Abstract

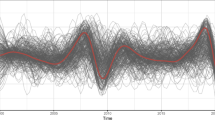

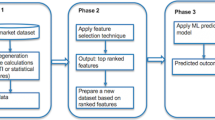

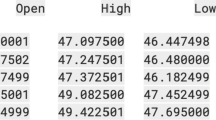

We investigate the interaction among stocks in the US market over various time horizons from a network perspective. Unlike the high-frequency data-driven multiscale correlation networks used in previous works, we propose method-driven multiscale correlation networks that are constructed by wavelet analysis and topological methods of minimum spanning tree (MST) and planar maximally filtered graph (PMFG). Using these techniques, we construct MST and PMFG networks of the US stock market at different time scales. The key empirical results show that (1) the topological structures and properties of networks vary across time horizons, (2) there is a sectoral clustering effect in the networks at small time scales, and (3) only a part of connections in the networks survives from one time scale to the next. Our results in terms of MSTs and PMFGs for different time scales supply a new perspective for participants in financial markets, especially for investors or hedgers who have different investment or hedging horizons.

Similar content being viewed by others

Notes

Note that scaling and multiscaling behaviors of financial time series have become “stylized facts” in the literature (see, e.g., Mantegna and Stanley 1995; Xu and Gençay 2003; Di Matteo et al. 2005; Di Matteo 2007; Segnon and Lux 2013; Buonocore et al. 2016). According to Di Matteo et al. (2005) and Di Matteo (2007), the scaling behavior in finance can be classified into two types: one is the scaling behavior of price fluctuations as a function of time intervals, which is usually characterized by the Hurst exponent; and the other is the scaling behavior in tails of the distribution of returns, which is often measured by a tail index of the distribution. In the first type, the scale invariance is called as self-similarity that is a crucial feature of fractals. Multiscaling (or multifractality) is an extension of self-similarity and is a form of generalized scaling (Xu and Gençay 2003). Unlike the above research on scaling and multiscaling analyses, our study uses the wavelet multiscaling (or multiresolution) approach to decompose financial data (i.e., stock returns) into multiple time scales associated with multiple time horizons. That is to say, our work focuses on the interaction behavior across stocks over various time scales using MST and PMFG networks.

The GICS denotes the Global Industry Classification Standard, which is an industry taxonomy developed by the Morgan Stanley Capital International (MSCI) and S&P. For the GICS sector definitions, see the link https://www.msci.com/resources/pdfs/GICSSectorDefinitions.pdf

Note that tests using (Pearson’s) correlation coefficients may be misleading because they ignore the fact that financial data are characterized by a high degree of heterogeneity. Besides, Forbes and Rigobon (2001, (2002), who investigated stock market comovements during financial crises and market crashes (e.g., the 1997 Asia financial crisis, the 1994 Mexican peso collapse, and the 1987 US stock market crash), pointed out that tests for contagion based on cross-market correlation coefficients can be biased in the presence of heteroscedasticity, endogeneity, and omitted variables. Using an adjusted correlation coefficient, they found that there is no contagion and only interdependence across stock markets during those crises. Therefore, the heteroscedasticity, endogeneity, and omitted variable bias in (Pearson’s) correlation coefficients may affect our empirical results. We leave this interesting topic of how to overcome the bias of (Pearson’s) correlation coefficients for future study.

The Pearson’s correlation coefficient (PCC) between two returns of stocks X and Y is defined as \(\rho _{X,Y} = \frac{\left\langle {r_X r_Y} \right\rangle - \left\langle {r_X } \right\rangle \left\langle {r_Y } \right\rangle }{\sqrt{\left( {\left\langle {r_X^2 } \right\rangle - \left\langle {r_X } \right\rangle ^2} \right) \left( {\left\langle {r_Y^2 } \right\rangle - \left\langle {r_Y } \right\rangle ^2} \right) } }\), where \(\left\langle \cdots \right\rangle \) indicates the time average of the period studied.

MST and PMFG graphs in this paper are drawn by the tool of Pajek. For detailed information of the tool of Pajek, see the link http://mrvar.fdv.uni-lj.si/pajek/.

The remaining MSTs for other wavelet time scales are not presented in this study due to space limitations, but they can be obtained from the authors upon request.

