Abstract

This article presents per capita GDP and income distribution estimates for preindustrial Poland. It is based on a social table for the Voivodeship of Cracow in 1578. Our evidence indicates that income in Poland was distributed more equally than in contemporary Holland. However, the extraction rate was much higher than in the North Sea area. Furthermore, income inequality in the countryside of the Voivodeship was higher than inequality in Cracow. This can be explained by the demesne economy based on serfdom that was prevalent in agriculture. Using trends in real wages and urbanisation, we also project Polish GDP forwards and backwards in time. Our results indicate that Polish per capita GDP was below that of Western Europe as early as the fifteenth century. This gap persisted despite moderate growth of the Polish economy in the sixteenth century. In the seventeenth century, Poland impoverished and became even poorer than Asian economies for which similar estimates are available. Poland recovered slightly in the eighteenth century but continued to lag behind Western Europe.

Similar content being viewed by others

1 Introduction

This article seeks to establish how the Polish historical experience relates to the debates on income inequalities within and between countries in the early modern period. We reconstruct a social table for one of the economic and political centres of Poland, the Voivodeship of Cracow, and on this basis also explore the level of per capita GDP of Poland in this period (we discuss the representativeness of the region for Poland as a whole later in the text). We compare the results internationally between 1410 and 1910. Our findings confirm the impressions provided by previous comparative studies of preindustrial Poland that the country lagged behind compared with England and The Netherlands (Allen 2001; Van Zanden 2001; Wójtowicz and Wójtowicz 2009; Baten and Szołtysek 2014). This growing apart of Poland and the North Sea region happens especially in the seventeenth and the eighteenth century. With this evidence, we validate the hypothesis known as the ‘Little Divergence’, which proposes that relative income levels in northwestern Europe increased vis-à-vis the rest of the continent through the early modern era (Allen 2001; Van Zanden 2001; Broadberry et al. 2015). We also confirm the claims made by Milanovic et al. (2011) about the link between the level of real income and income inequality. We demonstrate that income inequality in the Polish agricultural sector was constrained by the inequality possibility frontier. However, contrary to the theoretical model proposed by Kuznets (1955) and in opposition to the relations identified empirically for Western Europe (for example for Holland by Van Zanden 1995 and for Northern Italy by Alfani and Ammannati 2014), income in the Polish agricultural sector was distributed less equally than in the urban sector. We link this finding to the demesne economy based on serfdom, which defined class relations in the country.

This is not the first study that tries to chart the long-term growth curve of the Polish economy in the early modern period (Van Zanden 2001; Wójtowicz and Wójtowicz 2009), but our reconstruction is based on new data and on the methodology used in similar articles on GDP in pre-1800 Spain (Alvarez-Nogal and Prados de la Escosura (2013), Italy (Malanima 2010) and Germany (Pfister 2011), making the results comparable to those of these (and other) European countries. The methodology uses changes in real wages and urbanisation to gauge shifts in real income. Thanks to recent work by Malinowski (2016a), who estimated real wages in preindustrial Poland, we can use this methodology to make estimates for GDP per capita for the benchmark years 1500, 1578, 1662, and 1776. The results indicate a moderate growth in the economy in the sixteenth century, a strong contraction in the seventeenth century, and a stagnation in the eighteenth century. In the sixteenth century, Polish per capita GDP was already below that of Western Europe. After the seventeenth century crisis, Polish real income went down to a level below that of India or Japan.

Positioning Poland in the debate on early modern growth is one objective. The other is to test ideas about the determinants of income inequality. According to Kula (1983), in the Polish demesne economy based on serfdom, surplus generated by the peasants was extracted by their landlords. This suggests the existence of a wide income gap between the top and the bottom levels of Polish society, which could have resulted not only in high levels of income inequality but also in a high extraction rate (see Milanovic et al. 2011 for a definition of the concept), particularly in the agricultural sector. Contrariwise, according to Kuznets (1955) and Milanovic et al. (2011), poor and agrarian societies should be characterised by relatively low inequality. The latter authors propose that, for every value of per capita GDP there exists a maximum potential inequality, determined by real income and the subsistence minimum below which people cannot survive. This relationship is known as the inequality possibility frontier. The frontier is low in poor preindustrial societies, regardless of their political setup, and high in rich societies. Milanovic et al. (2011) built on the ideas of Kuznets (1955), who famously argued that early economic growth should result in a rise in income inequality. The latter author argued that, due to low productivity, agriculture should be characterised by low levels of income inequality. Kuznets theorised that economic growth is related to shifts of labour from agriculture to industry that is characterised by higher productivity. According to his model, due to the productivity gap between the rural and urban sectors and the arguably higher income inequality within the more productive sector, industrialisation/urbanisation makes societies richer, but it also makes them more unequal (Kuznets 1955: 7–8). Van Zanden (1995) suggested that Kuznets’s model could be also applied to explain preindustrial economic growth (so-called Super Kuznets’s Curve). He demonstrated that, in the case of Holland, income in the Dutch agricultural sector was relatively evenly distributed and that early modern economic growth went together with an increase in income inequality. In this article, we try to put the Polish experience into the Western European perspective, and investigate whether (A) demesne economy based on serfdom in early modern Poland resulted in relatively high levels of income inequality and extraction or (B) whether inequality in the country was constrained by the small size of its agricultural economy. We conclude that, contrary to Western Europe, the agricultural sector in Poland could have been more unequal than the urban one. Our evidence also indicates that income in Poland was distributed more equally than in contemporary Holland. However, the extraction rate in the Voivodeship was much higher than in the North Sea area.

2 Hypotheses

In this section, two contrasting hypotheses regarding Polish preindustrial inequality are presented: one stressing economic constraints to income inequality, the other suggesting that political institutions and agricultural class structures determine the level of income inequality.

We propose Hypothesis A that income inequality in Poland was relatively low, in comparison with other preindustrial societies, due to the low level of real income and the dominance of the agricultural sector. Milanovic et al. (2011) suggested a strong relationship between real income and the maximum feasible inequality. The authors assumed that every society has to ensure that the poorest classes receive enough resources for subsistence. The subsistence threshold is typically set at 300 1990 international, purchasing power parity dollars, also known as Geary–Khamis dollars (hereafter 1990$PPP), although some authors argue that it may be as low as 250 (Bolt and Van Zanden 2014). According to Milanovic et al. (2011), only surplus above the 300 1990$PPP threshold can be extracted by the elite. As a result, the richer the economy, the bigger the potential inequality. Building on these assumptions, Milanovic et al. (2011) formally defined the inequality possibility frontier \( G^{*} \) as:

where s is the subsistence minimum equal to 300 1990$PPP, μ is GDP per capita, and ε is the proportion of the population belonging to the upper class (the authors assume that this elite accounts for 1 % of the total population). \( G^{*} \) is the Gini index. It ranges from zero (perfect equality) when GDP per capita is at the level of subsistence to 100 (perfect inequality) when GDP per capita approaches infinity. The most important feature of the inequality possibility frontier is that its relation with the GDP per capita is not linear. \( G^{*} \) rises sharply at the initial stages of economic growth—particularly between 300 and 1000 1990$PPP—and nearly plateaus thereafter (see Fig. 3). For this reason, the concept is crucial for preindustrial economies, which are in transition between the Malthusian subsistence regime and modern economic growth.

The inequality possibility frontier does not dictate that inequality should always increase with growth. It only means that there is little space for income inequality in poor societies. According to Kuznets (1955), economic growth, at its early stages, results in a rise in income inequality. According to his model, the urban/industrial sector is characterised by a higher productivity and thus greater income inequality than the agricultural one (Kuznets 1955: 8). Therefore, poor and agricultural societies (like preindustrial Poland) should be characterised by low income inequality. According to Kuznets, the higher the share of people working outside agriculture, the greater the mean income, but also the greater the inequality (Kuznets 1955: 7–8). Inequality is expected to diminish after the point when a sufficiently high share of the labour force has moved to the secondary sector and, as a result of economic growth, relative incomes of the poorest industrial workers have increased and thus narrowed the income gap within the sector (Kuznets 1955: 17). This is the second phase of the well-known ‘inverted U-curve’ that was proposed by Kuznets. We will assess how well Kuznets’s ideas relate to the Polish case by comparing income inequality in the agricultural and the urban sectors of the country. Was income in preindustrial and agrarian Poland indeed distributed relatively equally? Was income inequality in the urban sector indeed higher than in the agricultural one?

