Abstract

Businesses and governments have increasingly attached importance to trade-in programs due to their environmental and financial benefits. There are always two programs: trade-old-for-new (TON) and trade-old-for-cash (TOC). Compared with TON, TOC provides old consumers with more flexibility. However, TON may increase the new product sales for firms. In this study, we consider that the manufacturer implements a TON program and the third-party collector provides a TOC program. We study the optimal pricing and subsidy decisions and investigate the effects of the TON subsidy on the firms, consumers, and society. Our main results are: (1) It is optimal to set the new product price at a constant level, independent of the trade-in programs. (2) Consumers focus on the product durability level when they make purchase decisions and firms can improve demand for trade-ins by designing suitable product durability. (3) The TON subsidy benefits the manufacturer, consumers, and society, but hurts the third-party collector when the product durability level is low. Moreover, the effects of subsidy constraints depend on the upper limit of policy constraints and the product durability level. (4) The government subsidy is not as high as possible. A suitable subsidy level should be set according to the subsidy constraints. Our analysis provides insights for firms and government on how to use trade-in programs to maximize profits and social welfare.

Similar content being viewed by others

Notes

Zhangzhou is a city in Fujian Province, China.

References

Ackere, V. A., & Reyniers, D. J. (1995). Trade-ins and introductory offers in a monopoly. The RAND Journal of Economics, 26(1), 58–74.

Agrawal, V. V., Ferguson, M., & Souza, G. C. (2016). Trade-in rebates for price discrimination and product recovery. IEEE Transactions on Engineering Management, 63(3), 326–339.

Bruce, N., Desai, P., & Staelin, R. (2006). Enabling the willing: Consumer rebates for durable goods. Marketing Science, 25(4), 350–366.

Cao, K. Y., Bo, Q. S., & He, Y. (2018). Optimal trade-in and third-party collection authorization strategies under trade-in subsidy policy. Kybernetes, 47(5), 854–872.

Cao, K., Xu, X., Bian, Y., & Sun Y. (2019). Optimal trade-in strategy of business-to-consumer platform with dual-format retailing model. Omega, 82, 181–192.

Chen, J. M., & Hsu, Y. T. (2015). Trade-in strategy for a durable goods firm with recovery cost. Journal of Industrial and Production Engineering, 32(6), 396–407.

Feng, L., Li, Y., Xu, F., & Deng, Q. (2019). Optimal pricing and trade-in policies in a dual-channel supply chain when considering market segmentation. International Journal of Production Research, 57(9), 2828–2846.

Ferrer, G., & Swaminathan, J. M. (2006). Managing new and remanufactured products. Management Science, 52(1), 15–26.

Han, X. H., Shen, Y., & Bian, Y. W. (2020). Optimal recovery strategy of manufacturers: Remanufacturing products or recycling materials. Annals of Operations Research, 290(1–2), 463–489.

Han, X., Yang, Q., Shang, J., & Pu, X. (2017). Optimal strategies for trade-old-for-remanufactured programs: Receptivity, durability, and subsidy. International Journal of Production Economics, 193, 602–616.

Hong, X., Xu, L., Du, P., & Wang, W. (2015). Joint advertising, pricing, and collection decisions in a closed-loop supply chain. International Journal of Production Economics, 167, 12–22.

Liu, W., Qin, D., Shen, N., Zhang, J., Jin, M., & Xie, N. (2020). Optimal pricing for a multi-echelon closed loop supply chain with different power structures and product dual differences. Journal of Cleaner Production, 257, 1–31.

Ma, Z., Zhang, N., Dai, Y., & Hu, S. (2016). Managing channel profits of different cooperative models in closed-loop supply chains. Omega, 59, 251–262.

Ma, Z., Zhou, Q., Dai, Y., & Sheu, J. (2017). Optimal pricing decisions under the coexistence of “trade old for new” and “trade old for remanufactured” programs. Transportation Research Part e: Logistics and Transportation Review, 106, 337–352.

Maiti, T., & Giri, B. C. (2017). Pricing and return product collection decisions in a closed-loop supply chain with dual-channel in both forward and reverse logistics. Journal of Manufacturing System, 42, 104–123.

Miao, Z., Mao, H., Fu, K., & Wang, Y. (2018). Remanufacturing with trade-ins under carbon regulations. Computers & Operations Research, 89, 253–268.

Miao, Z., Fu, K., Xia, Z., & Wang, Y. (2017). Models for closed-loop supply chain with trade-ins. Omega, 66, 308–326.

Mitra, S., & Webster, S. (2008). Competition in remanufacturing and the effects of government subsidies. International Journal of Production Economics, 111(2), 287–298.

Ovchinnikov, A. (2011). Revenue and cost management for remanufactured products. Production and Operations Management, 20(6), 824–840.

Park, S., & Mowen, J. C. (2007). Replacement purchase decisions: On the effects of trade-ins, hedonic versus utilitarian usage goal, and tightwadism. Journal of Consumer Behavior, 6(2–3), 123–131.

Rao, R. S. (2009). Understanding the role of trade-ins in durable goods markets: Theory and evidence. Marketing Science, 28, 950–967.

Savaskan, R. C., Bhattacharya, S., & Van Wassenhove, L. N. (2004). Closed-loop supply chain models with product remanufacturing. Management Science, 50(2), 239–252.

Vasudevan, H., Kalamkar, V., & Terkar, R. (2012). Remanufacturing for sustainable development: Key challenges, elements, and benefits. International Journal of Innovation Management, 3(1), 84–89.

