Abstract

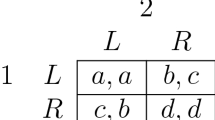

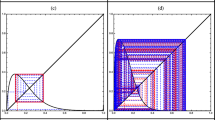

We propose a discrete-time exchange economy evolutionary model with two groups of agents. In our setting the definition of equilibrium depends also on agents’ population shares, which affect the market clearing conditions. We prove that, despite such difference with the classical Walrasian framework, for all economies and population shares there exists at least one equilibrium, and we show that for all population shares, generically in the set of the economies, equilibria are finite and regular. We then introduce the dynamic law governing the evolution of the population shares, and we investigate the existence and the stability of the resulting stationary equilibria. We assume that the reproduction level of a group is related to its attractiveness degree, which depends on the social visibility level, determined by the consumption choices of the agents in that group. The attractiveness of a group is described via a generic bell-shaped map, increasing for low visibility levels, but decreasing when the visibility of the group exceeds a given threshold value, due to a congestion effect. The model is able to reproduce the recurrent dynamic behavior typical of the fashion cycle, presenting booms and busts in the agents’ consumption choices, and in the groups’ attractiveness and population shares.

Similar content being viewed by others

Notes

Cf. also Gori et al. (2014), where an homotopy method is employed to prove existence of equilibria in a model with real assets and restricted participation.

We notice that, if \(u_{\alpha }=u_{\beta }\), then agents are homogeneous since endowments of both goods coincide between groups. In order not to overburden notation and not to excessively complicate the analysis, we will here focus on the case with \(w_{x,\alpha }=w_{x,\beta }=w_x\) and \(w_{y,\alpha }=w_{y,\beta }=w_y\), implicitly assuming that \(u_{\alpha }\ne u_{\beta }\), like it happens in the example considered in Sect. 3.

We remark that the argument above suggests that market equilibria exist for any economy even when \(a=0\) and \(a=1\), although such extreme cases are not encompassed in Proposition 1 due to the need to deal with open sets because of the differential topology kind of proof. We also notice that considering an open interval of the form \((-\varepsilon , 1+\varepsilon )\), with \(\varepsilon >0\) arbitrarily small, would not solve the issue, as some steps in the proof of Proposition 1 would not work anymore.

Actually, along the proof we show the validity of a stronger result, i.e., that in any time period and for every population share, for each choice of the utility functions in \({\mathcal {U}}\), there exists an open and full measure subset of the space of endowments where the generic regularity property holds. In particular, the fact that the smooth dependence of equilibria holds for all share values—for all utility functions in \({\mathcal {U}}\) and for almost all endowment combinations—is crucial, as we will characterize market stationary equilibria in terms of population shares. Indeed, for our purposes a result more in line with the approach in Chapter 8 in Villanacci et al. (2002), where economies are identified with endowments and the utility function vector is taken as given (see in particular Paragraph 8.7 therein), would suffice. Nonetheless, the smooth dependence of equilibria on utility functions comes as a byproduct of the proof of Proposition 2, which is in line with some recent generic regularity results in the general equilibrium literature (see, e.g., Carosi et al. 2009 and Hoelle et al. 2016). We chose to present such version of the proposition, since we believe that a more general result about generic regularity can be of independent interest.

We remark that \(V_{i}\), and consequently \({\mathscr {A}}_{i}\), also depend on the economy \(\widetilde{{\mathcal {E}}}\), which together with a determines the market equilibrium. However, in order not to overburden notation, we will not make such dependence explicit.

Although such feature is mentioned in Fisher (1972) for Stone–Geary utility functions when the coefficients \(c_i,\,d_i\) are non-negative, for \(i\in \{\alpha ,\beta \}\), a direct proof using the expression for the individual demand functions in (14) shows that the gross substitute property holds also in the case of negative coefficients, as long as their value is not excessively large in absolute value. See the discussion after (14) for more details.

We here consider polarized values for \(v_x\) and \(v_y\), as both of them are positive but one is much larger than the other. As observed in Sect. 2, such case approximates those frameworks in which visibility and attractiveness are produced by the consumption of a single good. However, our results hold true also for more balanced values of \(v_x\) and \(v_y\).