We thank a reviewer for pointing out the DBHT literature. For details of the DBHT method and the corresponding code, see Song et al. (2012).

The reason for choosing the GICS sector classification of stocks as a benchmark clustering partition is the evident sectoral clustering effect in the PMFGs for PCC and most time scales. But we should note that for stocks there is no benchmark community partition that can distinguish which clustering approach is better than others.

For details on ARI and AMI and their difference, see Vinh et al. (2010).

For a detailed introduction and the code for the MLE+KS approach, see Clauset et al. (2009) and the link http://tuvalu.santafe.edu/~aaronc/powerlaws/.

But we should keep in mind that algorithms like MST have a natural tendency to create scale-free graphs based on financial data.

Due to the limitation of the number of wavelet time scales, the multistep survival ratio proposed by Onnela et al. (2003), which is used to examine the long-run evolution of networks, is not suitable for discussion in our study.

References

Aste T, Di Matteo T, Hyde ST (2005) Complex networks on hyperbolic surfaces. Phys A 346(1–2):20–26

Aste T, Shaw W, Di Matteo T (2010) Correlation structure and dynamics in volatile markets. New J Phys 12(8):085009

Blondel VD, Guillaume J, Lambiotte R, Lefebvre E (2008) Fast unfolding of communities in large networks. J Stat Mech-Theory E 10:P10008

Boginski V, Butenko S, Pardalos PM (2005) Statistical analysis of financial networks. Comput Stat Data Anal 48(2):431–443

Bonanno G, Caldarelli G, Lillo F, Micciché S, Vandewalle N, Mantegna RN (2004) Networks of equities in financial markets. Eur Phys J B 38(2):363–371

Bonanno G, Lillo F, Mantegna RN (2001) High-frequency cross-correlation in a set of stocks. Quant Financ 1(1):96–104

Brida J, Risso W (2010) Dynamics and structure of the 30 largest North American companies. Comput Econ 35(1):85–99

Buccheri G, Marmi S, Mantegna RN (2013) Evolution of correlation structure of industrial indices of U.S. equity markets. Phys Rev E 88(1):012806

Buonocore RJ, Aste T, Di Matteo T (2016) Measuring multiscaling in financial time-series. Chaos Soliton Fract 88:38–47

Clauset A, Shalizi CR, Newman MEJ (2009) Power-law distributions in empirical data. SIAM Rev 51(4):661–703

Coelho R, Gilmore CG, Lucey B, Richmond P, Hutzler S (2007) The evolution of interdependence in world equity markets-evidence from minimum spanning trees. Phys A 376:455–466

Conlon T, Ruskin HJ, Crane M (2009) Multiscaled cross-correlation dynamics in financial time-series. Adv Complex Syst 12(4–5):439–454

Conlon T, Cotter J (2012) An empirical analysis of dynamic multiscale hedging using wavelet decomposition. J Futures Mark 32(3):272–299

Crowley PM (2007) A guide to wavelets for economists. J Econ Surv 21(2):207–267

Dajčman S, Festićm M, Kavkler A (2013) Multiscale test of CAPM for three Central and Eastern European stock markets. J Bus Econ Manag 14(1):54–76

Di Matteo T (2007) Multi-scaling in finance. Quant Finance 7(1):21–36

Di Matteo T, Aste T, Dacorogna MM (2005) Long-term memories of developed and emerging markets: using the scaling analysis to characterize their stage of development. J Bank Finance 29(4):827–851

Fernández J (2012) Wavelet multiple correlation and cross-correlation: a multiscale analysis of Eurozone stock markets. Phys A 391(4):1097–1104

Fernandez V (2006) The CAPM and value at risk at different time-scales. Int Rev Financ Anal 15(3):203–219

Forbes KJ, Rigobon R (2001) Measuring contagion: conceptual and empirical issues. In: Claessens S, Forbes KJ (eds) International financial contagion. Springer, New York, pp 43–66

Forbes KJ, Rigobon R (2002) No contagion, only interdependence: measuring stock market comovements. J Financ 57(5):2223–2261

Fortunato S (2010) Community detection in graphs. Phys Rep 486(3–5):75–174

Gençay R, Selçuk F, Whitcher B (2001) Scaling properties of foreign exchange volatility. Phys A 289(1):249–266

