Abstract

This paper focuses on studying the influence of diversification on systemic risk for networks, which consist of a set of companies holding common assets. Diversification prevents initial company failures, but permits financial contagions due to companies’ overlapping asset portfolios. We comprehensively study diversification’s effect on systemic risk by proposing not only three different measurements of systemic risk, but also an algorithm to increase a Poisson-random network’s diversification in simulations. The numerical results show that whether risk is measured in terms of the number of failed companies or the total assets’ loss of value, diversification and systemic risk exhibit an inverted U-shaped relationship. The mechanism to generate such a relationship is further analyzed by combining the tradeoff effect of diversification on both the initial risk and risk contagion. Moreover, we find that the inverted U-shaped relationship between diversification and systemic risk is more significant when the assets correlate less. Finally, we propose new methods for measuring general networks’ level of diversification, for which average degree of company nodes divided by number of companies is affirmed to be more appropriate via simulations performed on different sized random networks and a further analysis of the 2007 U.S. commercial banks balance sheet data. The mechanism to generate the relationship between diversification and systemic risk—as well as their measurement methods—provide valuable references for networks’ risk control and structure optimization.

Similar content being viewed by others

Data Availability

The datasets and material used in the current study are available from the corresponding author on reasonable request.

Code Availability

This paper uses MATLAB to perform simulations and the code are available from the corresponding author on reasonable request.

Notes

We would like to point out that whether the initially generated random network obeys the Poisson distribution is not essential. The only requirement here is that the level of diversification of an initially generated random network is sufficiently low. If the Poisson network is replaced by a regular network in which each company nodes' degree is 1, all the simulation results are not affected.

\(k\) is a sequence number indicating the \(k\)-th network that is randomly generated. Each time when new edges are added to an existing network to slightly increase the level of diversification of the network, a new network is generated, and the value of \(k\) is increased by 1. \(s\) is a sequence number indicating the \(s\)-th random external shock, and different external shocks are generated independently of each other. The maximum \(s\) is set to be a fixed value \(M\). Any network will be subject to \(M\) kinds of initial external shocks.

In the algorithm, the level of diversification of an existing network is gradually increased by constantly adding new edges, and many new networks are generated. Once a network is fully connected, its level of diversification is the largest and the whole program terminates. At this time, the sequence number of the network \(k\) is marked as \(N\). Only when the program terminates can how many networks have been generated in total, that is, the value of N, be determined.

The initial risk here is only considered given the percentage of initially failed companies, rather than the network’s ratio of initial losses of asset value. This is primarily because at the initial moment, all networked companies’ loss of value occurs with simply a loss of value from all the assets themselves, which does not pertain to the network’s structure, including the level of diversification.

Data source: https://wrds-web.wharton.upenn.edu/wrds/.

Data source: http://www.fdic.gov/bank/individual/failed/banklist.html.

The networks of the three states, Florida (FL), Georgia (GA) and Illinois (IL), with the largest proportion of bank failures, are applied to test the validation of our model. The results are shown in Appendix C.2.

References

Acemoglu, D., Carvalho, V. M., Ozdaglar, A., et al. (2012). The network origins of aggregate fluctuations[J]. Econometrica, 80(5), 1977–2016.

Acemoglu, D., Ozdaglar, A., & Tahbaz-Salehi, A. (2015). Systemic risk and stability in financial networks[J]. American Economic Review, 105(2), 564–608.

Allen, F., Babus, A., & Carletti, E. (2012). Asset commonality, debt maturity and systemic risk[J]. Journal of Financial Economics, 104(3), 519–534.

Allen, F., & Gale, D. (2000). Financial contagion[J]. Journal of Political Economy, 108(1), 1–33.

Bouchaud, J. P., Farmer, J. D., & Lillo, F. (2009). How markets slowly digest changes in supply and demand[M]. Handbook of financial markets: dynamics and evolution (pp. 57–160). North-Holland.

Caccioli, F., Shrestha, M., Moore, C., et al. (2014). Stability analysis of financial contagion due to overlapping portfolios[J]. Journal of Banking and Finance, 46, 233–245.

Diamond, D. W., & Dybvig, P. H. (1983). Bank runs, deposit insurance, and liquidity[J]. Journal of Political Economy, 91(3), 401–419.