We remark that the symmetry between the bounds of \(c_i\) and \(d_i\) is caused by the fact that, for the parameter configuration we deal with, it holds that \(w_x=(1-\alpha )w_y\). Of course, such peculiarity does not affect the outcomes. Indeed, in the scenario that we will consider below the parameters \(c_i\) and \(d_i\) will not bear any symmetry.

In regard to the second scenario, in Naimzada and Pireddu (2019b) we deal with \(c_{\alpha }=0.3,\,c_{\beta }=0.12,\,d_{\alpha }=0.1,\,d_{\beta }=0.15\).

See Naimzada and Pireddu (2019c) for the corresponding definition and for the proof, in our framework, of the first fundamental theorem of welfare economics, according to which every (stationary) equilibrium allocation is Pareto optimal. Since the employed concept of Pareto optimality concerns one single period at a time, we will use the expression “instantaneous Pareto optimal allocation” in the present work.

We stress that differently from what done in Villanacci et al. (2002), we normalize the price of the first commodity, rather than of the last one. Of course, this change does not affect the validity of the results.

References

Antoci, A., Brugnano, L., Galeotti, M.: Sustainability, indeterminacy and oscillations in a growth model with environmental assets. Nonlinear Anal. Real World Appl. 5, 571–587 (2004)

Benhabib, J., Day, R.H.: Rational choice and erratic behaviour. Rev. Econ. Stud. 48, 459–471 (1981)

Bischi, G.-I., Radi, D.: An extension of the Antoci–Dei–Galeotti evolutionary model for environment protection through financial instruments. Nonlinear Anal. Real World Appl. 13, 432–440 (2012)

Block, L.S., Coppel, W.A.: Dynamics in One Dimension. Springer Lecture Notes, vol. 1513. Springer, Berlin (1992)

Branch, W.A., McGough, B.: Replicator dynamics in a Cobweb model with rationally heterogeneous expectations. J. Econ. Behav. Org. 65, 224–244 (2008)

Cabrales, A., Sobel, J.: On the limit points of discrete selection dynamics. J. Econ. Theory 57, 407–419 (1992)

Carosi, L., Gori, M., Villanacci, A.: Endogenous restricted participation in general financial equilibrium. J. Math. Econ. 45, 787–806 (2009)

Caulkins, J.P., Hartl, R.F., Kort, P.M., Feichtinger, G.: Explaining fashion cycles: imitators chasing innovators in product space. J. Econ. Dyn. Control 31, 1535–1556 (2007)

Cavalli, F., Naimzada, A.: A multiscale time model with piecewise constant argument for a boundedly rational monopolist. J. Differ. Equ. Appl. 22, 1480–1489 (2016)

Cavalli, F., Naimzada, A., Sodini, M.: Oligopoly models with different learning and production time scales. Decis. Econ. Finance 41, 297–312 (2018)

Chang, J., Stauber, R.: Evolution of preferences in an exchange economy. Econ. Lett. 103, 131–134 (2009)

Coelho, P.R.P., McClure, J.E.: Toward an economic theory of fashion. Econ. Inq. 31, 595–608 (1993)

Corneo, G., Jeanne, O.: Segmented communication and fashionable behavior. J. Econ. Behav. Organ. 39, 371–385 (1999)

Day, R.H.: Rational choice and economic behavior. Theory Decis. 1, 229–251 (1970)

Di Giovinazzo, V., Naimzada, A.: A model of fashion: endogenous preferences in social interaction. Econ. Model. 47, 12–17 (2015)

Diamond, P.A.: National debt in a neoclassical growth model. Am. Econ. Rev. 55, 1126–1150 (1965)

Ekaterinchuk, E., Jungeilges, J., Ryazanova, T., Sushko, I.: Dynamics of a minimal consumer network with uni-directional influence. J. Evol. Econ. 27, 831–857 (2017)