Kuznets focused on the economic mechanisms behind inequality. We are also interested in the impact of the institutions. In particular, we look at political privileges and agricultural class structures. We propose Hypothesis B that Poland had relatively high income inequality due to its highly unequal political structure, in which only the landed nobility had full political and property rights. We hypothesise that a demesne economy based on serfdom could have coincided with relatively high income inequality within the agricultural sector, within the urban sector, and between the sectors. Landlords profited from their position via ‘direct’ and ‘mediated exploitation’ (for detailed discussions of these different forms see Kula 1983; Peters 1970; Melton 1988). Regarding ‘direct exploitation’, political privileges allowed for one-sided changes in contractual obligations by the landlords and subsequent surplus extraction from their tenant farmers. According to Kula (1983) and Topolski (1965), weak property rights in agriculture allowed landlords to enlarge their demesnes by incorporating land that had been previously leased to their tenant farmers, and modify the rents to extract their surplus production. According to this conventional knowledge, the demesne economy was based on the compulsory labour of the tenant farmers (corvée duties). However, Izodorczyk-Kamler (1990) demonstrated that the majority of Polish demesnes were also operated by paid workers. This labour was hired directly by the landlords or indirectly by the tenant farmers. According to Domar (1970: 20), the limitations on labour mobility imposed by the landlords/state on the peasants could have curbed wages in the agricultural sector. The author writes, ‘(…) so long as the workers are free to move, competition among the employers will drive the wage up to the value of the marginal product of labor, and since the latter is still fairly close to the value of the average product (because of the abundance of land) little surplus will remain. (…) With labor tied to land or to the owner, competition among employers ceases. Now the employer can derive a rent, not from his land, but from his peasants by appropriating all or most of their income above some subsistence level’. Moreover, according to Melton (1988: 336), who studied the economic implications of similar labour relations in Prussia and Livonia, tenant farmers were ‘labour brokers’ who hired landless agricultural labourers to fulfil their labour duties. Therefore, the Polish demesne economy relied partially on the mediation of the tenant farmers (see more on a similar system in Prussia: Dwyer 2013: 116). This might have had significant economic implications. According to our interpretation of Melton’s ideas, the author implicitly, although not explicitly, implies a high income gap between the landless workers and the farmers who took advantage of their relatively privileged position at the expense of the workers. Melton (1988: 336–337) places this relationship in a broader system of ‘mediated extraction’ proposed by Peters (1970), according to which it was the tenant farmers—as agents of the landlords—who exploited the landless workers. In sum, one would expect significant income gaps between the landed nobility, tenant farmers, and landless agricultural workers.

Moreover, according to Zurimendi (2014), the same mobility restrictions also limited the inflow of new workers into the urban sector. This, in turn, hampered competition between the sectors and made urban wages relatively higher than they would have been on a free labour market. Furthermore, according to Bush (1996: 5), serfdom, although it delayed the development of a capitalist agriculture, promoted large-scale commercial farming in societies where various factors ruled out capitalist production’. Malinowski (2016b) has identified empirically that this process stimulated urban growth under adverse market conditions typical for the preindustrial period. Therefore, surplus extraction redirected resources from the agricultural to the urban sector, making not only the landlords, but also the cities richer at the expense of the peasants. In sum, limitations on labour mobility and surplus extraction could have resulted in a high income gap between the urban and the rural sectors. Such a dissimilarity has been identified empirically for preindustrial Poland by Malinowski (2016a).

Regarding inequality within the urban sector, in line with Engel’s law, the richer a person, the less the share of income he or she devotes to basic consumables. For this reason, the higher the degree of extraction by the landlords, the more the money is redirected from relatively poor peasants to the landlords and the bigger the relative demand for high-value added manufactured products (see Kula 1976 on the consumption patterns of the landlords). For this reason, a demesne economy based on serfdom may be correlated with a high skill-premium and income inequality within the cities. According to Van Zanden (2009), Poland was characterised by an exceptionally high skill-premium, which supports this supposition. Figure 1 summarises the above-mentioned ideas about the probable impact of demesne economy based on serfdom on income inequalities between the main income groups.

3 Social table in the Voivodeship of Cracow in 1578

In this section, a social table of the Voivodeship of Cracow in 1578 is presented, based on estimates of the population and the number of households in various income groups. For practical reasons—the availability of sources—we concentrate on this part of the Polish Kingdom. This begs the question: Was it representative for Poland as a whole? In general, the Voivodeship of Cracow at the time was one of the more developed regions. It was well endowed with natural resources like salt, lead, and silver. It was also located on major trade routes and was well connected to economically prosperous cities like Prague and Breslau (for discussion of Cracow’s trade see Carter 1994). According to the available information on the special distribution of economic activity in sixteenth century Poland (Jankowiak-Konik 2011), the region had, in comparison with other regions of the kingdom, a relatively diverse proto-industry. Whereas other regions mostly specialised in only one type of industry (for example, the Voivodeship of Mazowia in grain trade and the Voivodeships of Poznań and Kalisz in textile production), the area around Cracow (on top of mining salt, lead, and silver) produced leather, iron, calamine, sulphur, and textiles (see Carter 1994: 219). The region, being located relatively far from the sea, was largely uninvolved in the Baltic grain trade that dominated the economic life of most of the regions north to the Voivodeship (Gierszewski 1982). Cracow was the historical capital of the country and one of the centres of its intellectual and cultural life. In the second half of the sixteenth century (the so-called Golden Age of Polish cultural development), workers in Cracow enjoyed the highest wages in the country (in real terms) (Malinowski 2016a). Due to the demand for skilled craftsmen related to the royal investment, the city at the time was also characterised by the highest skill-premium in the kingdom.

Our social table and GDP estimates depend heavily on urbanisation levels. Malinowski (2016a) proposed estimates of the degree of urbanisation of the Voivodeship in the early modern period. He based the estimates on the urban population data assembled by Kuklo (2009) and the demographic data proposed by Rusiński (1954), Vielrose (1957), and Bogucka and Samsonowicz (1986). A comparison of Malinowski’s figures with the urbanisation estimates for the whole country proposed by Bosker et al. (2013) indicates that the trends in urbanisation levels in Poland and in the Voivodeship were similar. The only exception is the eighteenth century. According to Malinowski’s data, there was an increase in urbanisation levels in the Voivodeship at the time. Conversely, Bosker et al. (2013)—as well as estimates proposed by Wójtowicz and Wójtowicz (2009) and Malanima (2009)—indicate a stagnation in Polish urbanisation levels in the eighteenth century. In short, by focusing on the Cracow region, we may perhaps somewhat overestimate real income (and inequality) of the kingdom as a whole, but other studies (of Holland by Van Zanden and Van Leeuwen 2012 and Italy by Malanima 2010) have similarly concentrated on the more advanced parts of the country. The long-term trends in the region seem to run closely parallel to those in the kingdom as a whole.

The starting point of our reconstruction of the social table is the estimate of the population of the Voivodeship provided by Vielrose (1957). According to this author, 476,000 people were living in the Voivodeship of Cracow in 1578, of which 309,000 people in villages and 167,000 in settlements with city rights. Given that these settlements could vary from few hundred inhabitants—an agricultural town—to several thousand people—a city—we classify the urban population into several categories. Bogucka and Samsonowicz (1986) grouped the towns and cities into four different categories: (A) one city with more than 10,000 inhabitants, Cracow, (B) 16 settlements with populations between 2000 and 10,000, (C) 30 with population between 600 and 2000, and (D) 25 below 600 inhabitants. According to urban population data collected by Kuklo (2009), Cracow in the late sixteenth century had 19,000 inhabitants. Moreover, Kuklo reported populations of three other big cities—Olkusz, Wieliczka, and Nowy Sącz—in the Voivodeship that had 5000 inhabitants each; there were no more cities above 5000 inhabitants in the Voivodeship. This brings the number of settlements between 2000 and 5000 to 13.