Eisenberg, L., & Noe, T. H. (2001). Systemic risk in financial systems[J]. Management Science, 47(2), 236–249.

Elliott, M., Golub, B., & Jackson, M. O. (2014). Financial networks and contagion[J]. American Economic Review, 104(10), 3115–3153.

Elsas, R., Hackethal, A., & Holzhauser, M. (2010). The anatomy of bankdiversification. Journal of Banking and Finance, 34, 1274–1287.

Freixas, X., Parigi, B. M., & Rochet, J. C. (2000). Systemic risk, interbank relations, and liquidity provision by the central bank[J]. Journal of Money, Credit and Banking, 32, 611–638.

Gai, P., & Kapadia, S. (2010). Contagion in financial networks[J]. Proceedings of the Royal Society a: Mathematical, Physical and Engineering Sciences, 466(2120), 2401–2423.

Gatheral, J. (2010). No-dynamic-arbitrage and market impact[J]. Quantitative Finance, 10(7), 749–759.

Glasserman, P., & Young, H. P. (2015). How likely is contagion in financial networks?[J]. Journal of Banking and Finance, 50, 383–399.

Greenspan, A. (1995). Remarks at a conference on risk measurement and systemic risk[J]. Washington, DC: Board of Governors of the Federal Reserve System.

Haldane, A. G., & May, R. M. (2011). Systemic risk in banking ecosystems[J]. Nature, 469(7330), 351–355.

Huang, X., Vodenska, I., Havlin, S., et al. (2013). Cascading failures in bi-partite graphs: Model for systemic risk propagation[J]. Scientific Reports, 3, 1219.

Ibragimov, I., Jaffee, D., & Walden, J. (2011). Diversification disasters. Journal of Financial Economics, 99, 333–348.

Jackson, M. O. (2010). Social and economic networks[M]. Princeton university press.

Kaufman, G. G. (1995). Comments on systemic risk, research in financial services, banking, financial markets and systemic risks. vol 7. edited by George G[J].

Kaufman, G. G. (1996). Bank failures, systemic risk, and bank regulation[J]. Cato Journal, 16, 17.

Lopomo, B., Wegner, D. (2014). Network formation and financial fragility[C]. In: 27th Australasian finance and banking conference.

Ma, J., He, J., Liu, X., et al. (2019). Diversification and systemic risk in the banking system[J]. Chaos, Solitons and Fractals, 123, 413–421.

Mas-Colell, A., Whinston, M. D., & Green, J. R. (1995). Microeconomic theory[M]. Oxford University Press.

May, R. M., & Arinaminpathy, N. (2010). Systemic risk: The dynamics of model banking systems[J]. Journal of the Royal Society Interface, 7(46), 823–838.

Mercieca, S., Schaeck, K., & Wolf, S. (2007). Small European banks: Benefits fromdiversification and the regulatory environment. Journal of Banking and Finance, 31, 1975–1998.

Nier, E., Yang, J., Yorulmazer, T., et al. (2007). Network models and financial stability[J]. Journal of Economic Dynamics and Control, 31(6), 2033–2060.

Parry, R. T. (1996). Global payments in the twenty first century: A central banker's view[J]. FRBSF Economic Letter.

Puhr, C., Seliger, R., Sigmund, M. (2012). Contagiousness and vulnerability in the Austrian interbank market[J]. Oesterreichische Nationalbank Financial Stability Report 24.

Raffestin, L. (2014). Diversification and systemic risk[J]. Journal of Banking and Finance, 46, 85–106.

Schweitzer, F., Fagiolo, G., Sornette, D., et al. (2009). Economic networks: The new challenges[J]. Science, 325(5939), 422–425.

Shen P, Li Z. Financial contagion in inter-bank networks with overlapping portfolios[J]. Journal of Economic Interaction and Coordination, 2019: 1–21.

Slijkerman, J. F., Schoenmaker, D., & de Vries, C. G. (2013). Systemic risk and diversification across European banks and insurers. Journal of Banking and Finance, 37, 773–785.

Stiroh, K. J., & Rumble, A. (2006). The dark side of diversification: The case of USfinancialholding companies. Journal of Banking and Finance, 30, 2131–2161.

