Abstract

One method to reduce greenhouse gas emissions is to subsidize emissions-reducing activities, and allocating such subsidies through auctions is an emerging mechanism. In a controlled experimental market setting, we conduct a laboratory experiment to compare the effects of a variety of auction mechanisms for allocating subsidies in an effort to reduce carbon emissions in China. In addition to the conventional auction mechanisms, we place particular focus on testing the performance of the auction mechanism proposed by Erik Maskin (Notes on auctions for pollution reduction. In: Keynote Speech at the 18th annual conference of European Association for Environmental and Resource Economists, Rome, 2011). We find that while the Maskin auction mechanism spends the most from a fixed subsidy budget and its emissions reduction is among the largest, its per-unit emissions reduction cost is higher than that of discriminatory and uniform-price auction mechanisms. Furthermore, from the government’s perspective, the Maskin auctions exhibit strong improvement tendency with repeated auctions.

Similar content being viewed by others

Notes

Among similar policies, the Australian government has implemented the Direct Action Plan, in which the Emissions Reduction Fund, designed to provide a direct incentive to reduce emissions, has been extended from 2014 to 2020 and includes initial allocations of $300 million, $500 million and $750 million. The aim of this fund is to allocate funds to select the lowest cost abatement through a reverse auction, as investigated in the present study, and this policy is believed to be “a far more effective means of reducing Australia’s emissions than the carbon tax” (Australian Department of the Environment 2013, page 3).

Furthermore, given the well-known negative consequences—such as traffic restriction, school closure, and the halting of construction sites and industrial production in the entire Beijing region (see, e.g., Smog in China closes schools and construction sites, cuts traffic in Beijing (2015) and the prohibition of straw burning in agricultural production in nearby provinces in response to the severe air pollution, as well as the huge long term and indirect costs associated to this pollution—the local government indeed has the financial capacity and a strong incentive to purchase emission reduction from nearby polluting firms (via, e.g., incentivizing them to cease production or to move far away), at least as a policy choice to improve the air quality.

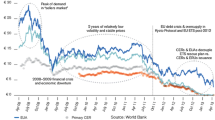

Periodically held auctions are used to improve the effectiveness of the emission reduction quota allocation and to determine the prices (Cramton and Kerr 2002). For example, the US sulfur dioxide emissions trading program, initiated in 1995, was specifically designed to apply an annual revenue-neutral auction (Burtraw 2000; Carlson et al. 2000). Low prices, thin trading, and large amounts of allowance banking characterized the early market for sulfur dioxide allowances (Ellerman et al. 2000). In the first mandatory emissions control and trading program for GHG emissions in the US, namely, the Regional Greenhouse Gas Initiative (RGGI), carbon dioxide allowances are sold through quarterly auctions using a uniform-price sealed-bid format. California, along with the Canadian provinces of Quebec and Ontario, has initiated a regional cap and trade program and uses quarterly uniform price auctions for allocating most allowances. Auctioning is also the default method to allocate emission allowances in the European Union Emissions Trading System (EU ETS), which operates in 31 countries and accounts for 45% of the EU’s GHG emissions. It is estimated that over half of the allowances will be auctioned during the currently operated third phase (2013–2020), and this auction method has been planned to be expanded to most other emissions sources by 2020 (Ellerman et al. 2016; Salant 2016).

Examples include discriminatory auctions for US sulfur dioxide permits and uniform-price auctions for nitrogen oxide permits in Virginia (Lopomo et al. 2011). See, e.g., Cramton and Kerr (2002), Cramton (2007a), and Betz et al. (2010) in support of discriminatory auctions and Holt et al. (2007, 2008) in support of uniform-price auctions. Lopomo et al. (2011) provide a detailed comparison of different types of auctions based on the case of carbon emissions permits.

In dynamic bid auctions, an auctioneer begins by calling out a low price and raises the price gradually until sufficient emissions reductions are supplied at the announced price, which consumes the entire subsidy. The winning bidders pay their bid prices in discriminatory-price auctions and pay a uniform market-clearing price in uniform-price auction.

Although the equilibrium bidding in Maskin auctions takes the simple form of bidding on cost and eliminating the incentive for strategic bidding behavior, this does not necessarily imply that the auction rules are simple. Therefore, it would be of interest to observe the dynamic bidding behavior.

For example, the performance (e.g., efficiency and increased emissions reductions) of Maskin auctions may not exceed that of other types of auctions in one-shot auctions; however, its performance can be improved gradually when more auctions are conducted.

Regarding the use of a sealed-bid or a dynamic-bid auction design, first, the sealed-bid format does not change the theoretical incentive structure compared to the dynamic-bid format under the independent private information assumption (Krishna 2009). Second, it is widely recognized that the dynamic-bid design increases information transparency, although it does not necessary induce more desirable auction outcomes than a sealed-bid design (Burtraw et al. 2011). Third, dynamic bidding facilitates collusive bidding (Alsemgeest et al. 1998; Holt et al. 2007). Fourth, some scholars argue that ascending-bid auctions outperform sealed-bid auctions in price discovery, especially for multiple products or new assets without established prices (see, e.g., Cramton 1998, 2007b; Cramton and Kerr 2002; and Betz et al. 2010), whereas others observe that sealed-bid uniform-price auctions achieve price discovery equivalent to simultaneous ascending-bid auctions (Burtraw et al. 2009).

Vickrey (1961) first recognizes that the multi-unit discriminatory and uniform-price mechanisms are inefficient due to bidders’ multi-unit demand. Subsequent theoretical studies show that both mechanisms would give rise to underpricing due to the bidders’ market power (Wilson 1979; Back and Zender 1993; Kremer and Nyborg 2004) and further focus on the issue of demand reduction (Ausubel et al. 2014). However, it is noteworthy that bidding on one’s true value is still a weakly dominant strategy in the case of single-unit demand auctions and in the first unit demanded in multi-unit demand auctions. As for empirical evidence, several experimental studies confirm the presence of demand reduction (List and Lucking-Reiley 2000; Kagel and Levin 2001; Engelbrecht‐Wiggans et al. 2006), while other studies find that underpricing in uniform auctions usually does not materialize (Simon 1994; Nyborg and Sundaresan 1996; Keloharju et al. 2005; Goldreich 2007).

The buyer (i.e., the government) in a procurement auction is set to be budget constrained, in line with the common situations in the real world, that is, the emissions abatement schemes using subsidy instruments in Australia, Germany, the UK, etc. (see, e.g., Smith and Swierzbinski 2007; the Australian Department of the Environment 2013; and the Productivity Commission 2011, for a review of carbon emission policies in various countries).

