Abstract

Online peer-to-peer (P2P) lending platform is an emerging FinTech business model that establishes a link between investors and recipients of capital in supply chains (SCs). Businesses face capital constraints impacting directly on their final product price and demand. This article studies optimal decisions and operational strategies in a logistics network considering two capital-constrained manufacturers who produce products of different qualities and sell them to a retailer having deterministic demand over a specific period. The high quality product manufacturer borrows capital through an online P2P lending platform with a service fee, while the low quality product manufacturer pre-sells products for competing with the high quality product manufacturer. In this study, we find optimal prices of the SC participants, service rate of the online P2P platform and percentage of the pre-ordering quantity of the retailer. We analyse optimal Stackelberg and Nash equilibrium of the SC participants. We find that an increase in the amount of opportunity cost will cause a decrease in the pre-ordering quantity of the retailer affecting the SC profit in numerous ways. The online P2P lending platform should consider the amount of the retailer’s target profit in determining the platform’s service rate. We posit some practical insights based on our numerical study and observations for SC managers enabling them to take appropriate measures about their optimal strategies according to the networks’ existing economic conditions.

Similar content being viewed by others

1 Introduction

In supply chains (SCs), intermediary firms with capital constraints often borrow money in two traditional ways, namely, bank credit financing (BCF) and trade credit financing (TCF). BCF is a bank loan that the firms borrow from the banks, while TCF is the credence that the firms’ upstream SCs participants consider them (Gao et al., 2018).

Online peer-to-peer (P2P) lending platform is one of the emerging FinTech business models that does not include traditional intermediaries (Jiang et al., 2018). In this platform, the lenders and borrowers do not interact face-to-face (Chen et al., 2014). The online P2P platform offers different business plans and estimates the amount of money the platform will gain after investing in the business. The P2P platform assesses the creditworthiness of the business. Following FinTech-based online P2P lending platform introduction, supply chain finance (SCF) has changed the participants’ bonds to a supply chain. Thus, it is important to recognise the participants’ optimal operation and financial decisions.

Product sale before manufacturing is gaining momentum as this strategy helps accumulate working capital. For example, Zhuhai Gree (www.gree.cn) acknowledges products’ pre-selling in their trade conditions (Xiao & Zhang, 2018). Under a pre-selling program, manufacturers offer to sell their products at a specific discounted rate. This opportunity provides an appropriate “win–win” solution for the firms involved in the SC. From the manufacturer’s perspective, pre-selling is crucial when the financial cost is high and the firm cannot access external financial sources. Pre-selling may have various models with some incentives to motivate the retailers to purchase the products before manufacturing. This strategy is especially beneficial when manufacturers face different challenges in their businesses. Determination of the pre-selling strategies is an important task. For example, an appropriate percentage of discount rate that the manufacturer offers to the retailer is a pre-selling factor. This factor is crucial as an inaccurate discount percentage may pose serious problems (e.g. profit loss) to the manufacturer. The quantity purchased by the retailer is another factor that the manufacturer should determine.

Product price is one of the main factors that considered by the consumers while purchasing products from a product pool. This factor gives them the privilege to choose among several options. A retailer sells multiple competing brands of a product supplied by different manufacturers (Cachon & Kök, 2010). Product price competition is often unavoidable because of the manufacturers’ disparate product quality and production costs (Li & Chen, 2018). Therefore identification of an optimal product price is considered as one of the main factors facilitating the consumers in product selection corresponding to their budgets.

Motivated by these pragmatic research gaps, this study contributes to the extant literature in numerous ways. It considers an SC with an online P2P lending platform, two manufacturers having products of different qualities, and a retailer. The high quality product manufacturer has access to loans offered by the online P2P lending platform. Because of their high product quality, lenders are encouraged to invest. The low quality product manufacturer is not qualified in obtaining loans from different investors, e.g. banks and online P2P lending platforms, etc. Thus, the low quality product manufacturer pre-sells the products to get sufficient capital to compete in the market. An examination of the earlier studies shows the need for a comprehensive model facilitating the SCs to consider several factors together, including capital constraints, product quality and pre-sale conditions for manufacturers. Determining the optimal price of products by considering these factors is one of the strengths of the proposed model in this study. This study investigates the retailer’s optimal ordering quantity. Our study discusses a Nash equilibrium between these two manufacturers and finds the optimal prices determined by each of them. We investigate the effects of market potential and initial capital of the capital constraint firms. We identify the optimal product quantity the retailer should purchase from the low quality product manufacturer. The study investigates how the Stackelberg game affects the optimal service rate of the lending platform within a supply chain. The analysis of the results shows that the proposed model can help managers determine different strategies considering economic conditions in their decisions.

The remainder of this paper is organised as follows. Section 2 reviews the extant literature. Section 3 defines the problem and presents the assumptions behind the proposed model. Section 4 designs a game-theoretic approach and analyses the decisions between the supply chain participants. Next, Sect. 5 analyses numerical examples, while Sect. 6 discusses the results and key parameters of the model that influence the decision variables. Section 7 delineates managerial implications of the outcomes. Section 8 concludes the article elucidating the scope for future research.

2 Literature review

We classify the extant literature into three groups. The first group of literature focuses on equilibrium strategies related to the problems in SC. The second group is related to the articles on online P2P lending platform strategies, and the last group of literature consists of pre-selling strategies in the SC. The following sections delineate the three streams of literature.

2.1 Equilibrium strategies

Literature reports optimal Stackelberg policies in SCs. Cachon and Kök (2010) consider competition among manufacturers and use one of the contracts, viz. wholesale price, quantity discount rate and two-part tariff. Raghavan and Mishra (2011) study a two-level SC with one manufacturer and one retailer, where both the businesses face capital constraints and fail to manufacture and order optimal quantities. Their study reports that if one of the businesses in the SC faces low cash constraints, joint decisions would be a sagacious idea for the lender, manufacturer and retailer. Kouvelis and Zhao (2015) consider financial constraints, bankruptcy costs, and coordination of one supplier and one retailer, where both firms are capital-constrained requiring financing. They report that during bankruptcy, revenue sharing contracts might have higher expected profit in comparison with the other circumstances. Yang et al. (2015) suggest that a firm’s bankruptcy potential can be harmful to its competitors while it can benefit its supplier and customers. The effect of the uncertain demand in an SC (Chen, 2015) considers a distribution channel that includes one manufacturer and one capital-constrained retailer having access to a competitive bank market or the manufacturer. Chen (2015) reports that trade credit makes both channel members trade better. The article further compares bank versus trade credit under a classical channel contract and revenue sharing contract. Firms’ budget constraint situation is a common phenomenon. Feng et al. (2015) identify cooperation with budget-constrained members in designing contracts for an SC when the financial market is unavailable. Yan et al. (2016) map an SCF comprising a capital-constrained retailer, a manufacturer and a commercial bank. Their study formulates a bi-level Stackelberg game where the bank acts as a leader in the SC. The study includes a partial credit guarantee (PCG) contract for the SCF. They find that the PCG contract may realise profit maximisation in the SC. Considering an SC with a supplier and a capital-constrained and emission-dependent manufacturer, Xu and Fang (2020) report equilibrium strategies. They consider a PCG and a combination of trade credit and PCG. Johari et al. (2018) propose an SC model. They report that an upstream credit period may incentivise a downstream credit period and retail price for a two-echelon SC. Yang et al. (2017) study the impact of external financing considering a supplier and two capital-constrained retailers. Considering a Cournot competition of the retailer, they suggest that when competition in the supply chain experiences a gradual increase, the Stackelberg leader (i.e. the supplier) may consider merging with one retailer to avoid double marginalisation. Ni et al. (2017) report debt financing concerning capacity decisions. They report agency problems when potential conflicts of interest exist between the firm owner and the lender. Li and Chen (2018) report a game-theoretic model where the retailer sells two different qualities products. They discuss the competition on price and quality in an SC using a backward integration strategy.

