Abstract

We study the relationship among inflation, economic growth, and financial development in a Schumpeterian overlapping generations model with credit constraints. In the baseline case, money is super-neutral. When the financial development exceeds some critical level, the economy catches up and then converges to the growth rate of the world technology frontier. Otherwise, the economy converges to a poverty trap with a growth rate lower than the frontier and with inflation decreasing with the level of financial development. We then study efficient allocation and identify the sources of inefficiency in a market equilibrium. We show that a particular combination of monetary and fiscal policies can make a market equilibrium attain the efficient allocation.

Similar content being viewed by others

Notes

In the period of 1950–2008, the average per capita GDP growth rates for the whole Latin America, Asia, and Africa were, respectively, 1.8%, 1.6%, and 1.2% (Maddison (2008)).

See Banerjee and Duflo (2005) for a survey.

AHM (2005) provide empirical evidence to support the importance of the credit constraints for convergence or divergence.

“Appendix B” presents data description.

Another approach is to introduce a cash-in-advance constraint.

Money growth has a short-run effect on the transition path.

In the knife-edge case where the second inequality in Assumption 1 holds as an equality, the efficient innovation rate \(\mu _\mathrm{FB}=1.\) In this case \(a_\mathrm{FB}=1\) and the economy reaches the world frontier technology level.

Notice that \(F^{\prime }\left( n\right) =1/\varPhi ^{\prime }\left( \mu \right) .\)

We need to prove that

$$\begin{aligned} \psi =\left( \chi -1\right) \left( \frac{\alpha }{\chi }\right) ^{\frac{1}{ 1-\alpha }}<(\frac{1}{\alpha }-1)\left[ \alpha ^{\frac{1}{1-\alpha }}-\left( \frac{\alpha }{\chi }\right) ^{\frac{1}{1-\alpha }}\chi \right] . \end{aligned}$$This inequality is equivalent to

$$\begin{aligned} \frac{\alpha }{1-\alpha }<\frac{\chi \left( \chi ^{\frac{\alpha }{1-\alpha } }-1\right) }{\chi -1}. \end{aligned}$$The expression on the right-hand side is equal to \(\alpha /\left( 1-\alpha \right) \) when \(\chi =1\) and increases with \(\chi >1.\)

We do not consider the knife-edge case of boundary solutions.

During the transition path, we may use the interest rate rule

$$\begin{aligned} R_{ft}=R_{f}\left( \frac{\varPi _{t}}{\varPi }\right) ^{\theta }. \end{aligned}$$

References

Abel, A.B.: Optimal monetary growth. J. Monetary Econ. 19, 437–450 (1987)

Acemoglu, D., Aghion, P., Zilibotti, F.: Distance to frontier, selection, and economic growth. J. Eur. Econ. Assoc. 4, 37–74 (2006). (1987)

Aghion, P., Bolton, P.: A model of trickle-down growth and development. Rev. Econ. Stud. 64, 151–172 (1997)

Aghion, P., Banerjee, A.V., Piketty, T.: Dualism and macroeconomic volatility. Q. J. Econ. 114, 1359–1397 (1999)

Aghion, P., Howitt, P., Mayer-Foulkes, D.: The effect of financial development on convergence: theory and evidence. Q. J. Econ. 120, 173–222 (2005)

Azariadis, C., Stachurski, J.: Poverty traps. In: Aghion, P., Durlauf, S.N. (eds.) Handbook of Economic Growth, vol. 1A, pp. 295–384. Elsevier, North Holland (2005)

Banerjee, A., Duflo, E.: Growth theory through the lens of development economics. In: Aghion, P., Durlauf, S.N. (eds.) Handbook of Development Economics, vol. 1A, pp. 473–552. Elsevier, Amsterdam (2005)

Banerjee, A., Newman, A.: Occupational choice and the process of development. J. Political Econ. 101, 274–298 (1993)

Bencivenga, V.R., Smith, B.D.: Financial intermediation and endogenous growth. Rev. Econ. Stud. 58, 195–210 (1991)

Chu, A.C., Cozzi, G., Furuakwa, Y., Liao, C.-H.: Inflation and innovation in a Schumpeterian economy with North–South technology transfer. J. Money Credit Bank. (2018). https://doi.org/10.1111/jmcb.12514

Chu, A.C., Cozzi, G.: R&D and economic growth in a cash-in-advance economy. Int. Econ. Rev. 55, 507–524 (2014)

Friedman, M.: The Optimum Quantity of Money. Macmillan, London (1969)

Galí, J.: Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework. Princeton University Press, Princeton (2008)

Galor, O., Zeira, J.: Income distribution and macroeconomics. Rev. Econ. Stud. 60, 35–52 (1993)