Ekaterinchuk, E., Jungeilges, J., Ryazanova, T., Sushko, I.: Dynamics of a minimal consumer network with bi-directional influence. Commun. Nonlinear Sci. Numer. Simul. 58, 107–118 (2018)

Fisher, F.M.: Gross substitutes and the utility function. J. Econ. Theory 4, 82–87 (1972)

Frijters, P.: A model of fashions and status. Econ. Model. 15, 501–517 (1998)

Gaertner, W.: A dynamic model of interdependent consumer behavior. Zeitschr. f. Nationalökonomie 34, 327–344 (1974)

Gaertner, W.: Periodic and aperiodic consumer behavior. Appl. Math. Comput. 22, 233–254 (1987)

Gaertner, W., Jungeilges, J.: A non-linear model of interdependent consumer behaviour. Econ. Lett. 27, 145–150 (1988)

Gaertner, W., Jungeilges, J.: “Spindles” and coexisting attractors in a dynamic model of interdependent consumer behavior: a note. J. Econ. Behav. Organ. 21, 223–231 (1993)

Gaertner, W., Jungeilges, J.: A model of interdependent consumer behavior: nonlinear dynamics in \({\mathbb{R}}^2\). In: Eichhorn, W. (ed.) Models and Measurement of Welfare and Inequality, pp. 941–962. Springer, Berlin (1994)

Gardini, L., Sushko, I., Matsuyama, K.: 2D discontinuous piecewise linear map: emergence of fashion cycles. Chaos 28, 055917 (2018). https://doi.org/10.1063/1.5018588

Geary, R.C.: A note on “A constant-utility index of the cost of living”. Rev. Econ. Stud. 18, 65–66 (1950)

Gloeckner, H.: Implicit functions from topological vector spaces to Banach spaces. Isr. J. Math. 155, 205–252 (2006)

Gori, M., Pireddu, M., Villanacci, A.: Regularity and Pareto improving on financial equilibria with price-dependent borrowing restrictions. Res. Econ. 67, 100–110 (2013)

Gori, M., Pireddu, M., Villanacci, A.: Existence of financial equilibria with endogenous short selling restrictions and real assets. Decis. Econ. Finance 37, 349–371 (2014)

Heffetz, O.: A test of conspicuous consumption: visibility and income elasticities. Rev. Econ. Stat. 93, 1101–1117 (2011)

Heffetz, O.: Who sees what? Demographics and the visibility of consumer expenditures. J. Econ. Psychol. 33, 801–818 (2012)

Heifetz, A., Shannon, C., Spiegel, Y.: The dynamic evolution of preferences. Econ. Theory 32, 251–286 (2007a)

Heifetz, A., Shannon, C., Spiegel, Y.: What to maximize if you must. J. Econ. Theory 133, 31–57 (2007b)

Hirsch, M.: Differential Topology. Springer, New York (1976)

Hoelle, M., Pireddu, M., Villanacci, A.: Incomplete financial markets with real assets and endogenous credit limits. J. Econ. 117, 1–36 (2016)

Hofbauer, J., Weibull, J.: Evolutionary selection against dominated strategies. J. Econ. Theory 71, 558–573 (1996)

Karni, E., Schmeidler, D.: Fixed preferences and changing tastes. Am. Econ. Rev. 80, 262–267 (1990)

Leibenstein, H.: Bandwagon, snob and Veblen effects in the theory of consumers. Q. J. Econ. 65, 183–207 (1950)

Lloyd, N.G.: Degree Theory, Cambridge Tracts in Mathematics, vol. 73. Cambridge University Press, Cambridge (1978)

Mas-Colell, A., Whinston, M.D., Green, J.R.: Microeconomic Theory. Oxford University Press, New York (1995)

Matsumoto, A.: Let it be: chaotic price instability can be beneficial. Chaos Solitons Fractals 18, 745–758 (2003)

Matsuyama, K.: Custom versus fashion: path-dependence and limit cycles in a random matching game. In: Working Paper in Economics, E-92-11, Hoover Institution; Northwestern University CMS-EMS DP # 1030 (1991)