Bogucka and Samsonowicz (1986) estimated the shares of different income groups in the four different categories of urban settlements. Their data relate to the turn of the fifteenth and the sixteenth century, but we assume that these relations persisted through the sixteenth century. In order to decompose the rural population, we use information provided by Cackowski (1961: 103) about the structure of the labour force in the villages belonging to the bishopric of Chałmno in 1614. We assume that the same structure existed in the Voivodeship of Cracow. The share of nobility in the population living outside the cities was taken from Kula (1951). The summary information on the occupational distribution of heads of households in the Voivodeship is given in Table 1.

The next step is to establish how many households were involved. We make different assumptions regarding the households of the tenant farmers and all the other households. Following Guzowski (2008), we assume that all tenant farmers lived in households composed of six people. Guzowski (2008: 121) following Leslett (Leslett 1983: 528) and Kopczyński (1998: 90) argued that in the case of Eastern Europe, due to the tradition of cohabitation between agricultural workers and farmers, rural households should be identified as entities composed of the biological family plus lodgers. These lodgers, being at the early stages of their life cycle, have not yet formed their own households. Guzowski (2008: 121), building on an empirical analysis conducted by Kopczyński (1998), assumed that, on average, such a household was composed of the farmer, his wife, two infants, and two live-in lodgers. For the sake of simplicity, in this study, we will assume that the lodgers were a part of the household. They lived, worked, and ate with the biological family. Although the lodgers often received a monetary compensation for their contributions to the households, we define these as internal transfers within a household.

In all other cases, we assume that households were composed of four people—one male, one female, and two children. According to Borowski (1975), who studied age distribution in Dobre Miasto in the seventeenth century, people below 19 years of age accounted for 45 % of the population. According to Karpiński (1983), workers had on average a little less than two children in contemporary Warsaw. This reinforces the idea that, on average, children accounted for around half the population. According to the data presented in Table 2 (which presents information on the eighteenth century), nuclear families were prevalent in the cities located in the Voivodeship. We furthermore assume that each household had only one (male) breadwinner. In so doing, we consciously overlook female labour participation and thus, most probably, underestimate the total GDP. However, due to scarce available historical information on female wages and their labour input, we are—at the current stage of Polish historiography—unable to remedy this problem.

3.1 Income of king, nobility, and clergy

Poland was an elective monarchy, and its public finances were based on the extensive properties of the king—the royal domain. Most of the remaining land was owned by the nobility or the Church and was in turn leased to their tenant farmers. The income of the political elites consisted of rents from towns and villages as well as the proceeds of production on their own demesnes. The income of the king came from two main sources: the domain (income from demesnes and rents from towns and villages) and mines. Regarding the royal domain, Rutkowski (2008) reported the number of villages (477) and towns (40) belonging to the king in the Voivodeship around 1580. Rutkowski (1938) also studied audits of the royal domain conducted in the 1560s. The auditors reported incomes from royal demesnes, towns, and villages. J. Rutkowski (1938: 270) compiled the results of the audit of 77 royal demesnes, 27 royal towns, and 232 royal villages located in the Voivodeship. We use these data to estimate the average income from a demesne, a town, or a village (see Table 3).

Rutkowski did not provide information on the total number of demesnes in the Voivodeship. We estimate the number of demesnes from the number of villages in the region. According to the audit data from the whole country, there was a constant 1:3 ratio between the number of demesnes and villages located in every region (see Fig. 2). Given that the king owned 477 villages, building on this stable relation, we assume that he also owned 159 demesnes in the Voivodeship.

Source Based on data from Rutkowski (1938)

Linear relation between number of demesnes and villages in a region.

Next to the income from rents and demesnes, the king had claims on the revenue from mining. We compile the information on the income generated by mines located in the Voivodeship. Molenda (1972) argued that the silver mine in Olkusz produced around 300 kg of silver and 823 tons of lead in 1577. The value of the output of silver can directly be measured in this way, as we know the silver contents of the currency. We consciously overlook the minting costs. According to Adamczyk (1935), the price of one funt of lead in nearby Lublin was 0.875 Grosze in 1580. Since one funt was equal to 406 g (Adamczyk 1935), the king earned approximately 58,978 ZŁP from lead. Additionally, according to J. Rutkowski (1938), the king earned 66,000 ZŁP annually from his salt mines in Wieliczka.

Regarding the nobility and the Church, we assume that the income of this group came only from their domains. Rutkowski (2008) reported the number of towns (33) and villages (2100) that belonged to the nobility and the Church (Table 3). On the basis of the previously discussed 1:3 ratio, we estimate that the nobility and the Church owned about 700 demesnes. We assume that the average income from demesnes, towns, and villages located in the land belonging to the Church or the nobility was the same as in the royal domain.

According to Rutkowski (1938), the aim of the auditors was to focus only on stable and reliable incomes. For this reason, they often did not note down the income from forestry, which was very volatile. This means that the income from demesnes is underestimated. In order to fill this gap, we estimate the minimum income from firewood in the Voivodeship. We assume this was the same as its consumption. According to Allen et al. (2011), a household needed nine BTU’s of energy. Allen (2001) compiled information on the price of energy in Cracow around 1580. The information on the total population in the Voivodeship, the number of households, their consumption requirements regarding energy and the price of firewood together allow us to estimate the income from this product. We assume that it was sold only by the demesnes, because use of forests by peasants for commercial purposes was often restricted by their landlords (Trzyna 1963). We divide the total number of the predicted demesnes (159 + 700) by the total predicted income from firewood to compute the expected average income of a demesne from forestry (165 ZŁP).

When we group all income of the nobility and the Church together and divide it by the number of households allocated to this group, we estimate that the elite earned on average 145 ZŁP. This value is below the income from a demesne because many nobles did not possess a demesne. The issue of inequality within the nobility around the sixteenth century was studied by Mączak (1982) and Wyczański (1977); our estimates, following the logic of the social table which assigns an average income to each social group, do not take this into account, however.

3.2 Income of tenant farmers

Guzowski (2008) analysed the economic situation of tenant farmers in the Małopolska Province, in which the Voivodeship of Cracow was located. He reconstructed the distribution of plot sizes, average harvests of rye, wheat, oats, and barley, and the seed used for it. He demonstrated that around 40 % of the land holdings were one-łan (11.6 ha) and 60 % were half-of-łan. He proposed two different budgets for these two different sizes of farms. We build on Guzowski’s research. In our reconstruction, the total net income from grains is rescaled to represent the total gross income before tax. The prices of rye, wheat, oats, and barley are based on the averages of the Cracow series from between 1558 and 1608. The data on prices were taken from a compilation made by Malinowski (2016a).

Guzowski did not account for animal production (although he subtracted grains used to feed the livestock). Żytkowicz (1962) analysed the animal stocks of peasantry living in the grounds belonging to the Cathedral chapter of Gniezno located in Wielkopolska, a province adjacent to the Voivodeship of Cracow. A household cultivating a one-łan farm (11.6 ha) had on average a certain stock of horses, cows, pigs, and sheep (Table 4). We assume that farmers living in the Voivodeship of Cracow had the same stock of animals and that a household operating on a half-of-łan farm had half of that stock. We divide the value of the animals by the typical life span of each species and compute the net yield for the stock. This value could be equated with the annual animal production of a household.

Now that the production of the two main components of the farmers’ income—grains and animals—is accounted for, one can also consider the remaining agricultural products like: hay, fibres, fruit, vegetables, hop, poultry and eggs, dairy products, wool, and feathers. According to Rutkowski (1938), in the Voivodeships of Mazowia and Rawa located in central Poland, grains and animals accounted for 89 % of the income of the demesnes, and all other products accounted only for the remaining 11 %. We multiply the total income from grain and animals by a 1.12 markup factor to account for this ca. 11 % income from the other products. In sum, the gross income/output of farms with one-łan was 34 ZŁP and that of half-a-łan 17 ZŁP.

3.3 Income of agricultural workers

Corvée duties—a signature institution of serfdom that does not involve use of money—were a form of payment for the right to use land and therefore affected tenant farmers. However, there was a significant group of the population that did not have land and was hired by the landlords to work on their demesnes next to the tenant farmers or who were employed by the tenant farmers to fulfil corvée duties in their place. The income of such agricultural workers is based on the data provided by Izodorczyk-Kamler (1990). The author argued that agricultural workers in demesnes located in the Voivodeship of Cracow were paid, in money and kind, around 158 Grosze annually (around 5 ZŁP). Agricultural workers in villages, towns, and cities are assumed to earn the same. According to Malinowski (2016a), such a nominal income was barely enough to sustain a family of four. According to our estimates, the gross income of the landless agricultural workers was several times lower than that of the tenant farmers. This supports the already-discussed ideas of Melton (1988) and Peters (1970) regarding the system of ‘mediated extraction’.

