Summary

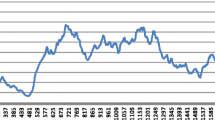

This paper studies the effect of correlation in the rational beliefs of agents on the volatility of asset prices. We use the technique of generating variables to study stable and non-stationary processes needed to characterize rational beliefs. We then examine how the stochastic interaction among such variables affects the behavior of a wide class of Rational Belief Equilibria (RBE). The paper demonstrates how to construct a consistent price state space and then shows the existence of RBE for any economy for which such price state space is constructed. Next, the results are used to study the volatility of asset prices via numerical simulation of a two agents model. If beliefs of agents are uniformly dispersed and independent, we would expect heterogeneity of beliefs to have a limited impact on the fluctuations of asset prices. On the other hand, our results show that correlation across agents can have a complex and dramatic effect on the volatility of prices and thus can be the dominant factor in the fluctuation of asset prices. The mechanism generating this effect works through the clustering of beliefs in states of different levels of agreement. In states of agreement the conditional forecasts of the agents tend to fluctuatetogether inducing more volatile asset prices. In states of disagreement the conditional forecasts fluctuatein diverse directions tending to cancel each other's effect on market demand and resulting in reduced price volatility.

Similar content being viewed by others

References

Ash, R. B.: Real analysis and probability. London: Academic Press 1972

Gray, R. M.: Probability, random processes, and ergodic properties. Berlin, New York: Springer-Verlag 1987

Gottardi, P.: On stationary monetary equilibrium in overlapping generations models with incomplete markets. Department of Applied Economics, University of Cambridge, UK, 1990

Hamilton, J. D.: Time series analysis. Princeton: Princeton University Press 1994

Kurz, M.: The Kesten-Stigum model and the treatment of uncertainty in equilibrium theory. In: Balch, M. S., McFadden, P. L., Wu, S. Y. (eds.) Essays on economic behaviour under uncertainty, pp 389–399. Amsterdam: North-Holland (1974a)

Kurz, M.: Equilibrium in a finite sequence of markets with transaction cost. Econometrica42, 1–20 (1974b)

Kurz, M.: On the structure and diversity of rational beliefs. Economic Theory4, 877–900 (1944a)

Kurz, M.: On rational belief equilibria. Economic Theory4, 859–876 (1994)

Kurz, M.: Asset prices with rational beliefs. Draft, Stanford University 1996 (to appear in a forthcoming monograph in the Springer seriesStudies in Economic Theory entitledEndogenous Economic Fluctuations: Studies in the Theory of Rational Beliefs, 1997)

Kurz, M., Schneider, M.: Coordination and correlation in Markov rational belief equilibria. Department of Economics, Stanford University, mimeo 1996

Kurz, M., Wu, H.-M.: Endogenous uncertainty in a general equilibrium model with price contingent contracts. Economic Theory8, 461–488 (1996)

Lucas, R.: Asset prices in an exchange economy, Econometrica46, 1429–1445 (1978)

Nielsen, C. K.: Weakly rational beliefs, structural independence and rational belief structures. Dissertation submitted to the Department of Economics, Stanford University 1994

Nielsen, C. K.: Rational belief structures and rational belief equilibria. Economic Theory8, 399–422 (1996)

Author information

Authors and Affiliations

Additional information

This research was supported, in part, by the Fondazione Eni Enrico Mattei of Milan, Italy, and by the Research Incentive Fund of Stanford University. The authors thank Carsten K. Nielsen and Ho-Mou Wu for valuable discussions on an earlier draft. Carsten K. Nielsen also made an important contribution to the development of Section 3.