Abstract

The purpose of this paper is to analyse the current financial inclusion situation in India, identify the gaps and suggest some way forward to bridge these gaps. In this study, situation-actor-process (SAP) learning-action-performance (LAP) model is applied to present the comprehensive view on financial inclusion in India. Further, the interrelation between the various elements of SAP–LAP is established through efficient interpretive ranking process. The SAP–LAP model helps to better understand the current situation of financial inclusion and helps the ‘actors’ to initiate appropriate actions based on the ‘learning’ of the study. The study highlights the area where stakeholders need to focus for better inclusion of people under banking system. The paper is first of its kind which provides a systematic framework to study the financial inclusion in India using SAP–LAP framework.

Similar content being viewed by others

Notes

Grameen Model was initiated by Prof. Mohammed Yunus in 1976 in Bangladesh with a pilot project to promote microfinance for poor. Later, the model was given an independent bank status (called Grameen Bank) in 1983. The model encourages people to take group-based collateral-free loan (Yunus 2006).

JAM stands for Pradhan Mantri Jan Dhan Yojana (PMJDY), Aadhaar and Mobile. Majorly, this trinity has potential to curb the financial leakage in government benefit schemes for poor and resolve the issue of last-mile coverage. (ESI 2016).

Direct benefit transfer (DBT) was initiated by Government of India (GOI) in 2013 to transfer subsidiary from a scheme directly into account of beneficiaries (usually below poverty line) (Details of each such schemes can be retrieved at https://dbtbharat.gov.in/).

References

Akotey, J. O., & Adjasi, C. (2014). The impact of microinsurance on household asset accumulation in Ghana: An asset index approach. Geneva Papers on Risk and Insurance: Issues and Practice, 39(2), 304–321. https://doi.org/10.1057/gpp.2014.6.

Allen, F., Demirguc-Kunt, A., Klapper, L., & Martinez Peria, M. S. (2016). The foundations of financial inclusion: Understanding ownership and use of formal accounts. Journal of Financial Intermediation, 27(1), 1–30. https://doi.org/10.1016/j.jfi.2015.12.003.

Allgood, S., & Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviours. Economic Inquiry, 54(1), 675–697.

Alvaredo, F., & Gasparini, L. (2015). Recent trends in inequality and poverty in developing countries. Handbook of Income Distribution, 2, 697–805. https://doi.org/10.1016/B978-0-444-59428-0.00010-2.

Amidžić, G., Massara, A., & Mialou, A. (2014). Assessing countries ’ financial inclusion standing: A new composite Index. IMF working papers no. 14/36. Washington, DC. https://doi.org/10.5089/9781475569681.001.

Anson, J. (2016). Postal savings and financial inclusion in Asia: Addressing the great geographic, gender and growth gaps. Presentation at the regional conference on postal saving system in Asia: What we know and what to expect? Tokyo, Japan, February.

Anson, J., Berthaud, A., Klapper, L., & Singer, D. (2013). Financial inclusion and the role of the post office. Policy Research Working Paper 6630, The World Bank, October.

Ardic, O. P., Heimann, M., & Mylenko, N. (2011). Access to financial services and the financial inclusion Agenda around the world a cross-country analysis with a new data set. Policy research working papers No. 5537, The World Bank, Washington, DC. January. https://doi.org/10.1021/acsanm.8b00219.

Arshinder, K. A., & Deshmukh, S. G. (2007). Supply chain coordination issues: An SAP–LAP framework. Asia Pacific Journal of Marketing and Logistics, 19(3), 240–264.

Atanasova, C. V., & Wilson, N. (2003). Bank borrowing constraints and the demand for trade credit: Evidence from panel data. Managerial and Decision Economics, 19(3), 240–264. https://doi.org/10.1002/mde.1134.

Atkinson, A., & Messy, F.-A. (2013). Promoting financial inclusion through financial education. OECD working papers on finance, insurance and private pensions, no. 34, OECD Publishing. http://doi.org/10.1787/5k3xz6m88smp-en.

Banerjee, A. V., & Duflo, E. (2007). The economic lives of the poor. Journal of economic perspectives, 21(1), 141–168.

Barnwal, P. (2015). Curbing leakage in public programs with biometric identification systems: Evidence from India’s fuel subsidies, job market paper. Retrieved from http://www.med.uio.no/helsam/english/research/news-andevents/events/conferences/2015/vedlegg-warsaw/subsidy-leakage-uid.pdf. Accessed July 12, 2018.

Basu, P., & Srivastava, P. (2005). Exploring possibilities: Microfinance and rural credit access for the poor in India. Economic and Political Weekly, 1747–1756.

Beck, T., Demirguc-Kunt, A., Laeven, L., & Levine, R. (2008). Finance, firm size, and growth. Journal of Money, Credit, and Banking, 40(7), 1379–1405. https://doi.org/10.1111/j.1538-4616.2008.00164.x.

Beck, T., Demirguc-Kunt, A., & Levine, R. (2007a). Finance, inequality and the poor. Journal of Economic Growth, 12(1), 27–49. https://doi.org/10.1007/s10887-007-9010-6.

Beck, T., Demirguc-Kunt, A., & Martinez Peria, M. S. (2007b). Reaching out: Access to and use of banking services across countries. Journal of Financial Economics, 85, 234–266. https://doi.org/10.1016/j.jfineco.2006.07.002.

Bhanot, D., Bapat, V., & Bera, S. (2012). Studying financial inclusion in north-east India. International Journal of Bank Marketing, 30(6), 465–484. https://doi.org/10.1108/02652321211262221.

Brown, M., Guin, B., & Kirschenmann, K. (2016). Microfinance banks and financial inclusion. Review of Finance, 20(3), 907–946. https://doi.org/10.1093/rof/rfv026.

Brune, L., Giné, X., Goldberg, J., & Yang, D. (2012). Commitments to save: A field experiment in rural Malawi. Policy research working paper 5748, The World Bank, August. https://doi.org/10.2139/ssrn.1904244.

Cámara, N., & Tuesta, D. (2015). Measuring financial inclusion: A multidimensional index, BBVA research, Working paper No. 14/26, Madrid, September. https://doi.org/10.2139/ssrn.2634616.

Chakrabarty, K. (2011). Financial inclusion and banks—Issues and perspectives. UNDP (The United Nations Development Programme) Seminar on “Financial Inclusion: Partnership between Banks, MFIs and Communities”, New Delhi, 14 October. Retrieved from https://www.bis.org/review/r111018b.pdf. Accessed October 20, 2018

Chakrabarty, K. C. (2012). Financial inclusion: issues in measurement and analysis. In Keynote address, BIS-BNM workshop on financial inclusion indicators, Kuala Lumpur, November.

Chakrabarty, K. C. (2013). Financial inclusion in India: Journey so far and way forward. Keynote Address at the finance inclusion conclave. Organized by CNBC TV, 18, New Delhi.

Chakravarty, S. R., & Pal, R. (2010). Measuring financial inclusion: An axiomatic approach. Journal of Policy Modeling, 35(5), 813–837.

Charan, P. (2012). Supply chain performance issues in an automobile company: A SAP–LAP analysis. Measuring Business Excellence, 16(1), 67–86. https://doi.org/10.1108/13683041211204680.

Chatrath, S. & Vallabh, G. (2006). Role of banks in agricultural and rural development. Chartered Accountant-New Delhi, 54(8), 1122. Retrieved at http://www.ruralfinance.org/fileadmin/templates/rflc/documents/102901122-1130.pdf. Accessed October 02, 2018.

Chauvet, L., & Jacolin, L. (2017). Financial inclusion, bank concentration, and firm performance. World Development, 97, 1–13. https://doi.org/10.1016/j.worlddev.2017.03.018.

Chiapa, C., Prina, S., & Parker, A. (2016). The effects of financial inclusion on Children’s schooling, and parental aspirations and expectations. Journal of International Development, 28(5), 683–696. https://doi.org/10.1002/jid.3137.

Chibba, M. (2009). Financial inclusion, poverty reduction, and the millennium development goals. European Journal of Development Research, 21(2), 213–230. https://doi.org/10.1057/ejdr.2008.17.

