Abstract

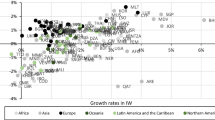

Sustainability can be assessed by non-declining inclusive wealth, which refers to man-made capital, human capital, natural capital, and all other types of capital that are sources of human well-being. As the previous studies—including Arrow et al. (J Econ Perspect 18(3):147–172, 2004) and the Inclusive Wealth Report (2012 and 2014)—suggest, total factor productivity (TFP) is one determinant of inclusive wealth, because it is related to the resource allocation mechanism. TFP is one important component of sustainability. When considering the contribution of TFP toward inclusive wealth, attention needs to be paid to the improvement in the usage of human and natural capital as well as the traditional man-made capital. However, in the previous studies, only man-made capital and labor force have been considered. This study extends current measures of sustainability by capturing the efficient utilization of natural resources, giving us inclusive wealth-based TFP. Therefore, in contrast to conventional TFP measures, we consider both human and natural capital in addition to man-made capital. We examine 43 countries and find that a new indicator which asserts countries previously considered sustainable by earlier studies such as Arrow et al. (J Econ Perspect 18(3):147–172, 2004) as no longer sustainable.

Similar content being viewed by others

Notes

GS is also called genuine investment (Arrow et al. 2003), inclusive investment (Dasgupta 2007), and adjusted net savings (World Bank 2006). However, these terms indicate a change in wealth as a source of well-being. These terms are sometimes used interchangeably, but some studies, e.g., Engelbrecht (2016), pay attention to the difference in each concept. The recent research project by the United Nations Development Corporation (UNDC) developed an inclusive wealth index and stressed the difference between this concept and GS in theoretical assumptions and empirical techniques (see UNU-IHDP and UNEP 2012, 2014). Since we need complete panel data to estimate TFP in our study, we use the data provided by the World Bank. The database is available at http://databank.worldbank.org/.

Xepapadeas and Vouvaki (2009) apply GDP as an output and, therefore, their externality-adjusted TFP is different from that proposed in this study. Barndt et al. (2014) also estimated TFP considering natural capital and externality using the data of CO2, NOx, and SOx, but the output is also production of goods.

Dasgupta (2004) provides mathematical proof why non-declining IW coincides with non-declining V.

As explained in detail in Sect. 3, the World Development Indicators (WDI) database includes man-made capital, human capital, and natural capital. Each is measured by net national investment, education expenditure as a proxy for human capital, and a few types of natural capital depletions, such as energy depletion, mineral depletion, forest depletion, and carbon dioxide damage. Other capitals related to human well-being, such as knowledge capital and institution, are omitted from our formulation.

It may be misleading to use the term IW-based “TFP”, because this concept includes both production and output use. However, because we follow the same procedure for estimation, we use the term TFP.

Using the same strategy, Jumbri and Managi (2016) estimate TFP using stock data. On the other hand, this paper focuses on the effect of TFP toward temporal change in inclusive wealth. It measures the transformation technology from input to output and consumption (investment) propensity.

In general, variables including negative values cannot apply to DEA estimation. However, variables related to IW (GS, human capital, and natural capital) include negative value. In this study, we use the variables that are weighted by the minimum value of each variable. Previous studies use the same way to treat the negative value in DEA estimation (for example, Ali and Seiford 1990). Recent studies developed and applied a more suitable way to consider the negative value in DEA estimation (for example, Kerstens and Van de Woestyne 2011; Fujii and Managi, 2016). Thus, our estimation has the possibility to incur bias by the difference of weighting in each variable. Such biases become more severe in the both-oriented model that previous studies focus on. However, our model employs an output-oriented model based on only one output. Therefore, biases that were considered in previous studies are not strong in this estimation.

Hence, our data set evaluates all variables in 2000 US dollars.

We use data of the International Country Risk Guide (http://www.prsgroup.com/icrg.aspx) for the institution variables.