The reasons why we choose discriminatory and uniform-price auctions as the alternative mechanisms are the following: First, in Maskin (2011), the Maskin mechanism is compared with the two auction mechanisms by Erik Maskin himself. Second, discriminatory and uniform-price mechanisms are the most widely used auction mechanisms in Multi-Unit auctions and has attracted attention on the comparisons between them (e.g., Engelbrecht-Wiggans and Kahn 1998a, b; Hortaçsu and McAdams 2010; Ausubel et al. 2014), and they are also the fundamental mechanisms introduced in classical text book (Krishna 2009; Milgrom 2004). Third, both discriminatory and uniform-price auctions have been suggested as the two most commonly employed mechanisms to allocate GHG emission permits (see, e.g., Joskow et al. 1998; Porter et al. 2009; Holt et al. 2007; Benz et al. 2010). Fourth, comparing the two auction mechanisms in the context of GHG emission reduction has attracted considerable attention from the literature while there is not a consensus on which mechanism performs better. For instance, evidence provided by Cramton and Kerr (2002), Cramton (2007a), and Betz et al. (2010) supports discriminatory auctions while Holt et al. (20072008) supports uniform-price auctions.

As noted by a reviewer, the budget is wasted for this purpose only in cases where the leftover budget cannot be rolled over into the future period of the auction. This is a conventional situation in which the government determines the future budget based on the actual spending of the current budget in related fields (Peacock and Wiseman 1961; Payne 1998; Guo and Yang 2007).

$10 is the reserved reduction price, equal to the total $100 subsidy divided by a single firm’s 10 unit reduction capacity.

Up to five winners can be selected in each market given the parameters imposed in this numerical example.

Therefore, compared to the uniform-price mechanism, the Maskin mechanism reduces the gap between transaction prices and a firm’s actual reduction costs, and it provides a theoretically more efficient way to spend a subsidy with the same bid structure.

We chose to use in-context instructions in this experiment because we are interested in the interpretability of the experimental results with respect to specific real-life policy situations regarding reduction in environmental harm (GHG emissions) and the directly related policy implications. The in-context results could differ from those when context-free instructions are used. This choice is in line with several studies that experimentally test auction design for carbon emissions reduction programs (e.g., Burtraw, et al. 2009; Burtraw, et al. 2011; Goeree et al. 2010) as well as experimental studies on procurement auction (e.g., Cummings et al. 2004). Regarding the debate on the usage of in-context versus context-free instructions, although the majority opinion is that context-free instructions should be formulated to avoid connotations caused by non-neutral words that might affect decision behavior (see, e.g., Davis and Holt 1993; Holt 1995; Kachelmeier and Shehata 1997), many scholars argue that the use of neutral instructions may distort the interpretability of experimental results with respect to the real-life situations researchers are interested in. For instance, Eckel and Grossmann (1996) emphasize that the importance of social and psychological factors can only be studied by (at least partially) abandoning abstraction, and similar arguments are put forward by, e.g., Gigerenzer (1996), Ortmann and Gigerenzer (1997), Loewenstein (1999), and Gächter and Riedl (2005). Loomes (1999, f39) comments: “it may be rather more useful to try to study the impact of context than to pursue the impossible goal of eliminating it.” Cummings et al. (2004, P 345–346) comments: “The complexity of the auction procedures being discussed convinced us that a fair amount of context would be useful to reduce confusion…” Zizzo (2010, P 82) also comments: “Context can help subjects’ understanding; it may help external validity for the specific real world context…; if the experiment is complex, context may to some extent be unavoidable.” As for the empirical evidence, Alm et al. (1992) and Abbink and Hennig-Schmidt (2006) respectively find no significant effect for the usage of in-context instructions on decisions regarding tax contributions and bribery, while Baldry (1986) finds that tax payment framed instructions result in subjects paying more taxes.

If the highest (lowest) production costs are drawn for both low and high emitters, the total subsidy needed for all firms to sell their emissions reduction at their costs is 105 (315) yuan; therefore, the actual amount is in the interval [105, 315], depending on the revealed production costs. This tight limitation of the available subsidy reflects real budget constraints.

It is worth noting that although firms have multiple units of emission reductions to sell, each firm is restricted to selling a fixed all-or-nothing quantity of reduction units with a single transaction price. This restriction guarantees that the auctions conducted in our experiment are essentially single-unit demand auctions.

However, learning was more difficult with the varying cost across auctions in each session; therefore, compared to constant cost across all auctions in a session, this experiment will present the lower bounds of learned bidding behavior.

It is noteworthy that although one can use an institution such as a seal-bid format without revealing bids – to prevent bidders seeing others’ actual bids during auctions in hopes of curbing collusion – it is hardly possible to effectively prohibit bidders from knowing this information after each monthly or quarterly held auction, such as in EU-ETS. Thus, revealing the bid after each period can be a natural choice to approach the situation in reality as well as to guarantee that subjects have equal information. This design choice is in line with Cummings et al. (2004), who allow all bidders to know all bids after each auction period, and with Burtraw et al. (2009), who provide an electronic chat room to let bidders explicitly communicate prior to each period of the sealed bid auctions. Moreover, a recent literature survey by Kagel and Levin (2016) shows evidence that collusion is difficult in auction markets when information is asymmetric and incomplete and when competition pressure is high. Additional evidence from literature on collusive behavior in oligopoly markets show that tacit collusion is almost never found in markets with more than four sellers (see, e.g., Huck et al. 2004, and Fonseca and Normmann 2012, and a literature survey by Haan et al. 2009, and Potters and Suetens 2013). Revealing bid information is also a common design feature for experiments on double oral auctions (see, e.g., Smith 1962; Plott and Smith 1978). We thus provide the aforementioned information while maintaining anonymity. We further show evidence in the results section that revealing the information does not have much effect on the bidding behavior in our experiment.

1 US dollar = 6.32 yuan at the time of the experiment.

In addition, the difference between the winner's bid and the winner's indifference price is a useful measure to reflect the role of each auction type in discovering firms’ actual costs of emission reduction. We find that this difference is considerably larger in discriminatory auctions than that in uniform-price and Maskin auctions, and the differences in uniform-price and Maskin auctions decrease significantly across periods, while this is not true in discriminatory auctions. To save space, we do not report the details of these results in this paper, but they can be found in the initial working paper version (He and Chen 2014). The findings thus indicate that both uniform-price and Maskin auctions outperform discriminatory auctions in price discovery, and they play a stronger role in preventing high bids from winning auctions. Consequently, the winner(s) in uniform-price and Maskin auctions is (are) more likely to have lower emissions reduction costs than those in discriminatory auctions, which leads to a more socially desirable outcome.

Because bidders’ bidding behavior depends on the other bidders’ bids in previous periods in the same markets, observations based on individual bidders are not independent. Only the observations based on the mean of all bids in one auction market across all periods are independent, and we will use this statistic for the nonparametric tests.

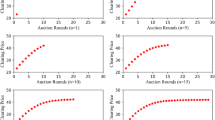

We can observe from Fig. 1 that the dynamic pattern of bids shows a reduction towards the indifference price, while it increases in the last three periods. This pattern is determined by the dynamic pattern of the cost of emission reduction, which is randomly drawn from an uniform distribution within certain intervals and the random cost draws were ensure to be balanced across treatments.

