Abstract

In this chapter, we illustrate some recent developments in the yield curve modeling by introducing a latent factor model called the dynamic Nelson-Siegel model. This model not only provides good in-sample fit, but also produces superior out-of-sample performance. Beyond Treasury yield curve, the model can also be useful for other assets such as corporate bond and volatility. Moreover, the model also suggests generalized duration components corresponding to the level, slope, and curvature risk factors.

The dynamic Nelson-Siegel model can be estimated via a one-step procedure, like the Kalman filter, which can also easily accommodate other variables of interests. Alternatively, we could estimate the model through a two-step process by fixing one parameter and estimating with ordinary least squares. The model is flexible and capable of replicating a variety of yield curve shapes: upward sloping, downward sloping, humped, and inverted humped. Forecasting the yield curve is achieved through forecasting the factors and we can impose either a univariate autoregressive structure or a vector autoregressive structure on the factors.

Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Zero coupon bonds are chosen to limit the “coupon effect,” which implies that two bonds that are identical in every respect except for bearing different coupon rates can have a different yield-to-maturity.

- 2.

Diebold and Li (2006) conduct a more extensive comparisons with competing models.

- 3.

The data can be found at http://www.federalreserve.gov/econresdata/researchdata.htm

References

Aruoba, B. S., Diebold, F. X., & Rudebusch, G. D. (2006). The macroeconomy and yield curve: A dynamic latent factor approach. Journal of Econometrics, 127, 309–338.

Christensen, J. H. E., Diebold, F. X., & Rudebusch, G. D. (2009). An arbitrage-free generalized Nelson-Siegel term structure model. Econometrics Journal, 12, 33–64.

Christensen, J. H. E., Diebold, F. X., & Rudebusch, G. D. (2011). The affine arbitrage-free class of Nelson-Siegel term structure models. Journal of Econometrics, 164, 4–20.

Cox, J. C., Ingersoll, J. E., & Ross, S. A. (1985). A theory of the term structure of interest rates. Econometrica, 53, 385–407.

Diebold, F. X., Ji, L., & Li, C. (2006). A three-factor yield curve model: Non-affine structure, systematic risk sources, and generalized duration. In L. R. Klein (Ed.), Macroeconomics, finance and econometrics: Essays in memory of Albert Ando (pp. 240–274). Cheltenham: Edward Elgar.

Diebold, F. X., & Li, C. (2006). Forecasting the term structure of government bond yields. Journal of Econometrics, 127, 337–364.

Diebold, F. X., Li, C., & Yue, V. (2008). Global yield curve dynamics and interactions: A generalized Nelson-Siegel approach. Journal of Econometrics, 146, 351–363.

Duffie, D., & Kan, R. (1996). A yield-factor model of interest rates. Mathematical Finance, 6, 379–406.

Fama, E., & Bliss, R. (1987). The information in long-maturity forward rates. American Economic Review, 77, 680–692.

Heath, D., Jarrow, R., & Morton, A. (1992). Bond pricing and the term structure of interest rates: A new methodology for contingent claims valuation. Econometrica, 60, 77–105.

Hua, J. (2010). Option implied volatilities and corporate bond yields: A dynamic factor approach (Working Paper). Baruch College, City University of New York.

Hull, J., & White, A. (1990). Pricing interest-rate-derivative securities. Review of Financial Studies, 3, 573–592.

Krishnan, C. N. V., Ritchken, P., & Thomson, J. (2010). Predicting credit spreads. Journal of Financial Intermediation, 19(4), 529–563.

Nelson, C. R., & Siegel, A. F. (1987). Parsimonious modeling of yield curve. Journal of Business, 60, 473–489.

Vasicek, O. (1977). An equilibrium characterization of the term structure. Journal of Financial Economics, 5, 177–188.

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Appendices

Appendix 1: One-Step Estimation Method

We illustrate the one-step method to estimate the DNS model. If the dynamics of betas (factors) follow a vector autoregressive process of first order, the model immediately forms a state-space system since ARMA state vector dynamics of any order may be transformed into a state-space form. Thus, the transition equation is

t = 1, …, T. The measurement equation, which relates N yields to the three unobserved factors, is

t = 1, …, T. In matrix notation, we rewrite the state-space system as measurement equation,

state equation,

For optimality of the Kalman filter, we assume that the white noise transaction and measurement errors be orthogonal to each other.

The state-space set up with the application of the Kalman filter delivers maximum-likelihood estimates and smoothed underlying factors, where all parameters are estimated simultaneously. Such representation also allows for heteroskedasticity, missing data, or heavy-tailed measurement errors. Moreover, other useful variables, such as macroeconomic variables, can be augmented into the state equation to understand the dynamic interactions between the yield curve and the macroeconomy.

Appendix 2: Two-Step Estimation Method

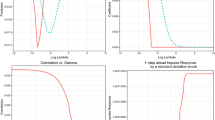

The estimation for the two-step procedure requires us to choose a λ value first. Once the λ is fixed, the values of the two regressors (factor loadings) can be computed, so ordinary least squares can be applied to estimate the betas (factors) at each period t. Doing so is not only simple and convenient, but also eliminates the potential for numerical optimization challenges. The question is: What is the appropriate value of λ. Recall that λ determines the maturity at which the loading achieves its maximum. For example, for Treasury data, 2 or 3 years are commonly considered medium term, so a simple average of the two is 30-month. The λ value that maximizes the loadings on the medium-term factor at exactly 30-month is 0.0609. For a different market, the medium maturity could be different, so the corresponding λ value could be different as well.

Rights and permissions

Copyright information

© 2015 Springer Science+Business Media New York

About this entry

Cite this entry

Hua, J. (2015). Term Structure Modeling and Forecasting Using the Nelson-Siegel Model. In: Lee, CF., Lee, J. (eds) Handbook of Financial Econometrics and Statistics. Springer, New York, NY. https://doi.org/10.1007/978-1-4614-7750-1_39

Download citation

DOI: https://doi.org/10.1007/978-1-4614-7750-1_39

Published:

Publisher Name: Springer, New York, NY

Print ISBN: 978-1-4614-7749-5

Online ISBN: 978-1-4614-7750-1

eBook Packages: Business and Economics