Abstract

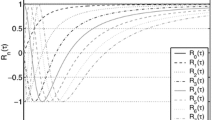

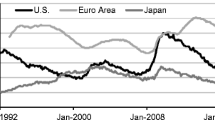

This paper presents the methodology used to construct reliable estimates of the term structure of interest rates for the United States during 1919–1930. These monthly term structures are based on individual corporate bonds' price quotations for the majority of U.S. railroad corporations' issues of that era. McCulloch's cubic spline methodology, coupled with Nelson and Siegel's parsimonious estimator, is used to derive curves for three investment-grade risk classes. These estimates compare favorably with Durand's hand-smoothed estimates as well as earlier annual estimates generated by Thies. They provide a consistent basis for a wide range of monetary and financial research on this period.

Similar content being viewed by others

References

Baum, C.F. and Thies, C.F. (1989) The term structure of interest rates and the demand for money during the great depression, Southern Economic J. 56(2), 490–498.

Board of Governors of the Federal Reserve System, Banking and Monetary Statistics, 1914–1941.

Carleton, W. and Cooper, I. (1976) Estimation and uses of the term structure of interest rates, J. Finance 31, 1067–1083.

Cecchetti, S. (1988) The case of negative nominal interest rates: new estimates of the term structure of interest rates during the great depression, J. Political Economy 96(6), 490–498.

Chambers, D., Carleton, W. and Waldman, D. (1984) A new approach to estimation of the term structure of interest rates, J. Financial Quantitative Anal. 19, 233–252.

Commercial and Financial Chronicle, various issues.

Durand, D. (1942) Basic yields on corporate bonds, 1900–1942. Technical paper No. 3, National Bureau of Economic Research.

Durand, D. (1958) A quarterly series of corporate bond yields, 1952–1957, and some attendant reservations, J. Finance 13, 348–356.

Eldred, W. (1933) The railroad debt, in E. Clark (ed.), The Internal Debt of the United States, Macmillan, New York, pp. 92–139.

Friedman, M. and Schwartz, A. (1982) Monetary trends in the United States and the United Kingdom, their relation to income, prices, and interest rates, 1867–1975, National Bureau of Economic Research.

Friedman, M. and Schwartz, A. (1982a) The effect of the term structure of interest rates on the demand for money in the United States, J. Political Economy 90(1), 201–212.

Hickman, W.B. (1960) Statistical Measures of Corporate Bond Financing Since 1900, Princeton University Press, Princeton.

Homer, S. (1963) A History of Interest Rates, Rutgers University Press.

Kessel, R.A. (1971) The cyclical behavior of interest rates, in J.M. Guttentag and P. Cagan (eds), Essays on Interest Rates, vol. II, National Bureau of Economic Research.

Litzenberger, R. and Rolfo, J. (1984) An international study of tax effects on government bonds, J. Finance 39, 1–22.

Macaulay, F. (1938) The Movements of Interest Rates, Bond Yields and Stock Prices in the United States since 1856, National Bureau of Economic Research.

Malkiel, B., 1966. The Term Structure of Interest Rates: Expectations and Behavior Patterns, Princeton University Press, Princeton.

McCulloch, J.H. (1971) Measuring the term structure of interest rates, J. Business 44, 19–31.

McCulloch, J.H. (1975) The tax-adjusted yield curve, J. Finance 30, 811–830.

Meeker, J.E. (1930) The Work of the Stock Exchange, Ronald Press, New York.

Meiselman, D. (1962) The Term Structure of Interest Rates, Prentice-Hall, New York.

Merton, R. (1974) On the pricing of corporate debt: the risk structure of interest rates, J. Finance 29, 449–470.

Moody's Manual of Investments, Railroad Securities, 1930.

Nelson, C. and Siegel, A. (1987) Parsimonious modeling of yield curves, J. Business 60(4), 473–489.

New York Stock Exchange, Yearbook, various issues.

Ostrolenk, B. and Massie, A. (1932) How Banks Buy Bonds, Harper Brothers, New York.

Robinson, R. (1941) Commercial bank operations, in Banking Studies (ed. Board of Governors of the Federal Reserve System), pp. 169–188.

Roll, R. (1970) The Behavior of Interest Rates: An Application of the Efficient Market Model to U.S. Treasury Bills, Basic Books, New York.

Sargent, T. (1972) Rational expectations and the term structure of interest rates, J. Money, Credit, Banking 4, 72–97.

Schaefer, S.M. (1981) Measuring a tax-specific term structure of interest rates in the market for British government securities, Economic J. 91, 415–438.

Shea, G. (1984) Pitfalls in smoothing interest rate term structure data: equilibrium models and spline approximations. J. Financial Quantitative Anal. 19, 253–269.

Thies, C. (1985) New estimates of the term structure of interest rates, 1920–1939, J. Financial Res. 8, 297–306.

Vasicek, O. and Fong, G. (1982) Term structure modelling using exponential splines, J. Finance 37, 339–348.

Wallace, N. (1964) The term structure of interest rates and the maturity composition of the federal debt, J. Finance 22, 301–312.

Author information

Authors and Affiliations

Rights and permissions

About this article

Cite this article

Baum, C.F., Thies, C.F. On the construction of monthly term structures of U.S. interest rates, 1919–1930. Computer Science in Economics and Management 5, 221–246 (1992). https://doi.org/10.1007/BF00426761

Received:

Issue Date:

DOI: https://doi.org/10.1007/BF00426761