Abstract

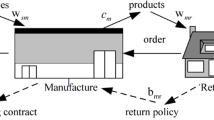

One of the major objectives of modern supply chain management is dealing with the negative impact of decentralization among the involved entities and minimizing double marginalization effect within the chain, especially when the end-customers’ demand is not deterministic. This paper investigates coordination issue in a three-level supply chain with one raw-material supplier, one manufacturer, and one retailer. The retailer determines the retail price, sales effort, and order quantity simultaneously before the selling season starts. Both the supplier and the manufacturer face random yield in production. A composite contract having two components—a contingent buyback with target sales rebate and penalty between the retailer and the manufacturer, and a revenue sharing contract between the manufacturer and the supplier is proposed. The proposed composite contract is shown to achieve supply chain coordination and allows arbitrary allocation of total channel profit among all the chain members. The impact of randomness in both demand and production, and the impact of non-existence of emergency resource for the final product on the performance of the entire supply chain are analyzed. A numerical example is provided to illustrate the developed model and draw some important managerial insights.

Similar content being viewed by others

Abbreviations

- \(c_s\)::

-

Unit production cost at the raw material supplier

- \(c_s^{\prime }\)::

-

Unit procurement cost of raw material from the secondary market

- \(c_m\)::

-

Unit manufacturing cost at the manufacturer

- v::

-

Unit salvage value of the final product

- \(v_s\)::

-

Unit salvage value of excess product at the raw material supplier

- \(g_r\)::

-

Retailer’s goodwill cost for unit unmet demand

- X::

-

A positive random variable with range [l, u], pdf \(f(\cdot )\), cdf \(F(\cdot )\), mean \(\bar{x}\), and variance \(\sigma ^2_x\) representing the stochastic portion of the customer demand

- Y::

-

A random variable with range [c,d], \(0\le c<d \le 1\), having pdf \(g(\cdot )\) and cdf \(G(\cdot )\), denoting the randomness of the production quantity produced by the manufacturer

- Z::

-

A random variable with range [a, b], \(0\le a<b \le 1\), with pdf \(h(\cdot )\) and cdf \(H(\cdot )\), denoting the randomness of the production quantity of the raw material produced by the supplier

- R::

-

Planned production quantity of the raw-material supplier, a decision variable (in units)

- Q::

-

Ordered quantity of the retailer, a decision variable (in units)

- p::

-

Unit retail price of the final product charged by the retailer, a decision variable

- e::

-

Effort level to summarize the retailer’s activities to influence market demand, a decision variable. We assume J(e) To be the retailer’s cost of exerting an effort level e with \(J(0)=0\), \(J'(e)>0\) and \(J''(e)>0\) when \(e>0\)

- \(w_s\)::

-

Unit wholesale price of the raw material offered by the supplier to the manufacturer, a decision variable

- \(w_m\)::

-

Unit wholesale price of the finished product charged by the manufacturer to the retailer, a decision variable

References

Arcelus, F. J., Kumar, S., & Srinivasan, G. (2008). Evaluating manufacturer’s buyback policies in a single-period two-echelon framework under price-dependent stochastic demand. Omega, 36(5), 808–824.

Cachon, G. P. (2003). Supply chain coordination with contracts. In S. C. Graves, A. G. de Kok (Eds.), Handbooks in operations research and management science: Supply chain management: Design, coordination and operation (Vol. 11, pp. 229–340). Elsevier.

Cachon, G. P., & Lariviere, M. A. (2005). Supply chain coordination with revenue sharing contracts: Strength and limitations. Management Science, 51(1), 30–44.

Choi, T. M., Govindan, K., Li, X., & Li, Y. (2017). Innovative supply chain optimization models with multiple uncertainty factors. Annals of Operations Research, 257(1–2), 1–14.

Chopra, S., Reinhardt, G., & Mohan, U. (2007). The importance of decoupling recurrent and disruption risks in a supply chain. Naval Research Logistics, 54(5), 544–555.

