Abstract

This paper considers a capital-constrained online retailer (OR) selling products through an e-commerce platform (EP) who also offers financial services to retailers. During the selling season, the OR exerts an effort to promote market demand through activities like sales promotions, advertising and live-streaming selling events. To investigate the EP-based financing scheme, a game-theoretic model is developed where the EP functions as the leader determining the interest rate and platform usage fee rate, and the OR functions as the follower determining the order quantity and effort level. We explore the impacts of the OR’s risk-aversion and find that when the OR is risk-averse (1) she sets a high effort level, and the EP sets a high usage fee rate; (2) a high risk-averse OR orders less products than low risk-averse OR. We design specific revenue-cost sharing contracts to coordinate the supply chain and demonstrate that the designed contracts are feasible. Moreover, we find that the OR consistently prefers EP financing compared to bank financing.

Similar content being viewed by others

1 Introduction

Amazon, one of the largest global e-commerce platforms (EP) worldwide, launched small-business lending services, namely, the Amazon Lending since 2011. From June 1, 2019 to May 31, 2020, Amazon had lent over $1 billion short-term loans ranging in size from $1,000 to $750,000 to its online retailers in the United States, China, Japan, India and the EU, for supporting their growth.Footnote 1 Similarly, Alibaba Group Holdings, the largest EP in China, offers credit to Taobao, Tmall merchants, and other small business owners via Alibaba's financial services arm, namely, Ant Financial. MYbank, an online commercial bank and associate of Ant Financial, has been providing financial services by offering small credit loans to its small and medium-sized enterprises (SMEs). Since its foundation in 2015, MYbank had served more than 40 million clients and provided credit worth over 3 trillion yuan with non-performing loan ratio at around 1.5%.Footnote 2

These two examples manifest that (1) a limited working capital is a ubiquitous operating constraint for online retailers (ORs, e.g., Taobao and Tmall merchants), which are typically SMEs. Furthermore, (2) EP financing becomes increasingly pervasive, and the nonperforming loan ratio is low.

In general, banks request for high-value collateral when providing financial services, and the average value of required collateral for bank loans is approximately 2.6 times the loan’s amount (World Bank Group, 2018). Hence, it is difficult for SMEs to obtain loans from commercial banks due to the lack of sufficient tangible assets as collateral.Footnote 3 The limited financing of SMEs is derived from their start-up nature, given the low amount of publicly available information and their operation in unfamiliar sectors.Footnote 4 Hence, banks cannot obtain adequate information on operations of SMEs and fear that they may divert the loan to other risk projects (Buzacott & Zhang, 2004). Consequently, bank credit financing (BCF) merely represents 13.59% of SMEs’ total financing (Abor et al., 2014).

In recent years, the rapid development of e-commerce has provided ORs a new financing source, namely, the EP financing. By controlling the daily trading data of ORs, EPs can provide financial services without collateral, with low default risk and quick granting of loans. An EP that provides financial services has clear benefits. On the one hand, the EP can earn interest from the loan. On the other hand, the contracted ORs sell additional products on the platform and thus, add to the earnings of EP. Hence, the EP should balance the operational revenue (the platform usage fee rate) and loan revenue (the loan interest rate) to optimize its profit and further achieve supply chain coordination.

ORs typically exert an effort to increase sales through sales promotions, advertising and live-streaming selling events, particularly during key sales season, such as the “Prime Day” in Amazon and the “double 11 shopping festival” in Tmall.com, which are the two famous EPs in the world. During the double 11 shopping festival in 2020, many ORs have greatly boosted sales by putting extra effort in sales activities. According to Tmall, the shopping festival in 2020 attracted more than 800 million shoppers and 250,000 brands, including 25,000 overseas enterprises from more than 220 countries and regions. In the meantime, it is estimated that live-streaming sales in China brought in about $125 billion in 2020.Footnote 5 However, the limited working capital situation of ORs may be aggravated due to the substantial increase in order quantity incurred by sales effort and the extra cost of such effort. In addition, demand uncertainty is the most critical risk for ORs when performing an ordering decision. Demand may be highly volatile and greatly influence loan contracts, thereby affecting ORs’ profitability. For example, the Tompkins Supply Chain Consortium conducted a survey and revealed that 60—80% of enterprises indicate a “high” to “medium” effect of uncertainty on their operations.Footnote 6In practice, most enterprises may be risk-averse in a market with high volatile demand (e.g., He et al., 2017; Liu et al., 2016). Risk aversion may influence ORs’ decision for setting an appropriate effort level and an order quantity to optimize their profit. Following the practices that EPs provide financial services to risk-averse ORs under demand uncertainty, we raise our research questions as follows. (1) What are the optimal decisions of the OR and EP, particularly when OR is capital-constrained? (2) What are the effects of risk-aversion on the OR and EP’s optimal decisions? (3) How to design feasible contracts to achieve supply chain coordination?

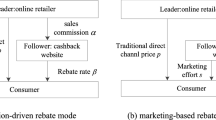

To address the questions above, we consider a supply chain that consists of a newsvendor-like OR and an EP, wherein the OR sells products through the EP. We develop two contrastive models, namely, the basic model with a capital-unconstrained OR and the extended model with a capital-constrained OR. In each model, we consider that the OR can be risk-neutral or risk-averse when facing the volatile market demand. In the extended model, the capital-constrained OR obtains financial support from the EP and accomplishes the repayment at the end of the selling season. We consider a Stackelberg game, wherein the EP serves as the leader that determines the optimal platform usage fee rate (and the loan interest rate in the extended model), and the OR serves as the follower that determines the optimal order quantity and the effort level on sales. We focus on the participants’ equilibrium decisions and the supply chain coordinating strategies.

Our study comprehensively analyzes how EPs should finance a contracted OR under demand uncertainty. We solve the optimal effort level and order quantity of the OR and the optimal usage fee rate of the EP. We design revenue-cost sharing contracts to coordinate the supply chain and demonstrate that they are feasible. Moreover, we find that a risk-averse OR would determine a higher effort level and a larger order quantity than those when the OR is risk-neutral. The optimal order quantity of OR depends on its risk-aversion degree. For example, the OR would determine a smaller order quantity when sufficiently risk-averse than when slightly risk-averse. We find that EP financing consistently yields better OR performance than do bank financing. Our analytical results provide operational and supply chain coordinating strategies for an EP to finance a capital-constrained OR.

The rest of this paper is organized as follows. We review the related studies in the next section. Section 3 presents the detailed model formations. A comprehensive analysis on the participant’s equilibrium decisions and the supply chain coordinating strategies are conducted in Sect. 4. Section 5 discusses numerical studies and bank financing. Concluding remarks, managerial insights, and future research are presented in Sect. 6.

2 Literature review

This study is related to primary streams of research: (1) the interface between operations and financial management; (2) coordinating strategy in supply chain finance, and (3) risk aversion in supply chain management. We concisely review certain related studies as follows.

2.1 Interface between operations and financial management

The first related stream is studies on the interface between operations and financial management. A comprehensive review on this topic is presented by the previous studies (e.g., Cai et al., 2012; Xu et al., 2016). Two typical financing schemes are available for the supply chain members to solve the capital-constrained problems, namely, internal and external financing. Among the external financing schemes, BCF is the most common. Through BCF, financial institutions offer loans to mitigate financial stress in supply chains. For example, Katehakis et al. (2016) consider a firm obtaining financial support from bank loans through inventory financing to fulfill random demand and propose an optimal ordering policy to maximize the firm’s profit. Alan and Gaur (2018) consider a business owner and a bank in a single-period game and study the bank’s optimal lending decision in the form of asset-based lending given to the business owner. However, EP financing are rarely discussed in the existing studies. With respect to internal financing, trade credit financing (TCF) is the most commonly applied one. For example, Wang et al. (2019) consider a third-party logistics firm that provides integrated logistics and financial services to capital-constrained manufacturer, while the financing schemes are similar to TCF. One can refer to Tang et al. (2017), Yang and Birge (2017a, 2017b) and Chod et al. (2019) for further discussion, and recent studies can be referred to Choi (2020b), Huo et al. (2020) and Zheng et al. (2020). Recently, e-tailing-platform-based financing schemes have received increasing attention. Chen et al. (2019) employ JD.com as a representative example to study the motivations and enabling factors for supply chain finance (SCF) adoption. They reveal that JD.com adopts SCF mainly to strengthen its ecosystem and attain competitive advantage. Gong et al. (2019) examine a powerful e-tailing platform and a budget-constrained seller and establish a theoretical model to investigate the platform-based financing scheme. They found that the platform should consistently provide financial aid to the seller, while both of them benefit from the platform-based financing scheme. Wang et al. (2019) investigate a scenario that an OR can obtain financial support from a bank and an EP and focus on supply chain coordination strategy. They reveal that the EP should likewise adjust its loan interest rate and usage fee rate to achieve SCF coordination. Yan et al. (2020) consider the pricing competition in a dual channel supply chain consisting of one capital-constrained supplier and one e-retailer providing finance, and find that e-retailer finance is a value-added service for e-retailer. Different from these previous studies, we study the effects of capital constraint and risk aversion on the equilibrium decisions of OR and EP. Moreover, we complement this stream of literature by designing revenue-cost sharing contracts between the EP and the OR to coordinate the supply chain.

