Abstract

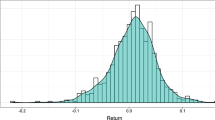

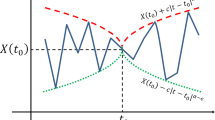

We propose an early warning system to timely forecast turbulence in the US stock market. In a first step, a Markov-switching model with two regimes (a calm market and a turbulent market) is developed. Based on the time series of the monthly returns of the S&P 500 price index, the corresponding filtered probabilities are successively estimated. In a second step, the turbulent phase of the model is further specified to distinguish between bullish and bearish trends. For comparison only, a Markov-switching model with three states (a calm market, a turbulent bullish market, and a turbulent bearish market) is examined as well. In a third step, logistic regression models are employed to forecast the filtered probabilities provided by the Markov-switching models. A major advantage of the presented modeling framework is the timely identification of the factors driving the different phases of the capital market. In a fourth step, the early warning system is applied to an asset management case study. The results show that explicit consideration of the models’ signals yields better portfolio performance and lower portfolio risk compared to standard buy-and-hold and constant proportion portfolio insurance strategies.

Similar content being viewed by others

Notes

For comparison, we also estimated the vector \(\varvec{\theta }\) using the numerical optimization scheme introduced in Hamilton (2005), which is more time-consuming than the EM algorithm; the estimation results were essentially the same as those reported here.

Note that the traffic light system is just a simplification for illustrative purposes. The information we actually create, that is, the probabilities for each regime, is much richer than a simple indication (indicating color) and may be used for advanced risk management or investment strategies.

As Hamilton (2005) numerical scheme provides similar results, we do not explicitly illustrate them.

For example, the OECD CLI Index of December is published in February. Thus the data set of December is shifted to February in our estimation database.

In case of the buy-and-hold strategy of a 100 % investment in the stock market and a buy-and-hold strategy consisting of a 50 % investment in the stock market and a 50 % investment in the risk-free asset the equality of the Sharpe ratio and the Omega measure, respectively, follows from the fact that the benchmark yield is given by the return of the risk-free asset.

In general, a CPPI strategy is as follows. First, a minimum repayment at maturity (referred to as “floor”) must be specified. For any point in time before maturity the difference between the current value of the portfolio and the discounted floor (denoted as “cushion”) is determined. As long as the cushion is positive, the cushion multiplied by the factor \(m\) (“exposure”) is invested in the risky assets. The remaining value of the portfolio is invested in the risk-free asset. Hence, the multiplier \(m\) indicates the investor’s risk appetite. If the value of the discounted floor exceeds the current value of the portfolio (cushion is negative) at any point in time, the risky investments are removed and the whole wealth is invested in the risk-free asset for the remaining time to maturity. For more information on CPPI strategies, see, e.g., Black and Perold (1992).

The test statistics of Jobson and Korkie (1981) for the modified Sharpe ratio provide: Strategy \(A\) vs. both buy-and-hold strategies 1.826 (significant 10 %); Strategy \(A\) vs. Strategy \(B\) 1.808 (significant 10 %); Strategy \(B\) vs. both buy-and-hold strategies 1.489.

The test statistics of Schmid and Schmidt (2008) for the Omega measure: Strategy \(A\) vs. both buy-and-hold strategies 1.659 (significant 10 %); Strategy \(A\) vs. Strategy \(B\) 1.551; Strategy \(B\) vs. both buy-and-hold strategies 1.431.

References

Abiad, A.: Early-warning systems: a survey and a regime-switching approach. IMF Work. Paper 32 (2003)

Akaike, H.: A new look at the statistical model identification. IEEE Trans. Autom. Control 19, 716–723 (1974)

Alexander, C., Dimitriu, A.: Detecting switching strategies in equity hedge funds returns. J. Alter. Invest. 8, 7–13 (2005)

Ang, A., Piazzesi, M., Wei, M.: What does the yield curve tell us about GDP growth? J. Econom. 131, 359–403 (2006)

Areal, N., Cortez, M., Silva, F.: The conditional performance of US mutual funds over different market regimes: do different types of ethical screens matter? Financ. Mark. Portf. Manag. 27, 397–429 (2013)

Barrell, R., Davis, P., Karim, D., Liadze, I.: Bank regulation, property prices and early warning systems for banking crises in OECD countries. J. Bank. Financ. 34, 2255–2264 (2010)

Baum, L., Petrie, T., Soules, G., Weiss, N.: A maximization technique occuring in the statistical analysis of probabilitistic functions of Markov chains. Ann. Math. Stat. 41, 164–171 (1970)

Bernhart, G., Höcht, S., Neugebauer, M., Neumann, M., Zagst, R.: Asset correlation on turbulent markets and the impact of different regimes on asset management. Asia Pac. J. Operat. Res. 28, 1–23 (2011)

