Abstract

High levels of trust can reduce the risk of inter-organizational relationships failing. Also, high levels of trust between business partners can be advantageous as less time and effort are spent controlling the motives and behavior of a company’s counterpart. This case study explores the management control systems between two small Norwegian salmon farming companies engaged in a joint venture. Specifically, we ask how trust influences management control in an inter-organizational relationship. We collected data by interviewing the management of the two companies constituting the joint venture and their collaborating partners throughout the value chain, resulting in two main findings. First, we find that collective values are the most critical control mechanism in managing the joint venture. As a result, other control mechanisms are toned down and become less prominent. Second, we find that a high level of trust enables management based on values. Hence, trust becomes directive for managing the joint venture. Our findings could be important for companies seeking to engage in different inter-organizational relationships. They indicate that it might benefit managers to seek out potential partners with the same fundamental values as themselves to facilitate trust-building.

Similar content being viewed by others

1 Introduction

The advent of globalization and enhanced levels of competition make many organizations acknowledge the difficulties of developing and maintaining the facilities necessary to compete successfully (Groot & Merchant, 2000; Langfield-Smith & Smith, 2003). Therefore, they engage in different kinds of inter-organizational relationships (IORs) to overcome such difficulties and seize the opportunities provided by these relationships to compete more effectively (Partanen et al., 2014). Research studies on IORs are proliferating due to their extensive dispersion in practice (Dekker, 2004). Scholars have a growing interest in understanding the managerial challenges posed by IORs (Chua & Mahama, 2007), and IORs as tools for efficiency have received increased attention in both private and public sectors (Ahlgren & Lind, 2023).

Risk is an issue for companies engaged in IORs as they are vulnerable to, among other things, opportunism (Nooteboom, 1996), in which one party strives for their own interest at the expense of others (Van der Meer-Kooistra & Vosselman, 2006). In IORs, trust is inextricably interlinked with risk (Das & Teng, 2001b). Trust is a central behavioral variable in studies of IORs (Anderson & Dekker, 2014). It is considered fundamental to collaborative success, and trust has become essential for managing IORs (Bstieler et al., 2017; Varoutsa & Scapens, 2018). Kauser and Shaw (2004) and Schumacher (2006) indicate that high levels of trust are good predictors of successful IORs. Furthermore, Balboni et al. (2017) find that trust shows a significant positive effect on alliance success. However, trust varies substantially across countries (Zak & Knack, 2001). High levels of social trust characterize Norway and the other Nordic countries, which is beneficial in a business context as it reduces costs of control (Andreasson, 2017).

Management control systems (MCS) are critical functions within most organizations (Merchant & Van der Stede, 2012) and is an increasingly popular topic in academic accounting research (Guffey & Harp, 2017). MCS are not only found within companies but also between companies engaged in IORs (Langfield-Smith & Smith, 2003). Hence quite a few scholars have been looking into the relationship between trust and control in IORs (e.g., Cäker and Siverbo, 2011; Das and Teng, 2001b; Groot and Merchant, 2000; Inkpen and Currall, 2004; Langfield-Smith and Smith, 2003; Van der Meer-Kooistra and Scapens, 2008; Varoutsa and Scapens, 2018). Trust and control are interlinked processes considered key for IORs (Costa & Bijlsma-Frankema, 2007). Two main points of view have emerged from the literature regarding the relationship between trust and control. One suggests a substitutional relationship, while the other indicates the relationship is complementary (Dekker, 2004).

Various forms of IORs have been studied, such as outsourcing (e.g., Cooper and Slagmulder, 2004; Langfield-Smith and Smith, 2003), supply chain (e.g., Free, 2008; Mouritsen et al., 2001), and joint ventures (e.g., Cäker and Siverbo, 2011; Groot and Merchant, 2000; Inkpen and Currall, 2004; Kamminga and Van der Meer-Kooistra, 2007). This paper examines two small salmon farming companies in Northern Norway that run a joint venture in the manufacturing and sales of salmon, i.e., they are engaged in an IOR. The primary motivation for this study is the governance of joint ventures and the MCS used in this specific type of IOR. We are particularly interested in the role of trust in relation to controls and how trust has developed as the joint venture relationship has matured. We draw on the three bases of trust proposed by Shapiro et al. (1992), namely deterrence-based trust, knowledge-based trust, and identification-based trust, to accentuate the different types of trust found in the studied joint venture. Furthermore, the joint venture has IORs both upstream and downstream their value chain. Hence, they are part of a network (Håkansson & Lind, 2007; Tomkins, 2001), which is of great importance as decisions made in one company propagate through the network value chain affecting collaborating partners (Chua & Mahama, 2007). Research identifies the importance of social controls such as trust and shared values in maintaining, developing, and controlling inter-organizational network relationships (Thrane & Mouritsen, 2022). The joint venture case companies in this study are located in the rural parts of Northern Norway. Also, they are both family-owned. This case study is interesting because both companies are too small to operate independently. They have therefore chosen to organize their operations as a joint venture rather than being acquired by bigger companies. We investigate the joint ventures’ MCS and their relation to trust. Our research question is: How does trust influence management control in an inter-organizational relationship?

This paper contributes to the literature in several ways. First, we find that trust develops as the relationship between the companies matures (Bstieler et al., 2017; Cäker & Siverbo, 2011; Varoutsa & Scapens, 2018). Trust in the joint venture has evolved over time and has reached the highest of the three trust-levels proposed by Shapiro et al. (1992). Further, we advocate the relationship between trust and control is dynamic (Tomkins, 2001; Van der Meer-Kooistra & Vosselman, 2006). The relationship between trust and control could be considered complementary in the earlier phases of the joint venture. However, the relationship is now considered substitutional, i.e., a high level of trust requires less use of formal controls (Das & Teng, 2001b). This aligns with findings from previous research on the relationship between trust and management control in IORs (e.g., Dekker, 2004; Tomkins, 2001; Van der Meer-Kooistra and Vosselman, 2006). However, we take a step further and nuance the picture somewhat. We argue that trust can be regarded as a “glue” that binds the various control mechanisms together. This ensures that the joint venture can be governed based on collective values, i.e., social controls, while other control elements, i.e., formal controls, can be toned down and become less influential. We further add to previous studies (e.g., Balboni et al., 2017; Kauser and Shaw, 2004; Schumacher, 2006) confirming that companies that have managed to build high levels of trust between them are associated with successful IORs. Also, we find that the joint venture’s relationships, both upstream and downstream of the value chain network, are primarily based on mutual trust and informal agreements rather than formal controls and arrangements. These findings support earlier studies, e.g., Williams (2005). Finally, we propose that the three bases for trust proposed by Shapiro et al. (1992) can be a helpful tool for describing how the relationship between trust and control changes as IORs mature.

The remainder of this paper is organized as follows. First, we present the theoretical underpinning. Then, we describe the empirical setting and the research method applied. Next, the empirical findings are presented and discussed. Finally, this study concludes with implications and suggestions for future research.

2 Theoretical underpinning

2.1 Management control systems and inter-organizational relationships

Management control, according to Otley (2014, p. 1), “is about the process of steering organizations through the environments in which they operate to achieve both short-term and longer-term goals.” Until the 21st century, management control and management accounting research mainly concentrated on relationships within organizations (Dekker, 2016; Van der Meer-Kooistra & Vosselman, 2000). Since the 1990s, the number of companies collaborating, i.e., engaging in IORs, has been increasing (Tomkins, 2001; Van der Meer-Kooistra & Kamminga, 2010). In the mid-1990s, several scholars emphasized the importance of extending the accounting domain so that it would also apply outside the boundaries of a company (Håkansson et al., 2010). Hopwood (1996) and Otley et al. (1995) are examples of strongly influential contributions in this regard. As a result, there has been growing interest in research on accounting and control across company boundaries (Cäker & Siverbo, 2011). Research on management control in IORs shows greater emphasis on controls such as behavior controls and social controls rather than outcome controls (Håkansson et al., 2010). According to Thrane and Mouritsen (2022, p. 238) “Shared values and trust can replace formal types of controls and safeguards as these are more effective in building relational advantages.”

