Abstract

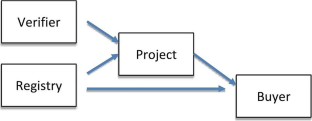

Carbon offsets are a critical factor in addressing the harmful effects of climate change. The recent growth in voluntary carbon offsets is a welcome development in a setting dominated by compliance-oriented carbon markets driven by government emissions targets. However, fragmentation, volatile pricing, and low quality offsets have been problematic indications of inefficiency in this market. We argue that the underlying economic theory for compliance-oriented markets is different from that of voluntary offsets. Coase’s (1960) Problem of Social Cost lays the groundwork for the former while Akerlof’s (1970) Market for Lemons underpins the latter. We propose a literature on successful responses to the lemons problem, which employ a two-sided market structure (or multi-sided platform, MSP). We suggest that the value chain in the voluntary offset market could be reconfigured using this structure, as one possible response to the lemons problem. This structure has the added advantage of driving innovation and adoption in accounting and other market standards that would be tailored to support the carbon offset market.

Similar content being viewed by others

Notes

It took several decades at the end of the 19th and beginning of the 20th centuries for the modern market for stocks, as we know them today, to emerge. Both underwriters and the NYSE played leading roles in establishing the standards that made efficient trading possible (Carosso, 1970; Banner, 1998).

References

Ahonen, H., Kessler, J., & Singh, A. (2023). Raising climate ambition with carbon credits, Perspectives, Freiburg.

Akerlof, G. (1970). The Market for Lemons: Qualitative Uncertainty and the Market Mechanism, Q. J. Econ, August, Vol. 84(3), pp. 488–900.

Banner, S. (1998). Anglo-american securities Regulation: Cultural and political roots, 1690–1860. Cambridge University Press.

Blaufelder, C., Levy, C., Mannion, P., & Pinner, D. (2021). A blueprint for scaling voluntary carbon markets to meet the climate challenge. McKinsey Sustainability.

BloombergNEF, (2023). Carbon Offset Market Could Reach $1 Trillion With Right Rules, January 23.

Broekhoff, D., Gillenwater, M., Colbert-Sangree, T., & Cage, P. (2019). Securing Climate Benefit: A guide to using Carbon offsets. Stockholm Environment Institute & Greenhouse Gas Management Institute.

Carosso, V. P. (1970). Investment Banking in America: A history. Harvard University Pres.

Civillini, M. (2023a). Revealed: How Shell cashed in on dubious carbon offsets from Chinese rice paddies. Climate Home News, March 28 at 3:07 PM.

Civillini, M. (2023b). Verra boss steps down after criticism of its carbon credits. Climate Home News, May 23 at 6:09 PM.

Coase, R. H. (1960). The Problem of Social Cost. Journal of Law and Economics, Vol. 3, October, pp. 31– 44.

Dhanda, K. K., & Laura, P. H. (2011). The ethics of carbon neutrality: A critical examination of voluntary carbon offset providers. Journal of Business Ethics, 100, 119–149.

Diamond, S. F., & Kuan, J. W. (2018). Are the stock markets “rigged”? An empirical analysis of regulatory change. International Review of Law and Economics, 55, 33–40.

Ecosystem, M. (2022). The art of Integrity: State of Voluntary Carbon markets, Q3 insights briefing. Forest Trends Association.

Forest Trends Association. State of the Voluntary Carbon Markets 2023. Washington DC: Forest Trends’ Ecosystem Marketplace, Foster, Vivien, & Hahn, R. W. (2023). 1995. Designing More Efficient Markets: Lessons from Los Angeles Smog Control. Journal of Law and Economics 38(1): 19–48.

Goulder, L. H. (2013). Markets for pollution allowances: What are the (new) lessons? Journal of Economics Perspectives, 27(1), 87–102.

Greenfield, P., & The Guardian (2023). Revealed: more than 90% of rainforest carbon offsets by biggest certifier are worthless, analysis shows: Investigation into Verra Carbon standard finds most are ‘phantom credits’ and may worsen global heating. Jan 18.

Halper, E. Los Angeles Times, 2021. Burned trees and billions in cash: How a California climate program lets companies keep polluting. Sept 8.

Jingle County Sailing Carbon Sink Development Co. LTD (2023). Xinzhou Echeng Afforestation Project Description.

Kaplan, R. S., Ramanna, K., & Roston, M. (2023a). Accounting for carbon offsets—Establishing the foundation for carbon-trading markets. Harvard Business School Working Paper 23–050.

Kaplan, R. S., Ramanna, K., & Roston, M. (2023b). Accounting for carbon offsets. Harvard Business Review.

MacDonagh, J., & Williams, A. (2024). Investigations into voluntary carbon credit quality have prompted increased focus on high-integrity credits, from both buyers and providers. PitchBook.

Mandelbrot, B. (1963). The variation of certain speculative prices. The Journal of Business, 36(4), 394–419.

Michaelowa, A., Shishlov, I., & Brescia, D. (2019). Evolution of international carbon markets: lessons for the Paris Agreement. Wiley Interdisciplinary Reviews: Climate Change. Vol. 10(6) November.

Nowicki, B. (2021). Resignation letter from California Air Resources Board available at https://ww2.arb.ca.gov/sites/default/files/2021-02/nowicki_brian_offsets_task_force_letter_020821.pdf

Parker, G. G., & Van Alstyne, M. W. (2005). Two-sided network effects: A theory of information product design. Management Science, 51(1), 1494–1504.

Reuters (2023). Voluntary carbon markets set to become at least five times bigger by 2030-Shell. January 19 at 2:13 am PST.

Rochet, J. C., & Tirole, J. (2003). Platform competition in two-sided markets. Journal of the European Economic Association, 1(4), 990–1029.

Rochet, J. C., & Tirole, J. (2006). Two-sided markets: A Progress Report. RAND Journal of Economics, 37(3), 645–667.

Roston, M., Seiger, A., & Heller, T. (2023). What’s next after carbon accounting? Emissions liability management. Stanford working paper.

SourceMaterial (2023). The Carbon Con, Source-Material.org, January 18.

Stanford Law, S. (2022). Voluntary Carbon Markets Symposium. October 25. https://conferences.law.stanford.edu/carbonmarkets1/

Stavins, R. (2022). The relative merits of carbon pricing instruments: Taxes versus trading. Review of Environmental Economics and Policy, 16(1), Winter 2022.

Stubbs, M., Hoover, K., & Ramseur, J. L. (2021). Agriculture and Forestry offsets in Carbon markets: Background and selected issues. Congressional Research Service Reports R46956, Nov. 3.

Twidale, S., & Mcfarlane, S. (2023). Carbon credit market confidence ebbs as big names retreat. Reuters Sept. 1.

Verra (2024). https://verra.org/about/overview/, last checked on Jan. 17, 2024.

West, T. A. P., Sven Wunder, E. O., Sills, J., Börner, S. W., Rifai, Alexandra, N., Neidermeier, & Kontoleon, A. (2023). Action needed to make carbon offsets from tropical forest conservation work for climate change mitigation, January 5, Preprint available at arXiv:2301.03354.

Zelljadt, E. (2022). Carbon markets on a bull run: Emissions trading gains influence. Refinitiv June 29.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors have no conflicts of interest related to this research.

Additional information

Publisher’s Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

About this article

Cite this article

Diamond, S.F., Kuan, J.W. The market for carbon offsets: insights from US stock exchanges. Rev World Econ (2024). https://doi.org/10.1007/s10290-024-00535-7

Accepted:

Published:

DOI: https://doi.org/10.1007/s10290-024-00535-7