Gerschenkron, A.: Economic Backwardness in Historical Perspective. Harvard University Press, Cambridge (1962)

Gomme, P.: Money and growth revisited: measuring the costs of inflation in an endogenous growth model. J. Monetary Econ. 32, 51–77 (1991)

Greenwood, J., Jovanovic, B.: Financial development, growth, and the distribution of income. J. Political Econ. 98, 1076–1107 (1990)

Howitt, P.: Endogenous growth and cross-country income differences. Am. Econ. Rev. 90, 829–846 (2000)

Howitt, P., Mayer-Foulkes, D.: R&D, implementation, and stagnation: a Schumpeterian theory of convergence clubs. J. Money Credit Bank. 37, 147–177 (2005)

Jones, L.E., Manuelli, R.E.: Growth and the effects of inflation. J. Econ. Dyn. Control 19, 1405–1428 (1995)

King, R.G., Levine, R.: Finance and growth: Schumpeter might be right. Q. J. Econ. 108, 717–737 (1993)

Levine, R., Loayza, N., Beck, T.: Financial intermediation and growth: causality and causes. J. Monetary Econ. 46, 31–77 (2000)

Lucas, R.E.J.: Expectations and the neutrality of money. J. Econ. Theory 4, 103–124 (1972)

Maddison, A.: Historical statistics of the world economy: 1–2008 AD. http://www.ggdc.net/maddison/Historical_Statistics/vertical-file_02-2010.xls (2008)

Marquis, M.H., Reffett, K.L.: New technology spillovers into the payment system. Econ. J. 104, 1123–1138 (1994)

McCaIlum, B.T.: The role of overlapping-generations models in monetary economics. In: Carnegie-Rochester Conference Series on Public Policy, vol. 18, pp. 9–44 (1983)

Miao, J., Xie, D.: Economic growth under money illusion. J. Econ. Dyn. Control 37, 84–103 (2013)

Mookherjee, D., Ray, D.: Readings in the Theory of Economic Development. Blackwell, New York (2001)

Nelson, R., Phelps, E.S.: Investment in humans, technological diffusion, and economic growth. Am. Econ. Rev. 56, 69–75 (1966)

Pritchett, L.: Divergence, big-time. J. Econ. Perspect. 11, 3–17 (1997)

Samuelson, P.A.: An exact consumption-loan model of interest with or without the social contrivance of money. J. Political Econ. 66, 467–82 (1958)

Sidrauski, M.: Rational choice and patterns of growth in a monetary economy. Am. Econ. Rev Pap. Proc. 51, 534–544 (1967)

Woodford, M.: Interest Rate and Prices: Foundation of a Theory of Monetary Policy. Princeton University Press, Princeton, NJ (2003)

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

We thank Zhengwen Liu for excellent research assistance. We also thank Xiaodong Zhu and participants in many conferences for helpful comments.

Appendices

Appendix

Proofs

Proof of Proposition 1

We first study the steady state. Using Eqs. (18), (19), (20), and (21) and setting \(z_{t}=z,\) we derive a system of four steady-state equations

and \(\varPi =\left( 1+z\right) /\left( 1+g\right) \) to determine four steady-state variables \(R_{f},\)a, n, and \(\varPi .\)

From these equations, we show that n is determined by the equation

Equivalently, it follows from \(n=\varPhi \left( \mu \right) \) and \(F=\varPhi ^{-1}\) that \(\mu \) is determined by the equation

where

and \(\varPi =\left( 1+z\right) /\left( 1+g\right) .\) Since \(\varPhi ^{\prime \prime }>0,\)\(\varPhi ^{\prime }>0\), and \(\varPhi \left( 0\right) =0,\) we can check that \(\varPhi \left( \mu \right) \left( g+\mu \right) /\mu \) decreases with \(\mu .\) Thus, the real interest rate \(R_{f}/\varPi \) is decreasing in \(\mu \) and \(\varPhi ^{\prime }\left( \mu \right) \) is increasing in \(\mu \). Given conditions (22) and (23), it follows from the intermediate value theorem that there is a unique solution \(\mu ^{*}\in \left( 0,1\right) \) to (A.4).Footnote 10 The associated R&D investment is given by \(n^{*}=\varPhi \left( \mu ^{*}\right) \) and hence \(R_{f}^{*}\) and \(a^{*}\) are determined by (A.1) and (A.2). We also assume that the condition

is satisfied so that (12) holds along the balanced growth path. We will verify later that this condition is indeed satisfied in the proof of Proposition 2.

