Abstract

This study explores the asymmetric effects of both aggregate and disaggregate forms of energy consumption along with economic growth on environmental quality for Pakistan covering the period from 1971 to 2014. We have employed unit root test with breaks for stationary checks, BDS test for nonlinearity check and nonlinear autoregressive distributed lag (NARDL) approach for assessing the asymmetric co-integrating relationships among the variables by decomposing them into positive and negative shocks. The empirical findings for aggregate consumption reveal that only negative shocks have a significant impact on ecological footprint. Similarly, different sources of energy consumption have diverse asymmetric effects on ecological footprint. The positive (negative) shocks to oil and gas consumption increase (decrease) ecological footprint. Thus, an increase in oil consumption has a deteriorating impact on environmental quality while a decrease in gas consumption has a favorable impact on environmental quality. The asymmetric relationships also hold between coal consumption, electricity consumption, and ecological footprint. The positive shocks to coal and electricity consumption are negatively related with environmental quality while negative shocks are positively related with environmental quality.

Similar content being viewed by others

Introduction

In the recent decades, human living standards and well-being have been improved to a greater extent because of high economic growth and prosperity. However, this growth has been compromising environmental quality as it heavily relies on energy-intensive inputs. Energy is a fundamental need for humans’ survival because without heat, light, and power, firms and industries cannot be built, cities cannot survive, and resultantly goods cannot be produced. This ensures that energy being the lifeblood of the global economy acts as a main driving force behind all economic activities (Alam 2006). According to IEA (2019), a tremendous rise in energy demand is observed across the globe. In 2018, the rate of global energy demand is recorded at about 2.3 % which was the ever fastest rise in the energy demand in the present decade.

In particular, its major effects on the economies are twofold. First, it contributes to the economy through extraction, transformation, and distribution of energy goods and services by creating jobs and boosting economic growth. Second, it acts as an input and can affect the economy through energy-related shocks (WEF 2012) and then to growth sustainability through a deteriorating environmental quality (Zhao et al. 2013; Majeed et al. 2020). Predominantly, energy comes from non-renewable resources (coal, oil, natural gas, nuclear) and has incredibly strong negative effects on the environment by producing carbon dioxide (CO2), methane (CH4) emissions, and other greenhouse gases (GHGs) in the atmosphere (Majeed and Luni 2019).

In Pakistan, like all other developing countries, the environmental issues have become the major concern of the government. The government of Pakistan (GoP) (2020) states that Pakistan is among the top ten countries which are highly vulnerable to climate change in the past 20 years. Eckstein et al. (2019) also inform that cost of environmental degradation is considerable in Pakistan as the country has lost 0.53 % per unit GDP, and economic losses of about 3792.53 million US dollars along with experiencing 152 extreme weather events from 1999 to 2018. Meanwhile, the country also witnessed a rise in energy demand from the last few decades as it is intently related to the development of the various sectors in the economy.

According to the World Data Atlas (WDA 2020), Pakistan’s primary energy consumption increased from 1.74 quadrillion btu in 1998 to 3.37 quadrillion btu in 2017, increasing at an average annual rate of 3.63%. The energy consumption in terms of oil equivalent stood at 460.23 million tons in 2014 as compared to 446.01 million tons in 2001. Along with this, the country also witnessed a severe energy crisis which has increased its reliance on imported oil. Therefore, the cost structure within the economy’s power generation sector increased, putting the country into a severe shortage of gas and electricity.

To address these issues, the government has formulated energy plans to provide indigenous, affordable, and sustainable energy for all. Consequently, Pakistan’s dependence on some non-renewable (renewable) energy sources in the overall energy mix is slightly declining (increasing) from the past few years. In 2018, in terms of the energy mix, Pakistan’s reliance on oil shrunk to 3.2 %, on gas 34.6 % (due to low consumption in the transport sector), and hydel energy to 7.7 % (due to short-sightedness of policy), respectively. The share of renewable energy remains 1.1 % in 2018 while the nuclear share increases about 2.7 % (GoP 2019).

The overall petroleum product consumption remains about 19.68 million tons per annum. The consumption of oil and gas increased by 1.25952 million tons and 4.727285 million tons of oil equivalent in 2014 as compared to 18.461 million tons and 16.2979 million tons of oil equivalent in 2001, respectively. The significant rise in coal and electricity consumption has also been noticed in the last decade. In 2014 the coal and electricity consumption raised by 7.061729 million tons of oil equivalent and 420.5071167 kW h−1 per capita from 2.105 million tons of oil equivalent and 345.8106331 kW h−1 per capita in 2001, respectively (Bp global, 2020). Along with this high energy use, the increase in carbon emissions is not surprising. The statistics show that total CO2 emissions from energy consumption increased by 147.620 million metric tons in 2014 from 103.160 million metric tons in 2001.

The links between energy consumption and environmental quality are also found in the existing literature (Baloch et al. 2019; Ozcan et al. 2020; Shujah-ur-Rahman et al. 2019). According to Danish et al. (2017) and Hassan et al. (2019), Pakistan’s economy is still in the development process where day by day increasing industrial activities are aggravating the existing energy demand. This demand is met by both renewable and non-renewable energy sources. The large share of energy comes from conventional energy sources such as coal, gas, and oil which contribute to high carbon emissions in the atmosphere. The increasing number of vehicles, transportation modes along with zero high-quality fuel, further exacerbates the environmental quality issues (Danish and Baloch 2017; Danish et al. 2018). However, renewable energy has helped to control carbon emissions to a certain extent as claimed by Danish and Wang (2017) and Wang et al. (2018) in their recent studies for Pakistan.

These studies have used linear econometric approaches and rely on a single measure of environmental CO2 emission. Further, in the overall literature, there are only two studies that use the nonlinear econometric approach to explore the relationship between energy and the environment (Munir et al. 2020; Baz et al. 2020). The study by Baz et al. (2020) used an asymmetric approach but restricted to employ only one measure of energy consumption, while Munir et al. (2020) used disaggregated energy data but restricted to the use of standard econometric techniques (time series) and environmental indicator (CO2).

Hence, this study contributes to the existing literature in many ways. First, we provide the nonlinear impacts of energy sources on environmental quality by employing the nonlinear autoregressive distributed lag (NARDL) method. Second, the study incorporates both aggregated and disaggregated energy consumption data. The aggregated data comprises total energy consumption while disaggregated energy data includes oil, coal, gas, and electricity consumption. Third, we proxied the environmental quality by ecological footprint (EF) which is considered the best measure of environmental sustainability. It is a comprehensive environmental indicator capturing various dimensions of the ecosystem namely built-up land, carbon, cropland, fishing grounds, grazing land, and forest products (Bagliani et al. 2008; Majeed and Mazhar 2019; Danish et al. 2019). Last, we use the maximum accessible available data covering the period from 1971 to 2014.

In the methodological setting, the study intends to use various unit root tests (ADF, ADF breakpoint, and PP), for checking nonlinearity (BDS test) and recently popularized estimation technique (NARDL) to find out the nonlinear energy consumption impact on ecological footprint. The findings of this study will help in numerous ways. The overall findings will provide important insights on energy and the environment nexus. They will also help to recognize the type of relationship between various energy sources and ecological footprint. By providing the analysis of nonlinear relationships, the findings will assist policymakers and practitioners in formulating the energy-mix policies, because policymakers need literature, clear evidence, and quality research for formulating their policies. Further, the findings also provide assistance in policymaking regarding switching of conventional energy sources to clean energy sources by identifying the most harmful energy source. Through this, policymakers can get the idea of what type of policies will work for the gradual shift of non-renewable energy sources to renewable energy sources to protect the environment.