Claessens, S. (2006). Access to financial services: A review of the issues and public policy objectives. The World Bank Research Observer, 21(2), 207–240.

Clamara, N., Peña, X., & Tuesta, D. (2014). Factors that matter for financial inclusion: Evidence from Peru. BBVA Working Paper No. 14/09, Madrid, February.

Cnaan, R. A., Moodithaya, M. S., & Handy, F. (2012). Financial inclusion: Lessons from rural South India. Journal of Social Policy, 41(1), 183–205. https://doi.org/10.1017/s0047279411000377.

Cohen, M., & Nelson, C. (2011). Financial literacy: A step for clients toward financial inclusion. Global Microcredit Summit, 14–17, November. Retrived from http://www.microcreditsummit.org/uploads/resource/document/cohenm_financial_literacy_39948.pdf. Accessed November 15, 2018.

Cole, S., Sampson, T. & Zia, B. (2009). Money or knowledge? What drives demand for financial services in emerging markets? Harvard Business School Working Paper, 09-117. Cambridge, MA: Harvard Business School.

Demirgüç-Kunt, A., Beck, T., & Honohan, P. (2008). Finance for all? Policies and pitfalls in expanding access. A World Bank Policy Research Report, The World Bank, Washington, DC. https://doi.org/10.1596/978-0-8213-7291-3

Demirgüç-Kunt, A., & Klapper, L. (2013). Measuring financial inclusion: Explaining variation in use of financial services across and within countries. Brookings Papers on Economic Activity, 2013(1), 279–340. https://doi.org/10.1353/eca.2013.0002.

Demirgüç-Kunt, A., Klapper, L., Dorothe, S., Ansar, S., & Hess, J. (2018). The Global Findex database 2017—Measuring financial inclusion and the Fintech revolution. Washington, DC: World Bank. https://doi.org/10.1596/978-1-4648-1259-0

Demirguc-kunt, A., Klapper, L., & Singer, D. (2017). Financial inclusion and inclusive growth: A review of recent empirical evidence. Policy research working paper no. 8040, The World Bank, Washington, DC. https://doi.org/10.1016/j.enbuild.2018.08.049.

Demirgüç-Kunt, A., Klapper, L. F., Singer, D. & Van Oudheusden, P. (2015). The Global Findex database 2014: Measuring financial inclusion around the world. Policy research working paper no. 7255, World Bank, Washington, DC.

Dixit, R., & Ghosh, M. (2013). Financial inclusion for inclusive growth of India—A study of Indian States. International Journal of Business Management and Research, 3(1), 147–156. https://doi.org/10.1016/0308-9126(82)90083-9.

DoFS. (2017). Report on various programmes including Stand Up India scheme. Department of financial services (DoFS), Government of India. Retrieved from http://financialservices.gov.in/project. Accessed September 30, 2018.

Dupas, P., & Robinson, J. (2013). Savings constraints and microenterprise development: Evidence from a field experiment in kenya. American Economic Journal: Applied Economics, 5(1), 163–192. https://doi.org/10.1257/app.5.1.163.

ESI. (2016). Economic survey report 2016–17. Government of India. http://indiabudget.nic.in/es2016-17/echapter.pdf. Accessed 2 Mar 2017.

Fungáčová, Z., & Weill, L. (2014). Understanding financial inclusion in China. China Economic Review, 34, 196–206. https://doi.org/10.1016/j.chieco.2014.12.004.

Garg, A., & Deshmukh, S. G. (2010). Engineering support issues for flexibility in maintenance: An SAP–LAP framework. Asia Pacific Journal of Marketing and Logistics, 22(2), 247–270. https://doi.org/10.1108/13555851011026980.

Ghosh, K., & Sahney, S. (2010). Organizational sociotechnical diagnosis of managerial retention in an IT organization: SAP–LAP framework. International Journal of Organizational Analysis, 18(1), 151–166. https://doi.org/10.1108/19348831011033258.

Ghosh, S., & Vinod, D. (2017). What constrains financial inclusion for women? Evidence from Indian micro data. World Development, 92, 60–81. https://doi.org/10.1016/j.worlddev.2016.11.011.

Gosavi, A. (2018). Can mobile money help firms mitigate the problem of access to finance in eastern sub-Saharan Africa? Journal of African Business, 19(3), 343–360. https://doi.org/10.1080/15228916.2017.1396791.

Gupta, S. D., & Chatterjee, S. (2018). Social entrepreneurship through micro-entrepreneurs of self-help groups. In A. Agrawal & P. Kumar (Eds.), Social entrepreneurship and sustainable business models (pp. 161–175). Cham: Palgrave Macmillan.

Gupta, P. J., & Suri, P. K. (2018). Analysing the influence of improved situation, capability level of actors and flexible process workflow on public value of e-governance projects in India. Global Journal of Flexible Systems Management, 19(4), 349–372.

Gupte, R., Venkataramani, B., & Gupta, D. (2012). Computation of financial inclusion index for India. Procedia - Social and Behavioral Sciences, 37, 133–149. https://doi.org/10.1016/S0892-1997(05)80195-X.

Gwalani, H., & Parkhi, S. (2014). Financial inclusion-building a success model in the Indian context. Procedia-Social and Behavioral Sciences, 133, 372–378.

Haleem, A., Sushil, Qadri, M. A., & Kumar, S. (2012). Analysis of critical success factors of world-class manufacturing practices: An application of interpretative structural modelling and interpretative ranking process. Production Planning and Control, 23(10–11), 722–734. https://doi.org/10.1080/09537287.2011.642134.

Hannig, A., & Jansen, S. (2010). Financial inclusion and financial stability: Current policy issues. ADBI working paper no. 259, Asian Development Bank Institute, Tokyo. https://doi.org/10.2139/ssrn.1729122.

Hoyo, C., Pena, X. & Tuesta, D. (2013). Demand factors that influence financial inclusion in Mexico: analysis of the barriers based on the ENIF survey. BBVA working papers no. 1337, June. Retrieved from https://www.bbvaresearch.com/KETD/fbin/mult/WP13 37tcm348-415216.pdf. Accessed November 05, 2018.

Inoue, T., & Hamori, S. (2012). How has financial deepening affected poverty reduction in India? Empirical analysis using state-level panel data. Applied Financial Economics, 22(5), 395–408. https://doi.org/10.1080/09603107.2011.613764.

Islam, A., Muzi, S., & Rodriguez Meza, J. L. (2017). Does mobile money use increase firms’ investment? Evidence from enterprise surveys in Kenya, Uganda, and Tanzania. Small Business Economics, 51(3), 687–708. https://doi.org/10.1007/s11187-017-9951-x.

Jack, W., & Suri, T. (2011). Mobile money: The economics of M-PESA. Working paper no. 16721, National Bureau of Economic Research. https://doi.org/10.3386/w16721.

Jack, W., & Suri, T. (2014). Risk sharing and transactions costs: Evidence from Kenya’ s mobile money revolution. American Economic Review, 104(1), 183–223. https://doi.org/10.1257/aer.104.1.183.

Janzen, S. A., & Carter, M. R. (2018). After the drought: The impact of microinsurance on consumption smoothing and asset protection. Working paper no. 19702, National Bureau of Economic Research. https://doi.org/10.1093/ajae/aay061.

Jones, P. A. (2008). From tackling poverty to achieving financial inclusion—The changing role of British credit unions in low income communities. Journal of Socio-Economics, 37(6), 2141–2154. https://doi.org/10.1016/j.socec.2007.12.001.

Kabakova, O., & Plaksenkov, E. (2018). Analysis of factors affecting financial inclusion: Ecosystem view. Journal of Business Research, 89, 198–205. https://doi.org/10.1016/j.jbusres.2018.01.066.

Kabra, G., & Ramesh, A. (2015). Analyzing ICT issues in humanitarian supply chain management: A SAP–LAP linkages framework. Global Journal of Flexible Systems Management, 16(2), 157–171. https://doi.org/10.1007/s40171-014-0088-3.

Kapoor, A. (2014). Financial inclusion and the future of the Indian economy. Futures, 56, 35–42. https://doi.org/10.1016/j.futures.2013.10.007.