References

Ali AI, Seiford LM (1990) Translation invariance in data envelopment analysis. Oper Res Lett 9(6):403–405

Arrow K, Dasgupta P, Mäler K-G (2003) Evaluating projects and assessing sustainable development in imperfect economies. Environ Resour Econ 26(4):647–685

Arrow K, Dasgupta P, Goulder L, Daily G, Ehrlich P, Heal G, Levin S, Mäler K-G, Schneider S, Starrett D, Walker B (2004) Are we consuming too much? J Econ Perspect 18(3):147–172

Arrow K, Dasgupta P, Goulder L, Munford K, Oleson K (2012) Sustainability and the measurement of wealth. Environ Dev Econ 17:317–353

Brandt N, Schreyer P, Zipperer V (2014) Productivity Measurement with Natural Capital and Bad Outputs. OECD Economics Department Working Papers, No. 1154, OECD Publishing

Collins S, Bosworth B (1996) Economic growth in East Asia: accumulation versus assimilation. Brook Pap Econ Activ 2:135–203

Dasgupta P (2004) Human well-being and the natural environment. Oxford University Press, New York

Dasgupta P (2007) Economics: a very short introduction. Oxford University Press, New York

Dietz S, Neumayer E, Soysa I (2007) Corruption, the resource curse and genuine saving. Environ Dev Econ 12:33–53

Engelbrecht (2016) Comprehensive versus inclusive wealth accounting and the assessment of sustainable development. Ecol Econ 129:12–20

Fujii H, Managi S (2016) An evaluation of inclusive capital stock for urban planning. Ecosyst Health Sustain 2(10)

Hamilton K, Atkinson G (2006) Wealth, welfare and sustainability. Edward Elgar, Cheltenham

Hamilton K, Clemens M (1999) Genuine savings rates in developing countries. World Bank Econ Rev 13(2):333–356

Jumbri IA, Managi S (2016) Global data. In: Managi S (ed) The wealth of nations and regions. Routledge, Abingdon

Kerstens K, Van de Woestyne I (2011) Negative data in DEA: a simple proportional distance function approach. J Oper Res Soc 62(7):1413–1419

Klenow PJ, Rodriguez-Clare A (1997) The neoclassical revival in growth economics: has it gone too far? In: Bernanke B, Rotemberg J (eds) NBER macroeconomics annual 1997. MIT Press, Cambridge

Kunte A, Hamilton K, Dixon J, Clemens M (1998) Estimating national wealth: methodology and results. World Bank Discussion Paper

Managi S (2003) Luenberger and Malmquist productivity indices in Japan, 1955–1995. Appl Econ Lett 10:581–584

Neumayer E (2000) Resource accounting in measures of unsustainability: challenging the World Bank’s conclusions. Environ Resour Econ 15(3):257–278

Pearce DW, Atkinson GD (1993) Capital theory and the measurement of sustainable development: an indicator of “weak” sustainability. Ecol Econ 8(2):103–108

Sato M (2015) Growth of inclusive wealth. In: Managi S (ed) The economics of green growth. Routledge, Abingdon

UNU-IHDP and UNEP (2012) Inclusive wealth report 2012. Cambridge University Press, Cambridge

UNU-IHDP and UNEP (2014) Inclusive wealth report 2014. Cambridge University Press, Cambridge

World Bank (2006) Where is the wealth of nations?. World Bank, Washington

World Commission on Environment and Development (1987) Our common future. Oxford University Press, Oxford

Xepapadeas A, Vouvaki D (2009) Total factor productivity growth when factors of production generate environmental externalities. Fond Eni Enrico Mattei Work Pap 281:1–31

Yamaguchi R (2016) Theoretical and conceptual aspects of green and wealth acounting. In: Managi S (ed) The wealth of nations and regions. Routledge, Abingdon

Acknowledgements

The authors also would like to express their gratitude to two anonymous reviewers and the editor for constructive and helpful comments and suggestions to improve the paper. This research was financially supported by Grant-in-Aid for Specially Promoted Research (26000001) by Japan Society for the Promotion of Science (JSPS).

Author information

Authors and Affiliations

Corresponding author

About this article

Cite this article

Sato, M., Tanaka, K. & Managi, S. Inclusive wealth, total factor productivity, and sustainability: an empirical analysis. Environ Econ Policy Stud 20, 741–757 (2018). https://doi.org/10.1007/s10018-018-0213-1

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10018-018-0213-1