The structure of the remaining paper is as follows: Section 2 discusses the related literature, Section 3 describes the data set, model and methodology, Section 4 presents the empirical findings, and the last section concludes the study.

Literature review

The research on energy growth the environment has becomes the hot topic of today’s world. The environment has a greater impact on the economy. In fact, economic system influences the environmental quality on a larger scale through excessive natural resource extraction and energy consumption. Therefore, the economic literature is abundant with “economic growth-environment” and “economic growth-energy consumption-environment” nexus. This section is segmented into the following sub-sections.

Economic growth and environment nexus

The relationship between economic growth and environmental quality is puzzling and remains a matter of debate among various researchers and policymakers. Economic theory suggests that there is a positive relationship between economic growth and environmental degradation. As in the initial stages, an increase in economic activities increases the use of energy and fossil fuels in the absence of clean technology that in turn harms environmental health. However, this happens up to a certain point, and after that, economic development contributes to environmental sustainability by changing the economic structure of the economies. This renowned relationship between economic growth and the environment is known as the environmental Kuznets curve (EKC) hypothesis.

Besides these theoretical predictions, the world academia is motivated to test this relationship empirically. For this purpose, the studies are conducted using cross-sectional, time series and panel data set and have used diverse methodologies and environmental indicators. Earlier studies, Shafik and Bandyopadhyay (1992) by using total and annual deforestation and Panayotou (1993) by using deforestation, sulfur dioxide (SO2), nitrogenous oxides (NOx), and solid particulate matter (SPM) for industrial- and energy-related pollutants tested the environment-national income relationship. They found that the income’s linear term is positive and concluded a positive relationship between environmental indicators and income. According to them, an increase in economic development increases the use of energy and material inputs that causes more waste and emissions. Alongside this, growth fosters the process of structural changes in the economy, from agriculture to industrial and industrial to service, making people more aware of the environmental quality and requirement of green technology. Thus, after a threshold, growth promotes environmental sustainability.

Selden and Song (1994) consider SO2, NOx, particulates, and carbon monoxide as environmental proxies while estimating the EKC hypothesis. They concluded the presence of an inverted U-shaped curve. Grossman and Krueger (1995) use more reliable data and several dimensions of water and air pollutants and validated the inverted U-shaped EKC. According to them, very poor countries are not in a position to manage environmental pressure with the increase in development level in the initial stages. However, after some time with the structural transformation, growth-environment relationship turns favorable.

Akbostancı et al. (2009) by employing time series co-integration and panel estimated generalized least squares (EGLS) find a monotonically increasing relationship and N-shaped EKC between carbon emissions and GDP and particular matter, SO2 and GDP, respectively. Fodha and Zaghdoud (2010) also obtained the monotonically increasing relationship between CO2 and GDP for the economy of Tunisia. The EKC, however, was validated by the study of Fodha and Zaghdoud (2010) for SO2 and GDP. Further, Narayan and Narayan (2010) and Jaunky (2011) use panel estimation techniques for 43 developing countries and 36 high-income countries, respectively. They find a positive relationship between income per capita and carbon emissions for most of the Middle Eastern and African countries and all of the South Asian, East Asian, and Latin American countries, and for the group of high-income countries, respectively.

Piaggio et al. (2017) utilize the data from 1882 to 2010 for the Uruguay economy and argued that with the increase in economic activities, carbon emissions increase at a decreasing rate. Further, the recent studies by Uddin et al. (2017) and Ulucak and Bilgili (2018) used ecological footprint (EFP) as an environmental indicator. Uddin et al. (2017) employed the dynamic OLS on the panel data set of 27 highest emitting countries and concluded the positive impact of real income on EFP. Similarly, Ulucak and Bilgili (2018) confirm the EKC hypothesis for upper, lower, and middle-income countries while employing continuously updated fully modified and bias-corrected techniques. Recently, Majeed and Mazhar (2020) reinvestigate the EKC using a longer time horizon more than half century (1961–2018) for different income groups and provide mixed evidence. They conclude that evidence on EKC is inconclusive based on methodology, sample data, and country heterogeneity.

Economic growth, energy consumption, and environment nexus

Economic development is a process of structural transformation that increases production activities and in turn the use of energy in the respective economy. Therefore, growth is highly linked with energy use which is exceedingly connected with the level of emissions. Numerous studies are conducted on this topic and present mixed results based on different econometric methods, sample size, and proxies used to measure environmental quality. Pao and Tsai (2010) and Pao and Tsai (2011) by employing panel co-integration techniques on BRIC economies data set have concluded the positive impact of energy consumption on CO2 emissions and also validated the EKC hypothesis (except Russia). In another study for Brazil, Pao and Tsai (2011) used the gray prediction model and panel co-integration techniques to explore the relationship among GDP, energy consumption and carbon emissions. They argue that energy is the most important determinant of CO2 emissions and have an inverted U-shaped relationship with income. As initially, energy consumption increases with the increase in income and then stabilizes and falls after some time.

Wang et al. (2011) by taking the panel data of 1995 to 2007 for 28 Chinese’s provinces and Shahbaz et al. (2012) by using the time series data of Pakistan’s economy over the period 1971–2009 find the long-run bidirectional causal relationship among energy consumption, GDP and CO2 emissions, and one-way causality from energy consumption to CO2 emissions, respectively. In contrast, Saboori and Sulaiman (2013) use the Malaysian economic data of aggregate and disaggregate energy resources, namely, gas, oil, coal, and electricity. Their findings suggest the existence of an EKC hypothesis for the analysis based on disaggregated energy data. Ozturk and Acaravci (2013) also studied the relationship between energy consumption and carbon emissions along with economic growth. By taking the data from 1960 to 2007 and employing the ARDL technique, they confirm the positive relationship between energy consumption and CO2 emission within the framework of the EKC hypothesis for Turkey.

In a similar context, Ahmad et al. (2016) conducted the study by utilizing the data from 1971 to 2014 for the Indian economy. His results confirmed the positive impact of energy consumption (aggregate and disaggregate) on CO2 emissions along with validating the EKC curve. According to him, energy consumption influence carbon emissions through the feedback effect. Ozturk et al. (2016) find different impacts depending on the income group of the countries. According to them, energy consumption is positively related to ecological footprint for most of the countries in all income groups. The EKC, however, is validated in most of the countries lying in the upper-middle and upper-income groups.

Esso and Keho (2016) and Bekhet et al. (2017) elaborated this relationship for 12 sub-Saharan African countries and GCC countries and obtained similar findings. Ozturk (2017) proves fossil fuel energy consumption as a risk for growth sustainability. His findings assure that nuclear energy has the power to control pollutant emissions along with improving economic growth. Further, Charfeddine and Mrabet (2017) by using a fully modified least squares (FMOLS) estimation technique have also explored the unfavorable impact of energy consumption on EF. In another study, Charfeddine (2017) applied Markov switching equilibrium correction model and obtained mixed findings. His findings support the unfavorable impact of electricity consumption on EF and the favorable impact on carbon footprint and carbon emissions.

