Abstract:

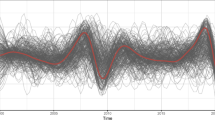

It is a common belief nowadays that the world economy is fairly well “integrated”. Yet, this belief often turns out to be in contradiction with empirical evidence. As a matter of fact the way distant markets interact is a question that has largely been ignored by economists. In this series of two papers we examine the role that space, that is to say geographical distance, plays in the economics of commodity markets. The first of these papers presents the empirical evidence while the second develops a theoretical framework. The empirical enquiry discloses several noteworthy features, e.g. (i) with respect to spatial interaction there is a sharp contrast between stock markets and commodity markets. While there is almost perfect spatial arbitrage in the first case, this is not true for commodity markets. (ii) In spite of their chaotic behavior in the course of time commodity prices display well defined spatial patterns, (iii) as in statistical physics and fluid dynamics interactions can be described in terms of correlation length. The correlation length of a set of markets is seen to increase along with the number of transactions; it also increases when transport costs decline as was the case during the “transportation revolution” of the mid-nineteenth century. Using the notion of correlation length one is able to give a quantitative meaning to the otherwise ill-defined concept of market integration.

Similar content being viewed by others

Author information

Authors and Affiliations

Additional information

Received 17 May 1999 and Received in final form 31 May 1999

Rights and permissions

About this article

Cite this article

Roehner, B. The correlation length of commodity markets 1. Empirical evidence. Eur. Phys. J. B 13, 175–187 (2000). https://doi.org/10.1007/s100510050021

Issue Date:

DOI: https://doi.org/10.1007/s100510050021