A joint venture is a well-known form of IOR (Van der Meer-Kooistra & Kamminga, 2010). Joint venture relationships can provide companies with several benefits. The companies engaged can share their knowledge and expertise. They can use each other’s production and sales infrastructure, as well as business and institutional networks. Important benefits are also sharing costs and risk reduction, as well as increased production capacity and economies of scale (Kamminga & Van der Meer-Kooistra, 2007; Van der Meer-Kooistra & Kamminga, 2010). Hence, a primary motivation for companies to engage in joint venture relationships is to create value by combining previously separate resources and capabilities as they become more valuable when used together (Doz & Hamel, 1998).

IORs can be particularly helpful for small and medium-sized enterprises (SMEs) (Franco & Haase, 2015), as SMEs may have significant limits related to their dimension (Agostini & Nosella, 2019). By engaging in IORs, SMEs can be more effective and compete with larger organizations, allowing them to expand their resources and capabilities (Lefebvre et al., 2014; O’Dwyer et al., 2011). However, IORs are associated with high risk, and research shows considerable instability and high failure rates (Das & Teng, 2000). Many aspects cause risk, including the potential for opportunistic exploitation of the dependent relationship between partners (Ahlgren & Lind, 2023; Langfield-Smith & Smith, 2003). Definitions of IOR failure vary, but research indicates that an important reason why approximately two out of three alliances fail is how IOR risk is controlled and managed (Chua & Mahama, 2007). Empirical studies have emphasized the formal mechanisms of control. However, their association with informal controls is found in the analysis of many studies (Anderson & Dekker, 2014). Partner selection for engaging in an IOR is a primary form of informal control and is related critically to the notion of exchange hazards and transaction costs (Anderson & Dekker, 2014; Desai, 2023). An example of a critical partner selection criteria is geographic proximity (Ben Letaifa & Rabeau, 2013; Desai, 2023). Further, when studying MCS in IORs, trust is an essential behavioral control mechanism (Anderson & Dekker, 2014). Once companies enter an IOR, trust becomes a vital managing tool (Varoutsa & Scapens, 2018).

2.2 Trust in inter-organizational relationships

According to Varoutsa and Scapens (2018), the literature provides numerous classifications and different concepts of trust. Many concepts seem to share similarities, with most definitions focusing on exposing oneself to vulnerability (Langfield-Smith, 2008). As an example, Tomkins (2001, p. 165) defines trust as the “adoption of a belief by one party in a relationship that the other party will not act against his or her interests, where this belief is held without undue doubt or suspicion and in the absence of detailed information about the actions of that other party.” Expectations are that neither party in an IOR will exploit the vulnerabilities of others (Sako & Helper, 1998) and that actions taken by one party are beneficial rather than detrimental to other parties (Child & Faulkner, 1998). As such, trust alleviates the fear that one’s partner will act opportunistically (Bradach & Eccles, 1989), enabling inter-organizational cooperation (Brattström & Bachmann, 2018).

Various claims have been made regarding the relationship between trust and control (Varoutsa & Scapens, 2018), and two main perspectives are distinguished in the literature – the substitution perspective and the complementary perspective (Dekker, 2004; Tomkins, 2001; Vélez et al., 2008; Vosselman & Van der Meer-Kooistra, 2009). The substitution perspective suggests that trust and control are inversely related. The substitution argument is founded on the premise that the emergence of trust between companies engaged in IORs “reduces behavioural uncertainty and diminishes the need for formal controls to manage partner behaviour” (Anderson & Dekker, 2014, p. 60). Discussing the relationship between trust and control in their study on joint ventures, Inkpen and Currall (2004, p. 589) stated that “At the extreme, when a firm can fully trust its partner, there may be no need to control the behavior of the joint venture entity.” An important note regarding the substitution perspective is that formal controls may be seen as a signal of low trust or even distrust if used to a greater extent than deemed necessary by one’s partner, which can damage IORs (Dekker, 2004).

In contrast, the complementary perspective relies on the premise that the relationship between trust and control is reinforcing (Varoutsa & Scapens, 2018). Because formal control mechanisms provide transparency and behavioral predictability, they can support the development of trust. “Trust in return supports joint routines, mutual understanding of objectives, needs and competencies and goal congruence, which are argued to support the development of formal controls that enable exchange partners to better manage coordination requirements and mitigate performance risks” (Anderson & Dekker, 2014, p. 60). However, Tomkins (2001) argues that conceptualizing the relationship between trust and MCS as either substitutional or complementary takes a rather static approach, which ignores that building trust is indeed a dynamic process (see also Van der Meer-Kooistra and Vosselman, 2006). Balboni et al. (2017) shed light on the debate regarding the substitutional or complementary nature of the relationship between trust and control in IORs. In their study, trust shows a significant positive effect on alliance success. Further, they find that trust moderates the impact of formal controls on alliance performance.

Trust can go through different stages (Lewicki & Bunker, 1995, 1996), and it has been emphasized that the relationship between trust and control can change as IORs mature (Tomkins, 2001). Still, previous research has adopted a somewhat static approach to exploring the relationship between trust and control (Varoutsa & Scapens, 2018). A consequence of this is limited insights into the processes concerned with trust development as IORs mature. In IORs, it is desirable to gain a certain balance between trust and control (Das & Teng, 2002). Due to the changing nature of IORs, the balance is unlikely to be static (Varoutsa & Scapens, 2018) and should be viewed as evolving (Currall & Inkpen, 2003). Hence, some scholars have taken a more dynamic approach to studying the relationship between trust and control. For example, Varoutsa and Scapens (2018) studied the IORs of a company as it restructured its supply chain within the aerospace industry, focusing on how the relationship between trust and control shifts over time, while Bstieler et al. (2017) investigated the moderating effect of relationship maturity with various trust bases in the context of university-industry research collaborations. Both studies found a shift in the relationship between trust and control as the IORs matured. Further, Mahama and Chua (2016) studied the formation and development of an outsourcing alliance in the telecom industry, mapping out the changing connections between trust and accounting, while Inkpen and Currall (2004) explored the relationship between trust and control in joint ventures and identified how these critical concepts impact joint venture processes. The results from these papers also indicate that the relationship between trust and control is not static. Studies on the relationship between MCS and trust in joint ventures have found that a high degree of trust will loosen formal control mechanisms over time (Cäker & Siverbo, 2011; Yan & Gray, 1994). Inkpen and Currall (2004) stated that companies engaged in joint ventures must balance the tradeoff between trust and control.

