Abstract

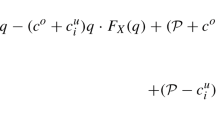

Based on the stochastic market demand, this paper considers the order decision-making strategies of the supply chain by introducing statement strategies. Consequently, the time-variant variance in the demands of the market is incorporated into the model. The retailer simultaneously determines the purchase time (i.e., lead time) and order quantity, and the manufacturer determines the statement strategy and the reserved profit rate. The results show that the no overtime statement strategy can induce the retailer to place more orders in advance by limiting the available order quantity within the available time. Finally, we also adopt numerical examples to support the conclusion of this paper.

Similar content being viewed by others

References

Blackburn, J.D. (1991). Time Based Competition: The Next Battle Ground in American Manufacturing. Business One lrwin, Homewood

Boyaci, T. & Ray, S. (2003). Product differentiation and capacity cost interaction in time and price sensitive markets. Manufacturing & Service Operations Management, 5(1): 18–36

Chatterjee, S., Slotnick, S.A. & Sobel, M.J. (2002). Delivery guarantees and the interdependence of marketing and operations. Production and Operations Management, 11(3): 393–409

Chen, M.S. & Chuang, C.C. (2000). An extended newsboy problem with shortage-level constraints. International Journal of Production Economics, 67(3): 269–277

Chiu, C.H., Choi, T.M. & Li, D. (2009). Price wall or price war: the pricing strategies for retailers. IEEE Transactions on Systems, Man, and Cybernetics, Part A-Systems and Humans, 39(2): 331–343

Choi, T.M. & Chow, P.S. (2008). Mean-variance analysis of quick response program. International Journal of Production Economics, 114(2): 456–475

Choi, T.M, Li, D. & Yan, H. (2006). Quick response policy with bayesian information updates. European Journal of Operational Research, 170(1): 788–808

Choi, T.M. & Sethi, S. (2010). Innovative quick response programs: a review. International Journal of Production Economics, 127(1): 1–12

Donohue, K.L. (1994). The economics of capacity and marketing measures in a simple manufacturing environment. Production and Operations Management, 3(2): 78–99

Duenyas, I. & Hopp, W.J. (1995). Quoting customer lead times. Management Science, 41(1): 43–57

Easton, F.F. & Moodie, D.R. (1999). Pricing and lead time decisions for make-to-order firms with contingent orders. European Journal of Operational Research, 116(2): 305–318

Feng, J., Liu, L. & Liu, X. (2011). An optimal policy for joint dynamic price and lead time quotation. Operations Research, 59(6): 1523–1527

Hill, T. (1994). Manufacturing strategy: text and case, 2th Edition. Irwin, Burr Ridge. IL

Ho, T.H. & Zheng, Y.S. (2004). Setting customer expectation in service delivery: an integrated marketing operations perspective. Management Science, 50(4): 479–488

Hua, Z.S., Li, S.J. & Liang, L. (2006). Impact of demand uncertainty on supply chain cooperation of single-period products. International Journal of Production Economics, 100(2): 268–284

Iyer, A. & Bergen, M. (1997). Quick response in manufacturer-retailer channels. Management Science, 43(4): 559–570

Keskinocak, P., Ravi, R. & Tayur, S. (2001). Scheduling and reliable lead time quotation for orders with availability intervals and lead time sensitive revenues. Management Science, 47(2): 264–279

Khouja, M. (1995). The newsboy problem under progressive multiple discounts. European Journal of Operational Research, 84(2): 458–466

Lederer, P.J. & Li, L. (1997). Pricing, production, scheduling, and delivery-time competition. Operations Research, 45(3): 407–420

Li, L. & Lee, Y.S. (1994). Pricing and delivery-time performance in a competitive environment. Management Science, 40(5): 633–646

Liu, L., Parlar, M. & Zhu, S.X. (2007). Pricing and lead time decisions in decentralized supply chains. Management Science, 53(5): 713–725

Liu, Y., Fry, M.J. & Raturi, A.R. (2009). Retail price markup commitment in decentralized supply chains. European Journal of Operational Research, 192(1): 277–292