Wang, J. B., Zhang, T., & Fan, X. J. (2020). Reverse channel design with a dominant retailer and upstream competition in emerging markets: Retailer-or manufacturer-collection. Transportation Research Part e: Logistics and Transportation Review. https://doi.org/10.1016/j.tre.2020.101924

Xiao, Y. (2017). Choosing the right exchange-old-for-new programs for durable goods with a rollover. European Journal of Operational Research, 259(2), 512–526.

Xiao, Y., & Zhou, S. X. (2020). Trade-in for cash or for upgrade? Dynamic pricing with consumer choice. Production and Operations Management, 29(4), 856–881.

Yin, R., Li, H., & Tang, C. S. (2015). Optimal pricing of two successive-generation products with trade-in options under uncertainty. Decision Sciences, 46(3), 565–595.

Yu, J. J., Tang, C. S., & Shen, Z. J. M. (2018). Improving consumer welfare and manufacturer profit via government subsidy programs: Subsidizing consumers or manufacturers? Manufacturing Service Operations Management, 20(4), 752–766.

Acknowledgements

The authors are grateful to the associate editor and anonymous reviewers for the constructive comments and invaluable contributions to enhance the presentation of this paper. This paper was supported by the National Natural Science Foundation of China (No. 71772115).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1 Proof of the main models

1.1 Proof of Lemma 1

Case 1: Substituting the demand functions into Eqs. (1)–(2), we have

It can be verified that \({\pi }_{t}^{NS}\) is strictly concave in \({p}_{c}\). By solving the first-order derivative \(\frac{\partial {\pi }_{t}^{NS}}{\partial {p}_{c}}=\frac{1-\alpha }{\delta }(t-2{p}_{c})=0\), the response function of the cash price can be obtained as: \({p}_{c}=\frac{t}{2}\). Then substitute \({p}_{c}=\frac{t}{2}\) into \({\pi }_{m}^{NS}\). For a given \(t\), Hessian matrix of manufacturer’s profit \({\pi }_{m}^{NS}\) with \({p}_{n}\), \({p}_{r}\) is as follows:

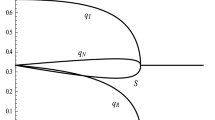

We can easily observe that Hessian matrix is negative definite and \({\pi }_{m}^{NS}\) is a jointly concave function in \({p}_{n}\), \({p}_{r}\). There exist unique optimal pricing solutions for the manufacturer. By solving first-order derivatives \(\frac{\partial {\pi }_{m}^{NS}}{\partial {p}_{n}}=0\),\(\frac{\partial {\pi }_{m}^{NS}}{\partial {p}_{r}}=0\), we can get \({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{v+\delta }{2}\). Then substitute \({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{v+\delta }{2}\) into \({\pi }_{m}^{NS}\). Considering the second-order derivative \(\frac{{\partial }^{2}{\pi }_{m}^{NS}}{\partial {t}^{2}}=\left(1-\alpha \right)\frac{-2}{2\delta }<0\), we can conclude that \({\pi }_{m}^{NS}\) is a jointly concave function in \(t\). By solving the first-order derivative \(\frac{\partial {\pi }_{m}^{NS}}{\partial t}=\left(1-\alpha \right)\frac{v-2t}{2\delta }=0\), we can get \({t}^{*}=\frac{v}{2}\). Then optimal prices can be obtained as follows: \({{p}_{1n}^{NS}}^{*}=\frac{1+c}{2}\), \({{p}_{1r}^{NS}}^{*}=\frac{v+\delta }{2}\), \({{t}_{1}^{NS}}^{*}=\frac{v}{2}\), \({{p}_{1c}^{NS}}^{*}=\frac{v}{4}\); the optimal demands are:\({{q}_{1n}^{NS}}^{*}=\frac{\alpha }{2}(1-c)\), \({{q}_{1t}^{NS}}^{*}=\frac{\left(1-\alpha \right)(1-\delta -c+v)}{2(1-\delta )}\), \({{q}_{1c}^{NS}}^{*}=\frac{(1-\alpha )v}{4\delta }\); the optimal profits are: \({{\pi }_{1m}^{NS}}^{*}=\frac{\alpha {(1-\text{c})}^{2}}{4}+\frac{\left(1-\alpha \right){(1-\delta -c+v)}^{2}}{4(1-\delta )}+\frac{(1-\alpha ){v}^{2}}{8\delta }\), \({{\pi }_{1t}^{NS}}^{*}=\frac{(1-\alpha ){v}^{2}}{16\delta }\).

Case 2: Substituting the demand functions into Eqs. (1)-(2), we have

It can be verified that \({\pi }_{t}^{NS}\) is strictly concave in \({p}_{c}\). By solving the first-order derivative \(\frac{\partial {\pi }_{t}^{NS}}{\partial {p}_{c}}=(1-\alpha )(t-2{p}_{c}-{p}_{n}+{p}_{r})=0\), the response function of the cash price can be obtained as: \({p}_{c}=\frac{t-{p}_{n}+{p}_{r}}{2}\). Then substitute \({p}_{c}=\frac{t-{p}_{n}+{p}_{r}}{2}\) into \({\pi }_{m}^{NS}\). For a given \(t\), Hessian matrix of manufacturer’s profit \({\pi }_{m}^{NS}\) with \({p}_{n}\), \({p}_{r}\) is as follows:

We can easily observe that Hessian matrix is negative definite and \({\pi }_{m}^{NS}\) is a jointly concave function in \({p}_{n}\), \({p}_{r}\). There exist unique optimal pricing solutions for the manufacturer. By solving first-order derivatives \(\frac{\partial {\pi }_{m}^{NS}}{\partial {p}_{n}}=0\),\(\frac{\partial {\pi }_{m}^{NS}}{\partial {p}_{r}}=0\), we can get \({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{2t-1}{2}\). Then substitute \({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{2t-1}{2}\) into \({\pi }_{m}^{NS}\). Solving the first-order derivative \(\frac{\partial {\pi }_{m}^{NS}}{\partial t}=-\left(1-\alpha \right)<0\), we can conclude that \({\pi }_{m}^{NS}\) decreases with \(t\). Therefore, we can get the maximize profit when \(t\) is the minimum. Thus, we can get \(t\ge \frac{(1+\delta )(2+c)}{4}\) and the optimal transfer price is \({t}^{*}=\frac{(1+\delta )(2+c)}{4}\).