Coughlan, A., & Wernerfelt, B. (1989). Credible delegation by oligopolists: A discussion of distribution channel management. Management Science, 35(2), 226–239.

Dada, M., Petruzzi, N. C., & Schwarz, L. B. (2007). A newsvendor’s procurement problem when suppliers are unreliable. Manufacture Service and Operations Management, 9(1), 9–32.

Dant, R. P., & Berger, P. D. (1996). Modelling cooperative advertising decisions in franchising. Journal of the Operational Research Society, 47(9), 1120–1136.

Ding, D., & Chen, J. (2008). Coordinating a three level supply chain with flexible return policies. Omega, 36(5), 865–876.

Emmons, H., & Gilbert, S. (1998). The role of returns policies in pricing and inventory decisions for catalogue goods. Management Science, 44(2), 276–283.

Giri, B. C., & Bardhan, S. (2014). Coordinating a supply chain with backup supplier through buyback contract under supply disruption and uncertain demand. International Journal of Systems Science, 1(4), 193–204.

Giri, B. C., & Bardhan, S. (2015). Coordinating a supply chain under uncertain demand and random yield in presence of supply disruption. International Journal of Production Research, 53(16), 5070–5084.

Giri, B. C., Bardhan, S., & Maiti, T. (2016). Coordinating a three-layer supply chain with uncertain demand and random yield. International Journal of Production Research, 54(8), 2499–2518.

Güler, M., & Bilgiç, T. (2009). On coordinating an assembly system under random yield and random demand. European Journal of Operational Research, 196(1), 342–350.

Güler, M., & Keskin, E. (2013). On coordination under random yield and random demand. Expert Systems with Applications, 40(9), 3688–3695.

He, Y., Wang, H., Guo, Q., & Xu, Q. (2019). Coordination through cooperative advertising in a two-period consumer electronics supply chain. Journal of Retailing and Consumer Services, 50, 179–188.

He, Y., Yang, D., & Wu, Q. (2006). Revenue-sharing contract of supply chain with effort dependent demand. Computer Integrated Manufacturing Systems, 12(11), 1865–1868.

He, Y., & Zhang, J. (2008). Random yield risk sharing in a two-level supply chain. International Journal of Production Economics, 112, 769–781.

He, Y. J., & Zhang, J. (2010). Random yield supply chain with a yield dependent secondary market. European Journal of Operational Research, 206(1), 221–230.

He, Y., Zhao, X., Zhao, L., & He, J. (2009). Coordinating a supply chain with effort and price dependent stochastic demand. Applied Mathematical Modelling, 33(6), 2777–2790.

He, Y., & Zhao, X. (2012). Coordination in multi-echelon supply chain under supply and demand uncertainty. International Journal of Production Economics, 139(1), 106–115.

Hsieh, C., & Wu, C. (2008). Capacity allocation, ordering, and pricing decisions in a supply chain with demand and supply uncertainties. European Journal of Operational Research, 184(2), 667–684.

Hu, B., Qu, J., & Meng, C. (2018). Supply chain coordination under option contracts with joint pricing under price-dependent demand. International Journal of Production Economics, 205, 74–86.

Jaber, M. Y., & Goyal, S. K. (2008). Coordinating a three-level supply chain with multiple suppliers, a vendor and multiple buyers. International Journal of Production Economics, 116(1), 95–103.

Kazaz, B. (2004). Production planning under yield and demand uncertainty with yield-dependent cost and price. Manufacture Service and Operations Management, 6(3), 209–224.

Karim, R., & Nakade, K. (2019). A stochastic model of a production-inventory system with consideration of production disruption. International Journal of Advanced Operations Management, 11(4), 287–316.

Lee, H., & Whang, S. (2002). The impact of the secondary market on the supply chain. Management Science, 48(6), 719–731.

Lariviere, M. A. (1999). Supply chain contracting and coordination with stochastic demand. Quantitative Models for Supply Chain Management, 17, 233–268.