Previous successes, failures, and partner interactions will influence the level of trust as IORs age and mature (Inkpen & Currall, 2004). Shapiro et al. (1992) suggest three bases, or levels, of trust describing IOR development in the context of business. The first is deterrence-based trust, founded on the assurance of behavioral consistency. If someone is always trusted to do what they say they will do, behavioral uncertainty is reduced, minimizing the need to monitor behavior. Deterrence is a primary motivation for acting as promised. When the potential cost of partnership termination or high probability of retributive action outweighs the advantage of distrustful behavior, deterrence-based trust exists. The second type of trust suggested by Shapiro et al. (1992) is knowledge-based trust, established on behavioral predictability. Knowing your partner sufficiently well will make their behavior anticipatable. Rather than relying on deterrence, knowledge-based trust relies on information. Information exchange between the parties involved contributes to predictability, and predictability contributes to trust. This can be information on wants, preferences, or how to solve problems (Lewicki & Bunker, 1996). The last and highest level of trust is identification-based trust (Shapiro et al., 1992), which “assumes that one party has fully internalized the other’s preferences” (p. 371). Lewicki and Bunker (1995) state that the parties effectively understand, agree with, and endorse each other’s needs. Furthermore, they argue that this mutual understanding can develop to the point where one party can act for the other, thus permitting a party “to serve as the other’s agent and to substitute for the other” (p. 151). Without monitoring or surveillance, the other party can be confident that their business interests are both defended and protected. Many of the activities carried out in building deterrence-based and knowledge-based trust are part of the development of identification-based trust (Lewicki & Bunker, 1996). One of these activities, considered an efficient tool for increasing perceived identification, is creating the same products and goals. Proximity, or colocation, is another way to create common identification – we typically tend to identify the most with those closely located (Shapiro et al., 1992). However, Shapiro et al. (1992) state that shared values are probably the most powerful activity. If partners develop shared values and a shared sense of interdependence over time, the perfect form of trust occurs.

2.3 Inter-organizational relationships – the network perspective

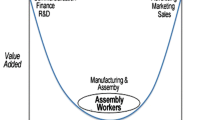

Most IOR research has focused on the dyadic relationship between two collaborating companies (Håkansson & Lind, 2007; Lind & Thrane, 2010). However, IORs can also be seen in the context of networks, where one relationship is viewed as embedded in a set of different relationships (Håkansson & Lind, 2007; Tomkins, 2001). As such, a network implies more than just a dyadic relationship. It has been argued that to fully understand dyadic relationships, attention must be given to the embedded context in which such relationships occur (Anderson et al., 1994). Some empirical papers have looked into the simultaneous handling of multiple IORs (e.g., Håkansson and Lind, 2004; Mouritsen and Thrane, 2006). This situation “adds a focal actor, which is located between a buyer and a supplier in the value chain” (Lind & Thrane, 2010, p. 64). In contrast to dyadic relationships, a network situation focuses on both upstream and downstream relationships. Hence, the focal firm (the joint venture in our study) is considered part of a relationship chain (Lind & Thrane, 2010).

From the network perspective, it is crucial to consider the effects of one’s decisions on all companies in the value chain (Shank & Govindarajan, 1993). According to Shank and Govindarajan (1993), it is not enough for companies to reduce their costs by passing them on to other members of the network value chain. It will only reduce the value chains’ competitiveness. Instead, all companies should try to reduce total value chain costs by eliminating activities that do not add value. Chua and Mahama (2007) studied the operation of accounting controls in the performance management of network IORs. There was an agreement of fixed prices for various services from the suppliers. Aiming to reduce costs over time, the focal company designed an incentive scheme with its suppliers. Quite unexpectedly, though, the suppliers increased their prices on supplementary services not included in the agreement. The focal company managed to find new suppliers to deliver these services and then made a cost reduction. However, this most likely led to unnecessary transaction costs. The results of Chua and Mahama (2007) underscore that decisions made in one company propagate through the network value chain and can negatively affect collaborating partners.

On many occasions, companies might not be in a position to manage or shape the network within which they reside, according to Tomkins (2001). Suppose an organization seeks to change the framework of its operating network. In that case, it must accomplish this by changing a sequence of bilateral alliances, even if a broader consensus for change exists. Further, Tomkins (2001) argues that most companies will already find themselves in a network. Hence, in contrast to creating something entirely new, efforts to manage the network usually require negotiating adjustments to existing business relations. Nevertheless, a certain influence over the network can be exercised to the extent that relationships can, in fact, change. According to Tomkins (2001), there are some managerial issues concerned with network design, one of which is whether a company’s portfolio of IORs is appropriate for meeting its goals. Social controls such as trust and shared values are recognized as valuable in maintaining, developing, and controlling network relationships (Thrane & Mouritsen, 2022). In the conclusion section of Williams’ (2005) study on structure and design in inter-organizational networks, he suggested that such networks are more likely to promote and sustain cooperation and objectives if they rely on mutual trust and informal agreements rather than formalized arrangements.

3 Empirical setting and research method

3.1 Empirical setting

Norway is world-leading in producing and exporting farmed salmon, and salmon farming is now the biggest export industry in Norway, alongside oil and gas (Bailey & Eggereide, 2020; Hersoug et al., 2019). The Norwegian government has indicated support for massive long-term production growth (Bailey & Eggereide, 2020; Norwegian Ministry of Trade, Industry, and Fisheries, 2014), making salmon farming important for future value creation in Norway. In Norway, the first salmon farms were established in the early 1970s. Salmon farming in Norway faces strong regulation (NOU, 2019). Starting in 1973, government-issued farming licenses were needed to establish new production of farmed salmon (Nøstbakken & Selle, 2019). Each company was restricted to owning only a single license, and license owners needed to be part of the company’s local community. The authorities wished to increase employment in rural coastal areas. Hence, farming licenses were used as a political instrument to strengthen rural coastal communities by preventing bigger centralized companies from draining earnings from these local communities (Hersoug et al., 2019; Steinset, 2017). In 1991 the Norwegian Aquaculture Act was liberalized, opening for ownership interests in multiple salmon farms simultaneously, and external ownership was allowed. Many companies then merged or were acquired by others. More than 800 smaller companies in 1991 had shrunk to approximately 120 in 2021. Most of these companies are small and located in rural coastal communities, with approximately 3 out of 4 being family owned. Salmon farmers in Norway that own fewer than 10 farming licenses are considered small companies. Medium-sized companies own 10–20 licenses, while the largest companies own more than 20 (Norwegian Ministry of Trade, Industry, and Fisheries, 2021; Nøstbakken and Selle, 2019; Steinset, 2017). Growth and development in rural communities along the Norwegian coast are deemed important, and the Norwegian government has made facilitation for attractive job opportunities and activity in such communities a priority (Norwegian Ministry of Local Government and Regional Development, 2021).

This study is based on two small fish farming companies in Northern Norway, i.e., they both own less than 10 farming licenses. Both have been farming salmon for decades. These companies were deliberately chosen because they are engaged in a typical IOR within the Norwegian salmon farming industry, i.e., a joint venture (Karlsen et al., 2019). They are family-owned, private limited companies located in two separate rural communities along the coast across the same fjord within close proximity. Both are presumably too small to operate independently. In addition to farming licenses, salmon farmers also need certified localities. Getting a locality approved for salmon farming usually requires approval from the municipality and different authorities within the sector. Hence, localities are a scarcity factor in the industry (NOU, 2019). The two companies run a joint venture to gain access to additional localities and utilize employees and equipment more efficiently. They jointly own all the salmon according to an agreed-upon allocation key specified in a contract. This key is based on the number of farming licenses owned by each company. Company 1 (C1) owns a slightly larger number of farming licenses than company 2 (C2). Hence, the companies’ sales revenue and production cost are divided accordingly. Each salmon farming license includes a maximum allowable biomass (MAB) in the sea at all times (Hersoug, 2021). Salmon farming licenses initially have a standard MAB of 780 metric tons each. However, licenses for companies in Northern Norway have a MAB of 945 metric tons each (Norwegian Ministry of Trade, Industry, and Fisheries, 2014).