Xiao et al. (2017) consider a supplier and a retailer and provide a financially constrained SC model. In their model, the supplier sells the products to a retailer who does not have access to bank finance due to their low credit rating. The study designs a generalised revenue-sharing contract that harmonises the SC with flexible profit allocation and shows its superiority over revenue-sharing and buyback contracts using some numerical examples. Li et al. (2018) study an SC in which the retailer is capital-constrained whereas the supplier is risk-averse. In their model, the supplier’s risk aversion behaviour is measured with the conditional value-at-risk method under two strategies of PCG financing and TCF. They obtain equilibrium solutions and identify the preference of two financing strategies. Cao and Yu. (2018) examine an emission-dependent SC that includes a producer and a retailer. In their model, the retailer is capital-constrained who finances its business through trade credit obtained from the manufacturer. The study examines the interaction between financial and operational decisions under the carbon cap-and-trade mechanism. In continuation to emission-dependent SC research, Cao et al. (2019) examine the financing preferences of the SC of a competitive bank or supplier. In situations where demand is uncertain, their study considers an emission-dependent SC with an emission-dependent manufacturer and capital-constrained supplier who needed short-term financing.

Lin and Xiao (2018) study a credit guarantee scheme in an SC with one capital-constrained manufacturer. The study reports a Stackelberg model with the retailer as the leader under different order contracts (i.e. push and pull). Their results suggest that the retailer should manage manufacturers of different types to decide how to finance while the bank controls financing risk. Chakraborty et al. (2019) address three different contract scenarios under cost-sharing mechanisms where two competing manufacturers invest for improving their products' quality and their common retailer sells higher quality products. Liu and Wang (2019) provide a game-theoretic approach and formulate a network equilibrium model using variational inequality theory for financial hedging decisions of multiple competing SC firms. Zhen et al. (2020) present a dual-channel SC model and elucidate a capital-constrained manufacturer's preference for a third-party platform as a financing strategy. To investigate competing SCs with financing risk, Wu et al. (2019) use duopoly models. Their study identifies that the capital investment risk does not affect the choice of equilibrium quantities and prices. Wu and Kung (2020) study a Cournot competition model in an SC considering the asymmetric financing risk in carbon emission technology investment and report the impact of investment on the competition equilibria.

Zhang et al. (2019) consider a situation where a manufacturer sells goods through a platform that selects contract forms. The study uses an analytical model to examine the inter-relationship between the platform’s contract choice and the manufacturer’s product quality decision. Jiang et al. (2020) study a service-oriented manufacturing SC in which a manufacturer and an operator decide concerning the quality of equipment and maintenance services. The study reports decision-support models – one for under-decentralised decisions for the manufacturer and operator and the other for under-centralised decisions for obtaining optimal SC decisions. Two strategies, namely, cost-sharing and performance-based strategy, are introduced to coordinate the SC. Taleizadeh et al. (2021) report an SCF study considering an SC consisting of one manufacturer and two competing retailers. The study aims to identify the optimum decisions of the retailers for pricing and ordering along with the best contract in achieving maximum profit for the SC. Zhuo et al. (2021) study an SC consisting of a supplier and a capital-constrained retailer. The study examines optimum decisions of the supplier and retailer considering the players’ loss aversion decision-making under different financing strategies. The study reports a Stackelberg equilibrium using a wholesale price contract under two financing schemes and identifies the effects of the loss aversion coefficients and the level of initial capital on operational and financial decisions. Pal et al. (2021) examine a dual-channel SC using the vertical Nash and manufacturer Stackelberg models in a decentralised structure.

Motivated by the research gaps found in the extant literature, our article considers the effect of quality and competition between two manufacturers. Further, our article considers financial constraints simulating real-world problems and provides better insights for the managers.

2.2 Online peer-to-peer lending platform

Lending through an online platform is an emerging FinTech business model which is gradually gaining momentum. The bibliometric analysis of Liu et al. (2020) identifies 221 articles published in the last 10 years with research priorities on the P2P lending platform. Guo et al. (2016) evaluate the assessment of the credit risk loan and its appropriate allocation. Serrano-Cinca and Gutiérrez-Nieto (2016) propose a profit scoring system to anticipate P2P loan profitability and analyse the factors determining the loan probability of default. The investment risk is one of the most crucial aspects that the firms should regard. Cai et al. (2016) use signalling theory and compare the effects of various signals on the likelihood of successful finding in three models, viz. first time borrowing, repeated borrowing with, and without prior lending, by using logistic regression. Gao et al. (2018) formulate a model comprising a manufacturer, i.e. a Stackelberg leader, a P2P lending platform, i.e. a sub-leader, and a capital-constrained retailer, i.e. a follower, to determine the optimal service rate of the lending platform. The lending platform identifies an optimal value of the service rate for the loan that helps the investment profitability. Metawa et al. (2017) propose an intelligent model based on a genetic algorithm for selecting optimum decisions for the bank lending process to maximise bank profits in a credit crunch environment. An empirical study in China examines the factors determining the likelihood of getting a loan in online P2P lending (Zhang et al., 2017). Zeng et al. (2017) consider an iterative computation model for evaluating unknown loans based on a bipartite graph model. For model validation, the study performs numerical experiments based on the data of the largest P2P lending marketplace in the United States. The hybrid model integrating the integrated repetitive computation model and logistic classification model of their study is more efficient than the individual model. Wang and Chen (2017) examine an SC of fresh produce consisting of a supplier and a retailer in the newsvendor framework. In their model, the supplier is a Stackelberg leader and the retailer is a follower. Jiang et al. (2018) present a model for extracting valuable features from the descriptive text about loans. They propose a default prediction method for lending P2P with soft information and four default prediction models to demonstrate the performance of these features. Liu et al. (2019) propose a model to examine optimal risk control ability in a P2P lending platform. Wang et al. (2019) propose a Stackelberg game elucidating the interactions between a capital-constrained retailer as a follower in the game and electronic business (EB) platform financing or bank credit financing as a Stackelberg leader. They observe that the EB platform can provide coordinated SC financing contracts and other financing strategies. Park et al. (2021) consider time and cost simultaneously for tackling slack problems. Giri (2021) considers effort and price in SC.

This article analyses the service rate of the online lending platform, which is still under-researched and discussed in the literature. The service rate is one of the key operating criteria for these lending platforms. Thus, in P2P businesses, an optimal service rate identification at the beginning of their operations is an important task.