2.2 Coordinating strategy in supply chain finance

Studies on supply chain coordination grown dramatically and have become a promising field (Ali & Nakade, 2016; Cachon & Lariviere, 2005; Heydari et al., 2020; Hosseini-Motlagh et al., 2020; Li et al., 2020; Long et al., 2020). To mitigate double marginalization and improve the integrated efficiency of supply chain finance, several studies investigate the coordination schemes in the financing system. Lee and Rhee (2011) consider a newsvendor framework with a supplier’s trade credit and markdown allowance guarantee and reveal that the supplier fully coordinates the retailer’s decisions for the largest joint profit. Zhang et al. (2014) investigate supply chain coordination in a retailer–manufacturer system considering trade credit and its risk and propose a modified quantity discount based on both order quantity and advance payment to coordinate the supply chain. Chen (2015) compares BCF and TCF in a distribution channel consisting of one manufacturer and one capital-constrained retailer and shows that revenue sharing contract for BCF and TCF can coordinate the channel. Yan et al. (2016) consider a supply chain finance system comprising a capital-constrained retailer, a manufacturer, and a commercial bank and design a partial credit guarantee contract to coordinate the channel based on a suitable guarantee coefficient. Lin et al. (2018) examine three modified modes of confirming warehouse financing (CWF): case-advance discount compensation CWF, deposit withholding CWF and two-way compensation CWF, to find optimal mode to coordinate the supply chain with capital-constrained retailers. Cao and Yu (2018) consider an emission-dependent supply chain with a manufacturer and a capital constrained retailer who obtain financial support from the manufacturer, and design a contract with emission and capital constraints to coordinate the supply chain. Wang et al. (2019) consider a newsvendor-like OR who is capital-constrained and obtains finances from an electronic business platform or a bank and found that the electronic business platform should be active to adjust the loan interest rate and usage fee rate together and consequently achieve the SCF coordination. Shi et al. (2020) consider a capital-constrained newsvendor problem in which a manufacturer provides a buyback contract to compensate the lender in the case of retailer’s default, and investigate coordination strategies with Pareto improvement. We complement the above studies by considering a risk-averse and capital-constrained OR. We focus on the influences of the OR’s risk-aversion on the participants’ equilibrium decisions and supply chain coordination strategies.

2.3 Risk aversion in supply chain management

A number of studies have concentrated on risk-averse behavior in supply chains by employing the following three typical methods, namely, value-at-risk (VaR, see the pioneering work by Luciano et al. (2003) and Tapiero (2005)), conditional value-at-risk (CVaR, see Wu et al. (2006)), and mean–variance (MV, see Chiu and Choi (2016), Wang et al. (2019), Choi et al. (2020)). Choi and Chiu (2012) provide a comprehensive review on risk analysis employing VaR, CVaR, and MV in stochastic supply chains and demonstrate that risk aversion is commonly incorporated in supply chains management studies without financial constraint. However, few studies on supply chain management considering members’ risk aversion when facing financial constraint have been conducted. Gang et al. (2011) examine a supply chain comprising a supplier and a manufacturer who are subject to financial risk and risk-averse and compare the three different supply chain strategies, namely, vertical integration, manufacturer’s and supplier’s Stackelberg. They show that supply chain strategy and risk-aversion likewise exhibit significant effects on quality investment and pricing. Cui et al. (2016) study a risk-averse retailer’s optimal decision to introduce his/ her store brand product by using the mean–variance formulation and examine the effects of the substitution factor, the capital constraint, and the development cost. They show that the retailer’s capital constraint could distort its risk management. Li et al. (2018) investigate a supply chain wherein the retailer is capital-constrained and the supplier is risk-averse and characterize the preference of two financing strategies, namely, partial credit guarantee (PCG) and TCF. They show that a region wherein TCF outperforms PCG for both players exists. Using loss-averse theory, Yan et al. (2018) examine two supply chain financing schemes for the capital-constrained retailer, namely, supplier finance (SF) and supplier investment (SI); and find that loss aversion influences the participants’ decisions, particularly the loss-averse retailer orders more under the SI than under the SF. Zhang et al. (2020) conduct a mean–variance-skewness-kurtosis (MVSK) analysis for the newsvendor problem and address the supply chain coordination in the presence of MVSK agents. We contribute to this stream of studies by comparing a capital-constrained OR’s decisions on order quantity and effort level with and without EP financing. Furthermore, we also shed light on the supply chain coordinating strategies via revenue-cost sharing contracts.

2.4 Summary of the literature

We summarize the differences between this study and the related literature in Table 1 to highlight our academic contributions. First, we complement the existing literature by designing revenue-cost sharing contracts between the EP and the OR to coordinate the supply chain. Second, we employ a mean-CVaR approach to capture the OR’s risk-attitude, and focus on the influences of the OR’s risk-aversion on the participants’ equilibrium decisions and supply chain coordination strategies. Third, our paper is first one that jointly consider the capital-constrained OR with risk aversion and coordinating strategies in an e-commerce supply chain.

3 Model formulation

We consider a supply chain that consists of an EP (referred to as “he”, e.g., JD.com) and an OR (referred to as “she”), wherein the EP is an agency seller.Footnote 7 The OR purchases products from upstream suppliers with a wholesale price \(w\) and sells via the EP with a retail price \(p\). The EP charges a platform usage fee rate \(\lambda \) from the OR (Chen et al., 2021; Wang et al., 2019). Therefore, the EP acts as an agency seller and his revenue comes from sharing the OR’s revenue. In practice, ORs typically rent an EP’s warehouses for products storage.Footnote 8 We assume that the EP charges warehousing fee \({c}_{1}\) from the OR with a warehousing cost \({c}_{2}(<{c}_{1})\). At the beginning of the selling season, the order quantity of the OR is \(Q\), and the leftover value of the unsold products at the end of the selling season is denoted by \(s(<w)\). The market is volatile, which is denoted by a nonnegative stochastic variable \(D.\) In particular, the OR can exert an effort \(e\) to stimulate the market demand during key sale promotion, and the promotion costs are specified as \(c\left(e\right)=a{e}^{2}\), where \(a\left(>0\right)\) is the promotion cost coefficient. Hence, with the OR’s effort level \(e\), the market demand can be specified as \(D+e\) (Lau et al., 2012; Moon et al., 2018).

The probability density function (p.d.f.) and cumulative distribution function (c.d.f.) of \(D\) are denoted by \(f\left(\cdot \right)\) and \(F\left(\cdot \right)\), respectively. We define the hazard function \(h\left(D\right)=f\left(F\right)/\overline{F }\left(D\right)\) and the generalized failure rate \(H\left(D\right)=Dh\left(D\right)\) in terms of the uncertain demand (Lariviere & Porteus, 2001), in which the term \(\overline{F }\left(D\right)\) is given as \(\overline{F }\left(D\right)=1-F\left(D\right)\). To ensure the existence and uniqueness of the equilibrium, we assume that \(F\left(D\right)\) satisfies the following properties (Kouvelis & Zhao, 2011; Lariviere & Porteus, 2001):

1. It is absolutely continuous with density \(f\left(D\right)>0\) in \(\left(x,y\right)\), for \(0\le x\le y\le \infty \).

2. It has a finite mean \(\overline{D }\).

3. The hazard function \(h\left(D\right)\) is increasing in \(D\ge 0\), which is defined as increasing generalized failure rate (IGFR).

Based on the above properties, the stochastic demand is satisfied by most popular distributions such as the log-Normal, Exponential, Normal, Uniform, Weibull and Gamma distributions. Hence, in Sect. 5.1, we assume the demand follows a uniform distribution and conduct a numerical analysis to explore the impact of market factors.

We consider a basic model in which the OR is capital-unconstrained, and an extended model in which the capital-constrained OR borrows capital from the EP to sustain her products procurement. In each model, we consider that the OR may be risk-neutral and risk-averse. Hence, we obtain four contrastive scenarios, namely, the BN (a risk-neutral OR in the basic model), BA (a risk-averse OR in the basic model), EN (a risk-neutral OR in the extended model), and EA (a risk-averse OR in the extended model). All the notations are summarized in Table 2. We have \(p>w>{c}_{1}>{c}_{2}\) to rule out the trivial case in which it is never optimal to provide products. Notably, if the superscripts BN, BA, EN, and EA are added, we refer to the equilibrium outcomes in scenarios BN, BA, EN, and EA.

3.1 Basic model

We initially consider the basic model in which the OR is capital-unconstrained. Let \({\pi }_{r}\) denote the OR’s profit and \({\pi }_{p}\) denote the profit of the EP.

Scenario BN: When the OR is risk-neutral, her expected profit is expressed as follows.

The EP profits come from the usage fee of the platform and warehousing fee. Hence, the expected profit of EP is expressed as follows.

Scenario BA: We use the CVaR as the criterion to evaluate the risk-aversion of the OR. Based on the general definition of CVaR (Rockafellar & Uryasev, 2002), the CVaR function can be defined as \(CVaR\left({\pi }_{r}\right)={\mathrm{max}}_{v\in R}\left\{v-\frac{1}{\beta }E{\left[v-{\pi }_{r}\right]}^{+}\right\}\), where \(v\) is a real number that reflects a specified profit level for the OR and \(R\) represents set of real numbers. \(\beta \in \left(\mathrm{0,1}\right]\) is the risk parameter representing the OR’s aversion for downside risk. A large \(\beta \) represents that the OR has a high risk-averse tendency. We use the Mean-CVaR approach (Jammernegg & Kischka, 2012) to measure the OR utility. Hence, the OR’s Mean-CVaR objective function is specified below.

where \(t\in \left[\mathrm{0,1}\right]\) represents the weight of expected profit in the Mean-CVaR objective function. The OR’s objective is to maximize the Mean-CVaR function. The EP’s objective is to maximize his expected profit, which is similar to the scenario BN.

The event sequence in the BN and BA scenarios is illustrated as follows. First, the EP determines an optimal usage fee rate to maximize his expected profit. Second, the OR determines an optimal order quantity and effort level to maximize her expected profit (Mean-CVaR objective function) in scenario BN (scenario BA). Based on backward induction, the equilibrium outcomes can be derived (see, e.g., Proof of Proposition 1).

3.2 Extended model

In the extended model, we consider a capital-constrained OR that borrows capital from the EP to sustain her products procurement during the sales promotion. Let \(r\) represent the risk-free loan interest rate and \(B\) denote the initial capital of OR. Clearly, the order quantity decision of OR depends on her initial capital.