3.4 Income of masters, unskilled artisans in the cities, and artisans in the rural areas

Artisans are divided into three groups: (a) masters, (b) artisans in the cities, and (c) artisans in the rural areas. Małecki (1963) gathered information on the number of workshops in the Voivodeship of Cracow. He based this study on tax registers from 1581. According to his research, there were 3442 workshops in the Voivodeship. We assume that each workshop had one master. We assume that masters’ wages were similar to the wages of the masters in Cracow’s construction sector. According to the data compiled by Pelc (1935), in the last quarter of the sixteenth century, the average daily nominal wage in silver of master masons and carpenters was 5.4. According to the same data, the average daily nominal wage in silver of the unskilled workers at the time was around two grams of silver. According to Molenda (1978), there were around 100 holidays a year. We assume that all waged labourers worked full time, i.e., 265 days a year. We assume that the so-called free workers—for the most part artisans that were not part of the guild system—enjoyed the same wage as the unskilled labourers inside the guilds. Regarding the artisans from the rural areas, we equal the income of this group with that of the agricultural workers. We equate agricultural workers with rural artisans because the level of the skill required to construct the basic products was not significant. Second, we assume seasonality of employment and economics of makeshift between basic manufacturing and crop cultivation. In sum, according to our estimations, masters, urban artisans, and rural artisans annually earned around 58, 21, and 5 ZŁP, respectively.

3.5 Income of servants in the cities

We assume that servants who lived in the cities had the same annual income as unskilled workers (ca. 21 ZŁP).

3.6 Income of servants in the countryside

We assume that servants who lived in the countryside had the same annual income as agricultural workers (ca. 5 ZŁP).

3.7 Income of beggars

We assume that beggars’ income was equal to the lowest identified income among all the observed income groups, i.e., that of the agricultural workers (ca. 5 ZŁP). This is motivated by the fact that we cannot assume null income for any group, as it would imply its starvation.

3.8 Income of merchants in Cracow and other merchants

Merchants are by far the most difficult income group to measure. We divide the merchant population into two categories: (a) elite merchants living in Cracow (the economic centre of the Voivodeship and the only city with more than 10,000 inhabitants) and (b) poorer merchants in Cracow and those living in other smaller cities and towns. We propose that all merchants from the latter category earned annually as much as the unskilled artisans from Cracow (ca. 21 ZŁP). This is motivated by the fact that these people were primarily small retailers.

All the prominent merchants are assumed to have clustered in Cracow, the commercial centre of the Voivodeship. In order to gauge the average earning of this group, we use information on wealth inequality in the city in the mid-seventeenth century provided by Wagner (2013) and based on rich historical data on a tax on wealth. According to the property tax data gathered and analysed by the author, the top 5 % of the population paid around 40 % of the total collected tax. We assume that this observation provides us with information about the merchant elite. We also assume that the levels of wealth and income inequality were similar. Given that wealth inequality, due to savings, tends to be usually higher than income inequality, we expect that this operation overestimates the between-groups inequality in the city. Building on Wagner’s research, we assume that the top richest merchants were 5 % of Cracow’s population in 1578 and that their income amounted to 40 % of the total income of the city. Using the data on occupational structure from Table 5, we estimate that there were 570 merchant households in Cracow. We assume that the merchants—not nobles—were the people with the highest incomes in the city, as the rich nobles tended to live in the countryside. We conclude that the richest merchants’ annual income must have been 357 ZŁP per household in order to account for 40 % of the total income in Cracow.

Table 6 presents the social table for the whole Voivodeship. The results indicate that 70 % of the total income came from the primary sector (including rents from villages and towns and income from mining), 20 % came from (proto-)industry/artisans, and 10 % was generated by services. The results also show that productivity from demesnes rather than rents was the main source of income for the landed elite. Due to the agrarian character of the country, despite the fact that towns generated much greater revenue individually, in total, the villages brought more revenue than the cities. These findings are consistent with the conventional knowledge that Poland, at the time, was a primarily agricultural society.

4 Income inequality in 1578

In this section, we calculate Gini coefficient of the inequality of the distribution of incomes in the Voivodeship of Cracow around 1578. We measure income inequality in (a) the whole of the Voivodeship, (b) only in Cracow, and (c) in the non-urban/agricultural/primary sector. We compare our results internationally.

The approach of the social table assumes equal income between the households in the various social categories. As it would be expected, there was high income inequality within the nobility and the Church. In order to identify the households with the highest income, and thus construct a more reliable measure of inequality, we look at the sizes of the biggest noble and ecclesiastical landholdings. Rutkowski (2008) compiled data on the number of towns and villages belonging to the 26 richest noble families and all of the 48 ecclesiastical estates located in the Voivodeship in the late sixteenth century. Using the data from Table 3 and the 1:3 ratio between demesnes and villages, we can calculate the incomes of these top 74 households. According to our estimates, together they provided ca. 231,000 out of ca. 704,000 ZŁP of the total income of the nobility and the Church. The richest of these biggest individual estates belonging to the nobility and reported by H. Rutkowski generated 14,640, while the most ‘modest’ one generated 1211 ZŁP of income.

Estimates of the Gini coefficient of the inequality of the distribution of incomes in the whole Voivodeship of Cracow can be made on the basis of Table 6. The Gini coefficient varies depending on the studied population. If we assume that the ecclesiastical estates provided income for a household of four, the Gini coefficient of incomes in the late sixteenth century in the Voivodeship of Cracow was 53. If we exclude the king, the coefficient drops to 48. These estimates include the differentiation within the elite.

What happens if we look at the agricultural and the urban sector (the city of Cracow) separately? We exclude the smaller cities (i.e. the ones with populations between two and ten thousands, see Table 1), an in-between group, from either of the categories. If we look at the relations in the primary sector (groups 1, 2, 3, 4, 5, 8, 10, and 13 in Table 6 and the differentiation within the elite), the Gini coefficient of the inequality of the distribution of incomes was 57. This value might seem very high in international comparison (compare Milanovic et al. 2011). The high value of the coefficient is partially a result of treating the king as a single individual holding 10 % of the total income. However, even if we exclude the king, the Gini index still remains high—51. This indicates that the high inequality in the agricultural sector was not driven only by the inclusion of the king. The mean income per head in the sector (including the king) was 5.5 ZŁP. Conversely, according to income and population data presented in Table 5, the Gini coefficient of the inequality of the distribution of incomes in Cracow was 48.2; if we exclude agricultural workers and the noble families living in the city in order to clearly separate the two sectors, the Gini becomes slightly lower—46.9. The mean income per head in the city was 10.7 ZŁP, almost double the average income of the countryside.

It should be highlighted that the observed income inequality in Cracow (Gini coefficient ca. 48) was lower than the inequality in the agricultural sector (Gini coefficient ca. 57). This corresponds to similar differences between wealth inequality within the elite of the agricultural sector of the Voivodeship and within the elite of Cracow. Wyczański (1977: 47) assembled historical records on wealth tax collected from 1158 land estates located in the Voivodeship between 1563 and 1565. He divided the data into ten groups, reported the number of households in every group, and calculated the total tax paid by each of the groups. The Gini inequality index based on Wyczański’s data is 71.5. This indicates that the landed elite of the Voivodeship was highly unequal. Conversely, Wagner (2013) collected similar information on a wealth tax paid by the 802 richest Cracow households in 1653. According to her findings, the Gini inequality index of the city’s elite was 67.6. This indicates that the wealth of the elite in the city could have been more evenly distributed than that of the landed nobility in the Voivodeship. Our estimates contradict the notion proposed by Kuznets that inequality in the agricultural sector at the initial stages of economic growth is lower than in the urban sector (Kuznets 1955: 7–8, 17). They also differ from previous studies of income and wealth inequality in the towns and countryside of Holland (Van Zanden 1995) and Italy (Alfani and Ammannati 2014), which demonstrates that the inequality in the cities was higher than in the countryside. Income inequality in the primary sector in Poland was high, due to the income of the landed elite from the demesnes. If we exclude the elite from the estimates of inequality in the agricultural sector (we base it on Table 6 and groups 3,4,5,8,10, and 13), the Gini coefficient decreases drastically from 57 to 30.1 (and a mean income of 3.1 ZŁP)—a level of income inequality (though not mean income) similar to that observed by Van Zanden (1995) for villages in Holland around the same time.