Karpowicz, I. (2016). Financial inclusion, growth and inequality: A model application to Colombia. Journal of Banking and Financial Economics, 2(6), 68–89. https://doi.org/10.7172/2353-6845.jbfe.2016.2.4.

Kim, D. W., Yu, J. S., & Hassan, M. K. (2018). Financial inclusion and economic growth in OIC countries. Research in International Business and Finance, 43, 1–14. https://doi.org/10.1016/j.ribaf.2017.07.178.

Klapper, L., Lusardi, A., & van Oudheusden, P. (2015). Financial literacy around the world: Insights from the Standard & Poor’s Ratings services global financial literacy survey. Retrieved from http://www.openfininc.org/wp-content/uploads/2016/04/2015-Finlitpaper17F3SINGLES.pdf. Accessed December 02, 2018.

Koomson, I., & Ibrahim, M. (2017). Financial inclusion and growth of non-farm enterprises in Ghana, network for socioeconomic research and advancement. Working paper no. 4, June. SSRN. https://doi.org/10.2139/ssrn.2993624.

Kpodar, K., & Andrianaivo, M. (2011). ICT, financial inclusion, and growth evidence from African countries. IMF working papers no. 11–73, International Monetary Fund. https://doi.org/10.5089/9781455227068.001.

Kumar, N. (2013). Financial inclusion and its determinants: Evidence from India. Journal of Financial Economic Policy, 5(1), 4–19. https://doi.org/10.1108/17576381311317754.

Kumar, R., Singh, R. K., & Shankar, R. (2012). Supply chain management issues in an Indian SME: A SAP–LAP Analysis. Global Journal of Flexible Systems Management, 1(2), 34.

Kulshreshtha, R., Kumar, A., Tripathi, A., & Likhi, D. K. (2017). Critical success factors in implementation of urban metro system on PPP: A case study of hyderabad metro. Global Journal of Flexible Systems Management, 18(4), 303–320.

Leeladhar, S. (2006). Taking banking services to the common man-financial inclusion. Reserve Bank of India Bulletin, 60(1), 73–77.

Levine, R., Loayza, N., & Beck, T. (2000). Financial intermediation and growth: Causality and causes. Journal of Monetary Economics, 46(1), 31–77. https://doi.org/10.1016/S0304-3932(00)00017-9.

Leyshon, A., & Thrift, N. (1996). Financial exclusion and shifting boundaries of the financial system. Environment and Planning A, 28, 1150–1156. https://doi.org/10.1016/0169-7552(96)90005-7.

Lyons, A. C., Grable, J. E., & Zeng, T. (2017). Infrastructure, urbanization, and demand for bank and non-bank loans of households in the People’s Republic of China. ADBI Working Paper 767. Asian Development Bank Institute, Tokyo. Retrieved from https://www.adb.org/publications/infrastructure-urbanization-and-demand-bank-and-nonbank-loans-households-prc. Accessed November 04, 2018

Mahajan, R., Garg, S., & Sharma, P. B. (2013). Frozen corn manufacturing and its supply chain: Case study using SAP–LAP approach. Global Journal of Flexible Systems Management, 14(3), 167–177. https://doi.org/10.1007/s40171-013-0040-y.

Mangla, S. K., Kumar, P., & Barua, M. K. (2014). A flexible decision framework for building risk mitigation strategies in green supply chain using SAP–LAP and IRP approaches. Global Journal of Flexible Systems Management, 15(3), 203–218. https://doi.org/10.1007/s40171-014-0067-8.

Martínez, C.H., Hidalgo, X.P. & Tuesta, D. (2013). Demand factors that influence financial inclusion in Mexico: analysis of the barriers based on the ENIF survey. BBVA research working paper no. 37, Mexico, December.

Mas, I., & Morawczynski, O. (2010). Designing mobile money services: Lessons from M-PESA. SSRN. https://doi.org/10.2139/ssrn.1552753.

Mateut, S., Bougheas, S., & Mizen, P. (2006). Trade credit, bank lending and monetary policy transmission. European Economic Review, 50(3), 603–629. https://doi.org/10.1016/j.euroecorev.2005.01.002.

Mohan, R. (2006). Economic growth, financial deepening, and financial inclusion. Reserve Bank of India Bulletin, 1305–1320. https://doi.org/10.2319/022013-147.1.

Mohanty, D. (2015). Report of the committee on medium-term path on financial inclusion, Reserve Bank of India (RBI), Mumbai. Retrieved from https://rbidocs.rbi.org.in/rdocs/PublicationReport/Pdfs/FFIRA27F4530706A41A0BC394D01CB4892CC.PDF. Accessed April 02, 2018.

Morgan, P., & Pontines, V. (2014). Financial stability and financial inclusion. ADBI working paper 488. Asian Development Bank Institute, Tokyo. Retrieved from http://www.adbi.org/working-paper/2014/07/07/6353.financial.stability.inclusion/, https://doi.org/10.2139/ssrn.2464018. Accessed April 24, 2018.

NABARD. (2010). Status of micro finance in India 2009–10, National Bank for Agriculture and Rural Development (NABARD), Mumbai. Retrieved from https://www.nabard.org/auth/writereaddata/tender/3107173739SMFI%202009-10%20Eng.pdf. Accessed December 20, 2018

Palanisamy, R. (2012). Building information systems flexibility in SAP–LAP framework: A case study evidence from SME sector. Global Journal of Flexible Systems Management, 13(1), 57–74. https://doi.org/10.1007/s40171-012-0005-6.

Paramasivan, C., & Ganeshkumar, V. (2013). Overview of financial inclusion in India. International Journal of Management and development studies, 2(3), 45–49.

Park, C.-Y., & Mercado, R. (2015). Financial inclusion, poverty, and income inequality in developing Asia. ADB working paper series no 426, Asian Development Bank, Manila, January. SSRN. https://doi.org/10.2139/ssrn.2558936.

Park, C. Y. & Mercado, R. V. (2018). Financial inclusion: New measurement and cross-country impact assessment. ADB working paper series no 539, Asian Development Bank, Manila, March. http://doi.org/10.22617/WPS189270-2.

PMJDY. (2014). Pradhan Mantri Jan-Dhan Yojana (PMJDY). Ministry of Finance, Government of India. Retrieved from www.pmjdy.gov.in/files/E-Documents/PMJDYBROCHURE_ENG.pdf. Accessed November 22, 2017.

PMJDY. (2017). Pradhan Mantri Jan Dhan Yojana progress report. Retrieved from https://www.pmjdy.gov.in/account. Accessed March 3, 2018.

PMMY. (2016). Pradhan Mantri Mudra Yojana annual report 2016–17. Retrieved from https://www.mudra.org.in/. Accessed April 03, 2018

Rajan, R. G. (2015). A hundred small steps: Report of the committee on financial sector reforms. Planning Commission, Government of India. Retrieved from http://planningcommission.nic.in/reports/genrep/repfr/cfsrall.pdf. Accessed January 25, 2018

Ramakrishnan, D. (2011). Financial literacy and financial inclusion. Conference paper at 13th thinkers and writers forum 29th SKOCH summit refuelling growth, Mumbai, June. SSRN. https://doi.org/10.2139/ssrn.1958417.

Rangarajan, C. (2008). Report of the committee on financial inclusion. Ministry of Finance, Government of India, January. Retrieved from https://www.sidbi.in/files/Rangarajan-Commitee-report-on-Financial-Inclusion.pdf. Accessed January 02, 2018

Ravallion, M. (2013). How long will it take to lift one billion people out of poverty? Review. World Bank Research Observer, 139–158. https://doi.org/10.1093/wbro/lkt003.

RBI. (2006). Financial inclusion and millennium development goals. RBI Bulletin, 50(2), 239–243.

RBI. (2011a). Financial inclusion and banks: Issues and perspectives. RBI Monthly Bulletin, November.

RBI. (2011b). Know your customer norms—Letter issued by Unique Identification Authority of India (UIDAI) containing details of name, address and Aadhaar number. Reserve Bank of India, Mumbai, September. Retrieved from https://rbidocs.rbi.org.in/rdocs/notification/PDFs/CKYC28092011.pdf. Accessed December 12, 2018

RBI. (2013). Guidelines for licensing of new banks in the private sector. Retrieved from https://rbidocs.rbi.org.in/rdocs/Content/PDFs/GFLNB2222013.pdf. Accessed December 20, 2018.