Most of the employees are employed in the joint venture, which currently has an employed labor force of 30–40 people. Since both companies are family-owned, both managers and the board of directors are mainly members from the respective families. Furthermore, the joint venture manager is from C1, while the joint venture board of directors consists of members from C1 and C2. Another point specified in the beforementioned contract relates to how different areas of responsibility are to be shared between the companies. For example, the contract states that C1 does most of the procurement for the on-sea operations, whereas C2 takes care of salmon sales and freight logistics. Over the past few years, the total sales revenue of salmon from the joint venture has amounted to tens of millions of euros per year. C1 and C2 both invest in their respective local communities. They are involved and contribute to developing companies upstream and downstream of their value chain, with an ownership interest in both the hatchery and the harvesting plant, where they are minority and majority shareholders, respectively. In sum, this results in many jobs and fruitful opportunities within the rural communities where they are located. In addition to the previously mentioned content of the contract, the contract also contains information on the distribution of jobs between the respective municipalities of the salmon farmers’ locations. Registering the joint venture in a different municipality than the harvesting plant’s location (where they are majority shareholders) ensures that value creation and income tax are distributed between several Norwegian municipalities.

The companies engaged in the joint venture have had IORs with the same hatchery and harvesting plant for a long time. They provide smolt (juvenile salmon) and process salmon, respectively. Both the hatchery’s and the harvesting plant’s locations are close to C1 and C2. The joint venture is the primary customer at the hatchery, and the harvesting plant receives most of its raw material (farmed salmon) from the joint venture. The joint venture relationship between C1 and C2 is the main focus of this study. However, the relationships with the hatchery and the harvesting plant are part of the joint venture’s value chain network. The joint venture is the focal actor with IORs upstream and downstream of its value chain. Hence, the joint venture’s value chain network is also part of the study.

3.2 Research approach and methods

We analyzed more than one sub-unit and used an embedded case study (Yin, 2017) to investigate the joint ventures’ MCS in relation to trust. Data were gathered through semi-structural interviews conducted by the researchers with the management in the two companies constituting the joint venture, as well as collaborating partners both upstream and downstream their value chain – the hatchery and harvesting plant, respectively. Two group interviews were conducted, as well as two one-on-one interviews. All informants explicitly agreed to partake in this study and participated voluntarily. An interview guide was developed before the interviews. First, group interviews were conducted with the CEOs and members of the board of directors in C1 and C2. In one group interview, the CEO and one board member from C1 were interviewed. In the other group interview, the CEO and two board members were interviewed from C2. Both group interviews were conducted in 2021 at the respective companies’ headquarters and lasted approximately two hours. Each group interview was conducted by two of the authors. To secure detailed and accurate historical data, at least one of the informants in both group interviews was somehow involved in establishing the companies. Furthermore, the hatchery and harvesting plant CEOs were interviewed as part of this study to understand better the value chain and their relationship with the two companies engaged in the joint venture. These interviews were conducted in 2021 as one-on-one interviews by one author at the respective companies’ headquarters. Both one-on-one interviews lasted approximately one hour. Every informant in this study had been in managing positions in their respective companies for many years, some even from the establishment of the companies.

We avoided asking leading questions in the interviews and included follow-up questions on vital topics and questions to ensure reliability. The interview guide was structured around the main topics of the study. All interviews were recorded using voice recorders and transcribed before being sent to the informants for validation. All informants provided written consent for us to record the interviews. The interviewees conducted the interviews in Norwegian. Hence, quotations and questions are translated into English. When the informants had validated the transcribed interviews, we, the authors, read through them and discussed the information they had given us. We used the data analysis computer software NVivo by QSR International to organize and categorize all the transcribed interviews. The data were categorized based on the theoretical underpinning. Further, we created several sub-categories for each of the main categories. Then, we thoroughly analyzed the data. The interviews were compared to each other to reveal similarities and differences. In addition, we used financial statements, annual reports, and websites to prepare for the interviews to get a better picture of the companies’ operations and doing of things. After completing the interviews, we used these documents to see if revenue and production costs were distributed according to the allocation key provided by the informants. As mentioned, the allocation key is based on each company’s number of farming licenses. The research project was approved by the Norwegian Centre for Research Data.

4 Empirical findings

4.1 Motives underpinning the inter-organizational relationship

The informants from C1 and C2 agreed that the primary motivation to form a joint venture relationship was access to localities for farming salmon, as both companies had too few localities for an efficient operation individually. This is related to governmental regulations stating that salmon farmers must separate different generations of salmon. Fallow time must also be taken into consideration to reduce the environmental footprint. Hence, there is a need for multiple localities to reduce downtime in their production, as the smolt is placed into the sea at certain time intervals at different localities. Using the pooled localities enables more continuous operations. Informant 1 from C1 said:

That is, in fact, the utility value of it. If we could share our localities, we would have a better regiment for putting new generations of salmon into the sea.

Furthermore, informant 1 from C2 commented:

So, to operate as a small company, we had to look for others in the same situation within close proximity because we are relatively small. So that was the motivation behind it. In fact, it was a necessity.

The joint venture relationship enables scale economies through a better operational structure. However, the informants pointed out they are still looking for even more localities to increase their production levels. Informant 1 from C2 commented on the matter:

In order to increase the production level to where we want to be, we need more localities. We have applied to start production at a couple of new localities, but these application processes take a very long time.

Another motivational factor for C1 and C2 to run a joint venture was the importance of retaining local ownership. Discussing why they wish to keep local ownership, informant 1 from C1 stated:

Because we see that it provides more jobs, it makes people settle in rural communities, and that is what we want, we seek to provide for activity and settling in rural communities in this part of the country. Of course, we could sell our companies [to larger non-local actors] and live well off the profits, but then many jobs would disappear.

Local ownership and job opportunities are important throughout the whole value chain, which was emphasized by the informant from the hatchery, who noted:

We are local patriots like the other companies here [C1 and C2]. Hence, we want to create job opportunities in these rural communities.

The informant from the hatchery further said that for the time being, they had deliberately chosen to be an “old-fashioned harvesting plant” with limited automation in their production. Hence, they do not replace people with machines, even if it would most likely be more profitable.

Other advantages are also attained from the joint venture structure. Although C1 and C2 have similar mindsets regarding farming salmon, both companies bring different kinds of experience and knowledge into the joint venture. Informant 2 from C1 said that:

[…] we are two family-owned companies with quite a similar mindset.

Informant 1 from C1 continued:

But at the same time, the competence we possess is quite different. We complement each other, which I see as a strength.

For example, C1 has brought innovative solutions to life regarding farming equipment over the years, while C2 has been quite knowledgeable on fish biology. Hence, C1 and C2 bring complementary experience and knowledge into the joint venture.

Although C1 and C2 eventually agreed on the contractual content of the joint venture, there were some challenges along the way. Through initial talks, the companies had drawn up a plan for how operations were to be carried out. The management of both companies then met at a hotel in a nearby town to formalize the new, collaborating relationship. Informant 2 from C2 summarized the meeting and its aftermath as follows:

[…] within five minutes, we disagreed so much that a collaboration did not seem to be happening, and we went our separate ways. But you know, then some time passed, we started to talk again, and then […] we started production of our first jointly owned salmon.

Another example the informants in both companies brought forward was disagreements in the start-up phase of the joint venture related to the growth rate. According to the C2 informants, C1 wanted to grow much faster than C2, which has apparently been slightly more risk averse than C1 in the past. However, they quickly agreed on a more aligned growth strategy.

Further, the informants in C2 highlighted a suggestive incident that created considerable friction a few years back. Most C1 owners suddenly decided they wanted to sell when a larger company showed interest. This immediately created a slightly chaotic atmosphere in C2, as a sale is challenging for several reasons. The most imminent was that the two companies jointly own all the fish that are already in the sea at their pooled localities. If C1 decided to sell, C2 would be left owning salmon with strangers. Also, C2 was concerned about whether continuing its current operations would be possible with a new partner. To protect themselves against the risk of being “forced” into an IOR with strangers, C2 quickly chose to sell their salmon already in production to C1. However, the offer to buy the company was subsequently turned down, and C1 convinced C2 that C1 was not for sale and should remain family-owned for the unforeseeable future. Hence, there have been some challenges for the two companies, especially at the earlier stages of their relationship. Informant 3 from C2 said:

Those first years of working together… It was not easy, and it was not without a hitch. It was a lot of things, like how things should be managed and operated […].