Conversely, income inequality in Cracow could have been relatively small due to the relative underdevelopment of the Polish urban sector, as is clear from the low level of urbanisation by European standards (Table 7). Income inequality in Cracow was lower than in the cities located in one of the most prosperous and urbanised regions, The Netherlands. According to Van Zanden (1995: Table 5), the Gini coefficients of the inequality of the distribution of incomes in Dutch cities around 1562 were 52 (56 when looking only at Amsterdam). According to Alfani (2010), in the case of Northern Italy, immigration from rural areas to the cities in the preindustrial era resulted in an increase in income inequality in the urban sector. One could hypothesise that constraints on the labour mobility of the enserfed peasantry could have curbed a similar formation of income inequality in Cracow.

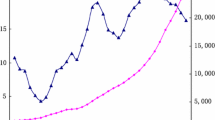

Figure 3 puts the estimates in an international context. It compares the Gini coefficients and income levels from a range of preindustrial economies within the context of the inequality possibility frontier. Despite the fact that the concept of the inequality possibility frontier was derived to analyse territorial units and whole economies, we also plot, for comparison, the estimates for Cracow and the countryside around it. The data for the other countries are taken from Milanovic et al. (2011) (we add the real GDP per capita levels specified in the next section where we establish a conversion rate between ZŁP and 1990$PPP). Our evidence indicates that, despite serfdom, income in Poland was distributed more equally than in contemporary Holland. However, the extraction rate in the Voivodeship was much higher than that identified for the North Sea area. In more detail, contrary to the theoretical underlying mechanism behind the well-known ‘inverted U-curve’ that was proposed by Kuznets, our findings suggest that due to high inequality in the agricultural sector under serfdom, in the case of preindustrial Poland, urbanisation (movement of labour to a sector with less institutional coercion) could have mitigated rather than increased the inequality of the distribution of incomes already at the initial stages of economic growth. Our findings indicate that a demesne economy based on serfdom might have been very ‘successful’ at extracting surplus from the peasants in general as well as creating inequality between the tenant farmers and the agricultural workers. The extraction rate (the ratio between the historical and the feasible Gini indices that measures how successful the elites were in appropriating surplus in an economy) in the Voivodeship was 86 % in comparison with 76 % in contemporary Holland or 57 in seventeenth century England and Wales (see Milanovic et al. 2011). The inequality in the primary sector was at its maximum theoretical level (extraction rate around 100 %). As discussed, the inequality was primarily attributed to the wealth of the elite. Conversely, the city of Cracow, despite having much higher mean income, was characterised by lower income inequality. If we look at both the urban and agricultural sectors (i.e. the whole social table), the observed level of inequality is below that identified for the agricultural sector. It is also much further from the inequality possibility frontier (Fig. 3).

5 Gross domestic product

The estimates of the social table in 1578 also make it possible to explore the relative income level of (this part of) Poland in the early modern period, and to chart the development of GDP per capita in the long run. How did Poland perform during the period of the Little Divergence? Recent research reconstructing the growth pattern of England and Holland in this period highlighted signs of sustainable economic growth in the North Sea region before the Industrial Revolution (Van Zanden and Van Leeuwen 2012; Broadberry et al. 2015). By contrast, Mediterranean economies declined or at best stagnated during the early modern era (Malanima 2010, 2013; Álvarez-Nogal and Prados de la Escosura 2013). These findings led to the belief that the North Sea region outperformed the rest of the continent prior to the Industrial Revolution. Furthermore, according to Maddison (2001) and the recent Maddison update (Bolt and Van Zanden 2014), income levels in late medieval Europe were already higher than in Asia.

There are, however, relatively few empirical studies that place Eastern Europe in this analytical framework, and those available provide a mixed picture. According to two independent Polish GDP estimates, the divergence might have occurred prior to the early modern period (Van Zanden 2001; Wójtowicz and Wójtowicz 2009). However, studies of the ‘grain wages’—nominal wages expressed in litres of rye or wheat—suggest that incomes of the urban wage earners from Eastern European cities were superior to those of their Western counterparts (Mączak 1995 [1983]; Van Zanden 1999). Allen (2001) investigated differences in the income levels between countries by deflating urban nominal wages not by grains prices, but by a broad basket of goods known as the ‘respectability basket’. Based on this evidence, Allen found that the economic advantage of the North Sea region vis-á-vis Eastern Europe dated back to the sixteenth century. Conversely, according to Malinowski (2016a), who weighted real wages by the occupational structure, the gap only opened up in the seventeenth century when urbanisation levels in Poland declined as a result of devastating warfare.

We contribute to this debate by estimating GDP per capita for Poland and by comparing these results with the international estimates. In the standard growth accounting framework, assuming no foreign transfers, GDP should be equal to gross domestic income, which implies that we can use the estimates from the social table to infer the level of GDP.

We know very little about historical GDP per capita in Poland. The accounts compiled by Maddison begin only in 1870 with 946 1990$PPP. There have been two previous attempts to reconstruct long-term series of GDP in early modern Poland. According to Van Zanden (2001), who was interested mainly in the relative not absolute levels of GDP, Polish living standards in the sixteenth century were below those of Italy and The Netherlands but on par with those of England. The author demonstrated that the Polish series began to also lag behind the English values in the seventeenth century due to growth in the latter series. According to a study of GDP made by Wójtowicz and Wójtowicz (2009), people living in Poland enjoyed only around 70 % of the goods and services available to the inhabitants of Western Europe in the sixteenth century. This value declined to around 40 % in the late eighteenth century. Wójtowicz also found evidence of growth in Poland in the sixteenth century as well as contraction in the seventeenth century, contradicting the findings by Van Zanden. According to Wójtowicz and Wójtowicz’s figures, the country underwent significant economic recovery in the eighteenth century.

We follow Federico and Malanima (2004), Malanima (2010), Álvarez-Nogal and Prados de la Escosura (2013), and Pfister (2011), who developed and popularised a method of projecting historical income levels backwards from the values known for the statistical era. The authors assume that certain crucial relations persisted from the Middle Ages to the nineteenth century and that we can build on these relations to extrapolate historical income levels.

We use this method, together with the information on historical cost of a consumption basket, real wages, and population, to estimate the values of GDP per capita for the benchmark years 1500, 1578, 1662, and 1776. We choose these benchmarks because of the relative abundance of historical demographic information for these years. Via an international comparison of the purchasing power of the ‘barebones basket’ (see Malinowski 2016a), we link the 1578 estimates to the estimates of GDP per capita in 1990 international dollars in Holland and England. This makes it possible to compare Polish real incomes in the early modern period internationally. Next, we use series of real wages (in Cracow) between 1410 and 1910 and estimates of the development of the urbanisation ratio in the fifteenth and nineteenth century to create a tentative, very long-term series of Polish GDP per capita during these five centuries. Because these series are based on speculative intrapolations of the population data between benchmark years, these results are produced just to illustrate the long-term trends of the Polish economy.

The method of estimating historical GDP benchmarks consists of two steps. First, we estimate food production from its consumption. We assume that the production is equal to income (in the agricultural sector). Secondly, we rescale it to reconstruct total GDP. The procedure used to estimate agricultural output was developed by Wrigley (1985) and Allen (1999: 212–214, 2000: 13–14). According to the authors, the net agricultural output can be represented as follows:

where Q At is agricultural output, N t is the total population, c t is the real food consumption per capita, and r is the ratio of food consumption to food production. Allen (1999) proposed to estimate real per capita food consumption through a demand equation:

where a is a scaling factor, P t is the real price of agricultural goods (we proxy this with the cost of foodstuffs in the barebones basket), I t is the real income per capita (we proxy it with real wages), and M t is the real price of consumer goods apart from food (we proxy it with the cost of products other than food in the barebones basket). e, g, and b denote the food price, income, and cross-price elasticities of food demand, respectively. In order to construct the scaling factor a, we use the relations for the time period s—in this case 1578—for which we reconstruct the share of income from the agricultural output.