2.3 Pre-selling strategies

Different pricing strategies are beneficial for maximising profit in businesses. Businesses offer pre-selling to encourage consumers to purchase when they are unconcerned about the precision of their consumption (Fay & Xie, 2010). This strategy may incur losses to the buyers. To minimise the effect of pre-selling on the buyers, Xiao and Zhang (2018) discuss the effect of the opportunity cost. Boyacı and Özer (2010) illustrate that the pre-selling may enhance considerably the manufacturer’s profit, and the market attributes (e.g. demand variability) affect the value of information in the SC. Nasiry and Popescu (2012) consider the effect of anticipated regret on consumer decisions and the firm’s profit and policies in a pre-selling context where buyers have uncertain valuation. Cho and Tang (2013) analyse an SC where the manufacturer sells seasonal products to the retailer. They examine the pre-selling of products after observing the firm’s demand. The article reports that postponing the ordering decisions could be detrimental to the retailers, while the uncertainties could be meaningful to them. Lim and Tang (2013) report that in a sinking market, the seller adopts a dynamic pricing policy when expected valuation decreases over time. Kuthambalayan et al. (2015) consider the impact of pre-selling strategies with a price discount on a firm’s ability to maximise the expected profit. The other articles related to this aspect consider pre-selling strategies concerning production capacity constraints. Huang et al. (2017) characterise the optimal and quality level and production quantity of the seller over two periods. Xiao and Zhang (2018) investigate an SC with one manufacturer and one retailer where the manufacturer considers offering products at a lower discount rate before completion of the products. They examine the benefits of pre-selling strategies. The opportunity cost parameter in their article may lead to loss to the retailer or manufacturer, and the buyer should know precisely the pre-selling amount to diminish the amount of loss and enhance profit. Considering several pre-order strategies for retailers, Zhang and Yang (2021) report delays in payments from retailers to consumers during the advance selling period. Their study examines thresholds for pre-order strategies, optimum price and quantity and an advance selling strategy for the retailers under price commitment mechanism with stochastic demand and uncertain product valuation.

Our study provides a more pragmatic SC model. Comparing with the earlier studies reported in the extant literature, we have mapped the research gaps in Table 1. The earlier studies in this domain have considered some of the factors of online lending platforms, platforms’ competition and their pre-selling strategies for evaluating the SCs. The model presented in our study evaluates a supply chain by considering capital constraints, differences in the quality of products offered by the manufacturers and provisioning pre-sale conditions for the manufacturers. Our proposed model considers more realistic factors compared with earlier studies, which makes our model more pragmatic. Consideration of disparate factors enables the SC managers to adapt the appropriate strategies for dealing with volatile market scenarios. Our study investigates the effect of the opportunity cost and analyses the influence of this parameter on the manufacturer, other SC entities and the parameters associated with them under a FinTech business model.

3 Problem definition and assumptions

Consider a logistics network consisting of two different manufacturers, an online P2P lending platform and a retailer. These manufacturers produce two different qualities of products, i.e. high quality and low quality products. It is assumed that both manufacturers face capital constraints. The two manufacturers sell their products to the end customers through the retailer. The retailer purchases the commodities at a price of \(w_{L}\) or \(w_{H}\) and sells at a retail price of \(P_{L}\) or \(P_{H}\)(\(P_{L}\) > \(w_{L}\), \(P_{H}\) > \(w_{H}\)). The costs of production of low and high quality products are \(C_{L}\) and \(C_{H}\) respectively. The high quality product manufacturer has the privilege to access capital from the online P2P platform. This privilege is only available for this manufacturer as the platform encourages the manufacturer to produce high quality products for the market. The other type of manufacturer producing low quality products pre-sells the products in order to manage their capital constraints and compete with the high quality product manufacturer.

The following six decision variables are considered in this study:

- \(q_{l}\) :

-

The percentage of the quantity of retailer purchase from low quality manufacturer.

- \(w_{L}\) :

-

Selling price of low quality manufacturer.

- \(w_{H}\) :

-

Selling price of high quality manufacturer.

- \(P_{L}\) :

-

Retailer’s low quality product price.

- \(P_{H}\) :

-

The price of retailer for high quality product.

- \(s_{m}\) :

-

Optimal service rate of online lending platform.

Figure 1 illustrates the relationship between the supply chain participants. As delineated in this figure, the retailer determines the pre-ordering quantity and pays the manufacturer. Next, the low quality manufacturer invests the money in manufacturing and yields profit. The competition happens between the two manufacturers. These two manufacturers will determine their optimal prices corresponding to the competition. The online P2P lending platform service rate (\(s_{m}\)) will be determined according to the two prices of the two types of manufacturers. This research includes the following three assumptions.

Assumption 1

We assume that the market has two different segments with two different demands to be consumed by the retailer. Therefore, two product types are considered in this research to obtain the demand function of the retailer for the two different demands. For this reason, we have two deterministic demands for the two qualities of the products. Each product has the market potential corresponding to its qualities (\(\alpha_{H}\),\(\alpha_{L}\)) representing the maximum willingness to purchase the products. The \(\gamma\) represents the substitutability degree between the two types of products and the variation between the two types of products (Modak & Kelle, 2019). With these assumptions, we arrive at the following two equations:

Assumption 2

We assume the following demands of the market for the two different product types (\(D_{H}^{^{\prime}}\),\(D_{L}^{^{\prime}}\)) and define them as follows:

We know that the retailer has a specific amount of demand for its products which is different from the order quantity at the manufacturer. This assumption illustrates the amount which is equal to the demand function. Equations (3) and (4) elucidate the market demand for the two product types.

Assumption 3

The relationship between the discount rate of the low quality manufacturer and percentage of pre-ordering quantity is assumed to be as follows:

Equation (5) illustrates that when the pre-selling quantity from the retailer increases, the low quality manufacturer persuades to offer a higher discount rate. This situation arises in reality when the retailer plans to purchase more products from the manufacturer and the manufacturer offers a higher discount rate.

3.1 Notation

The notations are summarised below.

Notation | Definition |

|---|---|

\(C_{H}\) | Production cost of high quality commodity |

\(C_{L}\) | Production cost of low quality commodity |

\(i_{m}\) | Interest rate of investor |

\(D_{H}\) | Demand of the market for high quality product |

\(D_{L}\) | Demand of the market for low quality product |

\(\delta\) | Opportunity cost |

\(B_{m}\) | Initial capital of high quality manufacturer |

\(\eta\) | Discount rate of low quality manufacturer |

\(w_{H}\) | Selling price of high quality manufacturer |

\(w_{L}\) | Selling price of low quality manufacturer |

\(s_{m}\) | Service rate of online lending platform |

\(P_{H}\) | Retailer’s unit retail price of high quality product |

\(P_{L}\) | Retailer’s unit retail price of low quality product |

\(\alpha_{H}\) | Market potential of high quality commodity |

\(\alpha_{L}\) | Market potential of low quality commodity |

\(\gamma\) | Substitutability degree between two types of products |

\(\beta^{\prime}\) | Price sensitivity of market |

\(\beta_{L}\) | Price sensitivity of the low quality commodity |

\(\beta_{H}\) | Price sensitivity of the high quality commodity |

\(q_{l}\) | Percentage of pre-ordering quantity of the retailer |

4 Optimal decisions

We use a game-theoretical approach to analyse the decisions between the supply chain participants. We design a Stackelberg game between the SC participants.

4.1 Retailer’s optimal decision

In this study, the retailer is one of the essential players in the SC. Many optimal decisions are related to this entity of the SC. The retailer makes various decisions related to this part of the SC. The retailer should find the best ordering quantity from both manufacturers. One of the most important criteria for obtaining the best decision is the market demand. We assume that our market consists of two different segments – the first segment has better opportunities and better options to reach the high quality product while the other provides low quality products instead of high quality. We posit this part as a market potential (\(\alpha_{H} ,\alpha_{L}\)) that shows the willingness to purchase high and low quality products (i.e. Assumption 1). This demand will directly affect the SC and its profit. With this assumption, the profit function of the retailer is as follows:

Equation (6) illustrates the amount of money that the retailer will obtain from selling the two types of products (i.e. high and low). The first term of the equation symbolises the expected revenue from selling the products, while the second term is related to the cost that the retailer should consider. The second term includes two components, viz. the cost of purchasing the products and the cost related to the loss of the opportunities which could be attained from the opportunity cost (\(\delta\)). From Eq. (6), we obtain the amount of the pre-selling quantity of the retailer (\(q_{l}\)) and the prices of the high and low quality products that the retailer sells to the customers (\(P_{H}\),\(P_{L}\)). We define the interaction between the discount rate of the low quality product manufacturer and the amount of pre-selling quantity that should be bought by the retailer as \(\eta = \ln (q_{l} )\) (i.e. Assumption 3). \(\eta\) has an inverse relationship with the quantity to be purchased by the retailers. The relationship depicts that when the manufacturer’s offered price to the retailer decreases, the retailer is encouraged to purchase more products from the low quality product manufacturer. Further, it illustrates that when the prices are comparatively higher, the retailer does not desire to buy more products from the manufacturer. According to Assumption (2), the market demand for the two product types is deterministic. Considering this assumption, we first solve the problem where the retailer purchases products from both manufacturers and then sells them to the market.