Black, F., Perold, A.: Theory of constant proportion portfolio insurance. J. Econ. Dyn. Control 16, 403–426 (1992)

Boldin, M.: A check on the robustness of Hamilton’s Markov switching model approach to the economic analysis of the business cycle. Stud. Nonlinear Dyn. Econ. 1, 35–46 (1996)

Brockwell, P., Davis, R.: Time Series: Theory and Method, 2nd edn. Springer, New York (1991)

Chen, S.: Predicting the bear stock market: macroeconomic variables as leading indicators. J. Bank. Financ. 33, 211–223 (2009)

Chesnay, F., Jondeau, E.: Does correlation between stock returns really increase during turbulent periods? Econ. Notes 30, 53–80 (2001)

Davis, P., Karim, D.: Comparing early warning systems for banking crises. J. Financ. Stabil. 4, 89–120 (2008a)

Davis, P., Karim, D.: Could early warning systems have helped to predict the sub-prime crisis? Natl. Inst. Econ. Rev. 206, 35–47 (2008b)

Demirgüc-Kunt, A., Detragiache, E.: The determinants of banking crises in developed and developing countries. IMF Staff Paper 45, 81–109 (1998)

Demirgüc-Kunt, A., Detragiache, E.: Cross-country empirical studies of systemic bank distress: a survey. IMF Working Paper 05/96 (2005)

Dempster, A., Laird, N., Rubin, D.: Maximum likelihood from incomplete data via the EM algorithm. J. R. Stat. Soc. Ser. B 39, 1–38 (1977)

Diebold, F., Lee, J., Weinbach, G.: Regime switching with time-varying transition probabilities. Feder. Reserv. Bank Philad. Work. Paper 93(12), 283–302 (1994)

Duttagupta, R. Cashin, P.: The anatomy of banking crises. IMF Work. Paper 08/93 (2008)

Ernst, C., Grossmann, M., Höcht, S., Minden, S., Scherer, M., Zagst, R.: Portfolio selection under changing market conditions. Int. J. Financ. Serv. Manag. 4, 48–63 (2009)

Hamilton, J.: A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57, 357–384 (1989)

Hamilton, J.: Time Series Analysis. Princeton University Press, Princeton (1994)

Hamilton, J.: Regime-switching models. Palgrave Dict. Econ. (2005)

Hauptmann, J., Zagst, R.: Systemic risk. In: Quantitative Financial Risk Management, pp.321–338. Springer, Berlin (2011)

Jobson, J., Korkie, B.: Performance hypothesis testing with the Sharpe and Treynor measures. J. Financ. 36, 889–908 (1981)

Kamin, S., Schindler, J., Samuel, S.: The contribution of domestic and external factors to emerging market devaluation crises: an early warning systems approach. FRB Int. Financ. Discuss. Paper 711 (2001)

Kaminsky, G., Reinhart, C.: The twin crises: the causes of banking and balance-of-payments problems. FRB Int. Financ. Discuss. Paper 544 (1999)

Maheu, J., McCurdy, T.: Identifying bull and bear markets in stock returns. J. Bus. Econ. Stat. 18, 100–112 (2000)

Martinez-Peria, M.: A regime-switching approach to the study of speculative attacks: a focus on EMS crises. Empir. Econom. 27, 299–334 (2002)

Meichle, M., Ranaldo, A., Zanetti, A.: Do financial variables help predict the state of the business cycle in small open economies? Evidence from Switzerland. Financ. Mark. Portf. Manag. 25, 435–453 (2011)

Mittnik, S., Haas, M.: Mit gemischten Normalverteilungen gegen Bären. Portf. Inst. 16–19 (2008)

Schmid, F., Schmidt, R.: Statistical inference for performance measure Omega. Work. Paper (2008)

Schwarz, G.: Estimating the dimension of a model. Ann. Stat. 6, 461–464 (1978)

Shao, J.: Mathematical Statistics, 2nd edn. Springer, New York (2003)

So, M., Lam, K., Li, W.: A stochastic volatility model with Markov switching. J. Bus. Econ. Stat. 16, 244–253 (1998)

Timmermann, A.: Moments of Markov switching models. J. Econ. 96, 75–111 (2000)

Zhang, J., Stine, R.: Autocovariance structure of Markov regime switching models and model selection. J. Time Ser. Anal. 22, 107–124 (2001)

Zhang, Z.: Corporate bond spreads and the business cycle. Bank Can. Work. Paper 15 (2002)

Acknowledgments

We thank Johann Goldbrunner, Martin Hüfner, Klaus Meitinger and Oliver Schlick most sincerely for sharing their invaluable years of experience in capital markets. The joint discussions allowed us to improve the quality of this paper and to learn about the most important risk factors and their interrelations. We also thank the editor and an anonymous referee for constructive comments that led to improvement of the paper. Franz Ramsauer gratefully acknowledges the financial support of Pioneer Investments.