In order to rescale Q At into a GDP estimate, Federico, Malanima, Álvarez-Nogal, and Prados de la Escosura assumed a stable ratio p between the share of agriculture in total production and the share of agricultural employment in the total labour force. p allows for estimating the overall productivity when having information only on the agricultural output and the share of agricultural labour in the total labour. p is defined as:

where Q is the total output that we equal with the GDP, L A is the labour in agriculture, and L is the total workforce. Once Q At for every benchmark year t is computed and the constant p is estimated, we account for the share of agricultural labour in total employment. According to the short-cut method, the national product in years other than the base one is:

We modify the procedure slightly to meet the specific needs of this study. Due to data limitations, we do not account for P and M in the point estimates (but do in the case of the continuous series) of agricultural consumption/production. In other words, for the point estimates, only we set e and b to zero. By design, these factors take into account the short-time fluctuations in prices, which are not relevant to the point estimates which focus only on the long-term changes (a similar methodology was applied by Crafts 1985, and see Arroyo Abad and Van Zanden 2014 for a sensitivity analysis of this assumption). Table 7 presents the data used to extrapolate per capita GDP in the Voivodeship of Cracow in 1500, 1662, and 1776 by building on relations in 1578. Malinowski (2016a) compiled information on occupational distribution and real wages in the region around 1500, 1578, 1662, and 1776. Despite the fact that a part of the Voivodeship was annexed by Austria in 1772, Malinowski estimated the population of the Voivodeship in 1776 in constant ‘historical’ borders. We assume that the whole population N was part of the labour force L. Furthermore, following Malanima (2010), we equate L A with people living outside cities with populations above 5000. Malinowski (2016a) also estimated real wages of unskilled workers in Cracow. Income (I) in 1500 is proxied by average real wages between 1480 and 1520. The value for 1578 is an average between 1558 and 1608. Income in 1662 is supposed to capture a new situation after the wars of the mid-seventeenth century. It is the average wage between 1655—the beginning of the Swedish Deluge—and 1675. The value for 1776 is the average real wage between 1756 and 1795—the last partition of the country. Furthermore, following Allen (1999), we assume that e, g, and b should equal −0.6, 0.5, and 0.1, respectively (but only in the case of the continuous estimates, for the point estimates we set e and b to zero). Others have shown that changing this assumption has only small consequences for the estimate (see Álvarez-Nogal and Prados de la Escosura 2013). Lastly, for the sake of simplicity, we assume that there were no substantial agricultural imports and exports to and from the Voivodeship and, therefore, r was one—food production equalled food consumption. The Voivodeship was located far from the Baltic, and its economy did not rely on exports or imports of food (Carter 1994). The majority of grains exported from Poland came from the northern provinces of the country. According to Gierszewski (1982), in 1568 only 0.6 % of the total grain shipped on the Vistula down to Gdańsk came from the Voivodeship.

How can we integrate our estimates into the international framework to chart long-term economic growth as developed by Maddison? Due to the break in political entities around the turn of the eighteenth century, we cannot link the Polish estimates to the late nineteenth century data for Poland, so we have to develop another way to do this. For two countries, England and Holland, there are continuous series of GDP per capita in current prices and in 1990$PPP (the standard unit of Maddison’s work) which can be used for this purpose (Bolt and Van Zanden 2014). Via purchasing power parities (PPPs), we can link the Polish estimate (135 grams of silver for the benchmark 1578) with similar estimates for these two countries and then use the implicit conversion ratios between (a) pounds of 1578 and 1990$PPP and (b) guilders of 1578 and 1990$PPP to get estimates for the relative income level of Poland in that year. The PPPs can be derived from Allen’s work on the costs of a subsistence basket in the cities involved (Cracow, London, and Amsterdam). We use the basic barebones basket approach here, because the original series of Allen (2001) were strongly affected by the way in which grain prices were transformed into bread prices (see Allen et al. 2011 for the barebones basket and Malinowski 2016a for the real wages and prices estimates). It is no surprise that the average costs of a subsistence basket in Amsterdam and London were much higher than in Cracow, because the North Sea area imported a large part of its foodstuffs from Poland (Table 8). Taking this into account results in estimates of real GDP per capita that are far below the Western European level: The PPP transformation via Holland results in an estimate of 860 1990$PPP, via England this is 765 1990$PPP (see Table 8). We have no reason to assume that one is better than the other and therefore take the Fisher average of these two estimates—810 1990$PPP. This benchmark can then be used to link the other estimates to those of 1500, 1662, and 1776.

A rough check of these results is possible via the barebones basket. The basket used in this conversion represents the minimum/subsistence consumption requirements of an individual. According to Milanovic et al. (2011), the subsistence threshold is 300 1990$PPP. The authors admit that the threshold can be dependent on the level of economic development. According to Bolt and Van Zanden (2014), the threshold is between 250 and 300 1990$PPP. If we assume that: (a) the cost of the basket indeed represents the subsistence threshold, (b) this threshold is between 250 and 300 1990$PPP, and (c) Polish GDP per capita was equal to the cost of 2.93 baskets (Table 8), real income in the Voivodeship should have been between 732 and 879 1990$PPP. The 810 1990$PPP based on the implicit conversion ratios is nicely in the middle of this confidence interval, which reinforces the plausibility of the estimate.

How robust is this estimate to changes to some of the most controversial assumptions we made in order to construct the social table? In our view, the two most speculative points of the analysis are the reconstruction of the income of Cracow’s merchants and the assumption regarding the 265 days of work. Given the small size of Cracow’s economy, changes in the assumptions regarding the income of merchants do not affect the overall conclusions drastically. As discussed, since we derived the income of the richest merchants from the information on their relative wealth, we most likely overestimated rather than underestimated their average income and thus produced an upper band estimate of the total income generated in the city. If we assume that all the merchants earned the same income as did the unskilled workers, i.e., there were no rich merchants, we should be able to construct a lower band estimate. Such an operation would most likely underestimate the total income of the city. If we modify the estimate of the income of the merchants accordingly, the GDP per capita decreases only slightly from 810 to 795 1990$PPP—i.e., by only 2 %. Furthermore, in our reconstructions, we assume that all of the urban wage earners worked full time and that there were constant returns to their labour input. This probably overestimates the GDP per capita. If (on top of the assumption that all the merchants earned the same, low income) we arbitrarily assume that the wage earners worked 150 instead of 265 days a year, the GDP per capita decreases to 722 1990$PPP—i.e., 89 % of the base estimate. The difference is only 11 % because the majority of the income in Poland was generated in the agricultural sector, which is unaffected by these changes to the assumptions (as discussed, the information on the income of the agriculture workers already represents their annual remuneration and, therefore, does not require us to make any assumptions regarding the labour input in the sector).

According to the social table presented in Table 6, the share of the agricultural production of demesnes and farms was around 59 % of total income. This information together with the data in Tables 1 and 7 allows estimation of the scaling factors a (46) and p (0.62), using Eqs. 4 and 5. These data are sufficient to estimate GDP per capita in 1578 PPP grams of silver for other benchmark periods.

Table 9 shows the result of this procedure. It yields several important generalisations. First, it suggests that there was economic growth in the sixteenth century, known as the Golden Age of Poland. Second, the results confirm that there was a significant contraction of the economy between the end of the sixteenth and the middle of the seventeenth century. Third, there was little economic recovery in the eighteenth century. Economic growth between 1662 and 1776 was half (in absolute terms) of that between 1500 and 1578.

The contraction of the economy was the direct result of a sharp drop in real wages together with the destruction of Polish cities during the wars of the seventeenth century. Wars with Sweden, Russia, and Turkey—together with the Ukrainian uprising—all occurring around the same time have been long regarded as devastating for the Polish economy (for discussion see Przyboś 1957). Our findings confirm this.