Lemma 1

From Eq. (1), it is found that this function is concave and has maximum points.

Proposition 1

Given the pre-selling discount rate (\(\eta\)), the retailer’s optimal pre-selling quantity is satisfied, which is an exponential function, and the optimal pre-selling quantity is related to the amount of the opportunity cost (\(\delta\)), and the pre-selling quantity increases with this amount.

Proof is given in “Appendices–A and C”.

Proposition (1) shows that the pre-selling quantity only depends on the opportunity cost (\(\delta\)) of the low quality product manufacturer. With an increase in \(\delta\), the pre-selling quantity of the retailer will experience a slight decrease. Another interesting aspect in proposition (1) is that the other parameters, such as \(P_{H}\), are not significant in the pre-selling quantity as they do not affect the pre-selling quantity. This proposition suggests that the retailer should consider their opportunity cost properly.

Proposition 2

Considering the above assumptions, the price at which the retailer should sell its products to the customers for both products (i.e. high and low quality products) is as follows:

Proof is provided in “Appendix–C”.

Proposition (2) suggests that the prices of both products are inversely related to the amount of (\(\beta{^{\prime}}\)), and the amount \((w_{H} - w_{L} )\) plays a significant role in the price of both commodities.

4.2 Low quality manufacturer’s optimal decision

The manufacturer that produces low quality products faces capital constraints and requires a way to tackle this issue. For this reason, this manufacturer starts to pre-sell the products and obtains the capital to achieve the minimum amount of money to produce low quality products. The low quality product manufacturer considers offering a pre-selling contract to the retailer to achieve a specified amount of cash before production. However, the pre-selling activity is triggered by offering a discounted price to the retailer for placing advance orders. This manufacturer offers a discounted rate \(\eta \in (0,1)\) to the retailer. The first stage of this model is to consider the following profit function of the manufacturer (Eq. 10).

Equation (10) shows the amount of money that the manufacturer earns by selling the products to the retailer. The equation includes two parts, namely, the amount of money earned by pre-selling the products (\(\eta w_{L} q_{l}\)) and the manufacturer revenue from regular sales. The manufacturer achieves the amount of money related to the opportunity cost (\(\delta\)) of the retailer through various investments (e.g. saving money in the bank). Equation (10) elucidates that the decision variable to be determined by the low quality product manufacturer is the price of the low quality product (\(w_{L}\)).

Lemma 2

The mathematical relationship between the pre-selling discount rate of the low quality product manufacturer (\(\eta\)) and opportunity cost (\(\delta\)) is as follows:

Proof of Lemma 2 is given in “Appendix–B”.

4.3 High quality manufacturer’s optimal decision

The manufacturer who produces high quality products faces capital constraints for covering the production costs of the products. This strategy triggers the manufacturer to borrow from an online P2P lending platform. The manufacturer has an initial capital \(B_{m}\) in the first part of its selling period. The manufacturer requires a \((C_{H} D_{H} - B_{m} )\) amount of money to start production. Therefore, the manufacturer should return the total interest of the investor and the P2P platform, which is \((i_{m} + s_{m} )\). This interest includes the interest of the investor (\(i_{m}\)) and the service of the online lending platform. Following this, we express the high quality product manufacturer’s profit function as follows:

The first part of Eq. (12) is related to the total revenue of this producer. The expression includes production cost and interests that the manufacturer should pay to the P2P lending platform and the investor. We understand that if \(w_{H} D_{H}\) > total cost, the manufacturer will not face bankruptcy. In other respect, the manufacturer announces bankruptcy and pays the remaining revenue to the lending platform. Proposition (3) characterises the high quality product manufacturer’s optimal price and basic properties.

4.4 Competition between high and low quality producers

We consider competition between the two manufacturers to achieve the maximum share of the market based on anticipation of the retailer’s reaction. According to Assumption (1), the market requires two product types with competing manufacturers under disparate criteria (i.e. quality and price), and it is not obvious who will win the competition. The high quality product manufacturer offers a high quality product instead of a low quality commodity to the market, and this necessitates to access to the loan from the P2P lending platform. The low quality product manufacturer offers pricing strategies (pre-selling) to the customers in the market. We consider a Nash game between these manufacturers to reach the optimum price of the SC. All participants should obtain the maximum profit in their operations.

Proposition 3

Given the two manufacturers’ best responses, the price of the low and high quality product manufacturers can be as follows:

Proof of Proposition 3 is given in “Appendix–D”.

4.5 Optimal decisions of online peer-to-peer lending platform

One of the prominent components of this supply chain is the online P2P which plays a crucial role. This platform earns the service fees and lends the determined money to the investors. First, we assume the circumstances in which the high quality product manufacturer tackles its loan obligation, which is \((C_{H} D_{H} - B_{m} )(i_{m} + s)\). As mentioned earlier, if the total revenue of this manufacturer surpasses these costs, the manufacturer will be able to handle the costs. We will investigate the utility function of this platform. Therefore, we should obtain the platform’s optimal service rate (\(s_{m}\)).

Anticipating the high quality product manufacturer’s best response (\(w_{H}\)) the platform acts as a leader, whereas the manufacturer acts as a follower. What stands out from Eq. (2) is that this platform is going to obtain its maximum service in different aspects considering the other participants in the supply chain. This strategy leads to the following proposition:

Proposition 4

Given the optimum prices of the two manufacturers, the optimal service rate of the lending platform would be:

5 Numerical study

A numerical example is illustrated to evaluate the effectiveness of the proposed model. For every parameter of the model, we investigate the effects and subsequently provide managerial insights for the model to scrutinise the behaviour of each parameter on the decision variables. The numerical values of the parameters are \(\alpha_{H} = 2000\), \(\alpha_{L} = 1000\), \(\beta^{\prime} = 0.06\), \(\delta = 0.06\), \(\beta_{H} = 0.35\), \(\gamma = 0.25\), \(\beta_{L} = 0.65\), \(C_{L} = 300\), \(C_{H} = 1550\), \(i_{m} = 0.05\) and \(B_{m} = 950000\). The collated data are approximately similar to real-world situations. The opportunity cost (\(\delta\)) of the retailer is 7% for the investment (e.g. in the case of JP Morgan). In the automobile industry, tooling costs per car are approximately between $200 and $600 if one sells 1 million vehicles. If this sale drops below 100,000, the average production cost lies between $1000 to $5000 per car, which is five times more than the earlier cost. We have analysed our model according to these data for the low and high quality products (\(C_{H}\),\(C_{L}\)). In this example, the market potential of the high quality products is two times higher than the low quality products, which represents a rich society. By substituting these parameter values under concavity conditions, all conditions for this data set are satisfied, and therefore, all models are concave. Table 2 illustrates the values of the decision variables and profit by substituting the above data.