-

Scenario EN: When the OR is risk-neutral, the expected profit of the capital-constrained OR is provided as follows.

$$E\left[{\pi }_{r}^{EN}\right]=\left(1-\lambda \right)pE\left[\mathrm{min}\left(Q,D+e\right)\right]+sE{\left[Q-\left(D+e\right)\right]}^{+}-\left(\left(w+{c}_{1}\right)Q+c\left(e\right)\right)-\left(\left(w+{c}_{1}\right)Q+c\left(e\right)-B\right)r=\left(1-\lambda \right)p\left[{\int }_{0}^{Q-e}\left(x+e\right)f\left(x\right)dx+{\int }_{Q-e}^{+\infty }Qf\left(x\right)dx\right]+s{\int }_{0}^{Q-e}\left\{\left(Q-(x+e\right)\right)f\left(x\right)dx-\left(\left(w+{c}_{1}\right)Q+a{e}^{2}\right)-\left(\left(w+{c}_{1}\right)Q+a{e}^{2}-B\right)r.$$We assume \(\left(1-\lambda \right)p>\left(1+r\right)w\) to ensure that the profit margin of OR is positive. Different from the basic model, the profit of EP consists of the usage fee of platform and the loan interest rate. Hence, the expected profit of EP is specified as follows.

$$E\left[{\pi }_{p}^{EN}\right]=\lambda pE\left[\mathrm{min}\left(Q,D+e\right)\right]+\left({c}_{1}-{c}_{2}\right)Q+\left(\left(w+{c}_{1}\right)Q+c\left(e\right)-B\right)r=\lambda p\left[{\int }_{0}^{Q-e}\left(x+e\right)f\left(x\right)dx+{\int }_{Q-e}^{+\infty }Qf\left(x\right)dx\right]+\left({c}_{1}-{c}_{2}\right)Q+\left(\left(w+{c}_{1}\right)Q+a{e}^{2}-B\right)r.$$ -

Scenario EA: Similar to scenario BA, the OR maximizes her Mean-CVaR objective function when she is risk-averse. The Mean-CVaR objective function of OR can directly be derived based on her expected profit in scenario EN. Thus, the Mean-CVaR objective function of OR is provided as follows.

$${\pi }_{mc}^{EA}=tE\left[{\pi }_{r}^{EN}\right]+\left(1-t\right)CVaR\left({\pi }_{r}^{EN}\right)={\mathrm{max}}_{v\in R}\left\{tE\left[{\pi }_{r}^{EN}\right]+\left(1-t\right)\left\{v-\frac{1}{1-\beta }E{\left[v-{\pi }_{r}^{EN}\right]}^{+}\right\}\right\}.$$The event sequence is illustrated as follows. First, the EP simultaneously determines an optimal usage fee rate and loan interest rate to maximize his expected profit. Second, the OR simultaneously determines an optimal order quantity and effort level to maximize her expected profit (Mean-CVaR objective function) in scenario EN (scenario EA). Based on backward induction, the equilibrium outcome can be derived.

3.3 Centralized case

In each scenario, we consider a centralized case where the OR simultaneously determines an optimal effort level and an optimal order quantity to maximize the supply chain profit. The supply chain profits are same in all scenarios (scenarios BN, BA, EN, and EA), which is specified as follows.

Hence, the equilibrium in centralized case is summarized in Lemma 1.

Lemma 1

In centralized case, the equilibrium is given as \({e}^{C}=\frac{p-w-{c}_{2}}{2a}\) and \({Q}^{C}={F}^{-1}\left[\frac{p-w-{c}_{2}}{p-s}\right]+\frac{p-w-{c}_{2}}{2a}\).

By noting that \({e}^{C}\) and \({Q}^{C}\) are the optimal effort level and order quantity in the centralized case, respectively. Lemma 1 demonstrates that \({e}^{C}\), \({Q}^{C}\) and the corresponding \(E\left[{\pi }_{r}\right]\) and \(E\left[{\pi }_{p}\right]\) are all fixed, because \(p\), \(w\), \({c}_{2}\), \(a\) and \(s\) are all constant. The order quantity in the centralized case is used as a benchmark to examine whether the supply chain in each scenario is coordinated or not.

4 Analysis

In this section, we first derive the equilibrium in each scenario and analyze the equilibrium decisions of the OR and the EP. Based on the equilibrium, we then design revenue-cost sharing contracts \(\left(x,y\right)\) to coordinate the supply chain. By noting that \(x\in \left(0, 1\right)\) is the revenue-sharing ratio, and \(\left(1-x\right)\) represents the ratio that the EP shares from the revenue of the OR. Similarly, \(y\in \left(0, 1\right)\) is the cost-sharing ratio representing the ratio that the EP shares from the sum of promotion cost and purchase cost of OR.

Under the revenue-cost sharing contracts, the expected profits of the OR and the EP should be updated based on the analysis in model formation. When the OR is capital-unconstrained, the expected profit of the OR under revenue-cost sharing contract is specified as follows.

Similarly, it is easy to find the expected profit of the EP under revenue-cost sharing contract, which is directly given as follows.

When the OR is capital-constrained and borrows capital from the EP, the expected profit of the OR under revenue-cost sharing contract is given as follows.

Based on the extended model, the expected profit of the EP under revenue-cost sharing contract is given as follows.

We have derived the equilibrium of centralized case in Lemma 1. Hence, we can develop specific revenue-cost sharing contracts (\(x, y\)) to coordinate the supply chain by solving the equations \({e}^{*}={e}^{C}\) and \({Q}^{*}={Q}^{C}\), in which \({e}^{*}\) and \({Q}^{*}\) represent the equilibrium effort level and order quantity in each section. With such revenue-cost sharing contracts, the optimal decisions of the OR and the EP maximize not only their individual expected profits, but also the supply chain profits.

4.1 Scenario BN

In scenario BN, the OR is capital-unconstrained and determines an optimal effort level and order quantity, and the EP determines an optimal usage fee rate. The equilibrium is presented in Proposition 1.

Proposition 1

In scenario BN, the equilibrium is summarized as follows: (1) with respect to the OR, \({e}^{BN}=\frac{\left(1-{\lambda }^{BN}\right)p-\left(w+{c}_{1}\right)}{2a}\), \({Q}^{BN}={F}^{-1}\left[\frac{w+{c}_{1}-\left(1-{\lambda }^{BN}\right)p}{s-\left(1-{\lambda }^{BN}\right)p}\right]+\frac{\left(1-{\lambda }^{BN}\right)p-\left(w+{c}_{1}\right)}{2a}\); (2) with respect to the EP, \({\lambda }^{BN}\) satisfies \(ph\left({Q}^{BN},{e}^{BN}\right)+p{\lambda }^{BN}\frac{\partial h\left({Q}^{BN},{e}^{BN}\right)}{\partial {\lambda }^{BN}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{BN}}{\partial {\lambda }^{BN}}=0\), in which \(\left(Q,e\right)={\int }_{0}^{Q-e}\left(x+e\right)f\left(x\right)dx+{\int }_{Q-e}^{+\infty }Qf\left(x\right)dx\) is the sales volume of the OR.

As presented in Proposition 1, when the OR is capital-unconstrained, her optimal effort level \({e}^{BN}\) and order quantity \({Q}^{BN}\) are fixed. Given the usage fee rate of EP, a higher usage fee rate leads to a lower effort level (\(\frac{\partial {e}^{BN}}{\partial {\lambda }^{BN}}<0\)) and order quantity (\(\frac{\partial {Q}^{BN}}{\partial {\lambda }^{BN}}<0\)) of the OR. Therefore, we conclude that a high usage fee rate of an EP discourages ORs’ enthusiasm on stimulating sales, which leads to a small order quantity. With respect to the EP, his optimal usage fee rate is also fixed, which satisfies \(ph\left({Q}^{BN},{e}^{BN}\right)+p{\lambda }^{BN}\frac{\partial h\left({Q}^{BN},{e}^{BN}\right)}{\partial {\lambda }^{BN}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{BN}}{\partial {\lambda }^{BN}}=0\). \(h\left(Q,e\right)\) represents the actual sales volume of the OR in an uncertain market. By substituting \({e}^{BN}\), \({Q}^{BN}\) and \({\lambda }^{BN}\) to \(E\left[{\pi }_{r}\right]\) and \(E\left[{\pi }_{p}\right]\), we can obtain the expected profit of the OR and EP.

In addition, by comparing the equilibrium in Lemma 1, we find that the effort level of OR in scenario BN is consistently lower than that in the centralized case (\({e}^{BN}<{e}^{C}\)). A higher effort level and the elimination of double marginalization effect in centralized case lead to a larger order quantity (\({Q}^{BN}<{Q}^{C}\)). Based on the results in Lemma 1 and Proposition 1, we design a revenue-cost sharing contract to coordinate the supply chain in scenario BN. See the discussion in Proposition 2.

Proposition 2

In scenario BN, a revenue-cost sharing contract \(\left({x}^{BN},{y}^{BN}\right)\) can coordinate the supply chain, in which \({x}^{BN}=\frac{{c}_{1}\left(p-s\right)}{\left(1-{\lambda }^{BN}\right)p\left(p-s\right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{BN}\right)p-s\right)}\) and \({y}^{BN}=\frac{\left(1-{\lambda }^{BN}\right)p\left(p-s\right)-\left(\left(1-{\lambda }^{BN}\right)p-s\right)\left(p+{c}_{1}-{c}_{2}\right)}{\left(1-{\lambda }^{BN}\right)p\left(p-s\right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{BN}\right)p-s\right)}\).

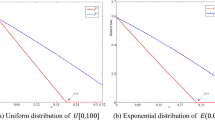

From Proposition 2, we present a contract \(\left({x}^{BN},{y}^{BN}\right)\) that can coordinate the supply chain. We conduct a numerical study (see Fig. 1) to investigate the properties of the contract \(\left({x}^{BN},{y}^{BN}\right)\) and derive several observations. First, such a revenue-cost sharing contract is feasible. Hence, given specific values of the parameters, we can employ such a revenue-cost sharing contract to coordinate the supply chain. Figure 1 also presents the equilibrium profits of the EP and OR. Clearly, the profit of OR decreases in \(\lambda \), while the profit of EP increases in \(\lambda \). We observe that when \(\lambda \) is relatively small, the OR obtains a larger expected profit than the EP. By contrast, when \(\lambda \) is sufficiently large, the EP obtains a larger expected profit than the OR.

