Abstract

We consider an energy system with n consumers who are linked by a Demand Side Management (DSM) contract, i.e. they agreed to diminish, at random times, their aggregated power consumption by a predefined volume during a predefined duration. Their failure to deliver the service is penalised via the difference between the sum of the n power consumptions and the contracted target. We are led to analyse a non-zero sum stochastic game with n players, where the interaction takes place through a cost which involves a delay induced by the duration included in the DSM contract. When \(n \rightarrow \infty \), we obtain a Mean-Field Game (MFG) with random jump time penalty and interaction on the control. We prove a stochastic maximum principle in this context, which allows to compare the MFG solution to the optimal strategy of a central planner. In a linear quadratic setting we obtain a semi-explicit solution through a system of decoupled forward-backward stochastic differential equations with jumps, involving a Riccati Backward SDE with jumps. We show that it provides an approximate Nash equilibrium for the original n-player game for n large. Finally, we propose a numerical algorithm to compute the MFG equilibrium and present several numerical experiments.

Similar content being viewed by others

Notes

see Energy prices and costs in Europe, European Commission, 2019.

See, for instance, Theorem 2.12 in Carmona and Delarue book (Carmona et al., 2017) Vol. II, which can be easily extended to our case with jumps exploiting in particular the fact that the intensities are constant.

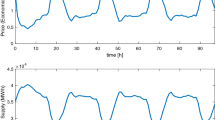

Source: French TSO https://www.services-rte.com.

References

Alasseur, C., Ben Tahar, I., & Matoussi, A.(2020) An extended mean field game for storage in smart grids. Journal of Optimization Theory and Applications, 184, pp. 644–670.

Bauso, D. (2017). Dynamic demand and mean-field games. IEEE Transactions on Automatic Control, 62, 6310–6323.

Benazzoli, C., Campi, L., & Di Persio, L. (2019). \(\varepsilon \)-Nash equilibrium in stochastic differential games with mean-field interaction and controlled jumps. Statistics & Probability Letters, 154, 108522.

Benazzoli, C., Campi, L., & Di Persio, L. (2020). Mean field games with controlled jump-diffusion dynamics. Existence results and an illiquid interbank market model. Stochastic Processes and their Applications, 130, 6927–6964.

Brémaud, P., & Yor, M. (1978). Changes of filtrations and of probability measures. Zeitschrift für Wahrscheinlichkeitstheorie und verwandte Gebiete, 45, 269–295.

Carmona, R. (2020). Applications of mean field games in financial engineering and economic theory, arXiv:2012.05237.

Carmona, R., Delarue, F., & Lachapelle, A. (2017). Probabilistic Theory of Mean Field Games with Applications I: Mean Field FBSDEs, Control, and Games (Probability Theory and Stochastic Modelling). Springer, New York: Probability Theory and Stochastic Modelling.

Couillet, R., Medina Perlaza,S., Tembine, H., & Debbah, M. (2012) Electrical vehicles in the smart grid: A mean field game analysis. IEEE Journal on Selected Areas in Communications, 30, 1086–1096.

De Paola, A., Angeli, D., & Strbac, G. (2016). Distributed control of micro-storage devices with mean field games. IEEE Transactions on Smart Grid, 7, 1119–1127.

De Paola, A., Trovato, V., Angeli, D., & Strbac, G. (2019). A mean field game approach for distributed control of thermostatic loads acting in simultaneous energy-frequency response markets. IEEE Transactions on Smart Grid, 10, 5987–5999.

Dumitrescu, R., & Labart, C. (2016). Numerical approximation of doubly reflected BSDEs with jumps and RCLL obstacles. Journal of Mathematical Analysis and Applications, 442, 206–243.

Dumitrescu, R., & Labart, C. (2016). Reflected scheme for doubly reflected BSDEs with jumps and RCLL obstacles. Journal of Computational and Applied Mathematics, 296, pp. 827–839.

Gomes,D. A. (2020). A mean-field game approach to price formation. Dynamic Games and Applications, pp. 1–25.

Graber, P. J. (2016). Linear quadratic mean field type control and mean field games with common noise, with application to production of an exhaustible resource. Applied Mathematics & Optimization, 74, 123–150.

Huang, M., Malhame, R. P., & Caines, P. E. (2006). Large population stochastic dynamic games: closed-loop McKean–Vlasov systems and the Nash certainty equivalence principle. Communications in Information and Systems, 6, 221–252.

Lasry, J.-M., & Lions, P.-L. (2006). Jeux à champ moyen. I-Le cas stationnaire. Comptes Rendus Mathématique, 343, 619–625.

Lasry, J.-M., & Lions, P.-L. (2006) Jeux à champ moyen. II–Horizon fini et contrôle optimal. Comptes Rendus Mathématique, 343, pp. 679–684.

Lejay, A., Mordecki, E., & Torres, S.(2014). Numerical approximation of backward stochastic differential equations with jumps, Inria report.

Li, Z., Reppen, A. M., & Sircar, R. (2019). A mean field games model for cryptocurrency mining. arXiv preprint arXiv:1912.01952.

Pham, H. (2016). Linear quadratic optimal control of conditional Mckean–Vlasov equation with random coefficients and applications. Probability, Uncertainty and Quantitative Risk, 1.

Protter, P. (2005). Stochastic integration and differential equations. New York: Springer.

Royer, M. (2006). Backward stochastic differential equations with jumps and related nonlinear expectations. Stochastic Processes and their Applications, 116, 1358–1376.

Slominski, L. (1989). Stability of strong solutions of stochastic differential equations. Stochastic Processes and their Applications, 31(2), 173–202.

Sun, J. (2015) Mean-field stochastic linear quadratic optimal control problems: Open-loop solvabilities, arXiv:1509.02100v2.

Yong, J. (1999). Linear forward-backward stochastic differential equations. Applied Mathematics and Optimization, 39, 93–119.

Yong, J. (2013). A linear-quadratic optimal control problem for mean-field stochastic differential equations. SIAM journal on Control and Optimization, 51(4), 2809–2838.

Acknowledgements

The authors thank the two anonymous referees for their insightful comments which helped to make the model more realistic.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

Springer Nature or its licensor (e.g. a society or other partner) holds exclusive rights to this article under a publishing agreement with the author(s) or other rightsholder(s); author self-archiving of the accepted manuscript version of this article is solely governed by the terms of such publishing agreement and applicable law.

About this article

Cite this article

Alasseur, C., Campi, L., Dumitrescu, R. et al. MFG model with a long-lived penalty at random jump times: application to demand side management for electricity contracts. Ann Oper Res 336, 541–569 (2024). https://doi.org/10.1007/s10479-023-05270-0

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-023-05270-0