RBI. (2014). Report of the Committee on Comprehensive Financial Services for Small Businesses and Low Income. RBI. Retrieved from https://www.rbi.org.in/Scripts/Statistics.aspx. Accessed October 28, 2018.

RBI. (2017). Report on trend and progress of banking in India 2016–17. Reserve Bank of India, Mumbai, June. Retrieved from https://rbidocs.rbi.org.in/rdocs/Publications/PDFs/0RTP20161778B7539711F4E088A31D52351BF6440.PDF. Accessed October 08, 2018.

Rillo, D. A. & Miyamoto, J. (2016). Innovating financial inclusion: Postal savings system revisited. Policy Brief No. 3, Asian Development Bank Institute, Tokyo, February. https://www.adb.org/sites/default/files/publication/190603/adbi-pb2016-3.pdf

Rojas-Suarez, L. (2010). Access to financial services in emerging powers: Facts, obstacles, and policy implications. OECD Global Development Background Papers, Washington DC, March.

Sahay, R., Cihak, M., N’Diaye, P., Barajas, A., Mitra, S., Kyobe, A., & Yousefi, R. (2015). Financial inclusion: Can it Meet multiple macroeconomic goals? IMF Staff Discussion Note, SDN/15/08, May. https://doi.org/10.5089/9781513585154.006.

Sahoo, T., Banwet, D. K., & Momaya, K. (2011). Strategic technology management in practice: SAP–LAP hills analysis of an automobile manufacturer in India. International Journal of Business Excellence, 4(5), 519–543. https://doi.org/10.1504/IJBEX.2011.042156.

Sarma, M. (2008). Index of financial inclusion. Indian Council for Research on International Economic Relations working paper no. 215, Indian Council for Research on International Economic Relations. https://doi.org/10.1007/978-81-322-1650-6_28.

Sarma, M., & Pais, J. (2008). Financial inclusion and development: A cross country analysis. In Annual conference of the human development and capability association (pp. 10–13), New Delhi, September. https://doi.org/10.1002/jid.

Sassi, S., & Goaied, M. (2013). Financial development, ICT diffusion and economic growth: Lessons from MENA region. Telecommunications Policy, 37(4–5), 252–261. https://doi.org/10.1016/j.telpol.2012.12.004.

Sehrawat, M., & Giri, A. K. (2016). Financial development, poverty and rural–urban income inequality: Evidence from South Asian countries. Quality & Quantity, 50(2), 577–590. https://doi.org/10.1007/s11135-015-0164-6.

Setboonsarng, S., & Parpiev, Z. (2013). Microfinance and the millennium development goals in Pakistan: Impact assessment using propensity score matching. ADB institute discussion papers no. 104, Asian Development Bank Institute (ADBI), Tokyo. https://doi.org/10.1038/ncomms6251.

Shamim, F. (2007). The ICT environment, financial sector and economic growth: A cross-country analysis. Journal of Economic Studies, 34(4), 352–370. https://doi.org/10.1108/01443580710817452.

Shankar, S. (2013). Financial inclusion in India: Do microfinance institutions address access barriers? ACRN Journal of Entrepreneurship Perspectives, 2(1), 60–74.

Sinclair, S. (2001). Financial exclusion: An introductory survey. CRSIS, Edinburgh College of Art/Heriot Watt University. https://doi.org/10.1021/jp900281h.

Singh, A. (2017). Financial inclusion & implementation of Jan Dhan Yojna—Information technology as enabler. International Journal of Scientific Research and Management, 5(7), 5913–5918.

Singh, N., & Kumar, S. (2014). Success of tata nano through marketing flexibility: A SAP–LAP matrices and linkages approach. Global Journal of Flexible Systems Management, 15(2), 145–160. https://doi.org/10.1007/s40171-014-0062-0.

Singh, C., Mittal, A., Garg, R., Goenka, A., Goud, R., Ram, K., et al. (2014). Financial inclusion in India: Select issues. IIM Bangalore working paper no. 474. Retrieved from https://iimb.ac.in/research/sites/default/files/WP%20No.%2 0474.pdf. Accessed January 10, 2018.

Suri, P. K., & Sushil, N. A. (2012). Planning and implementation of e-governance projects: A SAP–LAP based gap analysis. Electronic Government, An International Journal, 9(2), 178–199. https://doi.org/10.1504/EG.2012.046268.

Sushil, (2000). SAP–LAP models of inquiry. Management Decision, 38(5), 347–353. https://doi.org/10.1108/00251740010340526.

Sushil, (2009). Interpretive ranking process. Global Journal of Flexible Systems Management, 10(4), 1–10.

Sushil, (2017a). Efficient interpretive ranking process incorporating implicit and transitive dominance relationships. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2608-y.

Sushil, (2017b). Theory building using SAP–LAP linkages: An application in the context of disaster management. Annals of Operations Research. https://doi.org/10.1007/s10479-017-2425-3.

Sushil, (2018). Interpretive multi-criteria ranking of production systems with ordinal weights and transitive dominance relationships. Annals of Operations Research. https://doi.org/10.1007/s10479-018-2946-4.

Swamy, V. (2014). Financial inclusion, gender dimension, and economic impact on poor households. World Development, 56, 1–15. https://doi.org/10.1016/j.worlddev.2013.10.019.

Thorat, S. U. (2006). Financial inclusion and the millennium development goals. RBI Bulletin

Uma, H. R., & Rupa, K. N. (2013). The role of SHGS in financial inclusion: A case study. International Journal of Scientific and Research Publications, 3(6), 1–5.

Venkataramany, S., & Bhasin, B. (2009). Path to financial inclusion: The success of self-help groups-bank linkage program In India. International Business & Economics Research Journal, 8(11), 11–19. https://doi.org/10.1111/j.1442-9071.2005.01028.x.

Yunus, M. (2006). What is microcredit. Dhaka: Grameen Bank.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher's Note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendices

Appendix 1

Respondent’s Profile

Domain | Profile | Work experience | Number of respondents |

|---|---|---|---|

Public Bank | General Manager | 10–20 years | 2 |

Senior Manager | 5–10 years | 2 | |

Private Bank | General Manager | 10–20 years | 2 |

Senior Manager | 5–10 years | 2 | |

Academician | Professor | 20–25 years | 4 |

Government | Consultant | 10–15 years | 3 |

Appendix 2

SAP–LAP Model of Inquiry

SAP–LAP | Questions |

|---|---|

Situations | What is the current status of financial inclusion in India? What are the different initiatives adopted to promote and implement financial inclusion? What are the present issues faced by banks in providing financial products and services to the poor? What are the present issues faced by poor customers in utilizing financial products and services? |

Actors | Who are the key actors in influencing the supply side of financial inclusion? Who are the key actors in influencing the demand side of financial inclusion? |

Processes | What are the key processes adopted to promote financial inclusion of poor by the government? What are the key processes adopted by various banks to deliver financial products and services to the poor? What are the key processes through which monitoring of financial inclusion progress could be done? |

Learning | What are the challenges with respect to the current situation? What are the challenges with respect to various processes of financial inclusion? What are the challenges faced by various actors in implementing financial inclusion? |

Actions | What are the actions that need to be taken to address the challenges and issues impeding financial inclusion in the country? |

Performance | How these proposed actions are going to affect the current scenario of financial inclusion? What will be the potential impact of these actions on key influencer or actors of financial inclusion? What will be the potential impact on various processes of financial inclusion? |

