Abstract

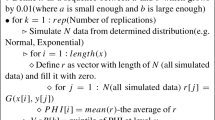

Semi-variance is a similar measure to variance, but it only considers values that are below the expected value. As important roles of semi-variance in finance, this paper proposes the concept of semi-variance for uncertain random variables. Also, a computational approach for semi-variance is provided via inverse uncertainty distribution. As an application in finance, portfolio selection problems of uncertain random returns are solved by minimizing semi-variance in mean-semi variance models. For better illustration, mean-semi variance model is compared with mean-variance one. Finally, for better understanding, some tables, figures and outputs are provided.

Similar content being viewed by others

References

Ahmadzade H, Gao R (2020) Covariance of uncertain random variables and its application to portfolio optimization. J Ambient Intell Humaniz Comput 11:2613–2624

Ahmadzade H, Gao R, Naderi H, Farahikia M (2020) Partial divergence measure of uncertain random variables and its application. Soft Comput 24:501–512

Ahmadzade H, Gao R, Dehghan MH, Sheng Y (2017) Partial entropy of uncertain random variables. J Intell Fuzzy Syst 33:105–112

Ahmadzade H, Sheng YH, Hassantabar Darzi F (2017) Some results of moments of uncertain random variables. Iran J Fuzzy Syst 14(2):1–21

Ayub U, Shah S, Abbas Q (2015) Robust analysis for downside risk in portfolio management for a volatile stock market. Econ Model 44:86–96

Chen L, Peng J, Zhang B, Rosyida I (2017) Diversified models for portfolio selection based on uncertain semivariance. Int J Syst Sci 48(3):1–12

Chen X, Kar S, Ralescu DA (2012) Cross-entropy measure of uncertain variables. Inf Sci 201:53–60

Gao JW, Yao K (2015) Some concepts and theorems of uncertain random process. Int J Intell Syst 30(1):52–65

Guo Q, Li J, Zou C, Guo Y, Yan W (2012) A class of multiperiod semi-variance portfolio for petroleum exploration and development. Int J Syst Sci 43(10):1883–1890

Hou YC (2014) Subadditivity of chance measure. J Uncertainty Anal Appl 2:Article 14

Ke H, Su TY, Ni YD (2015) Uncertain random multilevel programming with application to product control problem. Soft Comput 19(6):1739–1746

Liu B (2007) Uncertainty theory, 2nd edn. Springer, Berlin

Liu B (2009) Some research problems in uncertainty theory. J Uncertain Syst 3(1):3–10

Liu B (2009) Theory and practice of uncertain programming, 2nd edn. Springer, Berlin

Liu B (2010) Uncertainty theory: a branch of mathematics for modeling human uncertainty. Springer, Berlin

Liu B (2012) Why is there a need for uncertainty theory? J Uncertain Syst 6(1):3–10

Liu B (2013) Toward uncertain finance theory. J Uncertain Anal Appl 1:Article 1

Liu YH, Ha MH (2010) Expected value of function of uncertain variables. J Uncertain Syst 4(3):181–186

Liu YH (2013) Uncertain random variables: a mixture of uncertainty and randomness. Soft Comput 17(4):625–634

Liu YH (2013) Uncertain random programming with applications. Fuzzy Optim Decis Making 12(2):153–169

Liu YH, Ralescu DA (2014) Risk index in uncertain random risk analysis. Int J Uncertain Fuzziness Knowl Based Syst 22(4):491–504

Liu YH, Ralescu DA (2017) Value-at-risk in uncertain random risk analysis. Inf Sci 391:1–8

Markowitz H (1959) Portfolio selection: efficient diversification of investments. Wiley, New York

Mansinia R, Ogryczakb W, Speranzac M (2014) Twenty years of linear programming based portfolio optimization. Eur J Oper Res 234(2):518–535

Sheng YH, Samarjit K (2015) Some results of moments of uncertain variable through inverse uncertainty distribution. Fuzzy Optim Decis Making 14(1):57–76

Sheng Y, Shi G, Ralescu DA (2015) Entropy of uncertain random variables with application to minimum spanning tree problem. Int J Uncertain Fuzziness Knowl-Based Syst 25:1–17

Yan W, Li S (2009) Futures price modeling under exchange rate volatility and its multi-period semi-variance portfolio selection. Int J Syst Sci 40(11):1139–1148

Yao K (2015) A formula to calculate the variance of uncertain variable. Soft Comput 19(10):2947–2953

Author information

Authors and Affiliations

Contributions

Conceptualization, GC; formal analysis, HA; methodology, HA; resources, MY; software, MF; writing original draft, HA; funding acquisition, GC. All authors have read and agreed to the published version of the manuscript.

Corresponding author

Ethics declarations

Conflict of interest

The authors declare no conflict of interest.

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Cheng, G., Ahmadzade, H., Farahikia, M. et al. Uncertain random portfolio optimization via semi-variance. Int. J. Mach. Learn. & Cyber. 13, 2533–2543 (2022). https://doi.org/10.1007/s13042-022-01542-6

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s13042-022-01542-6

Keywords

- Chance theory

- Uncertain random variable

- Semi-variance

- Portfolio selection

- Monte-Carlo simulation

- Mean-semi variance model