Using (A.3) and (15), we can rewrite the credit constraint (6) along a balanced growth path as

The critical value of \(\kappa \) such that the credit constraint just binds in the steady-state equilibrium is given by

When \(\kappa >\kappa ^{*},\) the credit constraint does not bind. It follows from (A.4) that money supply does not affect the equilibrium innovation rate \(\mu ^{*}.\) An increase in the money growth rate raises the nominal interest rate one for one and hence does not affect savings. Thus, the supply of funds for innovation does not depend on monetary policy.

Next we study local dynamics. By defining \(r_{t}\equiv R_{ft}/\left( 1+z_{t+1}\right) \) and eliminating \(R_{ft}/\varPi _{t+1},\) we can reduce the equilibrium system (18), (19), (20), and (21) to three equations

for three variables \(a_{t},n_{t},\) and \(r_{t}.\) Assume that \(z_{t}\) is constant over time.

Log-linearizing the above equations around the steady state yields

where a variable without time subscript denotes the steady-state value and a variable with a hat denotes the log deviation from the steady state. It follows from condition (A.5) that \(\vartheta >0.\)

Eliminating \(\hat{n}_{t}\) yields a system of two linear difference equations

where

We now study the eigenvalues of J to determine the local stability of the equilibrium system. Consider the quadratic characteristic equation

After a tedious calculation, we obtain

and

Under conditions (24), (A.5), \(F^{\prime }>0,\) and \( F^{\prime \prime }<0\), we can check that \(G\left( 0\right) >0\) and \(G\left( 1\right) <0.\) It follows from the intermediate value theorem that there exists an eigenvalue \(\nu _{1}\in \left( 0,1\right) \) such that \(G\left( \nu _{1}\right) =0.\) Since \(\lim {}_{x\rightarrow \infty }G(x)=\infty ,\) it follows from the intermediate value theorem that there exists another eigenvalue \(\nu _{2}>1\) such that \(G\left( \nu _{2}\right) =0.\) We conclude that the steady state is a saddle point.

Finally, we study transition dynamics. We set \(z_{t}=z\) for all t for simplicity. Then, we can write the log-linearized equilibrium solution as

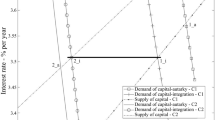

where \(r_{ft}\equiv R_{ft}/\varPi _{t+1}\) denotes the real interest rate. We want to determine the signs of all the coefficients. We first use the phase diagram in Fig. 6 to determine the signs of \(\phi _{a}\) and \(\phi _{r}\). By (A.11), the locus \(\hat{a}_{t+1}=\hat{a}_{t}\) represents the equation

which has a positive slope by condition (24). The locus \(\hat{r} _{t+1}=\hat{r}_{t}\) represents the equation

Since \(F^{\prime \prime }<0\) and \(F^{\prime }>0,\) the slope of this line may be either positive or negative. The left panel of Fig. 6 shows the plot of the case in which the locus \(\hat{r}_{t+1}=\hat{r}_{t}\) is negative. We can see that, if \(\hat{a}_{1}<0\), namely if the initial value \(a_{1}\) is below the steady state, the interest rate \(\hat{r}_{t}\) declines but \(a_{t}\) increases over time to their steady-state values along the saddle path. We now turn to case in which the slope of the locus \(\hat{r}_{t+1}=\hat{r}_{t}\) is positive, illustrated in the right panel of Fig. 6. We can show that the slope of the locus \(\hat{a}_{t+1}=\hat{a}_{t}\) is greater than the slope of the locus \(\hat{r}_{t+1}=\hat{r}_{t}\). We can see that, if the initial value \(a_{1}\) is below the steady state, \(r_{t}\) and \(a_{t}\) both increase over time, approaching their steady-state values.

In summary, we have shown that \(\phi _{a}\in \left( 0,1\right) \) and \(\phi _{r}\) can be either positive or negative. Up to the first-order approximation, the productivity growth satisfies

Thus, when \(a_{1}\) is slightly below the steady state, the productivity growth is positive and decreases to the steady state. By \(\hat{n}_{t}=\hat{a} _{t}+\vartheta \hat{r}_{t}\), we have \(\phi _{n}=1+\vartheta \phi _{r}\). If \( \phi _{r}>0\), then we have \(\phi _{n}>0\) since \(\vartheta >0\). In the case of \(\phi _{r}<0\) as in the left panel of Fig. 6, we see that the saddle path is flatter than the locus \(r_{t+1}=r_{t}\). Namely, we must have

This implies that

where the inequality follows from \(F^{\prime }>0,\)\(F^{\prime \prime }<0,\) and \(\vartheta >0\). Thus, as \(a_{t}\) increases to the steady state, \(n_{t}\) will do so too. Since \(\mu _{t}=F\left( n_{t}\right) \) and \(F^{\prime }>0,\)\( \mu _{t}\) also increases to the steady state.