Nachbar, J.H.: “Evolutionary” selection dynamics in games: convergence and limit properties. Int. J. Game Theory 19, 59–89 (1990)

Naimzada, A., Pireddu, M.: Endogenous evolution of heterogeneous consumers preferences: multistability and coexistence between groups. Econ. Lett. 142, 22–26 (2016)

Naimzada, A., Pireddu, M.: Fashion cycle dynamics in a model with endogenous discrete evolution of heterogeneous preferences. Chaos 28, 055907 (2018). https://doi.org/10.1063/1.5024931

Naimzada, A., Pireddu, M.: Fashion cycle dynamics induced by agents’ heterogeneity for generic bell-shaped attractiveness functions. J. Differ. Equ. Appl. (2019a). https://doi.org/10.1080/10236198.2019.1627344

Naimzada, A., Pireddu, M.: A general equilibrium evolutionary model with generic utility functions and generic bell-shaped attractiveness maps, generating fashion cycle dynamics. Extended version available as: University of Milan Bicocca Department of Economics, Management and Statistics Working Paper No. 401 (2019b)

Naimzada, A., Pireddu, M.: The first fundamental theorem of welfare in a general equilibrium evolutionary setting. University of Milan Bicocca Department of Economics, Management and Statistics Working Paper No. 415 (2019c)

Naimzada, A., Sacco, P., Sodini, M.: Wealth-sensitive positional competition as a source of dynamic complexity in OLG models. Nonlinear Anal. Real World Appl. 14, 1–13 (2013)

Pesendorfer, W.: Design innovation and fashion cycles. Am. Econ. Rev. 85, 771–792 (1995)

Sandholm, W.H.: Population Games and Evolutionary Dynamics. MIT Press, Cambridge (2010)

Sharkovsky, A.N., Kolyada, S.F., Sivak, A.G., Fedorenko, V.V.: Dynamics of One-Dimensional Maps. Kluwer Academic, Boston (1997)

Simmel, G.: Fashion. Int. Q. 10, 130–155 (1904)

Stone, R.: Linear expenditure systems and demand analysis: an application to the pattern of British demand. Econ. J. 64, 511–527 (1954)

Taylor, P.D., Jonker, L.B.: Evolutionarily stable strategies and game dynamics. Math. Biosci. 40, 145–156 (1978)

Veblen, T.: The Theory of the Leisure Class: An Economic Study of Institutions. Macmillan, New York (1899)

Vigneron, F., Johnson, L.: A review and a conceptual framework of prestige-seeking consumer behavior. Acad. Mark. Sci. Rev. 3, 1–15 (1999)

Villanacci, A., Carosi, L., Benevieri, P., Battinelli, A.: Differential Topology and General Equilibrium with Complete and Incomplete Markets. Springer, US (2002)

Wiggins, S.: Introduction to Applied Nonlinear Dynamical Systems and Chaos, Texts in Applied Mathematics, 2nd edn. Springer, New York (2003)

Zhang, W.-B.: Fashion with snobs and bandwagoners in a three-type households and three-sector neoclassical growth model. Rev. Mex. Econ. Finanz. 11, 1–19 (2016)

Zhang, W.-B.: Fashion and business cycles with snobs and bandwagoners in a multi-sector growth model. J. Bus. 2, 1–13 (2017)

Acknowledgements

The authors thank the anonymous Referees for the helpful and valuable comments.

Funding

This research did not receive any specific grant.

Author information

Authors and Affiliations

Corresponding author

Ethics declarations

Conflict of interest

The authors declare that they have no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Proof of the analytical results

Proof of the analytical results

Proof of Proposition 1

Since the arguments we shall employ are independent of the considered time period, in order not to overburden notation, we will omit the subscript t, as well as the stars, which will refer to the Pareto optimal allocationFootnote 16 only.

