Abstract

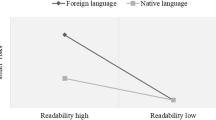

An emerging literature shows that shareholders benefit from the Securities and Exchange Commission’s (SEC) filing reviews in terms of improved disclosures and reduced information asymmetry. However, these reviews also impose significant costs on companies because comment letter remediation diverts time and resources away from normal operations and may result in restated or amended filings. Applying processing fluency theory, we examine whether the readability of the company’s initial response to an SEC comment letter is associated with the likelihood of unfavorable outcomes from the review. We find that less readable company responses are associated with longer SEC response times and a greater likelihood that the company restates or amends a reviewed filing. Because the company response is preceded by a specific request for information from the SEC (i.e., a prompt), our setting allows for an improved ability to disentangle the effects of disclosure readability from the effects of disclosure content.

Similar content being viewed by others

Notes

We thank an anonymous reviewer for helping us to identify and articulate this advantage of our setting.

See the SEC’s Division of Corporation Finance’s Filing Review Process at https://www.sec.gov/divisions/corpfin/cffilingreview.htm.

For more information about the SEC’s dissemination of comment letter conversations, refer to the SEC’s press release 2004–89 (available at http://www.sec.gov/news/press/2004-89.htm).

Schwarz (2004) provides a similar argument.

Bog Index values for 10-K filings from 1994 to 2015 are available at https://kelley.iu.edu/bpm/activities/bogindex.html. 10-K Bog Index is unavailable for 696 observations from our final sample used for the Fog Index and Flesch Reading Ease Index.

See, for example, Walmart’s response to the SEC on July 9, 2013 (available at http://www.sec.gov/Archives/edgar/data/104169/000010416913000022/filename1.htm). Walmart first lists the SEC’s original comment and then provides a company response.

We include controls for additional company characteristics in sensitivity analyses (see Section 4).

As stated on the SEC’s website: “The Division performs its primary review responsibilities through 11 offices staffed with approximately 80% of the Division’s employees. The members of these 11 offices have specialized industry, accounting, and disclosure expertise” (available at https://www.sec.gov/divisions/corpfin/cffilingreview.html).

An interesting paper by Oppenheimer (2006) sheds some light on the possible effects of managerial hubris and/or the pushback strategy. Using a series of experiments, Oppenheimer (2006) shows that, contrary to conventional wisdom, the authors of more complex texts are judged as being less intelligent than the authors of less complex texts. It is certainly possible that corporate executives are particularly susceptible to the tendency to use complex words when they are available.

References

Alter, A. L., & Oppenheimer, D. M. (2009). Uniting the tribes of fluency to form a metacognitive nation. Personality and Social Psychology Review, 13(3), 219–235.

Altman, E. I. (1968). Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance, 23(4), 589–609.

Bens, D. A., Cheng, M., & Neamtiu, M. (2016). The impact of SEC disclosure monitoring on the uncertainty of fair value estimates. The Accounting Review, 91(2), 349–375.

Bonsall, S. B., IV, Leone, A. J., Miller, B. P., & Rennekamp, K. M. (2017). A plain English measure of financial reporting readability. Journal of Accounting and Economics, 63(2–3), 329–357.

Bonsall, S. B., IV, & Miller, B. P. (2017). The impact of narrative disclosure readability on bond ratings and rating agency disagreement. Review of Accounting Studies, 22(2), 608–643.

Bozanic, Z., Dietrich, J. R., & Johnson, B. (2017). SEC comment letters and firm disclosure. Journal of Accounting and Public Policy, 36(5), 337–357.

Bozanic, Z., & Thevenot, M. (2015). Qualitative disclosure and changes in sell-side financial analysts’ information environment. Contemporary Accounting Research, 32(4), 1595–1616.

Brown, S. V., Tian, X., & Tucker, J. W. (2018). The spillover effect of SEC comment letters on qualitative corporate disclosure: Evidence from the risk factor disclosure. Contemporary Accounting Research, 35(2), 622–656.

Bushee, B. J., Gow, I. D., & Taylor, D. J. (2018). Linguistic complexity in firm disclosures: Obfuscation or information? Journal of Accounting Research, 56(1), 85–121.

Cassell, C. A., Dreher, L. M., & Myers, L. A. (2013). Reviewing the SEC’s review process: 10-K comment letters and the cost of remediation. The Accounting Review, 88(6), 1875–1908.