Gençay R, Selcuk F, Whitcher B (2002) An introduction to wavelets and other filtering methods in finance and economics. Academic Press, New York

Gençay R, Selçuk F, Whitcher B (2003) Systematic risk and timescales. Quant Financ 3(2):108–116

Górski AZ, Drożdż S, Kwapień J (2008) Scale free effects in world currency exchange network. Eur Phys J B 66(1):91–96

Huang WQ, Zhuang XT, Yao S (2009) A network analysis of the Chinese stock market. Phys A 388(14):2956–2964

Hubert L, Arabie P (1985) Comparing partitions. J Classif 2(1):193–218

In F, Kim S (2006a) The hedge ratio and the empirical relationship between the stock and futures markets: a new approach using wavelet analysis. J Bus 79(2):799–820

In F, Kim S (2006b) Multiscale hedge ratio between the Australian stock and futures markets: evidence from wavelet analysis. J Multi Fin Manag 16(4):411–423

Iori G, Ovidiu P (2007) Weighted network analysis of high-frequency cross-correlation measures. Phys Rev E 75(3):036110

Jang W, Lee J, Chang W (2011) Currency crises and the evolution of foreign exchange market: evidence from minimum spanning tree. Phys A 390(4):707–718

Keskin M, Deviren B, Kocakaplan Y (2011) Topology of the correlation networks among major currencies using hierarchical structure methods. Phys A 390(4):719–730

Kim S, In F (2005) The relationship between stock returns and inflation: new evidence from wavelet analysis. J Empir Financ 12(3):435–444

Kim S, In F (2006) A note on the relationship between industry returns and inflation through a multiscaling approach. Financ Res Lett 3(1):73–78

Kim S, In F (2007) On the relationship between changes in stock prices and bond yields in the G7 countries: wavelet analysis. J Int Financ Market Inst Money 17(2):167–179

Kruskal JB (1956) On the shortest spanning subtree of a graph and the traveling salesman problem. Proc Am Math Soc 7(1):48–50

Kwapień J, Drożdż S (2012) Physical approach to complex systems. Phys Rep 515(3–4):115–226

Kwapień J, Gworek S, Drożdż S (2009a) Structure and evolution of the foreign exchange networks. Acta Phys Pol B 40(1):175–194

Kwapień J, Gworek S, Drożdż S, Górski A (2009b) Analysis of a network structure of the foreign currency exchange market. J Econ Interact Coord 4(1):55–72

Laloux L, Cizeau P, Bouchaud JP, Potters M (1999) Noise dressing of financial correlation matrices. Phys Rev Lett 83(7):1467–1470

Mantegna RN (1999) Hierarchical structure in financial markets. Eur Phys J B 11(1):193–197

Mantegna RN, Stanley HE (1995) Scaling behaviour in the dynamics of an economic index. Nature 376(6535):46–49

Mantegna RN, Stanley HE (2000) An introduction to econophysics: correlations and complexity in finance. Cambridge University Press, Cambridge

Musmeci N, Aste T, Di Matteo T (2015a) Relation between financial market structure and the real economy: comparison between clustering methods. PloS ONE 10(3):e116201

Musmeci N, Aste T, Di Matteo T (2015b) Risk diversification: a study of persistence with a filtered correlation-network approach. J Netw Theory Finance 1(1):77–98

Naylor MJ, Rose LC, Moyle BJ (2007) Topology of foreign exchange markets using hierarchical structure methods. Phys A 382(1):199–208

Onnela JP, Chakraborti A, Kaski K, Kertiész J (2002) Dynamic asset trees and portfolio analysis. Eur Phys J B 30(3):285–288

Onnela JP, Chakraborti A, Kaski K, Kertesz J, Kanto A (2003) Dynamics of market correlations: taxonomy and portfolio analysis. Phys Rev E 68(5):056110

Onnela JP, Kaski K, Kertész J (2004) Clustering and information in correlation based financial networks. Eur Phys J B 38(2):353–362

Ozun A, Cifter A (2010) A wavelet network model for analysing exchange rate effects on interest rates. J Econ Stud 37(4):405–418

Percival DB, Walden AT (2006) Wavelet methods for time series analysis. Cambridge University Press, Cambridge