Then optimal prices can be obtained as follows: \({{p}_{2n}^{NS}}^{*}=\frac{1+c}{2}\), \({{p}_{2r}^{NS}}^{*}=\frac{c+c\delta +2\delta }{4}\), \({{t}_{2}^{NS}}^{*}=\frac{(1+\delta )(2+c)}{4}\), \({{p}_{2c}^{NS}}^{*}=\frac{2\delta +c\delta }{4}\); the optimal demands are:\({{q}_{2n}^{NS}}^{*}=\frac{\alpha }{2}(1-c)\), \({{q}_{2t}^{NS}}^{*}=\frac{\left(1-\alpha \right)(2-c)}{4}\), \({{q}_{2c}^{NS}}^{*}=\frac{\left(1-\alpha \right)(2+c)}{4}\); the optimal profits are: \({{\pi }_{2m}^{NS}}^{*}=\frac{\alpha {(1-\text{c})}^{2}}{4}+\frac{\left(1-\alpha \right)(8v-6c-4\delta +{c}^{2}-2c\delta )}{8}\), \({{\pi }_{2t}^{NS}}^{*}=\frac{(1-\alpha ){(2+c)}^{2}}{16}\).

Proof of Lemma 2 and 3 are similar to Lemma 1, thus we omit them here.

1.2 Proof of Proposition 1

For LS model, we get the first derivatives of the optimal prices with respect to the budget \(M\). Because of the complexity of expressions, we have \(\frac{\partial {{s}_{1}^{LS}}^{*}}{\partial M}>0\), \(\frac{\partial {{s}_{2}^{LS}}^{*}}{\partial M}>0\). Then we have: (1) \(\frac{\partial {{p}_{1n}^{LS}}^{*}}{\partial M}=0\); \(\frac{\partial {{p}_{1r}^{LS}}^{*}}{\partial M}=\frac{\partial {{p}_{1r}^{LS}}^{*}}{\partial {{s}_{1}^{LS}}^{*}}\frac{\partial {{s}_{1}^{LS}}^{*}}{\partial M}<0\); \(\frac{\partial {{t}_{1}^{LS}}^{*}}{\partial M}=0\); \(\frac{\partial {{p}_{1c}^{LS}}^{*}}{\partial M}=0\). (2) \(\frac{\partial {{p}_{2n}^{LS}}^{*}}{\partial M}=0\); \(\frac{\partial {{p}_{2r}^{LS}}^{*}}{\partial M}=\frac{\partial {{p}_{2r}^{LS}}^{*}}{\partial {{s}_{2}^{LS}}^{*}}\frac{\partial {{s}_{2}^{LS}}^{*}}{\partial M}<0\); \(\frac{\partial {{t}_{2}^{LS}}^{*}}{\partial M}=\frac{\partial {{t}_{2}^{LS}}^{*}}{\partial {{s}_{2}^{LS}}^{*}}\frac{\partial {{s}_{2}^{LS}}^{*}}{\partial M}<0\); \(\frac{\partial {{p}_{2c}^{LS}}^{*}}{\partial M}=\frac{\partial {{p}_{2c}^{LS}}^{*}}{\partial {{s}_{2}^{LS}}^{*}}\frac{\partial {{s}_{2}^{LS}}^{*}}{\partial M}<0\).

1.3 Proof of Propositions 2 and 3

Comparing the optimal prices, demands, and profits among three models, we have the following results.

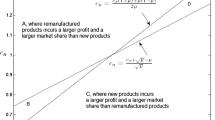

For Case 1, when the government’s budget is high, we can easily observe that the prices, demands, and profits of LS model are the same as those of S model. Then we will compare the results between NS model and S model. We can get:\({{p}_{1n}^{NS}}^{*}={{p}_{1n}^{S}}^{*}\),\({{p}_{1r}^{NS}}^{*}{{-p}_{1r}^{S}}^{*}=\frac{v-\delta +1-c+2{e}_{v}}{2}\),\({{t}_{1}^{NS}}^{*}={{t}_{1}^{S}}^{*}\),\({{p}_{1c}^{NS}}^{*}={{p}_{1c}^{S}}^{*}\);\({{q}_{1n}^{NS}}^{*}={{q}_{1n}^{S}}^{*}\),\({{q}_{1t}^{NS}}^{*}-{{q}_{1t}^{S}}^{*}=\frac{\left(1-\alpha \right)(-1+\delta +c-v-2{e}_{v})}{2(1-\delta )}\),\({{q}_{1c}^{NS}}^{*}={{q}_{1c}^{S}}^{*}\);\({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}\);\({{\pi }_{1m}^{NS}}^{*}-{{\pi }_{1m}^{S}}^{*}=\frac{\left(1-\alpha \right)\left(-1+\delta +c-v-2{e}_{v}\right)[3\left(1-\delta -c+v\right)+2{e}_{v}]}{4(1-\delta )}\). Considering\({{s}_{1}^{S}}^{*}=1-c-\delta +v+2{e}_{v}>0\), then we have\({{p}_{1r}^{NS}}^{*}{{>p}_{1r}^{S}}^{*}\),\({{q}_{1t}^{NS}}^{*}<{{q}_{1t}^{S}}^{*}\). In addition, considering\({{q}_{1t}^{NS}}^{*}=\frac{\left(1-\alpha \right)(1-\delta -c+v)}{2(1-\delta )}>0\), then we have\({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{S}}^{*}\).