Mantrala, M.K. & Raman, K. (1999). Demand uncertainty and supplier’s returns policies for a multi-store style-good retailer. European Journal of Operational Research, 115(2): 270–284

Pekgün, P., MGriffin, P.M. & Keskinocak, P. (2008). Coordination of marketing and production for price and leadtime decisions. IIE Transactions, 40(1): 12–30

Plambeck, E.L. (2004). Optimal lead-time differentiation via diffusion approximations. Operations Research, 52(2): 213–228

Ragatz, G.L. & Mabert, V.A. (1984). A framework for the study of due date management in job shops. International Journal of Production Research, 22(4): 685–695

Shang, W. & Liu, L. (2011). Promised delivery time and capacity games in time-based competition. Management Science, 57(3): 559–610

Song, J.C., Yano, C. & Lerssisuriya, P. (2000). Contract assembly: dealing with combined supply lead time and demand quantity uncertainty. Manufacturing & Service Operation Management, 2(3): 287–296

So, K.C. (2000). Price and time competition for service delivery. Manufacturing & Service Operations Management, 2(4): 392–409

So, K.C. & Song, J. (1998). Price, delivery time guarantees and capacity selection. European Journal of Operation Research, 111(1): 28–49

Webster, S. (2002). Dynamic pricing and lead time policies for make to order systems. Decision Sciences, 33(4): 579–599

Weng, Z.K. (2004). Coordinating order quantities between the manufacturer and buyer: a generalized newsvendor model. European Journal of Operational Research, 156(1): 148–161

Woeppel, M.J. (2001). Manufacturer’s guide to implementing. The Theory of Constraints, pp. 22

Xiao, T., Jin, J., Chen, G., Shi, J. & Xie, M. (2010). Ordering, wholesale pricing and lead-time decision in a three-stage supply chain under demand uncertainty. Computers & Industrial Engineering, 59(4): 840–852

Yano, C. (1987). Setting planned lead times in serial production systems with tardiness costs. Management Science, 33(1): 95–106

Yano, C.A. & Gilbert, S.M. (2003). Coordinated pricing and production/procurement decisions: a review. In Charkarvarty, A. & Eliashberg, J. (eds.), Managing Business Interfaces: Marketing, Engineering and Manufacturing Perspectives, pp. 65–103. Dordrecht: Kluwer Academic

Author information

Authors and Affiliations

Corresponding author

Additional information

This work was supported by the National Nature Science Foundation of China under Grant Numbers 71071059, 71001041 and 71172075.

Jiangtao Wang is a Ph.D. candidate in School of Business Administration, South China University of Technology, Guangzhou, China; His M.S degree was granted in Information and Computational Science from South China University of Technology. His Ph.D. research interests are supply chain management and operation management.

Liwen Wang is an associate professor in Management Science & Engineering, Beihang University. His research areas are management science and engineering and project management.

Fei Ye is currently a professor in the Department of Industrial Engineering at Business Administration School, South China University of Technology. His research interests are in the areas of supply chain management, decision making, and services operations management. He has been working on two projects granted by the National Natural Science Fund Commission(NSFC).He has published articles in European Journal of Operational Research, Computers & Industrial Engineering, International Journal of Production Economics and Applied Soft Computing.

Xuejun Xu Ph.D. was a professor and PhD supervisor in School of Business Administration, South China University of Technology, Guangzhou, China; His research areas were production and operation management.

Jianjun Yu Ph.D. is an associate professor in Department of Industrial Engineering, South China University of Technology. He received B. S. degree, M. S. degree and Ph.D. degree from Northwestern Polytechnical University, respectively in 2000, 2003 and 2007, and has worked as a postdoctoral researcher in University of Michigan. His research interests include operation management, optimization, supply chain management and advanced manufacturing systems.

Rights and permissions

About this article

Cite this article

Wang, J., Wang, L., Ye, F. et al. Order decision making based on different statement strategies under stochastic market demand. J. Syst. Sci. Syst. Eng. 22, 171–190 (2013). https://doi.org/10.1007/s11518-013-5217-6

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11518-013-5217-6