Abstract

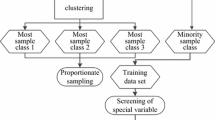

With the increasing popularity of credit, credit fraud is gradually increasing. Based on this, this paper takes use of computer technology and designs a credit fraud prediction model based on clustering analysis and integration improved support vector machine. First of all, adjust and reduce the imbalance based on K-means clustering analysis combined with more-than-half random sampling. Secondly, the idea of integrated learning was used to further deal with the imbalance of data and increase the attention of classifiers to minority classes. Finally, we tested the algorithm. The results showed that the algorithm effectively reduced the cost of accidental injury and provided a great possibility for the effective reduction of economic losses caused by credit fraud. It also provided a good theoretical basis for practical application.

Similar content being viewed by others

References

Guidi, G., Maffei, N., Vecchi, C., et al.: A support vector machine tool for adaptive tomotherapy treatments: prediction of head and neck patients criticalities. Phys. Med. 31(5), 442–451 (2015)

Tomar, D., Agarwal, S.: Twin support vector machine: a review from 2007 to 2014. Egyp. Inform. J. 16(1), 55–69 (2015)

García, V., Marqués, A.I., Sánchez, J.S.: An insight into the experimental design for credit risk and corporate bankruptcy prediction systems. J. Intell. Inform. Syst. 44(1), 159–189 (2015)

Tanaka, Y., Takahashi, M.: Dynamic time warping-based cluster analysis and support vector machine-based prediction of solar irradiance at multi-points in a wide area. In: Proceedings of the ISCIE International Symposium on Stochastic Systems Theory and its Applications, pp. 210–215 (2016)

Subudhi, S., Panigrahi, S.: Use of fuzzy clustering and support vector machine for detecting fraud in mobile telecommunication networks. Int. J. Secur. Netw. 11(1/2), 3 (2016)

Das, S.P., Padhy, S.: Unsupervised extreme learning machine and support vector regression hybrid model for predicting energy commodity futures index. Memetic Comput. 9, 333–346 (2016)

Tian, G., Li, K.: Chinese private lending risk and monetary policy operating. Bus. Manag. Stud. 2(2), 34–43 (2016)

Ionescu, F., Simpson, N.: Default risk and private student loans: implications for higher education policies. J. Econ. Dyn. Control 64, 119–147 (2016)

Wei, S.: Market-based regulatory responses to private lending in China: beyond a law and society paradigm. Asian J. Law Soc. 4(1), 59–79 (2017)

Kianmehr, K., Alhajj, R.: A fuzzy prediction model for calling communities. Int. J. Netw. Virtual Organ. 8(7), 75–97 (2017)

Dias, J.G., Vermunt, J.K., Ramos, S.: Clustering financial time series: new insights from an extended hidden Markov model. Eur. J. Oper. Res. 243(3), 852–864 (2015)

Niu, H., Wang, J.: Quantifying complexity of financial short-term time series by composite multiscale entropy measure. Commun. Nonlinear Sci. Numer. Simul. 22(1–3), 375–382 (2015)

Author information

Authors and Affiliations

Corresponding author

Rights and permissions

About this article

Cite this article

Li, X., Li, X. The design of financial risk control system platform for private lending logistics information. Cluster Comput 22 (Suppl 6), 13805–13811 (2019). https://doi.org/10.1007/s10586-018-2101-7

Received:

Revised:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10586-018-2101-7