Therefore, when the government’s budget is high, we have: \({{p}_{1n}^{NS}}^{*}={{p}_{1n}^{S}}^{*}={{p}_{1n}^{LS}}^{*}\), \({{p}_{1r}^{NS}}^{*}{{>p}_{1r}^{S}}^{*}={{p}_{1r}^{LS}}^{*}\), \({{t}_{1}^{NS}}^{*}={{t}_{1}^{S}}^{*}={{t}_{1}^{LS}}^{*}\), \({{p}_{1c}^{NS}}^{*}={{p}_{1c}^{S}}^{*}={{p}_{1c}^{LS}}^{*}\), \({{q}_{1n}^{NS}}^{*}={{q}_{1n}^{S}}^{*}={{q}_{1n}^{LS}}^{*}\), \({{q}_{1t}^{NS}}^{*}<{{q}_{1t}^{S}}^{*}={{q}_{1t}^{LS}}^{*}\), \({{q}_{1c}^{NS}}^{*}={{q}_{1c}^{S}}^{*}={{q}_{1c}^{LS}}^{*}\), \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{S}}^{*}\)=\({{\pi }_{1m}^{LS}}^{*}\), \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LS}}^{*}\).

When the government’s budget is low, we compare the optimal decisions of S model and LS model. We have:\({{p}_{1n}^{S}}^{*}={{p}_{1n}^{LS}}^{*}\),\({{p}_{1r}^{S}}^{*}-{{p}_{1r}^{LS}}^{*}=\frac{2\delta -1+c-2{e}_{v}}{2}-\frac{v+\delta -{{s}_{1}^{LS}}^{*}}{2}\),\({{t}_{1}^{S}}^{*}={{t}_{1}^{LS}}^{*}\),\({{p}_{1c}^{S}}^{*}={{p}_{1c}^{LS}}^{*}\);\({{q}_{1n}^{S}}^{*}={{q}_{1n}^{LS}}^{*}\),\({{q}_{1t}^{S}}^{*}-{{q}_{1t}^{LS}}^{*}=\frac{\left(1-\alpha \right)\left(1-\delta -c+v+{e}_{v}\right)}{1-\delta }-\frac{\left(1-\alpha \right)\left(1-\delta -c+v+{{s}_{1}^{LS}}^{*}\right)}{2\left(1-\delta \right)}\),\({{q}_{1c}^{S}}^{*}={{q}_{1c}^{LS}}^{*}\);\({{\pi }_{1m}^{S}}^{*}-{{\pi }_{1m}^{LS}}^{*}=\frac{\left(1-\alpha \right){\left(1-\delta -c+v+{e}_{v}\right)}^{2}}{1-\delta }-\frac{\left(1-\alpha \right){(1-\delta -c+v+{{s}_{1}^{LS}}^{*})}^{2}}{4(1-\delta )}\),\({{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LS}}^{*}\). According to Proposition 4, we can get\(\frac{\partial {{p}_{1r}^{LS}}^{*}}{\partial M}<0\). In other words, \({{p}_{1r}^{LS}}^{*}\) decreases as \(M\) increases. Therefore, when \(M\) is at a boundary value, there is\({{p}_{1r}^{S}}^{*}={{p}_{1r}^{LS}}^{*}\). When the value is lower than boundary value, we have\({{p}_{1r}^{S}}^{*}<{{p}_{1r}^{LS}}^{*}\). Similarly, we can get\({{q}_{1t}^{S}}^{*}>{{q}_{1t}^{LS}}^{*}\),\({{\pi }_{1m}^{S}}^{*}>{{\pi }_{1m}^{LS}}^{*}\). Next, we will compare the optimal decisions of LS model and NS model. We have\({{p}_{1n}^{NS}}^{*}={{p}_{1n}^{LS}}^{*}\),\({{p}_{1r}^{NS}}^{*}-{{p}_{1r}^{LS}}^{*}=\frac{{{s}_{1}^{LS}}^{*}}{2}>0\),\({{t}_{1}^{NS}}^{*}={{t}_{1}^{LS}}^{*}\),\({{p}_{1c}^{NS}}^{*}={{p}_{1c}^{LS}}^{*}\);\({{q}_{1n}^{NS}}^{*}={{q}_{1n}^{LS}}^{*}\),\({{q}_{1t}^{NS}}^{*}-{{q}_{1t}^{LS}}^{*}=\frac{\left(1-\alpha \right)\left(1-\delta -c+v\right)}{2\left(1-\delta \right)}-\frac{\left(1-\alpha \right)\left(1-\delta -c+v+{{s}_{1}^{LS}}^{*}\right)}{2\left(1-\delta \right)}<0\),\({{q}_{1c}^{NS}}^{*}={{q}_{1c}^{LS}}^{*}\);\({{\pi }_{1m}^{NS}}^{*}-{{\pi }_{1m}^{LS}}^{*}=\frac{\left(1-\alpha \right){\left(1-\delta -c+v\right)}^{2}}{4\left(1-\delta \right)}-\frac{\left(1-\alpha \right){\left(1-\delta -c+v+{{s}_{1}^{LS}}^{*}\right)}^{2}}{4\left(1-\delta \right)}<0\),\({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{LS}}^{*}\).