Solarin et al. (2017) along with confirming the EKC hypothesis found out somehow surprising effects of renewable energy consumption. According to them, the impact of both fossil fuel and renewable energy on carbon emissions is positive for the economy of Ghana, while Danish and Wang (2017) found a negative (positive) association among renewable (non-renewable) energy consumption and carbon emissions. They also validate the EKC hypothesis for Pakistan’s economy. Other studies such as Mrabet and Alsamara (2017) using ARDL, Atasoy (2017) using Augmented Mean Group (AMG) and Common Correlated Effects Mean Group Estimator (CCEMG), Danish et al. (2017) using ARDL, and Alvarado et al. (2018) employing panel estimation methods signify the presence of an inverted U-shaped EKC and a positive relationship between energy consumption and environmental indicators.

Focusing on ecological management, He et al. (2018a) analyze ecological vulnerability by construing an index of vulnerability. For this purpose, they used spatial analysis of Geographic Information System (GIS) method and multi-criteria decision analysis (MCDA). Their findings show that a larger population of China is living in an extremely ecologically valuable area where vulnerability is mainly caused by increasing economic activities (involving high energy consumption), natural resource consumption, inadequate environmental protection measures, and population pressure. In another study for Marcellus Shale in Pennsylvania and West Virginia, He et al. (2018b) emphasize on the integration of water management and greenhouse gas emission within the shale gas supply chain design and operations. Their analysis concludes that water discharge and water consumption both have a minute impact on economic efficiency, shale gas production, electric power generation, and overall greenhouse gas emissions.

Emphasizing environmental issues from another perspective, Zhang et al. (2018) look the role of e-commerce in reducing electronic waste (e-waste) in China. Using the primary data of 896 Chinese (through a questionnaire) and employing the order logit regression, they conclude that e-commerce has not obtained universal acceptance yet because price is involved in recycling plus its acceptance is mostly limited to the customers involved in online shopping. However, e-commerce is an economic option for controlling e-waste that requires better policy options. Further, using the ARDL model by Danish et al. (2018) and the NARDL model by Sohail et al. (2021) explained that carbon emissions can also be controlled in Pakistan by limiting the energy consumption in the transport sector as their findings confirm the positive connection between transport energy consumption and CO2 emissions. Lv et al. (2019) is of the same view as his analysis for China proves the emissions increasing impact of railway freight, waterway freight, road freight, and aviation freight. The impact of road freight is high compared to other modes.

Moreover, Baloch et al. (2019) for Belt and Road Initiative (BRI) countries and Ozcan et al. (2020) for Organization for Economic Co-operation and Development (OECD) economies find the detrimental impact of GDP and energy consumption on EF. Nathaniel et al. (2019) on the other hand confirm the detrimental effect only in the short run for South Africa. Shujah-ur-Rahman et al. (2019) and Munir et al. (2020) prove the EKC hypothesis and positive relationship among energy consumption and carbon emissions for Pakistan and ASEAN-5 countries, respectively. Zhao et al. (2020) consider the official driving cycle based on the fossil-fuel vehicle (FV) as a cause of environmental pollution in China comparative to the driving cycle based on electric vehicles (EV). They argue that EVs are more environmentally friendly as they don’t release any pollutant emissions.

Sarkodie et al. (2020) utilize the Prais-Winsten transformed regression with robust standard errors and dynamic ARDL simulations for China over the period 1961 to 2016. According to them, renewable energy consumption helps to control carbon emissions and EF while fossil fuel energy consumption exacerbates both environmental indicators. Supporting this, Wang et al. (2020) argue that replacing fossil fuel with biomass energy can help to control environmental issues. In another recent study, Shaari et al. (2020) find the positive impact of natural gas and energy consumption on carbon emissions of the Organization of Islamic Cooperation (OIC). Likewise, Majeed and Tauqir (2020) using extended STIRPAT modeling advocated a rise in carbon emissions as the result of energy consumption irrespective of different income categorizations of the sampled countries.

In a similar setting, Munir et al. (2020) and Baz et al. (2020) used the methodology of asymmetric or nonlinear ARDL while exploring the relationship between energy consumption, economic growth, and the environment. By doing so, they confirmed the asymmetric relationship among the variables. So, following them, the present study employed nonlinear ARDL (NARDL) for the empirical analysis. The contribution of this study is that it employs NARDL for Pakistan’s economy data using both aggregated and disaggregated energy sources taking EF as an environmental indicator. Although one similar study exists, its focus is on total energy consumption rather than types of energy (Baz et al. 2020). Further, the ones who employed disaggregated data have used time-series data and CO2 emissions (Munir et al. 2020). In addition, other few studies focused on various types of energy but utilize standard econometric techniques (Charfeddine (2017) along with using carbon emissions as an environmental indicator (Saboori and Sulaiman 2013; Ahmad et al. 2016; Shaari et al. 2020).

Data and methodology

Data

This study explores the asymmetric association between energy consumption, economic growth, gross fixed capital formation, and ecological footprint for Pakistan over the period 1971 to 2014. Energy is further divided into oil consumption, gas consumption, coal consumption, and electricity consumption. Ecological footprint is the dependent variable. Energy consumption, economic growth, gross fixed capital formation, oil consumption, gas consumption, coal consumption, and electricity consumption are taken as explanatory variables. The description and data source of all the variables are presented in Table 1.

Methodology

We have employed the NARDL model proposed by Shin et al. (2014) to explore the nonlinear and asymmetric association among the selected variables. NARDL approach comprises of a dynamic error correction model that permits to capture the short-run and long-run asymmetries. According to Romilly et al. (2001) and Ahmad et al. (2017), NARDL methodological framework allows co-integration and asymmetric nonlinearity in one equation jointly and does a better performance in the small samples as compared to other co-integration methods. Moreover, NARDL is more flexible to produce accurate and precise outcomes when variables are I (0), I (1), or a combination of both. Furthermore, when some of the regressors are endogenous, the NARDL will provide unbiased long-run approximations and test statistics. NARDL test takes numbers of lags and archives data generation procedure from general to a specific framework. Due to these features, the NARDL integrates short-run adjustment to long-run equilibrium without the loss of long-run information. Moreover, in NARDL model, we distinguish the short-run and long-run impacts of independent variables on the dependent variable. According to Shin et al. (2014) problem of multicollinearity should be solved by selecting the appropriate lag order. The simple regression model in linear form can be written as:

where EF is ecological footprint, GDP is economic growth, and GFCF is gross fixed capital formation. Considering the nonlinear behavior of variables, Shin et al. (2014) developed the method of NARDL by extending the Pesaran et al. (2001) bound test approach. The ARDL model can be presented as follow:

In eq.2, the coefficients attached with difference operators (α1, α2, α3, α4) measure short-run dynamics, whereas the terms with first lagged captures the long-run relationship. After this, to estimate the short-run dynamics, the error correction model (ECM) can be expressed in the following form:

Where, ECTt-1 is the error correction term and η indicates the speed of adjustment. We expect a negative relationship between ECM and the dependent variable.