The rules in Maskin auctions guarantee transaction prices no higher than those in uniform-price auctions if all bids are the same in both auctions, but we observe higher transaction prices in Maskin auctions. This phenomenon suggests that the function of Maskin auctions in suppressing the transaction price is dominated by its effects on increasing bids.

As pointed out by a reviewer, we first conduct Kruskal–Wallis tests for all the outcome variables and find that the results reject the null hypothesis that the population medians are equal (p < 0.001 for all cases).

However, the significant positive differences between bids and indifference prices in uniform-price (Wilcoxon signed-rank tests, p < 0.001) and Maskin auctions (p < 0.001) suggest that bidders are not induced to bid closely at their cost.

We conduct Wilcoxon rank-sum tests for all the performance variables presented in Table 4, with consideration for the correction on the potential family-wise errors following the method introduced by List, Shaikh and Xu (2019) and the clustered data structure of this experiment following the method introduced by Datta and Satten (2005), respectively. Both sets of the robustness check results shown in Tables A1 and A2 in Appendix 4 are qualitatively identical to those shown in Table 4, suggesting that the results in Table 4 are robust with both ways of statistical methodology adjustment.

We further conduct Wilcoxon rank-sum tests for all the performance variables presented in Table 4, but for the last ten and last five periods. The results in Table A3 in Appendix IV show that most of the results are similar compared to those in Table 4 in terms of both quantity and significance, suggesting that most of the significant results over all 20 periods are retained in the last ten periods and the last five periods, while a few results in Table 4 become insignificant mainly due to an increase in variation but without any change in the signs of the differences.

Further analysis provides evidence on the limited effect of revealing bids on bidding behavior in our experiment. First, we compare the bids between the first and second periods of various auction markets, in which bidders either do not know others’ bids or they know others’ bids in the first period when they made bidding decisions. We find no difference for any of the three auction mechanisms or for all data pooled together (Wilcoxon rank-sum tests, p > 0.1 in all cases). Second, given that Kagel and Levin (2016) show that veteran subjects can collude more easily, we conducted an additional experiment with veteran subjects from an experimental economics course. In some sessions, we even tried to provide tips to the subjects to spur them to collude. However, little evidence can be found that indicates the existence of collusion. Third, after the experiment, we asked the veteran subjects, “Did you consider coordinating with the other bidders to make higher profits from the auction market, and if so, how?” We found that no one had considered doing so. Therefore, the differences in bidding behavior across treatments are even less likely to be affected by revealing bids.

We also tried to include an interaction of treatment variables by period in each of the models. However, this analysis does not support the existence of interaction effects.

We compare subjects’ three individual characteristics (i.e., gender, grade and major belonging) recorded when recruiting them, and we find that, for all the three characteristics, the differences in mean of these characteristics across treatments are small (see Table 11 in Appendix IV) and both the p-values of all the Wilcoxon rank-sum tests between any two of the three treatments and the p-values of Kruskal–Wallis tests amongst the three treatments are above the conventional statistical level (see Table A5 in Appendix IV).

Following the criteria introduce in Wooldridge (2016), we choose random effects rather than fixed effects estimator based on the specific structure of our data. On the one hand, given the key independent variables being interested (i.e., the two treatment dummy variables) are constant over periods, these variables cannot be included in the fixed effects model. On the other hand, since the auction mechanisms are randomly assigned, our data satisfy the crucial assumption of the random effects model that the individual time-constant unobservable is independent of the treatment dummy variables. We thus choose the random effects estimator.

For example, as suggested by a reviewer, subsidies may be the only available instrument to incentivize reforestation by small landowners. The small landowners can be included in an emission trading system only when they are treated as the net winners (i.e., are implicitly subsidized by other sectors).

In our experiment setting, all firms have the same \(x\), which is 10. High emitters have 5 capacity and require 2 emission units to operate 1 unit of capacity. And low emitters have 10 capacity and require 1 emission to produce 1 unit. So both two kinds of firms have the same maximum possible emission.

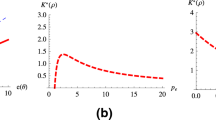

For example, when \(n = 2\), all \(F_{i}\) are the same and \(F^{\prime\prime} < 0,\;F^{\prime\prime} < - 4F^{\prime}(1/2)\;\forall c_{i}\).

In this part, each type of firms was only able to see the parameters of their own type that are in italic in the instructions.

References

Abbink K, Hennig-Schmidt H (2006) Neutral versus loaded instructions in a bribery experiment. Exp Econ 9(2):103–121

Albano GL, Cesi B, Iozzi A (2017) Public procurement with unverifiable quality: the case for discriminatory competitive procedures. J Public Econ 145:14–26

Alm J, McClelland GH, Schultze WD (1992) Why do people pay taxes? J Public Econ 48:21–38

Alsemgeest P, Noussair C, Olson M (1998) Experimental comparisons of auctions under single- and multi-unit demand. Econ Inq 36:87–97

Anari N, Goel G, Nikzad A (2018) Budget feasible procurement auctions. Oper Res 66(3):637–652

Asker J, Cantillon E (2010) Procurement when price and quality matter. Rand J Econ 41(1):1–34

Aulisi A, Farrell AE, Pershing J, Vandeveer S (2005) Greenhouse gas emissions trading in US States: observations and lessons from the OTC NOx Budget Program. WRI White Paper, available at: http://pdf.Wri.org/nox_ghg.pdf. Accessed 15 Mar 2021

Australian Department of the Environment (2013) Emissions reduction fund green paper. Agenda Item 7.1, AUASB Meeting 24 February 2014. Available at: https://www.auasb.gov.au/admin/file/content102/c3/Feb14_Agenda_Item_7.1_ERF-green-paper.pdf. Accessed 19 Jan 2017; Accessed 15 Mar 2021

Ausubel LM, Cramton P, Pycia M, Rostek M, Weretka M (2014) Demand reduction and inefficiency in multi-unit auctions. Rev Econ Stud 81(4):1366–1400

Back K, Zender JF (1993) Auctions of divisible goods: on the rationale for the treasury experiment. Rev Financ Stud 6(4):733–764

Benz E, Löschel A, SturmB (2010) Auctioning of CO2 emission allowances in Phase 3 of the EU emissions trading scheme. Clim Policy 10(6):705–718

Baldry JC (1986) Tax evasion is not a gamble. Econ Lett 22:333–335

Betz R, Seifert S, Cramton P, Kerr S (2010) Auctioning greenhouse gas emissions permits in Australia. Austral J Agric Resour Econ 54:219–238

Binmore K, Klemperer P (2002) The biggest auction ever: the sale of the British 3G telecom licences. Econ J 112:C74–C76