Despite these challenges, the informants from both companies clearly expressed that they are now fully invested in the joint venture. They want to ensure local ownership in the future. The informants from C1 and C2 said there will probably always be some minor disagreements between the companies on how to run the joint venture in the future, but it is important to work these out and quickly find a solution to move forward. All informants agreed the joint venture structure has mainly been favorable and running smoothly without too much disagreement. They further agreed that the companies have mostly found reasonable solutions to their challenges. Still, it has required a certain amount of tolerance and the ability to compromise on some issues.

4.2 Organizational structure and value chain

The organizational structure in the joint venture is rather flat, and job titles are somewhat diffuse. Titles are assigned founded on what is most practical at any given time. The informants seem less concerned with titles and more focused on everybody’s voices and opinions being heard. When asked what they think about the inter-organizational structure and the chosen way of governance in the joint venture, informant 1 from C1 responded:

For us, it is functional. So, we hope to keep it this way because we have found a way of working that fits the joint venture well […]. In fact, the organizational structure is based on how we figure it will be the most productive, economically efficient, and practical. And that is the template we use to build our organizational structure.

The companies have found a structure that works well for them. All informants work closely together. In a sense, they are each other’s bosses. There are primarily informal relationships in the joint venture. The same goes for the joint venture’s relations through the value chain. At both the hatchery and harvesting plant, the informants confirm that their relationship with C1 and C2 in the joint venture is rather casual. Although the relationships and work practices are primarily informal, there is still a rigid set of laws and regulations to consider. Reporting obligations to the authorities are due regularly. Furthermore, even if most of the daily business and duties are based on informal transactions, the motivation and objectives for running a joint venture, as well as the allocation key for cost and revenue, are regulated by written contracts. Formal contracts are also in place with both the hatchery and the harvesting plant. These contracts contain, among other things, information on the overall purpose of the collaboration. Further, the contract with the hatchery includes, e.g., clauses specifying pre-order intervals and to what extent the joint venture shall be prioritized if there is a situation with limited access to smolt. However, according to the hatchery and harvesting plant informants, the day-to-day interactions between the companies are highly informal and trust-based without formal controls.

The informants from the joint venture pointed out that they not only focus on their operations. They are co-owners of both the hatchery and the harvesting plant. Hence, it is in their interest that these companies are well-managed and profitable. Moreover, these co-ownerships also ensure the joint venture has better control of its value chain. The informant from the hatchery believes that, in general, it can be a little challenging for the entire value chain that the salmon farmers have significantly higher profits than the rest. Discussing this topic, the informant from the hatchery said:

So you could say that it has been a challenge within the entire value chain… That the salmon farmers make such big profits, while all subcontractors have a… Well, a somewhat limited profit in comparison. In value chains where the salmon farmers are majority shareholders in the hatcheries, the hatcheries tend to suffer because production mainly depends on the owners’ needs and demand. However, this does not lead to full utilization of the hatcheries’ facilities as they are not adjusting production to meet market demand. Hence, minority shareholders are left as a low-priority balancing item, so to speak… And that has been a major focus area for me when they [C1 and C2] came in as minority shareholders a little while back. This company should be managed as a proper business and not suffer because the co-owners only want us to tune our production to their demand.

The informant from the hatchery underlines that they do not suspect that C1 and C2 would have used a potential majority shareholder position to make decisions that could have negative consequences for the hatchery, as it is “not in their DNA”. The informant at the harvesting plant, where C1 and C2 are majority shareholders, corroborates this. According to the harvesting plant informant, C1 and C2 pay a reasonable price for harvesting and processing, perhaps even above market price. When asked whether it had been discussed to sell all shares to the joint venture, the informant from the harvesting plant said:

Yes, the topic has been discussed. But I understand that they [C1 and C2] are satisfied with how things are. Both C1 and C2 have made it a priority to look after the minority shareholders and make sure they do not feel pressured into anything.

The minority shareholders are all locals, and the joint venture sees it as contributing to their local community, ensuring that minority shareholders can continue to be owners and invest in the harvesting plant. Hence, C1 and C2 do not want to force them out.

The informants from the hatchery and the harvesting plant underscore that C1 and C2 both understand that they cannot succeed in salmon farming without their value chain partners. However, it is not only the salmon farmers who are concerned with the value chain relationships. When asked about interdependencies in the value chain, the informant from the hatchery commented:

Let us say something goes wrong at our facilities. If we cannot deliver as promised, then there will be consequences for the salmon farmers who cannot start the farming process. This, in turn, becomes a problem for the harvesting plant, which will not have any raw material [farmed salmon]. Therefore it is crucial that we can deliver as promised.

The informant from the harvesting plant is also aware of their place in the value chain:

I feel that we are very important in this value chain because the fish must be harvested and processed.

The informant said that if they must shut down operations for some reason, this is initially affecting the salmon farmers who need someone to process their fish. But it will, in turn, also affect the hatchery, as the salmon farmers will not buy smolt to start production if the salmon cannot be processed. The informants from the hatchery and the harvesting plant underlined that the examples were somewhat exaggerated, as finding other alternatives in the market is possible. However, their points remain valid, namely that it is important to focus on the entire value chain, not just your company.

4.3 Formal management control mechanisms

Regarding formal management controls, C1 and C2 in the joint venture are mainly concerned with costs and production planning. This is primarily based on their own experience through many years in the business. Since the salmon is sold weekly in the spot market, it is not easy to budget for income, as it can fluctuate substantially. When asked if they use any specific economic- or production planning systems, informant 1 from C2 answered:

We have our licensed biomass that directs and control how much we can produce. And then, it is our job to utilize this most efficiently every year by doing several things. And to be able to do this, we must invest in the proper production factors to produce the salmon […] But I do not have a pretty name for the system we use.

Several informants talk about how they both use and do not use budgets. They use cost budgets in the joint venture. In C1 and C2, on the other hand, they do not necessarily use them to the same degree. Informant 2 from C2 said:

When it comes to budgets… I know what you are asking. So, budgets and things like that… If we go back a few years, we did a lot of calculations, or at least I did. But […] Now, I have more of an intuition regarding these things.

For the salmon farmers engaged in the joint venture, much is based on experience. They seem to have good knowledge regarding their liquidity needs. The informants from C1 and C2 agree on having a solid economic backbone. C1 and C2 have restrictive dividend policies, and most profits are kept in the companies for reinvestments and buffers for potentially rainy days. Informant 2 in C1 said:

[…] it has always been the case that we have had something inherent saying we should have progression and growth. You could say that we have been trained from the start that growth must be built brick by brick. Actually, we have only gone to the bank once and borrowed a lot of money.

They borrowed money to buy two new salmon farming licenses in the case referred to. But apart from this, there has been no need to borrow large amounts of money as both companies have high equity ratios.

4.4 Cultural management controls

There is a prevailing value in the joint venture and throughout their value chain that animal welfare should be prioritized. The informants agreed that this is fundamental for everything that they do. Informant 2 from C1 pointed out that:

Absolutely nothing leads to better economic efficiency within salmon farming than good animal welfare.

