Abstract

Mergers & acquisitions feature prominently in today’s business world. At the same time, numerous failed transactions exemplify that the integration of enterprise resources requires special management attention. As corporate value chains become ever more permeated with information technology, integration in mergers & acquisitions increasingly turns into an issue of combining firms’ IT-resources.

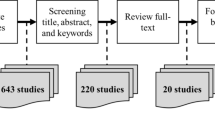

In face-to-face interviews with IT-managers, detailed insights into the integration of data centers, application suites and IT-organizations were gained for 20 horizontal, synergy-oriented mergers & acquisitions. A contingency model is used to analyze different integration practices for their situational drivers and success impact. The results offer support for business and IT-management in successfully integrating IT-resources in mergers & acquisitions.

Similar content being viewed by others

Literatur

Bohl, D. L. et al.: Tying the corporate knot: An American Management Association research report on the effects of mergers and acquisitions. AMA Membership Publication Division, New York 1989.

Bresnick, P.: IT strategies in the age of the megamerger. In: Insurance and Technology 23 (1998) 7, S. 42.

Buck-Lew, M.; Pliskin, N.; Wardle, C.: Accounting for information technology in corporate acquisitions. In: Information & Management (1992) 22, S. 363–369.

Buck-Lew, M.; Pliskin, N.; Wardle, C.: Corporate acquisitions in the 1990s: Paying attention to information technology. In: Journal of General Management 18 (1992) 2, S. 69–87.

Chatham, B. et al.: Leadership strategy. The Forrester Report 2 (1997) 5.

Couturier, G. W.; Kumbat, T. A.: Information technology costing methodology development after a corporate merger. In: Industrial Management & Data Systems (2000) 1, S. 10–16.

Dabui, M.: Postmerger-Management: Zielgerichtete Integration bei Akquisitionen und Fusionen. Gabler, Wiesbaden 1998.

Debus, T.: Die richtige Fusionierungs-strategie macht’s. In: it Management 5 (1998) 4, S. 34–38.

Ellis, J. A.; Pirko, M. T.: A Model for Merging Information Systems: A Case Study of the Air Force Material Command Merger. Unpublished master thesis, Air Force Institute of Technology, Wright-Patterson AFB 1994.

Gerpott, T. J.: Integrationsgestaltung und Erfolg von Unternehmensakquisitionen. Schäf-fer-Poeschel, Stuttgart 1993.

Giacomazzi, F. et al.: Information systems integration in mergers and acquisitions: A normative model. In: Information & Management (1997) 32, S. 289–302.

Glasser, P.: Secrets of the merger monster. In: CIO Magazine 12 (1999) 13, S. 32–44.

Haspeslagh, P. C.; Jemison, D. B.: Managing Acquisitions: Creating Value through Corporate Renewal. The Free Press, New York 1991.

Hövelmanns, N.; Baumgart, W.: IT-Integration: Merger erfolgreich gestalten. In: Die-bold Management Report (1999) 5/6, S. 12–15.

Hoffman, T.: Merger lesson: IT targets often elusive. In: Computerworld 32 (1998) 36, S. 1, 24.

Holzwart, G.: IT und die Mergermania: Für Demokratie ist hier kein Platz. In: Computerwoche 27 (2000) 4, S. 56.

Jaeger, F.: Der globale Markt als größeres Haus für größere Firmen. In: Siegwart, H.; Neugebauer, G. (Hrsg.): Mega-Fusionen: Analysen — Kontroversen — Perspektiven. Paul Haupt, Bern 1998, S. 11–38.

Jansen, S. A.: Mergers & Acquisitions: Unternehmensakquisitionen und -kooperationen: Eine strategische, organisatorische und kapitalmarkttheoretische Einführung. Gabler, Wiesbaden 1998.

Johnston, K. D.; Yetton, P. W.: Integrating information technology divisions in a bank merger: Fit, compatibility and models of change. In: Journal of Strategic Information Systems 5 (1996) 3, S. 189–211.