We define \(\theta =\left( p_{x},p_{y},\left( x_{i},y_{i}\right) _{i\in \{\alpha ,\beta \}}\right) \in \varTheta =(0,+\infty )^{6}\) and, according to Definition 2, we say that \(\theta \in \varTheta \) is a market equilibrium given \( E\in {\mathcal {E}}\) and \(a\in (0,1)\) if, for every \(i\in \{\alpha ,\beta \}\), \(\left( x_{i},y_{i}\right) \) solves problem (4) at \(\left( p_x,p_y,E\right) \) and \(\left( x_{i},y_{i}\right) _{i\in \{\alpha ,\beta \}}\) satisfies market clearing conditions (3) at \(\left( E,a\right) \).

We denote by \(\varTheta (E,a)\) the set of market equilibria for E and a, and we introduce

that is, the set of normalizedFootnote 17 market equilibria for E and a. We will show that \(\varTheta _{\mathrm {n}}(E,a)\ne \emptyset \), for every \((E,a)\in {\mathcal {E}}\times (0,1)\).

As one Walras’ law holds true in our model, just one market clearing condition in Definition 2 is significant. To fix ideas, we will focus on the equation for commodity y, i.e., on

The extended system for our economy with two groups of agents, whose numerosity may not coincide, reads as

Since we are going to study market equilibria in terms of first-order conditions associated with households’ maximization problems and (significant) market clearing conditions, we define

and the function

Given \((E,a)\in {\mathcal {E}}\times (0,1)\), it is immediate to prove that if \(\theta =\bigl (p_{x},p_{y},\left( x_{i},y_{i}\right) _{i\in \{\alpha ,\beta \}}\bigr )\) belongs to \(\varTheta _{\mathrm {n}}(E,a)\), then there exists the vector \((\lambda _{\alpha },\lambda _{\beta })\in (0,+\infty )^{2}\) such that \(\xi =\left( p_{x},p_{y},\left( x_{i},y_{i},\lambda _i\right) _{i\in \{\alpha ,\beta \}}\right) \in (0,+\infty )^{8}\) solves the system \({\mathcal {F}}(\xi ,E,a)=0\). Vice versa, if \(\xi =\left( p_{x},p_{y},\left( x_{i},y_{i},\lambda _i\right) _{i\in \{\alpha ,\beta \}}\right) \in (0,+\infty )^{8}\) solves \({\mathcal {F}}\left( \xi ,E,a\right) =0\), then \(\left( p_{x},p_{y},\left( x_{i},y_{i}\right) _{i\in \{\alpha ,\beta \}}\right) \in \varTheta _{\mathrm {n}}(E)\).

Let us then show that for all \((E,a)\in {\mathcal {E}}\times (0,1)\) there exists \(\xi \in (0,+\infty )^{8}\) which solves system \({\mathcal {F}}(\xi ,E,a)=0\). Fixing \((E,a)\in {\mathcal {E}}\times (0,1)\), we define

Let us also introduce the homotopy

with

where \(\left( x_{i}^{*},y_{i}^{*}\right) _{i\in \{\alpha ,\beta \}}\in (0,+\infty )^{4}\) is an instantaneous Pareto optimal allocation, whose existence can be proven as in Section 8.5 in Villanacci et al. (2002). In particular, denoting by r the vector of the total resources associated with E, we have \(r=(w_x,w_y)\in (0,+\infty )^{2}\) and, denoting by \(\underline{U}^r\) the set of utility level vectors attainable with resources r in correspondence to \(E\in {\mathcal {E}}\) and \(a\in (0,1)\), we have

We notice that \(H(\xi ,0)=F(\xi ),\,\forall \xi \in (0,+\infty )^{8}\). Setting

it holds that \(F,\,H\) and G are continuous functions. If we prove that, for some \({\widehat{\xi }}\in (0,+\infty )^{8}\),

then Theorem 1 can be applied with the identifications \(M=(0,+\infty )^{8},\,N={\mathbb {R}}^{8},\,y=0\in {\mathbb R^8},\,\varPhi =F,\,\varGamma =G,\,\varPsi =H\), to get \(F^{-1}(0)\ne \emptyset \), so that a market equilibrium exists in correspondence to the fixed \((E,a)\in {\mathcal {E}}\times (0,1)\).