Therefore, when the government’s budget is low, we have: \({{p}_{1n}^{NS}}^{*}={{p}_{1n}^{S}}^{*}={{p}_{1n}^{LS}}^{*}\), \({{p}_{1r}^{NS}}^{*}{{>p}_{1r}^{LS}}^{*}>{{p}_{1r}^{S}}^{*}\), \({{t}_{1}^{NS}}^{*}={{t}_{1}^{S}}^{*}={{t}_{1}^{LS}}^{*}\), \({{p}_{1c}^{NS}}^{*}={{p}_{1c}^{S}}^{*}={{p}_{1c}^{LS}}^{*}\), \({{q}_{1n}^{NS}}^{*}={{q}_{1n}^{S}}^{*}={{q}_{1n}^{LS}}^{*}\), \({{q}_{1t}^{NS}}^{*}<{{q}_{1t}^{LS}}^{*}<{{q}_{1t}^{S}}^{*}\), \({{q}_{1c}^{NS}}^{*}={{q}_{1c}^{S}}^{*}={{q}_{1c}^{LS}}^{*}\), \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{LS}}^{*}<{{\pi }_{1m}^{S}}^{*}\), \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LS}}^{*}\).

The proof of Case 2 is similar to that of Case 1, thus we omit it here.

1.4 Proof of Proposition 4

Comparing the consumer welfare and social welfare in these three scenarios, we have the following results.

For Case 1, the consumer welfare in these scenarios are as follows: \({{CS}_{1}^{NS}}^{*}=\frac{\begin{array}{c}-8v\left(-1+\alpha \right)\delta \left(-1+c+\delta \right)+{v}^{2}\left(-1+\alpha \right)\left(1+3\delta \right)\\ -4\delta (2c(-1+\delta )+(-1+\delta )(-1+3(-1+\alpha )\delta )+{c}^{2}(1-\alpha \delta ))\end{array}}{32(-1+\delta )\delta }\),\({{CS}_{1}^{S}}^{*}=\frac{\begin{array}{c}-32v\left(1-\alpha \right)\delta \left(1-c-\delta \right)-{v}^{2}\left(1-\alpha \right)\left(1+15\delta \right)\\ +4\delta \left(\left(-4+3\alpha \right)\left(-1+\delta \right)(-1+2c)+{c}^{2}\left(-4+\alpha \left(3+\delta \right)\right)\right)\\ -32(-1+\alpha )\delta (-1+c-v+\delta ){e}_{v}+16(-1+\alpha )\delta {e}_{v}^{2}\end{array}}{32(-1+\delta )\delta }\), \({{CS}_{1}^{LS}}^{*}={{CS}_{1}^{S}}^{*}\) when the subsidy budget is high, and \({{CS}_{1}^{LS}}^{*}=\frac{\begin{array}{c}8v\left(1-\alpha \right)\delta \left(-1+c-{{s}_{1}^{LS}}^{*}+\delta \right)+{v}^{2}\left(-1+\alpha \right)\left(1+3\delta \right)\\ -4\delta ((1-\alpha )({{{s}_{1}^{LS}}^{*})}^{2}+2{{s}_{1}^{LS}}^{*}(-1+\alpha )(-1+\delta )\\ +2c(-1+{{s}_{1}^{LS}}^{*}(-1+\alpha )+\delta )+(1-\delta )(1+3(1-\alpha )\delta )+{c}^{2}(1-\alpha \delta ))\end{array}}{32(-1+\delta )\delta }\) when the subsidy budget is low. First, we have \({{CS}_{1}^{S}}^{*}-{{CS}_{1}^{NS}}^{*}=\frac{\left(-1+\alpha \right)\left(3{\left(-1+c-v+\delta \right)}^{2}-8\left(-1+c-v+\delta \right){e}_{v}+4{e}_{v}^{2}\right)}{8\left(-1+\delta \right)}>0\). Second, when the budget is low, we define \(\Delta {\tilde{C}S }={{CS}_{1}^{LS}}^{*}-{{CS}_{1}^{S}}^{*}\) and have\(\frac{\partial \Delta \tilde{CS }}{\partial M}>0\). Therefore, when \(M\) is equal to the upper bound, there is \({{CS}_{{1}^{LS}}}^{*}={\tilde{CS }_{{1}^{S}}}^{*}\). Therefore, we have\(\Delta \tilde{CS }<0\). Moreover, when the budget is low, we define \( \Delta {\tilde{C}S } = CS_{1}^{{LS*}} - CS_{1}^{{NS*}} \) and have\( \frac{\partial \Delta \tilde{CS}}{\partial M} > 0 \). Therefore, when\(M=0\), there is\({{CS}_{1}^{LS}}^{*}={{CS}_{1}^{NS}}^{*}\). Therefore, we have\(\Delta \mathop {CS}>0\). In conclusion, when the budget is high, we have\({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{LS}}^{*}={{CS}_{1}^{S}}^{*}\); when the budget is low, we have\({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{LS}}^{*}<{{CS}_{1}^{S}}^{*}\).