We conduct a sensitivity analysis on \({x}^{BN}\) and \({y}^{BN}\) (see Corollary 1). We find that \({x}^{BN}\) decreases in \(s\). The OR willingly shares a smaller proportion of revenue when the leftover value of per unit unsold product increases. With respect to the retail price and usage fee rate, \({x}^{BN}\) can increase or decrease in \(p\) and \({\lambda }^{BN}\), depending on the value of \(s\) and \({c}_{2}\). For example, when \(s>{c}_{2}\) with an increasing retail price or a decreasing usage fee rate, the OR that shares a larger proportion of revenue can coordinate the supply chain. With respect to the cost-sharing ratio, we show that \({y}^{BN}\) always decreases in \(p\), and increases in both \({\lambda }^{BN}\) and \(s\). For example, it is intuitive that a high usage fee rate that leads to a higher \({y}^{BN}\), meaning the EP willing to bears a larger proportion of promotion cost and purchase cost. In sum, if an increasing of a parameter’s value help increase the OR’s (or the EP’s) profit, then she (or he) is willing to share a smaller proportion of revenue and a larger proportion of cost under supply chain coordination.

Corollary 1

A sensitivity analysis on \({x}^{BN}\) and \({y}^{BN}\) yields.

\(1.\;{x}^{BN}\) decreases in \(s\); \({x}^{BN}\) increases in \(p\) and decreases in \({\lambda }^{BN}\) if \(s>{c}_{2}\); \({x}^{BN}\) decreases in \(p\) and increases in \({\lambda }^{BN}\) if \(s<{c}_{2}\).

\(2.\;{y}^{BN}\) decreases in \(p\), and increases in both \({\lambda }^{BN}\) and \(s\).

4.2 Scenario BA

In scenario BA, the OR is risk-averse and maximizes her mean-CVaR objective function, and the EP determines an optimal usage fee rate. The equilibrium is presented in Proposition 3.

Proposition 3

In scenario BA, the equilibrium is summarized as follows.

-

(1)

With respect to the OR,

-

(1a)

\(e_{1}^{BA} = \frac{{\left( {1 - \lambda^{BA} } \right)p - w - c_{1} }}{2a}\) and \(Q_{1}^{BA} = F^{ - 1} \left[ {\frac{{\left( {w + c_{1} - \left( {1 - \lambda^{BA} } \right)p} \right)\left( {1 - \beta } \right)}}{{\left( {\left( {1 - \lambda^{BA} } \right)p - s} \right)\left( {t\beta - 1} \right)}}} \right] + \frac{{\left( {{1} - \lambda^{BA} } \right)p - \left( {w + c_{1} } \right)}}{2a}\), if \(\beta \le \frac{{w + c_{1} - s}}{{t\left( {\left( {1 - \lambda } \right)p - s} \right)}}\);

-

(1b)

\({e}_{2}^{BA}=\frac{\left(1-{\lambda }^{BA}\right)p-w-{c}_{1}}{2a}\) and \({Q}_{2}^{BA}={F}^{-1}\left[1+\frac{s-w-{c}_{1}}{t\left(\left(1-{\lambda }^{BA}\right)p-s\right)}\right]+\frac{\left(1-{\lambda }^{BA}\right)p-\left(w+{c}_{1}\right)}{2a}\), if \(\beta >\frac{w+{c}_{1}-s}{t\left(\left(1-\lambda \right)p-s\right)}\);

-

2.

With respect to the EP, \({\lambda }^{BA}\) satisfies \(ph\left({Q}^{BA},{e}^{BA}\right)+p{\lambda }^{BA}\frac{\partial h\left({Q}^{BA},{e}^{BA}\right)}{\partial {\lambda }^{BA}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{BA}}{\partial {\lambda }^{BA}}=0\), in which \({e}^{BA}=\{{e}_{1}^{BA},{e}_{2}^{BA}\}\) and \({Q}^{BA}=\{{Q}_{1}^{BA},{Q}_{2}^{BA}\}\).

Proposition 3 illustrates that the equilibrium effort level, order quantity, and usage fee rate are fixed in scenario BA. The equilibrium effort levels of OR decrease in the usage fee rate of EP. We have \({e}_{1}^{BA}={e}_{2}^{BA}=\frac{\left(1-{\lambda }^{BA}\right)p-w-{c}_{1}}{2a}\), which implies that the equilibrium effort level is independent of the OR’s risk-aversion degree. By contrast, the equilibrium order quantity depends on the risk-aversion degree of OR. We find that when the OR is sufficiently risk-averse (\(\beta >\frac{w+{c}_{1}-s}{t\left(\left(1-\lambda \right)p-s\right)}\)), her order quantity is smaller than that when she is slightly risk-averse (\({Q}_{2}^{BA}\le {Q}_{1}^{BA}\)). The intuition behind is clear. When the OR is sufficiently risk-averse, she tends to believe that the demand volume will be small in an uncertain market. Hence, she will order reduced products.

With respect to the EP, we find that the optimal usage fee rate is smaller than that in scenario BN (see Corollary 2). That is, when the OR is risk-averse, the EP will determine a lower usage fee rate. The OR tends to order less products when she is risk-averse. Thus, the EP sets a lower usage fee rate to prompt the OR to make more effort on demand stimulation. Intuitions suggest that when the OR is risk-averse, she would make lower effort level on demand stimulation because she tends to believe that the demand volume will be small. Interestingly, with a lower usage fee rate in scenario BA, we find that the OR consequently sets a higher effort level than that in scenario BN (\({e}^{BA}\ge {e}^{BN}\)). Similarly, the equilibrium order quantity may be larger or lower than that in scenario BN, depending on the usage fee rate of EP. If the usage fee rate is substantially low, the OR will set a large order quantity although she is risk-averse, because she can earn additional profits from products sales.

Corollary 2

Comparing the equilibrium usage fee rate between scenarios BN and BA yields \({\lambda }^{BA}\le {\lambda }^{BN}\).

We also design a revenue-cost sharing contract to coordinate the supply chain. The detailed contract is presented in Proposition 4. Proposition 4 shows that the revenue-cost sharing contract that coordinates the supply chain is related to the risk-aversion degree of OR.

Proposition 4

In scenario BA, (1) when\(\beta \le \frac{w\left(1-{y}_{1}^{BA}\right)+{c}_{1}-{x}_{1}^{BA}s}{t{x}_{1}^{BA}\left(\left(1-\lambda \right)p-s\right)}\), a revenue-cost sharing contract \(\left({x}_{1}^{BA},{y}_{1}^{BA}\right)\) can coordinate the supply chain, in which \({x}_{1}^{BA}=\frac{{c}_{1}\left(p-s\right)\left(1-\beta \right)}{\left(1-{\lambda }^{BA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{BA}\right)p-s\right)\left(1-t\beta \right)}\) and\({y}_{1}^{BA}=\frac{\left(1-{\lambda }^{BA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(\left(1-{\lambda }^{BA}\right)p-s\right)\left(p+{c}_{1}-{c}_{2}\right)\left(1-t\beta \right)}{\left(1-{\lambda }^{BA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{BA}\right)p-s\right)\left(1-t\beta \right)}\); (2) when\(\beta >\frac{w\left(1-{y}_{1}^{BA}\right)+{c}_{1}-{x}_{1}^{BA}s}{t{x}_{1}^{BA}\left(\left(1-\lambda \right)p-s\right)}\), a revenue-cost sharing contract \(\left({x}_{2}^{BA},{y}_{2}^{BA}\right)\) can coordinate the supply chain, in which \({x}_{2}^{BA}=\frac{\left(w-p+{c}_{2}\right)\left(p-s\right)}{t\left(p-{c}_{2}\right)\left(s-w-{c}_{2}\right)\left(\left(1-{\lambda }^{BA}\right)p-s\right)-\left(p-s\right)\left(s\left(p-{c}_{2}\right)-w\left(1-{\lambda }^{BA}\right)p\right)}\) and \({y}_{2}^{BA}=1-\frac{\left(w-p+{c}_{2}\right)\left(p-s\right)\left(1-{\lambda }^{BA}\right)p}{\left(p-{c}_{2}\right)\left(t\left(p-{c}_{2}\right)\left(s-w-{c}_{2}\right)\left(\left(1-{\lambda }^{BA}\right)p-s\right)-\left(p-s\right)\left(s\left(p-{c}_{2}\right)-w\left(1-{\lambda }^{BA}\right)p\right)\right)}+\frac{{c}_{1}}{p-{c}_{2}}\).

Similar to that in scenario BN, a numerical analysis (see Fig. 2) shows that the coordinating revenue-sharing contracts \(\left({x}_{1}^{BA},{y}_{1}^{BA}\right)\) and \(\left({x}_{2}^{BA},{y}_{2}^{BA}\right)\) are feasible. The contract properties are intuitive from Fig. 2. Intuitively, the sensitivity analysis of the contract parameters is similar to that in scenario BN.

4.3 Scenario EN

In scenario EN, the OR is capital-constrained and risk-neutral. The OR determines an optimal effort level and order quantity, and the EP determines an optimal usage fee rate and interest rate. The equilibrium is presented in Proposition 5.

Proposition 5

In scenario EN, the equilibrium is summarized as follows:

-

1.

\({e}^{EN}=\frac{\left(1-{\lambda }^{EN}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\), \({Q}^{EN}={F}^{-1}\left[\frac{\left(w+{c}_{1}\right)\left(1+r\right)-\left(1-{\lambda }^{EN}\right)p}{s-\left(1-{\lambda }^{EN}\right)p}\right]+\frac{\left(1-{\lambda }^{EN}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\).