The proof of conditions (22), (23) and (24) follows by standard arguments and it is omitted. \(\square \)

Proof of Proposition 2

Since the arguments we shall employ are independent of the considered time period, like in the proof of Proposition 1, in order not to overburden notation, we will omit the subscript t.

Recalling the definition of the map \({\mathcal {F}}\) in (20), it is evident that \({\mathcal {F}}\) is continuous. In order to apply Theorem 2 with the identifications \(f={\mathcal {F}},\,\mathbb R^n={\mathbb {R}}^8,\,O=(0,+\infty )^8,\,B={\mathcal {E}}\times (0,1),\,{\mathscr {B}}={\mathscr {E}}\times {\mathbb {R}}\), with \({\mathscr {E}}\) as in (1), we have to check that \({\mathcal {F}}\in \mathcal {C}^1((0,+\infty )^8\times {\mathcal {E}}\times (0,1),{\mathbb {R}}^8)\) according to the definition in (5), i.e., that

is well defined and continuous. Considering any \((\xi ,E,a)\in (0,+\infty )^8\times {\mathcal {E}}\times (0,1)\) and \((\nu ,\eta ,\kappa )\in {\mathbb {R}}^8\times {\mathscr {E}}\times {\mathbb {R}}\), it holds indeed that the limit

exists, and it is easy to check that the map \(\hbox {d}{\mathcal {F}}\) is continuous.

Next, we want to show that for every \(a\in (0,1)\) the set

is an open and full measure subset of \({\mathcal {E}}\). Namely, applying Theorem 2, we obtain the smooth dependence of the market equilibria associated with all population shares \(a\in (0,1)\) and to any economy \(E\in {\mathcal {D}}(a)\) on the elements \((E,a)\in {\mathcal {E}}\times (0,1)\).

Let us then sketch the proof that, for every \(a\in (0,1)\), \({\mathcal {D}}(a)\) is an open and full measure subset of \({\mathcal {E}}\).

The openness of \({\mathcal {D}}(a)\) follows by the closedness of the complement set \({\mathcal {E}}\setminus {\mathcal {D}}(a)\), due to the continuity of the involved functions. In order to show that \({\mathcal {D}}(a)\) is a full measure subset of \({\mathcal {E}}\), it suffices to show that, for every \((u_{\alpha },u_{\beta },a)\in \mathcal U^2\times (0,1)\) the set

is a full measure subset of \((0,+\infty )^2\). Since it can be proven that 0 is a regular value for the map

then, by a transversality result (cf. Theorem 6.3.294 in Villanacci et al. 2002), there exists a full measure subset \(\widetilde{{\mathcal {D}}}(u_{\alpha },u_{\beta },a)\) of \((0,+\infty )^2\) such that, for all \((w_x,w_y)\in \widetilde{{\mathcal {D}}}(u_{\alpha },u_{\beta },a)\), 0 is a regular value for the map \(\widetilde{{\mathcal {F}}}(\cdot ,w_x,w_y)\). As \(\widetilde{{\mathcal {D}}}(u_{\alpha },u_{\beta },a)\subseteq {\mathcal {D}}(u_{\alpha },u_{\beta },a)\), it follows that \({\mathcal {D}}(u_{\alpha },u_{\beta },a)\) is a full measure subset of \((0,+\infty )^2\). Consequently, for every \(a\in (0,1)\), \({\mathcal {D}}(a)\) is a full measure subset of \({\mathcal {E}}\).

The finiteness of the number of market equilibria associated with an element (a, E), with \(a\in (0,1)\) and \(E\in {\mathcal {D}}(a)\), comes now from the fact that, as it is easy to check, the projection

is proper, i.e., the inverse image through \(\pi \) of a compact subset of \({\mathcal {E}}\times (0,1)\) is compact, too.

The proof is complete. \(\square \)

Proof of Proposition 3

By Theorem 1 we know that, for any \(E\in {\mathcal {E}},\,t\in {\mathbb {N}}\) and \(a_t\in (0,1)\), there exists at least a market equilibrium at time t. Let us then check that the equilibrium is unique, omitting as usual the dependence on t, in order not to overburden notation.

