Abstract

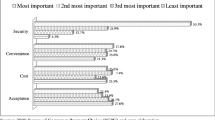

Using survey data from retail and gasoline cardholders, we examine the substitution of general purpose (bank) cards for proprietary cards and how issuers can predict which consumers are most likely to substitute. Convenience and rebates are the primary reasons for using a bank card. However, consumers use their proprietary gasoline cards to keep purchase records and proprietary retail cards to obtain better service. These results help explain the growth in popularity of “co-branded” cards.

Similar content being viewed by others

References

Baumol, William. 1952. “The Transaction Demand for Cash—An Inventory Theoretic Approach.”Quarterly Journal of Economics 66: 545–556.

Berger, Allen, and David Humphrey. 1988. “Interstate Banking and the Payments System.”Journal of Financial Services Research 1: 131–145.

Boeschoten, Willem. 1992. “Currency Use and Payment Patterns.” InFinancial and Monetary Policy Studies, Vol. 23. Dordrecht, The Netherlands: Kluwer Academic Publishers, pp. 4–41.

Canner, Glenn, and Anthony Cyrnak. 1985. “Recent Developments in Credit Card Holding and Use Patterns Among U.S. Families.”Journal of Retail Banking 7: 63–74.

Carow, Kenneth, and Michael Staten. 1999. “Debit Credit, or Cash: Survey Evidence on Gasoline Purchases.”Journal of Economics and Business 51: 409–421.

Duca, John, and Stuart Rosenthal. 1993. “Borrowing Constraints, Household Debt, and Racial Discrimination in Loan Markets.”Journal of Financial Intermediation 3: 77–103.

Duca, John, and William Whitesell. 1995. “Credit Cards and Money Demand: A Cross-Sectional Study.”Journal of Money, Credit, and Banking 27: 604–623.

Fargo, Jason. 2000. “The Fight for Retail Credit.”Credit Card Management 13: 41–45.

Fisher, Gregory, and Daniel Nagin. 1981. “Fixed Versus Random Coefficient Quantal Choice Models.” InStructural Analysis of Discrete Data with Econometric Application, edited by Charles Manski and Daniel McFadden. Cambridge, MA: MIT Press, pp. 273–304.

Fissel, Gregory, and Tullio Jappelli. 1990. “Do Liquidity Constraints Vary Over Time? Evidence from Survey and Panel Data.”Journal of Money, Credit, and Banking 22: 253–261.

Flannery, Mark. 1996. “Technology and Payments: Déjà Vu All Over Again?”Journal of Money, Credit, and Banking 28: 965–970.

Frank, John. 1996. “Cobranding The Second Act.”Credit Card Management 9: 26–31.

Hensher, David, and Lester Johnson. 1981.Applied Discrete-Choice Modeling. New York: Wiley Publishing.

Hirschman, Elizabeth. 1982. “Consumer Payment Systems: The Relationship of Attribute Structure to Preference and Usage.”Journal of Business 55: 531–545.

Horvitz, Paul. 1996. “Preserving Competition in Electronic Home Banking.”Journal of Money, Credit, and Banking 28: 971–974.

Godwin, Deborah. 1998. “Household Debt Quintiles: Explaining Changes 1983–1989.”The Journal of Consumer Affairs 32: 369–393.

Jappelli, Tullio. 1990. “Who is Credit Constrained in the U.S. Economy?.”Quarterly Journal of Economics 105: 219–234.

Lindley, James, Patricia Rudolph, and Edward Selby, Jr. 1989. “Credit Card Possession and Use: Changes Over Time.”Journal of Economics and Business 41: 127–142.

Market Research. 1999. The U.S. Market for General Purpose and Co-Branded Cards.

Martell, Terrence, and Robert Fitts. 1981. “A Quadratic Discriminate Analysis of Bank Credit Card User Characteristics.”Journal of Economics and Business, 33: 153–159.

Mayer, Martin. 1996. “The Past is a Lousy Prologue: Payments Systems Innovations and the Fed.”Journal of Money, Credit, and Banking 28: 975–979.

McFadden, Daniel. 1974. “The Measurement of Urban Travel Demand.”Journal of Public Economics 3: 303–328.

McFadden, Daniel. 1981. “Econometric Models of Probabilistic Choice.” InStructural Analysis of Discrete Data, edited by C. Manski and D. McFadden. Cambridge, Mass.: MIT Press.

Salandro, Dan, and William Harrison. 1997. “Determinants of the Demand for Home Equity Credit Lines.”The Journal of Consumer Affairs 31: 326–345.

Santomero, Anthony. 1974. “A Model of the Demand for Money by Households.”Journal of Finance 29: 89–102.

Santomero, Anthony, and John Seater. 1996. “Alternative Monies and the Demand for Media of Exchange.”Journal of Money, Credit, and Banking 28: 942–960.

Tobin, James. 1956. “The Interest Elasticity of Transaction Demand for Cash.”Review of Economics and Statistics 38: 241–247.

Whitesell, William. 1989. “The Demand for Currency Versus Debitable Accounts.”Journal of Money, Credit, and Banking 21: 246–251.

Whitesell, William. 1992. “Deposit Banks and the Market for Payment Media.”Journal of Money, Credit, and Banking 24: 483–498.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Carow, K.A., Staten, M.E. Plastic choices: Consumer usage of bank cards versus proprietary credit cards. J Econ Finan 26, 216–232 (2002). https://doi.org/10.1007/BF02755987

Issue Date:

DOI: https://doi.org/10.1007/BF02755987