-

2.

\( {\lambda }^{EN}\) satisfies \(ph\left({Q}^{EN},{e}^{EN}\right)+p{\lambda }^{EN}\frac{\partial h\left({Q}^{EN},{e}^{EN}\right)}{\partial {\lambda }^{EN}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{EN}}{\partial {\lambda }^{EN}}+\left(w+{c}_{1}\right)r\frac{\partial {Q}^{EN}}{\partial {\lambda }^{EN}}+2a{e}^{EN}r\frac{\partial {e}^{EN}}{\partial {\lambda }^{EN}}=0\), \(\overline{r }\) satisfies \({A}_{1}+{A}_{2}+{A}_{3}=\left(\left(w+{c}_{1}\right)Q+a{e}^{2}-B\right)\left(1+r\right)\), in which \({A}_{1}=\left(\left(\left(1-\lambda \right)p-s\right){e}^{EN}+s{Q}^{EN}\right)F\left(L\right)\), \({A}_{2}=\left(\left(1-\lambda \right)p-s\right){\int }_{0}^{L}xf\left(x\right)dx\), \({A}_{3}=\left(\left(w+{c}_{1}\right){Q}^{EN}+a{\left({e}^{EN}\right)}^{2}-B\right)\left(1+\overline{r }\right)\left(1-F\left(L\right)\right)\) and \(L=\frac{\left(\left(w+{c}_{1}\right){Q}^{EN}+a{\left({e}^{EN}\right)}^{2}-B\right)\left(1+\overline{r }\right)-s{Q}^{EN}}{\left(1-\lambda \right)p-s}-{e}^{EN}\).

Proposition 5 (1) shows that when the OR is capital-constrained and borrows capital from the EP, her optimal effort level and order quantity are fixed. Given the usage fee rate of EP, it is intuitive that a higher usage fee rate or interest rate leads to a lower effort level (\(\frac{\partial {e}^{EN}}{\partial {\lambda }^{EN}}<0\)) and order quantity (\(\frac{\partial {Q}^{EN}}{\partial {\lambda }^{EN}}<0\)) of the OR. Compared with the equilibrium in scenario BN, if given a same usage fee rate (\({\lambda }^{EN}={\lambda }^{BN}\)), the effort level is lower and the order quantity is smaller in scenario EN (\({e}^{EN}\le {e}^{BN}\), \({Q}^{EN}\le {Q}^{BN}\)). It is because an additional cost of interest rate discourages enthusiasm of OR in demand stimulation, which leads to a small order quantity. Only when the usage fee rate is substantially low that the OR would make more effort and order more products when she is capital-constrained.

With respect to the EP, he makes decision on both usage fee rate and interest rate, which are also fixed. We find that the optimal interest rate increases in the risk-free interest rate and decreases in the initial capital of OR (see Corollary 3). Risk-free interest rate represents the minimum interest rate that the EP can obtain. Hence, a higher risk-free interest rate drives the EP to determine a higher interest rate of the loan. In addition, if the OR has more initial capital, it implies the loan amount may be small. In this situation, the financial profit of the EP is small that the EP may charge a lower interest rate to stimulate the demand and increase his operational revenue. Hence, the optimal interest rate of EP decreases in the initial capital of OR.

Corollary 3

With respect to the equilibrium interest rate, we have \(\frac{\partial \overline{r}}{\partial r }>0\) and \(\frac{\partial \overline{r}}{\partial B }<0\).

We also design a revenue-cost sharing contract \(\left({x}^{EN},{y}^{EN}\right)\) to coordinate the supply chain. The detailed contract is presented in Proposition 6.

Proposition 6

In scenario EN, a revenue-cost sharing contract \(\left({x}^{EN},{y}^{EN}\right)\) can coordinate the supply chain, in which \({x}^{EN}=\frac{{c}_{1}\left(p-s\right)\left(1+r\right)}{\left(1-{\lambda }^{EN}\right)p\left(p-s\right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{EN}\right)p-s\right)}\) and \({y}^{EN}=\frac{\left(1-{\lambda }^{EN}\right)p\left(p-s\right)-\left(\left(1-{\lambda }^{EN}\right)p-s\right)\left(p+{c}_{1}-{c}_{2}\right)}{\left(1-{\lambda }^{EN}\right)p\left(p-s\right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{EN}\right)p-s\right)}\).

As presented in Fig. 3, we conduct a numerical analysis and show that such a revenue-cost sharing contract is feasible. The properties of this contract are intuitive from Fig. 3. For example, the revenue-sharing ratio decreases in \(\lambda \) and the cost-sharing ratio increases in \(\lambda \).

Form Proposition 6, we can find that closed-form expression of the parameters in the contract \(\left({x}^{EN},{y}^{EN}\right)\) is similar to that in scenario BN. To be specific, if \({\lambda }^{BN}={\lambda }^{EN}\), we have \({x}^{BN}<{x}^{EN}\) and \({y}^{BN}={y}^{EN}\). That is, under supply chain coordination, the EP shares more revenue but bears identical cost when the OR is capital-constrained and borrows capital from the EP. It is because when the EP shares more proportion of the revenue of OR, he may determine a lower usage fee rate to make the OR to order more products. Because the closed-form expression of the contract \(\left({x}^{EN},{y}^{EN}\right)\) is similar to the contract \(\left({x}^{BN},{y}^{BN}\right)\), the impacts of market factors such as usage fee rate on the contract parameters \({x}^{EN}\) and \({y}^{EN}\) are similar to that in Corollary 1.

4.4 Scenario EA

In scenario EA, the OR is capital-constrained and risk-averse. The OR determines an optimal effort level and order quantity, and the EP determines the optimal usage fee rate and interest rate. The equilibrium is summarized in Proposition 7.

Proposition 7

In scenario EA, the equilibrium is summarized as follows:

-

1.

If \(\beta \le \frac{\left(w+{c}_{1}\right)\left(1+r\right)-s}{t\left(\left(1-{\lambda }^{EA}\right)p-s\right)}\), \({e}_{1}^{EA}=\frac{\left(1-{\lambda }^{EA}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\) and \({Q}_{1}^{EA}={F}^{-1}\left[\frac{\left(\left(w+{c}_{1}\right)\left(1+r\right)-\left(1-{\lambda }^{EA}\right)p\right)\left(1-\beta \right)}{\left(\left(1-{\lambda }^{EA}\right)p-s\right)\left(t\beta -1\right)}\right]+\frac{\left(1-{\lambda }^{EA}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\); if \(\beta >\frac{\left(w+{c}_{1}\right)\left(1+r\right)-s}{t\left(\left(1-\lambda \right)p-s\right)}\), \({e}_{2}^{EA}=\frac{\left(1-{\lambda }^{EA}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\) and \({Q}_{2}^{EA}={F}^{-1}\left[1+\frac{s-\left(w+{c}_{1}\right)\left(1+r\right)}{t\left(\left(1-{\lambda }^{EA}\right)p-s\right)}\right]+\frac{\left(1-{\lambda }^{EA}\right)p-\left(w+{c}_{1}\right)\left(1+r\right)}{2a\left(1+r\right)}\).

-

2.

\({\lambda }^{EA}\) satisfies \(ph\left({Q}^{EA},{e}^{EA}\right)+p{\lambda }^{EA}\frac{\partial h\left({Q}^{EA},{e}^{EA}\right)}{\partial {\lambda }^{EA}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{EA}}{\partial {\lambda }^{EA}}+\left(w+{c}_{1}\right)r\frac{\partial {Q}^{EA}}{\partial {\lambda }^{EA}}+2a{e}^{EA}r\frac{\partial {e}^{EA}}{\partial {\lambda }^{EA}}=0\), in which \({e}^{EA}=\{{e}_{1}^{EA},{e}_{2}^{EA}\}\) and \({Q}^{EA}=\{{Q}_{1}^{EA},{Q}_{2}^{EA}\}\). \(\overline{r }\) satisfies \({\overline{A} }_{1}+{\overline{A} }_{2}+{\overline{A} }_{3}=\left(\left(w+{c}_{1}\right)Q+a{e}^{2}-B\right)\left(1+r\right)\), in which \({\overline{A} }_{1}=\left(\left(\left(1-\lambda \right)p-s\right){e}^{EA}+s{Q}^{EA}\right)F\left(\overline{L }\right)\), \({\overline{A} }_{2}=\left(\left(1-\lambda \right)p-s\right){\int }_{0}^{L}xf\left(x\right)dx\), \({\overline{A} }_{3}=\left(\left(w+{c}_{1}\right){Q}^{EA}+a{\left({e}^{EA}\right)}^{2}-B\right)\left(1+\overline{r }\right)\left(1-F\left(L\right)\right)\) and \(\overline{L }=\frac{\left(\left(w+{c}_{1}\right){Q}^{EA}+a{\left({e}^{EA}\right)}^{2}-B\right)\left(1+\overline{r }\right)-s{Q}^{EA}}{\left(1-\lambda \right)p-s}-{e}^{EA}\).

From Proposition 7, we have several straightforward findings. First, the optimal effort of OR level is independent of the risk-aversion degree while her optimal order quantity depends on the risk-aversion degree. Second, when the OR is sufficiently risk-averse (\(\beta >\frac{\left(w+{c}_{1}\right)\left(1+r\right)-s}{t\left(\left(1-\lambda \right)p-s\right)}\)), her optimal order quantity is smaller than that when she is slightly risk-averse (\(\beta \le \frac{\left(w+{c}_{1}\right)\left(1+r\right)-s}{t\left(\left(1-{\lambda }^{EA}\right)p-s\right)}\)). That is, \({Q}_{2}^{EA}\le {Q}_{1}^{EA}\), because the OR tends to believe that the demand volume will be small in an uncertain market when she is sufficiently risk-averse. Hence, she will order less products to reduce the risk. With respect to the EP, his optimal usage fee rate is smaller than that in scenario EN (see Corollary 4). Therefore, compared with the equilibrium in scenario EN, the optimal effort level of OR is higher and the order quantity may be larger in scenario EA when she is risk-averse due to a lower usage fee rate.

