Abstract

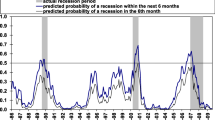

This paper presents a logit model that accurately forecasts business-cycle turning points with a lead of one-quarter. The sample period consists of an initialization subset (1959:Q3–1975:Q4), and a subset for out-of-sample forecast evaluation (1976:Q1–2005:Q4). In contrast with the record of disappointing results in the literature, the model correctly forecasts all turning points in the test subset without forecasting recessions that did not occur.

Similar content being viewed by others

References

Ahlers D, Lakonishok J (1983) A study of economists’ consensus forecasts. Manag Sci 29:1113–1125

Birchenhall CR, Jessen H, Osborn DR, Simpson P (1999) Predicting U.S. business-cycle regimes. J Bus Econ Stat 17:313–323

Burns AF, Mitchell WC (1946) Measuring business cycles. NBER, New York

Business Cycle Indicators Handbook (2000) The Conference Board, New York

Camacho M, Perez-Quiroz G (2001) This is what the U.S. leading indicators lead. J Appl Econometrics 17:61–80

Diebold FX, Glenn DR (1989) Scoring the leading indicators. J Bus 62:369–91

Diebold FX, Rudebusch GD (1991) Forecasting output with the composite leading index: a real-time analysis. J Am Stat Assoc 86:603–10

Emerson RA, Hendry DF (1996) An evaluation of forecasting using leading indicators. J Forecast 15:271–291

Estrella A, Hardouvelis G (1991) The term structure as predictor of real economic activity. J Finan 46:555–576

Estrella A, Mishkin F (1998) Predicting U.S. recessions: financial variables as leading indicators. Rev Econ Stat 80:45–61

Fels R, Hinshaw EC (1968) Forecasting and recognizing business cycle turning points. NBER, New York

Filardo AJ (1999) How reliable are recession prediction models? Economic Review, Federal Reserve Bank of Kansas City 2nd Quarter, pp 35–55

Hall R, Feldstein M, Frankel J, Gordon R, Mankiw N, Zarnowitz V (2002) The NBER’s business-cycle dating procedure. National Bureau of Economic Research

Hamilton JD, Perez-Quiroz G (1996) What do the leading indicators lead? J Bus 69:27–49

Hamilton JD, Kim DH (2002) A reexamination of the predictability of economic activity using the yield spread. J Money Credit Bank 34:340–360

Hendry DF (1995) Dynamic econometrics. Oxford University Press, Oxford

Hendry DF (2000) Econometrics alchemy or science? Oxford University Press, Oxford

Hendry DF, Krolzig HM (2001) Automatic econometric model selection using PcGets 1.0. Timberlake Consultants, London

Ivanova D, Lahiri K, Seitz F (2000) Interest rate spreads as predictors of German inflation and business cycles. Int J Forecast 16:39–58

Koch PD, Raasche RH (1988) An examination of the commerce department leading indicator approach. J Bus Econ Stat 6:167–187

Lahiri K, Moore GH (1991) Leading economic indicators: new approaches and forecasting records. Cambridge University Press, Cambridge

McNees SK (1987) Forecasting cyclical turning points: the record in the past three recessions. New England Economic Review, pp 31–40

McNees SK (1979) The forecasting record of the 1970s. New England Economic Review, pp 33–53

Moore GH (1980) Business cycles, inflation, and forecasting. National Bureau of Economic Research Studies in Business Cycles No 24, Ballinger, Cambridge, MA

Moore GH (1983) Business cycles, inflation, and forecasting, 2nd edn. Ballinger, Cambridge

Neftçi S (1982) Optimal prediction of cyclical downturns. J Econ Dyn Control 4:225–241

Stekler HO (1968) An evaluation of quarterly judgmental economic forecasts. J Bus 41:329–339

Stock JH, Watson MW (1989) New indices of leading and coincidental economic indicators. In: Blanchard O, Fisher S (eds) NBER macroeconomic annual. MIT Press, Cambridge, pp 351–394

Stock JH, Watson MW (1993) A procedure for predicting recessions with leading indicators: econometric issues and recent experience. In: Stock JH, Watson MW (eds) Business cycle indicators, and forecasting. The University of Chicago Press, Chicago, pp 95–156

Wecker WE (1979) Predicting the turning points of a time series. J Bus 52:35–50

Zarnovitz V (1967) An appraisal of short-term economic forecasts. NBER, New York

Zarnowitz V, Braun PA (1992) Twenty-two years of the NBER-ASA quarterly economic outlook surveys: aspects and comparisons of forecasting performance. NBER working paper#3965, Cambridge

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Pelàez, R.F. Ex ante forecasts of business-cycle turning points. Empirical Economics 32, 239–246 (2007). https://doi.org/10.1007/s00181-006-0083-4

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s00181-006-0083-4