British Columbia Ministry of Small Business and Revenue (2008) British Columbia carbon tax update. British Columbia Government. Available at: https://www.foodandwaterwatch.org/sites/default/files/rpt_1609_carbontax_web17011.pdf. Accessed 15 Mar 2021

Brosig J, Reiß JP (2007) Entry decisions and bidding behavior in sequential first-price procurement auctions: an experimental study. Games Econ Behav 58:50–74

Burtraw D (2000) Innovation under the tradable sulfur dioxide emission permits program in the U.S. electricity sector. Resources for the future discussion paper 00–38. Available at: https://media.rff.org/documents/RFF-DP-00-38.pdf. Accessed 15 Mar 2021

Burtraw D, Palmer K (2008) Compensation rules for climate policy in the electricity sector. J Policy Anal Manag 27:819–847

Burtraw D, Holt C, Goeree J, Myers E, Palmer K, Shobe W (2009) Collusion in auctions for emission permits: an experimental analysis. J Policy Anal Manag 28(4):672–691

Burtraw D, Goeree J, Holt C, Myers E, Palmer K, Shobe W (2011) Price discovery in emissions permit auctions. In: Isaac RM, Douglas NA (eds) Research in experimental economics, vol 14. Emerald Group Publishing Limited, pp 11–36

Carlson C, Burtraw D, Cropper M, Palmer K (2000) Sulfur dioxide control by electric utilities: what are the gains from trade? J Polit Econ 108(6):1292–1326

Cason TN (1995) An experimental investigation of the seller incentives in the EPA’s emission trading auction. Am Econ Rev 85(4):905–922

Cason TN, Gangadharan L (2005) A laboratory comparison of uniform and discriminative price auctions for reducing non-point source pollution. Land Econ 81:51–70

Chen N, Gravin N, Lu P (2011) On the approximability of budget feasible mechanisms. In: Proceedings of the Twenty-Second Annual ACM-SIAM Symposium on Discrete Algorithms (pp. 685–699). Society for Industrial and Applied Mathematics.

Chung KS, Ely JC (2002) Mechanism design with budget constraint. Working paper

Convery FJ (2009) Reflections—the emerging literature on emissions trading in Europe. Rev Environ Econ Policy 3(1):123–137

Cox JC, Smith VL, Walker JM (1985) Expected revenue in discriminative and uniform-price sealed-bid auctions. In: Smith VL (ed) Research in experimental economics, vol 3. JAI Press Inc, pp 183–208

Cramton P (1998) Ascending auctions. Eur Econ Rev 42:745–756

Cramton P (2007a) Possible design for a greenhouse gas emissions trading system. The NETT discussion paper. Available at: http://www.cramton.umd.edu/papers2005-2009/australia-nett-auction-design-report.pdf. Accessed 15 Mar 2021

Cramton P (2007b) Comments on the RGGI market design. Report for ISO New England and NYISO. Available at: http://www.cramton.umd.edu/papers2005-2009/cramton-rggi-market-design-comments.pdf. Accessed 15 Mar 2021

Cramton P, Kerr S (2002) Tradeable carbon permit auctions: how and why to auction and not grandfather. Energy Policy 30(4):333–345

Cramton P, Stoft S (2007) Why we need to stick with uniform-price auctions in electricity markets. Electric J 20(1):26–37

Cummings RC, Holt C, Laury S (2004) Using laboratory experiments for policy making: an example from the Georgia irrigation reduction auction. J Policy Anal Manag 23(2):341–363

Dasgupta S, Spulber DF (1990) Managing procurement auctions. Inf Econ Policy 4(1):5–29

Datta S, Satten GA (2005) Rank-sum tests for clustered data. J Am Stat Assoc 100(471):908–915

Davis DD, Holt C (1993) Experimental economics. Princeton University Press

De Silva DG, Dunne T, Kosmopoulou G (2002) Sequential bidding in auctions of construction contracts. Econ Lett 76(2):239–244

Eckel CC, Grossmann PJ (1996) Altruism in anonymous dictator games. Games Econ Behav 16:181–191

Ellerman AD, Joskow PL, Schmalensee R, Bailey EM, Monteiro PK (2000) Markets for clean air: the U.S. acid rain program. Cambridge University Press

Ellerman AD, Marcantonini C, Zaklan A (2016) The European Union emissions trading system: ten years and counting. Rev Environ Econ Policy 10(1):89–107

Engelbrecht‐Wiggans R, List JA, Reiley DH (2006) Demand reduction in multi‐unit auctions with varying numbers of bidders: theory and evidence from a field experiment. Int Econ Rev 47(1):203–231

Engelbrecht-Wiggans R, Kahn CM (1998a) Multi-unit auctions with uniform prices. Econ Theor 12(2):227–258

Engelbrecht-Wiggans R, Kahn CM (1998b) Multi-unit pay-your-bid auctions with variable awards. Games Econ Behav 23(1):25–42

Engelbrecht-Wiggans R, Haruvy E, Katok E (2007) A comparison of buyer-determined and price-based multiattribute mechanisms. Mark Sci 26(5):629–641

Ensthaler L, Giebe T (2014a) A dynamic auction for multi-object procurement under a hard budget constraint. Res Policy 43(1):179–189

Ensthaler L, Giebe T (2014b) Bayesian optimal knapsack procurement. Eur J Oper Res 234(3):774–779

Fabra N (2003) Tacit collusion in repeated auctions: uniform versus discriminatory. J Ind Econ II 2:271–293

Fischbacher U (2007) z-Tree: Zurich toolbox for ready-made economic experiments. Exp Econ 10(2):171–178

Fonseca MA, Normann HT (2012) Explicit vs. tacit collusion—The impact of communication in oligopoly experiments. Eur Econ Rev 56(8):1759–1772

Gächter S, Riedl A (2005) Moral property rights in bargaining. Manage Sci 51:249–263

Galinato GI, Yoder JK (2010) An integrated tax-subsidy policy for carbon emission reduction. Resour Energy Econ 32(3):310–326

Gigerenzer G (1996) Rationality: why social context matters. In: Baltes PA, Staudinger UM (eds) Interactive minds: life-span perspectices on the social foundations of cognition. Cambridge University Press, pp 319–346

Goeree JK, Palmer K, Holt CA, Shobe W, Burtraw D (2010) An experimental study of auctions versus grandfathering to assign pollution Permits. J Eur Econ Assoc 8(2–3):514–525

Goeree JK, Offerman T, Sloof R (2013) Demand reduction and pre-emptive bidding in multi-unit license auctions. Exp Econ 16(1):52–87

Goldreich D (2007) Underpricing in discriminatory and uniform-price treasury auctions. J Financ Quant Anal 42(2):443–466

Goswami G, Noe T, Rebello M (1996) Collusion in uniform-price auctions: experimental evidence and implications for treasury auctions. Rev Financ Stud 9(3):757–785

Guo Y, Yang D (2007) Budget revenue and expenditure of the Chinese government: a test of three variable error correction model. World Economy (In Chinese) 2007(7):28–37

Güth W, Ivanova-Stenzel R, Königstein M, Strobel M (2003) Learning to bid—an experimental study of bid function adjustments in auctions and fair division games. Econ J 113:477–494

Haan MA, Schoonbeek L, Winkel BM (2009) Experimental results on collusion. In: Hinloopen J, Normann H-T (eds) Experiments and competition policy. Cambridge University Press, Cambridge

Hammar H, Jagers S (2007) What is a fair CO2 tax increase? On fair emission reductions in the transport sector. Ecol Econ 6(2–3):377–387

Haruvy E, Katok E (2008) An experimental investigation of buyer determined procurement auctions. Penn State Working paper.