By extending the ARDL approach the asymmetric NARDL model is presented as follow:

Energy consumption is further disaggregated into oil consumption, gas consumption, coal consumption and electricity consumption. So, now the equations are as follows:

where the αi presents the long run and γi illustrates short-run coefficient with i=0, 1….7. In Eqs. 4 to 8, the short-run analysis shows the immediate impact of independent variables on the dependent variable, whereas the long-run coefficients show the reaction time of the adjustment in the direction of the equilibrium level. In this study, we applied the time series method to examine how independent variables, namely, energy consumption, economic growth, and capital, describe the correspondence of the environmental quality as extended by EF. EF is presented by EFt, energy consumption by ECt, economic growth by GDPt and capital by GFCFt, oil consumption by OCt, gas consumption by GSt, coal consumption by CCt, and electricity consumption by ECTt. In the structural break date, a dummy variable was recognized through the unit root test (Kim and Perron 2009) and also incorporated in the equation. By applying the Wald test, we investigate the long-run (α = α+ = α−) and short-run (γ = γ+ = γ−) asymmetry for all the variables. p and q present the optimal lag for dependent (EFt) and independent variables (ECt, GDPt, GFCFt, OCt, GSt, CCt and ECTt) determined through Akaike information criteria.

In the next step, the exogenous variables were decomposed into positive and negative partial sum as follows:

The asymmetric co-integration has been done by applying the bound test presented by Shin et al. (2014) for all the regressors with lagged levels. In addition, F-statistic proposed by Pesaran et al. (2001) and t statistic (Banerjee et al. 1998) have been employed for testing the null hypothesis of no co-integration γ = γ+ = γ− = 0 and γ =0, respectively.

Asymmetric Granger causality test

Granger’s (1969) work on causality attracted the attention of numerous scholars across the globe. After it scholar applied symmetric approach for determining the direction of casual relationship among the variables. Recently, Hatemi-J (2012) introduced asymmetric causality test among the positive and negative shocks of variables. This test works according to theory in Toda and Yamamoto (1995) by including nonlinear impacts and differentiating between the positive and negative shocks. This test is known as (Hacker and Hatemi-J 2012) causality test and helps in examining the asymmetric relationship between the variables.

Firstly, Hatemi-J (2012) supposed that the integrated variables y1 and y2 work in a following way:

where y1 and y2 denote initial values, and t=1, 2…., T and two white noise disturbance term are represented by ε1i and ε2i. Onwards these error terms are decomposed into positive and negative shocks: \( {\varepsilon}_{1i}^{+}=\mathit{\max}\left({\varepsilon}_{1i},0\right) \)and \( {\varepsilon}_{2i}^{+}=\mathit{\max}\left({\varepsilon}_{2i},0\right) \) represent positive changes and \( {\varepsilon}_{1i}^{-}=\mathit{\max}\left({\varepsilon}_{1i},0\right) \) and \( {\varepsilon}_{2i}^{-},0 \) denotes the negative changes. In the next step, we decomposed the initial values into positive and negative shocks; the following was observed: \( {\varepsilon}_{1i}={\varepsilon}_{1i}^{+}+{\varepsilon}_{1i}^{-} \) and\( {\varepsilon}_{2i}={\varepsilon}_{2i}^{+}+{\varepsilon}_{2i}^{-} \). The variables in asymmetric form can be presented as follow:

After it, every variable is fractionated into positive and negative shocks and presented in cumulative form as \( {y}_{1t}^{+}={\Sigma}_{i=1}^t{\varepsilon}_{1i}^{+},{y}_{1t}^{-}={\Sigma}_{i=1}^t{\varepsilon}_{1i}^{-},{y}_{2t}^{+}={\Sigma}_{i=1}^t{\varepsilon}_{2i}^{+},{y}_{2t}^{-}={\Sigma}_{i=1}^t{\varepsilon}_{2i}^{-} \). Furthermore, for capturing the asymmetric causality between the variables, we applied vector autoregressive introduced by Hatemi-J (2012) within the order of p. For the optimal lag length, we employed the HJC model introduced by Hatemi-J (2003) and Hatemi-J (2008) as follow:

The symbol \( \mid {A}_J^{\hat{\mkern6mu}}\mid \) represents the determinants of the variance-covariance matrix of the white noise disturbance term in the VAR model, where q is lag order, ln denotes the natural logarithm, and T represents the total observations.

In the next step, we specified the null hypothesis of the kth elements of y2, which does not cause the wth element of y1 in the causality test. The hypothesis is tested by applying the Wald test (Hatemi-j 2012). Ho: wth row, kth column in Ar is equal to zero for r= 1…p.

The null hypothesis of Wald test for no causality is

Where β = vec (D) denotes the column-stacking operator, and C represents the p × n (1+ np) indicator matrix.⨂ denotes the Kronecker product, and Su shows the estimated VAR covariance matrix of the unrestricted VAR model as \( {S}_u=\frac{\delta {\prime}_u{\delta}_u}{T-q} \) in each equation of VAR model, and q denotes the number of parameters. The hypothesis is rejected for no causality if the calculated values of the Wald statistic are beyond the bootstrap critical values.

Results and discussion

This section presents and discusses the empirical findings obtained using EViews 9.

Descriptive statistics and stationary unit root tests

Table 2 displays descriptive statistics of the variables used in this study. The statistics show that for Pakistan economy, the maximum and minimum value of ecological footprint is 0.9261 and 0.041, respectively. The country has maximally consumption energy at 6.215, whereas its minimum economy consumption is 5.652. Concerning GDP per capita constant 2010 US, Pakistan’s per capita economic growth is 11.390, while the lowest is 10.545. Furthermore, the values of gross fixed capital formation lie between the maximum and minimum values of 10.158 and 8.984. The maximum value for oil, gas, coal, and electricity consumption is 3.032, 3.448, 2.391, and 6.499, respectively, in the country. Likewise, the minimum consumption of oil, gas, coil, and electricity in the country is 0.231, 0.838, −0.668, and 4.995, correspondingly.

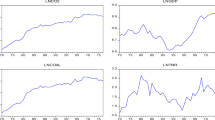

This study examines the stationarity properties of the variables before estimating asymmetries in the models. Table 3 reports the order of integration of the variables using Dickey and Fuller (1979) and Phillips and Perron (1988) unit root tests. The results of these tests show that all variables are stationary at first difference. Further, all variables at intercept and level have unit root process which later changes to stationary at first different in both ADF and PP unit root tests.

Further, the existences of structure breaks in the series are also observed. Perron (1989) pointed out that the presence of structural break when ignored in traditional unit root tests produces biased empirical results. Therefore, structural breaks in unit root tests are important to accommodate for accurate and unbiased estimates. Perron (1989) resolved this problem. Unit root test with structural break dates is presented in Table 3. The statistics show that all variables have a unit root process (non-stationary) in the presence of a structural break in them. For instance, the ecological footprint is non-stationary in structural break date 2011, energy consumption in 1986, economic growth in 2000, capital formation in 2012, oil consumption in 1988, gas consumption in 1986, coal consumption in 2002, and consumption of electricity in 1983. Therefore, the existence of unit root in these variables motivates us to investigate asymmetric co-integration among environmental quality, energy consumption (in aggregate and disaggregate forms), and economic growth for Pakistan using NARDL modelling.

Co-integration analysis

Table 4 presents both short-run and long-run estimates obtained using economic growth and energy consumption (in aggregate form) as focused variables. The long-run results indicate that asymmetric relationship between aggregate energy consumption and ecological footprint holds as coefficients size of positive shock (4.691) and negative shock (19.851) greatly differ. Besides, only the impact of the negative shock is significant, and the coefficient is carrying a positive sign which is inconsistent with the previous studies (Saboori and Sulaiman 2013; Charfeddine and Mrabet 2017; Destek and Sinha 2020). Therefore, this surprising finding gives us room for moving towards the disaggregate energy consumption analysis for obtaining a clear understanding regarding the relationship between these two variables.