Recalling Definition 2 and the formulation of the market clearing conditions with shares in (3), we have to prove that if the gross substitute property holds for all the individual demand functions there exists one solution \(({\widehat{p}}_x,\widehat{p}_y)\in (0,+\infty )^2\) to the system

Since we can normalize one price, to show the uniqueness of the solution, we may focus on the price vectors \((1,p)\in (0,+\infty )^2\), with \(p=p_y/p_x\). Assuming that \(a\, x^{*}_{\alpha }(1,\widehat{p})+(1-a)\, x^{*}_{\beta }(1,{\widehat{p}})-w_{x}=0=a\, y^{*}_{\alpha }(1,{\widehat{p}})+(1-a)\, y^{*}_{\beta }(1,\widehat{p})-w_{y}\), let us prove that no \((1,{\widetilde{p}})\), with \(\widetilde{p}\ne {\widehat{p}}\), may solve (25). Namely, if \({\widetilde{p}}< {\widehat{p}}\), by the gross substitute property it would hold that \(x^{*}_i(1,{\widetilde{p}})<x^{*}_i(1,\widehat{p}),\,i\in \{\alpha ,\beta \}\), and thus, since \(a\in (0,1)\), we would have

so that \((1,{\widetilde{p}})\) would not be a solution to (25). Similarly, if \({\widetilde{p}}>{\widehat{p}}\), by the gross substitute property it would hold that \(x^{*}_i(1,\widetilde{p})>x^{*}_i(1,{\widehat{p}}),\,i\in \{\alpha ,\beta \}\), and thus, since \(a\in (0,1)\), it would follow that

so that \((1,{\widetilde{p}})\) would not solve (25).

This completes the proof. \(\square \)

Proof of Proposition 4

The conclusion immediately follows by observing that the solutions to the fixed-point equation \(g(a)=a\), with g as in (10), are given by \(a=0,\,a=1\), as well as by all solutions to the equation \(V_{\alpha }(a)=V_{\beta }(a)\), if any, and by all the solutions to the equation \((V_{\alpha }(a)+V_{\beta }(a))/2={\overline{V}}\), if any. Namely, the nontrivial equilibria for Equation (9) are found as solutions to the equation \({\mathscr {A}}_{\alpha }=f(\sigma \,d^2(\overline{V},V_{\alpha }))=f(\sigma \,d^2(\overline{V},V_{\beta }))={\mathscr {A}}_{\beta }\). Since f is strictly decreasing, all solutions have to satisfy \(d(\overline{V},V_{\alpha })=d({\overline{V}},V_{\beta })\), i.e., \(V_{\alpha }=V_{\beta }\) or \((V_{\alpha }+V_{\beta })/2={\overline{V}}\), as desired. This concludes the proof. \(\square \)

Proof of Proposition 5

Since \(g'(0)=1/(\exp \left( \mu \left( {\mathscr {A}}_{\beta }(0)-{\mathscr {A}}_{\alpha }(0)\right) \right) )\), the condition \(g'(0)>-1\) is always fulfilled, while \(g'(0)<1\) is fulfilled for \({\mathscr {A}}_{\beta }(0)>{\mathscr {A}}_{\alpha }(0)\). Independently of f, exploiting the strictly decreasing behavior of \({\mathscr {A}}_{i}\) with respect to \(d^2({\overline{V}},V_i)\), we then find \((V_{\alpha }(0)-{\overline{V}})^2>(V_{\beta }(0)-{\overline{V}})^2\), as desired.

As concerns the local stability of \(a=1\) for map g, we find that \(g'(1)= \exp \left( \mu \left( {\mathscr {A}}_{\beta }(1)-{\mathscr {A}}_{\alpha }(1)\right) \right) \). Hence, the condition \(g'(1)>-1\) is always fulfilled, while \(g'(1)<1\) is fulfilled for \({\mathscr {A}}_{\beta }(1)<{\mathscr {A}}_{\alpha }(1)\). Independently of f, exploiting again the strictly decreasing behavior of \({\mathscr {A}}_{i}\) with respect to \(d^2({\overline{V}},V_i)\), we find \((V_{\alpha }(1)-{\overline{V}})^2<(V_{\beta }(1)-{\overline{V}})^2\).

