Abstract

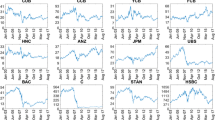

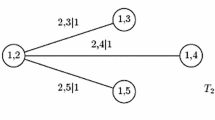

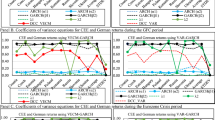

This paper studies the tail dependence for two smaller stock markets that are Taiwanese Taiex and South Korean Kospi against four larger stock markets that are S& P500, Nikkei, MSCI China, and MSCI Europe. The vector autoregression result indicates that both S&P500 and MSCI China indeed have the greatest impact and significance on the other four stock markets. However, the tail dependence of Taiex and Kospi versus either S&P500 or MSCI China are lower due to unilateral impacts from US or China. The Clayton copula yields the jumps of tail dependence and the elliptical copulas generate the trends of tail dependence. The threshold tests of Clayton Kendall’s taus between most stock markets are significant in both subprime and Greek debt crises while the tests of Student-t Kendall’s taus are only significant for the subprime crisis. It appears that the subprime has changeable trend and jump states of contagion risk while Greek debt has one steady trend state and changeable jump states of contagion risk.

Similar content being viewed by others

Notes

Refer to Embrechts et al. (2002) for the relations between \(\rho _{\tau }, \rho _{s}\), and correlation coefficient \(\rho \).

References

Aas, K., & Berg, D. (2009). Models for construction of multivariate dependence—A comparison study. European Journal of Finance, 15(7–8), 639–659.

Aas, K., Czado, C., Frigessi, A., & Bakken, H. (2009). Pair-copula constructions of multiple dependence. Insurance, Mathematics and Economics, 44, 182–198.

Ang, A., & Bekaert, G. (1999). International asset allocation with time-varying correlations. NBER Working Paper 7056.

Ang, A., & Chen, J. (2002). Asymmetric correlations of equity portfolios. Journal of Financial Economics, 63(3), 443–494.

Bae, K. H., Karolyi, G. A., & Stulz, R. M. (2003). A new approach to measuring financial contagion. The Review of Financial Studies, 16, 717–763.

Beford, T., & Cooke, R. (2001). Probabilistic risk analysis: Foundations and methods. Cambridge, UK: Cambridge University Press.

Bollerslev, T. (1986). Generalized autoregressive conditional heteroskedasticity. Journal of Econometrics, 31, 307–327.

Bollerslev, T., Engle, R. F., & Wooldridge, J. M. (1988). A capital asset pricing model with time-varying covariances. The Journal of Political Economy, 96, 116–131.

Chen, M. C., Tsai, H. J., Sing, T. F., & Yang, C. Y. (2015). Contagion and downside risk in the REIT market during the subprime mortgage crisis. International Journal of Strategic Property, 19(1), 42–57.

Cherubini, U., Luciano, E., & Vecchiato, W. (2004). Copula methods in finance. Chichester: John Wiley Finance Series.

Clayton, D. G. (1978). A model for association in bivariate life tables and its application in epidemiological studies of familial tendency in chronic disease incidence. Biometrika, 65, 141–151.

Ding, Z., Granger, C. W. J., & Engle, R. F. (1993). A long memory property of stock market returns and a new model. Journal of Empirical Finance, 1, 83–106.

Doan, T. (2005). Varlagselect: RATS procedure to select lag length for a VAR model. Statistical Software Components RTS00228, Boston College Department of Economics.

Embrechts, P., Lindskog, F., & McNeil, A. (2001). Modelling dependence with copulas and applications to risk management. ETHZ, Working Paper.

Embrechts, P., McNeil, A., & Strauman, D. (2002). Correlation and dependence properties in risk management: Properties and pitfalls. In M. Dempster (Ed.), Risk management: Value at risk and beyond. Cambridge University Press.

Engle, R. F. (1982). Autoregressive conditional heteroskedasticity with estimates of the variance of U.K. inflation. Econometrica, 50, 987–1008.

Engle, R. F. (2002). Dynamic conditional correlation—A simple class of multivariate GARCH models. Journal of Business and Economic Statistics, 20(3), 339–350.

Engle, R. F., & Ng, V. K. (1993). Measuring and testing the impact of news on volatility. The Journal of Finance, 48, 1749–1777.

Frank, M. J. (1979). On the simultaneous associativity of \(F(x, y)\) and \(x + y -F(x, y)\). Aequationes Mathamatics, 19, 194–226.

Glosten, L., Jagannathan, R., & Runkle, D. (1993). Relationship between the expected value and the volatility of the nominal excess return on stocks. The Journal of Finance, 48, 1779–1801.