Appendix 3

Highlights of Some Recent Initiatives by Government of India on FI

Pradhan Mantri Jan Dhan Yojana (PMJDY): PMJDY is a recent scheme to boost the financial inclusion in India. The earlier target of this scheme was to open 7.5 crore new bank accounts (PMJDY 2017) Pradhan Mantri MUDRA Yojana (PMMY): PMMY is intended to promote financial inclusion by encouraging small and micro-enterprises to take up the loan. The loans are usually extended through various commercial banks, RRBs, microfinance institutions, etc. Based on the loan amount, the Mudra Loans have been classified under three categories ‘Shishu’ (up to INR 50,000), ‘Kishore’ (above INR 50,000 to up to 5 lakh) and ‘Tarun’ (above INR 5 lakh to up to 10 lakh) (PMMY 2016) Direct Benefit Transfer schemes (DBTs): The role of Jan Dhan-Aadhaar-Mobile (JAM) is significant in affecting various direct money transfer schemes (DBTs) (ESI 2016) Stand-Up India Scheme: The scheme aims at promoting the entrepreneurship especially among backward castes (Scheduled caste/scheduled tribe) and women by extending bank loan of INR 10 lakh to 1 crore. Credit Guarantee Fund for Stand-Up India (CGFSI) has been constituted under this scheme to promote collateral-free coverage (DoFS 2017) Besides this, there are some recent social security schemes in insurance and pension sectors like Pradhan Mantri Jeevan Jyoti Bima Yojana (PMJJBY), Pradhan Mantri Suraksha Bima Yojana (PMSBY), Atal Pension Yojana (APY) and Pradhan Mantri Vaya Vandana Yojana which also facilitate the financial inclusion (DoFS 2017) |

Appendix 4

Various Processes of Financial inclusion

Processes | Description |

|---|---|

Bank led programme | i) Self-Help Groups (SHGs)-bank linkage In this mode, the banks extend a loan to SHG which is generally a group of 10–20 people usually poor or underprivileged. The bank provides the loan against the money deposited by them. SHG serve group guarantee of each other and take a collective decision in lending to any member (ii) Business Correspondents (BCs) In this mode, the BCs are enabled to extend banking services in far and remote areas of difficult financial access (iii) Microfinance-bank led programme Under this model, banks refinance the microfinance institutions which in turn extend micro-loans to the poor |

Simplified KYC norms | RBI eased the Know Your Customer (KYC) requirement to address the documentation issues |

Bank branch authorization | RBI liberalized the bank authorization policies especially in remote and rural areas. This permits the banks to open new branches without undergoing much authorization approval in those areas |

Basic savings bank deposit accounts (BSBDAs) | RBI introduced no-frill accounts (zero or minimum balance account) in 2005. Later, it was replaced by basic saving bank deposit accounts (BSBDAs) with a facility of overdraft limit |

General credit cards (GCC) | The general credit card provides a facility to people residing in rural and semi-urban to avail easy access of up to INR 25,000 without security |

Kisan credit cards (KCCs) | These are the smart cards issued by banks helping farmers to avail their credit need timely |

Mobile banking | Mobile banking is an innovative platform which enables the user to operate the banking services like paying bills, fund transfer, etc., on a mobile phone |

Financial Stability Development Council (FSDC) | RBI revised norms for financial literacy centres (FLCs). The focus of this council is to promote financial inclusion through financial literacy |

Appendix 5

Interpretive logic—knowledge base-ranking of actors w.r.t. processes

Paired comparison | Interaction with process | Interpretive logic |

|---|---|---|

A2 Dominating A4 | P1 | Banks have a predominate role in extending credit to SHGs for various entrepreneurial activities against group guarantee |

A3 Dominating A1, A2 and A4 | P1 | Poor beneficiaries have more influence in SHG formation, repayment and demand for credit |

A4 Dominating A1 | P1 | NBFCs work more closely in far and distant places in disbursing loans to SHGs |

A2 Dominating A1 | P3 | Banks refinance various microfinance institutions to extend micro-loans to poor |

A3 Dominating A2 and A4 | P3 | The demand for micro-loan by poor influences the borrowing from microfinance institutions |

A4 Dominating A1 and A2 | P3 | NBFCs as microfinance institutions (MFI) disburse micro-loans more closely to the poor residing in far and unbanked places |

A1 Dominating A3 | P4 | Government through various policy interventions for biometric authentication have significant influence in simplification of KYC (Know Your Customers) norms |

A2 Dominating A1 and A3 | P4 | Banks have more influence in regulation and implementation of various KYC norms |

A3 Dominating A2 | P6 | Poor beneficiaries (or end-users) impact more on the utilization of BSBDA |

A1 Dominating A3 | P7 | Government through policies interventions impact on the dissemination of Kisan credit card, (KCC), general credit card, etc. |

A1 Dominating A2, A3 | P8 | Government provides funding to create awareness for financial products and services for poor |

A2 Dominating A3 | P8 | Banks has predominant role in promoting financial literacy through various awareness camps and programmes |

Appendix 6

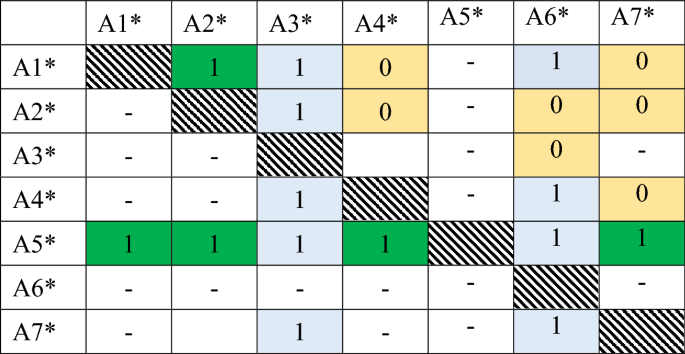

Pair-wise dominance of actors (A1 to A4) for different processes (P1 to P8)

-

(a)