Maihami, R., Govindanb, K., & Fattahic, M. (2019). The inventory and pricing decisions in a three-echelon supply chain of deteriorating items under probabilistic environment. Transportation Research Part E, 131, 118–138.

Moorthy, S. (1987). Managing channel profits: Comment. Marketing Science, 6(4), 375–379.

Nagler, M. G. (2006). An exploratory analysis of the determinants of cooperative advertising participation rates. Marketing Letters, 17(2), 91–102.

Parlar, M., & Wang, D. (1993). Diversification under yield randomness in inventory models. European Journal of Operational Research, 66(1), 52–64.

Petruzzi, N. C., & Dada, M. (1999). Pricing and the newsvendor problem: A review with extensions. Operations Research, 47(2), 183–194.

Taylor, T. (2002). Supply chain coordination under channel rebates with sales effort effects. Management Science, 48(8), 992–1007.

Tsay, A., Nahmias, S., & Agrawal, N. (1998). Modeling supply chain contracts: A review. In S. Tayur, R. Ganeshan, & M. Magazine (Eds.), Quantitative models for supply chain management. Boston: Kluwer.

Van der Rhee, B., Van der Veen, J., Venugopal, V., & Vijayender, R. N. (2010). A new revenue sharing mechanism for coordinating multi-echelon supply chains. Operations Research Letters, 38(4), 296–301.

Voelkel, M. A., Sachs, A. L., & Thonemanna, U. W. (2020). An aggregation-based approximate dynamic programming approach for the periodic review model with random yield. European Journal of Operational Research, 281(4), 286–298.

Wang, C., & Chen, X. (2017). Option pricing and coordination in the fresh produce supply chain with portfolio contracts. Annals of Operations Research, 248(1–2), 471–491.

Wang, C., Chen, J., Wang, L., & Luo, J. (2020). Supply chain coordination with put option contracts and customer returns. Journal of Operation Research Society, 71(6), 1003–1019.

Wang, C., & Webster, S. (2007). Channel coordination for a supply chain with a risk-neutral manufacturer and a loss-averse retailer. Decision Science, 38(3), 361–389.

Xiao, T., Yu, G., Sheng, Z., & Xia, Y. (2005). Coordination of a supply chain with one-manufacturer and two-retailers under demand promotion and disruption management decisions. Annals of Operations Research, 135, 87–109.

Xu, H. (2010). Managing production and procurement through option contracts in supply chains with random yield. International Journal of Production Economics, 126(2), 306–313.

Yadav, S., & Agrawal, A. K. (2020). A single manufacturer multiple buyers integrated production-inventory model with third-party logistics. International Journal of Business Performance and Supply Chain Modelling, 11(2), 91–127.

Yan, G., & He.,Y. (2019). Coordinating pricing and advertising in a two-period fashion supply chain. 4OR, 1-20.

Yan, R. (2010). Cooperative advertising, pricing strategy and firm performance in the e-marketing age. Journal of the Academy of Marketing Science, 38(4), 510–519.

Yao, Z., Leung, S. C. H., & Lai, K. K. (2008). Analysis of the impact of price-sensitivity factors on the returns policy in coordinating supply chain. European Journal of Operational Research, 187(1), 275–282.

Zha, Y., Zhang, J., Yue, X., & Hua, Z. (2015). Service supply chain coordination with platform effort-induced demand. Annals of Operations Research, 235(1), 785–806.

Zhao, S., & Zhu, Q. (2017). Remanufacturing supply chain coordination under the stochastic remanufacturability rate and the random demand. Annals of Operations Research, 257(1–2), 661–695.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Giri, B.C., Majhi, J.K., Bardhan, S. et al. Coordinating a three-level supply chain with effort and price dependent stochastic demand under random yield. Ann Oper Res 307, 175–206 (2021). https://doi.org/10.1007/s10479-021-04257-z

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s10479-021-04257-z