The estimates for economic growth indicate that the effect of positive shocks to economic growth improves environmental quality in the long run. This long-run impact of economic growth is supported by the study by Zafar et al. (2019) and Tahir et al. (2020). The coefficient suggests that 1% increase in economic growth enhances environmental sustainability by 8.886%. The increase in economic growth in the form of a rise in real incomes helps improve environmental quality. This positive impact of economic growth on ecological footprint is supported by studies such as York et al. (2003), Bagliani et al. (2008), and Moran et al. (2008) who concluded that after a certain level of economic growth, the rise in it does not damage the environment. As economic growth increases, real incomes of economic agents increase and the affordability and willingness of the masses to pay for mitigating the harmful pollutants increase, thereby enhancing environmental sustainability. Furthermore, high economic growth owing to improvement in technology also produces less pollution. As far as the negative shocks to economic growth are concerned, it has no significant impact on the ecological footprint in the long run.

Furthermore, the impact of capital formation on ecological footprint is negative indicating that an increase in capital formation decreases environmental quality by 5.149%. This negative impact suggests that long-run fiscal investments hamper the environment of Pakistan. Our finding implies that as Pakistan’s economy is in the developing stage, therefore, most of the investment is made in such technologies that help achieve economic growth targets. These attempts of achieving targeted economic growth at the cost of the environment create pollution and deteriorate environmental quality.

Considering short run, the impact of both positive and negative shocks to energy consumption has no significant impact on ecological footprint. The same is the case with its lag term. These findings imply that there is no asymmetric impact of energy consumption on the environmental quality of Pakistan in the short run. Similarly, the energy consumption of the previous year also does not affect the environmental sustainability of the country in the short term. However, concerning the impact of economic growth of the country, it has a significant impact on the ecological footprint. The result indicates that both positive and negative shocks in economic growth affect ecological footprint positively. In other words, all shocks to economic growth lead to environmental sustainability in the short run. The coefficients suggest that a 1% rise in positive and negative shocks individually causes ecological footprint to increase by 3.588 and 9.768%, respectively. These findings are evident that Pakistan’s economic growth, despite being small or large, helps sustaining environmental quality and consequently improves the environmental performance index of the country in the short run. Further, capital formation in the short run has the same negative impact on ecological footprint as in the long run. The finding suggests that an increase in capital formation in the country degrades the environment and contributes to global warming. This implies that an increase in capital investment (whether in the long or short run) in the country enhances technological advancement at the cost of environmental degradation and consequent ecological footprint decreases. Concerning the lag term of capital formation, ecological footprint increases by 0.918 percent as a result of 1% rise in the previous year’s capital investment in the country. This implies that capital formation has a lag effect on the environment quality of the country. It is because after achieving a certain level of growth through particular capital formation, the country starts focusing on decreasing its environment deteriorating impact which in turn conserves environmental quality. Earlier studies such as Sodersten et al. (2018) also advocated that countries in the early phases of development invest in resource-intensive assets, basic infrastructure, and industrial machinery which lead to environmental deterioration. The error term is negative and significant indicating that the error correction mechanism exists. Its efficiency suggests that the speed to adjustment is slow as only 40% of disequilibrium recovers to equilibrium in the short run.

Table 5 reports the asymmetric effects of energy consumption in its several dis-integrated forms (oil, gas, coal, and electricity) along with the effect of economic growth. Here, findings reveal that different energy sources have different impacts on ecological footprint level of Pakistan which might depend on how much and how frequently each source is exploited. In the case of oil consumption, our study finds that a partial positive sum of oil consumption has a positive and significant impact on ecological footprint while the partial negative sum has a negative but insignificant impact on ecological footprint. The coefficient of positive shock (0.903) indicates that the increased amount of oil consumption is one of the main reasons for large ecological distortions in the country. In Pakistan, a steady increase in population, changes in people lifestyle, and changes in petroleum prices cause an increase in oil consumption, thereby enhancing the use and production of petroleum products. This in turn affects the environment through air and water pollution. The result is in line with the findings of Pao and Tsai (2010, 2011), and Ozturk and Acaravci (2013) who also reported the environmental deteriorating impact of energy consumption. The positive shock of gas consumption is positively and insignificantly associated with ecological footprint, while the negative shock is negatively and significantly related with the ecological footprint. This means that a 1 % decline in gas consumption can decrease the ecological footprint by 6.976%. This finding is in line with (Munir and Riaz 2020). In Pakistan, natural gas accounts for the largest share of Pakistan’s energy use, representing about 44% of total energy consumption. However, from the past few years, Pakistan’s reliance on natural gas consumption has declined due to the introduction and promotion of liquefied natural gas and compressed natural gas use and shifting of cement sector production activities from gas to coal fire system (GoP 2011). This helps the economy to control its ecological footprint resulting from high gas consumption.

The asymmetry also holds in the case of coal consumption, electricity consumption, and ecological footprint. The positive shocks to coal consumption and electricity consumption are insignificant and negative while negative shocks are positive and significant. These findings are against our expectations; however, there can be various reasons behind this relationship. As in terms of energy-mix, Pakistan’s dependence on thermal, local coal, and imported coal is decreasing from the last few years and also coal’s share in total energy consumption is not much significant. Besides, the share of electricity consumption to overall energy is less relative to oil and gas consumption (GoP 2011).

Concerning the effect of shocks (positive) to economic growth on ecological footprint is positive and significant when coal consumption asymmetry is analyzed. Similar is the effect of both positive and negative shocks to economic growth when asymmetry in electricity consumption is estimated. This positive impact of economic growth irrespective of coal and electricity consumption implies that as the economic growth of Pakistan increases, it degraded the environmental quality of the country through increased consumption of non-renewable resources. Previous studies such as Pao and Tsai (2010, 2011) and Ozturk and Acaravci (2013) also reported the rise in environmental degradation due to an increase in energy consumption.

Considering the impacts in the short run, the results indicate that the impact of negative shocks to oil, gas, coal, and electricity consumption increases ecological footprint. Furthermore, the lag of negative shocks to gas consumption also raises environmental degradation. These findings are consistent with the findings of previous studies that advocated that less use of oil, gas, coal, and electricity helps sustain the environment. As we consume less oil, gas, and electricity, the emissions of toxic fumes in the atmosphere lower down. Moreover, less consumption also conserves natural resources and protects the ecosystem from degradation thereby increasing environmental sustainability. These findings of decreasing disaggregated forms of energy consumption and resultant betterment in environmental sustainability are in accordance with the results of Saboori and Sulaiman (2013). On contrary, the positive shocks to the consumption of coal and electricity insignificantly impact ecological footprint. Furthermore, the lag effect of positive shocks to economic growth is positive and significant in the analysis of oil and gas consumption. Similarly, in the analysis of coal consumption, both positive and negative shocks and only positive shocks to economic growth in case of electricity consumption raise environmental degradation. This impact of economic growth on ecological footprint is in accordance with the results of Uddin et al. (2017) and Danish et al. (2019)

Lastly, we derived multiplier dynamics adjustments graphs. Figure 1 shows the cumulative multipliers for energy consumption and environmental quality. The graph indicates that there exists a positive association between energy consumption and ecological footprint, and negative shock in energy consumption is initially dominant than positive shock. The cumulative multipliers for economic growth and ecological footprint are represented in Fig. 2. The figure shows that a negative association exists between economic growth and ecological footprint (environmental quality). Similarly, the disintegrated forms of energy consumption such as oil, coal, gas, and electricity consumption and their association with ecological footprint are shown in Figs. 3, 4, 5, 6, 7, 8, 9, and 10, respectively. These figures show that positive shocks in all disintegrated forms of energy consumption are dominant; the negative shocks expect in gas consumption where its negative shock dominates.