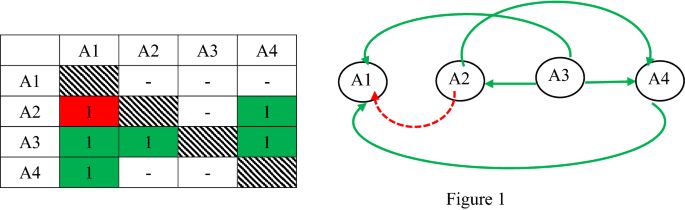

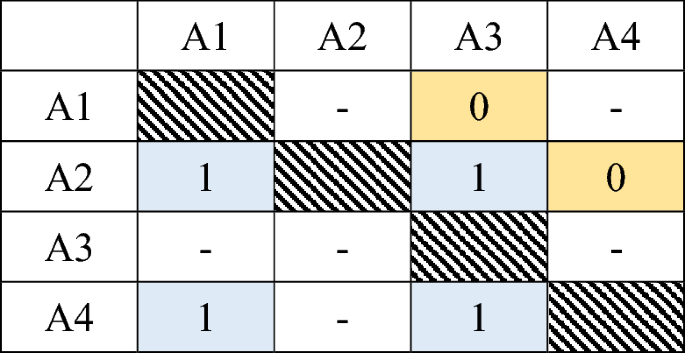

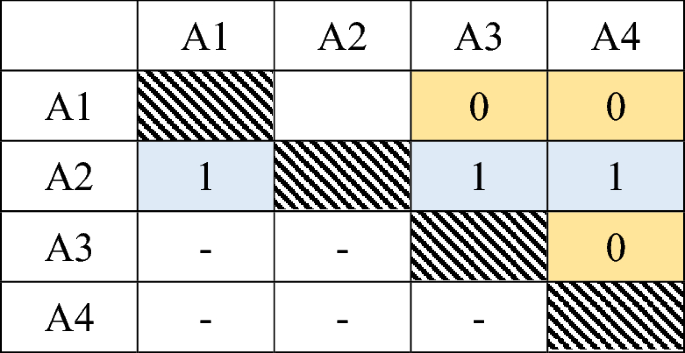

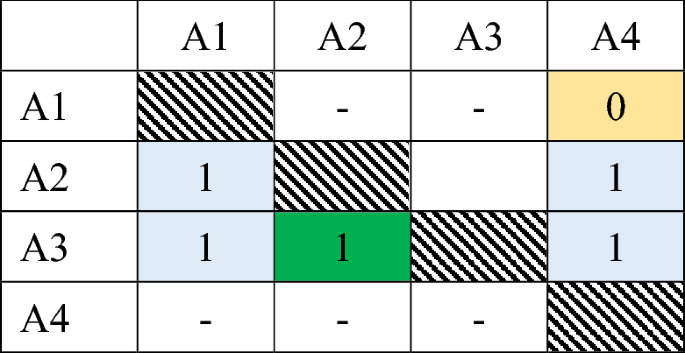

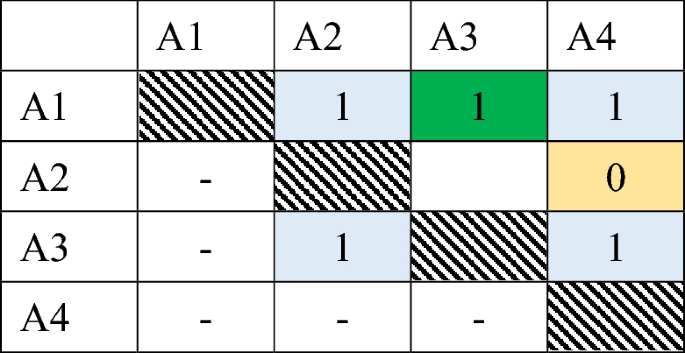

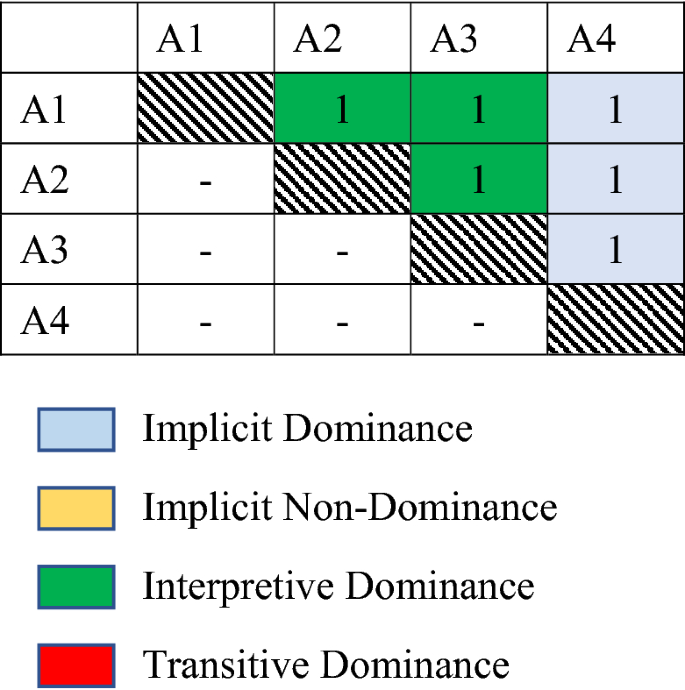

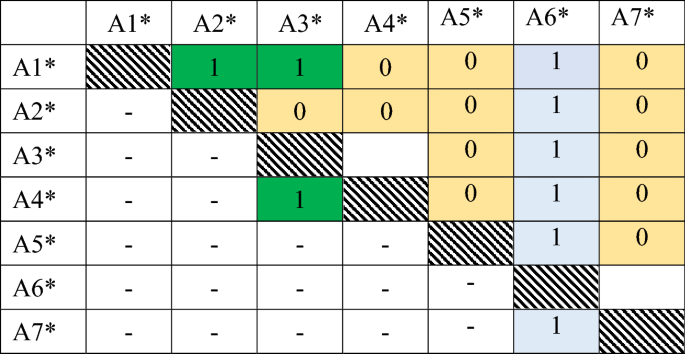

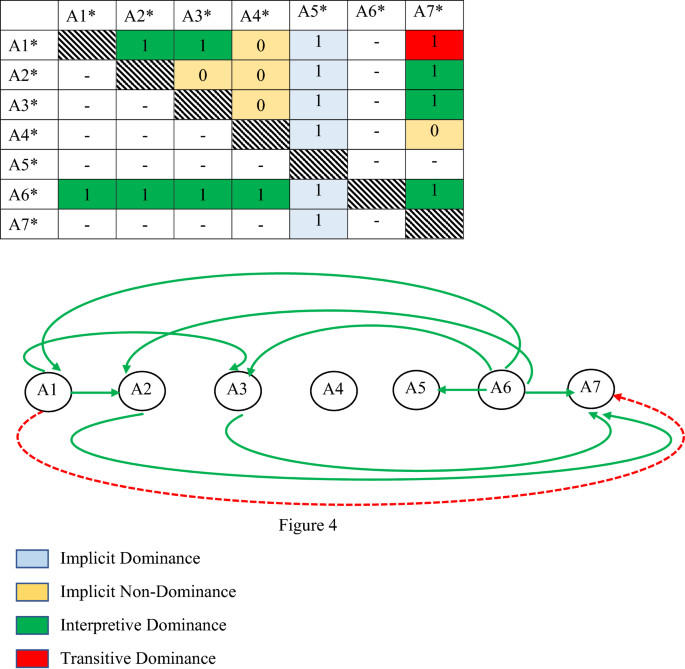

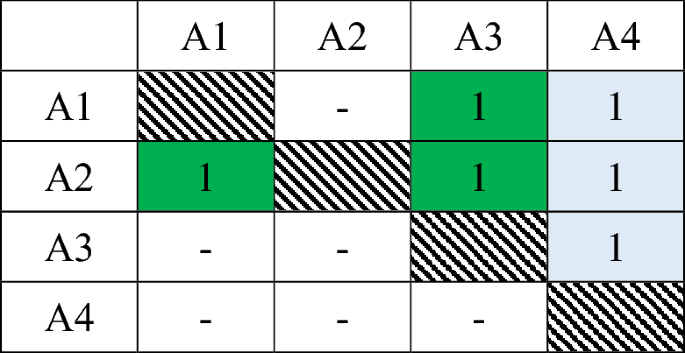

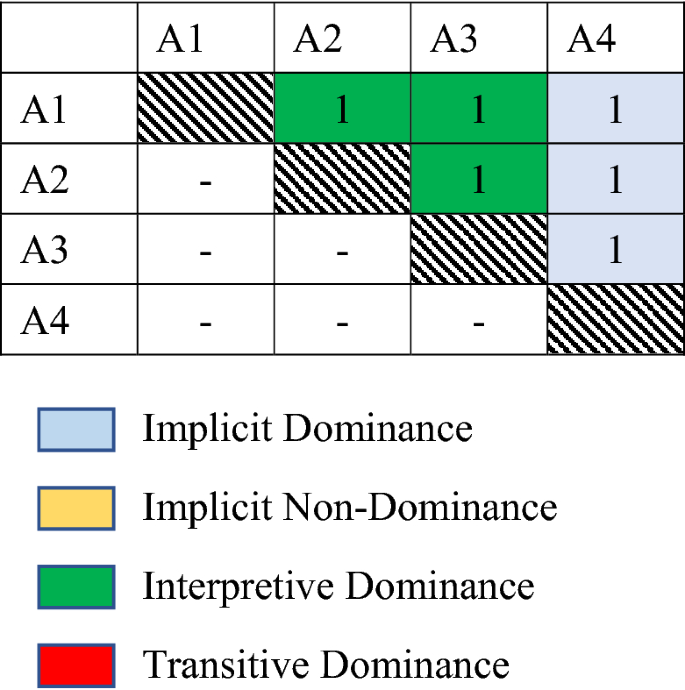

Dominating Interaction Matrix of Actors for Process P1 (with Fig. 1 Transitive interaction graph)

-

(b)

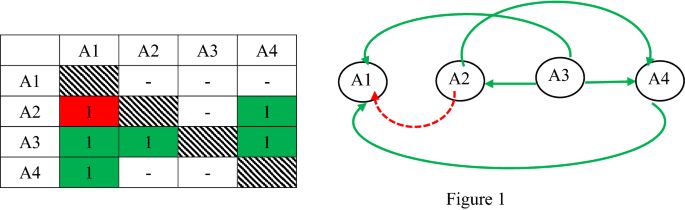

Dominating Interaction Matrix of Actors for Process P2

-

(c)