Next, the social welfare in these three scenarios are as follows: \({{SW}_{1}^{NS}}^{*}=\frac{\begin{array}{c}-24v\left(-1+\alpha \right)\delta \left(-1+c+\delta \right)+{v}^{2}\left(-1+\alpha \right)\left(7+5\delta \right)\\ +4\delta \left(6c\left(1-\delta \right)+\left(1-\delta \right)\left(-3+\left(-1+\alpha \right)\delta \right)+3{c}^{2}\left(-1+\alpha \delta \right)\right)\\ +8(-1+\alpha )(v(1+\delta )-2\delta (-1+c+\delta )){e}_{v}\end{array}}{32(-1+\delta )\delta }\), \({{SW}_{1}^{S}}^{*}=\frac{\begin{array}{c}-32v\left(-1+\alpha \right)\delta \left(-1+c+\delta \right)+{v}^{2}\left(-1+\alpha \right)\left(7+9\delta \right)\\ +4\delta \left(\left(4-\alpha \right)\left(1-\delta \right)(-1+2c)+{c}^{2}\left(-4+\alpha +3\alpha \delta \right)\right)\\ +8(-1+\alpha )(v+3v\delta +4\delta (1-c-\delta )){e}_{v}+16(-1+\alpha )\delta {e}_{v}^{2}\end{array}}{32(-1+\delta )\delta }\), \({{SW}_{1}^{LS}}^{*}={{SW}_{1}^{S}}^{*}\) when the subsidy budget is high, and \({{SW}_{1}^{LS}}^{*}=\frac{\begin{array}{c}-8v\left(-1+\alpha \right)\delta \left(-3+3c-{{s}_{1}^{LS}}^{*}+3\delta \right)+{v}^{2}\left(-1+\alpha \right)\left(7+5\delta \right)\\ +4\delta (-({{{s}_{1}^{LS}}^{*})}^{2}(-1+\alpha )+c(6-2{{s}_{1}^{LS}}^{*}(-1+\alpha )-6\delta )\\ -\left(-1+\delta \right)\left(-3+\left(-1+\alpha \right)\delta \right)+2{{s}_{1}^{LS}}^{*}\left(-1+\alpha +\delta -\alpha \delta \right)\\ +3{c}^{2}(-1+\alpha \delta ))+8(-1+\alpha )(v(1+\delta )-2\delta (-1+c-{{s}_{1}^{LS}}^{*}+\delta )){e}_{v}\end{array}}{32(-1+\delta )\delta }\) when the subsidy budget is low. First, we have \({{SW}_{1}^{S}}^{*}-{{SW}_{1}^{NS}}^{*}=\frac{(-1+\alpha ){(-1+c-v+\delta -2{e}_{v})}^{2}}{8(-1+\delta )}>0\). Second, when the budget is low, we define \(\Delta \tilde{SW}={{SW}_{1}^{LS}}^{*}-{{SW}_{1}^{S}}^{*}\) and have \(\frac{\partial \Delta \tilde{SW}}{\partial M}>0\). Therefore, when \(M\) is equal to the upper bound, there is \({{SW}_{1}^{LS}}^{*}={{SW}_{1}^{S}}^{*}\). Therefore, we have \(\Delta \tilde{SW }<0\). Moreover, when the budget is low, we define \(\Delta \tilde{SW}={{SW}_{1}^{LS}}^{*}-{{SW}_{1}^{NS}}^{*}\) and have \(\frac{\partial \Delta \tilde{SW}}{\partial M}>0\). Therefore, when \(M=0\), there is \({{SW}_{1}^{LS}}^{*}={{SW}_{1}^{NS}}^{*}\). Therefore, we have \(\Delta {{S}W}={{SW}}>0\). In conclusion, when the budget is high, we have \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LS}}^{*}={{SW}_{1}^{S}}^{*}\); when the budget is low, we have \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LS}}^{*}<{{SW}_{1}^{S}}^{*}\).

The proof of Case 2 is similar to that of Case 1, thus we omit it here.

Appendix 2 Proof of extensions

2.1 Proof of Lemma 4

Case 1: Substituting the demand functions into Eqs. (10)–(11), we have

It can be verified that \({\pi }_{t}^{LU}\) is strictly concave in\({p}_{c}\). Combing\(\frac{\partial {\pi }_{t}^{LU}}{\partial {p}_{c}}=0\), we obtain the response function of the third-party collector:\({p}_{c}=\frac{t}{2}\). Then substituting \({p}_{c}=\frac{t}{2}\) into\({\pi }_{m}^{LU}\), we can easily prove that \({\pi }_{m}^{NS}\) is a jointly concave function in\({p}_{n}\),\({p}_{r}\). Combining \(\frac{\partial {\pi }_{m}^{LU}}{\partial {p}_{n}}=0\) and \(\frac{\partial {\pi }_{m}^{LU}}{\partial {p}_{r}}=0\), we have\({p}_{n}=\frac{1+c}{2}\),\({p}_{r}=\frac{v+\delta -s}{2}\). Then substituting\({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{v+\delta -s}{2}\) into the manufacturer’s profit function, we find that \({\pi }_{m}^{LU}\) is a jointly concave function in\(t\). Therefore, we obtain\(t=\frac{v}{2}\). Substituting the best response functions of the firms into the government’s objective function, we have\(\frac{{\partial }^{2}{SW}^{LU}}{\partial {s}^{2}}=\left(1-\alpha \right)\frac{-1}{4(1-\delta )}<0\). Therefore, the government can achieve social welfare maximization with respect to\(s\). We build Lagrangian function of the government’s objective function as: \(L={SW}^{LU}+\lambda (S-s)\). When\(\lambda =0\), the optimal subsidy is \({{s}_{1}^{LU}}^{*}=1-c-\delta +v+2{e}_{v}\) and the condition for this case is \(S\ge 1-c-\delta +v+2{e}_{v}\). When \(\lambda >0\), the optimal subsidy is \({{s}_{1}^{LU}}^{*}=S\) and the condition for this case is \(S<1-c-\delta +v+2{e}_{v}\). Accordingly, we can get the firms’ optimal decisions, demands, and profits as follows: when the upper limit is high, the optimal results in the LU model are the same as those in the S model, which are shown in Table 3; when the upper limit is low, the optimal results in this scenario are shown in Table 6.