Tasca, P., Battiston, S., & Deghi, A. (2017). Portfolio diversification and systemic risk in interbank networks[J]. Journal of Economic Dynamics and Control, 82, 96–124.

Tasca, P., Mavrodiev, P., & Schweitzer, F. (2014). Quantifying the impact of leveraging and diversification on systemic risk[J]. Journal of Financial Stability, 15, 43–52.

Wagner, W. (2008). The homogenization of the financial system and financial crises. Journal of Financial Intermediation, 17(3), 330–356.

Wagner, W. (2010). Diversification at financial institutions and systemic crises[J]. Journal of Financial Intermediation, 19(3), 373–386.

Yang, H. F., Liu, C. L., & Chou, R. Y. (2020). Bank diversification and systemic risk[J]. The Quarterly Review of Economics and Finance, 77, 311–326.

Zhou, Y., & Li, H. (2019). Asset diversification and systemic risk in the financial system[J]. Journal of Economic Interaction and Coordination, 14(2), 247–272.

Acknowledgements

This work was supported by the Fundamental Research Funds for the Central Universities (Grant no. BLX201722), and by the major project of the National Social Science Foundation of China (Grant no. 16ZDA008).

Funding

This work was supported by the Fundamental Research Funds for the Central Universities (Grant No. BLX201722), and by the major project of the National Social Science Foundation of China (Grant No. 16ZDA008).

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflicts of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A

See Figs.

The result of regression analysis on the data from Fig. 4. The x-axis corresponds to the logarithm of diversification level, namely, the logarithmic value of the x-axis in Fig. 4.”SD” in the figure represents the data obtained from the simulation which are exactly the same as those in Fig. 4, and”OLS” represents the curve of the corresponding quadratic regression model of ordinary least squares. Panel (A) computes Type I systemic risk under random external shocks to assets, while Panel (B) computes Type I systemic risk under a random initial collapse. The quadratic regression model in (A) is f(x) = − 0.0398x2 − 0.2062x + 0.0893 and the quadratic regression model in (B) is f(x) = − 0.0162x2 + 0.0927x + 1.0013:

20,

The result of regression analysis on the data from Fig. 5. The x-axis corresponds to the logarithm of diversification level, namely the logarithmic value of the x-axis in Fig. 5.”SD” in the figure represents the data obtained from the simulation which are exactly the same as those in Fig. 5, and”OLS” represents the curve of the corresponding quadratic regression model of ordinary least squares. Panel (A) computes Type II systemic risk under random external shocks, with µ as 20%, 50%, and 80%, respectively; Panel (B) computes Type II systemic risk under random initial collapses for three differentµs. As the value of µ changes from 20 to 50%, and to 80%, the quadratic regression models in (A) are f(x) = − 0.0398x2 − 0.2601x − 0.0009, f(x) = − 0.0532x2 − 0.2676x + 0.0151 and f(x) = − 0.0587x2 − 0.2687x + 0.0243 respectively, while the quadratic regression models in (B) are f(x) = − 0.0055x2 + 0.0943x + 1.0017, f(x) = − 0.0227x2 + 0.0841x + 1.0110 and f(x) = − 0.0301x2 + 0.0809x + 1.0160 respectively

21 and

The result of regression analysis on the data from Fig. 6. The x-axis corresponds to the logarithm of diversification level, namely the logarithmic value of the x-axis in Fig. 6.”SD” represents the data obtained from the simulation which are exactly the same as those in Fig. 6, and”OLS” represents the curve of the corresponding quadratic regression model of ordinary least squares. Panel (A) computes Type III systemic risk under random external shocks, with v as 25%, 70%, and 80%, respectively; Panel (B) computes Type III systemic risk under random initial collapses for three different v s. As the value of v changes from 25 to 70%, and to 80%, the quadratic regression models in (A) are f(x) = − 0.0336x2 − 0.2142x + 0.0417, f(x) = − 0.0483x2 − 0.2425x + 0.0131 and f(x) = − 0.0503x2 − 0.2616x − 0.0606 respectively, while the quadratic regression models in (B) are f(x) = − 0.0003x2 + 0.1350x + 1.0257, f(x) = − 0.0259x2 + 0.0429x + 0.8691 and f(x) = − 0.0545x2 − 0.1796x + 0.4058 respectively

22.