Diagnostic statistics

In econometric analysis pre-estimation (diagnostic) tests are essentially required for accurate empirical estimates and sound policy implications. Table 6 illustrates estimates of several diagnostic tests employed in this study. The findings show that in all the models, there is no issue of serial correlation as the null hypothesis of no serial correction gets accepted. Similarly, all models are correctly specified and do not suffer from omitted variables misspecification. However, the prevalence of the issue of heteroscedasticity varies across our models. There is the problem of heteroscedasticity when energy consumption in aggregate form is analyzed in model 1. On the other hand, the existence of homoscedasticity is observed when energy consumption in dis-aggregate forms (oil, gas, and electricity consumption) is analyzed except in coal consumption (model 4) where heteroscedasticity exists. The coefficients of R-square are reasonably high (0.9) in all estimated models. Furthermore, there is also no problem of autocorrelation in all the estimated models according to Durbin Watson statistics.

Lastly in the diagnostic test, we have employed the nonlinear BDS test given by Broock et al. (1996). Table 7 reports estimates obtained through the BDS test within VAR consisting of m dimension. The result reveals that nonlinearity exists as the null hypothesis of linearity gets rejected for all the variables. This existence of nonlinearity confirms the presence of disturbance and chaotic behavior in our data. Furthermore, all obtained diagnostic statistics confirm that the specified model of our study is well designed, appropriate for policy suggestion, and the results are consistent and reliable.

Conclusion

Over the past few decades, the exploitation of natural resources and degradation of the overall environment have gone up at an alarming rate mainly because of high economic growth concerns. As growth increases production activities which are highly based on energy-intensive inputs, therefore, it has a worsening impact on environmental quality. This study investigated the impact of energy consumption in aggregate and disaggregate forms along with economic growth on ecological footprint over the period 1971–2014 for Pakistan economy. A neoclassical production function has been applied to investigate the asymmetric nexus using the nonlinear ARDL co-integration technique. Our findings confirm the presence of asymmetric associations among the concerned variables.

The NARDL results suggest that in long-run equilibrium, negative shocks in energy consumption decrease ecological footprint significantly. This finding validates that as energy consumption decreases, it impedes environmental quality. The same is the case when energy consumption is taken dis-integrated in the forms of coal and electricity consumption. However, positive shocks to oil and negative shocks to gas consumption increase ecological footprint. The economic growth of the country is also found to enhance ecological footprint. Furthermore, capital formation in the country decreases the ecological footprint.

Contribution of the study

The empirical research on energy consumption, economic growth, and the environment has been extensively explored in the last few decades. However, these researchers broadly use emissions as a measure of environmental quality which is one component of ecological footprint (Pao and Tsai 2011; Wang et al. 2011; Alvarado et al. 2018; Majeed and Mazhar (2019). Therefore, these existing studies capture an incomplete picture of the environment. This study contributes to the existing literature in the number of ways. First, it incorporates ecological footprint as a comprehensive indicator of the environment depicting the complete environmental impact of energy consumption and economic growth. Second, it analyses the dynamic effects of both aggregate and disaggregate forms of energy consumption on environmental quality. Third, this study investigated the asymmetric effects of energy consumption and economic growth on ecological footprint. To the best of our knowledge, this is the first study that analyzes the asymmetric effects of energy consumption and economic growth in Pakistan. Fourth, this study performs the analyses using overall and disaggregated forms of energy consumption. The study also covers the long time period of 1971 to 2014. Furthermore, asymmetry in energy consumption, economic growth, and ecological footprint is explored using an efficient technique NARDL for clear findings.

Policy implications

On the policy front, this study suggests that policymakers may focus on negative shocks in energy consumption so that environmental quality can sustain. Similarly, disintegrated forms of energy consumption may also be analyzed while forming environmental protection policies. The government may encourage the use of clean energy (biomass) for the fulfillment of the country’s energy requirements. Further, economic growth may be achieved through an eco-friendly growth stance. As Pakistan is the agro-based economy, the country may extensively focus on its agricultural sector growth which ultimately helps to achieve economic growth targets. The authorities may invest in pollution-free modern technologies and production equipment, thereby protecting environmental quality. The ongoing COVID-19 crisis has the negative effects on travel, industrialization, and other economic activities, alleviating the burden on the environment. However, the lower demand for energy may negatively affect efforts for transition to clean energy sources. In this scenario, government needs to support decarbonizing projects by strictly focusing on environment-friendly capital formation projects. This can be done by using updated technology in capital formation to manage environmental sustainability.

References

Ahmad A, Zhao Y, Shahbaz M, Bano S, Zhang Z, Wang S, Liu Y (2016) Carbon emissions, energy consumption and economic growth: an aggregate and disaggregate analysis of the Indian economy. Energy Policy 96:131–143

Ahmad N, Du L, Lu J, Wang J, Li HZ, Hashmi MZ (2017) Modelling the CO2 emissions and economic growth in Croatia: is there any environmental Kuznets curve? Energy 123:164–172

Akbostancı E, Türüt-Aşık S, Tunç Gİ (2009) The relationship between income and environment in Turkey: is there an environmental Kuznets curve? Energy Policy 37(3):861–867

Alam MS (2006) Economic growth with energy (Working Paper No. 1260). University of Munich, Germany

Alvarado R, Ponce P, Criollo A, Córdova K, Khan MK (2018) Environmental degradation and real per capita output: new evidence at the global level grouping countries by income levels. J Clean Prod 189:13–20

Atasoy BS (2017) Testing the environmental Kuznets curve hypothesis across the US: evidence from panel mean group estimators. Renew Sust Energ Rev 77:731–747

Bagliani M, Bravo G, Dalmazzone S (2008) A consumption-based approach to environmental Kuznets curves using the ecological footprint indicator. Ecol Econ 65(3):650–661

Baloch MA, Zhang J, Iqbal K, Iqbal Z (2019) The effect of financial development on ecological footprint in BRI countries: evidence from panel data estimation. Environ Sci Pollut Res 26(6):6199–6208

Banerjee A, Dolado J, Mestre R (1998) Error-correction mechanism tests for cointegration in a single-equation framework. J Time Ser Anal 19(3):267–283

Baz K, Xu D, Ali H, Ali I, Khan I, Khan MM, Cheng J (2020) Asymmetric impact of energy consumption and economic growth on ecological footprint: using asymmetric and nonlinear approach. Sci Total Environ 718:137364

Bekhet HA, Matar A, Yasmin T (2017) CO2 emissions, energy consumption, economic growth, and financial development in GCC countries: dynamic simultaneous equation models. Renew Sust Energ Rev 70:117–132

Broock WA, Scheinkman JA, Dechert WD, LeBaron B (1996) A test for independence based on the correlation dimension. Econometric Reviews 15(3):197–235