De Franco, G., Hope, O.-K., Vyas, D., & Zhou, Y. (2015). Analyst report readability. Contemporary Accounting Research, 32(1), 76–104.

Dechow, P., Lawrence, A., & Ryans, J. (2016). SEC comment letters and insider sales. The Accounting Review, 91(2), 401–439.

DeFond, M. L., & Hung, M. (2003). An empirical analysis of analysts’ cash flow forecasts. Journal of Accounting and Economics, 35(1), 73–100.

Deloitte: Deloitte, Touche LLP. (2013). SEC Comment Letters - Including Industry Insights: Constructing Clear Disclosures, 7th Edition. (December 5). Available at http://deloitte.wsj.com/riskandcompliance/files/2013/12/SEC-Comment-Letters-2014-Including-Industry-Insights-2014-Constructing-Clear-Disclosures.pdf. Accessed 19 Mar 2015.

Ege, M., Glenn, J. L., Robinson, J. R. (2019). Unexpected SEC Resource Constraints and Comment Letter Quality. Contemporary Accounting Research, forthcoming.

Ertimur, Y., & Nondorf, M. (2006). IPO firms and the SEC comment letter process. Berkeley: Working paper, Duke University and University of California.

Ettredge, M., Johnstone, K., Stone, M., & Wang, Q. (2011). The effects of firm size, corporate governance quality, and bad news on disclosure compliance. Review of Accounting Studies, 16(4), 866–889.

Francis, J., Philbrick, D., & Schipper, K. (1994). Shareholder litigation and corporate disclosures. Journal of Accounting Research, 32(2), 137–164.

Gunny, K., Hermis, J.. (2019). How busyness influences SEC compliance activities: Evidence from the filing review process and comment letters. Contemporary Accounting Research, forthcoming.

Hennes, K. M., & Schenck, K. M. (2014). The development of reporting norms without explicit guidance: An example from accounting for gift cards. Accounting Horizons, 28(3), 561–578.

Johnson, S. (2010). The SEC has a few questions for you. CFO (May): 25–28.

Johnson, B. A. (2015). The impact of SEC comment letter releases: Short window evidence of information content and changes in information asymmetry. Dissertation, The Ohio State University.

Johnston, R., & Petacchi, R. (2017). Regulatory oversight of financial reporting: Securities and Exchange Commission comment letters. Contemporary Accounting Research, 34(2), 1128–1155.

Kubick, T. R., Lynch, D. P., Mayberry, M. A., & Omer, T. C. (2016). The effects of regulatory scrutiny on tax avoidance: An examination of SEC comment letters. The Accounting Review, 91(6), 1751–1780.

Laksmana, I., Tietz, W., & Yang, Y. W. (2012). Compensation discussion and analysis (CD&A): Readability and management obfuscation. Journal of Accounting and Public Policy, 31(2), 185–203.

Lawrence, A. (2013). Individual investors and financial disclosure. Journal of Accounting and Economics, 56(1), 130–147.

Lawrence, A., Minutti-Meza, M., & Vyas, D. (2018). Is operational control risk informative of financial reporting deficiencies? Auditing: A Journal of Practice and Theory, 37(1), 139–165.

Lee, Y.-J. (2012). The effect of quarterly report readability on information efficiency of stock prices. Contemporary Accounting Research, 29(4), 1137–1170.

Lehavy, R., Li, F., & Merkley, K. (2011). The effect of annual report readability on analyst following and the properties of their earnings forecasts. The Accounting Review, 86(3), 1087–1115.

Lennox, C. S., Francis, J. R., & Wang, Z. (2012). Selection models in accounting research. The Accounting Review, 87(2), 589–616.

Li, F. (2008). Annual report readability, current earnings, and earnings persistence. Journal of Accounting and Economics, 45(2), 221–247.

Li, F. (2010). Textual analysis of corporate disclosures: A survey of the literature. Journal of Accounting Literature, 29, 143–165.

Maa, P., Moussawi, R.. (2014). WRDS SEC Analytics Suite: SEC Readability and Sentiment Data (April). Wharton research data services: University of Pennsylvania. Available at https://wrds-web.wharton.upenn.edu/wrds/support/Data/_001Manuals%20and%20Overviews/_099WRDS%20SEC%20Analytics%20Suite/_004WRDS-SEC%20Readability%20and%20Sentiment/WRDS%20SEC%20Readability%20and%20Sentiment%20Manual.pdf.cfm. Accessed 28 Feb 2017.

Miller, B. P. (2010). The effects of reporting complexity on small and large investor trading. The Accounting Review, 85(6), 2107–2143.

