimation among the bracketed methods under consideration.

Similar content being viewed by others

Data Availability

The data that support the findings of this study are available from the first author upon reasonable request.

Code Availability

Programming codes implemented in this study are available from the first author upon reasonable request.

References

Ashmore, D. (2023, May 5). Bitcoin price history 2009 to 2022. Forbes Advisor India. https://www.forbes.com/advisor/in/investing/cryptocurrency/bitcoin-price-history-chart/

Badr, E., Almotairi, S., & Ghamry, A. E. (2021). A comparative study among new hybrid root finding algorithms and traditional methods. Mathematics, 9(11), 1306.

Bandi, F. M., & Reno, R. (2016). Price and volatility co-jumps. Journal of Financial Economics, 119(1), 107–146.

Binance. (2017). Binance—Cryptocurrency exchange for Bitcoin, ethereum and altcoins. https://www.binance.com

Blazevic, D., & Marcusson, F. (2019). Volatility evaluation using conditional heteroscedasticity models on bitcoin. Ethereum and Ripple.

Chi, Y., & Hao, W. (2021). Volatility models for cryptocurrencies and applications in the options market. Journal of International Financial Markets, Institutions and Money, 75, 101421.

Deribit—Crypto Options and Futures Exchange for Bitcoin, Ethereum, Solana and More. (2016). Crypto options and futures exchange—Deribit. https://www.deribit.com/

du Plooy, R., & Venter, P. J. (2021). Pricing vanilla options using artificial neural networks: Application to the South African market. Cogent Economics & Finance, 9(1), 1914285.

Duan, J. C. (1995). The GARCH option pricing model. Mathematical Finance, 5(1), 13–32.

Ethereum, W. (2014). Ethereum whitepaper. Ethereum. https://ethereum.org

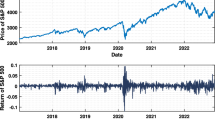

Ethereum’s Price History. (2013–2023, $). Prices of Ethereum on a daily basis. https://www.globaldata.com/data-insights/financial-services/ethereums-price-history/

Fang, F., Ventre, C., Basios, M., Kanthan, L., Martinez-Rego, D., Wu, F., & Li, L. (2022). Cryptocurrency trading: A comprehensive survey. Financial Innovation, 8(1), 1–59.

Giudici, G., Milne, A., & Vinogradov, D. (2020). Cryptocurrencies: Market analysis and perspectives. Journal of Industrial and Business Economics, 47, 1–18.

Hou, A. J., Wang, W., Chen, C. Y., & Härdle, W. K. (2020). Pricing cryptocurrency options. Journal of Financial Econometrics, 18(2), 250–279.

Investopedia. (2023a, March 31). Derivatives: Types, considerations, and pros and cons. https://www.investopedia.com/terms/d/derivative.asp

Investopedia. (2023b, April 24). What are options? Types, spreads, example, and risk metrics. https://www.investopedia.com/terms/o/option.asp

Investopedia. (2023c, April 18). Why should anyone invest in crypto? https://www.investopedia.com/tech/question-why-should-anyone-invest-crypto/

Jalan, A., Matkovskyy, R., & Aziz, S. (2021). The Bitcoin options market: A first look at pricing and risk. Applied Economics, 53(17), 2026–2041.

Katsiampa, P. (2017). Volatility estimation for Bitcoin: A comparison of GARCH models. Economics Letters, 158, 3–6.

Liang, S., & Tahara, Y. (2009). A formula to compute implied volatility, with error estimate. Interdisciplinary Information Sciences, 15(2), 267–272.

Liu, S., Oosterlee, C. W., & Bohte, S. M. (2019). Pricing options and computing implied volatilities using neural networks. Risks, 7(1), 16.

Mahrudinda, M., Munandar, D., & Purwani, S. (2021). Efficiency and convergence of Bisection, Secant, and Newton Raphson methods in estimating implied volatility. World Scientific News, 153(2), 157–168.

Manaster, S., & Koehler, G. (1982). The calculation of implied variances from the Black-Scholes model: A note. The Journal of Finance, 37(1), 227–230.

Mansouri, P., Asady, B., & Gupta, N. (2015). The bisection–artificial bee colony algorithm to solve fixed point problems. Applied Soft Computing, 26, 143–148.

Options Strategies Center. (2023). What is implied volatility and why is it important in option trading?s. https://optionstrategiesinsider.com/blog/what-is-implied-volatility-and-why-is-it-important-in-option-trading/

Pagnottoni, P. (2019). Neural network models for Bitcoin option pricing. Frontiers in Artificial Intelligence, 2, 5.

PitchBook. (2023). 13 VC firms investing in blockchain and cryptocurrency. https://pitchbook.com/blog/vc-firms-investing-in-blockchain-and-cryptocurrency

Sabharwal, C. L. (2019). Blended root finding algorithm outperforms bisection and regula falsi algorithms. Mathematics, 7(11), 1118.

Sapna, S., & Mohan, B. R. (2023). Estimation of implied volatility for Ethereum options using numerical approximation methods. In: Key Digital Trends Shaping the Future of Information and Management Science. ISMS 2022. Lecture Notes in Networks and Systems (Vol. 671). Springer.

Scholes, M., & Black, F. (1973). The pricing of options and corporate liabilities. Journal of Political Economy, 81(3), 637–654.

Taneja, H. C., Batra, L., & Gaur, P. (2019, December). Entropy as a measure of implied volatility in options market. In AIP Conference proceedings (Vol. 2183, No. 1, p. 110005). AIP Publishing LLC.

Venter, P. J., Mare, E., & Pindza, E. (2020). Price discovery in the cryptocurrency option market: A univariate GARCH approach. Cogent Economics and Finance, 8(1), 1803524.

Venter, P. J., & Maré, E. (2021). Univariate and multivariate GARCH models applied to Bitcoin futures option pricing. Journal of Risk and Financial Management, 14(6), 261.

Wintermeyer, L. (2021, August 12). Institutional money is pouring into the crypto market and its only going to grow. Forbes. https://www.forbes.com/sites/lawrencewintermeyer/2021/08/12/institutional-money-is-pouring-into-the-crypto-market-and-its-only-going-to-grow/

Woebbeking, F. (2021). Cryptocurrency volatility markets. Digital Finance, 3(3–4), 273–298.

Zulfiqar, N., & Gulzar, S. (2021). Implied volatility estimation of bitcoin options and the stylized facts of option pricing. Financial Innovation, 7, 1–30.

Acknowledgements

The authors would like to thank the reviewers for their valuable comments and suggestions to improve the quality of the paper.

Funding

Not applicable.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Sapna, S., Mohan, B.R. Comparative Analysis of Root Finding Algorithms for Implied Volatility Estimation of Ethereum Options. Comput Econ (2023). https://doi.org/10.1007/s10614-023-10446-8

Accepted:

Published:

DOI: https://doi.org/10.1007/s10614-023-10446-8