Charfeddine L (2017) The impact of energy consumption and economic development on Ecological Footprint and CO2 emissions: evidence from a Markov Switching Equilibrium Correction Model. Energy Econ 65:355–374

Charfeddine L, Mrabet Z (2017) The impact of economic development and social-political factors on ecological footprint: a panel data analysis for 15 MENA countries. Renew Sust Energ Rev 76:138–154

Danish, Baloch MA (2017) Dynamic linkages between road transport energy consumption, economic growth, and environmental quality: evidence from Pakistan. Environ Sci Pollut Res 25(8):7541–7552

Danish, Wang Z (2017) Role of renewable energy and non-renewable energy consumption on EKC: evidence from Pakistan. J Clean Prod 156:855–864

Danish, Zhang B, Wang Z, Wang B (2017) Energy production, economic growth and CO2 emission: Evidence from Pakistan. Nat Hazards 90(1):27–50

Danish, Baloch MA, Suad S (2018) Modeling the impact of transport energy consumption on CO2 emission in Pakistan: evidence from ARDL approach. Environ Sci Pollut Res 25(10):9461–9473

Danish, Hassan ST, Baloch MA, Mahmood N, Zhang J (2019) Linking economic growth and ecological footprint through human capital and biocapacity. Sustain Cities Soc 47:101516

Destek MA, Sinha A (2020) Renewable, non-renewable energy consumption, economic growth, trade openness and ecological footprint: evidence from organisation for economic Co-operation and development countries. J Clean Prod 242:118537

Dickey DA, Fuller WA (1979) Distribution of the estimators for autoregressive time series with a unit root. J Am Stat Assoc 74(366a):427–431

Eckstein D, Künzel V, Schäfer L, Winges M (2019) Global climate risk index 2020. Germanwatch, Berlin Available at: https://germanwatch.org/sites/germanwatch.org

Esso LJ, Keho Y (2016) Energy consumption, economic growth and carbon emissions: cointegration and causality evidence from selected African countries. Energy 114:492–497

Fodha M, Zaghdoud O (2010) Economic growth and pollutant emissions in Tunisia: an empirical analysis of the environmental Kuznets curve. Energy Policy 38(2):1150–1156

GoP (2011) Economic survey of Pakistan. Economic Advisor’s Wing, Ministry of Finance, Islamabad, Pakistan, Islamabad Available at: http://www.finance.gov.pk/survey_1920.html

GoP (2019) Economic survey of Pakistan. Economic Advisor’s Wing, Ministry of Finance, Islamabad, Pakistan, Islamabad Available at: http://www.finance.gov.pk/survey_1819.html

GoP (2020) Economic survey of Pakistan. Economic Advisor’s Wing, Ministry of Finance, Islamabad, Pakistan, Islamabad Available at: http://www.finance.gov.pk/survey_1920.html

Granger CW (1969) Investigating causal relations by econometric models and cross-spectral methods. Econometrica 37:424–438

Grossman GM, Krueger AB (1995) Economic growth and the environment. Q J Econ 110(2):353–377

Hacker S, Hatemi-J A (2012) A bootstrap test for causality with endogenous lag length choice: theory and application in finance. J Econ Stud 39:144–160

Hassan ST, Danish, Khan SUD, Xia E, Fatima H (2019) Role of institutions in correcting environmental pollution: an empirical investigation. Sustain Cities Soc 53:101901

Hatemi-j A (2003) A new method to choose optimal lag order in stable and unstable VAR models. Appl Econ Lett 10(3):135–137

Hatemi-J A (2008) Forecasting properties of a new method to determine optimal lag order in stable and unstable VAR models. Appl Econ Lett 15(4):239–243

Hatemi-j A (2012) Asymmetric causality tests with an application. Empir Econ 43(1):447–456

He L, Shen J, Zhang Y (2018a) Ecological vulnerability assessment for ecological conservation and environmental management. J Environ Manag 206:1115–1125

He L, Chen Y, Li J (2018b) A three-level framework for balancing the tradeoffs among the energy, water, and air-emission implications within the life-cycle shale gas supply chains. Resour Conserv Recycl 133:206–228

IEA (International Energy Agency). 2019. Global energy demand rose by 2.3% in 2018, its fastest pace in the last decade. IEA News, 26 March 2019, Updated 28 March 2019. https://www.iea.org/newsroom/news/2019/march/global-energy demandrose-by-23-in-2018-its-fastest-pace-in-thelast-decade.html.

Jaunky VC (2011) The CO2 emissions-income nexus: evidence from rich countries. Energy Policy 39(3):1228–1240

Kim D, Perron P (2009) Unit root tests allowing for a break in the trend function at an unknown time under both the null and alternative hypotheses. J Econ 148(1):1–13

Lv Q, Liu H, Yang D, Liu H (2019) Effects of urbanization on freight transport carbon emissions in China: common characteristics and regional disparity. J Clean Prod 211:481–489

Majeed MT, Luni T (2019) Renewable energy, water, and environmental degradation: a global panel data approach. Pak J Commer Soc Sci 13(3):749–778

Majeed MT, Mazhar M (2019) Financial development and ecological footprint: a global panel data analysis. Pak J Commer Soc Sci 13(2):487–514

Majeed M, Mazhar M (2020) Reexamination of environmental Kuznets curve for ecological footprint: the role of biocapacity, human capital, and trade. Pak J Commer Soc Sci 14(1):202–254

Majeed MT, Tauqir A (2020) Effects of urbanization, industrialization, economic growth, energy consumption, financial development on carbon emissions: an extended STIRPAT model for heterogeneous income groups. Pak J Commer Soc Sci 14(3):652–681

Majeed MT, Samreen I, Tauqir A, Mazhar M (2020) The asymmetric relationship between financial development and CO 2 emissions: the case of Pakistan. SN Appl Sci 2(5):1–11

Moran DD, Wackernagel M, Kitzes JA, Goldfinger SH, Boutaud A (2008) Measuring sustainable development—nation by nation. Ecol Econ 64(3):470–474

Mrabet Z, Alsamara M (2017) Testing the Kuznets Curve hypothesis for Qatar: a comparison between carbon dioxide and ecological footprint. Renew Sust Energ Rev 70:1366–1375

Munir K, Riaz N (2020) Asymmetric impact of energy consumption on environmental degradation: evidence from Australia, China, and USA. Environ Sci Pollut Res:1–11

Munir Q, Lean HH, Smyth R (2020) CO2 emissions, energy consumption and economic growth in the ASEAN-5 countries: a cross-sectional dependence approach. Energy Econ 85:104571

Narayan PK, Narayan S (2010) Carbon dioxide emissions and economic growth: panel data evidence from developing countries. Energy Policy 38(1):661–666

Nathaniel S, Nwodo O, Adediran A, Sharma G, Shah M, Adeleye N (2019) Ecological footprint, urbanization, and energy consumption in South Africa: including the excluded. Environ Sci Pollut Res 26(26):27168–27179

Ozcan B, Tzeremes PG, Tzeremes NG (2020) Energy consumption, economic growth and environmental degradation in OECD countries. Econ Model 84:203–213

Ozturk I (2017) Measuring the impact of alternative and nuclear energy consumption, carbon dioxide emissions and oil rents on specific growth factors in the panel of Latin American countries. Prog Nucl Energy 100:71–81

Ozturk I, Acaravci A (2013) The long-run and causal analysis of energy, growth, openness and financial development on carbon emissions in Turkey. Energy Econ 36:262–267