He H, Chen Y (2014) Auction mechanisms for allocating subsidies for carbon emissions reduction: an experimental investigation (No. DP-14–06-EfD). Available at: https://media.rff.org/documents/EfD-DP-14-06.pdf. Accessed 15 Mar 2021

Holt C (1980) Competitive bidding for contracts under alternative auction procedures. J Polit Econ 88(3):433–445

Holt C (1995) Industrial organization: a survey of laboratory research. In: Kagel JH, Roth AE (eds) The handbook of experimental economics. Princeton University Press, pp 349–443

Holt C, Shobe W, Burtraw D, Palmer K, Goeree J (2007) Auction design for selling CO2: emission allowances under the regional greenhouse gas initiative. Final report, Resources for the future. Available at: https://mde.maryland.gov/programs/Air/ClimateChange/RGGI/Documents/RGGI_Auction_Design_Final.pdf. Accessed 15 Mar 2021

Holt C, Shobe W, Burtraw D, Palmer K, Goeree J, Myers E (2008) Auction design for selling CO2 emission allowances under the regional greenhouse gas initiative. Addendum: Response to selected comments. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2459462. Accessed 15 Mar 2021

Hortaçsu A, Mcadams D (2010) Mechanism choice and strategic bidding in divisible good auctions: an empirical analysis of the Turkish treasury auction market. J Polit Econ 118(5):833–865

Huck S, Normann HT, Oechssler J (2004) Two are few and four are many: number effects in experimental oligopolies. J Econ Behav Organ 53(4):435–446

Isaac RM, Walker JM (1985) Information and conspiracy in sealed-bid auctions. J Econ Behav Organ 6:139–159

Jackson M, Kremer I (2007) On the informational inefficiency of discriminatory price auctions. J Econ Theory 132(1):507–517

Jarman F, Meisner V (2015) Ex-post optimal knapsack procurement. Working Paper.

Jarman F, Meisner V (2017) Ex-post optimal knapsack procurement. J Econ Theory 171:35–63

Jofre-Bonet M, Pesendorfer M (2000) Bidding behavior in a repeated procurement auction. Eur Econ Rev 44(4–6):1006–1020

Jofre-Bonet M, Pesendorfer M (2003) Estimation of a dynamic auction game. Econometrica 71(5):1443–1489

Joskow PL, Schmalensee R, Bailey EM (1998) The market for sulfur dioxide emissions. Am Econ Rev 88(4):669–685

Kachelmeier SJ, Shehata M (1997) Internal auditing and voluntary cooperation in firms: a cross-cultural experiment. Account Rev 72:407–431

Kagel JH (1995) Auctions: a survey of experimental research. In: Kagel JH, Roth AE (eds) The handbook of experimental economics. Princeton University Press, pp 501–557

Kagel JH, Levin D (2001) Behavior in multi‐unit demand auctions: experiments with uniform price and dynamic Vickrey auctions. Econometrica 69(2):413–454

Kagel JH, Levin D (2012) Auctions: a survey of experimental research (1995–2010). In: Kagel J, Roth A (eds) The handbook of experimental economics, vol 2. Princeton University Press, Princeton

Kagel JH, Levin D (2016) Auctions: a survey of experimental research. Handb Exp Econ 2:563–637

Keloharju M, Nyborg KG, Rydqvist K (2005) Strategic behavior and underpricing in uniform price auctions: evidence from Finnish treasury auctions. J Finan 60(4):1865–1902

Keyuraphan S, Thanarak P, Ketjoy N, Rakwichian W (2012) Subsidy schemes of renewable energy policy for electricity generation in Thailand. Procedia Eng 32:440–448

Kollmuss A, Lazarus M (2010) Buying and cancelling allowances as an alternative to offsets for the voluntary market: a preliminary review of issues and options. OECD environmental working paper no. 21. OECD Publishing. Available at: https://www.oecd-ilibrary.org/content/paper/5km975qmwp5c-en?crawler=true. Accessed 15 Mar 2021

Kremer I, Nyborg KG (2004) Underpricing and market power in uniform price auctions. Rev Financ Stud 17:849–877

Krishna V (2009) Auction theory, 2nd edn. Academic Press

Kwasnica AM, Sherstyuk K (2013) Multi-unit auctions. J Econ Surveys 27(3):461–490

List JA, Lucking-Reiley D (2000) Demand reduction in multiunit auctions: evidence from a sportscard field experiment. Am Econ Rev 90(4):961–972

List JA, Shaikh AM, Xu Y (2019) Multiple hypothesis testing in experimental economics. Exp Econ 22(4):773–793

Loewenstein G (1999) Experimental economics from the vantage point of behavioural economics. Econ J 109:F25–F34

Loomes G (1999) Some lessons from past experiments and some challenges for the future. Econ J 109(453):35–45

Lopomo G, Marx LM, McAdams D, Murray B (2011) Carbon allowance auction design: an evaluation of the current debate. Rev Environ Econ Policy 5(1):25–43

Maskin E (2002) How to reduce greenhouse gas emissions-an application of auction theory. Nancy L Schwartz Mem Lect Northwestern Univ 41(3):580–591

Maskin E (2011) Notes on auctions for pollution reduction. In: Keynote Speech at the 18th annual conference of European Association for Environmental and Resource Economists, Rome.