Gumbel, E. J. (1960). Bivariate exponential distributions. Journal of the American Statistical Association, 55, 698–707.

Hansen, B. E. (1996). Inference when a nuisance parameter is not identified under the null hypothesis. Econometrica, 64(2), 413–430.

Hansson, B., & Hordahl, P. (1998). Testing the conditional CAPM using multivariate GARCH. Applied Financial Economics, 8, 377–388.

Hu, L. (2006). Dependence patterns across financial markets: A mixed copula approach. Applied Financial Economics, 16, 717–729.

Joe, H. (1997). Multivariate models and dependence concepts. Chapman and Hall.

Jondeau, E., & Rockinger, M. (2002). Conditional dependency of financial series: The copula-GARCH Model. FAME Research Paper Series rp69.

Jondeau, E., & Rockinger, M. (2006). The copula-Garch model of conditional dependencies: An international stock market application. Journal of International Money and Finance, 25, 827–853.

Krupskii, P., & Joe, H. (2013). Factor copula models for multivariate data. Journal of Multivariate Analysis, 120, 85–101.

Kurowicka, D., & Cooke, R. (2004). Distribution-free continuous Bayesian belief nets. In Proceedings in mathematical methods in reliability.

Longin, F., & Solnik, B. (2001). Extreme correlations in international Equity Markets. The Journal of Finance, 56, 649–676.

Longstaff, F. A. (2010). The subprime credit crisis and contagion in financial markets. Journal of Financial Economics, 97(3), 436–450.

Lu, Liu. (2014). Extreme downside risk spillover from the United States and Japan to Asia-Pacific stock markets. International Review of Financial Analysis, 33, 39–48.

Nelsen, R. B. (1999). An introduction to copulas. New York: Springer.

Nelson, D. B. (1991). Conditional heteroscedasticity in asset returns: A new approach. Econometrica, 59, 347–370.

Ng, L. (1991). Tests of the CAPM with time-varying covariances: A multivariate GARCH approach. The Journal of Finance, 46, 1507–1521.

Patton, A. J. (2001). Modelling time-varying exchange rate dependence using the conditional copula. Working Paper, U.C. San Diego.

Patton, A. J. (2006). Modelling asymmetric exchange rate dependence. International Economic Review, 47(2), 527–556.

Schweizer, B., & Wolff, E. (1981). On nonparametric measures of dependence for random variables. Annals of Statistics, 9, 879–885.

Sklar, A. W. (1959). Fonctions de répartitionà n- dimension et leurs marges. Publications de lSInstitut de Statistique de lSUniversité de Paris, 8, 229–231.

Soofi, A. S., Li, Z., & Hui, X. (2012). Nonlinear interdependence of the Chinese stock markets. Quantitative Finance, 12(3), 397–410.

Tong, H., & Lim, K. (1980). Threshold autoregression, limit cycles, and cyclical data. Journal of the Royal Statistical Society, 42, 245–292.

Tse, Y. K., & Tsui, K. C. (2002). A multivariate generalized autoregressive conditional heteroscedasticity model with time-varying correlations. Journal of Business and Economic Statistics, 20, 351–362.

Yip, P. S. L. (2014). The risk of property bubbles in Hong Kong and Singapore another aftershock risk of the global financial tsunami? Singapore Economic Review, 59(3). doi:10.1142/S021759081450026X.

Acknowledgments

The authors would like to thank the anonymous reviewers and the editor for their constructive comments.

Author information

Authors and Affiliations

Corresponding author

Appendix: The Log Likelihood of Gaussian, Student-t, and Clayton Copula

Appendix: The Log Likelihood of Gaussian, Student-t, and Clayton Copula

-

1.

The log likelihood of Gaussian copula is

where \({\varvec{\varepsilon }}_t=({\phi }^{-1} (u_{1,t}),\ldots ,{\phi }^{-1} (u_{p,t}))\) is the vector of the transformed standardized residuals and \(\mathbf{R}\) is the correlation matrix of \({\varvec{\varepsilon }}_t \) and p is the number of residual series.

-

2.

The log likelihood of Student-t copula

where \(v_c \) is the degree of freedom.

-

3.

The log likelihood of Clayton copula

where \(\theta \) is solved optimally as \(\frac{2\rho _{\tau }}{1-\rho _{\tau }}\) and \(\rho _{\tau }\) is Kendall’s tau.

Rights and permissions

About this article

Cite this article

Su, E. Measuring and Testing Tail Dependence and Contagion Risk Between Major Stock Markets. Comput Econ 50, 325–351 (2017). https://doi.org/10.1007/s10614-016-9587-y

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10614-016-9587-y