Appendix B

2.1 B.1 Results of Type-2 Diversification

See Figs.

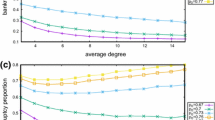

Type I systemic risk as a function of Type-2 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-2 diversification level. Panel (A) computes Type I systemic risk under random external shocks; Panel (B) computes Type I systemic risk under a random initial collapse condition

23,

Type II systemic risk as a function of Type-2 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-2 diversification level. Panel (A) computes Type II systemic risk under random external shocks; Panel (B) computes Type II systemic risk under a random initial collapse condition

24 and

Type III systemic risk as a function of Type-2 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-2 diversification level. Panel (A) computes Type III systemic risk under random external shocks; Panel (B) computes Type III systemic risk under a random initial collapse condition

25.

2.2 B.2 Results of Type-3 Diversification

See Figs.

Type I systemic risk as a function of Type-3 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-3 diversification level. Panel (A) computes Type I systemic risk under random external shocks; Panel (B) computes Type I systemic risk under a random initial collapse condition

26,

Type II systemic risk as a function of Type-3 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-3 diversification level. Panel (A) computes Type II systemic risk under random external shocks; Panel (B) computes Type II systemic risk under a random initial collapse condition

27 and

Type III systemic risk as a function of Type-3 diversification level. In Total, 832 investment matrices are generated for random networks of size n = 100; 200; 300; 400; or 500 and m = 20; 40; 60; 80; or 100. M = 103 groups of the initial assets’ values are generated. The x-axis corresponds to type-3 diversification level. Panel (A) computes Type III systemic risk under random external shocks; Panel (B) computes Type III systemic risk under a random initial collapse condition

28.

Appendix C

3.1 C.1 Data Information

See Figs.

29 and

30.

See Table

1.

3.2 C.2 Model Validation

We take Florida (FL), Georgia (GA) and Illinois (IL), the three states with the largest proportion of bank failures during the 2008 financial crisis, as examples to test the validation of our model. For each state, a bilateral network of banks_investments in different asset types can be established based on U.S. commercial banks balance sheet data of December 31, 2007. According to the simulation algorithm proposed in Sect. 3, a large number of assets’ prices are randomly generated for each network of FL, GA and IL. In all the simulation results, the number of successive bank failures in the network under some appropriate external initial shocks are quite consistent with the real situation which is shown in Fig.

The number of failed banks changes over time. Panels (A)-(C) are the results of FL, GA and IL reprectively. In each figure, the blue circles are the results of real data which show the number of banks that have closed down every six months since the beginning of 2008, while the red dots are the results of simulation which shows the number of failed banks in each wave since the network suffers a certain external initial shock to assets. That is to say, the x-axis coordinates for real data correspond to how many halves of a year passed since 2008 while those for simulation results correspond to the number of waves of bank failures due to risk contagion

31. In any of the three graphs in Fig. 31, the overall trend of the curve and the magnitude of the number of the bank failures in the simulations are quite consistent with those of the real results. All these analyses and results confirm that the network models and simulations we give in this paper are close to reality.

3.3 C.3 Regression Results

See Fig.

Type I systemic risk as a function of Type-1 and Type-2 diversification, respectively. The y-axis corresponds to the percentage of failed banks, or the Type I systemic risk. The x-axis in panels (A) corresponds to the logarithm of Type-1 diversification level and the x-axis in panels (B) corresponds to the logarithm of Type-2 diversification level. In both (A) and (B), the curves show the results of quadratic regression of the scatter data from Fig. 19(A) and Fig. 19(B) respectively. The quadratic regression models in (A) and (B) are f(x) = − 0.0418x2 − 0.3106x − 0.5024 and f(x) = − 0.0422x2 − 0.1579x − 0.0598, repectively

32.

See Tables

2,

3,

4 and

5.

Rights and permissions

About this article

Cite this article

Huang, Y., Liu, T. Diversification and Systemic Risk of Networks Holding Common Assets. Comput Econ 61, 341–388 (2023). https://doi.org/10.1007/s10614-021-10211-9

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-021-10211-9