Mason CF, Plantinga AJ (2013) The additionality problem with offsets: optimal contracts for carbon sequestration in forests. J Environ Econ Manag 66(1):1–14

Metcalf GE (2009) Designing a carbon tax to reduce U.S. greenhouse gas emissions. Rev Environ Econ Policy 3(1):63–83

Milgrom PR (2004) Putting auction theory to work. Cambridge University Press

Miller GJ, Plott CL (1985) Revenue-generating properties of sealed-bid auctions: an experimental analysis of one-price and discriminative processes. In: Smith VL (ed) Research in experimental economics, vol 3. JAI Press, pp 159–182

National Development and Reform Commission (NDRC) (2008) The progress of ten key energy-conservation projects. Available at http://www.gov.cn/2008jhbg/content_924842.htm. Accessed 15 Mar 2021

Nyborg KG, Sundaresan S (1996) Discriminatory versus uniform treasury auctions: Evidence from when-issued transactions. J Financ Econ 42(1):63–104

Ortmann A, Gigerenzer G (1997) Reasoning in economics and psychology: why social context matters. J Inst Theor Econ 153:700–710

Payne JE (1998) The tax-spend debate: Time series evidence from state budgets. Public Choice 95(3):307–320

Peacock A, Wiseman J (1961) The growth of public expenditures in the UK. Princeton University Press

Pearce D (1991) The role of carbon taxes in adjusting to global warming. Econ J 101(40):938–948

Plott CR, Smith V (1978) An experimental examination of two exchange institutions. Rev Econ Stud 45(1):133–153

Porter D, Rassenti S, Shobe W, Smith V, Winn A (2009) the design, testing, and implementation of Virginia’s NOx allowance auction. J Econ Behav Organ 69(2):190–200

Potters J, Suetens S (2013) Oligopoly experiments in the current millennium. J Econ Surveys 27(3):439–460

Price L, Levine MD, Zhou N, Fridley D, Aden N, Lu H, McNeil M, Zheng N, Qin Y, Yowargana P (2011) Assessment of China’s energy-saving and emission-reduction accomplishments and opportunities during the 11th Five Year Plan. Energy Policy 39(4):2165–2178

Productivity Commission (2011) carbon emission policies in key economies. Research report, Canberra

Rob R (1986) The design of procurement contracts. Am Econ Rev 76(3):378–389

Saini V, Suter J (2015) Capacity constraints and information revelation in procurement auctions. Econ Inq 53:1236–1258

Salant SW (2016) What ails the European Union׳ s emissions trading system? J Environ Econ Manag 80:6–19

Selten R, Buchta J (1999) Experimental sealed-bid first price auctions with directly observed bid functions. In: Budescu D, Erev E, Zwick R (eds) Games and human behavior: essays in honor of Amnon Rapoport. Lawrenz Associates, pp 79–102

Setyawan D (2014) Formulating revolving fund scheme to support energy efficiency projects in Indonesia. Energy Procedia 47:37–46

Shachat J, Swarthout JT (2010) Procurement auctions for differentiated goods. Decis Anal 7(1):6–22

Shachat J, Wei L (2012) Procuring commodities: first-price sealed-bid or English auctions? Mark Sci 31(2):317–333

Shobe W, Palmer K, Myers E, Holt C, Goeree J, Burtraw D (2010) An experimental analysis of auctioning emissions allowances under a loose cap. Agric Resour Econ Rev 39(2):162–175

Simon DP (1994) Markups, quantity risk, and bidding strategies at treasury coupon auctions. J Financ Econ 35(1):43–62

Singer Y (2010) Budget feasible mechanisms. In: 2010 IEEE 51st Annual Symposium on foundations of computer science (pp. 765–774). IEEE

Smith VL (1962) An experimental study of competitive market behavior. J Polit Econ 70(2):111–137

Smith V (1967) Experimental studies of discriminatory versus competition in sealed-bid auction markets. J Bus Res 40:56–84

Smith S, Swierzbinski J (2007) Assessing the performance of the UK Emissions Trading Scheme. Environ Resour Econ 37(1):131–158

Smith V, Williams AW, Bratton WK, Vannoni MG (1982) Competitive market institutions: double auctions vs. sealed bid-offer auctions. Am Econ Rev 72(1):58–77

Smog in China closes schools and construction sites, cuts traffic in Beijing (2015). Aailable at http://edition.cnn.com/2015/12/07/asia/china-beijing-pollution-red-alert/index.html. Accessed 15 Mar 2021

The Climate Institute (2013) A review of subsidy and carbon price approaches to emission reduction. Sinclair Knight Merz report #SH43458. Available at: http://www.climate.org/archive/index.html. Accessed 15 Mar 2021

Vickrey W (1961) Counterspeculation, auctions, and competitive sealed tenders. J Finance 16(1):8–37

Wilson R (1979) Auctions of shares. Q J Econ 93(4):675–689

Wooldridge JM (2016) Introductory econometrics: a modern approach, 6th edn. Cengage Learning

Wu Y, Zhang L (2017) Can the development of electric vehicles reduce the emission of air pollutants and greenhouse gases in developing countries? Transport Res Part D Transport Environ 51:129–145

Zetland D (2013) All-in-Auctions for water. J Environ Manag 115:78–86

Zhao X, Yin H, Zhao Y (2015) Impact of environmental regulations on the efficiency and CO2 emissions of power plants in China. Appl Energy 149:238–247

Zizzo DJ (2010) Experimenter demand effects in economic experiments. Exp Econ 13(1):75–98

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Dallas Burtraw, William Shobe, Juha Siikamäki, Qian Weng, and Congying Zuo for helpful discussions and comments on this paper. We are grateful to Wei Ma and Yunfeng Zhu for assistance in conducting the experiment. Financial support from the Swedish International Development Cooperation Agency (SIDA) through the Environment for Development Initiative (EfD), MOE (Ministry of Education in China) Project of Humanities and Social Sciences (18YJA790032), the Natural Science Foundation of China (71973016 & 71773111), and the Beijing Natural Science Foundation (9192013) is gratefully acknowledged. All errors and omissions remain the sole responsibility of the authors.

Supplementary Information

Below is the link to the electronic supplementary material.

Appendices

Appendix 1. A theoretical characterization of the Maskin auction mechanism

1.1 Problem

Assume that there is one mechanism designer (government) and \(n\) potential subjects (participating firms). Let \(i\in I:=\{1,\dots ,n\}\) denote a typical firm and \(x_{i}\) is maximum possible pollution abatement of firm \(i\).Footnote 37 Firm \(i\) faces constant marginal cost \({c}_{i}\) to reduce emission. The costs are the firms' private information and are independently drawn from a distribution \({F}_{i}\). \({x}_{i}\) and \({F}_{i}\) are the common knowledge. Government has a fixed budget constraint \(B\). After firms report their marginal cost and \({\varvec{p}}\) is the bid vector, a mechanism or auction will determine the allocation set \(A\) and the transfer vector \({\varvec{t}}\) that government pay to the firms. Formally, denote \({q}_{i}({\varvec{p}})=1\) if firm \(i\) gets the subsidy (zero otherwise), so the allocation set \(A({\varvec{p}}):=\{i\in I|{q}_{i}({\varvec{p}})=1\}\). The subject \(i\)'s utility is given by its transfer minus the cost:

The government wants to maximize the aggregate pollution abatement and its utility is

A direct mechanism \(\langle {q}_{i},{t}_{i}\rangle\) maps from cost vector \({\varvec{c}}\in {\times }_{i}^{n}{F}_{i}\) into allocation decision and transfer. The mechanism subjects to several constraints. First is the ex-post participation constraint (PC) which is that the transfer must at least cover the cost,

In addition, the government has a budget constraint (BC) that it cannot exceed its budget \(B\)

Last, ex-post incentive compatibility (IC) must be hold. The actual cost \({c}_{i}\) should be a (weakly) dominant strategies for firm \(i\) for every realization of the cost vector

1.2 Maskin auction

To give a characterization of the Maskin auction, we need some notation. Let \({l}_{i}\) denote the set of firms with bid above the bidder \(i\). Let \({p}_{{A}^{c}}\) denote the smallest reported cost among those who are not in the allocation.