Log-linearizing equation (18) yields

It follows from \(F^{\prime \prime }<0,\)\(F^{\prime }>0,\) and \(\phi _{n}>0\) that \(\phi _{rr}<0\). Thus, as \(a_{t}\) increases to the steady state, the real interest rate \(r_{ft}\) decreases to the steady state. Finally, log-linearizing equation (20) given \(z_{t}=z\) for all t yields

If \(\phi _{r}<0\), then we have \(\phi _{\varPi }>0\). If \(\phi _{r}>0\), we use the equation

to deduce \(\phi _{\varPi }>0\). In both cases, \(\varPi _{t}\) increases with \(a_{t}\) to the steady state. \(\square \)

Proof of Proposition 2

The equilibrium system consists of Eqs. (19), (20), (21), and (25). First, we study the steady state, in which the equilibrium system becomes (A.2), (A.3), and the following equation

where \(\varPi =\left( 1+z\right) /\left( 1+g\right) .\) The expression on the left-hand side of equation (A.16) is increasing in \(R_{f}\) and the expression on the right-hand side is decreasing in \(R_{f}.\) When \( R_{f}/\left( 1+z\right) =1+\gamma /\beta ,\) the credit supply takes the value \(\lambda \), which is below the borrowing limit when \(\beta R_{f}/\varPi -\kappa >0.\) When \(R_{f}\rightarrow \infty ,\) the credit supply approaches \( \lambda +\frac{\left( 1-\lambda \right) \beta }{1+\beta +\gamma }\), which is higher than the credit limit \(\lambda .\) Thus, by the intermediate value theorem there is a unique solution for \(R_{f}\) to equation (A.16) such that

Let \(R_{f}^{**}\) denote the solution. Using Eqs. (A.3), ( A.2), and (A.16), we derive that

We can equivalently rewrite this equation in terms of \(\mu \) as

Notice that there is a trivial solution \(\mu =0\) to the above equation since \(\varPhi \left( 0\right) =0\). We rule out this solution by the following condition:

Then, it follows from the intermediate value theorem that there is a unique solution, denoted by \(\mu ^{**}\in \left( 0,1\right) ,\) to Eq. (A.18). The corresponding R&D investment level is denoted by \(n^{**}=\varPhi \left( \mu ^{**}\right) >0.\)

Define the critical values \(\kappa ^{**}\) and \(\bar{\kappa }\) for \( \kappa \) such that

where \(R_{f}^{**}\) is the solution to Eq. (A.16) and is a function of \(\kappa .\) We can verify that the expression

increases with \(\kappa \) along the supply curve in Fig. 3. Thus, the values \(\kappa ^{**}\) and \(\bar{\kappa }\) are unique. When \(\kappa ^{**}<\kappa <\bar{\kappa },\) condition (A.19) holds.

From Fig. 3, we can see that the unconstrained equilibrium interest rate under perfect credit market is higher than that under binding credit constraint. Thus, (A.17) and hence (22) and (A.5) must hold for the unconstrained equilibrium. If \(\kappa ^{**}<\kappa <\min \left\{ \kappa ^{*},\bar{\kappa }\right\} ,\) then the unconstraint equilibrium derived in Proposition 1 violates the credit constraint and condition (A.19) is satisfied. For (26) to hold, we need

Since (A.1) holds at \(n^{*}\) and \(R_{f}^{*}\) and since \( n^{**}<n^{*}\) and \(R_{f}^{**}<R_{f}^{*},\) the above condition follows from the concavity of F. The rest of the proof follows from the analysis in the main text using Fig. 3. In particular, an increase in \(\kappa \) raises the nominal interest rate \( R_{f}^{**}\) and hence raises \(n^{**}\) by combining Eqs. (A.3) and (A.2). It also raises the corresponding \(a^{**}\) by (A.2). But there is no growth effect because the economy still grows at the rate g on the balanced growth path.

Next we study the local stability. As in the proof of Proposition 1, we rewrite the equilibrium system (19), (20), (21), and (25) as

Define \(r_{ft}\equiv R_{ft}/\varPi _{t+1}.\) Log-linearizing this system yields

where \(\vartheta \) is given in (A.10). Notice that \(\varrho ,\vartheta >0\) by condition (A.17).