Table 2 shows that the optimal service rate of the platform is 0.05, which is equal to the investors’ interest rate. Another interesting point is that the selling price of the low quality product manufacturer to the retailer is half of the amount of the high quality product manufacturer. The retailer should not add much to the price of high and low quality products (\(P_{H} = 5299\),\(P_{L} = 5217\)). Table 3 shows that the retailer will reach the highest amount of profit compared to the other entities of the supply chain. The low quality manufacturer who acts as a follower in the SC will also reach desired profit in the designated game.

6 Results, sensitivity analysis and discussion

We consider different parameters and their effects on the profit of the supply chain participants, viz. retailer, high and low quality commodity producers, and lending platform. The key parameters of the model that influence the decision variables are \(\delta\), \(\alpha_{H}\), \(\alpha_{L}\), \(\beta_{L}\) and \(\beta_{H}\).

6.1 \(\delta\) (opportunity cost)

Opportunity cost is one of the crucial parameters in the SC that directly affects the decisions related to the retailer. The opportunity cost is the percentage of money that the retailer obtains by investing in a business, and the retailer suffers by pre-ordering the products from the manufacturer. The higher the amount of \(\delta\), the retailer purchases more products from the manufacturers. Proposition (1) delineates this relationship. Table 4 illustrates how the opportunity cost impacts the decision variables and profits of the SC components while keeping the other parameters constant.

As noticed from Table 4, the percentage of the pre-ordering quantity of the retailer (\(q_{l}\)) has an inverse relationship with the opportunity cost of the retailer (\(\delta\)), and fluctuations of this percentage of pre-ordering quantity cause changes in the quality. This change would not lead to significant fluctuation in the price of the low and high quality product manufacturers and the market price of the retailer (\(P_{H}\),\(P_{L}\)). The service rate of the platform (\(s_{m}\)) does not have significant changes in most of the intervals. We observe from Table 4 that the profit of the online lending platform increases significantly with the growth of the opportunity cost. It signifies that although the service rate of the platform does not have significant variation, the profit of the online lending platform witnesses a dramatic increase. Table 4 illustrates a decrease in the amount of the profit of the retailer. This phenomenon plays a pivotal role in the model affecting decisions related to the SC components, and these components should make their decisions according to the opportunity cost.

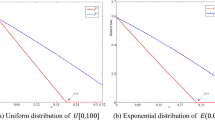

Figure 2a elucidates a direct relationship of the opportunity cost with the service rate. Interestingly, a higher amount of the opportunity cost (e.g. 0.75) yields an insignificant increase in the service rate of the platform. This implies that under critical circumstances of the market, it is not required for the lending platform to apply a higher amount of service rate. Further, the online lending platform should consider the opportunity cost of the retailer and the market to determine the optimal service rate for the high quality product manufacturer. An inappropriate service rate would lead to a loss in the entire SC.

6.1.1 Opportunity cost and dealership

A higher amount of the opportunity cost (e.g. 0.75) indicates that the price of the high quality product is more than twice compared with that of the low quality product. It implies that in a weak economy, this situation may affect the market purchase potential as people of that economy can only afford to buy low quality commodities. Further, a higher opportunity cost would affect the profit of the low quality product manufacturer as they cannot afford to compete in this market. However, such a market situation would not affect the profit of the online lending platform. This situation will encourage dealerships in the market instead of a boom in the production segment. The P2P lending platform in this type of economy would reach the maximum amount of profit (e.g. Faircent in India) as seen in Fig. 2b.

6.2 Market potentials of the products (\(\alpha_{H}\), \(\alpha_{L}\))

In an economy, the market potentials of the two types of products are different. The market potentials indicate the amount of money available in a society to purchase commodities from the market. As specified in Assumption (1), the market potentials directly affect the market demand for the two product types. As noticed from the profit functions of the SC participants, the market demand plays a significant role in the decisions they should make in the model. The market potentials can change according to the willingness to purchase the products.

As illustrated in Table 5(a), the market potential of the high quality product (\(\alpha_{H}\)) directly affects the online platform’s service rate (\(s_{m}\)). The service rate of the platform grows when \(\alpha_{H}\) increases. The online platform can charge a higher service rate when the market potential rises. On the other hand, with an increase in the market potential of the high quality product, both prices of the high and low quality products of the retailer (\(P_{L} ,P_{H}\)) and manufacturers (\(w_{L} ,w_{H}\)) increase. The profit values of the SC participants witness a dramatic growth in the intervals of Table 5(a). Another interesting point is that the value of the percentage of the pre-ordering quantity of the retailer (\(q_{l}\)) remains constant.

Concerning the growth of the market potential of the low quality products (\(\alpha_{L}\)) in Table 5(b), the service rate of the platform (\(s_{m}\)) does not change significantly. However, the profit of the P2P lending platform increases as \(\alpha_{L}\) rises. Both retailer’s and low quality product manufacturer’s profits increase where the high quality product manufacturer’s profit grows at a comparatively slower pace. The percentage of the pre-ordering quantity of the retailer (\(q_{l}\)) remains stable in Table 5(b). Figure 3a illustrates how the profit of the P2P lending platform increases as \(\alpha_{H}\) rises. Figure 3b shows that the retailer’s profit increases with an increase in the market potential of the high quality product (\(\alpha_{H}\)).

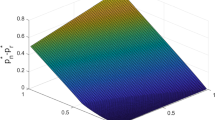

The service rate of the online P2P lending platform (\(s_{m}\)) depends on the market potential of the high quality product (\(\alpha_{H}\)). However, as elucidated in Fig. 4, the market potential of the low quality product (\(\alpha_{L}\)) affects the service rate of the lending platform. This fact demonstrates that the lending platform should take into account not only the high quality product manufacturer but also consider the low quality product manufacturer. This concern affects the decisions of the high quality product manufacturer.

As noticed in Fig. 5a, an increase in the both market potentials (e.g. high and low) causes a rise in the service rate of the online P2P lending platform. This phenomenon illustrates that when the market has sufficient potential for various products, the online P2P lending platform could grow the amount of their service rate instead of declining its value. Further, from Fig. 5b, it is observed that the market potential of low quality products has a substantial effect on the selling price of the low quality product manufacturer in comparison with the market potential of high quality products. Figure 6a illustrates that the market potential of high quality products has a high impact on the selling price of the high quality product manufacturer compared with the market potential of low quality products. Figure 6b illustrates the effect of the changing market potentials of different product qualities on the retailer’s unit retail price for the low quality product.

6.3 Initial capital of high quality product manufacturer (\(B_{m}\))

The initial capital of the high quality manufacturer is critical in various aspects. Businesses consider this parameter to make crucial decisions. If we look at the profit function of the high quality product manufacturer and online P2P lending platform, this parameter exists in them. Further, this parameter is regarded as one of the main factors for startups. From the investors’ perspective, this parameter aids in making SC decisions. This parameter determines the investment decisions of the firms by the investors. There are reasons why the initial capital of the high quality product manufacturer is to be analysed. Table 6 illustrates the results related to the variation of the initial capital of the high quality product manufacturer (\(B_{m}\)).

Overall, what stands out from Table 6 is the downward trend of the service rate of the platform (\(s_{m}\)). An increase in factor \(B_{m}\) triggers a decline in the profit of the online P2P platform in the interval of Table 6. It is evident that when the firms have sufficient initial capital, they are not required to borrow money from the online platform. It affects the profit of the lending platform. The products’ prices fluctuate with the variation of the initial capital of the high quality product manufacturer. The retailer’s profit slightly increases with a rise in \(B_{m}\)(Fig. 7). Further, the high quality product manufacturer’s profit improves with an increase in \(B_{m}\).