Ozturk I, Al-Mulali U, Saboori B (2016) Investigating the environmental Kuznets curve hypothesis: the role of tourism and ecological footprint. Environ Sci Pollut Res 23(2):1916–1928

Panayotou T (1993) Empirical tests and policy analysis of environmental degradation at different stages of economic development (Working Paper No. 992927783402676). International Labour Organization, Geneva

Pao HT, Tsai CM (2010) CO2 emissions, energy consumption and economic growth in BRIC countries. Energy Policy 38(12):7850–7860

Pao HT, Tsai CM (2011) Multivariate Granger causality between CO2 emissions, energy consumption, FDI (foreign direct investment) and GDP (gross domestic product): evidence from a panel of BRIC (Brazil, Russian Federation, India, and China) countries. Energy 36(1):685–693

Perron P (1989) The great crash, the oil price shock, and the unit root hypothesis. Econometrica:1361–1401

Pesaran MH, Shin Y, Smith RJ (2001) Bounds testing approaches to the analysis of level relationships. J Appl Econ 16(3):289–326

Phillips PC, Perron P (1988) Testing for a unit root in time series regression. Biometrika 75(2):335–346

Piaggio M, Padilla E, Román C (2017) The long-term relationship between CO2 emissions and economic activity in a small open economy: Uruguay 1882–2010. Energy Econ 65:271–282

Romilly P, Song H, Liu X (2001) Car ownership and use in Britain: a comparison of the empirical results of alternative cointegration estimation methods and forecasts. Appl Econ 33(14):1803–1818

Saboori B, Sulaiman J (2013) Environmental degradation, economic growth and energy consumption: evidence of the environmental Kuznets curve in Malaysia. Energy Policy 60:892–905

Sarkodie SA, Adams S, Owusu PA, Leirvik T, Ozturk I (2020) Mitigating degradation and emissions in China: the role of environmental sustainability, human capital and renewable energy. Sci Total Environ 719(137530):2–14

Selden TM, Song D (1994) Environmental quality and development: is there a Kuznets curve for air pollution emissions? J Environ Econ Manag 27(2):147–162

Shaari MS, Abdul Karim Z, Zainol Abidin N (2020) The effects of energy consumption and national output on CO2 emissions: new evidence from OIC countries using a panel ARDL analysis. Sustainability 12(8):3312

Shafik N, Bandyopadhyay S (1992) Economic growth and environmental quality: Time-series and cross-country evidence (Working Paper No. 904). World Bank Publications, Washington, DC

Shahbaz M, Lean HH, Shabbir MS (2012) Environmental Kuznets curve hypothesis in Pakistan: cointegration and Granger causality. Renew Sust Energ Rev 16(5):2947–2953

Shin Y, Yu B, Greenwood-Nimmo M (2014) Modelling asymmetric cointegration and dynamic multipliers in a nonlinear ARDL framework. In: Festschrift in honor of Peter Schmidt. Springer, New York, pp 281–314

Shujah-ur-Rahman, Chen S, Saleem N, Bari MW (2019) Financial development and its moderating role in environmental Kuznets curve: evidence from Pakistan. Environ Sci Pollut Res 26(19):19305–19319

Sodersten CJ, Wood R, Hertwich EG (2018) Environmental impacts of capital formation. J Ind Ecol 22(1):55–67

Sohail MT, Ullah S, Majeed MT, Usman A (2021) Pakistan management of green transportation and environmental pollution: a nonlinear ARDL analysis. Environ Sci Pollut Res:1–10

Solarin SA, Al-Mulali U, Musah I, Ozturk I (2017) Investigating the pollution haven hypothesis in Ghana: an empirical investigation. Energy 124:706–719

Tahir T, Luni T, Majeed MT, Zafar A (2020) The impact of financial development and globalization on environmental quality: evidence from South Asian economies. Environ Sci Pollut Res:1–14

Toda HY, Yamamoto T (1995) Statistical inference in vector autoregressions with possibly integrated processes. J Econ 66(1-2):225–250

Uddin GA, Salahuddin M, Alam K, Gow J (2017) Ecological footprint and real income: panel data evidence from the 27 highest emitting countries. Ecol Indic 77:166–175

Ulucak R, Bilgili F (2018) A reinvestigation of EKC model by ecological footprint measurement for high, middle and low-income countries. J Clean Prod 188:144–157

Wang SS, Zhou DQ, Zhou P, Wang QW (2011) CO2 emissions, energy consumption and economic growth in China: a panel data analysis. Energy Policy 39(9):4870–4875

Wang Z, Danish, Zhang B, Wang B (2018) Renewable energy consumption, economic growth and human development index in Pakistan: evidence form simultaneous equation model. J Clean Prod 184:1081–1090

Wang Z, Bui Q, Zhang B (2020) The relationship between biomass energy consumption and human development: empirical evidence from BRICS countries. Energy 194(116906):2–10

WDA (2020) World Data Atlas. [Online] Available at: https://knoema.com/atlas/Pakistan/Primary-energy-consumption (July 14, 2020).

WEF (2012) Industry agenda energy for economic growth. Word Economic Forum, Geneva

York R, Rosa EA, Dietz T (2003) Footprints on the earth: The environmental consequences of modernity. Am Sociol Rev 68:279–300

Zafar MW, Zaidi SAH, Khan NR, Mirza FM, Hou F, Kirmani SAA (2019) The impact of natural resources, human capital, and foreign direct investment on the ecological footprint: the case of the United States. Res Policy 63:101428

Zhang B, Du Z, Wang B, Wang Z (2018) Motivation and challenges for e-commerce in e-waste recycling under “Big data” context: a perspective from household willingness in China. Technol Forecast Soc Chang 144:436–444

Zhao JL, Li G, Su Y, Liu JG (2013) Regional differences and convergence analysis of energy efficiency in China: on stochastic frontier analysis and panel unit root. Chin J Manag Sci 21:175–184

Zhao X, Ye Y, Ma J, Shi P, Chen H (2020) Construction of electric vehicle driving cycle for studying electric vehicle energy consumption and equivalent emissions. Environ Sci Pollut Res 27(30):37395–37409

Availability of data

Data sources are clearly mentioned. Interested person can access the data.

Computational codes

Computational codes are available on demand

Author information

Authors and Affiliations

Contributions

This idea was given by Muhammad Tariq Majeed. Muhammad Tariq Majeed supported in all sections of this work and completed the final write up of the paper. Aisha Tauqir analyzed the data and discussed the results, Maria Mazhar helped in introduction and literature review sections, and Isma Samreen wrote the methodology and concluded the study. All authors have read and approved the manuscript.

Corresponding author

Ethics declarations

Ethical approval

This article does not contain any studies with human participants or animals performed by any of the authors.

Consent to participate

I am free to contact any of the people involved in the research to seek further clarification and information.

Consent for publication

Not applicable.

Conflict of interest

The authors declare no competing interests.

Additional information

Responsible Editor: Ilhan Ozturk

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Rights and permissions

About this article

Cite this article

Majeed, M.T., Tauqir, A., Mazhar, M. et al. Asymmetric effects of energy consumption and economic growth on ecological footprint: new evidence from Pakistan. Environ Sci Pollut Res 28, 32945–32961 (2021). https://doi.org/10.1007/s11356-021-13130-2

Received:

Accepted:

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11356-021-13130-2