If all firms are in the allocation, then \({p}_{{A}^{c}}\) is a enough big number.

Given the bid vector \({\varvec{p}}\), Maskin auction implements allocation \(A\) and transfer \(t\) where

In our setting, the \({x}_{i}\) are all the same. So the Maskin auction reduces to the form below

where \(|A|\) denote the number of elements in set \(A\). So as \(|{l}_{i}|\).

Proposition 1

Maskin auction satisfies an ex-post participation constraint (PC), an ex-post incentive compatibility constraint (IC) and the budget is not exceeded (BC).

Proof It's clearly a (weakly) dominant strategy for firm \(i\) to bid \({p}_{i}={c}_{i}\) in this auction. Given \({{\varvec{c}}}_{-i}\), if bidding the true cost \({c}_{i}\) would be in the allocation, then the action that firm \(i\) changes its bid would not increase firm \(i\)'s profit if the new bid is still in the allocation. Because the transfer does not depend on the bid if it has been in the allocation. For situation that bidding the true cost \({c}_{i}\) would not be in the allocation given \({{\varvec{c}}}_{-i}\), firm \(i\) needs to set its bid lower to get in the allocation. However, it would induce a lost. To see how this lost occurs, we divide analysis into three cases below. (1) when \({p}_{{A}^{C}({c}_{i},{{\varvec{c}}}_{-i})}={c}_{i}\) and \(A({p}_{i},{{\varvec{c}}}_{-i})=A({c}_{i},{{\varvec{c}}}_{-i})\cup \{i\}\), we have \({t}_{i}({p}_{i},{{\varvec{c}}}_{-i})\le {x}_{i}\cdot B/{\sum }_{j\in {l}_{i}}{x}_{j}\le {c}_{i}{x}_{i}\); (2) when \({p}_{{A}^{C}({c}_{i},{{\varvec{c}}}_{-i})}={c}_{i}\) but \(\exists j\in A({c}_{i},{{\varvec{c}}}_{-i})\),\(j\notin A({p}_{i},{{\varvec{c}}}_{-i})\), we have \({t}_{i}({p}_{i},{{\varvec{c}}}_{-i})\le {p}_{{A}^{c}({p}_{i},{{\varvec{c}}}_{-i})}\cdot {x}_{i}\le {c}_{j}{x}_{i}<{c}_{i}{x}_{i}\); (3) when \({p}_{{A}^{c}({c}_{i},{{\varvec{c}}}_{-i})}\ne {c}_{i}\), we have \({t}_{i}({p}_{i},{{\varvec{c}}}_{-i})\le {p}_{{A}^{c}({c}_{i},{{\varvec{c}}}_{-i})}\cdot {x}_{i}<{c}_{i}{x}_{i}\). Therefore in both circumstances, bidding the true cost is a (weakly) dominant strategy. The auction satisfies IC.

As for PC, it's trivial when firm \(i\) is not in the allocation. When firm \(i\) is in the allocation, if \({p}_{{A}^{c}}\le B/{\sum }_{j\in A}{x}_{j}\), it's also obvious. For \({p}_{{A}^{c}}\ge B/{\sum }_{j\in A}{x}_{j}\), then

where \(\bar{c}: = max\{ {c}_{j} |j \in A\}\) and \({l}_{\bar{c}}=A\). So auction satisfies PC.

Last, the auction also satisfies BC since

Therefore Maskin auction “outperforms” discriminatory auction and uniform auction at some aspects. Discriminatory auction is obviously not incentive compatible and bids would be higher than costs. Although both the uniform and Maskin auction are incentive compatible, the Maskin auction has a “wider” allocation set than the uniform auction under the same bids, which means there are more winners and more reduction in Maskin auction. Because the condition of allocation rule in uniform auction is \({\bar{p}}_{i}\cdot {\sum }_{j\in {l}_{i}}{x}_{j}\le B\), where \({\bar{p}}_{i}\) is the least price greater than \({p}_{i}\), so it's tighter than Maskin auction. When \({\bar{p}}_{i}\) is much greater than \({p}_{i}\), then player \(i\) could probably be in the allocation in Maskin but not in uniform. So Maskin auction can spend the budget more efficiently in some stances.

However, Maskin auction is not necessarily the optimal mechanism for this problem. Maskin (2002) proofs that Maskin auction is optimal for special classes of distributions\(F\).Footnote 38 Ensthaler and Giebe (2014a) derive the optimal mechanism under a soft budget constraint that only needs the sum of expected transfers within the budget. Ensthaler and Giebe (2014b) consider a clock mechanism which is quite similar to the Maskin auction and they run some simulations to show that this auction outperforms those mechanisms used in practice. Jarman and Meisner (2015) construct an optimal mechanism for a slightly different problem where government here cares about residual money and they indicate that this mechanism outperforms that of Ensthaler and Giebe (2014b).

Appendix 2. Experimental Instructions in English

You seat number is ______. Please sit at the corresponding desk.

Instructions (Originally in Chinese)

In this experiment, a given amount of government-provided subsidies will be allocated to firms via auctioning. There will be 6 production firms taking part in the auction market. You will act as a decision-maker of one of the firms, and you will bid for the subsidy. You may earn a significant amount of money if you understand this instruction and make good bidding decisions. How much you can earn depends on both your and other participants’ decisions. There will be multiple rounds of auctions.

Background information of the firms

Production capacity Your firm will be given a number of capacity units. Each capacity unit can be transferred to one unit of the product via production, and the product can be sold to obtain profit. The price of the product and its production cost will be revealed later, and the product’s profit will be the price of the product minus its cost.

Therefore, the lowest payoff you can obtain is the product’s profit from operating the capacity to produce the product. (You can always obtain a payoff from selling the products to experimenters at a certain price).

Product price All firms produce identical products and the price of all products is identical.

Randomly assigned product cost Product costs are randomly determined in a certain range, and the costs differ from one firm to another. New random costs are determined for each firm at the beginning of each new auction.

Product-emission unit Production will generate carbon dioxide emission (“carbon emission” hereafter). You will know the emission unit that your firm will generate from producing one product.

Carbon-emission-reduction subsidy To reduce carbon emission, the government will provide a given amount of budget to subsidize firms that reduce their carbon emission. Each firm can reduce its carbon emission by reducing its product outputs such that it can obtain the government-provided subsidy by selling its emission-reduction units.