There is controversy in Polish historiography as to whether there was economic growth in the country in the eighteenth century. The discussion is motivated by the fact that the country was partitioned by Russia, Prussia, and Austria between 1772 and 1795. Some scholars have traditionally seen the reason behind the dissolution of the country in its inner weakness and advance evidence of political and economic underperformance in the eighteenth century to reinforce this supposition. Their opponents have argued that the partitions occurred despite ongoing political reforms and economic recovery (for a summary of the discussion see Sosnowska 2004). Our results indicate that there was only little recovery before 1776. This contradicts the findings of Rusiński (1954), who put forward evidence of economic change in the county in the second half of the eighteenth century. Furthermore, according to Wójtowicz and Wójtowicz’s GDP estimates, there was a substantial recovery; their estimates indicate that the Polish economy grew from 540 in 1720 to 790 2007$PPP in 1790 and nearly re-established the level from 1470. It is possible that the recovery accelerated after 1764 when numerous growth-enhancing institutional changes were undertaken (for discussion see Rusiński 1954). Our benchmark of 1776 may be too early to capture the probable post-1764 growth that can, however, be observed by the later benchmark of Wójtowicz. The issue of economic growth at the eve of the second and the third partitions of 1793 and 1795 requires further investigation.

One way to research this is to use the model for reconstructing benchmarks of GDP per capita for estimating much more tentative annual series of real income. We have intrapolated the benchmark estimates of population and urbanisation between 1500 and 1776 from Table 7, knowing that this may distort historical reality as declines in population and urbanisation were often the results of sudden shocks due to warfare. We added a tentative estimate for the urbanisation ratio at the start of the fifteenth century (2.2 %). To this purpose, we used the urbanisation ratio for Poland from Bosker et al. (2013). We intrapolated urbanisation ratio between 1400 and 1500 assuming a constant linear trend. Given that by 1500 Poland (based on Bosker et al. 2013) and the Voivodeship (Table 3) had similar urbanisation levels (3 %), we have reason to believe that the estimate for the whole country around 1400 can be used to proxy the situation in the Voivodeship. In order to estimate the income in the Voivodeship in the fifteenth century, we make use of the real wage series for Cracow going back to 1410 (from Allen 2001). In order to construct a continuous wage series, we assumed a constant ratio between Malinowski’s series (based on the barebones basket) that go back to the beginning of the sixteenth century and Allen’s series (based on the ‘respectability basket’) that go back to 1410. In a similar way, we speculate about how the very low GDP levels of the eighteenth century can be linked to the first estimates produced by Maddison (1870: 946 1990$PPP, 1900: 1536 1990$PPP); is the model based on real wages and urbanisation ratio able to explain the growth that must have happened in the nineteenth century? To this purpose, we also used urbanisation ratios for Poland as a whole (also based on Bosker et al. 2013) and the real wages in Cracow reconstructed by Allen (2001). Because we use data for Poland as a whole for the nineteenth century, we linked the series of GDP estimates to the 1870 estimate from Maddison. Estimating and interpreting any long-term series of Polish GDP are complicated because of the partitions of the country that persisted between 1795 and ca. 1918. At the time, Poland was divided between Prussia, Russia, and Austria (Cracow and its immediate surroundings, before it was incorporated to Austria in 1846, formed a semi-autonomous republic). Therefore, it can be interpreted that our estimates of per capita GDP in the nineteenth century represent the situation in the ‘Polish lands’, i.e., territories that are currently in Poland.

Figure 4 presents the estimates derived in this rough way. The model does a good job of explaining nineteenth century growth: real wages go up by a factor 2.5–3 between 1820 and 1910, and the urbanisation ratio increases from 7 to 28 % in the same years, more than explaining the increase in GDP from about 500 1990$PPP in 1820 to almost 2500 1990$PPP in 1910. Our figures link well with the point estimates proposed by Maddison for 1890 and 1900. However, whereas our model predicts sharp economic growth between 1900 and 1910, Maddison’s figures suggest a much lower value for 1910 (1689 instead of 2430 1990$PPP). More to the point, both series, anchored on 1578 for the period 1410–1800 and on 1870 for 1811–1910, nicely ‘meet’ at about the same level in the early 1800s. The estimated decline of GDP per capita in the years 1800–1811 (from 543 in 1799 to 445 1990$PPP in 1811) is entirely due to the decline of the real wage by more than 40 % in these years (as wage data are missing for the intervening years, we cannot reconstruct the decline of GDP). Between 1410 and 1800, the annual series also picks up the swings suggested by the benchmarks (which is of course not unexpected as they are based on the same data). The ‘growth spurt’ in the sixteenth century is quite clear from this evidence, as is the decline after 1570, and the long stagnation during the rest of the early modern period. We do not identify any economic growth in the late eighteenth century. Lastly, as elsewhere in Europe, real wages were relatively high in the fifteenth century, but this did not translate itself into high incomes due to the very low rate of urbanisation.

Table 10 puts the Polish figures in a global perspective. It presents GDP per capita estimates for England, The Netherlands, Northern Italy, Spain, Germany, the Ottoman Empire, Japan, India, and Poland. The comparison yields several important generalisations about the place of Poland in the narratives of the so-called Great and Little Divergence in income levels around the world and within Europe. If we take the accounts at their face value, it appears that at the beginning of the fifteenth century Poland was already lagging behind the Western European countries represented in the sample. Its level of economic development was closer to that of Asian rather than Western European countries. However, by 1600, due to economic expansion during its Golden Age (i.e. the sixteenth century), Poland was richer than most Asian countries. However, its relatively high growth rate at the time was insufficient to reach the level of the Western European countries.

As a result of the crisis of the seventeenth century, the Polish economy contracted even below the low levels characteristic of Asia. After the crisis of the seventeenth century, Poland was the poorest country in the sample. This reinforces previous findings of Polish historiography about the severity of the crisis (Przyboś 1957; Sosnowska 2004). At the same time, the North Sea region accelerated and the Mediterranean economies defended their relatively—in a global perspective—high equilibrium. As already discussed, the crisis was followed by a slow recovery. By the end of the eighteenth century, Polish GDP per capita was barely above that of Japan and India and below that of the Ottoman Empire. During the eighteenth and the nineteenth century, however, the country managed to surpass the Asian figures. Nonetheless, its absolute growth rate in the first century after the onset of the Industrial Revolution on the continent was much lower than that of Western Europe. By around 1870, the average GDP per capita of the European countries in the sample other than Poland was 2077 1990$PPP. The Polish economy in per capita terms was less than half of that level.

6 Conclusion

Our inquiry into the long-term growth curve of the Polish economy confirms the conventional knowledge that Poland/Eastern Europe was a European periphery. Our figures reinforce the notion suggested by all of the previous studies of Polish per capita GDP that the county already lagged behind Western Europe in economic development at the end of the Middle Ages. The disproportion between the country and the front-runners located in the North Sea region as well as the other Western European countries widened through the period. The growth in the gap was not only a result of growth of the Western—particularly northwestern—European economies, but also by the contraction of the Polish economy.

Furthermore, our investigation of income inequality in sixteenth century Poland contributes to a broader discussion about the link between economic growth and inequality. We demonstrated that, contrary to the theoretical claims made by Kuznets (and in opposition to the growing empirical evidence on the historical experience of preindustrial Western Europe), income inequality in the Polish agricultural sector was most probably higher than in the urban sector. This was a result of vast income differences brought about by a demesne economy based on serfdom with a class of landed nobility at the top and disenfranchised peasants at the bottom of the social ladder. This points to the crucial role of institutions (not only economic growth) when trying to understand the formation of income inequality. It is not to say that economic growth and income levels are unimportant. According to our findings, the inequality was curbed by the level of per capita income. In line with the theoretical claims made by Milanovic and collaborators, the level of inequality in the Polish agricultural sector, although relatively high, was limited by the inequality possibly frontier.