Plerou V, Gopikrishnan P, Rosenow B, Amaral LAN, Stanley HE (1999) Universal and nonuniversal properties of cross correlations in financial time series. Phys Rev Lett 83(7):1471–1474

Podobnik B, Stanley HE (2008) Detrended cross-correlation analysis: a new method for analyzing two nonstationary time series. Phys Rev Lett 100(8):084102

Ramsey JB (2002) Wavelets in economics and finance: past and future. Stud Nonlinear Dyn Econom 6(3):1–27

Rua A, Nunes LC (2009) International comovement of stock market returns: a wavelet analysis. J Empircal Finance 16(4):632–639

Segnon M, Lux T (2013) Multifractal models in finance: their origin, properties, and applications. Kiel Working Paper No. 1860, Kiel Institute for the World Economy

Song WM, Di Matteo T, Aste T (2012) Hierarchical information clustering by means of topologically embedded graphs. PLoS ONE 7(3):e31929

Song DM, Tumminello M, Zhou WX, Mantegna RN (2011) Evolution of worldwide stock markets, correlation structure, and correlation-based graphs. Phys Rev E 84(2):026108

Tabak BM, Serra TR, Cajueiro DO (2010) Topological properties of stock market networks: the case of Brazil. Phys A 389(16):3240–3249

Tumminello M, Aste T, Di Matteo T, Mantegna RN (2005) A tool for filtering information in complex systems. Proc Natl Acad Sci USA 102(30):10421–10426

Tumminello M, Di Matteo T, Aste T, Mantegna RN (2007) Correlation based networks of equity returns sampled at different time horizons. Eur Phys J B 55(2):209–217

Tumminello M, Lillo F, Mantegna RN (2010) Correlation, hierarchies, and networks in financial markets. J Econ Behav Organ 75(1):40–58

Vandewalle N, Brisbois F, Tordoir X (2001) Non-random topology of stock markets. Quant Financ 1(3):372–374

Vinh NX, Epps J, Bailey J (2010) Information theoretic measures for clusterings comparison: variants, properties, normalization and correction for chance. J Mach Learn Res 11(2):2837–2854

Wang GJ, Xie C (2015) Correlation structure and dynamics of international real estate securities markets: a network perspective. Phys A 424:176–193

Wang GJ, Xie C (2016) Tail dependence structure of the foreign exchange market: a network view. Expert Syst Appl 46:164–179

Wang GJ, Xie C, Han F, Sun B (2012) Similarity measure and topology evolution of foreign exchange markets using dynamic time warping method: evidence from minimal spanning tree. Phys A 391(16):4136–4146

Wang GJ, Xie C, Chen YJ, Chen S (2013) Statistical properties of the foreign exchange network at different time scales: evidence from detrended cross-correlation coefficient and minimum spanning tree. Entropy 15(5):1643–1662

Wang GJ, Xie C, Zhang P, Han F, Chen S (2014) Dynamics of foreign exchange networks: a time-varying copula approach. Dyn Nat Soc 170921

Xu Z, Gençay R (2003) Scaling, self-similarity and multifractality in FX markets. Phys A 323:578–590

Zhou WX (2008) Multifractal detrended cross-correlation analysis for two nonstationary signals. Phys Rev E 77(6):066211

Acknowledgments

We are grateful to the editor and four anonymous referees for their insightful suggestions. This work was supported by the National Natural Science Foundation of China (Grant Nos. 71501066 and 71373072), the China Scholarship Council (Grant No. 201506135022), the Specialized Research Fund for the Doctoral Program of Higher Education (Grant No. 20130161110031), and the Foundation for Innovative Research Groups of the National Natural Science Foundation of China (Grant No. 71521061).

Author information

Authors and Affiliations

Corresponding author

Electronic supplementary material

Below is the link to the electronic supplementary material.

Rights and permissions

About this article

Cite this article

Wang, GJ., Xie, C. & Chen, S. Multiscale correlation networks analysis of the US stock market: a wavelet analysis. J Econ Interact Coord 12, 561–594 (2017). https://doi.org/10.1007/s11403-016-0176-x

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11403-016-0176-x

Keywords

- Econophysics

- Networks

- Stock market

- Wavelet analysis

- Minimum spanning tree

- Planar maximally filtered graph