Auction markets for allocating carbon emission reduction subsidies:

Total subsidy budget: There is a budget of 100 yuan of government-provided subsidies that will be used to purchase firms’ carbon-emission-reduction units. Each firm will participate in an auction market for the allocation of subsidies as one bidder. In this auction market, the government will purchase all carbon-reduction units from bidders based on their bids (bids are the price at which firms are willing to sell their reduction units) from low to high, until the 100-yuan budget is depleted.

Types of firms: In total, there are six firms participating in each auction market including your firm. Hereinto, 3 firms are high emitters requiring 2 emission units to operate each capacity unit, and the other 3 firms are low emitters requiring 1 emission unit to operate each capacity unit. The total emission capacity of a firm is the product of product emission units and production capacity.

Rules for bidding: Each bidder can bid only for a single price for all its emission units. The price for selling an emission unit should be no lower than the unit emission value (the “unit emission value” is equal to the profit from selling products that are produced using one emission unit) such that you can obtain a higher profit from winning the auction than from producing and selling products. You may lose money when winning if you bid for selling emission units at prices that are lower than the value. In contrast, you may not be able to win an auction if you bid too high. The minimum increment for your bid is 0.1 yuan.

Bid limits The upper bidding limit for an emission unit is 10 yuan; thus, you cannot bid higher than this bid limit.

Experimental payoff

-

1.

If you win an auction with a bid no lower than the unit emission value, you will earn a higher profit than from producing and selling products. Thus, you must completely stop production to reduce all your emissions and earn the maximum payoff. When winning an auction, your experimental payoff is specified as follows:

$${\text{Profit of winning an auction }} = {\text{ Transaction price }} \times {\text{ Total emission capacity}}$$ -

2.

If you do not win an auction with a bid no lower than the unit emission value, you will not need to reduce emissions. Thus, you must produce products using all your production capacity to earn the maximum payoff. When not winning an auction, your experimental payoff is specified as follows:

Notes: Your bid for emission units will affect whether you can win an auction and how much subsidy payoff you can obtain from the auction market. If you win an auction, you will have to stop production and sell all your emission units. Thus, as a winning bidder, you have to give up the profit from production to obtain the payoff from selling all your emission units in the auction market. If you bid properly, you can always guarantee that your payoff from winning an auction is no lower than your profit from producing and selling products; therefore, you may obtain extra payoff by participating in an auction.

Detailed information of your firm

Your firm is a high/low emitter with the information below.

-

1.

Your firm has 5/10 production capacities;

-

2.

Each production capacity can produce one product, and the product price is 11 yuan;

-

3.

The product cost is the same for all your products, and you will be informed about the randomly determined new product cost at the beginning of each auction.

-

4.

The production of one product generates 2/1 units of carbon emission.

-

5.

Thus, the unit emission value is equal to the product price minus product cost and then divided by carbon emission units per product; that is,

The Example:

Suppose that your firm’s product cost is randomly determined as 3 yuan, and each product generated by each capacity unit can be sold at a price of 11 yuan; thus, the product profit is 8 yuan. If you are a high emitter, the production of one product generates 2 units of carbon emission; therefore, the production profit lost from reducing one unit of carbon emission is 4 yuan. That is, your firm’s unit emission value is 4 yuan.

If you cannot sell your emission units in the subsidy auction market, you can use these units to produce products and obtain production profit. However, if you can sell your emission units at a price no lower than 4 yuan, you may obtain a higher profit by stopping production. The difference between the selling price of one emission reduction unit in the auction market and the unit emission value is the extra payoff you can obtain.

Auction rules

Winner and transaction price determination When all bids are collected and ranked from low to high, the specific rules for determining the winner(s) and the transaction price are shown in the table below. The winner(s) will be the one or a few of the bidders with the lowest bid(s). When using the rules to determine the winner(s) and the transaction price, one should compare the actual situation of bids and number of bidders with the conditions stated in the five scenarios shown in the table with the order from scenario 1 to scenario 5. Any actual situation will satisfy one and only one of the five scenarios. The winner(s) and the transaction price will then be determined by the conditions stated in that scenario.

Winner and transaction price determination rules in Maskin auction | |||

|---|---|---|---|

Scenario | Condition | Number of winners | Transaction price |

1 | More than 0 bid belong to [0, ¥10] & | 1 | min {¥10, 2nd lowest price} |

no more than 1 bid belongs to [0, ¥5] | |||

2 | More than 1 bid belong to [0, ¥5] & | 2 | min {¥10, 3rd lowest price} |

no more than 2 bids belong to [0, ¥3.3] | |||

3 | More than 2 bids belong to [0, ¥3.3] & | 3 | min {¥3.3, 4th lowest price} |

no more than 3 bids belong to [0, ¥2.5] | |||

4 | More than 3 bids belong to [0, ¥2.5] & | 4 | min {¥2.5, 5th lowest price} |

no more than 4 bids belong to [0, ¥2] | |||

5 | More than 4 bids belong to [0, ¥2] & | 5 | min {¥2, 6th lowest price} |

no more than 5 bids belong to [0, ¥1.7] | |||

Please note that all winner(s) have to sell their emission units at the uniform transaction price specified by the scenario that the actual situation falls into. This price will be no lower than the winning bid(s).

Other rules

-

1.

In an auction market, each bidder can bid only once, and all bidders submit bids simultaneously. Thus, all bidders make their bids without knowing others’ bids.

-

2.

If two or more bidders bid at the same price but the subsidy budget is not enough for purchasing emission units from all of the bidders, only some of the bidders will be selected by a random device as the winner(s). The unused subsidy budget will be withdrawn.

-

3.

Uniform price: emissions from all winners in an auction will be purchased at the same price determined in one of the aforementioned scenarios. That is, there is no difference between the transaction prices of different winners.

Information about participating in multiple rounds of auction markets

The experiment consists of multiple rounds of the aforementioned auction markets. The round of auctions will not be announced in advance. The six bidders in each auction market will remain the same throughout all rounds. However, it is not possible to identify each other. Moreover, if you obtain a subsidy from the auction market, you must reduce your emission units immediately. The emission units cannot be “banked” from one round to the next. That is, to exchange subsidies in the auction market, you can reduce production only up to your production capacity in each round of auction.

Important earnings announcement

Your experimental payoff in each round is either a carbon emission reduction subsidy or a production profit. You total payoff will be the accumulated payoff from all rounds. Please note that your cash earnings will be 8% of your total payoff. At the end of the experiment, your cash earnings plus the 10 yuan show-up fee will be immediately paid to you in cash in private in another room.

Appendix 3. Additional figures

See Fig.

6.

Appendix 4. Additional tables

See Table 8, 9, 10, 11 and 12.

Rights and permissions

About this article

Cite this article

He, H., Chen, Y. Auction mechanisms for allocating subsidies for carbon emissions reduction: an experimental investigation. Soc Choice Welf 57, 387–430 (2021). https://doi.org/10.1007/s00355-021-01318-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00355-021-01318-x