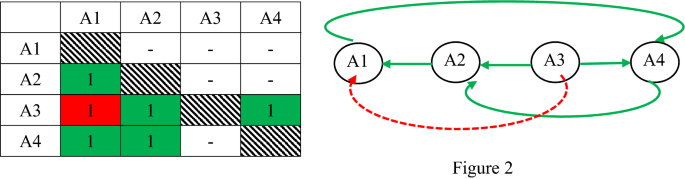

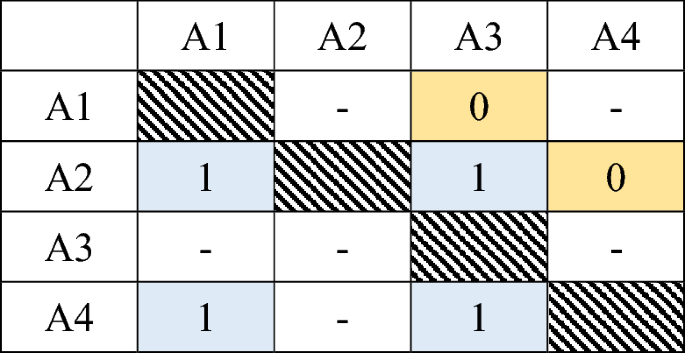

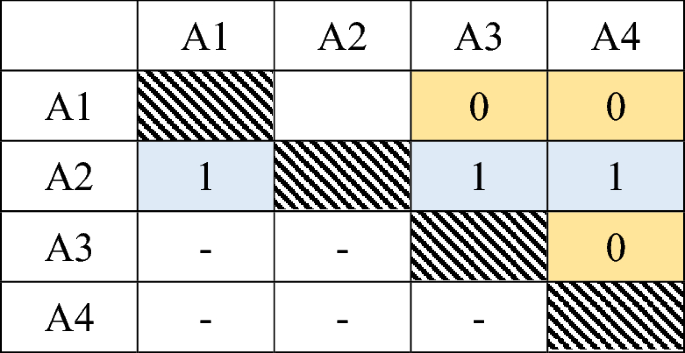

Dominating Interaction Matrix of Actors for Process P3 (with Fig. 2 Transitive interaction graph)

-

(d)

Dominating Interaction Matrix of Actors for Process P4

-

(e)

Dominating Interaction Matrix of Actors for Process P5

-

(f)

Dominating Interaction Matrix of Actors for Process P6

-

(g)

Dominating Interaction Matrix of Actors for Process P7

-

(h)

Dominating Interaction Matrix of Actors for Process P8

Appendix 7

Interpretive logic—knowledge base-ranking of actions w.r.t. performances

Paired comparison | Interaction with process | Interpretive logic |

|---|---|---|

A1* Dominating A2* | P1* | ICT-based financial products are more likely to impact the macro-economic conditions |

A1* Dominating A2* | P2* | Similarly, ICT-based financial technology have more impact on improving the micro-economic conditions of individuals and businesses |

P4* | ICT-based products like mobile banking have potential to outreach larger masses in far and distant rural places | |

P5* | ICT-based products provide ease in utilizing various banking services | |

A1* Dominating A3* | P1* | Although micro-insurance services have long-term benefit, the improvement in ICT-based products have more impact on overall growth and development |

P2* | Technology provides an opportunity to reach rural masses through a mobile phone; online banking with the business correspondent model has made banking services more accessible and easier | |

P5* | ICT has the potential to ease in access and utilization of various financial services | |

A1* Dominating A7* | P3* | ICT-based platform provides more safe and transparent financial transactions |

A2* Dominating A7* | P5* | Though micro-insurance instils saving and insurance towards accidental, health and agricultural losses, etc. However, differentiated banks on the other hand facilitate utilization of varieties of financial services like small deposit and lending, etc. |

A3* Dominating A7* | P5* | The significance of micro-insurance programmes linked with banks has recently emerged in many sectors like various farm and entrepreneurial activities which in turn impact banking services utilization |

A4* Dominating A2* | P2* | Jan Dhan-Aadhaar-Mobile (JAM) trinity has the potential to bring a large mass under the mainstream banking sector with direct cash payments to beneficiaries account |

A4* Dominating A3* | P1* | JAM trinity is likely to impact the country’s growth by raising banks saving fund and subsequent investment for development and employment |

A4* Dominating A7* | P3* | JAM which involves mobile banking provides comparatively safe and transparent option for financial transactions |

A5* Dominating A1*, A2*, A4* and A7* | P4* | Post offices in India provide one stop financial solutions to many services like payment collection on behalf of subscribers like electricity, telephone, etc., receiving benefits under various state and central government schemes particularly in remote areas |

A5* Dominating A3* | P1* | Micro-insurance is an emerging sector in India, but post offices are wide spread and have become an access point to many financial services, which, in turn, most likely impact productivity and employability |

P2* | Post offices may play a significant role in providing financial service to financially excluded segment like less educated, poor, labourers, farmers, etc., particularly in rural areas | |

A6* Dominating A1*, A2*, A3*, A4* and A7* | P5* | Increasing financial literacy may improve utilization of various financial products and services |

A7* Dominating A2* | P1* | Though differentiated banks target niche demographic segments, it may fail to sustain without infrastructure developments (like the road, internet, phone connectivity, etc.) |

P2* | Expanding infrastructure is most likely to increase the access to financial services by individuals and micro-enterprises | |

A7* Dominating A5* | P1* | Building financial infrastructure through collaboration may help to build macro-economic sphere by increasing the productivity of the firms |

P2* | A better physical infrastructure may help to disseminate banking services more easily to people living in far and unbanked places where even post offices are unavailable. |

