Access this chapter

Tax calculation will be finalised at checkout

Purchases are for personal use only

Similar content being viewed by others

Notes

- 1.

Through subsidies or quotas, see, for example, Jaromir et al. (2012).

- 2.

For more details on the history of Brownian motion in finance, the reader will find extensive literature. The book of Mandelbrot (2004) provides an elegant discussion.

- 3.

For the unfamiliar reader, the GBM is the reference model to the Black and Scholes (1973) option price formula.

- 4.

- 5.

We treat \( J \) as the absolute price jump. The relative price change is then treated as \( d{S_t}/{S_t}=(J{S_t}-{S_t})/{S_t}={J_t}-1 \).

- 6.

The difference is in the quality: the less sulfur, the easier it is to refine the crude into gasoline.

- 7.

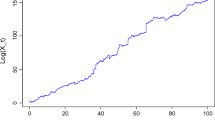

Source: Bloomberg Energy.

- 8.

Practically, the first instance was due to the closure of the refinery, while the second owes to the unrest in Lybia.

- 9.

Since we are using a mean-reverting jump-diffusion model in our analysis, we also perform the tests over the periods we use to calibrate model parameters for every of our runs. We discuss this further in the text.

- 10.

To save space, we have not included our first estimation windows that start on 3 January 2001 and use the previous 12 months to estimate model parameters.

- 11.

The inverse leverage effect is usually observed in agricultural commodities.

- 12.

We note to the reader that the errors for so long-term forecasts the errors are substantially high.

- 13.

It is out of the scope of this chapter to propose the methodology for switching between models.

- 14.

Dan Morris, Global Strategist at J.P. Morgan Asset Management (in March 2012).

References

Ait-Sahalia Y (1996) Testing continuous-time models of the spot interest rate. Rev Financ Stud 9(2):385–462

Ait-Sahalia Y (2002) Maximum-likelihood estimation of discretely-sampled dif- fusions: a closed-form approximation approach. Econometrica 70(1):223–262

Ait-Sahalia Y (2008) Closed-form likelihood expansions for multivariate diffusions. Ann Stat 36(2):906–937

Ait-Sahalia Y (2010) Handbook of financial econometrics. Elsevier, Amsterdam

Ait-Sahalia Y, Mykland PA (2003) The effects of random and discrete sampling when estimating continuous-time diffusions. Econometrica 71:483–549

Alquist R, Kilian L, Vigfusson RJ (2011) Forecasting the price of oil. Working paper, Bank of Canada

Arouri MEH, Jouini J, Nguyen DK (2012) On the impacts of oil price fluctuations on european equity markets: volatility spillover and hedging effectiveness. Energy Econ 34(2):611–617

Black F, Scholes M (1973) The pricing of options and corporate liabilities. J Polit Econ 81(3):637–654

Brigo D, Dalessandro A, Neugebauer M, Triki F (2009) A stochastic processes toolkit for risk management: mean reverting processes and jumps. J Risk Manag Financ Inst 3(1):1752–8895

Cont R, Tankov P (2002) Non-parametric calibration of jump-diffusion models. Internal research report 490, CMAP

El-Gamal MA, Jaffe AM (2010) Oil, dollars, debt, and crises. Cambridge University Press, New York, NY

Geman H (2005) Energy commodity prices: is mean-reversion dead? J Altern Invest 8(2):31–45

Gupta E (2008) Oil vulnerability index of oil importing countries. Energy Policy 36(3):1195–1211

Hamilton J (2009) Causes and consequences of the oil shock of 2007–08. Brookings Pap Econ Act 1:215–261

Hull JC (2000) Options, futures, and other derivatives, 4th edn. Prentice Hall, Upper Saddle River, NJ

Jaromir B, Chauvet M, Kamenik O, Kumhof M, Laxton D, Mursula S, Selody J (2012) The future of oil: geology versus technology. Working paper WP/12/109, IMF

Jensen B, Poulsen R (2002) Simulated likelihood estimation of diffusions with an application to exchange rate dynamics in incomplete markets. J Deriv 9(4):18–32

Jewell J (2011) The IEA model of short-term energy security (MOSES). Technical report, International Energy Agency

Karlin S, Taylor HM (1975) A first course in stochastic processes. Academic, New York, NY

Kilian L (2009) Not all oil price shocks are alike: disentangling demand and supply shocks in the crude oil market. Am Econ Rev 99(3):1053–1069

Kou SG (2002) A jump-diffusion model for option pricing. Manag Sci 48(8):1086–1101

Lo AW (1988) Maximum likelihood estimation of generalized Ito processes with discretely sampled data. Econom Theory 4:231–247

Madan DB, Seneta E (1990) The variance gamma (v.g.) model for share market returns. J Bus 63:511–524

Mandelbrot BB (2004) The (Mis)behaviour of markets: a fractal view of risk, ruin and reward. Profile Books, London

Merton RC (1976) Option pricing when underlying stock returns are discontinuous. J Financ Econ 3(1–2):125–144

Pedeersen AR (1995) A new approach to maximum likelihood estimation for stochastic differential equations based on discrete observations. Scand J Stat 22:55–71

Phillips P, Perron P (1988) Testing for unit root in time series regression. Biometrica 75:335–346

Pindyck R (2001) The dynamics of commodity spot and futures markets: a primer. Energy J 22(3):1–29

Said S, Dickey D (1984) Testing for unit roots in autoregressive moving average models of unknown order. Biometrika 71:599–607

U.S. Chamber of Commerce (2010) Index of U.S. energy security risk: assessing America’s vulnerabilities in a global energy market. Technical report, U.S. Chamber of Commerce, Washington, DC

van Vuuren KB, de Vries H, Groenenberg H (2009) Indicators for energy security. Energy Policy 37(6):2166–2181

Vasicek O (1977) An equilibrium characterization of the term structure. J Financ Econ 5(1):177–188

Wicks M (2009) Energy security: a national challenge in a changing world. Technical report

Yu J (2007) Closed-form likelihood approximation and estimation of jumpdiffusions with an application to the realignment risk of the chinese yuan. J Econom 141(2):1245–1280

Author information

Authors and Affiliations

Corresponding author

Editor information

Editors and Affiliations

Rights and permissions

Copyright information

© 2013 Springer-Verlag London

About this chapter

Cite this chapter

Skindilias, K., Lo, C.C. (2013). Energy Security: Stochastic Analysis of Oil Prices. In: Leal Filho, W., Voudouris, V. (eds) Global Energy Policy and Security. Lecture Notes in Energy, vol 16. Springer, London. https://doi.org/10.1007/978-1-4471-5286-6_10

Download citation

DOI: https://doi.org/10.1007/978-1-4471-5286-6_10

Published:

Publisher Name: Springer, London

Print ISBN: 978-1-4471-5285-9

Online ISBN: 978-1-4471-5286-6

eBook Packages: EnergyEnergy (R0)