Simplifying yields a system of two equations for \(\hat{a}_{t}\) and \(\hat{r}_{t}\):

Consider the quadratic characteristic equation \(G\left( \nu \right) \equiv \left| J-\nu I\right| =0.\) We can check that \(G\left( 0\right) >0\) and \(G\left( 1\right) <0\) by condition (27). Moreover, \( \lim _{x\rightarrow \infty }G\left( x\right) =\infty \) As in the proof of Proposition 1, we deduce that there is an eigenvalue inside the unit circle and an eigenvalue outside the unit circle. Thus, the steady state is a saddle point.

Finally, we study transition dynamics using the phase diagram in Fig. 7. The locus \(a_{t+1}=a_{t}\) represents the line

and the locus \(r_{t+1}=r_{t}\) represents the line

Notice that both lines have a positive slope and the locus \(\hat{r}_{t+1}= \hat{r}_{t}\) is flatter than the locus \(\hat{a}_{t+1}=\hat{a}_{t}\). Thus, if the initial value \(\hat{a}_{1}<0\), then both \(\hat{r}_{t}\) and \(\hat{a}_{t}\) will increase over time to their steady-state values.

We now examine the dynamics of other variables. As in the proof of Proposition 1, we only need to study the signs of coefficients \(\phi _{rr},\)\(\phi _{n},\) and \(\phi _{\varPi }.\) Since \(R_{ft}=r_{t}(1+z)\) and z is constant, \(R_{ft}\) increases over time as \(a_{t}\) increases over time given initial \(\hat{a}_{1}<0\). Since \(\hat{n}_{t}=\hat{a}_{t}+\vartheta \hat{r} _{t}\equiv \phi _{n}\hat{a}_{t}\) and \(\phi _{n}>0\), as both \(\hat{a}_{t}\) and \(\hat{r}_{t}\) increase overtime, so does \(\hat{n}_{t}.\) Since

we have \(\phi _{rr}<0.\) Thus, the real interest rate \(R_{ft}/\varPi _{t+1}\) decreases with \(a_{t}\) to the steady state. The growth rate of the economy up to the first-order approximation is given by

It follows from \(\phi _{a}\in \left( 0,1\right) \) that the growth rate of the economy declines as \(a_{t}\) increases. It follows from

\(\phi _{r}>0,\) and \(\phi _{rr}<0\) that the inflation rate \(\varPi _{t}\) increases with \(a_{t}\) to the steady state. \(\square \)

Proof of Proposition 3

The equilibrium system still consists of Eqs. (19), (20), (21), and (25). We first study the steady state which is characterized by Eqs. (A.3), (A.2), (A.16), and

Notice that \(a_{t}\) may not converge to a positive constant when \(0<\kappa <\kappa ^{**}\). As in the proof of Proposition 2, Eq. (A.18) still holds. But when \(\kappa \in \left( 0,\kappa ^{**}\right) ,\) the first inequality in assumption (A.19) is violated so that the following inequality holds in the steady state:

Thus, the only solution to Eq. (A.18) is \(\mu ^{p}=0.\) As a result, we have \(n^{p}=a^{p}=0\) in the steady state.

The following algebra shows that the productivity growth will converge to a rate between 0 and \(1+g\) for \(\kappa <\kappa ^{**}:\)

where we have used Eqs. (A.3) and (A.16) and \(\mu _{t}\rightarrow 0\) to derive the second last equality. The last inequality holds because (A.27) holds. By (A.26) and the above expression for \(\underset{t\rightarrow \infty }{\lim }\frac{a_{t+1}}{a_{t}},\) the steady-state inflation rate satisfies

The poverty trap steady state is characterized by a system of two equations (A.16) and (A.28) for two variables \(R_{f}\) and \(\varPi \).

We modify Fig. 3 to show the existence of a unique solution denoted by \( \varPi ^{p}\) and \(R_{f}^{p}.\) Now the horizontal axis shows the real interest rate \(R_{f}/\varPi \) instead of the nominal interest rate \(R_{f}.\) The borrowing-limit curve still describes the expression on the right-hand side of equation (A.16) as a decreasing function of \(R_{f}/\varPi \). The supply curve describes the expression on the left-hand side of (A.16), which is written as a function \(R_{f}/\varPi \):

where we have used (A.28) to substitute for \(\varPi .\) We can check that the above expression increases with \(R_{f}/\varPi .\) As in the proof of Proposition 2, there is a unique intersection point between the borrowing-limit and supply curves such that (A.17) holds, which determines the equilibrium real interest rate \(R_{f}/\varPi \). Then \(\varPi ^{p}\) and \(R_{f}^{p}\) are determined.