Oppenheimer, D. M. (2006). Consequences of erudite vernacular utilized irrespective of necessity: Problems with using long words needlessly. Applied Cognitive Psychology, 20, 139–156.

Rennekamp, K. (2012). Processing fluency and investors’ reactions to disclosure readability. Journal of Accounting Research, 50(5), 1319–1354.

Robinson, J. R., Xue, Y., & Yu, Y. (2011). Determinants of disclosure noncompliance and the effect of the SEC review: Evidence from the 2006 mandated compensation disclosure regulations. The Accounting Review, 86(4), 1415–1444.

Ryans, J. (2019). Textual classification of comment letters. Working paper: London Business School.

Schwarz, N. (2004). Metacognitive experiences in consumer judgment and decision making. Journal of Consumer Psychology, 14(4), 332–348.

SEC: Securities and Exchange Commission. (1998). A Plain English Handbook: How to Create Clear SEC Disclosure. SEC Office of Investor Education and Assistance. Washington, D.C.: Government Printing Office.

Acknowledgements

We thank Paul Fischer (editor), the anonymous reviewer, Khrystyna Bochkay, Andrew Doucet, Ole-Kristian Hope, Bret Johnson, Miguel Minutti-Meza, Linda Myers, Fellipe Raymundo, Roy Schmardebeck, Jonathan Shipman, Nikki Skinner, participants in the University of Arkansas Accounting Research Conference and the Indiana University Audit Readings Group, and workshop participants at the University of Miami, the University of Tennessee, and the University of Wisconsin for providing helpful comments and suggestions. We benefited from valuable programming assistance from Joshua Hunt, Jonathan Lisic, and Jamie Zhou, and research assistance from Christina Adams, Joel Bucher, Steven Hawkins, Dora McPeak, and Katherine Sartin. Cory Cassell gratefully acknowledges financial support from the Ralph L. McQueen Chair in Accounting at the University of Arkansas. Ling Lisic gratefully acknowledges financial support from the L. Mahlon Harrell Junior Faculty Fellowship at Virginia Tech.

Author information

Authors and Affiliations

Corresponding author

Additional information

Publisher’s note

Springer Nature remains neutral with regard to jurisdictional claims in published maps and institutional affiliations.

Appendix

Appendix

1.1 Variable Definitions

10K_Readability | readability of the 10-K filing referenced in the SEC’s comment letter (REFERENCED_FILING_FTP_FILE_FKEY) using the same measure as Response_Readability (Audit Analytics, WRDS SEC Analytics Suite (Fog Index and Flesch Reading Ease Index), https://kelley.iu.edu/bpm/activities/bogindex.html (Bog Index)) |

AudTenure | the number of consecutive years (through year t) during which the auditor has audited the company (Audit Analytics) |

BankruptcyRank | the decile rank of Altman’s bankruptcy score, calculated following DeFond and Hung (2003) and Altman (1968). The deciles are increasing with the probability of bankruptcy (i.e., the companies with the weakest financial health are in the highest decile). (Compustat) |

Big4 | an indicator variable set equal to one if the company is audited by Deloitte, Ernst & Young, KPMG, or PricewaterhouseCoopers and zero otherwise (Audit Analytics) |

CL_Amend | an indicator variable set equal to one if a 10-K/A is filed by the company between the second SEC comment letter and the “no further comment” letter |

CL_Restate | an indicator variable set equal to one if the company files a 10-K restatement between the second SEC comment letter and the “no further comment” letter related to the comment letter issues and zero otherwise. We use the Audit Analytics Non-Reliance database to identify 10-K restatement announcements. We then read all restatement-related disclosures and all letters in the comment letter conversation to determine whether the restatement is related to the comment letter issues, following Cassell et al. (2013) |

CL Unfavorable Outcomes | CL_Amend or CL_Restate |

Comment_10K_Readability | an indicator variable set equal to one if the SEC comment letter includes Audit Analytics classification ‘223’ (Plain English), ‘819’ (Repetitious wording), or the field “CL_TEXT” contains “Plain English,” “Readable,” or “Readability,” and zero otherwise (Audit Analytics) |

CompanyAge | the total number of years (through year t) assets are reported (Compustat) |

ExtFinancing | the sum of equity financing and debt financing scaled by total assets, measured in t + 1, following Ettredge et al. (2011) (Compustat) |