Author information

Authors and Affiliations

Corresponding author

Appendices

Appendix A: Underlying data set

In the following we give an overview of all data that were used directly or after some transformations (e.g., absolute/relative change of the same variable over time, spread between two different variables, etc.). We also provide the data sources so as to simplify the verification of the results set out in Sect. 3.2.

Balance on Current Account

http://research.stlouisfed.org/fred2/series/BOPBCA

Belgischer Frühindikator

Datastream (BG000183Q)

Capacity Utilization Rate for Total Industry

http://research.stlouisfed.org/fred2/series/TCU

Civilian Unemployment Rate

http:research.stlouisfed.org/fred2/search?st=Civilian+Unemployment+Rate

Consumer Price Index (CPI) for All Urban Consumers (All Items)

http://research.stlouisfed.org/fred2/series/CPIAUCSL

JPM EMBI+ Composite - Total Return Index

Datastream(JPMPTOT)

Foreign Exchange Rate EURO - USD

http://www.global-view.com/forex-trading-tools/forex-history/

Effective Federal Funds Rate

http://research.stlouisfed.org/fred2/series/FEDFUNDS

Gross Domestic Product (GDP)

http://research.stlouisfed.org/fred2/series/GDP

U.S. High Yield Master II Effective Yield

http://research.stlouisfed.org/fred2/series/AAA

Moody’s Seasoned Aaa Corporate Bond Yield

http://research.stlouisfed.org/fred2/series/BAMLH0A0HYM@EY

Ifo Weltwirtschaftsklima Index

http://www.cesifo-group.de/portal/page/portal/ifoHome/a-winfo/d6zeitreihen/15reihen/_reihenwes

Industrial Production Index

http://research.stlouisfed.org/fred2/series/INDPRO

3-Month US-D LIBOR Interest Rate

http://www.global-rates.com/interest-rates/libor/american-dollar/american-dollar.aspx

can-dollar/american-dollar.aspx

1-Month and 3-Month LIBOR-OIS Spread

Reuters

Board of Governors Monetary Base, Adjusted for Changes in Reserve Requirements

http://research.stlouisfed.org/fred2/series/BOGAMBSL

M1 Money Stock

http://research.stlouisfed.org/fred2/series/M1SL

M2 Money Stock

http://research.stlouisfed.org/fred2/series/M2SL

Nonfarm Payroll Employment Indicator

http://www.philadelphiafed.org/research-and-data/real-time-center/real-time-data/data-files/EMPLOY/

OECD Composite Leading Indicator (OECD + Major 6 NME)

http://stats.oecd.org/index.aspx?datasetcode=MEI_CLI

Personal Saving Rate

http://research.stlouisfed.org/fred2/series/PSAVERT

ISM Manufacturing: PMI Composite Index

http://research.stlouisfed.org/fred2/series/NAPM

Producer Price Index: All Commodities

http://research.stlouisfed.org/fred2/series/PPIACO

Put-Call Ratios

http://www.cboe.com/data/putcallratio.aspx

Spot Oil Price: West Texas Intermediate

http://research.stlouisfed.org/fred2/series/OILPRICE

Moody’s Seasoned Aaa Corporate Bond Yield

http://research.stlouisfed.org/fred2/series/AAA

Moody’s Seasoned Baa Corporate Bond Yield

http://research.stlouisfed.org/fred2/series/BAA

S & P500 Price Index

http://research.stlouisfed.org/fred2/series/SP500

Treasury Bill Eurodollar Difference

http://www.federalreserve.gov/releases/h15/data.htm

3-Month Treasury Constant Maturity Rate

http://research.stlouisfed.org/fred2/series/GS3M

5-Year Treasury Constant Maturity Rate

http://research.stlouisfed.org/fred2/series/GS5

10-Year Treasury Constant Maturity Rate

http://research.stlouisfed.org/fred2/series/GS10

Treasury International Capital System (Cross-Border Financial Flows)

http://www.treasury.gov/resource-center/data-chart-

center/tic/Pages/ticsec2.aspx

Federal Government Debt: Total Public Debt

http://research.stlouisfed.org/fred2/series/GFDEBTN

Trade Weighted Exchange Index: Major Currencies

http://research.stlouisfed.org/fred2/series/TWEXMMTH

University of Michigan: Consumer Sentiment

http://research.stlouisfed.org/fred2/series/UMCSENT

Datastream (USUMCONSH)

CBOE Volatility Index

http://www.cboe.com/micro/vix/historical.aspx

Appendix B: Illustrations

Rights and permissions

About this article

Cite this article

Hauptmann, J., Hoppenkamps, A., Min, A. et al. Forecasting market turbulence using regime-switching models. Financ Mark Portf Manag 28, 139–164 (2014). https://doi.org/10.1007/s11408-014-0226-0

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11408-014-0226-0