Abstract

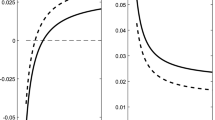

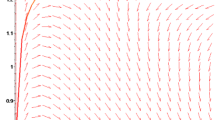

The impact of exchange-rate changes on industrial prices seems ambiguous. Incomplete and even “perverse” pass-through has been observed: the import prices in the depreciating country decrease while those in the appreciating country increase. To explain these “counterintuitive” price reactions we consider a situation of international Bertrand competition: two firms, based in different countries, are selling in both countries simultaneously. The profit-maximizing duopolists set the prices for their products in each of the two markets which are segmented on the demand side. We then study the qualitative effect of an exogenous exchange-rate change on the Bertrand-Nash equilibrium. Under the strong assumption of linear demand and cost functions we have “normal” exchange-rate pass-through. However, allowing for more general cost structures in this simple static model enables us to show that the import prices in both countries might move in counterintuitive directions.

Similar content being viewed by others

References

Baniak, A., and Phlips, L. (1995): “La Pléiade and Exchange Rate Pass-Through.”International Journal of Industrial Organization 13: 195–211.

Berger, M., and Gostiaux, B. (1988):Differential Geometry: Manifolds, Curves, and Surfaces. New York: Springer.

Bulow, J. I., Geanakoplos, J., and Klemperer, P. (1985): “Multimarket Oligopoly: Strategic Substitutes and Complements.”Journal of Political Economy 93: 488–511.

Corchón, L. C., and Mas-Colell, A. (1996): “A Note on the Stability of Best Reply and Gradient Systems with Applications to Imperfectly Competitive Models.”Economics Letters 51: 59–65.

Dixit, A. (1986): “Comparative Statics for Oligopoly.”International Economic Review 27: 107–122.

Fisher, E. (1989): “A Model of Exchange Rate Pass-Through.”Journal of International Economics 26: 119–137.

Friedman, J. W. (1977):Oligopoly and the Theory of Games. Amsterdam: North-Holland.

Hens, T. (1997): “Exchange Rates and Perfect Competition.”Journal of Economics/Zeitschrift für Nationalökonomie 65: 151–161.

Hens, T., Jäger, E., Kirman, A., and Phlips, L. (1999): “Exchange Rates and Oligopoly.”European Economic Review 43: 621–648.

Kirman, A., and Phlips, L. (1996): “Exchange Rate Pass-Through and Market Structure.”Journal of Economics/Zeitschrift für Nationalökonomie 64: 129–154.

Krugman, P. (1987): “Pricing to Market When the Exchange Rate Changes.” InReal-Financial Linkages among Open Economies, edited by S. W. Arndt and J. D. Richardson. Cambridge, Mass.: MIT Press.

Martin, S., and Phlips, L. (1995): “Product Differentiation, Market Structure and Exchange rate Passthrough.” InMarket Evolution: Competition and Cooperation, edited by A. van Witteloostuijn (Studies in Industrial Organization, vol. 20). Dordrecht: Kluwer.

Shapiro, C. (1989): “Theories of Oligopoly Behavior.” InHandbook of Industrial Organization, vol. I, edited by R. Schmalensee and R. D. Willig. Amsterdam: North-Holland.

Quirk, J. (1997): “Qualitative Comparative Statics.”Journal of Mathematical Economics 28: 127–154.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Jäger, E. Exchange rates and bertrand oligopoly. Journal of Economics Zeitschrift für Nationalökonomie 70, 281–307 (1999). https://doi.org/10.1007/BF01224740

Received:

Revised:

Issue Date:

DOI: https://doi.org/10.1007/BF01224740