In regard to \(a={\hat{a}}\), recalling that \(V_{\alpha }({\hat{a}})=V_{\beta }({\hat{a}})\), we find that \(g'({\hat{a}})=1-2\mu \sigma {\hat{a}}(1-{\hat{a}})\frac{\partial {\mathscr {A}}_{\beta }(a)}{\partial (\sigma d_{\beta }^2)}\vert _{a={\hat{a}}}(V_{\beta }({\hat{a}})-\overline{V})(V_{\beta }'({\hat{a}})-V_{\alpha }'({\hat{a}}))\). Since \(\frac{\partial {\mathscr {A}}_{\beta }(a)}{\partial (\sigma d_{\beta }^2)}\vert _{a={\hat{a}}}\) is negative, then \(a={\hat{a}}\in (0,1)\) is unstable for map g for all positive values of \(\mu \) if \((V_{\beta }({\hat{a}})-{\overline{V}})(V_{\beta }'({\hat{a}})-V_{\alpha }'({\hat{a}}))>0\). If instead \((V_{\beta }({\hat{a}})-{\overline{V}})(V_{\beta }'({\hat{a}})-V_{\alpha }'({\hat{a}}))<0\), then \(g'({\hat{a}})<1\) is always fulfilled, while, if \({\mathscr {A}}_{\beta }\) does not depend on \(\mu \), \(g'({\hat{a}})>-1\) is fulfilled for \(\mu <{\hat{\mu }}\), with \({\hat{\mu }}\) as in (11), obtaining the desired conclusion about the local stability of \(a={\hat{a}}\in (0,1)\) for map g, too. The condition for the flip bifurcation follows by setting \(g'({\hat{a}})=-1\).

Finally, in regard to \(a={\tilde{a}}\), recalling that \(V_{\beta }(\tilde{a})-{\overline{V}}={\overline{V}}-V_{\alpha }({\tilde{a}})\), we find that \(g'({\tilde{a}})=1-2\mu \sigma {\tilde{a}}(1-\tilde{a})\frac{\partial {\mathscr {A}}_{\beta }(a)}{\partial (\sigma d_{\beta }^2)}\vert _{a={\tilde{a}}}({\overline{V}}-V_{\alpha }(\tilde{a}))(V_{\alpha }' ({\tilde{a}})+V_{\beta }'({\tilde{a}}))\). Since \(\frac{\partial {\mathscr {A}}_{\beta }(a)}{\partial (\sigma d_{\beta }^2)}\vert _{a={\tilde{a}}}\) is negative, then \(a=\tilde{a}\in (0,1)\) is unstable for map g for all positive values of \(\mu \) if \(({\overline{V}}-V_{\alpha }({\tilde{a}}))(V_{\alpha }'(\tilde{a})+V_{\beta }'({\tilde{a}}))>0\). If instead \((\overline{V}-V_{\alpha }({\tilde{a}}))(V_{\alpha }'({\tilde{a}})+V_{\beta }'(\tilde{a}))<0\), then \(g'({\tilde{a}})<1\) is always fulfilled, while, if \({\mathscr {A}}_{\beta }\) does not depend on \(\mu \), \(g'({\tilde{a}})>-1\) is fulfilled for \(\mu <{\tilde{\mu }}\), with \({\tilde{\mu }}\) as in (12). The condition for the flip bifurcation follows by setting \(g'(\tilde{a})=-1\). This concludes the proof. \(\square \)

Rights and permissions

About this article

Cite this article

Naimzada, A., Pireddu, M. A general equilibrium evolutionary model with two groups of agents, generating fashion cycle dynamics. Decisions Econ Finan 43, 155–185 (2020). https://doi.org/10.1007/s10203-020-00280-0

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10203-020-00280-0