Abstract

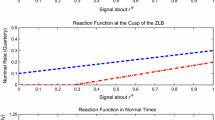

In the two-country, monetary-policy game of this paper, each policymaker can choose his money supply or his interest rate as his instrument. With no uncertainty there are four noncooperative equilibria, one for each possible instrument pair. A policymaker is indifferent between instruments: his payoff depends not on his choice but on his opponent's. With uncertainty, the number of equilibria is reduced, sometimes to one. A policymaker is not indifferent between instruments; his payoff depends on his choice as well as on his opponent's. In some cases each policymaker prefers the equilibrium instrument choice of his opponent, but in others at least one would prefer another choice.

Similar content being viewed by others

References

Barro, Robert and David, Gordon (1983) “Rules, Discretion and Reputation in a Model of Monetary Policy,”Journal of Monetary Economics 12, 101–121.

Bertrand, J. (1883)“Revue de la Théorie Mathématique de la Richesse Sociale et des Recherches sur les Principes Mathématiques de la Théorie des Richesses,” Journal des Savant, 499–508.

Canzoneri, Matthew and Dale Henderson (1988) “Is Sovereign Policymaking Bad?,”Carnegie-Rochester Series on Public Policy 28.

Canzoneri, Matthew and Dale Henderson (forthcoming)Noncooperative Monetary Policies in Interdependent Economies. Cambridge: M.I.T. Press.

Canzoneri, Matthew and Dale Henderson (1989) “Optimal Choice of Monetary Policy Instruments in a Simple Two-Country Game”. In Frederick van der Ploeg and Aart de Zeeuw (eds).Dynamic Policy Games in Economics. Amsterdam: North-Holland Publishing Company.

Cournot, A. (1838)Recherches sur les Principes Mathématiques de la Theorie des Richesses. Paris: L. Hachette.

Giavazzi, Francesco and Alberto Giovannini (1989) “Monetary Policy Interactions Under Managed Exchange Rates,”Economica 56, 199–213.

Klemperer, Paul and Margaret Meyer (1986) “Price Competition vs. Quantity Competition: the Role of Uncertainty.”Rand Journal of Economics 17, 618–638.

Kydland, Finn and Edward Prescott (1977) “Rules Rather than Discretion: The Inconsistency of Optimal Plans,”Journal of Political Economy 85, 473–491.

Poole, William (1970) “Optimal Choice of Monetary Policy Instruments in a Simple Stochastic Macro Model,”Quarterly Journal of Economics 84, 197–216.

Singh, Nirvikar and Xavier Vives (1984) “Price and Quantity Compettion in a Differentiated Duopoly,”Rand Journal of Economics 15, 546–554.

Tabellini, Guido (1987) “Optimal Monetary Instruments and Policy Games,”Ricerche Economiche 41, 315–325.

Turnovsky, Stephen and Vasco d'Orey (1986) “Monetary Policies in Interdependent Economies with Stochastic Disturbances: A Strategic Approach,”Economic Journal 96, 696–721.

Turnovsky, Stephen and Vasco d'Orey (1989) “The Choice of Monetary Instrument in Two Interdependent Economies Under Uncertainty,”Journal of Monetary Economics 23, 121–133.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Henderson, D.W., Zhu, N. Uncertainty and the choice of instruments in a two-country monetary-policy game. Open Econ Rev 1, 39–65 (1990). https://doi.org/10.1007/BF01886175

Issue Date:

DOI: https://doi.org/10.1007/BF01886175