Kieser, A.; Kubicek, H.: Organisation. 3. Aufl., de Gruyter, Berlin 1992.

Kretschmann, J.: Die Diffusion des kritischen Rationalismus in der Betriebswirtschaftslehre. Poeschel, Stuttgart 1990.

Kromer, G.: Integration der Informationsverarbeitung in Mergers & Acquisitions: Eine empirische Untersuchung. Eul, Köln 2001.

Kromer, G.; Stucky, W.: IT-Integration in Mergers & Acquisitions — Outline to an Empirical Study. In: Gan, R. (Hrsg.): Proceedings of the 16th World Computer Congress 2000 — Information Technology for Business Management. Publishing House of Electronics Industry, Beijing, China 2000, S. 201–208.

Kromer, G.; Stucky, W.: Zielsetzungen und Erfolge der Integration der Informationsverarbeitung in Mergers & Acquisitions. In: Richter, R. (Hrsg.): Management und Controlling von IT-Projekten. dpunkt, Heidelberg 2001, S. 19–39.

Kubicek, H.: Empirische Organisationsforschung. Poeschel, Stuttgart 1975.

LaJoux, A. R.: The Art of M&A Integration: A Guide to Merging Resources, Processes, and Responsibilities. McGraw-Hill, New York 1997.

Linder, J. C.: Integrating Organizations where Information Technology Matters. Unpublished doctoral thesis, Harvard Business School, Harvard 1989.

Main, T. J.; Short, J. E.: Managing the merger: Building partnership through IT planning at the new Baxter. In: MIS Quarterly 13 (1989) 4, S. 469–484.

McKiernan, P.; Merali, Y.: The strategic positioning of information systems in post-acquisition management. In: Journal of Strategic Information Systems 2 (1993) 2, S. 105–124.

McKiernan, P.; Merali, Y.: Integrating information systems after a merger. In: Long Range Planning 28 (1995) 4, S. 54–62.

Osterloh, J.: Deutscher Markt für Unternehmenskontrolle auf Hochtouren. In: M&A Review 9 (1998) 1, S. 5–8.

o.V.: Der Club der Innovatoren. In: Infor-mationWeek 2 (1998) 1, S. 10–43.

Paprottka, S.: Unternehmenszusammen-schlüsse: Synergiepotentiale und ihre Umset-zungsmöglichkeiten durch Integration. Gabler, Wiesbaden 1996.

Penzel, H.-G.; Fuchs, W.: Banken-EDVHochzeit: Grö ßte Integration im deutschen Bankensektor erfolgreich abgeschlossen. In: geldinstitute 29 (1998) 1, S. 26–33.

Perin, S.: Synergien bei Unternehmens-akquisitionen: Empirische Untersuchung von Finanz-, Markt- und Leistungssynergien. Gabler, Wiesbaden 1996.

Robbins, S. S.; Stylianou, A. C.: Post-merger systems integration: The impact on IS capabilities. In: Information & Management (1999) 36, S. 205–212.

Strassmann, P. A.: Information Productivity: Assessing the Information Management Costs of U.S. Industrial Corporations. The Information Economics Press, New Canaan 1999.

Stylianou, A. C.; Jeffries, C. J.; Robbins, S. S.: Corporate mergers and the problems of IS integration. In: Information & Management (1996) 31, S. 203–213.

Violano, M.: The importance of being ruthless. In: Institutional Investor 24 (1990) 4, S. 127–129.

Weber, Y.; Pliskin, N.: The effects of information systems integration and organizational culture on a firm’s effectiveness. In: Information & Management (1996) 30, S. 81–90.

Author information

Authors and Affiliations

Corresponding authors

Rights and permissions

About this article

Cite this article

Kromer, G., Stucky, W. Die Integration von Informationsverarbeitungsressourcen im Rahmen von Mergers & Acquisitions. Wirtschaftsinf 44, 523–533 (2002). https://doi.org/10.1007/BF03250871

Issue Date:

DOI: https://doi.org/10.1007/BF03250871