The proof of Case 2 is similar to that of Case 1, thus we omit it here.

2.2 Proof of Proposition 5

For Case 1, when the upper limit is high, we can find that the optimal results under the unit subsidy constraint are the same as those under no subsidy constraint. Therefore, based on the results of Proposition 3, we have \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{S}}^{*}={{\pi }_{1m}^{LU}}^{*}\), \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LU}}^{*}\), \({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{S}}^{*}={{CS}_{1}^{LU}}^{*}\), \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LU}}^{*}={{SW}_{1}^{S}}^{*}\). When the upper limit is low, comparing the manufacturer’s profit in these three scenarios, we have \({{\pi }_{1m}^{LU}}^{*}-{{\pi }_{1m}^{NS}}^{*}=\frac{\left(1-\alpha \right){[(1-\delta -c+v+S)}^{2}-{\left(1-\delta -c+v\right)}^{2}]}{4\left(1-\delta \right)}>0\), \({{\pi }_{1m}^{LU}}^{*}-{{\pi }_{1m}^{S}}^{*}=\frac{\left(1-\alpha \right){[(1-\delta -c+v+S)}^{2}-4{(1-\delta -c+v+{e}_{v})}^{2}]}{4\left(1-\delta \right)}\). Considering \(S<1-c-\delta +v+2{e}_{v}\), we obtain \({{\pi }_{1m}^{LU}}^{*}<{{\pi }_{1m}^{S}}^{*}\). Therefore, for the manufacturer, there is \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{LU}}^{*}<{{\pi }_{1m}^{S}}^{*}\). Comparing the third-party collector’s profit in these three scenarios, we have \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LU}}^{*}\). Comparing the consumer surplus in these three scenarios, we have \({{CS}_{1}^{LU}}^{*}-{{CS}_{1}^{NS}}^{*}=\frac{S\left(-1+\alpha \right)\left(2-2c+S+2v-2\delta \right)}{8\left(-1+\delta \right)}>0\) and \({{CS}_{1}^{LU}}^{*}-{{CS}_{1}^{S}}^{*}=-\frac{(1-\alpha )(3+3{c}^{2}-2S-{S}^{2}+6v-2Sv+3{v}^{2}-6\delta +2S\delta -6v\delta +3{\delta }^{2}+2c(-3+S-3v+3\delta )-8(-1+c-v+\delta ){e}_{v}+4{e}_{v}^{2})}{8\left(1-\delta \right)}\). Defining \(\Delta \overline{CS }={{CS}_{1}^{LU}}^{*}-{{CS}_{1}^{S}}^{*}\), we have \(\frac{\partial \Delta \overline{CS}}{\partial S }>0\). When \(S\) is equal to the upper bound, there is \(\Delta \overline{CS }=0\). Therefore, we can obtain \({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{LU}}^{*}<{{CS}_{1}^{S}}^{*}\). Comparing the social welfare in these three scenarios, we have \({{SW}_{1}^{LU}}^{*}-{{SW}_{1}^{NS}}^{*}=-\frac{S(-1+\alpha )(-2+2c+S-2v+2\delta -4{e}_{v})}{8(-1+\delta )}>0\) and \({{SW}_{1}^{LU}}^{*}-{{SW}_{1}^{S}}^{*}=-\frac{\left(-1+\alpha \right){\left(-1+c+S-v+\delta -2{e}_{v}\right)}^{2}}{8\left(-1+\delta \right)}<0\). Therefore, we can obtain \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LU}}^{*}<{{SW}_{1}^{S}}^{*}\). The proof of Case 2 is the same as that of Case 1, thus we omit it here.

2.3 Proof of Lemma 5

Case 1: We use the same proof method as Lemma 4 to obtain the best reaction functions with respect to the government subsidy as follows: \({p}_{c}=\frac{v}{4}\), \({p}_{n}=\frac{1+c}{2}\), \({p}_{r}=\frac{v+\delta -s}{2}\), and \(t=\frac{v}{2}\). Substituting the best response functions of the firms into the government’s objective function, we have \(\frac{{\partial }^{2}{SW}^{LQ}}{\partial {s}^{2}}=\left(1-\alpha \right)\frac{-1}{4(1-\delta )}<0\). Therefore, the government can achieve social welfare maximization with respect to \(s\). We build Lagrangian function of the government’s objective function as: \(L={SW}^{LQ}+\lambda (Q-{q}_{t})\). When \(\lambda =0\), the optimal subsidy is \({{s}_{1}^{LQ}}^{*}=1-c-\delta +v+2{e}_{v}\) and the condition for this case is \(Q\ge \frac{\left(1-\alpha \right)(1-\delta -c+v+{e}_{v})}{1-\delta }\). When \(\lambda >0\), the optimal subsidy is \({{s}_{1}^{LQ}}^{*}=\frac{2Q\left(1-\delta \right)-(1-\alpha )(1-c+v-\delta )}{1-\alpha }\) and the condition for this case is \(Q<\frac{\left(1-\alpha \right)(1-\delta -c+v+{e}_{v})}{1-\delta }\). Accordingly, we can get the firms’ optimal decisions, demands, and profits as follows: when the upper limit of the quantity constraint is high, the optimal results in the LQ model are the same as those in the S model, which are shown in Table 3; when the upper limit is low, the optimal results in this scenario are shown in Table 7. The proof of Case 2 is similar to that of Case 1, thus we omit it here.