It follows from (A.28) that \(\varPi ^{p}>\left( 1+z\right) /\left( 1+g\right) \) and \(\varPi ^{p}\) decreases with \(\kappa \) as \(\frac{\lambda \beta R_{f}/\varPi }{\beta R_{f}/\varPi -\kappa }\) increases with \(\kappa \) (see Fig. 3). Similarly, \(\underset{t\rightarrow \infty }{\lim }A_{t+1}/A_{t}\) increases with \(\kappa .\)

Next we study the local stability of the poverty trap steady state. The equilibrium system is still given by Eqs. (A.20) through (A.23). Since the steady-state values of \(n_{t}\) and \(a_{t}\) are zero, we cannot use log-linearization. Instead we use linearization in levels to derive

Substituting this equation into (19) yields

Combining Eqs. (21) and (25) yields

Linearizing around the steady state yields

Substituting this equation into (A.29), we obtain the approximate law of motion for \(a_{t}\):

We have shown earlier that

when \(\kappa \in \left( 0,\kappa ^{**}\right) .\) It follows from (A.31) that \(a_{t}\) decreases monotonically to the steady state \(a^{p}=0\) whenever it starts at any small \(a_{1}>0.\) Thus, the steady state is a saddle point. It follows from (A.30) that \(n_{t}\) also decreases monotonically to the steady state \(n^{p}=0.\) Since \(\mu _{t}=F\left( n_{t}\right) ,\)\(\mu _{t}\) also decreases monotonically to the steady state \(\mu ^{p}=0.\)

We can derive the approximate productivity growth rate around the steady state

where the second equality follows from substitution of (A.31). Since \( F^{\prime }\left( 0\right) >0\) and \(\frac{\lambda \beta R_{f}/\varPi }{\beta R_{f}/\varPi -\kappa }>0,\) the productivity growth rate increases to the steady state when \(a_{t}\) decreases to the steady state.

We log-linearize equation (A.21) to derive

where we define \(r_{ft}=R_{ft}/\varPi _{t+1}\) and

Here the second equality follows from Eq. (A.31). We then obtain the log-linearized equation

Substituting (A.24) into (A.33) yields

We now drop the quadratic term in (A.31) and write the first-order approximation to the law of motion as \(a_{t+1}=\phi _{a}a_{t},\) where \(\phi _{a}\in \left( 0,1\right) .\) Since \(r=R_{f}/\left( 1+z\right) >1\) and \( \varrho >0\) by (A.17), we iterate (A.34) forward to derive

Thus, as \(a_{t}\) decreases to the steady state, \(\hat{r}_{t}\) also decreases to the steady state and so does \(R_{ft}.\) It follows from (A.24) and \( \varrho >0\) that the real interest rate \(r_{ft}=R_{ft}/\varPi _{t+1}\) increases to the steady state when \(\hat{r}_{t}\) or \(R_{ft}\) decreases to the steady state. Finally, since

the inflation rate \(\varPi _{t}\) decreases to the steady state when \(\hat{r} _{t} \) decreases to the steady state. \(\square \)

Proof of Proposition 4

Let \(\beta ^{t}\varLambda _{t}\) and \(\beta ^{t}\varLambda _{t}q_{t}\) be the Lagrange multipliers associated with (32) and (13), respectively. The variable \(q_{t}\) represents the shadow value of the technology \(A_{t+1}.\) The first-order conditions are given by

In the steady state, we have

and

Equation (13) implies

Using the above three equations, we can derive

This equation is equivalent to Eq. (34). We can easily check that the expression on the left-hand side of the equation is an increasing function of \(\mu \) and the expression on the right-hand side is a decreasing function of \(\mu \). Given Assumption 1, it follows from the intermediate value theorem that there is a unique solution, denoted by \(\mu _\mathrm{FB}\in \left( 0,1\right) ,\) to the above equation. Then, we obtain the efficient investment level \(n_{F}=\varPhi \left( \mu _\mathrm{FB}\right) \). Plugging it into (A.35) gives \(a_\mathrm{FB}.\) The efficient consumption and production allocation is derived in the main text. \(\square \)

Proof of Proposition 5

Suppose that there is no fiscal policy. When money increments are transferred to entrepreneurs instead of savers, the saver’s consumption and portfolio choices are given by

where we assume that

so that savings and money demand are positive. Notice that the demand for money and savings depends on the nominal interest rate instead of the real interest rate. The monetary transfer is given by

where the second equality follows from (A.38).

The competitive equilibrium for a given interest rate sequence \(\left\{ R_{ft}\right\} \) under perfect credit markets can be summarized by a system of four difference equations, (18), (19), (20), and

for four sequences \(\{z_{t}\},\left\{ a_{t}\right\} ,\{\varPi _{t+1}\},\) and \(\{n_{t}\}\) such that (6) and \(R_{ft}>1+\gamma /\beta \) are satisfied. Equation (A.40) says that R&D investment is financed by the entrepreneur’s wage income, monetary transfer, and external credit.