Good animal welfare ensures more healthy salmon is delivered to the harvesting plant and, just as important, leads to a better quality of the fish, as salmon farmers are paid based on fish quality. One example brought forward by the informants is that they use a more expensive feed than many others, even if it is the most considerable production cost, as it leads to better animal welfare. The informant from the harvesting plant confirms that the joint venture mainly delivers high-quality salmon and has always focused on providing them with superior quality. They also focus on animal welfare and high quality upstream in the value chain at the hatchery, as high-quality salmon at the salmon farms starts with high-quality smolt. At the hatchery, the informant said:

[…] you cannot always focus on money to deliver high quality. You will have to forget about money for a minute to secure high-quality and an excellent product.

Sustainability is also an essential value. The joint venture continuously invests in available technology to reduce its environmental footprint, e.g., camera surveillance of net pens. Now they can constantly monitor and control the feed volume. Hence, they never feed more than necessary. Feed that the salmon do not eat will accumulate on the seafloor under the localities, potentially causing biological and chemical changes to the floor conditions. Asked about potential environmental footprints at their localities, informant 2 from C1 answered:

If we raise all anchors on our net pens, you will not find any trace of us, except for maybe a few monkey wrenches and stuff we have lost over the years […].

Furthermore, all the companies wish to give back to their local communities. When asked if C1 and C2 have developed shared values, informant 1 from C1 said:

[…] we have a shared fundamental idea in that we wish to produce high-quality salmon, we wish to be present in our local communities, and we wish to create interesting jobs.

C1 and C2 have deliberately chosen to divide job positions in the joint venture between the two communities where they are located. This way, they contribute to activity in two Norwegian municipalities rather than mainly in one. They also focus on creating jobs and giving back to the community through the rest of the value chain, which was emphasized by the informant at the hatchery:

[…] it makes me very happy when you can hire a person, and maybe just a year after signing a contract of employment, this person can maybe buy their own house and a new car and… To me, that feels quite good […] The people living in these rural areas really seem to appreciate that we are here.

According to all informants, values such as animal welfare and fish quality, environmental issues, and giving back to the local community are important. It’s seemingly an established culture throughout the joint venture value chain to focus on these issues.

4.5 Levels of trust

4.5.1 Deterrence-based trust

When asking the informants if they trust that the other company always makes decisions in favor of the joint venture rather than themselves, informant 1 from C1 quickly answered:

Yes! And that is fundamental. We all trust each other to work towards the same common goal.

The informants from C1 and C2 discussed the importance of not misusing or breaking trust. They ensure that they act and behave in a manner so that trust is not challenged. This leads to behavioral consistency, the foundation of deterrence-based trust (Shapiro et al., 1992). The informants’ statements made it clear that the companies are interdependent. That is, it would be challenging to exit the joint venture. In this respect, exiting the joint venture is seen as a deterrence. When asked if they would have managed to operate alone, informant 2 from C2 answered:

If the joint venture had ended now, it would be pretty challenging for sure.

Furthermore, informant 1 from C1 stated:

Today, we are entirely interdependent […], and it seems impossible to move on alone.

Using the combined localities of the companies engaged in the joint venture enables more continuous production. If the companies were to dismantle the joint venture, it would therefore be impossible to maintain the current production level. Informant 2 from C2 said:

When you look at the solitaire of localities in this fjord, we would probably not be able to be more profitable on our own because we could not put new fish in the sea every year. We would have lost certain years.

Both companies trust the other party to act in the best interest of the joint venture when making decisions, and they seem to regard formal MCS as less important. Informant 2 from C2 pointed out that:

It would not have been possible to work together for such a long period of time if trust were not present… We would have worn each other out.

Because trust is essential to keep the joint venture running, deterrence is a motivation for not challenging trust by either company. Informant 2 from C1 said:

There are many synergetic effects [from running a joint venture]. It opens for a different kind of operation as we can structure things differently. Gaining certain cost advantages is quite important for a joint venture like ours. Separately we might be small and vulnerable […].

If the joint venture were to be dismantled, it would lead to higher costs for both companies. Also, an important matter is the possibility of collaborating with other salmon farming companies if the joint venture is dismantled. The informants from both C1 and C2 say that few other companies are near C1 and C2, making it difficult to find partners within geographic proximity for a fruitful collaboration. On the topic of dismantling the joint venture, informant 2 from C2 commented:

A question is whether we can even survive on our own… We are so small alone… To achieve certain scale advantages, we must collaborate with other salmon farmers. But there are not many other options around here.

Informant 3 from the same company followed up:

We have known each other for so long through our joint venture and invested so much time and effort… It ishardto imagine that you can achieve a similar relationship with someone else….

It was also pointed out by the informants from C1 that there are no other potential collaboration partners nearby. They expressed that face-to-face interactions were essential and a crucial reason for trusting their current joint venture partner. Hence, a joint venture partner not within close proximity is not an option.

4.5.2 Knowledge-based trust

Even if the companies are trusted to make decisions on behalf of each other, they still communicate and share information daily in both a formal and informal manner. They meet in person as often as possible. Informant 1 from C1 stated:

I feel that they grant me their trust, which I really [appreciate]… But still, if there is anything that needs to be resolved, I just make a call. Basically, not a day goes by when we do not talk to each other. That is just how it is. Now that we use Teams […], there are fewer [visits in person], which is a little sad. There used to be a lot of boat trips back and forth [between the two companies’ headquarters].

According to Shapiro et al. (1992), this makes for predictable behavior upon which knowledge trust is based. If there is doubt about a decision that needs to be made, they always talk to each other. Hence, they build trust through information sharing. Knowledge-based trust relies on information, e.g., how to solve a problem, rather than deterrence (Lewicki & Bunker, 1996).

4.5.3 Identification-based trust

The members of the executive management in the joint venture all have their own individual strengths. Work tasks are assigned based on these strengths. Hence the management in C1 and C2 has different areas of responsibility. Each person can do their work without it being checked or verified by the rest. The informants agree that they trust various work tasks to be performed most effectively for the joint venture. Informant 2 from C1 explained:

We cannot all sell the same fish. That is just nonsense. So, we must trust that those given the responsibility for different work tasks will perform in the best way possible. We need to trust them.

The trust between the companies engaged in the joint venture has evolved since they started working together and has become stronger over the years. When the informants were asked if they felt that trust between the companies had grown stronger over time, informant 2 from C2 immediately answered:

It has become stronger.

Informant 3 from C2 followed up:

Yes, absolutely.

Furthermore, informant 1 from C2 commented on the same note:

They [the people in the other company] are honest and decent people.

The informants describe the trust as so strong that they can act on behalf of one another. Shapiro et al. (1992) describe this level of trust as identification-based trust. Matters such as the content of and motive for the joint venture are found in written contracts, but the informants made it clear that both companies trust the other party to have the welfare of the joint venture at heart. Furthermore, the informants from both the hatchery and the harvesting plant pointed out that trust is vital for their relationships with the joint venture. Even though written contracts are in place, the relationships are described as casual and informal.

5 Discussion and conclusion

In this paper, we have examined the collective MCS in a joint venture and the influence of trust. The research question was how trust influences management control in an inter-organizational relationship. An embedded case study has been presented, resulting in two main findings that we will discuss. First, we find that collective values are the most critical control mechanism in managing the joint venture. Other control mechanisms are toned down and become less prominent. Second, we find that a high level of trust enables management based on collective values. Hence, trust becomes directive in managing the joint venture and its value chain relationships.

5.1 Management based on collective values

The MCS in the joint venture relationship we study includes plans and projections. It also includes management controls in the form of budgets, at least to a certain degree. Sold salmon are graded on quality, and the joint venture strives to produce the highest quality grade. Furthermore, the joint venture has specific policies and procedures to follow (e.g., reporting obligations to the authorities). It has established a board of directors and chosen a particular organizational and governance structure. There are also social (cultural) controls influencing behavior which are derived from shared norms, values, and beliefs (Cäker & Siverbo, 2011; Langfield-Smith, 2008). The two companies constituting the joint venture have the same fundamental ideas, or core values, regarding how salmon shall be farmed. That is, they wish to manufacture salmon of premium quality while maintaining local ownership. At the same time, they protect and create job opportunities and wealth creation in the rural communities where they are located. Other core values are sustainability and animal welfare, which are both prerequisites for their salmon farming operations.