References

Adamczyk W (1935) Ceny w Lublinie. Instytut Popierania Polskiej Twórczości Naukowej, Lviv

Alfani G (2010) Wealth inequalities and population dynamics in Northern Italy during the early modern period. J Interdiscip Hist XL(4):513–549

Alfani G, Ammannati F (2014) Economic inequality and poverty in the very long run: The case of the Florentine State. Dondena Working Papers no. 70

Allen RC (1999) Tracking the agricultural revolution. Econ Hist Rev 2nd Ser 52:209–235

Allen RC (2000) Economic structure and agricultural productivity in Europe, 1300–1800. Eur Rev Econ Hist 4:1–26

Allen RC (2001) The great divergence in European wages and prices from the middle ages to the first world war. Explor Econ Hist 38:411–447

Allen RC, Bassino JP, Ma D, Moll-Murata C, Van Zanden JL (2011) Wages, prices, and living standards in China, 1738–1925: in comparison with Europe, Japan, and India. Econ Hist Rev 64:8–38

Álvarez-Nogal C, de la Escosura LP (2013) The rise and fall of Spain (1270–1850). Econ Hist Rev 66(1):1–37

Abad LA, Van Zanden JL (2014) Growth under extractive institutions? Latin American per capita GDP in colonial times. CGEH Working Paper Series no. 61

Baten J, Szołtysek M (2014) A golden age before serfdom? The human capital of Central-Eastern and Eastern Europe in the 17th–19th centuries, MPIDR Working Paper WP2014-008

Bogucka M, Samsonowicz H (1986) Dzieje miast i mieszczaństwa w Polsce przedrozbiorowej. Zakład Narodowy Im. Ossolińskich, Wrocław

Bolt J, Van Zanden JL (2014) ‘The Maddison Project’: collaborative research on historical national accounts. Econ Hist Rev 67(3):627–651

Borowski S (1975) Próba odtworzenia struktór społecznych i procesów demograficznych na Warmii. Przeszłość Demograficzna Polski VIII:125–198

Bosker M, Buringh E, Van Zanden JL (2013) From Baghdad to London: unravelling Urban Development in Europe, the Middle East, and North Africa, 800–1800. Rev Econ Stat 95(4):1418–1437

Broadberry S, Campbell B, Klein A, Overton M, Van Leeuwen B (2015) British economic growth, 1270–1870. Cambridge University Press, Cambridge

Bush M (1996) Introduction. In: Bush M (ed) Serfdom and slavery. Studies in legal bondage. Longman, London-New York

Cackowski S (1961) Gospodarstwo wiejskie w dobrach biskupstwa i kapituły chełmińskiej. PWN, Toruń

Carter FW (1994) Trade and urban development in Poland. An economic geography of Cracow, from its origins to 1795. Cambridge University Press, Cambridge

Crafts N (1985) British economic growth during the industrial revolution. The Clarendon Press, New York

Domar D (1970) The causes of slavery or serfdom: a hypothesis. J Econ Hist 30:18–32

Dwyer P (2013) The rise of Prussia 1700–1830. Routledge, New York

Federico G, Malanima P (2004) Progress, decline, growth: product and productivity in Italian agriculture, 1000–2000. Econ Hist Rev 2nd Ser 57:437–464

Gierszewski S (1982) Wisła w dziejach Polski. Wydawnictwo Morskie, Gdański

Guzowski P (2008) Chłopi i Pieniądze na przełomie średniowiecza i czasów nowożytnych. Avalon, Cracow

Hoszowski S (1928) Ceny we Lwowie w XVI i XVII wieku. Instytut Popierania Polskiej Twórczości Naukowej, Lviv

Izodorczyk-Kamler A (1990) Wynagrodzenie pracowników najemnych w folwarkach małopolskich w XVI i pierwszej połowie XVII wieku. Przegląd Historyczny 81:655–667

Jankowiak-Konik B (2011) Atlas Histoii Polski. Demart S.A, Warsaw

Karpiński A (1983) Pauperes, o mieszkańcach Warszawy XVI i XVII wieku. PWN, Warsaw

Kopczyński M (1998) Studia nad rodziną chłopską w koronie. Krupski i S-ka, Warsaw

Kuklo C (2009) Demografia Rzeczypospolitej przedrozbiorowej. DiG, Warsaw

Kula W (1951) Stan i potrzeby badań nad demografią historyczną dawnej Polski. Roczniki Dziejów Społecznych i Gospodarczych XIII:71

Kula W (1976) An economic theory of the feudal system. Western Printing Services, London

Kula W (1983) Teoria ekonomiczna ustroju feudalnego. Ksiązka i Wiedza, Warszawa

Kuznets S (1955) Economic growth and income inequality. Am Econ Rev 45:1–28

Laszuk A (1999) Ludność województwa podlaskiego w drugiej połowie XVII wieku. Białostockie Towarszystwo Naukowe, Warsaw

Leslett P (1983) Family and household as work group and kin group. In: Wall R, Robin J, Laslett P (eds) Family forms in historic Europe. Cambridge University Press, Cambridge

Mączak A (1982) The structure of power in the Commonwealth of the sixteenth and seventeenth centuries. In: Fedorowicz JK (ed) A republic of nobles. Studies in Polish history to 1864. Cambridge University Press, Cambridge, pp 109–134

Mączak A (1995 [1983]) Development levels in early-modern Europe. In: Idem (ed) Money, prices and power in Poland. Norfolk: Variorum

Maddison A (2001) The world economy. A millennial perspective. OECD, Paris

Malanima P (2009) Pre-modern European economy. Brill, Leiden

Malanima P (2010) The long decline of a leading economy: GDP in central and northern Italy, 1300–1913. Eur Rev Econ Hist 15:169–219

Malanima P (2013) When did England overtake Italy? Medieval and early modern divergence in prices and wages. Eur Rev Econ Hist 17:45–70

Małecki J (1963) Studia nad rynkiem regionalnym Krakowa w XVI wieku. PWN, Warsaw

Malinowski M (2016a) Little Divergence revisited: Polish living standards in a European perspective, 1500–1800. Eur Rev Econ Hist 20(3):345–367

Malinowski M (2016b) Serfs and the city: market conditions, surplus extraction institutions, and urban growth in early modern Poland. Eur Rev Econ Hist 20(2):123–146

Melton E (1988) Gutsherrschaft in East Elbian Germany and Livonia 1500–1800: a critique of the Model. Cent Eur Hist 21:315–349

Milanovic B, Lindert P, Williamson J (2011) Pre-industrial inequality. Econ J 121:255–272

Molenda D (1972) Kopalnie rud ołowiu na terenie złóż śląsko-krakowskich. Zakad narodowy Im. Ossolińskich, Wrocław

Molenda D (1978) Ludzie pracy. In: Hensel W, Pazdura J (eds) Historia kultury materialnej Polski, vol III. Wrocław, Zakład Narodowy Im. Ossolińskich, pp 206–214

Pamuk Ş (2009) Estimating GDP per capita for the Ottoman Empire in a European Comparative Framework, 1500–1820. Paper presented at the XVth World Economic History Congress, August 2009, Utrecht

Pelc K (1935) Ceny w Krakowie w Latach 1369–1600. Instytut Popierania Polskiej Twórczości Naukowej, Lviv

Peters J (1970) Ostelbische Landarmut: Statistisches uber landlose und landarme Agrarproduzenten im Spatfeudalismus (Schwedisch-Pommern und Sachsen). Jahrbuch fur Wirtschaftsgeschichte 1:115–116

Pfister U (2011) Economic growth in Germany, 1500–1850. Paper presented at the conference on quantifying long run economic development, Venice

Przyboś A (ed) (1957) Polska w okresie drugiej wojny północnej 1655–1660. PWN, Warsaw

Rusiński W (1954) O rynku wewnetrzynym w Polsce w drugiej połowie XVIII wieku. Roczniki Dziejów Społecznych i Gospodarczych 16:113–149

Rutkowski J (1938) Badania nad podziałem dochodów w Polsce w czasach nowożytnych. Polska Akademia Umiejętności, Cracow

Rutkowski H (ed) (2008) Atlas historyczny Polski, Województwo Krakowskie. Neriton, Warsaw

Sosnowska A (2004) Zrozumieć zacofanie. TRIO, Warsaw

Topolski J (1965) Narodziny kapitalizmu w Europe. Państwowe Wydawnictwo Naukowe, Warsaw

Trzyna E (1963) Położene ludności wiejskiej w królewszczyznach Województwa Krakowskiego w XVII wieku. Zakład Narodowy Im. Ossolińskich, Wrocław

Van Zanden JL (1995) Tracing the beginning of the Kuznets’ Curve. Econ Hist Rev 48(4):643–664

Van Zanden JL (1999) Wages and the standard of living in Europe, 1500–1800. Eur Rev Econ Hist 2:175–197