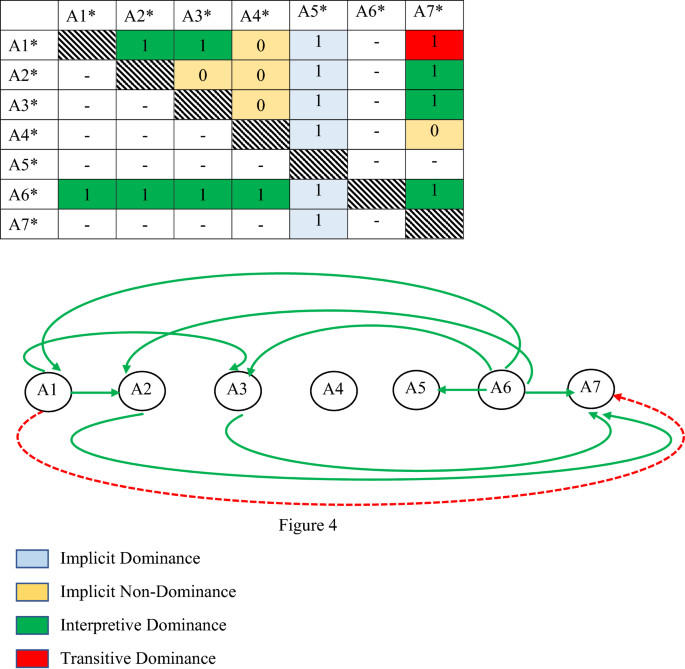

Appendix 8

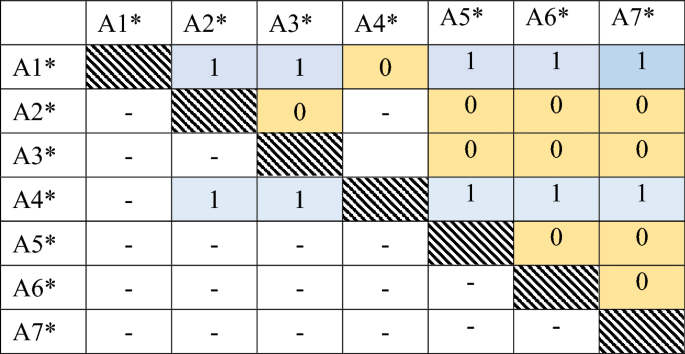

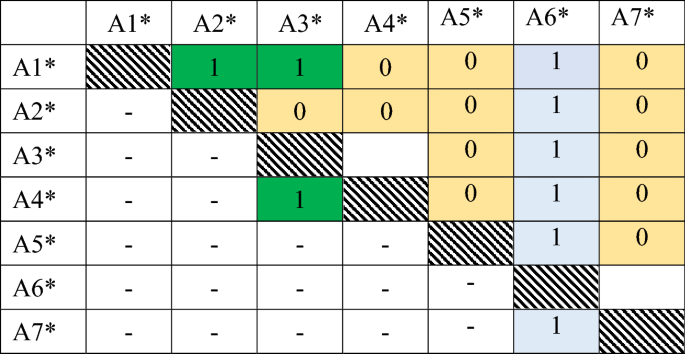

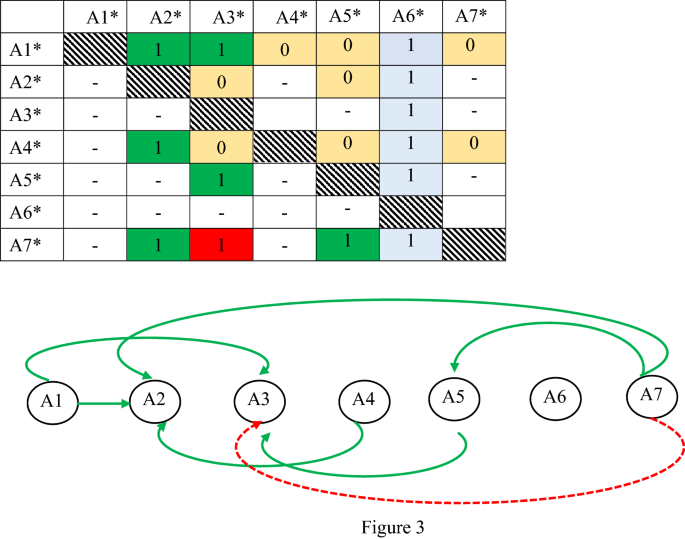

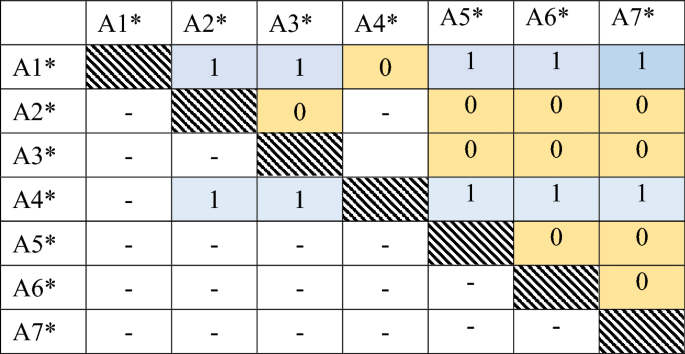

Pair-wise dominance of actions (A1 to A7) for different performances (P1 to P5)

-

(a)

Dominating Interaction Matrix of Action for Performance (P1*)

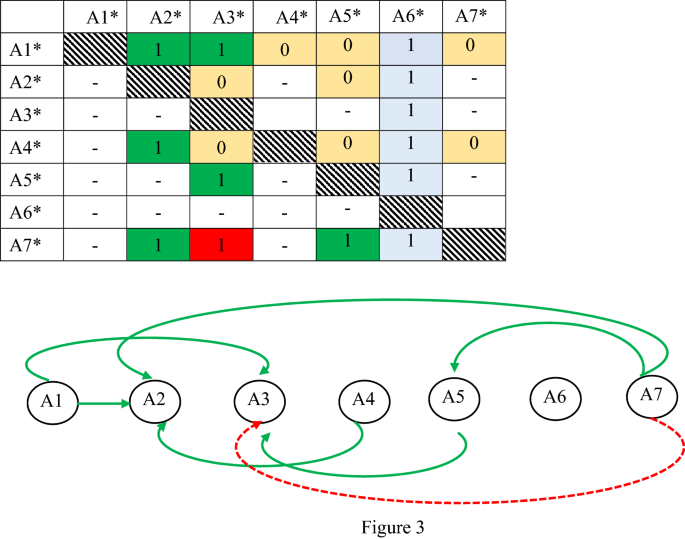

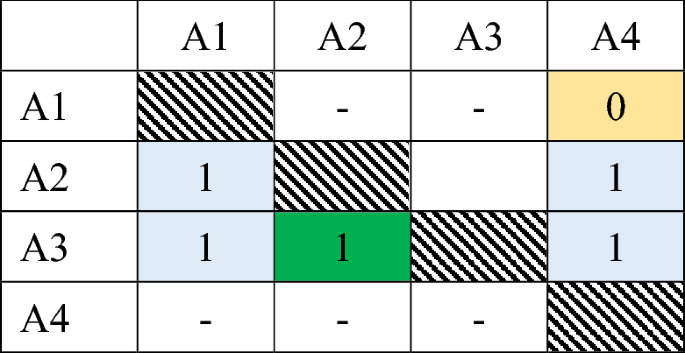

-

(b)

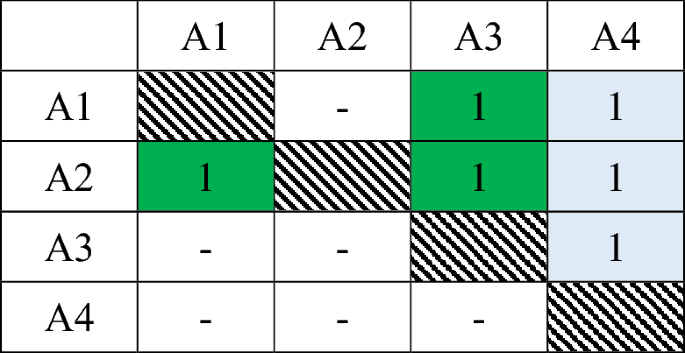

Dominating Interaction Matrix of Action for Performance (P2*) P3 (with Fig. 3 Transitive interaction graph)

-

(c)

Dominating Interaction Matrix of Action for Performance (P3*)

-

(d)

Dominating Interaction Matrix of Action for Performance (P4*)

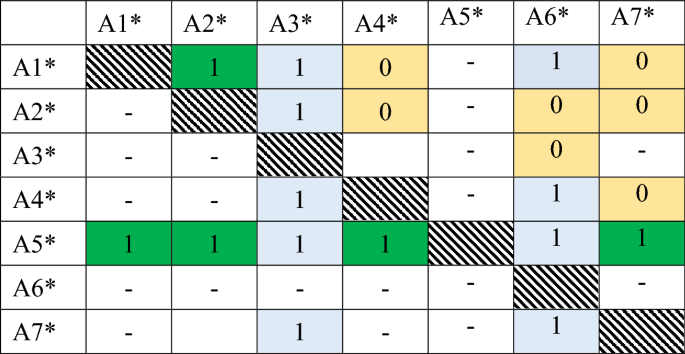

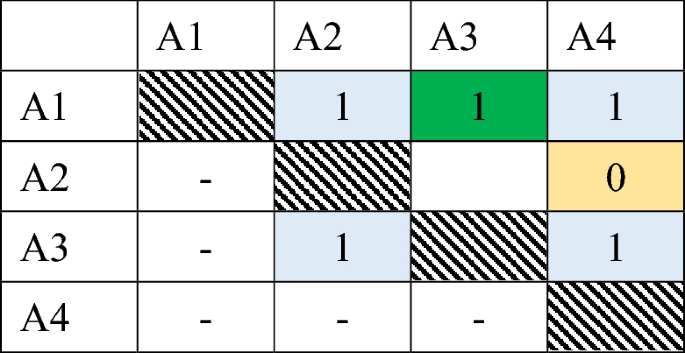

-

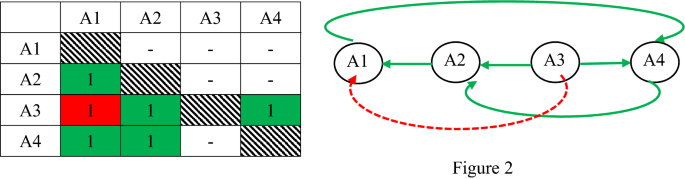

(e)

Dominating Interaction Matrix of Action for Performance (P5*) P3 (with Fig. 4 Transitive interaction graph)

Rights and permissions

About this article

Cite this article

Malik, S., Maheshwari, G.C. & Singh, A. Understanding Financial Inclusion in India: A Theoretical Framework Building Through SAP–LAP and Efficient IRP. Glob J Flex Syst Manag 20, 117–140 (2019). https://doi.org/10.1007/s40171-019-00207-8

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s40171-019-00207-8