Corollary 4

Comparing the equilibrium usage fee rate between scenarios BN and BA yields \({\lambda }^{EA}\le {\lambda }^{EN}\).

We also design a revenue-cost sharing contract to coordinate the supply chain. The detailed contract is presented in Proposition 8.

Proposition 8

In scenario EA, (1) when \(\beta \le \frac{\left(w\left(1-{y}_{1}^{EA}\right)+{c}_{1}\right)\left(1+r\right)-s}{t\left(\left(1-{\lambda }^{EA}\right)p-s\right)}\), a revenue-cost sharing contract \(\left({x}_{1}^{EA},{y}_{1}^{EA}\right)\) can coordinate the supply chain, in which \({x}_{1}^{EA}=\frac{{c}_{1}\left(p-s\right)\left(1+r\right)\left(1-\beta \right)}{\left(1-{\lambda }^{EA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{EA}\right)p-s\right)\left(1-t\beta \right)}\) and \({y}_{1}^{EA}=\frac{\left(1-{\lambda }^{EA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(\left(1-{\lambda }^{EA}\right)p-s\right)\left(p+{c}_{1}-{c}_{2}\right)\left(1-t\beta \right)}{\left(1-{\lambda }^{EA}\right)p\left(p-s\right)\left(1-\beta \right)-\left(p-{c}_{2}\right)\left(\left(1-{\lambda }^{EA}\right)p-s\right)\left(1-t\beta \right)}\); (2) when \(\beta >\frac{w\left(1-{y}_{2}^{EA}\right)+{c}_{1}-s}{t\left(\left(1-{\lambda }^{EA}\right)p-s\right)}\), a revenue-cost sharing contract \(\left({x}_{2}^{EA},{y}_{2}^{EA}\right)\) can coordinate the supply chain, in which \({x}_{2}^{EA}=\frac{\left(w-p+{c}_{2}\right)\left(p-s\right)\left(1+r\right)}{t\left(p-{c}_{2}\right)\left(s-w-{c}_{2}\right)\left(\left(1-{\lambda }^{EA}\right)p-s\right)-\left(p-s\right)\left(s\left(p-{c}_{2}\right)-w\left(1-{\lambda }^{EA}\right)p\right)}\) and \({y}_{2}^{EA}=1-\frac{\left(w-p+{c}_{2}\right)\left(p-s\right)\left(1-{\lambda }^{EA}\right)p}{\left(p-{c}_{2}\right)\left(t\left(p-{c}_{2}\right)\left(s-w-{c}_{2}\right)\left(\left(1-{\lambda }^{EA}\right)p-s\right)-\left(p-s\right)\left(s\left(p-{c}_{2}\right)-w\left(1-{\lambda }^{EA}\right)p\right)\right)}+\frac{{c}_{1}}{p-{c}_{2}}\).

Similar to the coordinating contracts in other scenarios, a numerical study shows that the coordinating contact in scenario EA is feasible. The contract properties can be intuitively observed in Fig. 4.

As presented in Proposition 8, the designed contracts are associated the risk-aversion degree of OR. Comparing these two contracts with that in scenario BA, assuming that\({\lambda }^{BA}={\lambda }^{EA}\), we can easily find that\({x}_{1}^{EA}=\left(1+r\right){x}_{1}^{BA}\), \({x}_{2}^{EA}=\left(1+r\right){x}_{2}^{BA}\), \({y}_{1}^{EA}={y}_{1}^{BA}\) and\({y}_{2}^{EA}={y}_{2}^{BA}\). This finding is consistent with the comparative results of coordinating contracts between scenarios EN and BN. That is, under supply chain coordination, the OR obtains more revenue but the EP gets less when the OR is capital-constrained. However, in this situation, the EP bears identical cost whether the OR is capital-constrained or not.

Based on the discussions above, we briefly summarize the comparative results among the four scenarios, which are summarized in Table 3. First and counterintuitive, a risk-averse OR determines a higher effort level when she is risk-averse, regardless of whether she is capital-constrained or not. This is because the EP sets a small usage fee rate, which drives the OR to exert additional effort on demand stimulation. Second, with a high effort level, a risk-averse OR may set a larger or smaller order quantity than that when she is risk-neutral, depending on the usage fee rate. Third, a risk-averse OR’s optimal quantity depends on her risk-aversion degree. When she is sufficiently risk-averse, she would determine a smaller order quantity than that when she is slightly risk-averse. Fourth, the specific forms of the revenue-cost sharing contracts that coordinate the supply chain are similar when OR has an identical risk-attitude. Compared with the situations involving a capital-unconstrained OR, given a specific usage fee rare of the EP, the revenue-sharing ratio becomes larger while the cost-sharing ratio remains unchanged when the OR is capital-constrained.

5 Discussions

5.1 Numerical analysis

In this section, we conduct a numerical analysis to explore the effect of the key market factors, such as the usage fee rate, the OR’s effort level, and the OR’s order quantity. According to Wang, et al. (2019), the value settings of the parameter are presented as \(p=2, w=0.8, s=0.1, r=0.05, t=0.5, \beta =0.4, a=0.4, {c}_{1}=0.05,{c}_{2}=0.04, B=10\). In addition, we assume that the demand follows a uniform distribution \(U\sim (\mathrm{100,200})\). To clarify the results, we add a bar (\(-\)) to the expected profits to represent that the EP and the OR’s expected profit under supply chain coordination.

Figure 5 illustrates the effect of usage fee rate. Several observations are derived from this figure. First, in all scenarios regardless of whether they are under the supply chain coordination or not, the EP’s expected profit increases in the usage fee rate, and the expected profit of OR decreases in the usage fee rate. Second, supply chain coordination consistently results in a larger expected profit for the OR, whereas the EP may obtain a smaller expected profit under supply chain coordination. If the usage fee rate is substantially large, then OR and EP obtain a larger expected profit under supply chain coordination with the revenue-cost sharing contract. In this situation, their incentives on supply chain coordination are aligned.

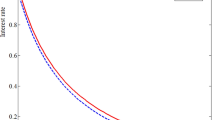

We examine the effect of the OR’s effort level. As presented in Fig. 6, we have several observations. First, in all scenarios, the EP’s expected profit increases in the OR’s effort level. A higher effort level of the OR leads to a larger demand, which benefits the EP. Second, under supply chain coordination, the expected profit of OR increases in her effort level.

In addition, we examine the effect of order quantity on the expected profit of the EP and OR. Figure 7 shows that the effect of order quantity is similar to the effect of the OR’s effort level. Based on Fig. 7, we have several observations. First, with an uncoordinated supply chain, an optimal order quantity maximizing the expected profit of OR exists. We have analytically provided the optimal closed-form expression of order quantity and effort level in the analysis of each scenario. Second, under supply chain coordination, the OR consistently obtains a larger expected profit than the EP. However, with an uncoordinated supply chain, the OR’s expected profit can be larger or smaller than the EP’s, depending on the order quantity.

5.2 Bank financing

In practice, capital-constrained ORs may borrow capital from financial institutions, such as banks (Wang et al., 2019; Yan et al., 2016), which is generally named as bank financing. In this section, we consider that the capital-constrained OR borrows capital from a bank and the OR is risk-neutral. In this situation, the OR borrows capital from the bank under the credit guarantee from the EP. Hence, the bank takes the credit risk of the OR in bank financing. We focus on comparison of the equilibrium between bank financing and EP financing.

Similar to that in scenario EN, the OR’s expected profit is given as:

Different from scenario EN, the profit of EP does not include the loan interest rate because the OR borrows capital from the bank. Hence, the expected profit of EP is given as:

The bank’s expected profit is intuitive and presented as follows.

The event sequence is illustrated as follows. First, the bank announces an interest rate to maximize its expected profit under the credit guarantee from the EP. Thereafter, the EP sets an optimal usage fee rate to maximize its expected profit. Finally, the OR simultaneously determines an optimal order quantity and effort level to maximize her expected profit.

Let \({r}_{a}\) denote the risk-free interest rate and \({\overline{r} }_{a}\) represent the optimal interest rate of the bank. Similar to the scenario EN, the equilibrium is derived and summarized in Proposition 9.

Proposition 9

Under bank financing, the equilibrium is summarized as follows:

-

1.

\({e}^{B}=\frac{\left(1-\lambda \right)p-\left(w+{c}_{1}\right)\left(1+{r}_{a}\right)}{2a\left(1+{r}_{a}\right)}\) and \({Q}^{B}={F}^{-1}\left[\frac{\left(w+{c}_{1}\right)(1+{r}_{a})-\left(1-\lambda \right)p}{s-\left(1-\lambda \right)p}\right]+\frac{\left(1-\lambda \right)p-\left(w+{c}_{1}\right)\left(1+{r}_{a}\right)}{2a\left(1+{r}_{a}\right)}\).

-

2.

\({\lambda }^{B}\) satisfies \(ph\left({Q}^{B},{e}^{B}\right)+p{\lambda }^{B}\frac{\partial h\left({Q}^{B},{e}^{B}\right)}{\partial {\lambda }^{B}}+\left({c}_{1}-{c}_{2}\right)\frac{\partial {Q}^{B}}{\partial {\lambda }^{B}}=0\), \({\overline{r} }_{a}\) satisfies \({B}_{1}+{B}_{2}+{B}_{3}=\left(\left(w+{c}_{1}\right)Q+a{e}^{2}-B\right)\left(1+{\overline{r} }_{a}\right)\), in which \({B}_{1}=\left(\left(\left(1-\lambda \right)p-s\right){e}^{B}+s{Q}^{B}\right)F\left(\overline{L }\right)\), \({B}_{2}=\left(\left(1-\lambda \right)p-s\right){\int }_{0}^{\overline{L} }xf\left(x\right)dx\), \({B}_{3}=\left(\left(w+{c}_{1}\right){Q}^{B}+a{\left({e}^{B}\right)}^{2}-B\right)\left(1+{\overline{r} }_{a}\right)\left(1-F\left(\overline{L }\right)\right)\) and \(\overline{L }=\frac{\left(\left(w+{c}_{1}\right){Q}^{B}+a{\left({e}^{B}\right)}^{2}-B\right)\left(1+{\overline{r} }_{a}\right)-s{Q}^{B}}{\left(1-\lambda \right)p-s}-{e}^{B}\).