As observed in Fig. 7, the initial capital of the high quality product manufacturer affects the retailer’s profit. This phenomenon illustrates that the retailer would be satisfied when the manufacturer has enough funds to run the business. Besides this, the retailer should encourage the manufacturer for enough funds to produce high quality products. Figure 8 illustrates the relationship between the initial capital of the high quality product manufacturer and the selling prices of the high and low quality product manufacturers. The selling prices of high and low quality products decline when the initial capital grows.

6.4 Price sensitivity (\(\beta_{L}\),\(\beta_{H}\))

According to Assumption (1), the price sensitivity parameter (\(\beta_{L}\),\(\beta_{H}\)) affects the market demand for the two product types. This parameter is one of the most critical criteria businesses should consider for making decisions. In this section, we modify the ratio, keeping \(q_{l}\) stable.

According to Assumption (1), the price sensitivity of the low and high quality products directly affects the market demand, and each price sensitivity component is sensitive to demand. Table 7(a) demonstrates that the prices of the low quality products fall with a slight increase in \(\beta_{L}\). Further, the service rate and profit of the lending platform decrease. The growth of the price sensitivity causes a decline in the profit value of all of the SC components. Similarly, according to Assumption (1), the price sensitivity of the high quality product (\(\beta_{H}\)) has an impact on the demand. Table 7(b) elucidates that an increase in \(\beta_{H}\) causes a loss of demand for the high quality product, which affects all the SC entities. All decision variables are affected as noticed in Table 7(b).

7 Managerial implications

The results of the sensitivity analysis provide some meaningful insights to the practitioners (e.g. supply chain managers), stakeholders and decision-makers. The insights facilitate them in adopting the right strategies under disparate situations. The supply chain managers and investors can determine optimal strategies for competing in the market by observing different parameters such as risk-taking, expected profit and product type. As the retailer is one of the crucial components of an SC, their decision can directly affect the manufacturers' pricing strategies. The managers of the high quality product manufacturer should be aware that if retailers decide to increase the quantity of the pre-purchase, they will have to raise capital through the platform to compete, which will increase interest rates. The increase in costs will lower their profit margins and make it difficult to compete. The managers of the low-quality product manufacturers should also pay attention to the fact that by increasing the discounted offer and pre-selling, they lower the product price resulting in a reduction in the profit. In such an environment, where the level of competition between the manufacturers is high and borrowing is difficult, one of the businesses launches an online P2P lending platform, which are highly profitable.

The high quality product manufacturer is suggested to invest in economies that have good market potentials for those products. In those markets, they would be able to sell the products at a much higher profit with a low replacement rate. In those economies, the profits of all supply chain participants will improve. In this situation, managers can provide the required capital through an online platform with a lower risk. In other words, managers can borrow capital via an online means (e.g. the P2P platform).

The initial capital is a crucial factor influencing the final price of the products. In weak economies where market demand is price-sensitive, if the manufacturer wants to raise a large part of their initial capital through the online P2P platform, they should increase the selling price due to rising costs. This strategy will affect them in competing in the market. In stronger economies or luxury goods markets, where demand is not price-sensitive, the managers can initially raise a large portion of their initial capital to start a business through the P2P online platform. The managers may determine their initial capital financing strategy according to the product types and existing market conditions.

The managers having a target to achieve a specific profit amount should manufacture low price-sensitive products. In high price-sensitive economies, demand decreases with a slight increase in the price. The risk of borrowing from the online platform increases for the high price-sensitive products. As a result, these products will increase their price, which may cause a loss. Therefore, the managers and risk-averse investors are advised not to opt for high price-sensitive commodities. We infer from the results that the high price-sensitive products have high risk.

8 Conclusions

This study proposes a supply chain FinTech business model comprising two manufacturers, a retailer and an online P2P lending platform. The proposed model captures the interactions between the SC participants in the logistics network regarding their financial decisions. We analyse optimal Stackelberg and Nash equilibriums of the SC participants. We designate a pre-selling strategy as a policy to accumulate capital for the low quality product manufacturer. Pre-selling to the retailer provides an opportunity for the low quality product manufacturer. Pre-selling helps the SC participants improve their profits, which is one of the aims of this study. We compute the optimal prices of the SC participants, the service rate of the online P2P platform, and the percentage of the pre-ordering quantity of the retailer. We perform a sensitivity analysis of the key parameters to obtain some interesting managerial insights. Our study examines the pre-selling of low quality products as a competitive strategy when competing with the high quality product manufacturer having access to financial supports. This strategy assists the low-quality product manufacturer to find market potential. The competition between the low and high quality product manufacturers is one of the interesting aspects of this study.

This study considers three realistic assumptions. The first assumption meets the retail demand by the manufacturers with two product types having different qualities. A percentage of the demand is shifted corresponding to the conditions of the two goods. Without this assumption, one manufacturer would meet the entire demand while the other manufacturer would become redundant. Further, the competition between the two manufacturers would be meaningless without this assumption, eliminating dependence between the products. The second assumption makes the model closer to the reality where a percentage of demand is assumed to be price sensitive. As the products are not essential goods, this assumption will facilitate the model in creating a relationship between price and demand. Withdrawal of this assumption would result in the disappearance of the substitution of demand between the products and competitive pricing. The third assumption states the relationship between the discount rate and order quantity. This assumption helps simplify the relationship between the discount rate and pre-selling price so that the model can consider different scenarios. Without this assumption, the retailer would not obtain any incentive for the pre-purchase of the low quality products. Further, the low quality product manufacturer would face a lack of capital and fail to compete in the market as the manufacturer would not use the online P2P lending platform.

This study provides meaningful insights into the opportunity cost of the market for both types of manufacturers, which has impacts on the P2P online lending platform. We find that an increase in the opportunity cost causes a decrease in the pre-ordering quantity of the retailer. This phenomenon affects the entire SC profit in numerous ways as a lower amount of purchase of different products from different manufacturers affects the profit of the other SC components. We also find that the service rate of the platform has a direct relationship with the opportunity cost although the effect is not significant. The online P2P lending platform should consider the profit that the retailer plans to achieve. Although this phenomenon is not related to the lending platform, they should consider this matter in their financial decisions especially when they wish to determine the service rate for their platform to reach the maximum profit. The initial capital of the high quality product manufacturer affects the selling price of the low and high quality manufacturers and the retailer’s profit. This effect should be considered by the low quality product manufacturer and retailer in their business operations. Many firms do not consider the amount of initial capital of their competitor, and this ignorance can affect the firms’ profit in numerous ways. We demonstrate that the initial capital of the high quality product manufacturer should be considered by the low quality manufacturer. The retailer should also consider this initial capital of the high quality product manufacturer, although it is not significant.

This study has some limitations which are regarded as opportunities for future research. First, in this study, we consider a deterministic demand in the market that does not represent reality. Therefore, future research could introduce some scenario-based solutions and analyses. Assuming stochastic demand and defining disparate scenarios, future research could design, solve and analyse two-stage / multi-stage stochastic programming problems, which would resemble reality. Second, in the proposed model, the SC participants may have different categories of SC finance contracts. Cooperation between the SC participants and contracts, such as revenue sharing and cost sharing, affecting the price of the products along with other different parameters, should be regarded as future scope of research.

References

Boyaci, T., & Özer, Ö. (2010). Information acquisition for capacity planning via pricing and advance selling: When to stop and act? Operations Research, 58(5), 1328–1349.

Cachon, G. P., & Kök, A. G. (2010). Competing manufacturers in a retail supply chain: On contractual form and coordination. Management Science, 56(3), 571–589.