2.4 Proof of Proposition 6

For Case 1, when the upper limit is high, we can find that the optimal results under the quantity constraint are the same as those under no subsidy constraint. Therefore, based on the results of Proposition 3, we have \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{S}}^{*}={{\pi }_{1m}^{LQ}}^{*}\), \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LQ}}^{*}\), \({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{S}}^{*}={{CS}_{1}^{LQ}}^{*}\), \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LQ}}^{*}={{SW}_{1}^{S}}^{*}\). When the upper limit is low, comparing the manufacturer’s profit in these three scenarios, we have \({{\pi }_{1m}^{LQ}}^{*}-{{\pi }_{1m}^{NS}}^{*}=\frac{{[2Q\left(1-\delta \right)]}^{2}-[\left(1-\alpha \right){\left(1-\delta -c+v\right)]}^{2}}{4\left(1-\delta \right)\left(1-\alpha \right)}\), \({{\pi }_{1m}^{LQ}}^{*}-{{\pi }_{1m}^{S}}^{*}=\frac{{[Q\left(1-\delta \right)]}^{2}-[\left(1-\alpha \right){\left(1-\delta -c+v+{e}_{v}\right)]}^{2}]}{\left(1-\delta \right)\left(1-\alpha \right)}\). Considering \({{s}_{1}^{LQ}}^{*}=\frac{2Q\left(1-\delta \right)-(1-\alpha )(1-c+v-\delta )}{1-\alpha }>0\), we have \({{\pi }_{1m}^{LQ}}^{*}-{{\pi }_{1m}^{NS}}^{*}>0\). Moreover, considering \(Q<\frac{\left(1-\alpha \right)(1-\delta -c+v+{e}_{v})}{1-\delta }\), we have \({{\pi }_{1m}^{LQ}}^{*}-{{\pi }_{1m}^{S}}^{*}<0\). Therefore, for the manufacturer, there is \({{\pi }_{1m}^{NS}}^{*}<{{\pi }_{1m}^{LQ}}^{*}<{{\pi }_{1m}^{S}}^{*}\). Comparing the third-party collector’s profit in these three scenarios, we have \({{\pi }_{1t}^{NS}}^{*}={{\pi }_{1t}^{S}}^{*}={{\pi }_{1t}^{LQ}}^{*}\). Comparing the consumer surplus in these three scenarios, we have \({{CS}_{1}^{LQ}}^{*}-{{CS}_{1}^{NS}}^{*}=\frac{{c}^{2}{(1-\alpha )}^{2}-2c{(1-\alpha )}^{2}(1+v-\delta )+{(1-\alpha )}^{2}{(1+v-\delta )}^{2}-4{Q}^{2}{(-1+\delta )}^{2}}{8(1-\alpha )(-1+\delta )}\) and \({{CS}_{1}^{LQ}}^{*}-{{CS}_{1}^{S}}^{*}=-\frac{{c}^{2}{(-1+\alpha )}^{2}+{(-1+\alpha )}^{2}{(1+v-\delta )}^{2}-{Q}^{2}{(-1+\delta )}^{2}-2c{(-1+\alpha )}^{2}(1+v-\delta )-2{(-1+\alpha )}^{2}(-1+c-v+\delta ){e}_{v}+{(-1+\alpha )}^{2}{e}_{v}^{2}}{2(-1+\alpha )(-1+\delta )}\). Defining \( \Delta \overline{\overline{{CS}}} = CS_{1}^{{LQ*}} - CS_{1}^{{NS*}} \), we have \( \frac{\partial \Delta \overline{\overline{{CS}}} }{\partial Q} > 0 \). Considering \({{s}_{1}^{LQ}}^{*}=\frac{2Q\left(1-\delta \right)-(1-\alpha )(1-c+v-\delta )}{1-\alpha }>0\), we have \(Q>\frac{(1-\alpha )(1-c+v-\delta )}{2\left(1-\delta \right)}\). When \(Q=\frac{(1-\alpha )(1-c+v-\delta )}{2\left(1-\delta \right)}\), then \(\Delta \overline{\overline{{CS}}}=0\). Therefore, there is \({{CS}_{1}^{LQ}}^{*}-{{CS}_{1}^{NS}}^{*}>0\). Moreover, defining \(\Delta \widehat{CS}={{CS}_{1}^{LQ}}^{*}-{{CS}_{1}^{S}}^{*}\), we have \(\frac{\partial \Delta \widehat{CS}}{\partial Q}>0\). When \(Q<\frac{\left(1-\alpha \right)(1-\delta -c+v+{e}_{v})}{1-\delta }\), there is \(\Delta \widehat{CS}=0\). Therefore, there is \({{CS}_{1}^{LQ}}^{*}-{{CS}_{1}^{S}}^{*}<0\). In conclusion, we can obtain \({{CS}_{1}^{NS}}^{*}<{{CS}_{1}^{LQ}}^{*}<{{CS}_{1}^{S}}^{*}\). Similarly, we can prove that \({{SW}_{1}^{NS}}^{*}<{{SW}_{1}^{LQ}}^{*}<{{SW}_{1}^{S}}^{*}\).

The proof of Case 2 is similar to that of Case 1, thus we omit it here.

Rights and permissions

About this article

Cite this article

Guo, X., Fan, X. & Wang, S. Trade-in for cash or for new? Optimal pricing decisions under the government subsidy policy. Ann Oper Res (2022). https://doi.org/10.1007/s10479-022-04664-w

Accepted:

Published:

DOI: https://doi.org/10.1007/s10479-022-04664-w