The equilibrium under bank financing is similar to that under EP financing. For example, if \({r}_{a}=r\), the equilibrium effort level and order quantity of the OR under bank financing are identical with that under EP financing. So is the optimal interest rate decision of the bank.

In addition, as presented in Corollary 5, if \({r}_{a}=r\), we have \({\lambda }^{B}\ge {\lambda }^{EN}\) and \(E\left[{\pi }_{r}^{EN}\right]\ge E\left[{\pi }_{r}^{B}\right]\). That is, with an identical risk-free interest rate of the bank and the EP, the capital-constrained OR prefers the EP’s financial support, which leads to a higher profit gain. This is because the EP has two revenue sources, namely, operational revenue (usage fee rate of the platform) and loan revenue (interest rate of the loan). Under EP financing, the EP can determine a lower usage fee rate (\({\lambda }^{B}\ge {\lambda }^{EN}\)) because of the interest revenue, which consequently benefits the OR.

Corollary 5

If \({r}_{a}=r\), we have \({\lambda }^{B}\ge {\lambda }^{EN}\) and \(E\left[{\pi }_{r}^{EN}\right]\ge E\left[{\pi }_{r}^{B}\right]\).

We also solve the equilibrium in centralized case under bank financing, which are summarized in Proposition 10. Comparing with the results in the centralized case with EP financing, we can easily find that \({\overline{e} }^{C}\le {e}^{C}\) and \({\overline{Q} }^{C}\le {Q}^{C}\) (we add a bar of the equilibrium in bank financing to distinguish them from that in EP financing). That is, bank financing leads to a lower effort level and a smaller order quantity of the OR in the centralized case. It is because the introduction of a bank makes the supply chain more decentralized than that with EP financing. The double marginalization effect consequently leads to a lower effort level and a smaller order quantity of the OR. On basis of Propositions 9 and 10, a revenue-cost sharing contract \(\left({x}^{B},{y}^{B}\right)\) can be easily designed to coordinate the supply chain under bank financing.

Proposition 10

Under bank financing, the equilibrium in centralized case is given as \({\overline{e} }^{C}=\frac{p-w-{c}_{2}-\left(w+{c}_{1}\right){r}_{a}}{2a\left(1+{r}_{a}\right)}\) and \({\overline{Q} }^{C}={F}^{-1}\left[\frac{p-w-{c}_{2}-\left(w+{c}_{1}\right){r}_{a}}{p-s}\right]+\frac{p-w-{c}_{2}-\left(w+{c}_{1}\right){r}_{a}}{2a\left(1+{r}_{a}\right)}\).

6 Conclusions

Observing that ORs may be capital-constrained and increasingly obtain financial support from EPs, this paper considers a supply chain consisting of a newsvendor-like OR and an EP to investigate the EP’s financing schemes. We compare four scenarios (i.e., scenarios BN, BA, EN, and EA) to investigate the effects of the OR’s risk aversion and capital constrains on the OR and EP’s equilibrium decisions. We focus on the supply chain coordinating strategies based on revenue-cost sharing contracts. In addition, we also discuss the differences between EP financing and bank financing. Our main findings are summarized as follows.

We analytically obtain the equilibrium in each scenario, namely, the OR’s effort level on sales and order quantity, and the EP’s usage fee rate and interest rate (with EP financing). We reveal that the OR’s optimal effort level and order quantity decrease in the EP’s usage fee rate in all scenarios. When the OR is risk-averse, we derive the following findings: (1) the OR would determine a higher effort level than that when she is risk-neutral regardless of whether she is capital-constrained or not. (2) The optimal order quantity of OR depends on her risk-averse degree. For example, when the OR is sufficiently risk-averse, her order quantity is smaller than that when she is slightly risk-averse. (3) The EP sets a lower usage fee rate than that when the OR is risk-neutral. The OR tends to believe the demand would be small when she is risk-averse. Thus, the EP sets a small usage fee rate to drive the OR to make more effort on demand stimulation. (4) The OR may set a larger or smaller order quantity than that when she is risk-neutral, depending on the usage fee rate of EP. Moreover, we show that with EP financing, the optimal interest rate of EP increases in the risk-free interest rate and decreases in the initial capital of OR.

In each scenario, we design a revenue-cost sharing contract to coordinate the supply chain, which consists of a revenue-sharing ratio and a cost-sharing ratio. We found that all the designed contracts are feasible. Basically, the revenue-sharing ratio decreases, whereas the cost-sharing ratio increases in the usage fee rate. By comparing different scenarios, we find that the specific forms of the revenue-cost sharing contracts that coordinate the supply chain are similar when OR has an identical risk attitude. Furthermore, we conduct a numerical analysis to investigate how the key market factors influence the equilibrium. For example, we reveal that risk-aversion reduces the OR’s obtained profits from supply chain coordination. Supply chain coordination consistently results in an increased expected profit for the OR, whereas the EP may obtain a reduced expected profit under supply chain coordination. Furthermore, by comparing the different financing schemes, namely, EP financing and bank financing, we find that a capital-constrained OR consistently prefers EP financing.

The results have the following potential managerial implications. First, with a high usage fee rate and interest rate of the EP, the OR should make a low effort level on sales. Second, the EP and OR should carefully consider the OR’s risk-aversion when making operational decisions. For example, the OR should make a high effort level and the EP should set a low usage fee rate when the OR is risk-averse. Third, the managers of the EP and OR can apply a revenue-cost sharing contract to coordinate the supply chain according our analytical results. Fourth, a capital-constrained OR is suggested to choose EP financing scheme rather than bank financing scheme.

We recognize the limitations of our model. Therefore, we raise several issues and avenues for future research. First, the revenue-cost sharing contract is employed to coordinate the supply chain in our model. Several contracts (see, e.g., Cachon, 2003) can also be designed to coordinate the supply chain in future study. Second, our model considers a bilateral monopoly setting with one EP and one OR. In general, competition among ORs via a common EP may exist. Therefore, future studies can consider multiple ORs and investigate the effects of competition. Third, heuristics algorithm such as genetic algorithm (Mamun et al., 2012) can be considered to handle the computational complexity of the problem in practice.

Notes

“Amazon 2020 SMB Impact Report Highlights Success for Small and Medium-Sized Businesses Despite COVID-19; American Sellers Average $160,000 in Annual Sales”, accessed on July 30, 2021, https://press.aboutamazon.com/news-releases/news-release-details/amazon-2020-smb-impact-report-highlights-success-small-and.

“MYbank’s use of digital technology leads to record growth in rural clients”, accessed on July 30, 2021, https://www.businesswire.com/news/home/20210623005998/en/MYbank%E2%80%99s-Use-of-Digital-Technology-Leads-to-Record-Growth-in-Rural-Clients.

“ City alliance investing in potential of companies”, accessed on July 30, 2021, http://www.chinadaily.com.cn/cndy/2019-08/15/content_37502052.htm

“Addressing the SME finance problem”, accessed on August 2, 2021, http://blogs.worldbank.org/allaboutfinance/addressing-sme-finance-problem.

“China's Singles Day shopping spree injects impetus into global economy”, accessed on June, 13, 2021, https://www.chinadaily.com.cn/a/202011/12/WS5fad0059a31024ad0ba93bb8.html.

“How to Deal with Uncertainty in the Supply Chain”, access on August 2, 2021, https://news.thomasnet.com/imt/2011/01/11/how-to-deal-with-uncertainty-in-the-supply-chain.

In practice, EPs can serve as resellers (e.g., Tmall) and agency sellers (e.g., Amazon, JD.com). In this paper, we consider the situation that the EP acts as agency seller. Please refer to Abhishek et al. (2016) for further discussions on the differences between agency selling and reselling.

For example, JD.com is one of the China’s largest EP and operates a network of over 650 warehouses. This EP provides warehousing and e-tailing services for the ORs. See https://corporate.jd.com/ourBusiness.

References

Abhishek, V., Jerath, K., & Zhang, Z. J. (2016). Agency selling or reselling? Channel structures in electronic retailing. Management Science, 62(8), 2259–2280.

Abor, J. Y., Agbloyor, E. K., & Kuipo, R. (2014). Bank finance and export activities of small and medium enterprises. Review of Development Finance, 4(2), 97–103.

Alan, Y., & Gaur, V. (2018). Operational investment and capital structure under asset-based lending. Manufacturing & Service Operations Management, 20(4), 637–654.

Ali, M. S., & Nakade, K. (2016). Coordinating a supply chain system for production, pricing and service strategies with disruptions. International Journal of Advanced Operations Management, 8(1), 17–37.

Buzacott, J. A., & Zhang, R. Q. (2004). Inventory Management with asset-based financing. Management Science, 50(9), 1274–1292.

Cachon, G. P. (2003). Supply chain coordination with contracts. Handbooks in Operation Research and Management Science, 11, 227–339.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue-sharing contracts: Strengths and limitations. Management Science, 50(1), 30–44.

Cai, G., Dai, Y., & Zhou, S. (2012). Exclusive channels and revenue sharing in a complementary goods market. Marketing Science, 31(1), 172–187.

Cao, E., & Yu, M. (2018). Trade credit financing and coordination for an emission-dependent supply chain. Computers & Industrial Engineering, 119, 50–62.

Chen, C., Zhuo, X., & Li, Y. (2021). Online channel introduction under contract negotiation: Reselling versus agency selling. In Press.

