Abstract

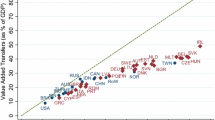

We propose a spillover index of external connectedness that measures the outer influences among countries from estimated return volatilities of 645 European firms. We find that Gross Domestic Product per capita is directly related to this index, as countries with lower Gross Domestic Product per capita are influenced in a greater way than they influence others, while higher Gross Domestic Product per capita countries influence others more than they receive. From a risk management perspective, firms should quantify the influence from markets located in other countries, in order to predict possible future movements.

We want to have a special acknowledgement to “Fundación BBVA, ayudas a proyectos de investigación en Big Data”, AGAUR “PANDÈMIES” grant and the Spanish Ministry of Science grant PID2019-105986GB-C21 for their support to our research.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

References

Baruník, J., Křehlík, T.: Measuring the frequency dynamics of financial connectedness and systemic risk. J. Finan. Economet. 16(2), 271–296 (2018)

Baumöhl, E., Shahzad, S.J.H.: Quantile coherency networks of international stock markets. Finan. Res. Lett. 31, 119–129 (2019)

BenSaïda, A.: Good and bad volatility spillovers: an asymmetric connectedness. J. Finan. Mark. 43, 78–95 (2019)

Chuliá, H., Fernández, J., Uribe, J.M.: Currency downside risk, liquidity, and financial stability. J. Int. Money Finan. 89, 83–102 (2018)

Demirer, M., Diebold, F.X., Liu, L., Yilmaz, K.: Estimating global bank network connectedness. J. Appl. Economet. 33(1), 1–15 (2018)

Diebold, F.X., Yilmaz, K.: Measuring financial asset return and volatility spillovers, with application to global equity markets. Econ. J. 119(534), 158–171 (2009)

Diebold, F.X., Yilmaz, K.: Better to give than to receive: Predictive directional measurement of volatility spillovers. Int. J. Forecast. 28(1), 57–66 (2012)

Douven, R., Peeters, M.: GDP-spillovers in multi-country models. Econ. Model. 15(2), 163–195 (1998)

Kastner, G.: Dealing with stochastic volatility in time series using the r package stochvol. arXiv:1906.12134 (2019)

Kastner, G., Frühwirth-Schnatter, S.: Ancillarity-sufficiency interweaving strategy (ASIS) for boosting MCMC estimation of stochastic volatility models. Comput. Statist. Data Anal. 76, 408–423 (2014)

Lewis, K.K.: Global asset pricing. Annu. Rev. Financ. Econ. 3(1), 435–466 (2011)

Lyócsa, Š, Vỳrost, T., Baumöhl, E.: Return spillovers around the globe: a network approach. Econ. Model. 77, 133–146 (2019)

Nyangarika, A.M.: Correlation of oil prices and gross domestic product in oil producing countries (2018)

Taylor, S.J.: Financial returns modelled by the product of two stochastic processes-a study of the daily sugar prices 1961–75. Time Ser. Anal. Theory Pract. 1, 203–226 (1982)

Zou, H., Zhang, H.H.: On the adaptive elastic-net with a diverging number of parameters. Ann. Stat. 37(4), 1733 (2009)

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2022 The Author(s), under exclusive license to Springer Nature Switzerland AG

About this paper

Cite this paper

Vidal-Llana, X., Uribe, J.M., Guillen, M. (2022). External Spillover Index and Its Relation with GDP per Capita on European Countries. In: Corazza, M., Perna, C., Pizzi, C., Sibillo, M. (eds) Mathematical and Statistical Methods for Actuarial Sciences and Finance. MAF 2022. Springer, Cham. https://doi.org/10.1007/978-3-030-99638-3_70

Download citation

DOI: https://doi.org/10.1007/978-3-030-99638-3_70

Published:

Publisher Name: Springer, Cham

Print ISBN: 978-3-030-99637-6

Online ISBN: 978-3-030-99638-3

eBook Packages: Mathematics and StatisticsMathematics and Statistics (R0)