Cai, S., Lin, X., Xu, D., & Fu, X. (2016). Judging online peer-to-peer lending behavior: A comparison of first-time and repeated borrowing requests. Information and Management, 53(7), 857–867.

Cao, E., & Yu, M. (2018). Trade credit financing and coordination for an emission-dependent supply chain. Computers and Industrial Engineering, 119, 50–62.

Cao, E., Du, L., & Ruan, J. (2019). Financing preferences and performance for an emission-dependent supply chain: Supplier vs. bank. International Journal of Production Economics, 208, 383–399.

Chakraborty, T., Chauhan, S. S., & Ouhimmou, M. (2019). Cost-sharing mechanism for product quality improvement in a supply chain under competition. International Journal of Production Economics, 208, 566–587.

Chen, D., Lai, F., & Lin, Z. (2014). A trust model for online peer-to-peer lending: A lender’s perspective. Information Technology and Management, 15(4), 239–254.

Chen, X. (2015). A model of trade credit in a capital-constrained distribution channel. International Journal of Production Economics, 159, 347–357.

Chen, X., Zhang, H., Zhang, M., & Chen, J. (2017). Optimal decisions in a retailer Stackelberg supply chain. International Journal of Production Economics, 187, 260–270.

Cho, S. H., & Tang, C. S. (2013). Advance selling in a supply chain under uncertain supply and demand. Manufacturing and Service Operations Management, 15(2), 305–319.

Fay, S., & Xie, J. (2010). The economics of buyer uncertainty: Advance selling vs. probabilistic selling. Marketing Science, 29(6), 1040–1057.

Feng, X., Moon, I., & Ryu, K. (2015). Supply chain coordination under budget constraints. Computers and Industrial Engineering, 88, 487–500.

Gao, G.-X., Fan, Z.-P., Fang, X., & Lim, Y. F. (2018). Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. European Journal of Operational Research, 267(2), 585–597.

Giri, B. C., Majhi, J. K., Bardhan, S., Chaudhuri, K. S. (2021). Coordinating a three-level supply chain with effort and price dependent stochastic demand under random yield. Annals of Operations Research, pp. 1–32.

Guo, Y., Zhou, W., Luo, C., Liu, C., & Xiong, H. (2016). Instance-based credit risk assessment for investment decisions in p2p lending. European Journal of Operational Research, 249(2), 417–426.

Guyader, H., & Piscicelli, L. (2019). Business model diversification in the sharing economy: The case of GoMore. Journal of Cleaner Production, 215, 1059–1069.

Huang, K. L., Kuo, C. W., & Shih, H. J. (2017). Advance selling with freebies and limited production capacity. Omega, 73, 18–28.

Jiang, C., Wang, Z., Wang, R., & Ding, Y. (2018). Loan default prediction by combining soft information extracted from descriptive text in online peer-to-peer lending. Annals of Operations Research, 266, 511–529.

Jiang, Z. Z., He, N., Qin, X., Sun, M., Wang, P. (2020). Optimizing production and maintenance for the service-oriented manufacturing supply chain. Annals of Operations Research, pp. 1–26.

Johari, M., Hosseini-Motlagh, S.-M., Nematollahi, M., Goh, M., & Ignatius, J. (2018). Bi-level credit period coordination for periodic review inventory system with price-credit dependent demand under time value of money. Transportation Research Part e: Logistics and Transportation Review, 114, 270–291.

Kouvelis, P., & Zhao, W. (2015). Supply chain contract design under financial constraints and bankruptcy costs. Management Science, 62(8), 2341–2357.

Kuthambalayan, T. S., Mehta, P., & Shanker, K. (2015). Managing product variety with advance selling and capacity restrictions. International Journal of Production Economics, 170, 287–296.

Li, B., An, S. M., & Song, D. P. (2018). Selection of financing strategies with a risk-averse supplier in a capital-constrained supply chain. Transportation Research Part e: Logistics and Transportation Review, 118, 163–183.

Li, W., & Chen, J. (2018). Backward Integration Strategy in a Retailer Stackelberg Supply Chain. Omega, 75, 118–130.

Lim, W. S., & Tang, C. S. (2013). Advance selling in the presence of speculators and forward-looking consumers. Production and Operations Management, 22(3), 571–587.

Lin, Q., & Xiao, Y. (2018). Retailer credit guarantee in a supply chain with capital constraint under push and pull contract. Computers and Industrial Engineering, 125, 245–257.

Liu, J., Li, X., & Wang, S. (2020). What have we learnt from 10 years of fintech research? a scientometric analysis. Technological Forecasting and Social Change, 155, 120022. https://doi.org/10.1016/j.techfore.2020.120022

Liu, H., Qiao, H., Wang, S., & Li, Y. (2019). Platform competition in peer-to-peer lending considering risk control ability. European Journal of Operational Research, 274(1), 280–290.

Liu, Z., & Wang, J. (2019). Supply chain network equilibrium with strategic financial hedging using futures. European Journal of Operational Research, 272(3), 962–978.

Metawa, N., Hassan, M. K., & Elhoseny, M. (2017). Genetic algorithm based model for optimizing bank lending decisions. Expert Systems with Applications, 80, 75–82.

Modak, N. M., & Kelle, P. (2019). Managing a dual-channel supply chain under price and delivery-time dependent stochastic demand. European Journal of Operational Research, 272(1), 147–161.

Nasiry, J., & Popescu, I. (2012). Advance selling when consumers regret. Management Science, 58(6), 1160–1177.

Ni, J., Chu, L. K., & Li, Q. (2017). Capacity decisions with debt financing: The effects of agency problem. European Journal of Operational Research, 261(3), 1158–1169.

Park, K. T., Yang, H., & Sohn, S. Y. (2021). Recommendation of investment portfolio for peer-to-peer lending with additional consideration of bidding period. Annals of Operations Research, pp. 1–23.

Pal, B., Cárdenas-Barrón, L. E., & Chaudhuri, K. S. (2021). Price, delivery time, and retail service sensitive dual-channel supply chain. Scientia Iranica, 28(3), 1765–1779.

Raghavan, N. S., & Mishra, V. K. (2011). Short-term financing in a cash-constrained supply chain. International Journal of Production Economics, 134(2), 407–412.

Serrano-Cinca, C., & Gutiérrez-Nieto, B. (2016). The use of profit scoring as an alternative to credit scoring systems in peer-to-peer (P2P) lending. Decision Support Systems, 89, 113–122.

Taleizadeh, A. A., Noori-daryan, M., Soltani, M. R., Askari, R. (2021). Optimal pricing and ordering digital goods under piracy using game theory. Annals of Operations Research, pp. 1–38.

Wang, C., & Chen, X. (2017). Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research, 248(1–2), 471–491.

Wang, C., Fan, X., & Yin, Z. (2019). Financing online retailers: Bank vs. electronic business platform, equilibrium, and coordinating strategy. European Journal of Operational Research, 276(1), 343–356.

Wu, T., & Kung, C.-C. (2020). Carbon emissions, technology upgradation and financing risk of the green supply chain competition. Technological Forecasting and Social Change, 152, 119884. https://doi.org/10.1016/j.techfore.2019.119884

Wu, T., Zhang, L.-G., & Ge, T. (2019). Managing financing risk in capacity investment under green supply chain competition. Technological Forecasting and Social Change, 143, 37–44.

Xiao, S., Sethi, S. P., Liu, M., & Ma, S. (2017). Coordinating contracts for a financially constrained supply chain. Omega, 72, 71–86.

Xiao, Y., & Zhang, J. (2018). Preselling to a retailer with cash flow shortage on the manufacturer. Omega, 80, 43–57.