Chen, X. (2015). A model of trade credit in a capital-constrained distribution channel. International Journal of Production Economics, 159(1), 347–357.

Chen, X., Liu, C., & Li, S. (2019). The role of supply chain finance in improving the competitive advantage of online retailing enterprises. Electronic Commerce Research and Applications, 33, 100821.

Chiu, C. H., & Choi, T. M. (2016). Supply chain risk analysis with mean-variance models: A technical review. Annals of Operations Research, 240(2), 489–507.

Chod, J., Lyandres, E., & Yang, S. A. (2019). Trade credit and supplier competition. Journal of Financial Economics, 131(2), 484–505.

Choi, T. M. (2020b). Supply chain financing using blockchain: Impacts on supply chains selling fashionable products. Annals of Operations Research, 1–23.

Choi, T. M., & Chiu, C. H. (2012). Risk analysis in stochastic supply chains: A mean-risk approach. Springer.

Choi, T. M., Chung, S. H., & Zhuo, X. (2020). Pricing with risk sensitive competing container shipping lines: Will risk seeking do more good than harm? Transportation Research Part B-Methodological, 133, 210–229.

Cui, Q., Chiu, C. H., Dai, X., & Li, Z. (2016). Store brand introduction in a two-echelon logistics system with a risk-averse retailer. Transportation Research Part E-Logistics and Transportation Review, 90, 69–89.

Gang, X., Wang, S., & Lai, K. K. (2011). Quality investment and price decision in a risk-averse supply chain. European Journal of Operational Research, 214(2), 403–410.

Gong, D., Liu, S., Liu, J., Ren, L. 2019. Who benefits from online financing? A sharing economy E-tailing platform perspective. International Journal of Production Economics. In Press

He, J., Ma, C., & Pan, K. (2017). Capacity investment in supply chain with risk averse supplier under risk diversification contract. Transportation Research Part E, 106, 255–275.

Heydari, J., Govindan, K., & Basiri, Z. (2020). Balancing price and green quality in presence of consumer environmental awareness: A green supply chain coordination approach. International Journal of Production Research, 59(7), 1–19.

Hosseini-Motlagh, S., Jazinaninejad, M., Nami, N. (2020). Recall management in pharmaceutical industry through supply chain coordination. Annals of Operations Research, 1–39.

Huo, Y., Lee, C. K. M., Zhang, S. (2020). Trinomial tree based option pricing model in supply chain financing. Annals of Operations Research, 1–21.

Jammernegg, W., Kischka, P. 2012. Newsvendor problems with VaR and CVaR consideration. In T.M. Choi (Ed.), Handbook on newsvendor problems: Models, Extensions and Applications.

Katehakis, M. N., Melamed, B., & Shi, J. (2016). Cash-flow based dynamic inventory management. Production and Operations Management, 25(9), 1558–1575.

Kouvelis, P., & Zhao, W. (2011). The newsvendor problem and price-only contract when bankruptcy costs exist. Production and Operations Management, 20(6), 921–936.

Lariviere, M. A., & Porteus, E. L. (2001). Selling to the newsvendor: An analysis of price-only contracts. Manufacturing and Service Operations Management, 3(4), 293–305.

Lau, H. S., Su, C., Wang, Y. Y., & Hua, Z. S. (2012). Volume discounting coordinates a supply chain effectively when demand is sensitive to both price and sales effort. Computers & Operations Research, 39(12), 3267–3280.

Lee, C. H., & Rhee, B. D. (2011). Trade credit for supply chain coordination. European Journal of Operational Research, 214(1), 136–146.

Li, B., An, S., & Song, D. P. (2018). Selection of financing strategies with a risk-averse supplier in a capital-constrained supply chain. Transportation Research Part E-Logistics and Transportation Review, 118, 163–183.

Li, X., Du, J., & Long, H. (2020). Mechanism for green development behavior and performance of industrial enterprises (GDBP-IE) using partial least squares structural equation modeling (PLS-SEM). International Journal of Environmental Research and Public Health, 17(22), 8450.

Lin, Q., Su, X., & Peng, Y. (2018). Supply chain coordination in confirming warehouse financing. Computers & Industrial Engineering, 118, 104–111.

Liu, M., Cao, E., & Salifou, C. K. (2016). Pricing strategies of a dual-channel supply chain with risk aversion. Transportation Research Part E, 90, 108–120.

Long, H., Liu, H., Li, X., & Chen, L. (2020). An evolutionary game theory study for construction and demolition waste recycling considering green development performance under the Chinese Government’s reward-penalty mechanism. International Journal of Environmental Research and Public Health, 17(17), 6303.

Luciano, E., Peccati, L., & Cifarelli, D. M. (2003). VaR as a risk measure for multiperiod static inventory models. International Journal of Production Economics, 81–82, 375–384.

Mamun, A. A., Khaled, A. A., Ali, S. M., & Chowdhury, M. M. (2012). A heuristic approach for balancing mixed-model assembly line of type I using genetic algorithm. International Journal of Production Research, 50(18), 5106–5116.

Moon, I., Dey, K., & Saha, S. (2018). Strategic inventory: Manufacturer vs. retailer investment. Transportation Research Part E-Logistics and Transportation Review, 109, 63–82.

Rockafellar, R. T., & Uryasev, S. (2002). Conditional value-at-risk for general loss distributions. Journal of Banking & Finance, 26, 144–1471.

Shi, J., Du, Q., Lin, F., Li, Y., Bai, L., Fung, R. Y. K., & Lai, K. K. (2020). Coordinating the supply chain finance system with buyback contract: A capital-constrained newsvendor problem. Computers & Industrial Engineering, 146, 106587.

Tang, C. S., Yang, S. A., & Wu, J. (2017). Sourcing from suppliers with financial constraints and performance risk. Manufacturing & Service Operations Management, 20(1), 70–84.

Tapiero, C. S. (2005). Value at risk and inventory control. European Journal of Operational Research, 163(3), 769–775.

Wang, C., Fan, X., & Yin, Z. (2019a). Financing online retailers: Bank vs. electronic business platform, equilibrium, and coordinating strategy. European Journal of Operational Research, 276, 343–356.

Wang, F., Yang, X., Zhuo, X., & Xiong, M. (2019b). Joint logistics and financial services by a 3PL firm: Effects of risk preference and demand volatility. Transportation Research Part E-Logistics and Transportation Review, 130, 312–328.

World Bank Group. 2018. Finance. access on June 25, 2019. https://www.enterprisesurveys.org/data.

Wu, J., Yue, W., Yamamoto, Y., & Wang, S. (2006). Risk analysis of a pay to delay capacity reservation contract. Optimization Methods & Software, 21, 635–651.

Xu, Y., Pinedo, M., & Xue, M. (2016). Operational risk in financial services: A review and new research opportunities. Production and Operations Management, 26(3), 426–445.

Yan, N., He, X., Liu, Y. 2018. Financing the capital-constrained supply chain with loss aversion: supplier finance vs. supplier investment. Omega. In press.

Yan, N., Liu, Y., Xu, X., & He, X. (2020). Strategic dual-channel pricing games with e-retailer finance. European Journal of Operational Research, 283, 138–151.

Yan, N., & Sun, B. (2013). Coordinating loan strategies for supply chain financing with limited credit. Or Spectrum, 35(4), 1039–1058.

Yan, N., Sun, B., Zhang, H., & Liu, C. (2016). A partial credit guarantee contract in a capital-constrained supply chain: Financing equilibrium and coordinating strategy. International Journal of Production Economics, 173, 122–133.

Yang, S. A., Birge, J. (2017a). Trade credit, risk sharing, and inventory financing portfolios. Management Science. Available at SSRN: https://ssrn.com/abstract=2746645.

Yang, S. A., Birge, J. (2017b). Trade credit in supply chains: multiple creditors and priority rules. Available at SSRN: https://ssrn.com/abstract=1840663.

Zhang, J., Sethi, S. P., Choi, T. M., & Cheng, T. C. E. (2020). Supply chains involving a mean-variance-skewness-kurtosis newsvendor: Analysis and coordination. Production and Operations Management, 29(6), 1397–1430.

Zhang, Q., Dong, M., Luo, J., & Segerstedt, A. (2014). Supply chain coordination with trade credit and quantity discount incorporating default risk. International Journal of Production Economics, 153, 352–360.

Zheng, K., Zhang, Z., Gauthier, J. (2020). Blockchain-based intelligent contract for factoring business in supply chains. Annals of Operations Research, 1–21.

Acknowledgements

The authors are grateful to the editors and the reviewers for their helpful comments. This work is partially supported by National Natural Science Foundation of China (NSFC) (Nos. 72071050, 71901227 and U1811462) and Natural Science Foundation of Guangdong Province of China (No. 2022A1515010541).

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

Proof of Lemma 1

In the centralized case, we have \(\left(1-\lambda \right)p>w +{c}_{2}>s\). From the second-order derivative of \(E\left[{\pi }_{SC}\right]\) with respect to \(Q\) and \(e\), we have \(\frac{{\partial }^{2}E\left[{\pi }_{SC}\right]}{\partial {Q}^{2}}=\left(s-\left(1-\lambda \right)p\right)f\left(Q-e\right)<0\) and \(\frac{{\partial }^{2}E\left[{\pi }_{SC}\right]}{\partial {e}^{2}}=-\left(\left(1-\lambda \right)p-s\right)f\left(Q-e\right)-2a<0\). Hence, by solving \(\frac{\partial E[{\pi }_{SC}]}{\partial Q}=0\) and \(\frac{\partial E[{\pi }_{SC}]}{\partial e}=0\), we derive \({e}^{C}=\frac{p-w-{c}_{2}}{2a}\) and \({Q}^{C}={F}^{-1}\left[\frac{p-w-{c}_{2}}{p-s}\right]+\frac{p-w-{c}_{2}}{2a}\). Q.E.D.

Proof of Proposition 1