These values appear crucial in managing the joint venture, while other management control mechanisms are seemingly toned down. For example, management controls like budgets become less prominent, and furthermore, the governance structure is somewhat absent in the sense that “everyone is each other’s bosses.” Previous studies (e.g., Langfield-Smith, 2008) have shown that cultural controls are essential to MCS in IORs. Management based on values, which can be viewed as a cultural control mechanism, has seemingly been successful for the joint venture. But how can a joint venture be managed based mainly on values, with a modest focus on formal management controls? The most obvious explanation is that neither company experience any risk at all that the other company will act deceitfully, i.e., they do not have to worry about opportunistic behavior. As a result, they can focus on managing the joint venture according to their core values rather than spending valuable resources on behavioral management controls. The two companies can steer the joint venture this way due to one essential factor – a strong and mature relationship of trust built on years of learning and adaption. As such, trust has become the “glue” binding the various control systems together.

5.2 Trust – a necessity in inter-organizational management control

The relationship between the two companies engaged in the joint venture is characterized by honesty and openness, and they have managed to develop and maintain a high level of trust. In line with previous research (Bstieler et al., 2017; Inkpen & Currall, 2004; Varoutsa & Scapens, 2018), the level of trust has not been static. Instead, trust has evolved and become stronger as the IOR has matured. From the start of the relationship, there has been deterrence-based trust, the lowest level of trust according to Shapiro et al. (1992). The deterrence in this respect would be dismantling the joint venture, which will arguably be challenging for C1 and C2. To enable the production of a similar scale and scope as today while retaining local ownership, both companies depend on collaborating partners within close proximity. However, finding a new collaborating partner is not necessarily easy, if even possible. Firstly, there is no guarantee that collaborations with new partners will be successful. It is a known fact that many partnerships fail (Chua & Mahama, 2007). Secondly, there may be no collaborating options. The very few companies within the immediate vicinity are already involved in joint ventures. Or, they are large-scale companies for whom engaging in joint ventures is not interesting. Fittingly, Das and Teng (2001a, p. 19) stated that “joint ventures by their very nature imply very high exit costs.” This is why choosing the “right” partner is considered important to reduce inter-organizational risks (Anderson & Dekker, 2014) and is further deemed essential to the success of IORs (Hitt et al., 2000). An important partner selection criterion is geographical proximity (Desai, 2023). Hence, dismantling the joint venture will presumably be challenging, as prospects for new collaborating partners within close proximity are low.

Knowledge-based trust has also been present for a long time, as trust between the two companies is built on communication and information sharing. Frequent communication and exchange of information build trust as it enhances the transparency of each other’s behavior, i.e., it makes their behavior predictable (Lane & Lubatkin, 1998; Shapiro et al., 1992). Knowledge-based trust is the second-highest level of trust (Shapiro et al., 1992). After decades of running a joint venture, the trust can now be described as what Shapiro et al. (1992) refers to as identification-based trust, which on their “scale” is the highest level. Reaching this level of trust indicates that the two companies are both heavily invested in the relationship, as the investments required to engender identification-based trust are greater than those necessary for lower levels of trust (Shapiro et al., 1992). An interesting question is how the two companies have transitioned into the highest level of trust.

We argue that the answer is identification, created by specific activities – or criteria – according to Shapiro et al. (1992). The first, probably most obvious, is making the same product, i.e., farmed salmon. Geographical proximity is another. But the most powerful is the two companies’ shared, or core, values. We suggest that the same core values essential for managing the joint venture also play a big part in the trust-building process. An essential benefit of identification-based trust highlighted by Shapiro et al. (1992) is that it enables C1 and C2 to act independently. Both fully trust each other to make decisions favoring the joint venture. High levels of trust provide autonomy for the respective companies to decide what works best (Das & Teng, 2001b). Further, it makes for quick and easy decision-making (Shapiro et al., 1992). It was pointed out by Groot and Merchant (2000, p. 580) that “a lack of trust between partners sometimes leads to more complex and, hence, destructively slow decision-making processes.”

In addition to obtaining the highest level of trust, it is desirable to make it last. As knowledge and identification of each other develop with time, the two companies not only know and identify with each other but also understand what they must do to sustain each other’s trust (Lewicki & Bunker, 1996). The absence of perceived risk regarding opportunistic behavior is seemingly due to the presence of identification-based trust. This is in accordance with previous research, where it has been found that high levels of trust could reduce the possibility of opportunistic behavior (Langfield-Smith & Smith, 2003). Inkpen and Currall (2004, p. 595) stated: “With the growth of trust there is an increasing willingness to accept risk and to increase commitment to the joint venture. As a firm gets to know its joint venture partner, it will adjust its assessment of the partner’s trustworthiness.” In this scenario, the risk of opportunistic behavior is mitigated (Das & Teng, 2000), and trust becomes directive for the joint venture’s MCS. Our study supports previous research that trust may substitute formal controls by reducing behavioral uncertainty (e.g., Cäker and Siverbo, 2011; Groot and Merchant, 2000; Langfield-Smith, 2008).

It was argued by Tomkins (2001) that the relationship between trust and control is not static, i.e., the relationship is not necessarily either substitutional or complimentary throughout the collaboration’s lifespan. Although we argue that the relationship can now be considered substitutional due to high levels of trust, it has not always been of substitutive character. Because trust has increased as the joint venture has matured, it is reasonable to assume that the relationship between trust and control could, to a greater extent, be perceived as complementary in the earlier phases of the relationship. Formal controls can provide transparency and behavioral predictability (Anderson & Dekker, 2014). As already argued, this can also be achieved through frequent communication and information exchange, laying the foundation for knowledge-based trust (Lane & Lubatkin, 1998; Shapiro et al., 1992). Hence, formal controls can support the development of trust, i.e., the relationship is complimentary. In our study, we advocate a dynamic relationship between trust and control, which support Tomkins’ (2001) arguments on this matter. Similar arguments were also made by Van der Meer-Kooistra and Vosselman (2006).

C1 and C2 must also consider the joint venture’s role in a larger network. The joint venture is the focal company in the value chain which, in addition to themselves, includes the hatchery and harvesting plant. C1 and C2 have been majority shareholders in the harvesting plant for a long time. Also, they recently took a position as minority shareholders in the hatchery. This way, they have acquired complete control downstream in the value chain and gained more control upstream. A point made by Chua and Mahama (2007) was that events and decisions in one company propagate through the value chain. We find a prominent example of this point in our network. Because although the studied joint venture was mainly motivated by pooled localities, they are still not producing at their maximum licensed capacity as even more localities are needed. This spreads to both the hatchery and the harvesting plant. The hatchery operates at a lower production level than desired, and the harvesting plant must shut down for two months each year. Both these issues will be solved if the joint venture acquires more localities. However, in our case, the joint venture tries to impact the network positively by acquiring more localities. Thus, operational decisions made in the joint venture are of great importance for the entire network. This was emphasized by Shank and Govindarajan (1993), who stated that it was essential to consider the effect of one’s decisions on all the companies in the value chain.