Xu, S., & Fang, L. (2020). Partial credit guarantee and trade credit in an emission-dependent supply chain with capital constraint. Transportation Research Part e: Logistics and Transportation Review, 135, 101859.

Yan, N., Sun, B., Zhang, H., & Liu, C. (2016). A partial credit guarantee contract in a capital-constrained supply chain: Financing equilibrium and coordinating strategy. International Journal of Production Economics, 173, 122–133.

Yadav, S., Agrawal, A. K., & Vora, M. K. (2020). A single manufacturer multiple buyers integrated production-inventory model with third-party logistics. International Journal of Business Performance and Supply Chain Modelling, 11(2), 91–127.

Yang, H., Zhuo, W., & Shao, L. (2017). Equilibrium evolution in a two-echelon supply chain with financially constrained retailers: The impact of equity financing. International Journal of Production Economics, 185, 139–149.

Yang, S. A., Birge, J. R., & Parker, R. P. (2015). The supply chain effects of bankruptcy. Management Science, 61(10), 2320–2338.

Zeng, X., Liu, L., Leung, S., Du, J., Wang, X., & Li, T. (2017). A decision support model for investment on P2P lending platform. PLoS ONE, 12(9), e0184242.

Zhang, Y., Li, H., Hai, M., Li, J., & Li, A. (2017). Determinants of loan funded successful in online P2P Lending. Procedia Computer Science, 122, 896–901.

Zhang, J., Cao, Q., & He, X. (2019). Contract and product quality in platform selling. European Journal of Operational Research, 272(3), 928–944.

Zhang, W., & Yang, W. (2021). Optimal pre-order strategy with delay in payments. Annals of Operations Research, 305(1), 347–374.

Zhuo, W., Yang, H., Cárdenas-Barrón, L. E., & Wan, H. (2021). Loss-averse supply chain decisions with a capital constrained retailer. Journal of Industrial and Management Optimization, 17(2), 711.

Zhen, X., Shi, D., Li, Y., & Zhang, C. (2020). Manufacturer’s financing strategy in a dual-channel supply chain: Third-party platform, bank, and retailer credit financing. Transportation Research Part e: Logistics and Transportation Review, 133, 101820.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix A: Proof of Lemma 1

To illustrate that Eq. (17), \(D_{L} = \alpha_{L} - \beta_{L} w_{L} - \gamma (w_{L} - w_{H} )\), has maximum point, we take second order derivatives of it with respect to the parameters (\(q_{L}\), \(P_{L}\) and \(P_{H}\)). The Hessian matrix can be rewritten as follows:

Obviously, \(- 2\beta{^{\prime}} < 0\) and \(\frac{{ - (w_{L} (1 + \delta )((\alpha_{L} - \beta_{L} w_{L} + \gamma (w_{H} - w_{L} ))}}{{q_{l} }} < 0\), therefore, the function is concave having maximum points.

Appendix B: Proof of Lemma 2

It is evident that \(\eta (1 + \delta )\,w_{L}\) should be less than the amount of the selling price of the low quality manufacturer (\(w_{L}\)); otherwise, it would not be lucrative for the manufacturer to offer a discount to the retailer. Therefore:

Appendix C: Proof of Propositions 1 and 2

According to Assumption (3), (\(\eta = \ln (q_{l} )\)) so the profit function of the retailer can be rewritten as:

Taking the first-order derivative of \(\pi (q_{l} )\) with respect to \(q_{l}\),\(P_{L}\),\(P_{H}\) we obtain:

\(\frac{{d\Pi (q_{l} )}}{{dq_{l} }} = 0\),\(\frac{{d\Pi (P_{L} )}}{{dP_{L} }} = 0\) and \(\frac{{d\Pi (P_{H} )}}{{dP_{H} }} = 0\).

We obtain the following expressions:

As seen from the above expressions, the prices of the two products are related to \(\beta^{\prime}\). An increase in \(\beta^{\prime}\) will lead to a decrease in the amount of \({P}_{H}\) and \({P}_{L}\). The preselling quantity depends on the amount the opportunity cost (\(\delta\)), which affects the amount of \({q}_{l}\).

Appendix D: Proof of Proposition 3

As per the Stackelberg game in our model, retailer acts as a follower and low quality product manufacturer acts as a leader. Thus, by placing the decision variable of the retailer into the profit function of the low quality product manufacturer, the low quality product manufacturer profit function can be rewritten as follows:

Substituting the amount of \(q_{l} = e^{{\left( {\frac{{w_{L} (\alpha_{L} - \beta_{L} w_{L} + \gamma (w_{H} - w_{L} )) - w_{L} (1 + \delta )(\alpha_{L} - \beta_{L} w_{L} + \gamma (w_{H} - w_{L} ))}}{{w_{L} (1 + \delta )(\alpha_{L} - \beta_{L} w_{L} + \gamma (w_{H} - w_{L} ))}} - 1} \right)}}\) into Eq. (25) and then taking the first-order derivative of Eq. (25) with respect to the decision variable of the low quality product manufacturer (\(w_{L}\))we obtain:

Similarly, for the profit of the high quality product manufacturer we obtain:

In this profit function, we substitute \(D_{H} = \alpha_{H} - \beta_{H} w_{H} - \gamma (w_{H} - w_{L} )\) in this equation arising from Assumption (2), which yields:

The first order derivative of Eq. (12) with respect to the decision variable of the high quality product manufacturer (\(W_{H}\)):

According to the competition between the manufacturers and the Nash competition between them, we solve the equation which is \(\frac{{d\Pi (w_{L} )}}{{d_{{W_{L} }} }} = \frac{{d\Pi (w_{H} )}}{{d_{{W_{H} }} }}\). The solution of the equation yields the following optimal amounts of the two decision variables, viz. \(W_{H}\) and \(W_{L}\) (i.e. the selling prices of the low and high quality product manufacturers) of Proposition 3.

The following expressions are related to the low quality product manufacturer:

The following expressions are related to the high quality product manufacturer (\(w_{H}\)):

Appendix E: Proof of the Proposition 4

We consider the following profit function of the online P2P lending platform:

In the above equation, substituting \(D_{H} = \alpha_{H} - \beta_{H} w_{H} - \gamma (w_{H} - w_{L} )\) we obtain:

As noticed from Eq. (33), the amount of the service rate of the P2P platform directly depends on the selling price of both manufacturers (\(w_{L} ,w_{H}\)). Thus, we substitute the expressions (\(w_{L} ,w_{H}\)) in Eqs. (30) and (31). Next, for the optimal amount of the service rate of the platform we set this value to zero:

After solving the above equation, the service rate of theP2P platform is obtained as follows:

The following expressions are represented to simplify the optimal service rate of the P2P platform (\(s_{m}\)):

Rights and permissions

Open Access This article is licensed under a Creative Commons Attribution 4.0 International License, which permits use, sharing, adaptation, distribution and reproduction in any medium or format, as long as you give appropriate credit to the original author(s) and the source, provide a link to the Creative Commons licence, and indicate if changes were made. The images or other third party material in this article are included in the article's Creative Commons licence, unless indicated otherwise in a credit line to the material. If material is not included in the article's Creative Commons licence and your intended use is not permitted by statutory regulation or exceeds the permitted use, you will need to obtain permission directly from the copyright holder. To view a copy of this licence, visit http://creativecommons.org/licenses/by/4.0/.

About this article

Cite this article

Taleizadeh, A.A., Safaei, A.Z., Bhattacharya, A. et al. Online peer-to-peer lending platform and supply chain finance decisions and strategies. Ann Oper Res 315, 397–427 (2022). https://doi.org/10.1007/s10479-022-04648-w

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-022-04648-w