Filings | the number of filings (e.g., 10-K, 8-K, 10-Q, DEF 14A) addressed in the initial SEC comment letter, based on the number of filings reported in LIST_FORM_DATES (Audit Analytics) |

Issue Complexity FE | indicator variables for each of the 45 Audit Analytics Accounting and Disclosure classification issues in variable ISS_ACCRL_DISC_KEYS (Audit Analytics) |

Length_Ratio | length (in words) of the company’s first substantial response divided by length (in words) of the SEC’s initial comment letter. See Section 3 for additional details on how we remove non-substantial company responses (e.g., those requesting an extension) (WRDS SEC Analytics Suite) |

Litigation | an indicator variable set equal to one if the company is in a litigious industry (four-digit SIC industry codes 2833–2836, 3570–3577, 3600–3674, 5200–5961, or 7370–7374, following Francis et al. (1994)), and zero otherwise (Compustat) |

lnAssets | the natural log of total assets (Compustat) |

Loss | an indicator variable set equal to one if income before extraordinary items (IB) is negative and zero otherwise (Compustat) |

M&A | an indicator variable set equal to one for non-zero acquisitions or mergers as reported on a pre-tax basis (AQP) and zero otherwise (Compustat) |

MWeak | an indicator variable set equal to one if the internal control audit opinion (under SOX Section 404) or the management certification (under SOX Section 302) is qualified for a material weakness and zero otherwise (Audit Analytics) |

NumTopics | the total number of issue codes (assigned by Audit Analytics) in the initial comment letter from the SEC (LIST_CL_ISSUE_TAXGROUP) (Audit Analytics) |

Pronouncement | an indicator variable equal to one if the company makes reference to specific accounting or SEC guidance, based on AA coded topics (ISS_FINGUIDE_KEYS, ISS_FSP_KEYS, ISS_ETIFGAAP_KEYS, ISS_FTB_KEYS, ISS_IFRS_KEYS, ISS_SABGUIDE_KEYS, ISS_SFAS_STAND_KEYS, ISS_SIC_REF_KEYS, ISS_SOP_KEYS, FASB_KEY_LIST, or FASB_CODIFICATION_LIST) and zero otherwise. See Section 3 for additional details. |

Response_Readability | separately estimated using one of three measures: 1) negative one times the Fog Index, 2) the Flesch Reading Ease Index, or 3) negative one times the Bog Index, of the first substantial letter from the company (CORRESP file type). See Section 3 for additional details on how we remove non-substantial company responses (e.g., those requesting an extension) (Audit Analytics, WRDS SEC Analytics Suite (Fog Index and Flesch Reading Ease Index), Microsoft Word StyleWriter Add-on (Bog Index)) |

Restate | an indicator variable set equal to one if the company filed a restatement in the two years before the receipt of the comment letter and zero otherwise (Audit Analytics) |

SEC_Busyness | the number of comment letter conversations open in the respective SEC Industry Office at the time of receipt of the company’s response divided by the total number of comment letter conversations processed by that SEC Industry Office in the past 365 days. The computation is based SIC industry codes for all conversations in the Audit Analytics comment letter conversations database. |

SEC_Readability | readability of the first letter from the SEC (UPLOAD file type) using the same measure as Response_Readability (Audit Analytics, WRDS SEC Analytics Suite (Fog Index and Flesch Reading Ease Index), Microsoft Word StyleWriter Add-on (Bog Index)) |

SEC_RespTime | the natural log of the number of days between the company’s first substantial response (CORRESP file type) and the second letter from the SEC (UPLOAD file type) (Audit Analytics) |

SEC Industry Office FE | indicator variables for each SEC Division of Corporation Finance office represented in the sample. SEC offices are assigned based on the two-digit industry code (https://www.sec.gov/info/edgar/siccodes.htm) (Compustat) |

Second-Tier | an indicator variable set equal to one if the company is audited by BDO Seidman, Crowe Horwath, Grant Thornton, or McGladrey & Pullen and zero otherwise (Audit Analytics) |

Segments | the number of business segments reported (Compustat) |

Year FE | indicator variables for each fiscal-year represented in the sample (Compustat) |

Rights and permissions

About this article

Cite this article

Cassell, C.A., Cunningham, L.M. & Lisic, L.L. The readability of company responses to SEC comment letters and SEC 10-K filing review outcomes. Rev Account Stud 24, 1252–1276 (2019). https://doi.org/10.1007/s11142-019-09507-x

Published:

Issue Date:

DOI: https://doi.org/10.1007/s11142-019-09507-x