In the steady state, the system becomes three equations (A.1), (A.2), and

for three unknowns n, z, and a, when the nominal interest rate \(R_{f}\) is set by the monetary authority. Given the efficient innovation rate \(\mu _\mathrm{FB}\), we have \(n_\mathrm{FB}=\varPhi \left( \mu _\mathrm{FB}\right) ,\) and

We now show that the monetary authority can set a specific nominal interest rate such that the efficient innovation can be implemented in a market equilibrium with a perfect credit market on the balanced growth path. Specifically, using the steady-state system, we can derive one equation for one unknown \(R_{f}\):

The expression on the right-hand side of the equation is an increasing function of \(R_{f}\). Under Assumption 2, this function takes a value lower than \(n_\mathrm{FB}\) at \(R_{f}=1+\gamma /\beta \) and a value higher than \(n_\mathrm{FB}\) when \(R_{f}\rightarrow \infty \). It follows from the intermediate value theorem that there exists a unique solution, denoted by \( \bar{R}_{f}>1+\gamma /\beta \), to the above equation. Given \(R_{f}=\bar{R} _{f},\) we can also easily show that \(n=n_\mathrm{FB}\) is the only equilibrium solution.

Once \(\bar{R}_{f}\) is determined, we can solve for the money growth rate z using (A.1):

Other equilibrium variables can also be easily determined.

Finally, we show that there exists a cutoff \(\kappa _{0}\) such that when \( \kappa \ge \kappa _{0}\) the credit constraint does not bind in the market equilibrium described above. The credit constraint is given by

where the second term in the square bracket is the monetary transfer. In the steady state, this constraint becomes

where we have used Eq. (15). The desired cutoff \(\kappa _{0}\) is defined by the following equation

The proof is completed. \(\square \)

Proof of Proposition 6

First, we show that for any given \(\mu _{t-1}\) the efficient GDP is higher than the market GDP because of the monopoly distortion. To show this result, we observe that the efficient GDP \(Y_{t}^{e}\) is given by (31). By ( 17), the equilibrium GDP in the market economy is given by

where we have substituted Eqs. (13) and (15) and the expressions for \(\zeta \) and \(\psi .\) We can easily verify that \( Y_{t}^{e}>Y_{t}.\)

To achieve the efficient GDP, the government can subsidize the final good firm’s input expenditure. Let \(\tau _{xt}(i)\) be the subsidy to input i in period t. Then the final good producer’s problem is given by

This leads to

Since \(p_{t}\left( i\right) =\chi \), it follows from (30) and ( A.42) that setting

achieves the efficient intermediate input level and final GDP \(Y_{t}^{e}\).

In this case, a successful innovator produces intermediate good \(x_{t}\left( i\right) =\alpha ^{\frac{1}{1-\alpha }}\bar{A}_{t}\) and earns monopoly profits

where \(\psi ^{*}\equiv \alpha ^{\frac{1}{1-\alpha }}(\chi -1)>\psi \). Since the final good firm earns zero profit, the real wage under the government policies is given by

The total subsidy is given by

Let \(w_{Dt}=w_{t}-T_{w}\bar{A}_{t}\) denote the after-tax wage. Since money increments are transferred to entrepreneurs instead of savers, we rederive the saver’s decision rules as

where we assume that

so that savings and money demand are positive.

The entrepreneur’s budget constraint (4) when young becomes

where \(\tau _{et}\) is the monetary transfer

The entrepreneur’s problem is to maximize his expected consumption when old:

Suppose that the credit constraint is slack. The first-order condition implies that

By the market-clearing condition for loans and Eqs. (A.46), (A.47), (A.48), and (A.49), we derive that

The three terms on the right-hand side of this equation give three sources of funds for the R&D investment: internal funds (wage), government monetary transfers, and external debt.

In the steady state, equation (A.2) still holds and (A.50) becomes

where \(\varPi =\left( 1+z\right) /\left( 1+g\right) .\) Using (15) and (A.2), we rewrite (A.51) as

where it follows from (A.43) that

is constant along a balanced growth path. The variable \(\eta \) represents the normalized after-tax wage on the balanced growth path.

By (A.48) and (A.49), the credit constraint (5) becomes

In the steady state, this constraint becomes

where we have used Eq. (A.54).