There are written contracts between C1 and C2 laying out the content of, and the motive for, the joint venture. Similarly, written contracts are also in place between the joint venture and the hatchery and harvesting plant, respectively. However, contracts rarely cover all possible aspects and situations, leaving partners to rely on trust (Langfield-Smith, 2008). Even though written contracts explain the intentions of the studied joint venture and its collaborating relationships, all these IORs are mainly trust-based and informal. Informal understandings based on trust may prove more powerful than written contracts in assuring successful IORs (Adobor, 2005). Trust has led to a successful joint venture and collaborations with the hatchery and harvesting plant. This aligns with findings from previous research, which indicate that high levels of trust are associated with successful IORs (Balboni et al., 2017; Kauser & Shaw, 2004; Schumacher, 2006; Solesvik & Westhead, 2010). Further, Williams (2005) concluded that networks are more likely to promote and sustain cooperation and objectives if the companies rely more on informal agreements and mutual trust than formalized arrangements, i.e., contracts.

5.3 Conclusion

The relationship between trust and control is complex (Van der Meer-Kooistra & Vosselman, 2006). Varoutsa and Scapens (2018) investigated the relationship between trust and control in the governance of IORs and stated that findings from previous studies are ambiguous. Two main perspectives on the relationship between trust and control are distinguished in the literature – the substitution and complementary perspectives (Das & Teng, 2001b). The relationship is now substitutional in the joint venture studied in this paper. However, we advocate the relationship to be of a dynamic character (Tomkins, 2001; Van der Meer-Kooistra & Vosselman, 2006). Hence, the relationship between trust and control was complementary in the earlier phases of the joint venture. As discussed, a high level of trust in the joint venture relationship mitigates the need for formal management controls (Cäker & Siverbo, 2011; Groot & Merchant, 2000; Langfield-Smith, 2008). Further, this does not apply exclusively to the dyadic relationship between C1 and C2. It also applies to the IORs upstream and downstream of their value chain (Williams, 2005). Groot and Merchant (2000) stated that trust is probably an important factor explaining a significant proportion of the variance in partners’ control tightness and breadth of control focus. However, they do not find trust to be a dominant factor. This is quite the opposite of our findings, which indicate that trust is highly prevalent.

We have found that trust considerably impacts MCS in IORs, and this study thus has several contributions. Aligned with previous research, we find that trust develops as IORs mature (Bstieler et al., 2017; Cäker & Siverbo, 2011; Varoutsa & Scapens, 2018). Our study shows that trust is an important aspect of management control in a collaborative setting, as trust becomes directive for the governance of the IORs. That is, the level of inter-organizational trust influences the use of formal management controls (see, e.g., Dekker, 2004; Tomkins, 2001; Van der Meer-Kooistra and Vosselman, 2006). The results indicate that trust enables management based mainly on collective values, i.e., informal controls because trust reduces the perceived risk of opportunistic behavior.

Furthermore, we add to previous literature on the role of trust in collaborative settings (e.g., Balboni et al., 2017; Kauser and Shaw, 2004; Schumacher, 2006), confirming that companies able to build and maintain high levels of trust between them are more likely to have successful IORs. Langfield-Smith (2008) examined MCS by focusing on the start-up and early stages of an IOR. Her paper shows that cultural control is an important part of MCS in an inter-organizational context. We find this in our study of the joint venture as well, as values are considered a cultural control, though with the notable difference that we investigate a mature relationship. Langfield-Smith (2008) emphasized that future research could look into the life cycle stages of IORs other than the start-up phase. In this regard, we contribute to the literature as we do not exclusively study the early stages of the joint venture relationship.

Also, we find that it is crucial for the joint venture to acknowledge that they are part of a business network. In line with previous research (Thrane & Mouritsen, 2022; Williams, 2005), we state that trust between all network members is vital for network success. Finally, we contribute towards increasing the knowledge on management and control systems within salmon farming companies.

Our findings could be important for companies seeking to engage in joint ventures or other IORs. A practical implication is that it can benefit company management to seek potential partners who share the same fundamental or core values, i.e., focus on partner selection criteria. This facilitates trust-building and enables management based on collective values, while formal management control mechanisms become less prominent. An important partner selection criterion is geographical proximity (Desai, 2023), which is also an important criterion for trust (Shapiro et al., 1992). One critical activity in IORs is strengthening and maintaining trust (Baldvinsdottir, 2013). To manage this, companies must be somewhat adaptable. High levels of trust can be advantageous as less time and effort are used for controlling the motives and behavior of a company’s counterpart and value chain (Tomkins, 2001), and more can be spent on value-creating activities. Hence, the risk of relationship failure can be reduced, and more value is potentially generated through a strong focus on the critical success factor of trust (Hoffmann & Schlosser, 2001; Shapiro et al., 1992). Finally, we propose that the three bases for trust proposed by Shapiro et al. (1992) can help describe how the relationship between trust and control changes as inter-organizational relationships mature.

This paper studies a joint venture involving two small salmon farming companies. Future research could detect if management control systems in joint ventures differ when larger salmon farming companies are involved. Will trust be less critical while other management control mechanisms appear more prominent? In addition, the companies examined in this paper operate in Norway, where trust generally is considered high (Andreasson, 2017), and trustworthy behavior can be expected (Delhey & Newton, 2005). An interesting matter for future research would be to examine the role of trust within similar IORs in countries with lower levels of general trust.

Data Availability

Due to agreements made with the informants, the data used to support this study’s findings are unavailable.

References

Adobor, H. (2005). Trust as sensemaking: The microdynamics of trust in interfirm alliances. Journal of Business Research, 58(3), 330–337. https://doi.org/10.1016/S0148-2963(03)00077-8.

Agostini, L., & Nosella, A. (2019). Inter-organizational relationships involving SMEs: A bibliographic investigation into the state of the art. Long Range Planning, 52(1), 1–31. https://doi.org/10.1016/j.lrp.2017.12.003.

Ahlgren, P. C., & Lind, J. (2023). The nordic research on accounting in inter-organizational relationships – the foundations of a microprocessual research approach to classical issues. Journal of Accounting & Organizational Change, 19(1), 115–141. https://doi.org/10.1108/JAOC-09-2021-0136.

Anderson, S. W., & Dekker, H. C. (2014). From make-or-buy to coordinating collaboration: Management Control in Strategic Alliances. In D. Otley, & K. Soin (Eds.), Management control and uncertainty. Palgrave Macmillan.

Anderson, J. C., Håkansson, H., & Johanson, J. (1994). Dyadic Business Relationships within a Business Network Context. Journal of Marketing, 58(4), 1–15. https://doi.org/10.1177/002224299405800401.

Andreasson, U. (2017). Trust – the Nordic Gold (2017:737 vol.). Nordic Council of Ministers.

Bailey, J. L., & Eggereide, S. S. (2020). Indicating sustainable salmon farming: The case of the new Norwegian aquaculture management scheme. Marine Policy, 117(July 2020), 103925. https://doi.org/10.1016/j.marpol.2020.103925.

Balboni, B., Marchi, G., & Vignola, M. (2017). The moderating effect of trust on formal control mechanisms in International Alliances. European Management Review, 15(4), 541–558. https://doi.org/10.1111/emre.12150.

Baldvinsdottir, G. (2013). Trust within the context of management accounting. In L. Fallan & K. Nyland (Eds.), Perspektiver på økonomistyring. Fagbokforlaget.

Ben Letaifa, S., & Rabeau, Y. (2013). Too close to collaborate? How geographic proximity could impede entrepreneurship and innovation. Journal of Business Research, 66(10), 2071–2078. https://doi.org/10.1016/j.jbusres.2013.02.033.

Bradach, J. L., & Eccles, R. G. (1989). Price, Authority, and Trust: From Ideal Types to Plural Forms. Annual Review of Sociology, 15(August 1989), 97–118. https://doi.org/10.1146/annurev.so.15.080189.000525.