Since we do not consider government spending and government debt, the following government budget constraint must be satisfied:

where the second term represents the total subsidy to intermediate inputs. By (A.49), this constraint along a balanced growth path becomes

The steady-state competitive equilibrium under fiscal and monetary policy instruments \(\{R_{f},\tau _{x}\left( i\right) , T_{w},\tau _{N} , T_{N}\}\) consists of four equations (A.2), (A.52), (A.53), and \(\varPi =\left( 1+z\right) /\left( 1+g\right) \) for four variables n, a, z, and \(\varPi \) such that (A.56) and (A.57) hold.Footnote 11

We use (33) and \(\omega =1\) to derive the efficient consumption for the young saver

To implement this efficient consumption in a market equilibrium, we use (A.44) to set the labor income tax as

Using Eqs. (15) and (31), we derive that

on the balanced growth path. We set \(T_{N}\) such that the government budget constraint (A.57) is satisfied.

It remains to choose \(\tau _{N}\) and \(R_{f}\) such that the competitive equilibrium implies efficient production and innovation such that \(a=a_\mathrm{FB} ,\)\(n=n_\mathrm{FB},\) and \(\mu =F\left( n_\mathrm{FB}\right) \). We maintain the following assumption similar to Assumption 2 such that the efficient R&D investment cannot be self-financed by the entrepreneur’s wage income and monetary transfers and external credit are needed.

Assumption 3

Parameter values are such that \(0<\gamma <1-\beta \) and

where \(\eta _\mathrm{FB}\) is defined in (A.54) and where \(T_{w}\) is defined in (A.58) with \(\mu =\mu _\mathrm{FB}\) and \(a=a_\mathrm{FB}\).

We now set policy variables \(R_{f}^{0},\)\(\tau _{N}^{0},\)\(T_{N}^{0},\) and \( T_{w}^{0}\) such that they satisfy

As in the proof of Proposition 5, we use the intermediate value theorem to show that under Assumption 3 there exists a unique solution for \( R_{f}^{0}>1+\gamma /\beta \) to equation (A.59).

Define the cutoff \(\kappa ^{0}\) by the equation

Then, when \(\kappa \ge \kappa ^{0}\) the credit constraint does not bind on the balanced growth path.

Given the above monetary and fiscal policy variables, the steady-state system (A.2), (A.52), (A.53), and \(\varPi =\left( 1+z\right) /\left( 1+g\right) \) becomes

for four variables \(n, a, \mu ,\) and z.

We can simplify this system to one equation for n:

where

We can check that \(n=n_\mathrm{FB}\) is a solution to equation (A.63). We next show that this is only solution. Since \(F\left( n\right) \) is concave and \( F\left( 0\right) =0,\) we can show that \(F\left( n\right) /n\) decreases with n. Thus, \(\eta /n\) decreases with n or \(n/\eta \) increases with n. We also know that the expression on the right-hand side of (A.63) increases with n. Two monotonic curves can only have one intersection point if there is any. Thus, there is a unique solution \(n=n_\mathrm{FB}\) to equation (A.63).

We can then verify that the solution to the above system is given by

Since the market real interest rate \(R_{f}^{0}/\varPi =\beta \left( 1+g\right) \) is the same as the efficient rate in (35), the old saver consumption satisfies \(c_{t+1}^{o}=c_{t}^{y}\left( 1+g\right) .\) Thus, \( c_{t}^{o}=c_{t}^{y}\) on the balanced growth path. We then attain consumption efficiency by (33) with \(\omega =1\). Since the above system has a unique solution, the preceding solution is the only steady-state equilibrium that attains the efficient innovation, production, and consumption allocation. \(\square \)

Data description

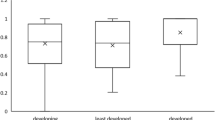

For Fig. 1, we follow Levine et al. (2000) and AHM (2005) and consider cross-sectional data on 71 countries over the period 1960–1995. As in their papers, we use private credit, defined as the value of credits by financial intermediaries to the private sector, divided by GDP, as our preferred measure of financial development. We construct this measure using the updated 2017 version of the Financial Development and Structure Database. We have also used other measures of financial development and the pattern in Fig. 1 does not change. We construct the average per capita GDP growth rates using the Penn World Table and construct the average inflation rates and the average (broad) money growth rates using the World Bank WDI database. We delete outliers with average inflation rates higher than 40%, but the pattern in Fig. 1 still holds for the full sample. The outliers are Argentina, Bolivia, Brazil, Chile, Israel, Peru, and Uruguay. The non-convergence countries used in Panel D of Fig. 1 are identified according to Table II of AHM (2005).

Rights and permissions

About this article

Cite this article

Lin, J.Y., Miao, J. & Wang, P. Convergence, financial development, and policy analysis. Econ Theory 69, 523–568 (2020). https://doi.org/10.1007/s00199-019-01181-z

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00199-019-01181-z